Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-exporters,

I have pleasure to bring to you the 10th issue of the CHEMEXCIL e-Bulletin for the month of February 2017, which contains the following activities undertaken by the Council and other useful information/Notifications, etc.

- Brief Report on Seminar on Impact of Budget on Exports followed by CAPINDIA 2017 Interactive meeting on 8th February 2017 at Vapi Industries Association, VIA House, Plot No. 135, GIDC, Vapi - 396195 jointly organized by CHEMEXCIL, PLEXCONCIL, and CAPEXIL & SHEFEXIL in association with Vapi Industries Association.

- Brief Report on seminar on impact of budget 2017 on exports along with CAPINDIA roadshow at Ahmedabad on 14.02.2017 at hotel Novotel, S. G. Highway, and Ahmedabad.

- Chemexcil’s “Chemicals Buyer Seller Meet” held on 21st February 2017 at Renaissance, Kuala Lumpur, Malaysia

- Chemexcil’s “Chemicals Buyer Seller Meet” held on 23rd February 2017 at Suntec Convention & Exhibition Centre, Singapore.

- UNION BUDGET 2017-18 - Highlights & provision for exports and chemicals sector

- Launching of schemes by Jawaharlal Nehru Port Trust (JNPT) like DPD (Direct Port Delivery) and DPE (Direct Port Export) for quicker clearances of imports and exports.

- Highlight of Union Budget 2017

I hope that you would find the newsletter informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions so as to enable us to improve this e-bulletin further.

With regards,

SHRI SATISH W. WAGH

Chairman,

CHEMEXCIL

|

BACK |

Chemexcil Seminar on Impact of Budget on Chemical Exports held on

8th February 2017, at Vapi Industries Association, VIA House, VAPI.

|

| From Left Mr. S.G. Bharadi Executive Director Chemexcil receives token of appreciation from Mr. Parthiv Mehta Hon. Secretary, Vapi Industries Association along with Mr. Vijay Shanker Pandey, Under Secretary, Ministry of Commerce and Industry, Govt of India. |

| |

|

| Mr. SudhakarKasture , Director, Exim Institute making presentation on Impact of budget. |

Chemexcil Mumbai Office organized Seminar on Impact of Budget on Exports followed by CAPINDIA 2017 Interactive meeting on 8th February 2017 at Vapi Industries Association, VIA House, Plot No. 135, GIDC, Vapi - 396195 jointly organized by CHEMEXCIL, PLEXCONCIL, and CAPEXIL & SHEFEXIL in association with Vapi Industries Association.

The seminar was attended by Shri Vijay Shanker Pandey US-EP(CAP), Ministry of Commerce and Industry, Govt. of India, Mr. S.G. Bharadi Executive Director, Chemexcil, Mr. Parthiv Mehta, Hon. Secretary, Vapi Industries Association , Mr. SudhakarKasture, Director, Exim Institute and 30-member exporters from Vapi region.

Mr. S.G. Bharadi, Executive Director, Chemexcil attended the seminar and shared his views on budget and requested participants to exhibit and visit CAPINDIA 2017 event dated 21-22 March-2017 . The seminar was well attended by the member – exporters of the Vapi and nearby region. Mr. S.G. Bharadi, emphasized the need to understand the budget and urged the participants to make best use of such educative seminars organized by the Council to add value to knowledge.

The session on impact of budget on Chemical Exports was conducted by Shri SudhakarKasture, Director Exim Institute an eminent consultant on Trade topics. Mr. SudhakarKasture in his presentation analyzed Union Budget 2017 with suitable illustrations which evoked a good response from the participants. He also clarified queries raised by the participants to their satisfaction.

BACK |

CHEMEXCIL SEMINAR ON IMPACT OF BUDGET 2017 ON EXPORTS ALONG WITH CAPINDIA ROADSHOW AT AHMEDABAD ON 14.02.2017 AT HOTEL NOVOTEL, S.G HIGHWAY, AHMEDABAD

|

| From Left- Ms. VaishaliZinzuwadia, Regional Director – Chemexcil; Mr. Sabyasachi Dutta, Executive Director - PLEXCONCIL; Mr. Gagan Kumar, Representative-REACHLaw, New Delhi; Mr.S.G.Bharadi, Executive Director-Chemexcil and Mr.SudhakarKasture, Director- Helpline Impex Pvt. Ltd. |

| |

Chemexcil organized seminar on impact of budget 2017 on exports along with CAPINDIA roadshow at Ahmedabad on 14.02.2017 at hotel Novotel, S. G. Highway, and Ahmedabad. Mr. Shankar Patel, President, The Green Environment Services Co-op. Soc. Ltd. was the Guest of Honour for this program along with Mr. Bhupendra Patel, Regional Chairman - Chemexcil; Mr. Sabyasachi Dutta, Executive Director - PLEXCONCIL; Mr.SudhakarKasture, Director- Helpline Impex Pvt. Ltd.; Mr. Gagan Kumar, Representative-REACHLaw;Mr.S.G.Bharadi, Executive Director - Chemexcil and Ms. VaishaliZinzuwadia, Regional Director – Chemexcil. Total 50-participants attended this seminar.

Mr. S. G. Bharadi, Exe. Director - Chemexcil welcomed the participants and briefed about CAPINDIA 2017 event.

Mr. SudhakarKasture –HELPLINE EXIM PVT. LTD., Mumbai briefed on IMPACT OF BUDGET ON EXPORTS and covered Future of Incentives, Trade Facilitation Agreement and Impact of Budget 2017

Mr. Gagan Kumar, Representative from REACH Law, New Delhi addressed the gathering on REACH 2018 Roadmap. He covered the brief work done by Chemexcil for exporters’ i.e. reimbursement of REACH ECHA fees, Awareness Seminar, REACH 2010 and 2013 Indian Registration status.

BACK |

Chemexcil’s “Chemicals Buyer Seller Meet” held on 21st February 2017 at Renaissance, Kuala Lumpur, Malaysia

As an export promotion measure, the Council has organised, with active support of High Commission of India, KL Malaysia and ASC Agenda Suria Communication Sdn. Bhd, it’s

Chemicals Buyer Seller Meeton 21st February 2017 at Renaissance, Kuala Lumpur, Malaysia.

Malaysia is India’s second most important trading partner amongst the ASEAN countries and also India’s gateway to ASEAN. Therefore, the objective of the event was to provide a platform to our member exporters to further explore the market potential for Council’s items in Malaysia and strengthen co-operation with Malaysian companies.

Total 29 delegates participated in the BSM under the umbrella of CHEMEXCIL. These were reputed companies from council’s various panels and are exporting to ASEAN region.

CHEMEXCIL’s BSM was graced by H.E Shri T.S Trimurti, High Commissioner of India to Malaysia who was also the Chief Guest for the opening ceremony.The event was also graced by Shri NikhileshGiri, Deputy High Commissioner of India to Malaysia, Shri Bramha Kumar- First Secretary (Commerce), HICOM- KL, Shri Sasi Kumar- Attache (Com) HICOM-KL, Shri Jag Rao, Simancha, CEO, ASC, Dato (Shri) J Palaniappan, Council Member (MFM), Shri NorsalanHadi Abdul Kadir, Deputy Director, MATRADE and others.

The Hon’ble High Commissioner, while addressing the gathering of Indian delegates and Malaysian visitors, was glad that such an event has been organized by the Council in Malaysia. He further added that with negotiation.

of RCEP in future and stability in MYR, the timing of the event was ideal and such an event be followed up by other events in future also which help the Indian delegates get foothold in the Malaysian Market.

The Hon’ble High Commissioner also interacted with the delegates and Malaysian visitors.

The BSM event evinced good response with around 95 Malaysian visitors from diverse sectors of end-user industries who are potential buyers of Indian delegates and were interested in co-operating with Indian companies.

The delegates were satisfied with the response during the BSM and shall now take it further with the potential clients for securing business.

BACK |

Glimpses of the Show

|

| H.E. Shri T.S. Tirumurti addressing opening ceremony of CHEMEXCIL Buyers - Sellers Meet at Kuala Lumpur on 21st February 2017 |

| |

|

| H.E Shri. T.S. Tirumurti, High Commissioner of India to Malaysia, other dignitaries with Chemexcil delegates for the BSM |

BACK |

Chemexcil’s “Chemicals Buyer Seller Meet” held on 23rd February 2017 at Suntec Convention & Exhibition Centre, Singapore

As an export promotion measure, the Council has organised, with active support of High Commission of India, Singapore and De Ideaz Pty Ltd, it’sChemicals Buyer Seller Meeton 23rd February 2017 at Suntec Convention & Exhibition Centre, Singapore.

Singapore is among India’s largest trade and investment partner in ASEAN with exports of around USD 294.36 Mn in 2015-16 (pertaining to chemexcil items). Therefore, this event was organised to promote our exports and also to assist our member exporters to further explore the market potential for Council’s items in Singapore.

Total 26 delegates participated in the BSM under the umbrella of CHEMEXCIL. These were reputed companies from council’s various panels and are exporting to ASEAN region.

CHEMEXCIL’s BSM was graced by Dr. PradyumnTripathi, First Secretary (Commerce), High Commission of India to Singapore who was also the Chief Guest for the opening ceremony.The event was also attended by Shri Nirmesh Kumar, Attache (Com) HICOM-Singapore and others.

Dr. PradyumnTripathi, while addressing the gathering of Indian delegates and local participants, was glad that such an event has been organized by the Council in Singapore. He further stressed the importance of the Singapore market in with negotiation of RCEP in future and also the assured the delegates of support in related matters.

Dr. Tripathi also interacted with the delegates and inquired about their current business and wished them well.

The BSM event evinced good response with around 63 Singapore visitors from diverse sectors of end-user industries who are potential clients for Indian delegates and were interested in co-operating with Indian companies.

The delegates were satisfied with the response during the BSM and shall now take it further with the potential clients for securing business.

BACK |

Glimpses of the Event

|

| Inauguration of CHEMEXCIL Buyers - Sellers Meet at Singapore on 23rd February 2017.

Dr.PradyumnTripathi, First Secretary (Commerce), High Commission of India to

|

| |

BACK |

UNION BUDGET 2017-18: Highlights & provision for exports and chemicals sector

| EPC/LIC/BUDGET/2017-18 |

2 nd February 2017 |

| |

| ALL THE MEMBERS OF THE COUNCIL |

| |

|

UNION BUDGET 2017-18: Highlights & provision for exports and chemicals sector |

|

Dear Sir/ Madam,

As you are aware, Hon’ble Union Minister of Finance Shri Arun Jaitely has presented the Union Budget 2017-18 on 1st February 2017.

The Agenda for Union Budget 2017-18 is- “Transform, Energise and Clean India” – TEC India.

As per the budget, it is proposed to focus on 10 broad themes — farmers, rural population, youth, poor and health care for the underprivileged; infrastructure; financial sector for stronger institutions; speedy accountability; public services; prudent fiscal management; tax administration for the honest.

The key economic indicators as per budget statement are following:

- Recommended 3% fiscal deficit for three years with deviation of 0.5% of GDP.

- Revenue deficit - 1.9 %

- Pegged fiscal deficit of 2017-18 at 3.2% of GDP and remain committed to achieving 3% in the next year.

- Foreign exchange reserves have reached 361 billion US Dollars as on 20th January, 2017

For the convenience of the members, given below is gist of provisions in Union Budget 2017-18 from exports and chemicals perspective.

Ø Customs Duty:

There is no change in the peak rate of BCD, however, changes in Customs duty have been made to address the problem of duty inversions in certain sectors. The changes related to chemical sector are as under-

|

Chemicals & Petrochemicals |

HS Code |

Existing Duty |

Proposed Duty |

1. |

o-Xylene |

29024100 |

BCD – 2.5% |

BCD – Nil |

2. |

2-Ethyl Anthraquinone for use in manufacture of hydrogen peroxide, subject to actual user condition. |

29146990 |

BCD – 7.5% |

BCD – 2.5% |

3. |

Vinyl Polyethylene Glycol (VPEG) for use in manufacture of Poly Carboxylate Ether, subject to actual user condition |

34042000 |

BCD – 10% |

BCD – 7.5% |

4. |

Medium Quality Terephthalic Acid (MTA) & Qualified Terephthalic Acid (QTA) |

29173600 |

BCD – 7.5% |

BCD – 5% |

5. |

Liquefied Natural Gas |

27111100 |

BCD – 5% |

BCD – 2.5% |

6. |

Catalyst for use in the manufacture of cast components of Wind Operated Electricity Generator [WOEG], subject to actual user condition |

38159000 |

BCD – 7.5% |

BCD – 5%

SAD- exempted |

Ø Central Excise Duty

There is no change in the peak rate of Excise Duty of 12.5%. However, amendments have been made to specific tariff rates in various sectors by exemption notifications.

Further, there is a clarification in TRU circular on Concessional / Nil rate of duty on inputs for EOUs otherwise available to DTA manufacturers. It has been clarified that the exemptions available to DTA manufacturers on raw materials and inputs at concessional or Nil rate of BCD, excise duty / CVD or SAD are also available to EOU manufacturers, subject to the fulfilment of conditions.

Ø Service Tax

The effective rate of service tax has been left unchanged at 15% (including Swachh Bharat Cess and Krishi Kalyan Cess).

Ø Amendments in HS Codes (without change of Duty)

· A new tariff line 1511 90 30 added for “Refined bleached deodorised palm stearin”

· Stearic Acid HS code 38231111 has been changed to 38231190

Ø Procedural Changes/ Important amendments related to CBEC

· Time limit for filing of bill of entry:

Sub-section (3) of Section 46 is proposed to be substituted to provide for filing of bill of entry before the end of the next day following the day on which the aircraft or vessel or vehicle carrying the goods arrives at a customs station at which such goods are to be cleared for home consumption or warehousing. If the bill of entry is not presented within the time prescribed and there is no sufficient cause for delay, the importer will be liable to pay charges for late presentation. There is no time limit prescribed at present.

· Time limit for payment of customs duty

Sub-section (2) of Section 47 is proposed to be amended to provide that the importer shall pay the duty on the date of presentation of the bill of entry in the case of self-assessment or within one day from the date on which the bill of entry is returned to him by the proper officer in the case of assessment, reassessment or provisional assessment or in the case of deferred payment, from such due date as may be specified. On failure to do so, the importer will be liable to pay interest on duty not paid at a rate not less than 10% and not exceeding 36% as notified by the Government. At present, the importer is liable to pay duty within two days from the date on which the bill of entry is returned to him for payment.

· Storage of imported goods permitted for warehousing

Section 49 is proposed to be substituted to extend the facility of storage to imported goods entered for warehousing in a public warehouse, before their removal. In terms of the present provision, the facility of storage of imported goods is only for goods intended for home consumption

Other important Budgetary provisions for MSME/ Exports/ Infrastructure

Ø Corporate tax: In order to make MSME companies more viable, it is proposed to reduce tax for small companies of turnover of up to Rs 50 crore to 25 %. This will reduce their tax liabilities.

Ø A new and restructured Central scheme namely, Trade Infrastructure for Export Scheme (TIES)will be launched to boost export infrastructure in states which also improve logistics and reduce transaction costs of exports.

Ø For transportation sector as a whole, including rail, roads, shipping, budget has provided 2,41,387 crores in 2017-18 which will spur an entire spectrum of economic activity.

You are requested to take note of the same. The major highlights of the budget 2017-18 are also available in the attached file for your ready reference.

Thanking You,

Yours faithfully,

Satish Wagh

Chairman

Chemexcil.

Enclosure:- Key Features of Budget 2017-2018 |

|

BACK

|

Direct Port Delivery (DPD) and Direct Port Export (DPE) facility at JNPT to expedite cargo clearance of Imports & Exports

| EPC/LIC/JNCH |

8th Feb 2017 |

| |

| ALL THE MEMBERS OF THE COUNCIL |

| |

|

UDirect Port Delivery (DPD) and Direct Port Export (DPE) facility at JNPT to expedite cargo clearance of Imports & Exports |

|

Dear Members,

We would like to inform you that Jawaharlal Nehru Port Trust (JNPT), the biggest container port of India has launched schemes like DPD (Direct Port Delivery) and DPE (Direct Port Export) for quicker clearances of imports and exports.

Kindly note that that DPD (Direct Port Delivery) facility has been introduced by the port as a part of its policy of ease of doing business. It is made available for all importers who are registered in the Accredited Client Programme (ACP) of the Customs department. Direct Port Delivery enables that consignments are cleared much faster than regular timelines. Similarly, the DPE (Direct Port Export) facility for exporters is supposed to enable cargo clearance within 24 hours.

During recent interactions with the Trade/ industry, the JNCH/ JNPT authorities have urged that Exporters and importers must take advantage of the Direct Port Delivery (DPD) and Direct Port Export (DPE) systems for speedy movement of goods between the port and the factory gate.

Members are requested to take note of the same. For further information, they may contact their logistics providers/ CHA who will handle the clearance.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL |

|

BACK

|

Initiation of Anti-Dumping and Countervailing Duty Investigation by MOFCOM China on Ortho Chloro Para Nitro Aniline (under HS code 29214200 ) originating in India

| EPC/LIC/ADD/OCPNA |

16th February 2017 |

| |

| ALL THE MEMBERS OF THE COUNCIL |

| |

|

Initiation of Anti-Dumping and Countervailing Duty Investigation by MOFCOM China on Ortho Chloro Para Nitro Aniline (under HS code 29214200 ) originating in India |

|

Dear Members,

This is in continuation of our circular dated 30th Jan 2017 informing you about filing of petition at MOFCOM China for initiation of anti-dumping and countervailing investigation against imports of Ortho Chloro Para Nitro Aniline (under HS code 29214200 ) originating in India.

Subsequently, consultations regarding anti-dumping and countervailing duty investigations were held in Beijing on 10 February 2017. The Indian side was represented by the Director, Directorate General of Anti-Dumping and Allied Duties.

Now, the Ministry of Commerce of the People's Republic of China (MOFCOM) has issued communication dated 13th Feb 2017 informing its decision to initiate the investigation regarding anti-dumping and countervailing duty with respect to import of Ortho chloro para nitro aniline originating from India.

All the relevant details of both investigations are provided in the attached communications of MOFCOM. Further, the contact details of TRIB, MOFCOM are as under-

Trade Remedy and Investigation Bureau of the MOFCOM

No.2 Dong Chang'an Avenue, Beijing

China (100731)

Tel: 0086-10-65198417, 65198473

Fax: 0086-10-65198415

Relevant websites: Sub-website (http://trb.mofcom.gov.cn) for the Trade Remedy and Investigation Bureau under the website for the MOFCOM

China Trade Remedy Information (http://www.cacs.mofcom.gov.cn)

Contact Person: Ma Ensheng, Tel: 0086-10-8509 3417 Zhao Hui, Tel: 010-6519 8184, maensheng@mofcom.gov.cn)

Member exporters who are exporting above product to China might have received this communication directly from MOFCOM. In case you are participating in the investigation, kindly do the needful submissions as per the guidelines/ timelines and also confirm to us on e-mail id’s- Deepak.gupta@chemexcil.gov.in and balani.lic@chemexcil.gov.in .

In case you need any support from the council in this regard, please do let us know.

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl: As above.

http://chemexcil.in/uploads/tbts/scan0070.pdf

http://chemexcil.in/uploads/tbts/MOFCOM_Announcement_No.4_OCPNA_1.docx

http://chemexcil.in/uploads/tbts/MOFCOM_Annoucement_No.5_OCPNA_.docx |

|

BACK

|

The International North–South Transport Corridor (INSTC) for CIS Trade

|

Background

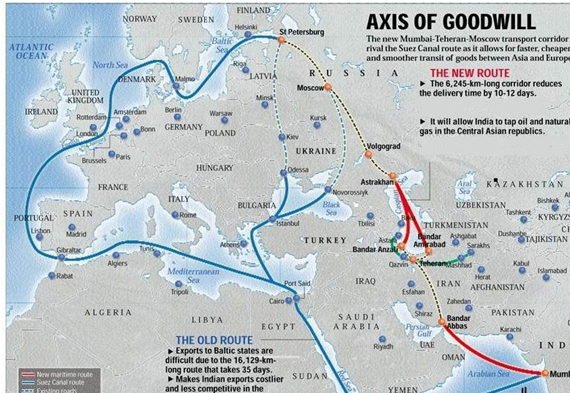

The International North–South Transport Corridor (INSTC) is the multi-modal connectivity (ship, rail, and road route) for moving freight between India, Russia, Iran, Europe and Central Asia.

INSTC was established in Sept 2000 in St. Petersburg, by Iran, Russia and India for the purpose of promoting transportation cooperation among the Member States.

Later on, INSTC was expanded to include eleven new members, namely: Republic of Azerbaijan, Republic of Armenia, Republic of Kazakhstan, Kyrgyz Republic, Republic of Tajikistan, Republic of Turkey, Republic of Ukraine, Republic of Belarus, Oman, Syria and Bulgaria (Observer).

Current Status

The International North South Transport Corridor (INSTC) linking India to Central Asia and Russia via Iran is likely to get operationalized shortly and it would offer a shorter and cost effective trade route for India's bilateral trade with Russia and other CIS countries.

The Dry Run carried out by the Federation of Freight Forwarders Associations of India (FFFAI) in 2014 and transportation of 5 containers from Bengaluru to Moscow via INSTC route in October, 2016has clearly demonstrated that compared to the traditional route from Mumbai via St. Petersburg which takes about 41 days, the INSTC routes take only about 20 to 25 days. Efforts are underway to further reduce the transportation time to 19 days.

At this stage, there are two operational INSTC routes:

- Mumbai — Bandar Abbas — Astara — Samur — Moscow

- Mumbai — Bandar Abbas — Amirabad — Astrakhan — Moscow

At present, except India and Oman, all other 12 countries which have signedthe 1NSTC Agreement, are signatories to TIR Convention, 1975.

Union Cabinet has on 6th March, 2017 approved India's accession to the Customs Convention on International Transport of Goods under cover of TIR Carnets (TIR Convention) and for completion of necessary procedures for ratification. This will facilitate seamless movement of container cargo from India to Russia with further reduction in transit time and transportation costs.Once volume of EXIM cargo increases, there could be further reduction in transportation costs.

INSTC advantages

- Asian and European countries could make their cargo transportation through North-South Corridor with double speed compared to Suez channel,

- Carriage time reduced from 40-60 days to 25-30 days i.e. 40% shorter.

- Carriage cost is 30% less,

- The most suitable route for transit traffic between Asia and Europe

- A few countries exist along the route therefore (less border crossings and easier for the countries to reach agreements),

- It is recommended by international organizations like UN, UIC and ECO.

Conclusion:

The Department of Commerce has held consultations with the trade and industry to create awareness on INSTC and also understand the existing logistics issues concerning exports to CIS. For further information on INSTC and understanding the modalities, members may contact “Federation of Freight Forwarders Association in India”.

(Source: Presentation by “Federation of Freight Forwarders Association in India” under the aegis of Department of Commerce, Ministry of Commerce & Industry, GOI)

|

|

BACK |

UNION BUDGET 2017: IT PROVIDES IMPETUS TO MANUFACTURING, EXPORT INFRASTRUCTURE, SAYS NIRMALA SITHARAMAN

|

| The Budget 2017-18 has provided an impetus to manufacturing, export infrastructure and government e-marketplace, Commerce and Industry Minister Nirmala Sitharamantoday said. (Source: IE)

|

| |

The Budget 2017-18 has provided an impetus to manufacturing, export infrastructure and government e-marketplace, Commerce and Industry Minister Nirmala Sitharaman today said. She said that Finance Minister ArunJaitley has announced several measures for the ministry. The Budget “provides renewed impetus to manufacturing and Make in India, export infrastructure and government e-marketplace,” she said in a statement.

The measures include proposed scheme for creating employment in leather and footwear industries, further liberalisation of FDI policy and abolition of the Foreign Investment Promotion Board (FIPB). “The long standing demand of startups has been accepted and the profit (linked deduction) exemption available to them for 3 years out of 5 years is changed to 3 years out of 7 years,” she added.

MAT (minimum alternate tax) credit is allowed to be carried forward up to a period of 15 years instead of 10 years at present. She said: “For creating an eco-system to make India a global hub for electronics manufacturing, a provision of Rs 745 crores in 2017-18 in incentive schemes like M-SIPS and EDF. The incentives and allocation has been exponentially increased following the increase in number of investment proposals”.

She also said that inverted duty has been rectified in several products in the chemicals, petrochemicals, textiles, metals and renewable energy sectors.

Infrastructure a key pillar under the Make in India programme has been strengthened with a large budgetary allocation, the minister said, adding measures for MSMEs would make them more competitive.

The outlay for the department of commerce for 2017-18 has pegged at Rs 4,465.83 crore, down from Rs 4,562.74 crore in the revised estimate for the current fiscal. However, in case of the Department of Industrial Policy and Promotion (DIPP), the outlay has been increased to Rs 3,608.87 crore for 2017-18 as compared to Rs 2,016.26 crore in the revised estimate for the current fiscal.

(Ref. http://www.financialexpress.com/budget/union-budget-2017-it-provides-impetus-to-manufacturing-export-infrastructure-says-nirmala-sitharaman/534142/ dated 2nd February-2017)

|

|

BACK |

REFORMS IN INDIA’S FOREIGN TRADE POLICY

|

| Make in India, Digital India, Skill India, The list of slogans for the government’s economic initiatives is ever expanding.

|

| |

This public relations effort remains critical for the government, which needs to reshape how foreign business people perceive India to increase foreign investment.

However, many local business people are concerned that the government has not implemented more measures to support its bold sloganeering.

The Modi administration’s first Foreign Trade Policy, unveiled on April 1, represents a pragmatic step forward in this regard. Much like the admiration’s first budget, unveiled on February 28, the policy targets critical industries with useful reforms and incentives.

Perhaps more importantly, however, the trade policy has sought to back-end the government’s ambitious goals.

The global economy is undergoing a major transition whether it is from the point of view of the producer or the consumer. This major change is occurring due to the rapid technological and socio-economic changes that are occurring.

Technological changes have led to major innovations and faster obsolescence of existing products. Earlier, the developing economies had more time to adapt and evolve with the changes in the environment. However, the availability of time is a luxury nowadays which is not easily available.

Consumers are defining consumption patterns globally and owing to their technological literacy skills, they are able to adapt to the new products and technologies at a rapid rate.

As a result of the above changes and use of artificial intelligence in production processes, there is need for the emerging economies to reorient their trade policies in a manner that keeps pace with this quick evolution.

India: Foreign Trade Policy

Although India has steadily opened up its economy, its tariffs continue to be high when compared with other countries, and its investment norms are still restrictive. This leads some to see India as a ‘rapid globaliser’ while others still see it as a ‘highly protectionist’ economy.

Till the early 1990s, India was a closed economy: average tariffs exceeded 200 percent, quantitative restrictions on imports were extensive, and there were stringent restrictions on foreign investment. The country began to cautiously reform in the 1990s, liberalizing only under conditions of extreme necessity.

Since that time, trade reforms have produced remarkable results. India’s trade to GDP ratio has increased from 15 percent to 35 percent of GDP between 1990 and 2005, and the economy is now among the fastest growing in the world.

Average non-agricultural tariffs have fallen below 15 percent, quantitative restrictions on imports have been eliminated, and foreign investments norms have been relaxed for a number of sectors.

India however retains its right to protect when need arises. Agricultural tariffs average between 30-40 per cent, anti-dumping measures have been liberally used to protect trade, and the country is among the few in the world that continue to ban foreign investment in retail trade. Although this policy has been somewhat relaxed recently, it remains considerably restrictive.

Nonetheless, in recent years, the government’s stand on trade and investment policy has displayed a marked shift from protecting ‘producers’ to benefiting ‘consumers’.

This is reflected in its Foreign Trade Policy for 2004/09 which states that, "For India to become a major player in world trade ...we have also to facilitate those imports which are required to stimulate our economy."

It has assumed a leadership role among developing nations in global trade negotiations, and played a critical part in the Doha negotiations.

Regional and Bilateral Trade Agreements

India has recently signed trade agreements with its neighbors and is seeking new ones with the East Asian countries and the United States. Its regional and bilateral trade agreements - or variants of them - are at different stages of development:

- India-Sri Lanka Free Trade Agreement,

- Trade Agreements with Bangladesh, Bhutan, Sri Lanka, Maldives, China, and South Korea.

- India-Nepal Trade Treaty,

- Comprehensive Economic Cooperation Agreement (CECA) with Singapore.

- Framework Agreements with the Association of Southeast Asian Nations (ASEAN), Thailand and Chile.

- Preferential Trade Agreements with Afghanista, Chile, and Mercosur (the latter is a trading zone between Brazil, Argentina, Uruguay, and Paraguay).

Problems

India’s trade policy has a major limitation wherein it focuses on incentivizing businesses after exports have taken place. As a result the trade promotion incentives do not target emerging firms to attain export competitiveness but reward already successful exporters to improve their margins.

The trade policy does not have provisions for interventions focusing on value-addition and employment generation. This implies that the policy is not working on long term structural measures but more towards short term result oriented measures which are not sustainable in the long run.

Trade promotion is still restricted to traditional trade fair type activities. No doubt that these activities are important for promotion and business development, but a change of approach is required in this age of growing internet and mobile technology which requires activities to be more network oriented.

Absence of institutions which can provide support for new product development and their placement in the global market in a selfless manner. These institutions can be used for ancillary activities such as development of prototypes, research and development etc.

India’s trade policy also suffers from an archaic design. The trade policy and negotiations over emphasis on tariffs which are not very important for market access gains. Trade today is guided by various other factors such as technical and quality standards.

India has not been successful in tapping the potential that the huge domestic markets and the economies of scale offer to attract foreign direct investment and technology transfers. This is observed based on trends which show that MNCs attracted by the size of the Indian consumer base often do not expand operations in India.

Investors have to face a combination of high transaction and input costs, supply-side constraints, and infrastructure deficits which is a major obstacle in setting up and operations of industries. As a result international investors also show reluctance in setting up and expanding business in India.

Reforms needed

India has to overcome the existing limitations in the trade policy. Simultaneously it also has to gear up for the upcoming changes in technology and socio economic setup to meet the rapidly evolving needs and demands of consumers and producers India needs to bring changes as suggested below.

India should restructure in a manner where it is able to move human resources and capital from under-performing or dying sectors and re-employ them in more competitive activities.

The trade policy should be on which adequately rewards value-addition and promotes employment in more productive sectors.

To match the pace of changes taking place, India should promote investment in innovation and new product development and also help such products find a global market.

Fair market access for Indian products subject to stringent technological and quality standards in global markets is also essential.

The huge Indian markets and the domestic economies of scale that they offer should be tapped efficiently to attract FDI in productive sectors.

Indian firms should be assisted and aided to be able to meet the quality and technical standards defined by government regulators or as a result of the competition in the market. Trade agreements and other institutional solutions can be used to reduce the cost of complying with these standards. This will also help in empowerment of the Small and Medium Enterprises (SME).

The challenges posed by changes in technology and global consumer preferences are changing the pattern of FDI-led outsourcing and reducing the future FDI-led export growth.

The governments measures in areas of administrative changes through ease of doing business reforms and infrastructure development might help in reviving the potential of FDI in economic growth.

A review of the overall trade strategy is the need of the hour for India. The changes have to be made in terms of trade promotion schemes and activities and the design of trade agreements and negotiating priorities.

These measures will determine India’s ability to undertake structural change and push for longer-term competitiveness.

(Ref. http://www.thehansindia.com/posts/index/Civil-Services/2017-02-02/Reforms-in-Indias-Foreign-Trade-Policy/277882 dated 02.02.2017)

|

|

BACK |

IGNORED IN BUDGET, EXPORTERS HOPE FOR SOPS IN FOREIGN TRADE POLICY REVIEW

|

| Exporters had made a number of demands such as creation of an export development fund, extension of interest equalisation scheme for merchant exporters and exemption for service tax

|

| |

NEW DELHI, FEBRUARY 5:

Exporters, who were largely ignored in the Budget, can hope for some incentives and thrust in the mid-term foreign trade policy (FTP) review in September with the Commerce Ministry ready to begin consultations.

“The Commerce Ministry will kick-off consultations with various export bodies and councils from February 9 to examine their list of demand and re-assess growth potential,” a government official told BusinessLine.

Another chance

While the Economic Survey for 2016-17 circulated on the eve of the Union Budget made a case for more support for exporters, especially from labour-intensive sectors such as apparels, leather and footwear, the Budget had no specific sops.

“Exporters had made a number of demands such as creation of an export development fund, extension of interest equalisation scheme for merchant exporters and exemption for service tax to be resolved in the Budget. The FTP review is another window for exporters to have their demands examined and met,” the official said.

The FTP review would also address issues that might creep up for exporters after the Goods & Services Tax is implemented.

Exporters’ concerns

“In the review, we plan to address all concerns that exporters may have on the implementation of the GST and its implications,” the official said.

India’s goods exports, which posted a decline in the past two fiscal years, is finally starting showing some growth in the on-going fiscal with four consecutive months of increase since September 2016. Global economic uncertainties, however, persist and the expectations that higher exports could push up the GDP by one percentage point 2017-18, articulated in the Economic Survey, is still a pipe dream.

“Exports have started looking up but the ground is still shaky. For high growth next fiscal, exporters would definitely need more hand-holding. The FTP review will examine the growth potential in every sector and the additional incentives that could be provided,” the official added. Exporters are disappointed with the Budget for ignoring their key demands. “The global challenges highlighted in the Budget require us to be on our toes and revisit our strategy to push exports in such volatile global conditions. It is disappointing that our proposal for an aggressive marketing strategy through an Export Development Fund did not see the light of the day,” said FIEO President SC Ralhan.

Extending sops

The Commerce Ministry has already made a case for expansion of the popular MEIS scheme to the Finance Minister. The scheme allows eligible exporters duty-free scrips, based on a percentage value of their exports (ranging between two per cent and five per cent), which can be used to import inputs by the exporter or sold to other entities.

“We want more items to be covered and higher levels of incentives for certain sectors requiring more support. Once our sectoral consultations are over, we can make more specific demands,” the official said.

The Commerce Ministry may have to prune the ambitious target of goods and services export of $900 billion set for 2020 fixed in the five year foreign trade policy.

“We could fix a new target after our sectoral consultations are over,” the official said.

(Ref. http://www.thehindubusinessline.com/economy/ignored-in-budget-exporters-hope-for-sops-in-foreign-trade-policy-review/article9522986.ece dated 5th February-2017)

|

|

BACK |

LOTS NEED TO BE DONE TO INCREASE INDIA’S EXPORTS, SAYS UNION MINISTER ANANT GEETE AT CHEMICAL AND ALLIED EXPORT PROMOTION COUNCIL OF INDIA

|

(Admitting that Indian businesses are facing multiple challenges in overseas markets due to the globally competitive environment, Union Minister AnantGeete today said a lot needs to be done to boost the country's shipments.)

Admitting that Indian businesses are facing multiple challenges in overseas markets due to the globally competitive environment, Union Minister AnantGeete today said a lot needs to be done to boost the country’s shipments. “We need to do a lot in the direction of increasing exports. In this era of globalisation, competition has reached a global level. Our businesses are facing multiple challenges to sustain in the global competitive environment,” Union Heavy Industries and Public Enterprises Minister AnantGeete said.

The Minister was addressing the export awards ceremony organised by Chemical and Allied Export Promotion Council of India (CAPEXIL) here.

“Unfortunately, since 2014 the export growth overall has not been very conducive although it has picked up over the last five months. Therefore, I urge all members of this exporting community (CAPEXIL) to find ways and means of boosting India’s exports,” J K Dadoo, Additional Secretary & Financial Advisor in the Ministry of Commerce said.

He pointed out that in 2015-16, exports from chemical and allied products stood at around USD 14 billion, comprising USD 5 billion worth of mineral and USD 9 billion of non-mineral articles.

(Ref. http://www.financialexpress.com/economy/lots-need-to-be-done-to-increase-indias-exports-says-union-minister-anant-geete-at-chemical-and-allied-export-promotion-council-of-india/543999/ dated 09.02.2017)

|

|

BACK |

COMMERCE DEPT. SPECIAL ARM MAY DRIVE FOREIGN TRADE POLICY

|

India’s future trade (policy) model should have the Commerce Department at the helm, supported by ministries including External Affairs and Finance, while a ‘transformed’ Directorate General of Foreign Trade (DGFT) should be the apex body for all trade promotion activities for the country, according to a government-commissioned report.

India’s foreign trade strategy and policy is currently being piloted predominantly by the Prime Minister’s Office and External Affairs Ministry.

Frost & Sullivan report

The report — prepared by the global consultancy firm Frost & Sullivan and submitted on December 23, 2016, to the commerce & industry ministry — also makes a strong case for a higher profile for the Indian Trade Service (ITS) in matters of trade policies & systems.

At present, the officials belonging to the Indian Administrative Service, Foreign Service and Revenue Service evidently have a relatively superior role over ITS cadre regarding decisions on crucial trade policy matters.

The report proposed that “… a dedicated ministerial arm under Department of Commerce will deal exclusively with trade-related policy inputs, their formulation and their rollout with the bulk of implementation work handled by a digital platform.”

The Frost & Sullivan report advocated that “the operational implementation of the Foreign Trade Policy (FTP) should reside with the department of commerce providing the trade community one single entity to deal with.”

The FTP should be considered a “dynamic document,” according to the report. It added that any change necessitated with respect to the ongoing requirements must be approved by the (commerce) departmental arm responsible for policymaking.

“Once approved by all ministerial stakeholders including the Department of Commerce, Department of Revenue and Ministry of External Affairs, a single communication should be issued by the departmental arm dedicated to FTP,” it stated.

Small, yet efficient

It observed: “The Prime Minister’s preferred model of a small and yet efficient government acting as a facilitator for businesses is most relevant and applicable to the DGFT. Furthermore, there is a critical need to transform the current DGFT by taking a holistic view of the existent trade environment in the country.”

The report mooted that a transformed DGFT should be made accountable for all trade promotion activities for India — providing services such as trade representation in foreign countries, research & development, market intelligence, business matchmaking services as well as public relations, advertising and marketing services.

The ‘DGFT 3.0’ — with DGFT pre- and post-liberalisation being the earlier two versions — should also provide (foreign trade) monitoring and training services, hold export promotion campaigns, industrial trade fairs and ensure greater focus on small and medium firms, the report suggested.

“The ITS is the only dedicated cadre within the Ministry of Commerce that has professionals with deep knowledge of trade policies and systems. Given their extensive involvement with DGFT and institutional memory, DGFT is best placed to continue with its role in providing policy inputs and aiding the policy formulation process,” the report recommended.

‘Recruit professionals’

Noting that the DGFT needs to re-skill its resources to be successful, the report said: “Future recruitment should focus on professionals with experience and qualifications in trade and commerce from reputed institutions.”

The report comes at a time when India’s goods exports have not yet recovered fully from the impact of a prolonged contraction from December 2014 to May 2016, as well as the government’s demonetisation exercise early November.

“For an improvement in India’s performance on the ease of doing business – currently ranked 130 out of 190 countries and particularly on the parameter of ‘trading across borders’ (where India is) currently ranked at a dismal 143 – it is imperative to deploy digital technology to transform the experience of doing trade in the country,” according to the report.

It also comes in the backdrop of the World Trade Organisation (WTO) stating in December 2016 that “… the number of new trade-restrictive measures being introduced (by WTO Member countries) remains worryingly high given continuing global economic uncertainty and the WTO's downward revision of its trade forecasts.”

(Ref. http://www.thehindu.com/business/Economy/Commerce-Dept.-special-arm-may-drive-foreign-trade-policy/article17292508.ece dated 12.02.20170

|

|

BACK |

INDIA: A LUCRATIVE MARKET FOR TEXTILE CHEMICALS

|

Textile chemicals have a close association with the textile industry; the growth in textiles market along with the growth of textile trade is expected to have a positive influence on the India textile chemicals market. An increasing thrust for export of quality textiles to Western countries is also positively driving the textile chemicals market. In addition, increasing investments by the industry players for the development of eco-friendly chemicals will also contribute to the growth of the India textile chemicals market.

Textile chemicals are a class of specialty chemicals that are used for dyeing and processing of textiles in order to obtain the final product with required characteristics. The India textile chemicals market is highly fragmented with a presence of more than 300 small and large players. The presence of a large number of players is attributed to the heavy subsidies provided by the Government of India to small players for setting up business operations. This accounts for the majority share being held by minor players. However, the share of small textile chemical manufacturers is expected to decline in the coming years due to the increasing preference for quality products and the increasing penetration of technical textiles.

Increasing Export of Quality Textiles Exhibit Demand for Auxiliaries Textile Chemicals

The production of textiles involves numerous water and chemical intensive processes. These chemicals, which are broadly classified into colourants and auxiliaries, are used during textile processing and manufacturing processes.

Auxiliaries will account for a major share of the India textile chemicals market owing to the increasing demand for quality textiles and technical textiles in both domestic and international markets. The increasing exports of high-quality textiles in the U.S. and Western Europe are also exhibiting an increasing demand for auxiliaries.

Chemicals such as azo dyes and formaldehyde that are used in textile processing pose a risk to the environment. To address this, textile chemical manufacturers are investing in R&D and striving to develop green products that are environmentally sustainable. Producers of textile chemicals are also stressing upon the use of bio-auxiliaries and alternate environment-friendly materials to curb the overall pollutant concentration.

The Indian textile chemicals industry is a major consumer of water and energy. The use of novel textile processing techniques such as beck dyeing modification, dye bath reuse, close cycle textile dyeing, foam process, mach nozzle fabric drying, and ink and film application can reduce water and energy consumption in the textile chemicals industry.

Launch of ‘Technology Mission' for Textiles by Government of India Encourages Entry of New Players

The India textile chemicals industry is witnessing a sea of change in terms of product innovation. Top players in the India textile chemicals market such as Clariant and Huntsman and BASF are striving for the development of eco-friendly products as well as high-end products that impart functional properties to textiles. These companies are extensively utilising bio-auxiliaries and other eco-friendly chemicals to curb the overall pollution caused by textile processing plants. Other than this, product manufacturers are implementing functional solutions such as negative ion therapy, anti-microbial effect, novel effect, and stain releases.

In this regard, the Government of India has introduced ‘Technological Mission' in the bid to encourage new players to participate in the technical textiles industry and allied industries. The programme aims to educate new players and share knowledge about technical textiles.

Apparel, home furnishing/textiles, and industrial textiles are the major end users of textile chemicals. Among these, apparel accounts for the largest share owing to the increasing demand for fashionable and eco-friendly products. The expeditious growth of the apparel industry is a major factor supporting the growth of the India textile chemicals market.

The information presented here is sourced from Future Market Insights latest report on the Asia Textile Chemicals Market. A free sample of this report is available upon request.

(Ref. https://www.oilvoice.com/Press/2224/India-A-Lucrative-Market-for-Textile-Chemicals?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+OilvoiceHeadlines+(OilVoice+Headlines) dated 15.2.2017)

|

|

BACK |

INDIA ON COLLISION COURSE WITH EU OVER TRADE TREATY

|

| European trade commissioner Cecilia Malmström had proposed EU and India first negotiate a bilateral investment treaty before they restart talks for the free trade agreement. Photo: Reuters

|

| |

New Delhi: As India’s 31 March deadline to unilaterally terminate all existing investment treaties with partner countries draws closer, New Delhi is likely to reject an offer from the European Union (EU) to start negotiations for a stand-alone bilateral investment treaty (BIT) while negotiations for the comprehensive bilateral trade and investment agreement (BTIA) remain in limbo.

European trade commissioner Cecilia Malmström, in a meeting with commerce minister Nirmala Sitharaman on the sidelines of the World Economic Forum at Davos last month, had proposed EU and India first negotiate a BIT before they restart talks for the free trade agreement (FTA).

India wants to follow the middle path and sign a toned-down version of BTIA which would include an investment chapter and leave aside contentious issues for the time being. However, EU hasn’t agreed to the offer so far.

“Once we have started the process of negotiation for a comprehensive trade and investment treaty, our policy is that we can only do it as part of BTIA. Last July, we had offered EU to do an early harvest of BTIA; they have not responded or accepted it so far. If they want to go for comprehensive BTIA, we have also expressed our willingness to restart negotiations. The ball is in EU’s court, not in our court,” a commerce ministry official said speaking under condition of anonymity.

“They knew existing investment treaties are coming to an end two years back; so now, it is up to them how they want to take it forward. We have acted in a transparent manner in this matter and have given countries enough time to restart negotiations for fresh BITs. They can still allow individual EU countries to sign BITs with India and we have conveyed it to them. But it is their policy problem that they don’t allow it,” the official added.

India is looking at a situation where it may not have a bilateral investment treaty with a large number of countries, including those in the EU, on 1 April 2017.

It would unilaterally terminate all such existing treaties on 31 March, having given one year’s time to countries to renegotiate the treaties based on the model Bilateral Investment Treaty (BIT) passed by the cabinet.

India brought out a new model BIT in December 2015, intending to replace its existing Bilateral Investment Promotion and Protection Agreements (BIPAs) and future investment treaties, after being dragged into international arbitration by foreign investors who sued for discrimination, citing commitments made by India to other countries in bilateral treaties.

The model BIT approved by the cabinet excludes matters relating to taxation. Controversial clauses such as most favoured nation (MFN) have been dropped while the scope of national treatment, and fair and equitable treatment clauses, have been considerably narrowed down.

In the recent past, many multinationals including Vodafone Group Plc and Sistema have dragged India to international arbitration, citing treaty violations. In the case of White Industries versus the government of India, for instance, the Australian investor cited a favourable substantive MFN provision in the India-Kuwait BIT that it said was absent in the India-Australia BIT. The Australian company, which argued for including the provision in the India-Australia BIT, won the case in 2012.

India has served termination notices to as many as 57 countries, including European nations, with whom the initial term of the treaty has either expired or will expire soon.

Geoffrey Van Orden, a member of the European Parliament and part of the European parliamentarians currently visiting India, told reporters on Monday the EU has said it would be very helpful if India could extend the existing BIPAs for six months to enable new mechanisms to be put in place.

“The EU has consistently wanted to have an ambitious agreement whereas I think on the Indian side, there’s more of an aim towards picking and choosing. I think we need to work hard if we agree to a FTA; it would do enormous good to both sides,” he added.

(Ref. http://www.livemint.com/Politics/UKLWUwDn33uBuwRrmBRE5M/India-on-collision-course-with-EU-over-trade-treaty.html dated 21.02.2017)

|

|

BACK |

EU WANTS BILATERAL INVESTMENT TREATIES EXTENDED BUT INDIA NOT KEEN

|

NEW DELHI: The EU wants India to extend the bilateral investment treaties with individual countries for six months, but it is unlikely India would do so.

"The termination of bilateral investment treaties by India is a problem. We, would like it to be extended by six months, and right now it is a hurdle in the FTA discussions" said Geoffrey van Orden, Chair of the European Parliament delegation for relations with India on Monday. "The EU wants an ambitious trade agreement, but India wants to pick and choose."

The EU parliamentarians added they would urge the Indian government to look more closely at the recently-concluded EU-Canada agreement - which has addressed the issue of arbitration and dispute settlement that India had objected to, moving it to a bilateral, public forum.

While the India-EU Free Trade Agreement talks continue to be in a slump+ , India's decision in July 2016 to put 83 bilateral investment treaties with different countries on notice would impact investment decisions from major European countries. The EU delegation, comprising among others, Jakob von Weisacker, AlojzPeterle, Cora van Neuwenhuzen and Neena Gill, met commerce minister Nirmala Sitharaman, energy minister Piyush Goyal and minister of state for external affairs V K Singh.

The India-Netherlands BIT lapsed in December 2016, and those with France and Germany among others will expire from March onwards. India put out a model BIT text in 2015, and wants this to be incorporated into the FTA with EU. The EU, on the other hand, wants the current BITs to be extended until the FTA talks restart, largely because, as they say, individual European countries don't have the power to negotiate individually.

The EU-India FTA, whose discussions started in 2007, continues to labour under numerous problems - the differences, over the years, have been pared down to some key ones, like services and automotives. It was expected that PM Modi's visit to Brussels in 2015 would give a fillip to the discussions. But apart from some informal talks and exchange of notes, there has been little movement.

Brexit was also believed to impact the EU-India FTA talks, because UK was the main opposition to India's demand on services. But, as Neuwenhuzen said, the upcoming elections in several key European countries later this year, from Netherlands to France and Germany, might impact their negotiating positions as well. Weisacker said, "Both in EU and India there could be shared interests to overcome differences in backdrop of US desire to walk away from multilateral trading."

India's decision to scrap the BITs will not have any immediate effect, because all existing investments would continue to be protected for anything between 10-15 years. New investments however, might be affected.

(Ref. http://timesofindia.indiatimes.com/india/eu-wants-bilateral-investment-treaties-extended-but-india-not-keen/articleshow/57262580.cms dated 21.02.2017)

|

|

BACK |

EUROPE KEEN ON RESUMING TRADE TALKS

|

| Warning that the impasse in the India-European Union free trade negotiations could also hurt investment into India, the Members of the European Parliament “Delegation for Relations with India” urged the government to consider a six-month extension of bilateral investment treaties until the FTA or the comprehensive BTIA (Bilateral Trade and Investment Agreement) negotiations are restarted.

|

| |

The delegation, one of three with senior officials from the EU and European Parliament visiting India this week, met Finance Minister ArunJaitley and Commerce Minister Nirmala Sitharaman to discuss their concerns.

Nearly 11 months after Prime Minister Narendra Modi visited Brussels and spoke about the issue, EU diplomats say there has been no movement on the BTIA/FTA talks that were suspended in 2013 after 16 rounds of negotiation.

“One of the problems is the termination of the bilateral investment treaties by India. The European Union is saying, it would be very helpful if they could consider extending these by at least about six months to enable new mechanisms to be put in place,” said Member of the European Parliament (MEP) Geoffery Van Orden, speaking to journalists in Delhi.

Need for urgency

The officials said there was a need for a “greater sense of urgency”, given that BITs with most EU countries would lapse within the first half of 2017. The Bilateral investment treaty with The Netherlands, a country that is home to the second largest population of people of Indian origin in Europe, after the UK, lapsed on November 30, and the rest are expected to follow shortly.

“We are hoping for at least an extension. Even Indians settled in the Netherlands are concerned about the trade relationship, so as soon as possible we would like to see the negotiations restarted,” said the member from the Netherlands, Cora Van Nieuwenhuizen.

Amongst the other arguments put forth by the delegation were that businesses in their countries would like to invest in India only once the government “guarantees” the process in India, which would follow the conclusion of the BTIA.

However, while the EU is keen for either negotiations to be started as soon as possible, Minister of State for Commerce and Industry Nirmala Seetharaman is understood to have conveyed that both negotiations should be taken up together. Insurance costs would also increase significantly in the absence of the agreements.

The MEPs also pointed out that in the wake of US President Trump’s decision to pull out of the Trans Pacific Partnership (TPP) with Asian countries and leave the Transatlantic Trade and Investment Partnership (TIPP) in limbo should worry India as well.

Apart from the BTIA, the MEPs said they were also concerned by “growing violence in Jammu and Kashmir” that was “hampering better ties between India and Pakistan”.

British MEP Mr. Orden also warned that many Human rights agencies had been enlisted by “apologists for terrorism”, adding that both at the EU and in the European parliament, “groups were trying again to work up the J&K issue,” in a reply to a specific question about the Universal Periodic Review of India at the Human Rights Council on May 4th, but clarified that he was not speaking for the European parliament, which in December 2016 raised Human rights concerns on Dalit issues.

(Ref. http://www.thehindu.com/news/national/Europe-keen-on-resuming-trade-talks/article17336098.ece dated 21.02.2017)

|

|

BACK |

AS FTA HANGS FIRE, EU WANTS INDIA TO EXTEND INVESTMENT PACTS

|

| Geoffrey Van Orden, European Union Parliamentarian |

| |

NEW DELHI, FEBRUARY 20:

The European Union (EU) has urged India to extend the Bilateral Investment Treaties (BITs), which it has with the member countries, by at least six months beyond March 31 in order to sustain the steady flow of investments from that region into the country.

“It will be helpful if the BITs can be extended for six months. This has become a particular problem within the FTA (Free Trade Agreement) talks … But we want India to first give us the extension. We are meeting Commerce Minister Nirmala Sitharaman and this will be one of the elements that we intend to take up,” said Geoffrey Van Orden, Chair of The European Parliament Delegation for relations with India, here on Monday.

Van Orden is leading a delegation of European Parliamentarians who are on a five-day visit to India. Besides Sitharaman, the delegation will be meeting Finance Minister ArunJailtey, Minister of State for External Affairs VK Singh and the Minister of Power, Coal and Mines Piyush Goyal.

The EU has been engaging with India on this issue for several months now as it intends to negotiate a single comprehensive BIT with India instead of separate ones with each member countries.

Last month, the Commerce Minister categorically stated that India will not give extensions and all old BITs will be cancelled by March 31. According to Sitharaman, these countries were given period of one year to renegotiate the new BITs but since they did not do it, the government will have to let them lapse.

In the absence of a BIT, fresh investments coming from European nations will not have legal protection.

According to EU, it was not feasible for these countries to negotiate the BITs because now only European Commission will be negotiating the BIT on behalf of the 23-member countries.

“Many foreign investors of EU are now asking for guarantees. A number of European companies who are looking at India to invest are now seeking some kind of assurance,” said EU Ambassador to India Tomasz Kozlowski.

The first BIT to lapse was the one between India and the Netherlands. The remaining are slated to expire in March, April and May.

At present India has 83 BITs that were inked since 1994, out of which 57 countries were sent termination reminders last year, including the EU nations. They were asked to negotiate a new BIT based on the new text the Cabinet had approved in December 2015.

India felt the necessity to revise all the BITs as it was being dragged to courts by a number of international firms. India became the topmost country in the world that was being sued maximum number of times, according to UNCTAD.

FTA talks to resume?

Meanwhile, the EU has said there is now a “will” to move forward in the negotiations for having a free trade agreement (FTA), or Bilateral Trade and Investment Agreement (BTIA) as it is officially called, with India.

However, according to Van Orden, there are several technical problems that continue to be stumbling blocks in resuming the talks, apart from the BIT issue.

(Ref. http://www.thehindubusinessline.com/economy/policy/as-fta-hangs-fire-eu-wants-india-to-extend-investment-pacts/article9552228.ece dated 21.02.2017)

|

|

BACK |

INDIA SHOULD NOT LET EUROPE UNDERMINE ITS NEW BIT AND TRIPS FLEXIBILITIES FOR MEDICINES

|

In the process of moving to a new approach to international investment law and dispute settlement, India has elaborated a model BIT (Bilateral Investment Treaty) that differs significantly from older agreements. It is much more balanced between investor interests and those of legitimate public policy. The model BIT, for instance, contains a tightly-drafted general exceptions clause like that of GATT Article XX, safeguarding key policy objectives like health and the environment. Compensation for expropriation may be less than full market value, to take into account policy considerations like environmental impacts. And anti-corruption and corporate responsibility obligations are imposed on investors, making this one of the first models for an investment agreement to be genuinely not one-sided; typically investment agreements impose burdens on states without any corresponding responsibilities on corporations, hardly an equitable state of affairs.

There is also in India’s model a robust exhaustion of local remedies provision: while exhaustion seems like a step back to the anachronistic world of diplomatic espousal, it is an arguably justified response to the way in which arbitrators have unpredictably expanded jurisdiction. The arbitrators constitute a small elite of lawyers dominated by West European males, who also act as counsel in cases on related matters, an egregious conflict of interest uncontrolled by arbitration rules. Arbitrators have allowed businesses to bring claims where the companies have reorganised on paper their corporate structure to fall within a particular treaty even without any real contact to that jurisdiction (the so-called “Dutch Sandwich”). They have facilitated end-runs around contractually-limited investor protection by elevating contractual claims into treaty violations (sometimes through expansive readings of “umbrella clauses” with vague aspirational language, suggesting a host state must honour all commitments to investors). They have even sometimes defined investors to include secondary market purchasers of sovereign bonds from holdouts in sovereign debt restructurings, who have nothing to do with the host country. It is a challenge to rein in such expansion of jurisdiction by arbitrator creativity, since arbitrators are judges for hire, and when they grant jurisdiction they get paid handsomely to hear the case. Exhaustion of local remedies seems an old-fashioned and blunt instrument, but it has the advantage of not being easy for arbitrators to interpret away.

In the transition to its new approach to investor protection, India has sought to terminate its existing BITs with individual European Union members. Now the European Commission is pressuring India to extend those existing treaties, which don’t have the safeguards of the new approach outlined above, for six months. India should not fall for this move, which would undermine significantly its negotiating power to get its economic partners to agree to new treaties based on the 2016 model BIT. The six-month extension would give European companies an opportunity to get in under the old regime, giving them 10 years’ or more protection, based on treaty norms that India has now determined are not in its national interests. Any company organised so as to be considered a national of any EU state that had an old BIT with India (including those exploiting the “Dutch sandwich” assuming that the Netherlands treaty—already expired—is included in the request for extension) could use the six-month window to engage in the de minimus level of economic activity to qualify as an investor or investment under the old agreements, and then depending on the treaty they would be guaranteed 10 to 15 years’ of protection. Having allowed practically any company with the legal resources to figure out how to qualify as an investor or investment of some EU country under one of the old treaties to lock in 10 to 15 years’ protection under the old standard (if this is really what the Commission is proposing for the extension), India will have little leverage to bring the EU to agreement on its new approach. The EU can resist India’s new, much more balanced approach, knowing its companies have used the six-month window to protect themselves under the old treaties.

It is a challenge to rein in expansion of jurisdiction by arbitrator creativity, since arbitrators are judges for hire, and when they grant jurisdiction they get paid handsomely to hear the case. Exhaustion of local remedies seems an old-fashioned and blunt instrument, but it has the advantage of not being easy for arbitrators to interpret away.

There is a certain irony in the Commission’s request because post-Lisbon it has sought generally the termination of investment agreements between individual EU member states and other states, in order to align member state practice with the shift in competence over investment from the member states to the EU level, as set out in the Lisbon treaty. Here the Commission proposal for extension is frustrating its own policy of a timely and efficient transition to the exercise of EU-level competence.

In the context of negotiating a Free Trade Agreement, the EU is also pressuring India to give up flexibilities it has a right to under the World Trade Organization intellectual property agreement (TRIPs). The EU’s demand that the data of patent medicine makers not be freely available for use in regulatory approvals for generic medicines is a way of significantly increasing costs to India’s efficient generic pharmaceutical industry—an industry which allows for the supply of affordable drugs not on in India but in many other places in the developing world. This would undermine the effectiveness of the right to compulsory licence, guaranteed to WTO members in TRIPs. Further, the EU is demanding that patent protection be extended beyond the period of 20 years required under TRIPs. There is no principled basis for these demands—they simply reflect Europe’s drug lobby. The social impact is a negative one—higher prices for consumers.

With Brexit and a US administration that is openly hostile to the EU integration project, Brussels is increasingly embattled as a global economic player. It is in no position to push around a major trading partner and dynamic world economic power like India. There may be a residual colonial attitude in some European negotiators. But it ill-fits the geopolitical and economic realities that the EU must face today. India would be selling itself short by not holding firm.

On the other hand, where Brussels is on more principled ground is in its effort to abolish the existing system of investment arbitration under BITs and replace it with a genuine multilateral court. This proposal deserves a closer look from India. Impartial judges well qualified in public law and compensated mostly through a fixed salary would be a big improvement over commercial lawyers and entrepreneurial academics who engage in arbitration as a route to personal wealth. A multilateral court might not only hold states to account, but also impose social and environmental responsibility on investors, as India’s own cutting-edge BIT rightly does. Indeed, the multilateral court proposal as articulated by the EU and Canada would allow India to keep the substance of its own model BIT, while taking advantage of the new tribunal.

Robert Howse is Lloyd C. Nelson Professor of International Law at New York University. He is a member of the American Bar Association Investment Treaty Working Group. This op-ed is an expanded and revised version of a post on the International Economic Law and Policy Blog.

(Ref. http://www.sundayguardianlive.com/opinion/8516-india-should-not-let-europe-undermine-its-new-bit-and-trips-flexibilities-medicines DATED 25.022017)

|

|

BACK |

Emulsifiers: Micro Technology with Macro Effect

|

EMULSIFIERS: MICRO TECHNOLOGY WITH MACRO EFFECT

Introduction

Water and oil, when mixed together and vigorously shaken, form a dispersion of oil droplets in water. Once the shaking stops, the phases start to separate. However, when an emulsifier is added to the system, the droplets remain dispersed, and a stable emulsion is obtained.

An emulsifier consists of a water-loving hydrophilic head and an oil-loving hydrophobic tail. The hydrophilic head is directed to the aqueous phase and the hydrophobic tail to the oil phase. The emulsifier positions itself at the oil/water or air/water interface, and has a stabilizing effect on the emulsion by reducing the surface tension.

Major Applications

• Food Industry: An emulsifier is well known in the food industry for its emulsifying effects, where it serves various functions. Following are some examples of the use of emulsifiers in the food industry:

- Modifies oil crystal and prevents water spattering in cooking

- Destroys emulsion to stabilize foam and to make smooth texture in ice cream, and keeps its shape

- Reacts with proteins to make a smooth easy-rising dough in bread

- Acts on starch to make bread soft

• Personal Care Industry: Emulsifiers are an important category of surfactants for personal care applications. They are essential in the production of creams and lotions. Emulsifiers enable oil and water/aqueous components to mix and remain stable over a long period of time. Choosing an optimum emulsifier system helps create evenly dispersed, small droplets, thus providing kinetic stability and an elegant texture, skin feel and appearance to creams and lotions. Typically, emulsions have a milky white, opaque appearance due to the type and level of emulsifiers used; however, there are microemulsions that appear clear or transparent to the human eye. These are

Article Mordor Intelligence

Emulsifiers

used in specialized applications, such as enhancing skin permeation of active substances. Emulsifiers often impart a specific texture or sensory aspect to the end product, so their selection is important for marketing appeal as well as technical aspects.

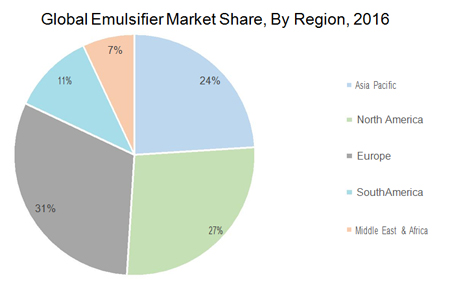

Current Market Scenario

The global emulsifiers market is expected to grow at a CAGR of 5.28% between 2016 and 2021. Factors contributing to the market growth include increasing popularity of natural emulsifiers and growing usage of emulsifiers in personal care products and the food & beverage industry. Technological advancements within the food processing industry are expected to further boost the market growth. Factors such as increasing demand for packaged food, escalating income levels and availability of packaged functional foods are boosting the demand for emulsifiers. However, consolidation within the food additive industry is expected to restrain the market growth.

Among all the products, lecithin represents the largest share in the emulsifiers market. Lecithin is used widely in feed, food, nutritional supplements and cosmetics. The United States represents the largest market worldwide, whereas Asia-Pacific is projected to grow at the highest CAGR due to sustained demand for natural emulsifiers.

Some of the key players in the emulsifiers market include Cargill Inc., Lonza Group, BASF, AAK Bakery Services Ltd., DSM Nutritional Products, DuPont, Lubrizol Advanced Material, Danisco A/S, Archer Daniels Midland Company, Dow Corning Corporation, Palsgaard A/S, Stepan Company, and Kerry Group.

Recent Developments

Emulsions are a fundamental product form for many cosmetic categories, which involves careful selection of optimum emulsifier systems. Cosmetic science has progressed a long way and at present there is a trend towards liquid crystal structures and emulsifiers that are acceptable and usable to manufacture certified natural cosmetics.

- Alfa Chemicals worked on emulsifier technology and developed an emulsifier with a trade name of Sucragel AOF BIO, which is a natural liquid emulsifier based on sucrose laurate. It can be used in the oil phase as a co-emulsifier for creams and lotions. It can also be used to gel oils, which can then in turn be diluted with water to form a fine sprayable emulsion.

- Azeis Personal Care developed emulsifier-based products, such as BlanovaMuls GMSC, BlanovaMuls Eco 77, and BlanovaMuls Eco 2277 Eco, among others. For example, BlanovaMuls GMSC is glyceryl stearate citrate based emulsifier, which is used to emulsify high amounts of oil. It is particularly suitable for the production of sprayable emulsions.

- Croda’s new product formulations based on emulsifier technology include Arlacel 1690, Arlacel 2121, NatraGem E145 and NaturGem E140. These products are developed in order to cater to the growing demand from the cosmetic industry. For example, NatraGem E145 is a natural emulsifier, which is compatible with both low and high polarity oils with excellent electrolyte, pH and temperature tolerances.

- Dow Corning developed DC ES-5612 Formulation Aid, which is a silicone emulsifier designed to prepare low viscosity water-in-silicone and water-in-oil emulsions.

Article Mordor Intelligence

Emulsifiers

Costs