Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-exporters,

I have pleasure to bring to you the 12th issue of the CHEMEXCIL e-Bulletin for the month of April 2017, which contains the following activities undertaken by the Council and other useful information/Notifications, etc.

- Brief Report on CHEMEXCIL’s participation in the China Interdye 2017 Exhibition.

- EDPMS Caution Listing- The Council has once again represented to RBI for additional time to exporters to follow-up with their AD’s and clear the entries in EDPMS system. RBI has granted further Temporary exemption to exporters whose IE codes are appearing in caution-list in EDPMS up-to May 20, 2017 to clear the entries in the system. Members are requested to take note of this temporary exemption up-to 20th May 2017 and do the needful within the timelines. (Please see the circular dated 28th April 2017.)

I hope that you would find the newsletter informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions so as to enable us to improve this e-bulletin further.

With regards,

SHRI SATISH W. WAGH

Chairman,

CHEMEXCIL

|

BACK |

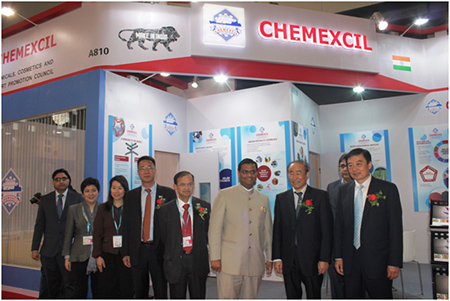

Brief Report on CHEMEXCIL’s participation in the China Interdye 2017 Exhibition

The 17th China Interdye Exhibition 2017 was a premier show for Dyes and Dye Intermediates, Pigments and Textile Chemical industry which was held at Shanghai World Expo Exhibition & Convention Centre (SWEECC), Shanghai, CHINA from 12th -14th April 2017.

It is an annual exhibition organized jointly by the China Dyestuff Industry Association, China Dyeing and Printing Association and China Council for the Promotion of International Trade, Shanghai Sub-Council. The co-organiser of this exhibition was Shanghai International Exhibition Service Co., Ltd.It was held concurrently with 2017 China International Digital Textile Printing and Dyeing Automatics Exhibition to create a one-step sourcing platform for textile printing and dyeing Industry.

The profile of exhibits included Dyestuffs, Whitening agents, Intermediates, Auxiliaries, Pigments, Textile Chemicals and Instruments &equipments. The exhibition occupied an area of 40,000-square meter and was held in two Halls namely Hall 1 & 2 of SWEECC.

CHEMEXCIL in synergy with SHEFEXIL had organised an India Pavilion which was spread over an area of 1660 sq m in the Hall 1 with 106 member-companies of CHEMEXCIL and 12 member-companies of SHEFEXIL participating in it. There were 3 member-companies of CHEMEXCIL who participated through catalogue display and advertisement in the catalogue. The India pavilion was inaugurated by His Excellency Shri Prakash Gupta, Consul GeneralofIndia to Shanghai who also visited the India Pavilion and interacted with the exhibitors.

The show was attended by more than 620 domestic and overseas exhibitors from different Countries and regions. The exhibitors profile can be categorised as Dyestuffs, Auxiliaries, Intermediates, textile chemicals, dyestuff pigments and organic pigments. The exhibition provided an excellent opportunity to the Indian manufacturers/ exporters to showcase their products and interact with the prospective buyers of the dyes and dyestuff industry ona commonplatform for expansion of their business in International marketplace.

| GLIMPSES OF THE CHINA INTERDYE EXHIBITION 2017 |

|

| Inauguration of the India Pavillion at the China Interdye 2017 Exhibition with the hands of H.E. Shri Prakash Gupta, Hon'ble Consul General of India, Shanghai alongwith Mr Shousheng Li, Chairman ofChina Petroleum and Chemical Industry Federation, Shri Sunil Ranjan, Deputy Secretary, Ministry of Commerce, Govt of India, Shri Ajay Kadakia, Vice Chairman, CHEMEXCIL and Shri S G Bharadi, Executive Director, CHEMEXCIL |

| |

|

| Shri Ajay Kadakia, Vice Chairman, CHEMEXCIL felicitating H.E. Shri Prakash Gupta, Hon'ble Consul General of India, Shanghai |

| |

|

| Shri S G Bharadi, Executive Director, CHEMEXCIL welcoming Mr Shousheng Li, Chairman of China Petroleum and Chemical Industry Federation |

| |

|

| Indian and Chinese Dignitaries at the CHEMEXCIL stall at the China Interdye Exhibition 2017 |

| |

|

| Indian at Chinese dignitaries visit the stalls of members in the India Pavillion |

| |

|

| |

|

| CHEMEXCIL's Stall at the China Interdye Exhibition 2017 |

BACK |

EDPMS Caution Listing - Temporary exemption to exporters whose IE codes are appearing in caution-list in EDPMS up-to May 20, 2017 to clear the entries in the system

| EPC/LIC/EDPMS/EXTENSION |

28th April, 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Suggestions on All Industry rates of Duty

Drawback under GST Framework |

|

Dear Members,

This is further to our earlier circular regarding EDPMS caution listing of exporters and feed-back on issues faced, if any.

Based on the feed-back received, the council had taken up the matter with the Reserve Bank of India and an extension up-to 20th April 2017 was granted. However, council has received further representations that despite extension, the entries are still not cleared in EDPMS and banks are not handling the shipping documents. Subsequently, council has once again represented to RBI for additional time to exporters to follow-up with their AD’s and clear the entries in EDPMS system.

Taking cognizance of the representations from the Trade & Industry, RBI has granted further temporary exemption to exporters whose IE codes are appearing in caution-list in EDPMS up-toMay 20, 2017 to clear the entries in the system.

As per communication received from The Chief General Manager, Reserve Bank of India

Foreign Exchange Department, Central Office, Mumbai, the extension will be operationalized as under:

For any exporter, if the outstanding export bills’ amount is up-to 20 per cent of total export bills or the number of open export bills is up-to 10 as indicated in the caution list appearing in EDPMS site, then AD banks should not treat such exporters as caution listed till May 20, 2017 subject to satisfaction of the AD based on following documentary evidence:

(i) The exporter has declared that the export proceeds have been realized in full for the export bills lying open in EDPMS and eBRC has been issued by bank/s and necessary reconciliation will be completed within 15 days.

(ii) In cases where the bills are not realized / partially realized, then the exporter should have submitted request to AD/s for (a) extension of time for realization of export bills and / or (b) request to AD/s for write off of export bills (fully or partially, as the case may be).

(iii)Request for cancellation of shipping bill has been submitted by the exporter to the Customs.

2. Exporters not falling within above category i.e. the outstanding export bills’ amount is more than 20 per cent of total export bills and the number of open export bills is more 10 shall have to obtain requisite approval from RBI.

3. It is clarified that:

i. Export bills for ‘free of cost’ exports having requisite indicator of Customs do not lead to caution listing

ii.Export bills in respect of goods reimported on account of quality issues or other reasons are required to be lodged and closed in EDPMS by providing necessary details.”

Members are requested to take note of this temporary exemption up-to 20th May 2017 and do the needful within the timelines. In case issues still persist, please write to us on Deepak.gupta@chemexcil.gov.in and info@chemexcil.gov.in .

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

SCOMET: New Notifications/ Public Notices issued by DGFT

| EPC/LIC/SCOMET |

26th April 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

SCOMET: New Notifications/ Public Notices issued by DGFT |

|

Dear Members,

We would like to inform you that O/o DGFT, New Delhi has issued several new Notifications/ Public Notices recently regarding SCOMET items.

As you are aware, in India the export of dual-use items are regulated by Director General of Foreign Trade (DGFT). The products under regulations and license are given the acronym “SCOMET” - which stands for - Special Chemicals, Organisms, Materials, Equipment and Technologies.

The details of the new Notifications/ Public Notices issued recently regarding SCOMET items are as follows:

Members are requested to take note of the same. For further information, you may download above said Notification/ PN using below link-

http://dgft.gov.in/exim/2000/scomet/2017/scomet2017.htm

Thanking You,

Yours faithfully,

S.G. Bharadi

Executive Director

CHEMEXCIL

|

|

BACK

|

EU-GSP - Inclusion of details/ clarifications on the Certification of Origin of Goods for EU-GSP - as notified vide Public Notice No.51 dated 30.12.2016

| EPC/LIC/EU-GSP |

18/04/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

EU-GSP - Inclusion of details/ clarifications on the Certification of Origin of Goods for EU-GSP - as notified vide Public Notice No.51 dated 30.12.2016 |

|

Dear Members,

As you are aware, Registered Exporter System (REX) was introduced under EU GSP vide PN no 51 dated 30/12/2016. This was informed to you by the council vide its circular dated 02/01/2017.

However, we understand that in subsequent period of operation various requests have been received by O/o DGFT for issuing clarifications on documentation, local users, link for pre-registration etc.

Taking cognizance of the requests from trade & industry, O/o DGFT has now issued Trade Notice no 03/2018 dated 17/04/2017 having various details/ clarifications along with updated list of local users for registration and other concerned agencies.

Members are requested to take note of the same and for further details, members may download the Trade Notice no 03/2018 dated 17/04/2017 using below link:

http://dgft.gov.in/Exim/2000/TN/TN17/TN0318.pdf

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

RBI : Draft guidelines for Simplified Hedging Facility

| EPC/LIC/RBI-HEDGING/DRAFT |

17th April 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

RBI : Draft guidelines for Simplified Hedging Facility |

|

Dear Members,

Kindly note that the Reserve Bank of India (RBI) has released draft guidelines on 12th April 2017 regarding Simplified Hedging Facility for Residents and Non-Residents which permits dynamic hedging of currency risk and simplifies the procedure involved in booking hedge contracts up-to USD 30 million.

For further details and operational guidelines, members may download the draft document using below link-

https://rbi.org.in/Scripts/bs_viewcontent.aspx?Id=3337

Further, in case of any comments/ suggestions, you may write to following RBI personnel by May 05, 2017 under copy to the Council:

The Chief General Manager

Reserve Bank of India

Financial Markets Regulation Department

Central Office

Fort, Mumbai-400 001

E-mail- fmrdfx@rbi.org.in

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl : HEDGING120420171073

|

|

BACK

|

DTA clearance of goods procured by EOUs/EHTP/STP units from indigenous sources – charging of Duty

| EPC/LIC/EOU's |

11th April 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DTA clearance of goods procured by EOUs/EHTP/STP units from indigenous sources – charging of Duty |

|

Dear Members,

We would like to inform you that Central Board of Excise & Customs has issued Circular No. 13/2017-Cus dated 10th April 2017 regarding charging of appropriate duty on DTA clearance of goods procured by EOUs/EHTP/STP units from indigenous sources.

Attention is drawn to Circular No.74/2001-Cus dated 04.12.2001 whereby it was clarified that in case raw materials/ capital goods etc., procured from indigenous sources by EOUs/EPZ/SEZ/EHTP/STP units are transferred/ sold back to DTA except for the purpose of replacement, the deemed export benefits already availed of against such goods shall be required to be refunded back and that the export benefits shall be deposited through TR in the designated bank. It was further clarified that the goods will be allowed to be cleared to DTA only on production of a certificate from the jurisdictional Development Commissioner to the effect that such deemed export benefits are paid back. In cases, where no deemed benefits were availed, a certificate to this effect from the jurisdictional Development Commissioner shall be produced. Only after production of such certificate, these raw materials/capital goods could be cleared on payment of appropriate central excise duty. However, issues were raised by Trade & Industry as many units might have shifted, closed down their activities, de-bonded etc.

Subsequently, an amendment was made to the Notification No.23/2003-CE dated 31.03.2003 vide Notification No.29/2007-CE dated 06.07.2007 whereby an ‘Explanation’ was added to the principal notification stating that “goods received from Domestic Tariff Area under the benefits of deemed exports under Paragraph 8.3(a) and (b) of the Foreign Trade Policy shall be treated as imported goods.” This amendment was made for the purpose of levy of duty on goods manufactured by such procured raw material so as not to treat them at par with goods manufactured out of wholly indigenous material.

However, field formations were still insisting on production of a certificate from the Development Commissioner as required under Circular no. 74/2001-Cus dated 04-12-2001 even after payment of applicable Customs Duties on clearance of capital goods procured from DTA by EOU/STP/EHTP units were deemed export benefits have been availed.

In this regard, CBEC has now issued Circular No. 13/2017-Cus dated 10th April 2017 and clarified that the indigenous goods supplied to the EOUs/EPZ/SEZ/EHTP/STP units after availing the deemed export benefits are to be treated as ‘imported goods’ and accordingly, duty as applicable to the imported goods is liable to be paid. Once the goods are treated as imported goods and applicable Customs Duty is paid at the time of their transfer/sale back into DTA or exit, there is no requirement of refund of the deemed export benefits availed on such goods or for the production of a certificate from the Development Commissioner regarding refund or non-availment of deemed export benefits at the time of clearance of such goods or exit.

Members are requested to take note of the same and for additional information, may download the Circular No. 13/2017-Cus dated 10th April 2017 using below link:

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/circ13-2017cs.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

http://chemexcil.in/uploads/tbts/circ13-2017cs(EOU).pdf

|

|

BACK

|

SOLAS VGM: ODeX- Electronic VGM Submission by DGS Deadline of 31st March 2017

| EPC/LIC/VGM-SOLAS |

4TH April 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

SOLAS VGM: ODeX- Electronic VGM Submission by DGS Deadline of 31st March 2017 |

|

Dear Members,

This is in continuation of our earlier mailers regarding implementation of SOLAS Convention guidelines concerning verified gross mass of the container.

You might be aware that as per the SOLAS guidelines from The Directorate of Shipping, the verified Gross Mass has to be electronically transmitted from theWeighbridge/Weighing appliance to the Dedicated secure websites like ODeX. This VGM data will then be electronically transferred to the master of the Vessel via the Dedicated Secure website.

Further, as per MS.Notice.15 released on 29th Nov 2016, the Directorate had suggested pragmatic approach till 31stMarch 2017. However, we understand that Shippers/Exporters/Trade are not supposed to submit VGM Declaration manually after 31st March 2017. Submission of VGM to the master of the vessel will only be permitted for VGM data transmitted electronically from an ODeX registered weighbridges post 31st March 2017. This will hold true for all VGM submitted to the Liners.

As per the SOLAS guidelines framed by IMO & regulations of D.G Shipping, VGM compliance is the primary responsibility of the Shipper. It is thus necessary to complete the registration for all Shippers (whose name appears on the Master B/L).

We hope you have done the needful within the deadline of 31st March 2017 to comply with VGM Solas requirements.

In case you are facing any issues (specially related to non-registration of Weighbridge/Weighing appliance which you are using present), please revert at the earliest with full details on our e-mail id’s- ed@chemexcil.gov.in & Deepak.gupta@chemexcil.gov.in .

Your early replies will be appreciated and also enable us take up further with concerned authorities, if needed, in case of industry-wide issue.

Thanking You,

Yours faithfully,

Satish Wagh

Chairman

CHEMEXCIL

|

|

BACK

|

Direct Port Delivery (DPD) and Direct Port Export (DPE)- Compilation of Public Notices issued by JNCH/ FAQ’s on DPD

| EPC/LIC/JNCH |

3rd April 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Direct Port Delivery (DPD) and Direct Port Export (DPE)- Compilation of Public Notices issued by JNCH/ FAQ’s on DPD |

|

Dear Members,

This is further to our recent mailer informing you about Jawaharlal Nehru Port Trust (JNPT), schemes like DPD (Direct Port Delivery) and DPE (Direct Port Export) for quicker clearances of imports and exports.

Since several PN’s have been issued in recent months on DPD & DPE, there have been request from various stakeholders for issue of “compilation of such Public Notices issued” for the sake of convenience.

The Jawaharlal Nehru Custom House (JNCH) has now issued such a compilation with brief about each Public Notice in tabular form.

The details are follows:

- Compilation of various Public Notices issued in relation to Direct Port Entry (DPE) Procedure:

Can be downloaded by using below link-

http://www.jawaharcustoms.gov.in/pdf/PN-2017/PN_NO_47.pdf

Compilation of various Public Notices issued in relation to DPD Procedure:

Can be downloaded by using below link-

http://www.jawaharcustoms.gov.in/pdf/PN-2017/PN_NO_45.pdf

Finally, JNCH has also issued FAQ’s on DPD, which are available on below link:

http://www.jawaharcustoms.gov.in/dpd/mobile/index.html

Members are requested to take note of the same.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

JNCH - Procedure for clearance of export cargo categorised as “Hazardous Goods”

| EPC/LIC/JNCH |

3rd April 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

JNCH - Procedure for clearance of export cargo categorised as “Hazardous Goods” |

|

Dear Members,

We would like to inform you that Jawaharlal Nehru Custom House (JNCH) has issued Public Notice No. 46/2017 dated 31/03/2017 regarding Procedure for clearance of export cargo categorised as “Hazardous Goods”.

As you are aware, “hazardous cargo” is categorized into 9 classes from 1 to 9 depending on the nature of the cargo. Analysis of the degree of danger in each class of the “hazardous cargo” reveals the health and environmental hazards in case of all classes of such substances.

Currently, containers declared to be containing Hazardous cargo are allowed Direct Port Entry without examination, even if RMS Instructions are for “Open & Examination”. It is given to understand that reason for such practice is difficulty in examination of such cargo.

However, JNCH has decided to revisit the present procedure for clearance of export cargo categorised as “Hazardous Goods”. The details of the procedures as per PN no. 46/2017 dated 31/03/2017 can be downloaded using below link:

http://www.jawaharcustoms.gov.in/pdf/PN-2017/PN_NO_46.pdf

Members are requested to take note of the same.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

Encl : http://chemexcil.in/uploads/tbts/PN_NO_46_(hAZ).pdf

|

|

BACK

|

NOTIFICATION NO. 04/2015-2020

| NOTIFICATION NO. 04/2015-2020 |

21.04.2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

NOTIFICATION NO. 04/2015-2020 |

|

S.O. (E) In exercise of the powers conferred by Section 5 of the Foreign Trade (Development and Regulation) Act, 1992, as amended , read with Para 1.02 of the Foreign Trade Policy, 2015-2020, the Central Government hereby makes the following amendments in the Foreign Trade Policy (FTP) 2015-2020 with immediate effect:

Presently, para 3.18 (a) of FTP 2015-20 reads as under:

"Duty Credit Scrip can be utilised/ debited for payment of Customs Duties in case of EO defaults for Authorisations issued under Chapters 4 and 5 of this Policy. Such utilization / usage shall be in respect of those goods which are permitted to be imported under the respective reward schemes. However, penalty / interest shall be required to be paid in cash."

After amendment the amended para 3.18 (a) of FTP 2015-20 shall read as under:

"Duty Credit Scrip can be utilised / debited for payment of Custom Duties in case of EO defaults for Authorizations issued under Chapters 4 and 5 of Foreign Trade Policy. Such utilization / usage shall be in respect of those goods which are permitted to be imported under the respective reward schemes. However, penalty / interest shall be required to be paid in cash."

Effect of this Notification: Duty Credit Scrip can be utilised /debited for payment of Custom Duties in case of EO defaults for Authorizations issued under Chapters 4 and 5 of previous FTPs as well. The Para 3.18 (a) of FTP 2015-20 has been amended to bring more clarity on the utilization of Duty Credit Scrips for payment of Customs Duties in case of EO defaults.

(A.K. Bhalla) |

|

BACK

|

CHEMICAL COMPANIES SWELL INVESTOR'S RETURNS

|

The Indian chemical industry is the 3rd largest producer in Asia and 12th in the world. Indian government recognises the chemical industry as a key growth element of the economy. In the chemical sector, 100% FDI is permissible. The government had targeted to increase the share of manufacturing in GDP to atleast 25% by 2025 (from current 16%). Further, initiatives taken by the government, like tax and import duty reduction, Make in India and relaxation of environmental norms for chemical industry, will help the chemical industry to grow. Currently, Indian chemical industry is trading at a P/E of 21x.

The chemical industry is sub divided into different categories: Chemicals, Fertilisers, Pesticides & Agrochemicals, Carbon Black and Dyes & Pigments.

We have analysed the companies who have given highest returns during last one month in different categories within the chemical industry.

In Chemicals segment, Mangalam Organics Ltd., Alufluoride Ltd., &Bhansali Engineering Polymers Ltd., have given highest returns of 49.06%, 45.32% & 45% respectively during last month.

In Fertilisers segment, National Fertilisers Ltd., Indra Industries Ltd., &Rashtriya Chemicals &Fertilisers Ltd., have given highest returns of 50.24%, 40.33% & 37.97% respectively during last month.

In Pesticides & Agrochemicals segment, Bharat Rasayan Ltd., & BASF India Ltd., have given highest returns of 23.79% & 16.97% respectively during last month.

In Carbon Black segment, Phillips Carbon Black Ltd., has given highest return of 17.12% during last month.

In Dyes & Pigments segment, Organic Coatings Ltd., &AdiRasayan Ltd., have given highest return of 23.16% & 19.74% respectively during last month.

The domestic chemical industry is expected to grow to $226 billion by 2020, Union Minister of State (independent charge) for Commerce and Industry Nirmala Sitharaman said while speaking to a leading English daily.

(Ref. https://www.dsij.in/article-details/articleid/19247/chemical-companies-swell-investors-returns.aspx dated 3.04.2017)

|

|

BACK |

THE FLIP SIDE OF ‘ONE NATION, ONE TAX’

|

India is the only large country in the world that is experiencing subnational income divergence

|

“A historic day for all of us” is how Union finance minister ArunJaitley described the passage of the goods and services tax (GST) Bill in the Lok Sabha on 29 March. “One nation, one tax” is the Union government’s slogan for GST. The implication is that uniform tax rates across all states of India will serve as a unifying force of efficiency. Replacing several hundreds of different tax rates across the 29 states of India with just five tax slabs for all goods and services will reduce friction in the movement of goods and services across state borders. This can boost economic activity and contribute substantially to gross domestic product (GDP) growth. For these reasons, the GST initiative has been justifiably acclaimed as a milestone economic reform in independent India. But there are reasons to be cautious.

GST aims to forge an economic union of India at a time when the economic disparity among the various states of India is at its peak. For the sake of “one nation, one tax”, states have sacrificed their fiscal rights. Such economic disparity combined with India’s unique political diversity renders the GST regime vulnerable to fractious demands.

India is currently experiencing a 3-3-3 paradox—the three richest states are three times richer than the three poorest states. This level of regional inequality is the highest in independent India’s history. Four states (Gujarat, Maharashtra, Tamil Nadu and Karnataka) account for as much inter-state trade as the other 25 states combined. One-fifth of all passenger cars and two-wheelers are sold in just two states—Maharashtra and Tamil Nadu. The average Tamilian earns Rs1.4 lakh per year, four times more than the average Bihari’s annual income of Rs35,000.

What is worse is that India is the only large country in the world that is experiencing subnational income divergence, i.e. the income gap between the richer and poorer states continues to widen and not shrink. The average Tamilian is 31 years old and a matriculate while the average Bihari is 19 and a primary-school dropout.

It is then evident that the policy priorities and taxation structure need to be different for these two states, in line with their economic and demographic differences. A smartphone may be considered a luxury product in Bihar but perhaps a necessity in Tamil Nadu. The GST council which gives equal representation to all states will attempt to strike a balance between such pulls and pressures. The future of GST hangs on this delicate balance, especially when inter-state economic disparity continues to widen. Recent research (see Mint, 8 February 2017: Will GST Exacerbate India’s Income Divergence? by Praveen Chakravarty and VivekDehejia) has shown that GST can potentially exacerbate regional inequality. What complicates this further in the Indian context is its unique nature of political diversity.

In 1982, the then chief minister of Tamil Nadu, M.G. Ramachandran (MGR), was able to fulfil his election promise of a midday meal scheme for all schoolchildren only by increasing taxes on all goods sold in the state. The scheme was a big success and Tamil Nadu’s literacy rate rose from 51% to 83% in two decades. Under a GST regime, such a one-time state-specific tax increase is not possible. This restricts the abilities of regional political parties to govern the state in accordance with the needs of the people of that state alone.

Nearly two-fifths of India’s GDP and one-third of the population are governed by regional political parties that have no electoral presence outside their specific states. Even after the Bharatiya Janata Party’s (BJP’s) recent landslide victory in Uttar Pradesh, more than 50 regional parties have as many legislators in state assemblies across India as do the two national parties.

Under GST, regional political parties will, for the first time, continue to have full political powers to govern their states bereft of full fiscal powers of taxation. Unlike national parties with a high-command culture, regional parties cannot easily be coerced into a “national” narrative at the risk of alienating their specific voter base. It will be a big challenge to balance the interests of a diverse set of states represented by a diverse set of political parties in the larger “national” interest on a sustained basis. Dispersed political power and stark economic disparity across states are bound to render the idea of a “one nation, one tax” even more challenging in India than in other federal economies. To be clear, this is not a criticism of GST but a plea to heed the intangible costs of GST that need to be carefully and constantly evaluated and contained. The economics of a “one nation, one tax” GST regime may be exciting to corporate India but the political economy of it can be daunting.

“One nation, one tax”, “One nation, one language”, “One nation, one election”, “One nation, one curriculum”—a “one nation” construct seems to be the cornerstone of many of the policy initiatives of the Union government, ironically headed by a prime minister who was once a staunch defender of India’s federalism as a chief minister of a state. Efficiency gains through standardization are often touted as the motivation for these policies. Such efficiency tugs at the heart of true federalism by implicitly demanding oneness.

In the 67 years since India became a republic, its states have diverged dramatically from each other in demographic, economic, social and political parameters. The big gamble of GST is that the economic benefits to the nation as a whole will trump the fissiparous predilections of India’s political union. Amid the jubilation over a newly forged tax union, it is perhaps appropriate to recall the warning of one of India’s tallest statesmen, C. Rajagopalachari, in the early years of the republic—“you cannot achieve unity of this country by imposing uniformity.”

(ref. http://www.livemint.com/Opinion/qoID41y9nvDbTRofFcvvTN/The-flip-side-of-one-nation-one-tax.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter dated 4.04.2017)

|

|

BACK |

India Stands in the Way of China’s Free Trade Ambitions

|

India’s refusal to open its markets is dashing China’s hopes to dominate trade in Asia.

A China-backed trade deal meant to cement the Beijing’s dominance in Asia has veered off course because India is hesitant to open its borders to cheap Chinese goods.

Without the participation of India, the third-largest Asian economy, the free-trade zone China hoped to create might still happen, but it won’t carry the same economic heft, depriving Beijing of the chance to set the trade rules for the region.

The missed opportunity puts China on much the same footing as the United States, as Chinese President Xi Jinping and U.S. President Donald Trump continue their first face-to-face meeting Friday at Trump’s Palm Beach, Fla. club, where the trade tensions between their two countries will be a major point of discussion. Trump withdrew from the sprawling Trans Pacific Partnership with 11 other countries as one of his first acts in office, squandering a chance for the United States to steer trade in Asia. Now China looks like it may lose its chance as well, over Indian Prime Minister Narendra Modi’s refusal to open its borders.

“India is reasons one, two and three why the deal might not get done,” said Douglas Paal, vice president for studies at the Carnegie Endowment for International Peace and a former adviser to Taiwan on trade. “There’s a strongly-held belief that this will bring in unwanted competition.”

The China-backed Regional Comprehensive Economic Partnership is currently being negotiated between the 10 members of the Association of Southeast Asian Nations

|

(ASEAN), plus six other Asian nations — Australia, China, India, Japan, South Korea and New Zealand. If approved, it would cover 46 percent of the world’s population and 24 percent of global GDP. It would also leave the United States on the sidelines, as Washington is not a signatory on the deal.

India, though it is participating in the trade talks, is balking at opening its market to Chinese products. Like the United States, India’s trade deficit with China is big: $52 billion. Modi doesn’t want lower cost imports to compete with ones made in India even if it means opening foreign markets to Indian companies.

“The Modi government — one of the most pro-business in India’s history — is not necessarily pro-trade,” Rick Rossow, the Wadhwani Chair in U.S.-India Policy Studies at the Center for Strategic and International Studies, said. “He’s still very uncomfortable with really deep trade integration.“

The Indian prime minister has made growing his country’s manufacturing sector a priority. In September 2014, he launched the “Make in India” initiative in an effort to expand manufacturing after growth there fell to its lowest level in a decade. The goal is to make the sector more efficient and attractive for foreign investment.

And it appears to be working. GE, Siemens, HTC, Toshiba, and Boeing have either established or are in process of setting up manufacturing operations in India, according to the Indian Brand Equity Foundation. Modi’s hope is to grow manufacturing to represent 25 percent of Indian GDP by 2025. Right now, it accounts for 16 percent.

Still, the RCEP is likely to be agreed to in some forms, multiple trade experts said. ASEAN, which is celebrating its 50th anniversary this year, has pledged to finalize the deal before the end of the year to mark the occasion. The next round of negotiations are set to take place in the Philippines in May.

“RCEP is a diplomatic exercise,” said Derek Scissors, a resident scholar at the American Enterprise Institute who studies the Indian and Chinese economies. “It’’s gotten more attention since TPP died, but diplomatically it’s important” to agree to something by the end of the year.

Any deal will be a watered-down version of the original plan to create a free-trade zone, which is something India would never agree to, Ross said. The current deal also lacks the protections for labor, human rights and the environment that were contained in the TPP.

“It’s a low grade deal as it is,” said Andrew Small, a China expert at the German Marshall Fund. “Whatever results form this is not going to be a free trade agreement that we would have seen with TPP. For India to agree, there would have to be even a lower bar than there is right now.”

Edmund Sim, a trade lawyer who has worked throughout Asia, said it’s misleading to compare the two deals because the regulatory, environmental, and worker standards were so much tougher in the TPP.

“RCEP had lower ambitions. Completing it will be less of a milestone that TPP would have been,” Sim, who is a partner at the Washington law firm Appleton Luff, said.

(Ref. http://foreignpolicy.com/2017/04/07/india-stands-in-the-way-of-chinas-free-trade-ambitions/ dated 7th Paril-2017)

|

|

BACK |

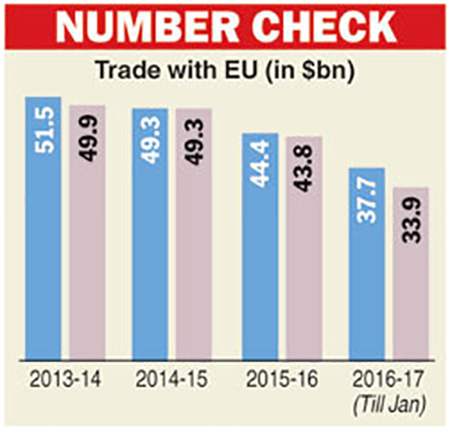

India-EU ties stumble over keeping tax out of bilateral investment treaty

|

The EU is concerned that this will leave little protection for its investors in India

The government has tried to plug the loopholes that enabled companies such as Vodafone and Cairn to go for international arbitration over tax disputes. As such, it came out with model Bilateral Investment Treaty (BIT), 2015.

BIT, the model draft of which was cleared by the Union Cabinet in December 2015, keeps taxation out of its ambit, with the idea that foreign companies finding themselves in a tax row with the government will not be able to invoke the investment treaty their parent countries signed with India, as is the case with the Bilateral Investment Protection and Promotion Agreements (BIPPA).

Besides, under BIT, countries can only seek the option of international arbitration when all domestic legal routes have been exhausted.

It is these provisions which are discouraging countries or regions to ink BITs with India. The latest being the European Union (EU). India has done away with older BITs for over 50 countries, including those in the EU, and has asked these countries to sign the new ones based on the new model. The previous BITs with these countries expired on April one.

The EU believes that foreign investments into India will reduce if the country does not extend the older BIT.

However, for the comfort of foreign investors, the model BIT does state that dispute-resolution tribunals, including foreign ones, can re-examine a legal issue settled by Indian judicial bodies.

But since it does not include tax dispute, that means that Vodfone and Cairn could not have gone to international arbitration had these issues come to the fore now and BIT was signed by India and UK or say the Netherlands.

BIT also states that India or any other country cannot nationalise or expropriate any asset of a foreign company unless the law is followed, is for the public purpose and fair compensation paid. Public purpose is not defined in any treaty India has signed with other nations.

However, dispute-resolution tribunals can question ‘public purpose’ and re-examine a legal issue settled by Indian judicial bodies.

BIT is expected to eventually replace the existing BIPPAs that India has signed with 72 nations. India will also sign BITs with countries it has had no comprehensive investment agreements with before, including the US.

In July last year, the Cabinet gave its approval for signing of BIT with Cambodia. The other BITs, however, will now not be signed any time soon.

So far as the EU is concerned, India plans to replace these BIPPAs with individual countries with a pan-EU treaty as part of its aim to attract and safe guard foreign investment while protecting public interest.

European Commission Vice-President Jyrki Katainen had earlier expressed concern about the lack of any legal protection for investors from EU nations. The letter had termed the move by India ‘unilateral’ and pointed to rising capital costs and legal uncertainty as concerns that will keep away investors.

The EU’s share in India’s total trade has also progressively shrunk in recent years. While Indian exports to the bloc constituted 22.52 per cent of all outbound trade in 2005-06, the figure came down to 16.95 per cent in 2015-16. Imports have witnessed a similar slide over the same period, going down from 17.42 per cent to 11.52 per cent.

(Ref. http://www.business-standard.com/article/economy-policy/india-eu-ties-stumble-over-keeping-tax-out-of-bilateral-investment-treaty-117041000416_1.html dated 10th April-2017)

|

|

BACK |

CABINET APPROVES IMPLEMENTATION OF SC'S JUDGMENT REGARDING TARGET PLUS SCHEME FOR EXPORTERS UNDER FTP 2004-09

|

New Delhi, Apr 13 (KNN) The Union Cabinet has approved implementation of Supreme Court’s Judgment to extend benefit to all the applicant exporters eligible as per provisions of the initially notified Target Plus Scheme (TPS) under Foreign Trade Policy (FTP) for the year 2005-06, and as per provisions of Foreign Trade Policy 2004-09 throughout the country.

The Judgement was passed on October 27, 2015. The revenue implication under the TPS arising from the Supreme Curt’s Judgment is about Rs. 2700 crore.

“The Target Plus Scheme (TPS) 2005-06 was already implemented partially. However, the claims which were denied as a result of retrospective Notification will be now settled as per direction of the Supreme Court in the CA No. 554 of 2006. The scheme has been discontinued w.e.f. 01.04.2006,” said a Cabinet release.

The claims will be considered as per original notifications till the date of the Notification No. 48 dated 20.02.2006 and Notification No. 8 dated 12.8.2006.

The guidelines and modalities for processing the claims will be worked out by the DGFT HQs in consultation with Deptt. of Revenue and is proposed to be completed in one year from the date of approval of the Cabinet.

The corrective measure will bring an end to multiple litigations with the Government and the claims under the TPS will be issued as per original provisions under Foreign Trade Policy in compliance with the decision of the Hon’ble Supreme Court.

In the Civil Appeal titled DGFT v/s Kanak Exports &Ors., the Supreme Court, in its Judgment dated 27.10.2015 gave verdict on the Target Plus Scheme for Export Promotion.

It held that the Notification No. 48/2005 dated February 20, 2006 (certain products were made ineligible) and Notification No. 8/2006 dated June 12, 2006 (rates were reduced to 5% from the earlier 5, 10 and 15%) related to the Target Plus Scheme (TPS) could not be applied retrospectively and they would be effective only from the date of their issue.

(Ref. http://knnindia.co.in/news/newsdetails/sectors/cabinet-approves-implementation-of-scs-judgment-regarding-target-plus-scheme-for-exporters-under-ftp-2004-09 13th April 2017)

|

|

BACK |

COMMERCE MINISTER EMPHASISES THE POTENTIAL FOR SYNERGIES BETWEEN INDIA AND JAPAN

|

he Indian delegation led by the Commerce and Industry Minister of State Smt. Nirmala Sitharaman, participated in day-long India conference in Nagoya city, in Aichi Prefecture of Japan.

Governor of Aichi Prefecture, Hideaki Ohmura thanked the Ministry of Commerce and Industry for establishing the Aichi Desk in 2016 within the Department of Industrial Policy and Promotion (DIPP). Governor Hideaki acknowledged that the India Conference will further encourage the companies in Aichi Prefecture to invest in India.

Smt. Sitharaman commended the contribution of Aichi Prefecture towards manufacturing value addition despite high savings rate among the Prefectures in Japan. It was discussed that India could learn from Aichi Prefecture as to how manufacturing can grow along with savings. The Minister acknowledged the increase in FDI from Japan in recent years. Although Japan is the 3rd largest foreign investor in India (USD 25.2 Billion in cumulative FDI during the April 2000 December 2016), behind Mauritius and Singapore (ranked 1 and 2) , it can be considered a top investor as the other two countries are used by companies from across the world to route investments.

Smt. Sitharaman urged the Governor to consider diversification of investment in other sectors such as Food Processing, Textiles, Medical Equipment, Electronics, Information Technology, etc. Both sides agreed for deeper engagement in future.

The Minister invited Governor Hideaki to lead a delegation of Japanese companies to MSME clusters in India to explore partnership and investment opportunities. It was discussed that the delegation could visit before the expected visit of Japanese Prime Minister in second half of 2017. Governor Hideaki mentioned that Aichi Prefecture companies have an appetite to grow their business overseas and hoped the partnership would bring prosperity to both sides.

The Minister reiterated the potential for huge synergies between India and Aichi Prefecture. She highlighted key reforms undertaken to ease the business operations in India including passage of Goods and Services Tax (GST) bill, advancement of the Budget session, introduction of a new Insolvency and Bankruptcy code, reduction in corporate tax and commitment to level it with international benchmarks, etc.

Smt. Sitharaman also emphasized the importance of flagship initiatives including Digital India, Start-Up India, and JAM (Jan Dhan, Aadhar, and Mobile) trinity in driving the future growth. She said India wants to increase the contribution of manufacturing sector to GDP to 25% and Japan is a natural partner in our goals.Ambassador of India to Japan ShSujanChinoy termed Commerce and Industry Minister's visit as a rare opportunity to review economic relations between the two countries.

A presentation on 'Make in India was made by Secretary DIPP, Mr. Ramesh Abhishek. The Secretary highlighted the unparalleled opportunities and advantages that investors could leverage by Making in India. The Secretary stressed on the recent reforms undertaken on Ease of Doing Business, the investments being made and planned for skilling under the Skill India program, and strengthening of Intellectual Property Regime.

The Indian economy is more open than ever with 100% FDI allowed in most sectors and the impact was shown in the comparison of FDI data from before and after the launch of 'Make in India' initiative. Total FDI increased by 56% from USD 83.7 Billion during July 2012-September 2014 period to USD 130.4 Billion during October 2014-January 2017 period; during the same period equity FDI increased by 69% from USD 57 Billion to USD 96.1 Billion. Secretary further highlighted the huge investments India is making in Infrastructure development .

Several meetings with leading Japanese companies were held to explore areas of mutual cooperation. The Minister also held interaction with the Japanese and Indian media.

(Ref. http://www.business-standard.com/article/government-press-release/commerce-minister-emphasises-the-potential-for-synergies-between-india-and-japan-117041301416_1.html 13th April 2017)

|

|

BACK |

SERVICES WAY FORWARD FOR INTERNATIONAL TRADE: PRESIDENT OF INDIA

|

Make in India, Digital India, Startup India and Skill India will further drive services growth as manufacturing is increasingly embedded with services, said the President.

“At a time when global merchandise trade is slowing down, trade in services can bring new benefits to the global economy,” stressed Shri Pranab Mukherjee, Hon’ble President of India. He was addressing the inaugural ceremony of the 3rd Global Exhibition on Services (GES) organized by the Department of Commerce, Ministry of Commerce and Industry, in association with the Confederation of Indian Industry (CII) and the Services Export Promotion Council (SEPC) at RashtrapatiBhavan today.

President of India added that India’s services exports help global businesses build their productivity and support jobs across the world, noting that India is also a growing market for the world in the sector. Make in India, Digital India, Startup India and Skill India will further drive services growth as manufacturing is increasingly embedded with services, said the President.

Pointing to legal, economic and political issues in international trade in services, he called for addressing policy matters such as access, transparency, and capacity building. In this regard, he said that India has submitted the Trade Facilitation in Services note to the WTO. “Exchange of services represents the way forward for global trade,” he concluded.

Smt Nirmala Sitharaman, Hon’ble Minister of Commerce and Industry, observed that 6 overseas ministers and 73 countries are participating in the GES. While manufacturing contributes 16.6 per cent of India’s gross value added, the services contribution stands at 53 per cent, and hence, the Government of India is according high priority to it. India’s share in global services exports is at 3.3 per cent and there is scope for more exports, she noted.

The previous two editions of the GES have resulted in concrete outcomes and agreements with other nations, said the Minister.

Shri Manoj Sinha, Hon’ble Minister of Communication, released a special stamp on the occasion of GES. He said that ‘My stamp’ is a customized issue of well-known places and interesting animals and plants and is increasingly being used for branding.

Recognising the participation of 24 states for the first time at GES, Shri Satyadev Pachauri, Minister of Uttar Pradesh, and Shri Chandra Mohan Patowary, Minister of Assam, were also present.

Smt Rita Teaotia, Commerce Secretary, Ministry of Commerce and Industry, said that India’s services sector is a significant contributor to income, trade, investments and employment and India has the potential to emerge as a global leader in multiple services verticals.

Dr Naresh Trehan, Chairman, Services Export Promotion Council of India, stressed that India can assist other countries in skill building and training as it offers quality healthcare at one-tenth the cost in many other economies.

Dr Naushad Forbes, President, CII, said that tourism and healthcare provide high opportunities for growth and job creation, and called for investment in skills and institutions.

MrChandrajit Banerjee, Director General, CII, observed that the GES has greatly expanded over the three editions.

GES 2017 brings together 550 exhibitors from 73 countries, with China as the Focus Country. The Exhibition will see over 5,000 business meetings and deliberations at more than 30 seminars.

The GES covers 20 key services sectors such as IT and BPM, tourism and hospitality, logistics, education and financial services. Incredible India Haat - A Cuisine, Culture and Handicrafts Show and Animation and Post Production Film Festival are added attractions.

India’s services exports increased from $52 billion in 2005 to $155 billion in 2015, with a share of 3.3% in global services exports. In the first 11 months of 2016-17, services exports stood at $146.5 billion, growing at 3%. India’s services trade witnessed a surplus of $59 billion in Apr-Feb 2016-17 with imports rising 12.1% to $87 billion. IT and software services contribute over 48% of India’s overall services exports with a leading position in the world.

(http://bwdisrupt.businessworld.in/article/Services-Way-Forward-for-International-Trade-President-of-India/18-04-2017-116492/ 18th April-2017)

|

|

BACK |

HURDLES TO EU TRADE PACT

|

New Delhi, April 19: India and the European Union remain stuck over an investment protection treaty as the EU's foreign policy chief Federica Mogheriniflies in later this week to kickstart the much delayed trade talks.

The EU wants India to extend existing investment treaties with its members, while it negotiates a trade-cum-investment pact, called EU-India Broad-based Trade and Investment Agreement. New Delhi, however, has till now resisted the pressures to extend the bilateral deals.

In the absence of an overarching investment pact, EU investments to India will be hit as individual agreements with EU members lapse.

India has written to most countries to renew their bilateral investment treaties. While many have signed, some including the EU are still continuing negotiations.

The EU has balked at India's proposals on arbitration and dispute settlement that New Delhi has built into its model treaty. New Delhi wants a foreign investor to first exhaust domestic legal challenges before seeking international arbitration.

Officials said the new clauses would not allow investors such as Vodafone or Cairn to rush to an international arbitration council without fighting the case in India's Supreme Court.

"The main difference between model BIPA which many of our investment partners have already signed and previous BIPAs is that it forces foreign firms to first exhaust all legal remedies in India before approaching an international tribunal and secondly it excludes government procurement rules, taxes, subsidies, licences and national security from being challenged in a court abroad," said officials.

However, officials expect a forward movement in both the investment and trade talks as India is keen to do two things. Firstly, protect its software professionals from a unilateral visa tightening; and second, have India declared a "data secure" nation, which would allow its software firms take up European contracts in India.

(Ref. https://www.telegraphindia.com/1170420/jsp/business/story_147268.jsp#.WP2uodKGPIU 20th April-2017)

|

|

BACK |

COMMERCE MINISTRY OFFICIALS TO HOLD TWITTER CHAT SESSIONS WITH PUBLIC

|

NEW DELHI: Officials of the commerce and industry ministry will soon hold Twitter chats

with public and take their suggestions on policy making. The ministry plans to capitalise its #mociseva on the social networking site to interact with the general public.

"In coming days, #mociseva would take a huge leap forward and would act as an interactive

platform to provide information about the ministry's work. For this, various divisions of the

ministry would organize Twitter chat sessions to engage with people and take suggestions

from them in policy making process," said a person in the know.

One such periscope live video sessions on Twitter and Facebook chat session would be

held on April 28 by the Directorate General of Foreign Trade (DGFT) to take suggestions

and provide clarifications on the midterm review of Foreign Trade Policy.

The expansion of the ministry's Twitter Seva from a grievance redressal mechanism for

startups and traders to an interactive platform comes on its first anniversary. The seva was launched on April 21, 2016. Of the 6,563 tickets raised till now, 6,565 have been closed. An average of 500 tickets have been raised per month.

As per the ministry, none of the tickets are pending beyond two working days. Moreover, the response time has come down to 12 days from 45 days in last one year. "We have not only responded to queries that pertain to our ministry, in fact #mociseva has responded to almost a thousand queries that belonged to other ministries," the person said.

Most of queries belong to DGFT, Startup India, Make in India and intellectual property rights.

(Ref. http://economictimes.indiatimes.com/news/economy/policy/commerce-ministry-babus-to-hold-twitter-talks-with-people-on-policy-making/articleshow/58295503.cms dated 22 April-2017)

|

|

BACK |

INDIA, EU RESOLVE TO DEEPEN BILATERAL TIES

|

New Delhi, Apr 21 (PTI) The European Union and India today resolved to step up counter-terror cooperation besides agreeing to expand engagement in a broad range of areas including maritime security, trade, energy and environment.

EU foreign policy chief Federica Mogherini had separate meetings with Prime Minister Narendra Modi and External Affairs Minister Sushma Swaraj during which key issues of common interest were discussed with a focus on further ramping up overall ties.

The EU said the two sides resolved to enhance cooperation, both at bilaterally and multilaterally, in combating terrorism apart from agreeing to work closely in dealing with multilateralism, climate change, sustainable development and ensuring free and fair trade.

In her meeting with Mogherini, Swaraj condemned the terror attack in Paris yesterday and emphasised that both India and EU should strengthen their cooperation to fight terrorism in all its forms and manifestations and demonstrate firm resolve to show zero-tolerance for such acts.

She called terrorism the "gravest threat" to humanity.

Mogherini, who arrived here on a two-day visit, held delegation-level talks with Minister of State for External Affairs M J Akbar during which the EU side is understood to have pushed for early resumption of talks for the long-pending India-EU Broad Based Trade and Investment Agreement.

Preparations for the annual India-EU summit, scheduled to be held here later this year, were also reviewed.

In a statement, the External Affairs Ministry said both sides discussed ways to take forward talks on the pact.

"The two sides reaffirmed their commitment to deepening their strategic partnership. They reviewed progress on the commitments made during 13th India-EU Summit in Brussels in March, 2016 including in the areas of counter-terrorism, migration and mobility," the MEA said.

On its part, the EU said both sides took stock of progress made on decisions taken at last year's EU-India summit and agreed to deepen cooperation in a broad range of areas like security and defence, trade, investment, climate change, water, new and renewable energy, environment, ICT, space and technology.

The two sides also decided to strengthen people-to-people contacts, including student exchanges through the Erasmus programme.

The EU said it and India have a direct interest in the stabilisation of many fragile areas such as the Korean Peninsula and Afghanistan.

"EU is one of India's largest trading partners with bilateral trade in goods reaching USD 85 billion in 2016. EU is also the largest destination for Indian exports and a key source of investment and cutting edge technologies.

"India seeks enhanced level of investments from EU companies in its flagship programmes like Clean India, NamamiGange, Skill India, Start-Up India, Smart Cities, renewable energy and next-generation infrastructure," the MEA said.

It said India greatly values its multi-faceted strategic partnership with European Union and the two seek to strengthen multilateralism and rules-based global order for the peace and prosperity for one and all.

The BTIA has been a major issue in ties between India and the EU.

The BTIA talks have been stalled since May 2013 when both sides failed to bridge substantial gaps on issues like data security status for the IT sector.

Launched in June 2007, negotiations for the proposed agreement have witnessed many hurdles as both sides have major differences on crucial issues.

In the last EU-India Summit in Brussels, the two sides had failed to make any announcement on resumption of the negotiations as many bottlenecks still remained.

The two sides are yet to iron out issues related to tariff and movement of professionals but the EU has shown an inclination to restart talks.

Besides demanding significant duty cuts in automobiles, the EU wants tax reduction in wines, spirits and dairy products, and a strong intellectual property regime.

On the other hand, India is asking the EU to grant it 'data secure nation' status. The country is among nations not considered data secure by the EU.

India's bilateral investment pacts with several European countries are expiring and citing this, the EU has been strongly pushing for moving ahead with the trade agreement.

The EU has been maintaining that expiry of the pacts will make it difficult for European countries to go for fresh investments in India.

(Ref. http://www.ptinews.com/news/8631791_India--EU-resolve-to-deepen-bilateral-ties.html dated 21st April-2017)

|

|

BACK |

INDIA PROBING DUMPING OF CHEMICAL FROM FOUR COUNTRIES

|

Anti-dumping duties are levied to provide a level playing field to local industry by guarding against cheap below-cost. Imports.

The government has initiated a probe on alleged dumping of a chemical used in pharmaceutical and agriculture sector from Indonesia, Malaysia, Thailand and Saudi Arabia. The commerce ministry’s investigation arm — Directorate General of Anti-dumping and Allied Duties (DGAD) — has found “sufficient evidence” of dumping of saturated fatty alcohols from these four countries.

If established in its probe that dumping has caused material injury to domestic players, the DGAD would recommend imposition of anti-dumping duty to the finance ministry which will then take a call on whether to impose the duty or not.

Anti-dumping duties are levied to provide a level playing field to local industry by guarding against cheap below-cost. imports.

The authority “hereby initiates an investigation into the alleged dumping,” the DGAD said in a notification.

Saturated fatty alcohols are mainly used for manufacturing of personal and home care products besides pharmaceutical and agriculture related items.

The DGAD is also probing dumping of several other products including certain chemicals, fibres and steel from different countries.

Countries initiate anti-dumping probes to determine if the domestic industry has been hurt by a surge in below-cost imports. As a counter-measure, they impose duties under the multi-lateral WTO regime.

(Ref. http://indianexpress.com/article/india/india-probing-dumping-of-chemical-from-four-countries-4628841/ dated 26th April-2017)

|

|

BACK |

Agrochemicals: Companies Worldwide Eyeing Major Market Opportunity

|

What are Agrochemicals?

'Agrochemicals'isageneric termforagriculturalchemicals.Thisumbrella termincludesabroadrange of pesticides, fertilizers, chemical growth agents, processed biosolids and raw animal manure.Pesticides cover biologically-basedherbicides,insecticides, fungicides and other products.This also includes organisms that perform specificactions that aids crop protection.Fertilizers used in this sector are majorly nitrogenous, phosphatic and potassic-based chemicals.

Being used solely for agricultural purposes, the agrochemicals market has seen an increase in their consumption worldwide. The last fewyears saw a significant amount of investments being made by conventional agrochemical companies, particularly so in the biological pesticidessector.The explosion in global population was responsible for this increase, creating promising markets for these companies. Their investment sencompassed new product development, expenditure on new facilities and a number of significant product and company acquisitions.

What was the global agrochemicals market trend by crop production in 2015?

Industries are looking for the most important crop outlet. The fruits and vegetable market is believed to be this outlet; it accounts for more than 50% of the total agrochemicals sales.This is followed by cotton and rice, with maize observing a gradual rise. Among these biological pesticides, ones with activity as nematicidal seed treatment shave the utmost impact on maize and cotton.Reproducibility of activity in open fields is a key concern for biological products, particularly formaj or markets of fruits and vegetables that are grown in closed controlled environments.

However, agradual shift can be with increasing usage of biological seed treatments; also incontrolled environments when products are encapsulated around the seed. This is boosting the usage of biological products in row crop sectors. A noticeable factor between a number of the recent mergers and acquisitions was product opportunities such as seed treatments, particularly those related to nematicidal activity.

What correlation does climate change hold with global agrochemicals demand?

It’s no secret that weather and agriculture are intricately linked.Hence,the demand for agro chemicals directly depends on weather conditions across countries.Europe,for example,benefitted from an early spring start,which improved crop volumes and prices.On the otherhand,northern Europe was affected by a wet summer.Central and eastern Europe benefitted from an improved economic position,but suffered from avery cold winter and a dry summer. The market in the UnitedStates got off to a good start,but was then the occurrence of a drought affected the central cornbelt.Other parts of the country, however,had a more positive out look. Strong crop prices and weaker currencies drove the growth in South American market despiteadry start in Argentina and Brazil. Markets in Asia showed a positive trend on the who leafter recovering from adverse weather in 2015;particularly in Japan and Thailand. On the otherhand,India sufferedanother variable monsoon season in 2015. In addition,wet weather affected Southern China and countries at a similar latitude. Which regions show a promising market for expansion? Asia is currently the leading market for agrochemicals, with a market share of 42.3%,followed by North America with a 28.4% share.In terms of markets incountries, the United States remains to be the leading market with an estimated value of USD 485 million,followed by China,Japan,Brazil.and India.The crop trends in 2015 remained positive, with strong crop prices and sustained futures prices throughout the year, primarily due to increase in consumption and limited harvests in Europeand North America. Wheat production showed improvement in Australia and Canada,but showed as light reduction in Europe. Fruit and vegetable production, however, have seen arise globally.

Which factors will decide the future of Agrochemicals? Increased research in weedand pest control is the need of the hour in order to address the severe agricultural problems of today and tomorrow. Emerging programs, such as Integrated Nutrient Management(INM) and Integrated Pest Management(IPM), are expected to increase the demand for agro chemicals in the future, by mean of increased awareness among farmer sand better economic conditions of emerging economies. With decreasing availability of land and rising population, the use of agro chemicals has become inevitable. However, genetically modified(GM) crops, being inherently resistant to pest sand adverse conditions, have poseda challenge to agro chemicals production.

Also,some agro chemicals, becoming banned and facing strict government regulations, area cause for concern for companies that are manufacturing pesticides. Yet, bio-friendly agro chemicals have emerged, which have increased agricultural out put saround the world. All of these factors depict agro chemicals as a promising segmentin the modern market fo ragriculture. Which companies are exploiting these opportunities? Major leading players in this market are eyeing potential opportunities for expansion through merger sand by introducing innovative products. Company sales performances were generally very positive in 2015, with the greatest growth recorded by Amvac with strong sales of corn soilinsecticides,by FMC assisted by the sign if i cant growth of the Brazilian market, a new joint venture in Argentina and product range

expansion based on an umber of product agreements. BASF, Bayer AG, Monsanto,and Syngenta have actively engaged acquisitions across market sona global scale and have filed numerous patents to expand their agro chemicals businesses. Greater investments in R&D are likely to beakey factor in this market, now that many major agro chemical companies have an interest in the sector. This, coupled with the market opportunities listed above, suggests that global demand for agro chemicals is expected to grow at fast erratein the coming years.

(The article is written by Mordor Intelligence which is a global market research and consulting firm. Mordor Intelligence Report sand their contents,including all the analysis and research containing valuable market information, are provided to a select group of customers in response to orders. No part of this strategic analysis service may be given, lent, resoldor disclosed to non-customers with out written permission. Reproduction and/or transmission in any form and by any means including photocopying, mechanical, electronic, recording or other wise, with out the permission of the publisher is prohibited.)

|

|

BACK |

|