Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-Exporters,

I have pleasure to bring to you the 16th issue of the CHEMEXCIL e-Bulletin for the month of August 2017, which contains the following activities undertaken by the Council and other useful information/Notifications, etc.

- Seminar organized by CHEMEXCIL on "Export / Import under GST Regime" held on 3rd August, 2017, New Delhi

- Chemexcil's participation in the ABG trade summit, Las Vegas, USA from 8-10 August-2017

I hope that you would find the newsletter informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions so as to enable us to improve this e-bulletin further.

With Regards,

SHRI SATISH W. WAGH

CHAIRMAN,

CHEMEXCIL

|

BACK |

CHEMEXCIL Seminar on "Export / Import under GST Regime" held on 3rd August, 2017, at New Delhi

Council had organized a seminar on "Export / Import under GST Regime" on 3rd August, 2017 at Hotel the Royal Plaza, New Delhi in association with PLEXCONCIL.

Shri Rajesh Srivastava, Deputy Regional Chairman, Northern Region gave the welcome address.

Shri ZubairRiazKamili, Director (Customs), Central Board of Excise & Customs, Ministry of Finance & Shri Ajay Srivastava, Jt. DGFT, O/o Directorate General of Foreign Trade, Ministry of Commerce & Industry, Govt. of India, delivered the key note address & interacted with the participants.

There was a good interaction during Q/A Session and the participants were satisfied with the clarifications given by the dignitaries on their queries.

Shri Hans Raj Chugh, Consultant & Chartered Accountant, M/s A S H M & Associates was the guest speaker for this seminar, who has made presentation on awareness of GST & interacted with the participants.

The seminar got excellent response with participation of nearly 65 delegates from the industry including officials from Ministry of Commerce & Industry. Shri Rajeev Kumar, Under Secretary, Ministry of Commerce & Industry and the representative from EP(CAP) Division also attended the Seminar.

Vote of thanks was delivered by Dr. J P Tiwari, Regional Director, CHEMEXCIL.

|

| On Dais (From Left to Right): Dr. J P Tiwari, Regional Director, CHEMEXCIL, Shri Ajay Kumar Srivastava, Joint DGFT, Ministry of Commerce & Industry, Shri Zubair Riaz Kamili, Director (Customs), Central Board of Excise & Customs, Ministry of Finance, Govt. of India, Shri Hans Raj Chugh, Guest Speaker & Shri Sanjiv Rai Dewan, Regional Director, PLEXCONCIL during the Seminar on “Export / Import under GST Regime” held on 3rd August, 2017 at New Delhi |

| |

BACK |

Chemexcil's Participation in ABG trade summit, Las Vegas, USA from 8-10 August-2017

|

| Mr. S.G. Bharadi, Executive Director, Chemexcil and Mr. Prafulla Walhe, Dy. Director Chemexcil at the Chemexcil booth at ABG Trade summit, Las Vegas, USA. |

| |

CHEMEXCIL Participated along with her members in ABG Trade Summit, 2017 held at Bally’s Las Vegas, 3645 S Las Vegas Blvd, Las Vegas, NV 89109, Nevada, United States from 8th to 10th August-2017.

Total 27 member-exporters from Chemexcil exhibited in the above exhibition under the umbrella of CHEMEXCIL. The said exhibition was followed by seminar on Agriculture technology, Formulation Science Symposium, R&D’s Role in Bringing New Products to Crop Protection Product Formulators and Distributors, etc.

Altogether 550-600 foreign visitors visited this exhibition which included importers/buyers of various agrochemical products. Total 40-50 visitors visited Chemexcil stall in 3-days’ time

CHEMEXCIL had deputed Mr. S.G. Bharadi, Executive Director and Mr. Prafulla Walhe, Dy. Director, to look after the entire arrangements of the event.

|

BACK |

Amendment in CGST Rules, 2017:

Notification regarding E-way bill

|

EPC/LIC/CGST/E_WAY |

31st August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Amendment in CGST Rules, 2017:

Notification regarding E-way bill |

|

|

Dear Members,

Kindly note that CBEC has come out with details of e-way bill system vide Notification number 27/2017-Central Tax, dt. 30-08-2017 providing details of amendments in Rule 138 of CGST Act 2017 which deals with e-way Rules.

For the sake of convenience, basic details are provided as follows:

Applicability:

The (GST) regime has provision for obtaining permits called e-way bills for transporting goods consignment of more than Rs 50,000 in value view to checking tax evasion.

It is proposed as a virtual permit in electronic format that will have details of the goods being transported, the mode used, origin and destination besides details of the supplier, recipient and transporter. There is no need of conveyance details when the distance of transport is less than 10 km within a state.

Exemption:

Earlier, GST Council in its meeting on August 5th, 2017 had approved a list of 153 items (mainly mass consumption) that have been exempted from the requirement of obtaining e-way bills. Details of items are available in the above-said notification.

Further, E-way bill is not required if goods are transported by non-motorised conveyances. Goods transported from international ports to hinterland ports for clearance by customs have been exempted from the requirement

Generation of e-way Bill:

E-way bill can be generated by registered supplier or recipient or the transporter. To generate an e-way bill, the supplier and transporter will have to upload details on the GSTN portal (FORM GST EWB-01), after which a unique EBN will be made available to the supplier, the recipient and the transporter on the common portal. Generation and cancellation of e-way bill may be permitted through SMS as well.

Effective Date:

The date from which the e-way bill would come into effect would be notified separately by the government.

Members are requested to take note of this development regarding e-way bill. For full details of the notification no. 27/2017-Central Tax, dt. 30-08-2017, please use below link-

http://www.cbec.gov.in/resources//htdocs-cbec/gst/Ntfn%2027_2017.pdf

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Electronic Sealing for Containers by exporters under self-sealing procedure

|

EPC/LIC/Self-Sealing |

29th August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Electronic Sealing for Containers by exporters under self-sealing procedure |

|

|

Dear Members,

This is in continuation of the CBEC circular 26/2017 -Customs dated 1.7.2017 regarding self-sealing of containers by exporters using electronic seals. The new procedure of self-sealing was supposed to become effective from 1st September 2017.

However, concerns were raised by the members due to lack of clarity on self-sealing permission application procedure, electronic seal availability, standard etc. These concerns were duly put forth by the council to CBEC requesting suitable clarification.

In this regard, the Board has issued Circular No. 36/2017-Customs 28th August, 2017 having details of the procedure to be followed by exporters. The new self-sealing procedure shall come into effect from 1st October 2017.

The details as per Circular No. 36/2017-Customs 28th August, 2017 are reproduced/ highlighted as follows for your convenience:

(a) The exporters who were availing sealing at their factory premises under the system of supervised factory stuffing, will be automatically entitled for self-sealing procedure. All exporter AEOs will also be eligible for self-sealing. It is clarified that all those exporters who are already operating under the self-sealing procedure need not approach the jurisdiction Customs authorities for the self-sealing permission.

(b) The permission to self-seal the export goods from a particular premise, under the revised procedure, once granted shall be valid unless withdrawn by the jurisdictional Principal Commissioner or Commissioner of Customs if non-compliance to law, rules and regulations is noticed. In case the exporter makes a request for a change in the approved premise (s), then the procedure prescribed in circular 26/20 17-Cus shall be followed, and a fresh permission granted before commencement of self-sealing at the new premises.

(c) With respect to para 9 (v) of the circular 26/20l7-cus, Principal Commissioners / Commissioners would be required to communicate to Risk Management Division (RMD) of CBEC, the IEC (Importer Exporter Code) of the following class of exporters:

(i) exporters newly granted permission for self-sealing.

(ii) exporters who were already operating under self-sealing procedure.

(iii) exporters who were permitted factory stuffing facility and

(iv) AEOs

The categories mentioned in c(ii), (iii) and (iv) may be communicated to RMD by 20-09-2017 .

Electronic Seal:

(a) Declaration in S/B: Under the new procedure, the exporter will be obligated to declare the physical serial number of the e-seal at the time of filing the online integrated shipping bill or in the case of manual shipping bill before the container is dispatched for the designated port/ICD/LCS.

(b) Availability: Exporters shall directly procure RFID seals from vendors, conforming to the standard specification mentioned below. Since the procedure seeks to enhance integrity of transportation of goods, the exporters will be required to obtain seals directly. They shall provide details such as IEC etc., at the time of purchase for identification as well as for using the standard web application necessary to support an RFlD self-sealing ecosystem.

(c) In case, the RFID seals of the containers are found to be tampered with, then mandatory examination would be carried out by the Customs authorities.

Standard Specification of the electronic Seal:

(a) The electronic seal referred to in Para 9 (vii) of the Circular No. 26/2017-Customs dated 01.07.2017 shall be an "RFID tamper proof one-time-bolt seal", each bearing a unique serial number. The exporters shall be responsible for procuring the seals at their own cost for use in self-sealing.

(b) Each seal shall be a one-time-bolt-seal bearing a unique serial number and brand of the vendor in the format ABCD XXXX XXXX, where ABCD stands for the brand of the vendor and X (8 digit) is a numerical digit from 0-9.

(c ) The RFID seal shall conform to ISO 17712:2013 (H) and ISO/IEC 18000-6 Class 1 Gen 2 which is globally accepted in industrial applications and can be read with the use of UHF (i.e. 860 MHz to 960 MHz) Reader-Scanners.

(d) The manufacturer or vendor, as the case may be, shall be in possession of certifications required for conformance of the ISO standard ISO 17712:2013 (H) namely, clauses 4, 5 and 6. Before commencement of sales, the vendor shall submit self-certified copies of the above certifications to the Risk Management Division (RMD) and all the ICDs/ Ports where he intends to operate along with the unique series of the seals proposed to be offered for sale.

Application, Record Keeping and Data Retrieval System:

(a)It is clarified that the information sought from the exporter in para 9 (vii) of the circular 26/2017- Customs shall now be read as:

IEC (Importer Exporter Code)

Shipping Bill Number

Shipping Bill Date

e-seal number

Date of sealing

Time of sealing

Destination Customs Station for export Container Number

Trailer- Truck Number

It is further clarified that the information need not be mounted "in the electronic seal but tagged to the seal using a 'web / mobile application' to be provided by the vendor of the RFID seals. Data once uploaded by the exporter should not be capable of being overwritten or edited.

(b) All vendors will be required to transmit information in para (a) above to RMD and the respective destination ports / ICDs of export declared by the exporter. The arrangements for transmission of data may be worked out in consultation with the RMD and nodal Customs officer at each ICD / Port.

(c) All vendors shall be required to make arrangements for reading / scanning of RFID one- time- Bolt seals at the Customs ports/ ICDs at their own cost, whether through handheld readers or fixed readers.

(d) The integrity of the RFID seal would be verified by the Customs officer at the port /ICD by using the reader-scanners which are connected to Data Retrieval System of the vendor.

(e) Since all ICDs / ports where containerized cargo is handled would require reader scanners, Principal Commissioners or Commissioners exercising administrative control over such ports/ ICDs shall notify the details of the nodal officers for the smooth operation of this system.

(f) The transaction history of the self-sealing should be visible to the exporters for their reference.

(g) The vendor shall also undertake to integrate the information stored on the data retrieval server with ICEGA TE at his own cost on a date and manner to be specified by the Directorate General of Systems, New Delhi.

The new self-sealing procedure shall come into effect from 1st October 2017.

Till then the existing procedure shall continue. All field formations have been advised to immediately notify an officer of the rank of Superintendent to act as the nodal officer for the self-sealing procedure. The officer shall be responsible for coordination of the arrangements for installation of reader-scanners, whether fixed or hand-held.

Members are requested to take note of the procedures/ modalities as contained in the Circular No. 36/2017-Customs 28th August, 2017. The original circular is available using below link for download:

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/circ36-2017cs.pdf

This circular may also be conveyed to your CHA/ Logistics providers so that they keep track of related developments at port level and also update you on electronic seal vendors etc.

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Revision in Entitlement to export freely exportable items on free of cost (FOC) basis by Status Holders

| EPC/LIC/DGFT |

28th August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Revision in Entitlement to export freely exportable items on free of cost (FOC) basis by Status Holders |

|

|

Dear Members,

The O/o DGFT New Delhi has issued Notification No: 23/2015-2020 dated 23rd August, 2017 regarding revision of Entitlement to export freely exportable on free of cost basis by Status Holders.

As you are aware, as per Existing Para 3.24 (j) of Chapter-3 of FTP 2015-2020, status holders are entitled to export freely exportable items on free of cost basis for export promotion subject to an annual limit of Rs. 10 lakh or 2% of average annual export realisation during preceding three licensing years, whichever is lower-.

However, in line with changing requirements of International Trade, the entitlement to export freely exportable on free of cost basis by Status Holders has been revised as follows:

“Status holders shall be entitled to export freely exportable items (excluding Gems and Jewellery, Articles of Gold and precious metals) on free of cost basis for export promotion subject to an annual limit of Rupees One Crore or 2% of average annual export realization during preceding three licensing years, whichever is lower. Such free of cost supplies shall not be entitled to Duty Drawback or any other export incentive under any export promotion scheme."'

Members are requested to kindly take of this revision. You may also refer to the Notification No: 23/2015-2020 dated 23 August, 2017 available on below link:

http://dgft.gov.in/Exim/2000/NOT/NOT17/Signed%20Notification%2023%20dated%2023%20August%202017%20English%20Scanned.pdf

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Amendments in Appendix 2G (List of Inspection and Certification Agencies) as per HBP 2015-20

| EPC/LIC/DGFT |

24th August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Amendments in Appendix 2G (List of Inspection and Certification Agencies) as per HBP 2015-20 |

|

|

Dear Members,

Kindly note that O/o DGFT New Delhi has issued Public Notice No. 19/2015-2020 dated 23/08/2017 regarding Amendments in Appendix 2G (List of Inspection and Certification Agencies) as per HBP 2015-20.

As per above PN, following amendments have been made:

1. Pre-Shipment Inspection Agency (PSIA) mentioned below is de-listed from Appendix 2G of H.B.P.

M/s SNG Inspection Services

Head Office:

LGF 58, Ansal Fortune Arcade, Sector 18

Noida – 201301

Uttar Pradesh, India

Tel +91-1206548424

Mob: +91-9654234675

Email: info@snginspection.com

Website: www.snginspection.com

Above PSIA with its branch offices in Malaysia, Vietnam and Indonesia is de-listed from Appendix 2G and made ineligible to issue Pre-Shipment Inspection Certificates.

2. Annexure to the Public Notice No.15/2015-2020 is being re-notified as in the Annexure attached to this Public Notice, containing the list of approved Spectrometers and Survey Meters for issuance of PSIC.

Details of agencies as in the Public Notice.

Members are requested to kindly take. For additional details, members may refer to the Public Notice No. 19/2015-2020 dated 23/08/2017 available on below link:

http://dgft.gov.in/Exim/2000/PN/PN17/public%20notice%2019-eng.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Harmonised MEIS Schedule in the Appendix 3B (Table - 2) with ITC (HS), 2017

| EPC/LIC/MEIS/HARMONIZED |

23rd August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Harmonised MEIS Schedule in the Appendix 3B (Table - 2) with ITC (HS), 2017 |

|

|

Dear Members,

This is in continuation of Public Notice No. 61/2015-20 dated 07/03/2017 wherein the MEIS HS codes were harmonized in line with ITC (HS) 2017 which was implemented w. e. f. 01/01/2017. However, in the earlier MEIS Schedule harmonization some items where pending.

O/o DGFT New Delhi has now issued Public Notice No. 17/2015-2020 dated 22/08/2017 covering Harmonisation of some other HS codes as per ITC (HS) 2017.

Members are requested to take note of above. For original circular, the same may be downloaded using below link-

http://dgft.gov.in/Exim/2000/PN/PN17/Public%20notice%2017-eng.pdf

In case of persistent issues, please revert on e-mail id’s: deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

GSTR-3B filing due date for July 2017 extended to August 28, 2017

(only for taxpayers who opt to use Transition Input Credit in the

current month return)

| EPC/LIC/GSTR-3B |

18th August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GSTR-3B filing due date for July 2017 extended to August 28, 2017

(only for taxpayers who opt to use Transition Input Credit in the

current month return) |

|

|

Dear Members,

As you are aware, GSTR-3B has to be filed for the month of July 2017 by the deadline of 20/08/2017. In this regard, we have already sent mailers informing about due dates of return filling for July and August 2017.

However, concerns have been raised by the trade about whether transitional credit would be available for discharging the tax liability for the month of July, 2017 as Trans-1 form is not active yet.

Taking cognizance of the concerns of industry, CBEC has issued notification No. 23/2017-Central tax and Press note both dated 17.08.2017 a wherein the date and conditions for filing the return in FORM GSTR-3B have been specified.

The deadline for first GST Return, GSTR- 3B, has been extended to 28th August 2017 from its original deadline of 20th August, 2017 only for taxpayers who opt to use the opening balance of pre-GST credit in the current month. Those who do not wish to claim opening credit in the current month or those who have no credit; the deadline continues to be August 20, 2017.

For the sake of convenience, salient points for filing the said return are reproduced/ highlighted as follows:

-

Registered persons planning not to avail transitional credit for discharging the tax liability for the month of July, 2017 or new registrants who do not have any transitional credit to avail need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse charge) – input tax credit availed for the month of July, 2017;

II. Tax payable as per (i) above to be deposited in cash on or before 20.08.2017 which will get credited to electronic cash ledger;

III. File the return in FORM GSTR-3B on or before 20.08.2017 after discharging the tax liability by debiting the electronic credit or cash ledger.

-

Registered persons planning to avail transitional credit for discharging the tax liability for the month of July, 2017 need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse charge) – (transitional credit + input tax credit availed for the month of July, 2017);

II. Tax payable as per (i) above to be deposited in cash on or before 20.08.2017 which will get credited to electronic cash ledger;

III. File FORM GST TRAN-1 (which will be available on the common portal from 21.08.2017) before filing the return in FORM GSTR-3B;

IV. In case the tax payable as per the return in FORM GSTR-3B is greater than the cash amount deposited as per (ii) above, deposit the balance in cash along with interest @18% calculated from 21.08.2017 till the date of such deposit. This amount will also get credited to electronic cash ledger;

V. File the return in FORM GSTR-3B on or before 28.08.2017 after discharging the tax liability by debiting the electronic credit or cash ledger.

Kindly note that tax liability in both cases will have to be discharged on or before 20th August, 2017.

Members are requested to take note of this notification and do the needful within the timelines suggested by the authorities. The original notification No. 23/2017-Central tax dated 17.08.2017 is attached for your reference.

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Grievance Redressal Committee (GRC) Meeting at Addl. DGFT Mumbai office on 13.09.2017 at 4.00 PM

| EPC/LIC/ADDL.DGFT |

17th July 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Grievance Redressal Committee (GRC) Meeting at Addl. DGFT Mumbai office on 13.09.2017 at 4.00 PM |

|

|

Dear Members,

The council has received intimation from the O/o Addl DGFT, Mumbai that the next Grievance Redressal Committee (GRC) Meeting has been scheduled as under-

-

Date: 13.09.2017

-

Time: 4.00 PM

-

Venue: Conference Room, 2nd Floor, Office of the Additional DGFT, Mumbai

Members are requested to please send pending issues pertaining to Addl. DGFT Mumbai Office by 31st August in the format provided below having details like IEC, Issue, File number etc-

|

Sr. No.

|

Name of Concerned EPC/ Name of firm

|

Grievance in detail with relevant file no.

(please mention, if the grievance has also been taken up with any other RA or DGFT HQs)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your early replies will be appreciated and enable us submit to Addl. DGFT, Mumbai office within the deadline.

The emails for sending replies are deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

State Levies still incurred by exporters Post GST Roll-Out

| EPC/LIC/STATE_LEVIES |

16th August, 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

State Levies still incurred by exporters Post GST Roll-Out |

|

|

Dear Members,

As you are aware, several state and central levies are subsumed in GST which has rolled out w.e.f 1st July 2017. Such levies are now part of CGST + SGST/ UTGST or IGST as the case may be.

However, we understand that there are still state levies like Electricity Duty, Toll Tax, Stamp duty etc not subsumed in GST which might be incurred and are a cost to the exporters as they are not refunded.

In this regard, we request the members to revert with inputs on such state levies incurred which are a cost and are not be available for refund post GST roll-out. The inputs in such cases must be sent along-with the supporting documents.

Your early replies will enable us examine such cases and accordingly put-forth to the Government of India for additional support (on the lines of a similar scheme existing in other sectors for value added products).

Your early replies shall be appreciated and be sent to us on Deepak.gupta@chemexcil.gov.in & info@chemexcil.gov.in

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCILL

|

|

BACK

|

India - BIMSTEC Goods negotiations

| EPC/LIC/LUT_BOND |

14th August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST:LUT/ BOND- CBEC Clarification on RCMC in lieu of BG/ Eligibility of LUT on INR Receipts/ Others |

|

|

Dear Members,

As you are aware, on 7th July 2017 CBEC has provided clarifications on LUT, Bond applicability and criteria.

However, there have been several requests from member-exporters to request government to allow RCMC in lieu of Bank Guarantee with Bond. In this regard, council had already sent representation to CBEC/GST for allowing RCMC in lieu of BG in the interest of MSME exporters.

Taking cognizance of the queries from the trade/industry, CBEC (GST Policy Wing) has issued Circular No. 5/5/2017 – GST on the issues related to RCMC instead of Bank Guarantee, Documents for LUT, INR receipts etc.

For the sake of your convenience, the major points from the Circular are reproduced/ highlighted as follows:

a. Eligibility to export under LUT:

It is hereby clarified that any registered person who has received a minimum foreign inward remittance of 10% of export turnover in the preceding financial year is eligible for availing the facility of LUT provided that the amount received as foreign inward remittance is not less than Rs. one crore. This means that only such exporters are eligible to LUT facilities who have received a remittance of Rs. one crore or 10% of export turnover, whichever is a higher amount, in the previous financial year. It may however be noted that a status holder as specified in paragraphs 3.20 and 3.21 of the Foreign Trade Policy 2015-2020 is eligible for LUT facility regardless of whether he satisfies the above conditions.

b. Form for LUT:

Bonds are furnished on non-judicial stamp paper, while LUTs are generally submitted on the letterhead containing signature and seal of the person or the person authorized in this behalf as provided in said Notification.

c. Time for acceptance of LUT/Bond:

As LUT/bond is a priority requirement for export, including supplies to a SEZ developer or a SEZ unit, the LUT/bond should be processed on top most priority and should be accepted within a period of three working days from the date of submission of LUT/bond along with complete documents by the exporter.

d. Purchases from manufacturer and form CT-1:

The scheme holds no relevance under GST since transaction between a manufacturer and a merchant exporter is in the nature of supply and the same has not been exempted under GST even on submission of LUT/bond. Therefore, such supplies would be subject to GST. The zero rating of exports, including supplies to SEZ, is allowed only with respect to supply by the actual exporter under LUT/bond or payment of IGST.

e. Transactions with EOUs:

Zero rating is not applicable to supplies to EOUs and there is no special dispensation for them. Therefore, supplies to EOUs are taxable under GST just like any other taxable supplies. The EOUs, to the extent of exports, are eligible for zero rating like any other exporter.

f. Forward inward remittance in Indian Rupee:

In terms of Para 2.52 of the Foreign Trade Policy (2015-2020), all export contracts and invoices shall be denominated either in freely convertible currency or Indian rupees but export proceeds shall be realized in freely convertible currency. However, export proceeds against specific exports may also be realized in rupees, provided it is through a freely convertible Vostro account of a non-resident bank situated in any country other than a member country of Asian Clearing Union (ACU) or Nepal or Bhutan”. Accordingly, it is clarified that acceptance of LUT instead of a bond for supplies of goods to Nepal or Bhutan or SEZ developer or SEZ unit will be permissible irrespective of whether the payments are made in Indian currency or convertible foreign exchange as long as they are in accordance with applicable RBI guidelines. It may also be noted that supply of services to SEZ developer or SEZ unit will also be permissible on the same lines.

The supply of services, however, to Nepal or Bhutan will be deemed to be export of services only if the payment for such services is received by the supplier in convertible foreign exchange.

g. Bank Guarantee:

Circular No. 4/4/2017 dated 7th July, 2017 provides that bank guarantee should normally not exceed 15% of the bond amount. However, the Commissioner may waive off the requirement to furnish bank guarantee taking into account the facts and circumstances of each case. It is expected that this provision would be implemented liberally. Some of the instances of liberal interpretation are as follows:

-

In the GST regime, registration is State-wise which means that the expression ‘registered person’ used in the said notification may mean different registered persons (distinct persons in terms of sub-section (1) of section 25 of the Act) if a person having one Permanent Account Number is registered in more than one State. It may so happen that a registered person may not satisfy the condition regarding foreign inward remittances in respect of one particular registration, because of splitting and accounting of receipts and turnover across different registered person with the same PAN. But the total amount of inward foreign remittances received by all the registered persons, having one Permanent Account Number, maybe Rs. 1 crore or more and it also maybe 10% or more of total export turnover. In such cases, the registered person can be allowed to submit bond without bank guarantee.

It has been clarified in Circular Nos. 2/2/2017 – GST dated 4th July, 2017 and 4/4/2017 – GST dated 7th July, 2017 that Bond/LUT shall be accepted by the jurisdictional Deputy/Assistant Commissioner having jurisdiction over the principal place of business of the exporter. The exporter is at liberty to furnish the bond/LUT before Central Tax Authority or State Tax Authority till the administrative mechanism for assigning of taxpayers to respective authority is implemented. It is reiterated that the Central Tax officers shall facilitate all exporters whether or not the exporter was registered with the Central Government in the earlier regime.

Documents submitted as proof of fulfilling the conditions of LUT shall be accepted unless there is any evidence to the contrary. Self-declaration shall be accepted unless there is specific information otherwise. For example, a self-declaration by the exporter to the effect that he has not been prosecuted should suffice for the purposes of notification No.16/2017 - Central tax dated 7th July, 2017. Verification, if any, may be done on post facto basis. Similarly, Status holder exporters have been given the facility of LUT under the said notification and a self-attested copy of the proof of Status should be sufficient.

-

Applicability of circulars on Bond/LUTs:

The instructions issued vide earlier circulars dated 07/07/2017 and this circular are applicable to any export made on or after the 1st July 2017.

Members are requested to take note of this circular and for full text, may use following link to download the same:

http://cbec.gov.in/resources//htdocs-cbec/gst/circularno-5-gst.pdf

In our view, above clarifications should resolve the existing issues related to Bond, LUT, BG etc. However, if any difficulty is still faced by the members, they may revert to us on deepak.gupta@chemexcil.gov.in and info@chemexcil.gov.in

Your timely replies shall be appreciated.

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

RBI EDPMS - Further extension up-to 31.08.2017 for AD banks to clear pendency in EDPMS

| EPC/LIC/EDPMS/EXTENSION |

10th August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

RBI EDPMS - Further extension up-to 31.08.2017 for AD banks to clear pendency in EDPMS |

|

|

Dear Members,

As you are aware, caution listing on account of RBI-EDPMS has been a cause of concern as it impacts export shipments and also resultant business.

Council on its part, has repeatedly taken up the issue with RBI who have kindly

taken cognizance of the problem and granted extensions in April, May and then till June 30 2017. However, we have received feed-back from some members that such cases persist even beyond 30th June 2017. The council has once again represented such cases to Foreign Exchange Dept (FED), RBI in July 2017 seeking support.

“In this regard, we have received communication from Foreign Exchange Dept (FED), RBI that another extension is being allowed up-to 31.08.2017, so that AD banks can clear the pendency in EDPMS. ”

Concerned Exporters who have realized export payments but are still caution listed are advised to approach their AD banks for clearing the outstanding entries in EDPMS.”

Members are requested to utilise this additional time up-to 31st August 2017 and liaise with their AD Banks so that needful is done within the timelines. The copy of RBI’s reply is also attached for reference of members and their AD Banks (if needed).

In case issues still persist, please write to us on Deepak.gupta@chemexcil.gov.in and info@chemexcil.gov.in .

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

IK-CEPA- Comments on request list from Korea for Rules of Origin

| SEPC/LIC/IKCEPA |

9th August 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

IK-CEPA- Comments on request list from Korea for Rules of Origin |

|

|

Dear Members,

This is with reference to the ongoing negotiations of upgrading India Korea CEPA.

In this regard, Korea had shared a request list of tariff lines on which they wanted to change the existing Rules of origin. The list was shared with the members, but no responses were received.

Lastly, there was a consultation meeting organised by Department of Commerce in New Delhi on 08.08.2017 on the topic.

During the above meeting, maintaining the status quo was suggested by representatives of other trade bodies particularly on following items:

2815.11

2815.20

2836.20

2836.40

2901.21

2901.22

2901.23

2901.24

2901.29

2902.42

2902.50

2903.11

2903.14

2915.24

On the remaining lines of Chapter 27-32, the stakeholders present during the meeting did not have any problem and agreed to have flexible rules.

In view of above, the Department of Commerce has once again requested feed-back from chemexcil members on above-mentioned specific tariff Lines.

Therefore, members are kindly requested to go through the above items and also attached list and revert with their comments by 10th August 2017 on our e-mail id’s deepak.gupta@chemexcil.gov.in and balani.lic@chemexcil.gov.in.

In absence of any inputs from industry/ trade, Ministry may agree for flexible rules, as requested by Korea, for rest of the items.

Your timely responses will be appreciated.

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl:Korean Request List (http://chemexcil.in/uploads/files/Chapter_27-32_for_comments.xlsx)

|

|

BACK

|

Due Dates for e-Filing of GST Returns for July /August 2017

| EPC/LIC/GST_RETURNS |

8th August, 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Due Dates for e-Filing of GST Returns for July /August 2017 |

|

|

Dear Members,

This is in continuation of our earlier circular dated 19th June 2017 informing you about relaxation in return filing procedure for first two months of GST.

As you might be aware, tax payers have to submit a simple return (Form GSTR-3B) containing summary of outward and inward supplies which will be submitted before 20th of the succeeding month. GSTR 3B return form submission last date is 20th August 2017 for the month of July. The GSTR 3B form is available for filing from 5th August 2017.

However, the invoice-wise details in regular GSTR-1 would have to be filed for the months of July and August, 2017 as per the timelines given below –

|

Due Dates for e-Filing of GST Returns for July /August 2017 |

|

Month

|

Date for filing of GSTR-3B

|

Time period for filing of details of outward supplies in

FORM GSTR-1

|

Time period for filing of details of inward supplies in FORM

GSTR-2

|

Time period for filing of details in

FORM GSTR-3

|

|

July 2017

|

20th August, 2017

|

1st to 5th September, 2017

|

6th to 10th September, 2017

|

11th to 15th September, 2017

|

|

August 2017

|

20th September, 2017

|

16th to 20th September, 2017

|

21st to 25th September, 2017

|

26th to 30th September, 2017.

|

For updates on returns/ utilities available etc, members are also advise to visit GST portal (www.gst.gov.in) .

Members are requested to take note of the same and do the needful within the timelines provided by the authorities.

Thanking You,

Yours faithfully,

S.G. BHARADI

Executive Director

CHEMEXCIL

|

|

BACK

|

Reminder - Inviting Pre-Budget Proposals for the Year 2018-19

| EPC/LIC/PRE_BUDGET_2018-19 |

4th August, 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Reminder - Inviting Pre-Budget Proposals for the Year 2018-19 |

|

|

Dear Members,

This is a gentle reminder further to our circulars dated 28th July & 19th July 2017 inviting Pre-Budget Proposals for the Year 2018-19. We are still awaiting responses from the members in this regard.

Kindly note that the Council has received intimation from the EP-CAP Section, Dept. of Commerce regarding commencement of the Pre-Budget Exercise for the forthcoming year 2018-19.

In this regard, export-related proposals are invited for consideration by Trade Finance Section, Department of Commerce which are duly filed in the prescribed Performa- I&II (Attached).

Further, specific points to be noted for the proposals as stated by Trade Finance Section are:

Budget Proposals should be complete in all respects, properly categorized and HS Codes for each commodity must be provided.

Justification given in favour of the proposals shall be restricted to 300 words and Annexures should be used, if necessary.

Issues discussed year after year but never agreed to, may not be raised again.

Proposals of small reduction/exemption in custom duty/ Other levies, tax etc. should be avoided unless they are absolutely necessary if such reduction/exemption are necessary, then ample justification should be given.

Members are once again requested to kindly forward their proposals in the specified pro-forma format latest by 7th August 2017 on our e-mail ids deepak.gupta@chemexcil.gov.in and balani.lic@chemexcil.gov.in.

Your timely/ complete responses will enable us examine the proposal, collate them and forward to the Ministry for consideration within the deadline.

Thanking You,

Yours faithfully,

S.G. BHARADI

Executive Director

CHEMEXCIL

http://chemexcil.in/uploads/files/New_Entry_Proforma-I.pdf

http://chemexcil.in/uploads/files/Updation_Proforma-II.pdf

|

|

BACK

|

Reminder - India- Japan CEPA:Issues for discussion in the Joint Committee meeting under India-Japan CEPA

| EPC/LIC/JAPAN |

3rd August, 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Reminder - India- Japan CEPA:

Issues for discussion in the Joint Committee meeting under India-Japan CEPA |

|

|

Dear Members,

This is in continuation of our circular dated 29th June 2017 in connection with communication from FT(NEA), Department of commerce that 4th Joint Committee meeting at Secretary level under India-Japan CEPA (Comprehensive Economic Partnership Agreement) is scheduled to be held in Japan in August 2017.

Therefore, in case you have any issues related to Market Access, SPS/TBT, Rules of Origin etc pertaining to Japan, kindly revert to us so that the same could be submitted to Department of Commerce, for deliberation during the above said meeting.

Your early responses will be appreciated and be mailed to us at the earliest on deepak.gupta@chemexcil.gov.in and balani.lic@chemexcil.gov.in.

Thanking You,

Yours faithfully,

S.G. BHARADI

Executive Director

CHEMEXCIL

|

|

BACK

|

Changes in S/B Declaration regarding All Industry Rates (AIRs) under Duty Drawback scheme

| EPC/LIC/DBK_SELF_DECLARATION |

3rd August, 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Changes in S/B Declaration regarding All Industry Rates (AIRs) under Duty Drawback scheme |

|

|

Dear Members,

Please note that the O/o Office Of The Commissioner Of Customs, Nhava Sheva-II has issued Public Notice No- 100/2017 dated 2nd August 2017 regarding “Implementation of GST in Customs-Changes in S/B Declaration”.

As you are aware, the higher All Industry Rates (AIRs) under Duty Drawback scheme viz. rates and caps available under columns (4) and (5) of the Schedule of All Industry Rates of Duty Drawback have been continued for a transition period of three months i.e. 1.7.2017 to 30.9.2017 (Circular No. 22/2017-Customs dated 30.6.2017).

Further, CBEC has amended Note and Condition 12A of Notification 131/2016-Cus (N.T.) dated 31.10.2016 by Notification 73/2017-Cus (N.T.) dated 26.7.2017 and dispensed with the requirement of the certificate from GST officer to claim higher rate of drawback.

To facilitate exports, the higher rate of drawback can be claimed on the basis of self-declaration to be provided by exporter in terms of revised Note and Condition 12A of Notification No.131/2016-Cus(N.T.) dated by Notification No.73/2017 Cus(N.T.)dated 26.07.2017.

It may be noted that the changes made in Note and Condition 12A shall be applicable w.e.f. 1.7.2017 itself. For all exports made w.e.f 1.7.2017 for which higher rate of drawback is claimed, exporter has to submit the self-declaration in the format attached in the PN-100-17 dated 2nd August 2017 . This format is also being suitably included in the EDI shipping bill.

In respect of exports that have already been made, exporters may submit a single declaration regarding the export products covered in past shipping bills for which let export order has been given from 1.7.2017 onwards. This shall be irrespective of any certificate or declaration, if any, given earlier.

Regarding cases where export goods had been cleared from factory, warehouse, etc. prior to 1.7.2017 but let export order has not been issued before 1.7.2017. Such goods are not supplies under GST and accordingly, said Note and Condition 12A is not applicable. For such goods, the declaration from exporter or certificate from the then Central Excise officer as applicable in terms of Note and Condition 12 of said Notification No. 131/2016-Customs (NT) shall continue.

Members are requested to take note of the above. For full text of the PN, please download using below link-

http://164.100.155.199/pdf/PN-2017/PN_NO_100.pdf

Thanking You,

Yours faithfully,

S.G. BHARADI

Executive Director

CHEMEXCIL

|

|

BACK

|

GST- Leviability of IGST on High Sea Sales of imported goods and point of collection

| EPC/LIC/HIGH_SEAS_SALE_IGST |

2nd August, 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST- Leviability of IGST on High Sea Sales of imported goods and point of collection |

|

|

Dear Members,

As you are aware, High Sea Sale is a common trade practice whereby the original importer sells the goods to a third person before the goods are entered for customs clearance.

However, with the onset of GST, there have been concerns about the points of taxation of IGST on such transactions.

In this regard, CBEC has issued Circular No. 33/2017-Cus dated 01/08/2017 whereby it is clarified that IGST on high sea sale (s) transactions of imported goods, whether one or multiple, shall be levied and collected only at the time of importation i.e. when the import declarations are filed before the Customs authorities for the customs clearance purposes for the first time. Further, value addition accruing in each such high sea sale shall form part of the value on which IGST is collected at the time of clearance

Concerned members are requested to take note of the same. For full details, Circular No. 33/2017-Cus dated 01/08/2017 can be downloaded using below link-

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/circ33-2017cs.pdf

Thanking You,

Yours faithfully,

S.G. BHARADI

Executive Director

CHEMEXCIL

|

|

BACK

|

Export Incentive Schemes Under the FTO – are exports still ‘incentivizing’ under the GST regime?

|

| Under the GST regime, MEIS and SEIS scrips can be used only for payment of Basic Customs Duty (BCD). |

The Government of India has always endeavoured to encourage and incentivise exports, and it has been an avowed policy to export goods and services and not taxes and duties. The Ministry of Commerce, Government of India has consistently formulated schemes aimed at diversifying Indian exports and creating a stable policy environment- Foreign Trade Policies (FTP). The FTP 2015-20 announced various schemes (some new and others modified existing schemes) as a step towards the Prime Minister’s much touted ‘Make in India’.

On June 30th, 2017 the Directorate General of Foreign Trade (DGFT) issued a Trade Notice amending the scope, applicability and procedural aspects of some of the FTP schemes, in view of and to align with the new GST regime that India embraced from 01st July, 2017 – all these changes took effect from July 1st, 2017. Are these FTP schemes still incentivising exports after the amendments? Some of the key amendments scheme-wise are discussed below:

Merchandise Exports from India Scheme (MEIS) and Service Exports from India Scheme (SEIS) are focussed on boosting merchandise and service exports from India. The rewards granted under these schemes are that of duty credit scrips. Previously, the scrips could be used for making payments of customs duties on the import of goods, excise duties on certain domestic procurement of goods and service tax on the receipt of specified services.

Under the GST regime, MEIS and SEIS scrips can be used only for payment of Basic Customs Duty (BCD), and cannot be used for payment of Integrated GST (IGST) and GST Compensation Cessleviable on imports, and Central GST (CGST), State GST (SGST), IGST and GST Compensation Cess on domestic procurements. Therefore GST will have to be paid in cash by importers, resulting in cash outflow at the point in time of import, although credit of such taxes paid in cash would be available to them. One moot aspect also is that the Government has assured refund for taxes paid in exports within 7 days (upto 90%), yet, it does not consider the life-cycle of production/service rendition from the point of import!

The Advance Authorization (AA) scheme and Duty-Free Import Authorization (DFIA) Scheme allow duty free import of inputs which are physically incorporated in the resultant exports to manufacturers/exporters including those associated with supporting manufacturers, subject to certain conditions.

Under the GST regime, while the exemption from payment of Customs duties, including BCD, Additional Customs Duties Anti-dumping Duty, Safeguard Duties and Customs Cesses continue, there is no exemption from payment of IGST and GST Compensation Cess for imports under AA/DFIA. Companies making local procurements will have to pay applicable GST using an Invalidation Letter of AA/DFIA.

Therefore, there can be seen to have occurred a paradigm shift in pattern and manner of business transactions. Previously, an exporter need not have funded the tax portion of imports in the production of goods, which will be necessary under the GST regime.

Further, the Advance Release Order (ARO) facility available for domestic procurement of inputs under AA has been restricted only to certain inputs (listed in the Fourth Schedule of Central Excise Act, 1944 (CE Act)) such as tobacco and petroleum products. Therefore, AA cannot be used for domestic procurement of other inputs.

The Export Promotion Capital Goods (EPCG) scheme encourages manufacturers / exporters to import capital goods including spares for pre-production, production and post-production activities at zero duty subject to an export obligation of 6 times of duty saved on capital goods imported under the EPCG scheme, to be fulfilled in 6 years from the authorization issue date.Under the GST regime, the exemption from import duties under EPCG does not extend to any IGST payable and is restricted to BCD. Further, the ARO facility for domestic procurement of capital goods has been discontinued.

Schemes in the nature of Export Oriented Unit (EOU), Electronics Hardware Technology Park (EHTP), Software Technology Park (STP) or Bio-Technology Park (BTP) were introduced to aid in the establishment of units proposing to export a broad spectrum of their goods and services with the exception of permissible sales in the Domestic Tariff Area (DTA). These units enjoyed duty-free import of input used in their activities.

In the GST regime, though exemption has been given to the import of goods covered under GST from customs duties, IGST and Compensation Cess is payable on these imports. Further, GST is payable on domestic procurement which was earlier exempted ab initio.Only procurement of goods covered under Fourth Schedule of the CE Act will continue to enjoy the ab initio exemption from central excise duty.

On DTA clearances of finished goods, GST will be payable by EOUs, along with the requirement to pay back the BCD on imported inputs. Further, the transfer/supply of goods from one unit of EOU/EHTP/STP/BTP to another has been made liable to GST, as these constitute “supply” under the GST law.

Deemed Exports: The deemed exports scheme is an incentive for transactions where certain goods are domestically supplied by the manufacturers or exporters for payment received in INR or free foreign exchange. For deemed exports, AA benefits have been continued, however, the duty exemptions under AA are restricted (as set out in point 2 above).

Deemed Export Drawback benefits have been restricted to refund of BCD only. Terminal Excise Duty refund has been made available only for goods covered under Schedule 4 of the CE Act subject to eligibility of the supply of such products as deemed exports. Therefore, the scope of the scheme has also been reduced.

Evidently, the changes in the FTP are substantial in as much as they restrict the purpose of the scrip and authorization holders as regards duty payment to a great extent. Effectively, the duty benefits under FTP scheme are by and large applicable only to customs duties and do not extend to levies of GST. Existing scrip and authorisation holders will have to immediately start paying GST in cash as opposed to debiting their scrips or enjoying an exemption, clearly resulting in cash flow considerations, even while credit of such taxes paid would be available as credit for set-off (as in the case of scrips presently held by importers as well).

The revamp of the export promotion schemes has in a manner raised certain pertinent questions as regards the FTP. Do schemes like AA and EPCG continue to be attractive options given the export obligation that comes with it? Have these amendments tilted the balance of convenience in favour of domestic supplies as opposed to export supplies?

Updation:

The Delhi HC has issued a notice to the Revenue department, that it shall hear a petition challenging curtailment of duty exemption benefits under Advance Authorisation scheme of Foreign Trade Policy, post implementation of GST.

While the upfront exemption is extended only to Basic Customs Duty, exporters are required to pay IGST on imports and/or CGST + SGST / UTGST on domestic procurements and thereafter claim the refund.

According to the petitioner, such mechanism adversely affects the working capital and puts all exporters in a tough position.

The High Court has therefore directed the Revenue dept. to file the counter affidavit, followed by a rejoinder by the petitioner before the next hearing scheduled on October 30.

(Source: https://www.thedollarbusiness.com/news/export-incentive-schemes-under-the-ftp-are-exports-still-incentivising-under-the-gst-regime/50903 dated 31st July-2017)

|

|

BACK |

Branding Strategy for Export Oriented Indian Products

|

New Delhi, July 31: India's Foreign Trade Policy Statement released in 2015emphasises the need of a branding strategy. The India Brand Equity Foundation (IBEF) established by the Department of Commerce works closely with stakeholders across government and industry to promote and create international awareness of the Indian products and services in overseas markets.

IBEF has undertaken focused branding activities for sectors namely engineering, pharma, plantations (tea, coffee and spices), services, textiles and leather. This is done through a 360o branding approach including onsite branding, advertising in media, digital marketing including social media, PR, knowledge kits and revamping the websites of many export promotion councils. IBEF actively works with Indian missions abroad for its branding activities in overseas events and also supports them with knowledge works and branding collaterals.

Department of Commerce encourages participation of exporters, export promotion councils, trade associations etc. in International Trade Fairs, Expos etc. India Trade Promotion Organization (ITPO) is the trade promotion agency of the Department of Commerce. ITPO has finalized participation in 31 overseas exhibitions for 2017-18. Based on the proposals submitted by the Export Promotion Councils/Trade Promotion Organizations, an annual plan for organizing participation of exporters in various international fairs and expos is drawn and supported under the Market Access Initiative (MAI) scheme by Department of Commerce.255 proposals for export promotion activities/events in India and abroad for 2017-18 have been approved for assistance under MAI scheme. No targets of earning from such events are fixed.

This information was given by the Commerce and Industry Minister Smt. Nirmala Sitharaman in a written reply in Lok Sabha today

(Source:-http://www.newkerala.com/news/fullnews-258936.html dated 31st July-2017)

|

|

BACK |

New Trade Agreement between India & Bhutan has come into force with effect from July 29, 2017

|

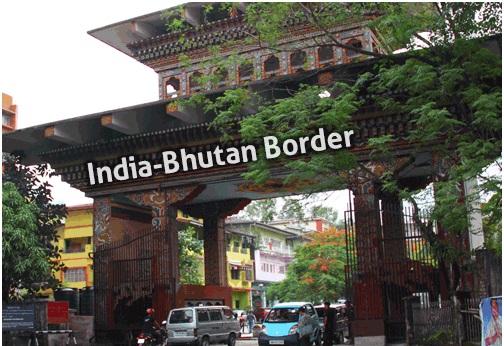

New Delhi, Aug 1 (KNN) The new Agreement on Trade, Commerce and Transit between India and Bhutan has come into force with effect from 29th July 2017.

The Agreement provides for a free trade regime between the territories of India and Bhutan. The Agreement also provides for duty free transit of Bhutanese merchandise for trade with third countries.

“The Agreement was last renewed on 29th July 2006 for a period of ten years. The validity of this Agreement was extended, with effect from 29th July 2016, for a period of one year or till the new agreement comes into force, through exchange of Diplomatic notes,” Ministry of Commerce & Industry said in a statement.

The new Agreement on Trade, Commerce and Transit Agreement was signed on 12th November 2016 by the Minister of State (IC), Ministry of Commerce and Industry on behalf of the Government of India during her visit to Bhutan on 11th-13th November, 2016.

(Source: http://knnindia.co.in/news/newsdetails/global/new-trade-agreement-between-india-bhutan-has-come-into-force-with-effect-from-july-29-2017 dated 1st August-2017)

|

|

BACK |

Commerce Minister Nirmala Sitharaman holds 'candid' talks with Chinese counterpart on growing trade deficit

|

HIGHLIGHTS

- India's trade deficit with China in 2015-16 swelled to $52.68 billion, which Indian officials say has become unsustainable

- Sitharaman sought the assistance of Chinese ministry of commerce in reducing the trade deficit, facilitating greater market access

|

| (Commerce Minister Nirmala Sitharaman in talks with her Chinese counterpart Zhong Shan. (Image: Twitter/@CimGOI ) |

BEIJING: Commerce Minister Nirmala Sitharaman has held "candid" talks with her Chinese counterpart Zhong Shan over the ballooning trade deficit in favour of China which has crossed over $52 billion and sought a level playing field for Indian IT and agro products.

India's trade deficit with China in 2015-16 swelled to $52.68 billion, which Indian officials say has become unsustainable. Besides pressing for access to IT and pharma products, the main stay of India's global exports, India has been insisting that China should compensate by stepping up investments.

"The two ministers exchanged views, in a candid manner, on further development of a strong, balanced and sustainable trade and investment partnership between India and China," Indian Consulate in Shanghai said in a statement on Tuesday.

"In particular, Minister Sitharaman sought the assistance of Chinese ministry of commerce in reducing the trade deficit, facilitating greater market access and for providing a level playing field for Indian IT, pharmaceuticals and agro products in China," it said.

The meeting between the minister of state for commerce and industry and Zhong was the second after their meeting on the sidelines of the Regional Comprehensive Economic Partnership (RCEP) Ministerial meeting in Hanoi, Vietnam in May 2017.

The ministers also agreed to further intensify India-China cooperation in the multilateral frameworks such as WTO, BRICS and Shanghai CooperationOrganisation (SCO), the statement said.

They decided to hold the 11th Joint Economic Group (JEG) in New Delhi at the earliest.

A host of BRICS ministerial and officials meeting on various fields were being held in China ahead of the five-nation grouping's summit to be held in September this year in the Chinese city of Xiamen.

The meetings were taking place as per schedule despite the India-China tensions over the standoff at Doklam in the Sikkim section.

Ahead of Sitharaman's visit, China's commerce ministry said India should avoid abusing trade remedy measures and called for settling trade disputes through consultation.

Reacting to India's move to launch an anti-dumping investigation over photovoltaic cells and units imported from China, Taiwan and Malaysia, Wang Hejun, head of the commerce ministry's trade remedy and investigation bureau said China was paying close attention to the probe and hopes India will conduct it in a prudent manner andas per relevant rules.

Wang said adopting restrictive measures for the trade of photovoltaic products would not only harm photovoltaic sector development in India, but also dampen the sector's long-term development worldwide as well as economic and trade cooperation between China and India.

Meanwhile, coinciding with Sitharamans's visit, an article in today's state-run 'Global Times' said protectionism against Chinese manufactured products will only boomerang on the Indian industry.

The list of Chinese products covered by India's trade remedy investigations is getting ever longer, expanding from garments, glass, minerals and other low-end items to advanced products such as new materials and machinery, it said.

It seems that the Indian government is trying to protect domestic industries from overseas competition through trade remedy measures, but although this strategy offers certain short-term benefits, it will eventually hinder India's industrial development, the article said.

India has initiated 12 investigations against Chinese products in the first half of this year, becoming the country with the most trade remedy probes against China, it said.

During the period, 11 investigations were launched by the US, it said, quoting China's ministry of commerce (MOFCOM).

"There are other explanations behind the intensified trade conflicts between India and China. After years of development, India's industries have made progress, and many companies in India now produce items that could compete with those from China," it said.

"Chinese producers still have the upper hand, but it seems understandable for the Indian government to be eager to protect local industries," the write-up claimed.

But it is wrong to resort to trade remedy measures to drive Chinese products out of the local market, it added.

"At the same time that it is making great efforts in liberalising foreign investment rules, India should also open up to foreign competition to facilitate the development of domestic manufacturing," it said.

(Source:-http://timesofindia.indiatimes.com/business/india-business/commerce-minister-nirmala-sitharaman-holds-candid-talks-with-chinese-counterpart-on-growing-trade-deficit/articleshow/59863944.cms dated 1st August-2017)

|

|

BACK |

Several countries including India adopting discriminatory trade policies'

|

Washington, Aug 2: Alleging that several countries, including India and China, have turned to discriminatory policies that unfairly disadvantage American companies, a US-based technology group has urged the Trump administration to overcome barriers to digital trade.

The group has also named South Korea, Russia, Vietnam, Canada, Mexico and Indonesia that have adopted discriminatory policies against US companies.

"Multiple foreign governments have turned to discriminatory or otherwise harmful policies that unfairly disadvantage American companies and impede the ability of technology products and services to drive growth," Information Technology Industry Council (ITI) said in its 'report to the president on Trade Agreement Violations and Abuses'. Rules that treat foreign firms and local companies differently are in India, China, Colombia, Indonesia, South Korea, Russia and Vietnam, the report said. Technical barriers to trade, standards and conformity assessment are in the EU, India, Mexico and Vietnam, and tariffs and fees on technology products or digital products in the EU and India, it said. Burdensome customs regulations are in Canada and Mexico, ITI said, alleging that investment restrictions, including local presence requirements, are in India, China, Indonesia, and Vietnam. There is restricted access to government procurement markets in India and South Korea, it said. In the India annex of the report, ITI alleges that tariffs on technology products are inconsistent with India's WTO commitments. "India continues to raise tariffs on an increasingly wide range of technology products, including products where it is bound under the WTO rules to apply zero tariffs, such as mobile phones, base stations, routers, and ink cartridges," the report said. "Our view is that India is blatantly acting in a manner that is inconsistent with its WTO commitments. We encourage USTR to consider enforcement actions, such as revoking India's GSP benefits or initiating WTO dispute settlement proceedings, to address India's behaviour as soon as possible, as we anticipate that India will continue to raise tariffs on additional technology products," it said.

Objecting to the recent Make in India initiative of the Indian government, the report said that the order released by the Department of Industrial Policy and Promotion (DIPP) in the summer of 2017 obliges government agencies to provide procurement preferences to locally produced products for all public procurement, varying by cost thresholds. In order to qualify for a local product, it must have 50 per cent local content, calculated by the product's bill of materials, it said. Governments around the world are preventing US tech companies from selling their products and services abroad; requiring the "localisation" of data, software, services and hardware within their borders; forcing technology transfer; and using regulatory and other barriers to put a thumb on the scale in favour of their own firms, it said. "These restrictions harm the US companies in all sectors, preventing manufacturers, service providers and small businesses from entering foreign markets and using technology products and services to support exports and other businesses in the US," it said.

ITI Senior vice president for Global Policy Josh Kallmer said that the US can be offered the greatest potential to use trade to enhance innovation, job creation and economic growth by removing the barriers and enabling digital information to move rapidly and freely, including across the borders. According to the report, data localisation and restrictions on cross-border data flows in China, Colombia, the European Union (EU), Indonesia, South Korea, Russia and Vietnam; while restrictions on the ability of cloud computing companies to compete is in China and South Korea. PTI

(Source:-http://www.oneindia.com/international/several-countries-including-india-adopting-discriminatory-trade-policies-2512793.html dated 2nd August-2017)

|

|

BACK |

Sale of scrips under export promotion schemes to attract 12% GST

|

The premium on the scrips is going to drop as a result of this

Exporters will now have to shell out the goods and services tax (GST) at 12 per cent when selling scrips of export-incentive schemes such as the Merchandise Export from India Scheme (MEIS).

The government on Thursday clarified that scrips received by exporters under the Services Exports from India Scheme and the Incremental Export Incentivization Scheme, apart from the MEIS, will be taxed.

Exporters earn duty credits through the form of scrips at fixed rates of 2 per cent, 3 per cent, and 5 per cent, depending upon the product and country. The earned scrips can be freely transferred to others or sold. Exporters have continued to maintain that more government help is needed to sustain India’s falling outbound trade.

“MEIS etc fall under heading 4907 and attract 12 per cent GST,” the Central Board of Excise and Customs (CBEC) said in its frequently asked questions on the GST.

The GST is based on a category of goods and services based on the harmonised system number (HSN) codes. HSN 4907 relates to financial securities such as shares and bond certificates, and bank notes, cheque forms, etc.

Exporters are up in arms with the FAQs and demanded that export-incentive scrips such as the MEIS be made a separate category with a different HSN code, and the rate be reduced to 5 per cent.

Sources said the GST Council might take up the demand at its meeting on Saturday.

“What is the legal sanctity of FAQs? It’s not a notification. It's an interpretation,” Federation of Indian Export Organisation Director General and Chief Executive Officer Ajay Sahai told Business Standard.

The CBEC also said in its disclaimer to FAQs that these clarifications were only for educational and guidance purposes and did not have legal validity.

Explaining the rationale of exporters’ demand to cut the rate on the MEIS to 5 per cent, he said those buying the scrips would have to wait to utilise the MEIS for tax purposes if the GST on their products is 5 per cent.

The premium on the scrips is going to drop as a result of this, the executive director of the Engineering Exports Promotion Council of India said.

The largest of such export promotion schemes in the form of scrips, the MEIS, was introduced in April 2015 under the Foreign Trade Policy and currently incentivises merchandise exports along with 7,913 items.

(Source:-http://www.business-standard.com/article/economy-policy/sale-of-scrips-under-export-promotion-schemes-to-attract-12-gst-117080400040_1.html dated 4th August-2017) |

|

BACK |

Establishment of India-Afghanistan air freight corridor hailed

|

The establishment of an India-Afghanistan air freight corridor this year was welcomed by all stakeholders at a meeting hosted by India of the Heart of Asia-Istanbul Process, a platform to encourage security, political, and economic cooperation among strife-torn Afghanistan and its neighbours, here on Monday.

"With regard to the bilateral initiatives taken by India, the recent establishment of the air freight corridor between India and Afghanistan was welcomed as providing fast and assured access to farmers of Afghanistan to the large markets in South Asia and beyond," the External Affairs Ministry said in statement following the eighth meeting of the Regional Technical Group of Confidence Building Measure on Trade, Commerce and Investment Opportunities under the Heart of Asia - Istanbul Process.

"India's assistance for capacity building and training of Afghan officials, including on PPP mode of project implementation; and the WTO-related matter, programmes for which that were conducted by the Ministry of Finance and the Department of Commerce, Government of India the past few months were also acknowledged positively," it added.

The India-Afghanistan air freight corridor was established earlier this year with the first flight taking off from Kabul for New Delhi on June 19.

Monday's meeting was co-chaired by the Acting Director General, Economic Cooperation Department in Afghanistan's Ministry of Foreign Affairs Hassan Soroosh, and Joint Secretary in India's Ministry of External Affairs Deepak Mittal.

It was attended by representatives of 17 participating countries and supporting international organisations, including Azerbaijan, Iran, Kyrgyzstan, Pakistan, Russia, Tajikistan, Turkey, Turkmenistan, the United Arab Emirates, Australia, Egypt, Germany, Britain, the US, the European Union and the UN.

"The participants shared the view that Afghanistan acted as a natural bridge in promoting regional connectivity and economic integration.

"There was consensus that economic development was an important factor in ensuring peace and stability in Afghanistan and the Heart of Asia region," the statement said.

The Heart of Asia-Istanbul Process was established in November 2011 to expand coordination between Afghanistan and its neighbors and regional partners in facing common threats, including counter-terrorism, counter-narcotics, poverty, and extremism.

The US and over 20 other nations and organisations support the process.

According to the statement, the participants in Monday's meeting shared views on various measures and steps to promote transit and trade and realising reliable and robust connectivity, with Afghanistan as the hub.

"This included the recognition of the need to make the existing transit and trade agreements more inclusive and comprehensive by expanding them both northwards and southwards to connect South Asia with Central Asia; strengthening growth of small and medium enterprises (SMEs) and involvement of women in economic development, including through women entrepreneurship; and simplifying customs procedures," it said.

The initiative by India to develop a web portal, with participation of industry body Ficci, for exchanging information on regional markets, trade and investment opportunities, and facilitating networking between businesses for the participating countries also came in for appreciation.

According to the statement, the steps taken for development of transit and transport through Chahbahar port in Iran involving India, Afghanistan and Iran, the proposed Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline project, and the CASA-1000 (Central Asia-South Asia power project) were appreciated.

The TAT (Turkmenistan-Afghanistan-Tajikistan) railway line and the Lapis Lazuli corridor were also assessed positively.

The Lapis Lazuli corridor connects Afghanistan with Turkmenistan, Azerbaijan, Georgia to the Black Sea and ultimately through Turkey to the Mediterranean Sea and Europe.

"All sides agreed on the value of such connectivity and economic integration projects to overall growth, stability and prosperity in Afghanistan," the statement said.

(Source:-http://www.business-standard.com/article/news-ians/establishment-of-india-afghanistan-air-freight-corridor-hailed-117080701244_1.html dated 7th August-2017) |

|

BACK |

IGST exemption: Small exporters face uncertainty

|

NEW DELHI, AUGUST 9:

Small exporters continue to face problems in securing exemption from paying Integrated Goods & Services Tax (IGST) on their shipments as Customs officials use their discretion to decide which exporter needs to furnish bank guarantees — instead of only a bond — in the absence of detailed guidelines on the matter.

Althought the Commerce Ministry is in discussions with the GST Council on the matter to see if the issue can be resolved through broad guidelines to check the discretionary powers of Customs officials, exporters are unhappy with the piece-meal redressal.

“Problems should be addressed at one go. On bank guarantees and bonds, the government has issued at least four instructions and things are still not smooth. Exporters don’t even know the time-line prescribed for acceptance of bond/LUT, and so accountability cannot be enforced when there is a delay,” pointed out Ajay Sahai of exporters’ body FIEO.

Contrary to an earlier communication from the Central Board of Excise and Customs, the GST Commissioner has to be satisfied about the track record of the exporter before granting exemption from IGST payment without a bank guarantee, pointed out TS Bhasin, President, Engineering Export Promotion Council. “This discretion-based system is not advisable,” he said.

Commerce Ministry officials are trying to sort out the problem. “The problems of status holders and other large exporters have largely been sorted out, with the Centre deciding to accept Letters of Undertaking (LUTs) instead of bank guarantees. We are in talks with the GST Council to see if some specific guidelines could be issued for small exporters to sort out their problem,” the official said.

According to the Central Goods and Services Tax Rules, 2017, exporters of goods without payment of integrated tax are required to furnish only an LUT instead of a bank guarantee if they are status-holders as specified in the Foreign Trade Policy or have sizeable inward remittances.

The instruction adds that smaller exporters with a good track record will have to furnish a bond on a non-judicial stamp paper while those whose export record is not good will have to furnish a bank guarantee. Since it is the GST commissioner who gets to decide whether the small exporters’ track record is good or not, there is a lot of discretion involved.

“There are excellent officials who are taking a broad view and asking for only bonds. But there are others who insist on bank guarantees as well, causing distress to exporters,” Sahai said. Furnishing of bonds supported by a bank guarantee blocks the working capital of exporters as they have to make a margin money deposit against the guarantee.

(Source:-http://www.thehindubusinessline.com/economy/policy/igst-exemption-small-exporters-face-uncertainty/article9809459.ece dated 9th August-2017 ) |

|

BACK |

IGST on high-seas sale of imports is levied only during customs clearance

|

Q. On high-seas sales, will IGST be levied twice — first on high-seas sales and then on custom clearance?