Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-exporters,

First of all, let me wish you and your family A VERY HAPPY & PROSPEROUS NEW YEAR 2017 AND CONTINUOUS SUCCESS IN ALL YOUR EFFORTS AND ENDEAVORS.

As you may be aware, I have taken over as Chairman of CHEMEXCIL w. e. f. 30th January, 2017 since the tenure of 2 years of Dr. B. R. Gaikwad as Chairman of Chemexcil is completed. Dr. B.R. Gaikwad has handed over Chemexcil in good shape and new developments. I would like to thank Dr. B.R. Gaikwad for the fantastic job he has done as Chairman. His leadership and clear vision has been much appreciated by Chemexcil’s Committee of Administration.

I am honored to have been selected and I am very much looking forward to taking on this important role. Chemexcil is a premier chemical export promotion council and we must always aim to improve our chemical exports and evolve to secure its future both in terms of the volume and value.

I have pleasure to bring to you the 9th issue of CHEMEXCIL e-bulletin for the month of January 2017.

As you are aware, for ease of doing business, CBEC has taken several positive steps such as Renewal of Self Sealing of containers and Self Certification Permission to the Exporters up-to 31st December 2020, Dispensing off the requirement of Mate Receipt, Reducing printouts of certain forms in Customs Clearance. The DGFT has also notified Registered Exporters System (REX) as of 1 January 2017 for the EU Generalised System of Preferences (GSP) etc. These measures will reduce transaction costs of exports.

Moreover, DGFT has also come out with an important policy clarification by notifying the Procedure for claiming Duty Credit Scrips under Chapter 3 of FTP 2009-14 for shipments where LEO date is up-to 31.03.2015 but date of export is on or after 01.04.2015. This will provide relief to exporters who had become in-eligible after policy change under FTP 2015-20 and can now apply for Chapter 3 incentive under erstwhile FTP 2009-14.

I am happy to announce launch of SMS alert service and CHEMEXCIL Mobile app. Now stay connected with Chemexcil through our SMS Alert and Mobile application facility.Chemexcil has started sending messages to members who opt for alert service, informing them the trade related activities of the Council. Members who have not registered their mobile numbers with the Council are requested to apply for this service by sending their mobile numbers.

In continuation of our capacity building initiative, the Council has organized a seminar on Model GST Law 2016 at Hotel Middleton Chamber, Kolkata on 6th January, 2017. The seminar was well attended by the member – exporters of the region. The technical session on Model GST Law was conducted by Shri Suresh Bhutra, an eminent tax consultant. Mr. Bhutra in his presentation analyzed thread bare the various provisions under the GST law 2016 with suitable illustrations which evoked a good response from the participants. He also clarified several queries raised by the participants to their satisfaction.

I am pleased to inform you that the second edition of CAPINDIA 2017 exhibition being held on 21st & 22nd March, 2017 at Bombay Exhibition Centre, Goregaon, Mumbai under the aegis of Ministry of Commerce & Industry is taking shape. This will be the largest event being organized by four Export Promotion Councils viz. CHEMEXCIL, PLEXCONCIL, CAPEXIL and SHEFEXIL and this time, Chemexcil will be the lead Council for organizing this exhibition. There will be 450 exhibitors comprising of manufacturer- exporters of chemicals, plastics and allied products and we are planning to invite more than 200 foreign buyers from different parts of the world. All the respective Councils have started correspondence with Indian Missions and in the process of inviting prominent foreign buyers for this event. We are organizing exclusive Buyer-Seller Meet with stall holders. I request all members to actively participate in this event by booking their stalls and take this opportunity to meet your buyers and make it a grand success.

We hope that you would find this Chemexcil News bulletin informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions which help us to improve this bulletin.

With regards,

SHRI SATISH W. WAGH

Chairman,

CHEMEXCIL

|

BACK |

Chemexcil Seminar on Model GST Law 2016 held on 6th January, 2017 at Middleton Chamber, Kolkata

|

| Sitting from Left Mr. S.G. Bharadi, Executive Director Chemexcil, Dr. B.R. Gaikwad, Chairman Chemexcil, Mr. Suresh Bhutra(Tax consultant faculty) |

| |

|

| Mr. Suresh Bhutra(Tax consultant faculty) presenting on GST law during the seminar |

Chemexcil’sKolkata Regional Office organized a Seminar on Model GST Law 2016 at Hotel Middleton Chamber, Kolkata. Dr. B.R. Gaikwad, Chairman and Mr. S.G. Bharadi, Executive Director, of the council attended the seminar and shared their views. The seminar was well attended by the member – exporters of the region.Dr. Gaikwad, Chairman of the Council emphasized the need to understand the new GST Law and urged the participants to make best use of such educative seminars organized by the Council to add value to knowledge.

Shri S.G. Bharadi, Executive Director then briefed the participants about the various export promotional initiatives undertaken by the council with a strong commitment to enhance export growth significantly. He informed the member-exporters of the region about the 2nd edition of CAPINDIA, a mega sourcing show organized under the aegis of the Ministry of Commerce, Government of India wherein four export promotion councils namely Chemexcil, Capexil, Plexconcil and Shefexil have joined their hand together to promote exports of Indian Products. He further apprised the participants that concerted efforts are being taken to invite 200 overseas buyers for one to one meetings with the Indian exporters and urged the members to take mileage out of the same.The technical session on Model GST Law was conducted by Shri Suresh Bhutra, an eminent tax consultant. Mr. Bhutra in his presentation analyzed thread bare the various provisions under the GST law 2016 with suitable illustrations which evoked a good response from the participants. He also clarified several queries raised by the participants to their satisfaction.

BACK |

CAPINDIA-2017 An Interactive Meeting with Allied Associations

|

| Dr. B.R. Gaikwad, Chairman Chemexcil addressing the gathering during CAPINDIA interactive meet |

| |

|

| Sitting from left Mr. Satish Wagh, Vice Chairman, Chemexcil, Mr. S.K. Ranjan, Dy. Secretary, EP (CAP) Dept of Commerce, Govt. of India, Mr Pradip Thakkar-Chairman Plexconcil, Mr. S.K Ghosh - Chairman, Shefexil. |

As you all know that second edition of CAPINDIA 2017 exhibition being held on 21st & 22nd March, 2017 at Bombay Exhibition Centre, Goregaon, Mumbai, under the aegis of Ministry of Commerce & Industry is taking shape. This will be the largest event being organized by four Export Promotion Councils viz. CHEMEXCIL, PLEXCONCIL, CAPEXIL and SHEFEXIL and this time, Chemexcil will be the lead Council for organizing this exhibition.

There will be 450 exhibitors comprising of manufacturer- exporters of chemicals, plastics and allied products and we are planning to invite more than 250 foreign buyers from different parts of the world. All the respective Councils have started correspondence with Indian Missions and in the process of inviting prominent foreign buyers for this event.

Cap India is India’s show for global markets and is expected to make Chemicals, Plastics, Construction Industry and Allied Products trade a major contributor to the country’s export growth and development and to popularize this mega event among the members an Interactive Meeting was conducted with allied associations followed by cocktail & dinner on 13th Jan 2017 at Hotel Leela, Mumbai at 7.30pm.

This meeting was chaired by Mr. S.K. Ranjan Dy. Secretary EP (CAP), Department of Commerce, Ministry of Commerce and Industry, Govt. of India. Other dignitaries were also present viz. Dr. B. R Gaikwad:-Chairman Chemexcil, Mr. Satish Wagh, Vice Chairman, Chemexcil, Pradip Thakkar-Chairman Plexconcil, Mr. S.K Ghosh:-Chairman, Shefexil, Mr. S.G. Bharadi:-Executive Director Chemexcil, Sabyasachi Dutta:-Executive Director Plexconcil, Dr. Debjani Roy:- Executive Director, Shefexil, V.R Chaitalia:- Director, Capexil, Mr. SoorajDhawan:-Falcon Exhibition, Event Manager.The meeting was started with welcome remark by Dr. B. R. Gaikwad chairman chemexcil followed by CAPINDIA 2017 presentation and CAPINDIA film with vote of thanks, question and answer session.

BACK |

LAUNCH OF CHEMEXCIL MOBILE APP

|

| From Left Mr. S.G. Bharadi Executive Director Chemexcil, Shri. Sunil Kumar, IAS, Joint Secretary EP (CAP),Dr. B.R. Gaikwad, Chairman, Chemexcil, Shri. Sunil Ranjan, Dy. Sec., EP (CAP),Shri Vijay Shanker Pandey US-EP(CAP), Ministrey of Commerce and Industry, Govt. of India at the CHEMEXCIL Mobile App launch at Hotel Le Meridian, New Delhi |

| |

All of you know the importance of going directly to where your customers are and although the app revolution only started a few years ago, this form of communication is growing fast with no signs of slowing down.

Currently 77% of the world’s population are online. With the rapid adoption of smartphones and tablets businesses are faced with more and more opportunities every day that will radically change how their service or product is delivered and accessed.

Mobility is all-consuming and is playing a significant role in our daily lives. Owing to this importance Chemexcil has decided to launch its mobile app. (CHEMEXCIL).

A Mobile app named “CHEMEXCIL” has been launched by Shri. Sunil Kumar, IAS, Joint Secretary, EP (CAP) Division, Department of Commerce, Ministry of Commerce and Industry, Govt. of India on 24.1.2017 at Hotel Le Meridian, New Delhi.

Shri. Sunil Kumar, IAS, Joint Secretary launched the app and mentioned that the App would help the Chemexcil members to find trade related information easily and track promotional event supported by Ministry of commerce and Industry under MDA, MAI Scheme by Online System. Now the Chemexcil members can get information digitally through Chemexcil online system and track the events on the go through the Chemexcil mobile app.

The app is available on Android Platform and soon will be made available iOS for use by Chemexcil members and others.

This Mobile app will provide a much faster alternative than web browsing, emailing and communication.

This app will provide you following important information of Chemexcil

- Alerts on important notification related to Chemical trade

- Important Circulars related to Trade Policy

- Seminars and Skill Development program details

- Trade promotional activities circulars

- Chemexcil Bulletin/Publication

- Important Web links related to trade

- Information on Chemexcil Membership

- Direct communication to Chemexcil on related matter

|

|

It will increase Chemexcil member engagement and will reduce the costs SMS messages and paper newsletters, staff workload by information requests and phone calls.

Android users can download this app by Google Store and iOS (Apple) users can download the same through Apple Store by searching CHEMEXCIL.

BACK |

CHEMEXCIL SMS (Short Message Service) Alert Service

Chemexcil is happy to announce launch of SMS alert service to her member. Now stay connected with Chemexcilthrough our SMS Alert and Request Facility.SMS refers to Short Messaging System. Chemexcil has started sending messages to her members who opt for alert service, informing them the trade related activities of council.

All members who have registered their mobile numbers with council are eligible for this service. Members can apply for this service by filling Chemexcil SMS alert form which is available on our website or can be requested to our membership section.

Currently below services are available on Chemexcil SMS alert service.

-

Alert related to policy

-

Events

-

Seminars

-

Government announcements

-

In House bulletin

-

And many more.

At present there no charges are levied on the members for sending these alerts.

CHEMEXCIL SMS Alert service Form

- Name of the Company:

- Name of the applicant:

- IEC Number

- Chemexcil Membership Number

- RCMC Number

- Correspondence address.

- Mobile Number

I undertake to abide by all terms and conditions for SMS alert facility as may be prescribed from time to time by Chemexcil.

Date Place Signature

-------------------------------------------------------------------------------------------------------------------------------

FOR OFFICE USE RCMC No.

The aforementioned standing instruction/ details have been logged and maintained in the system after verification of company and mobile number in use

Date Name of Concern officer Signature of Authorized person.

BACK |

INDIAN FIRM MAKES CARBON CAPTURE BREAKTHROUGH

|

| (Tuticorin thermal power station near the port of Thoothukudi on the Bay of Bengal, southern India. The plant is said to be the first industrial-scale example of carbon capture and utilisation (CCU). Photograph: Roger Harrabin) |

Carbonclean is turning planet-heating emissions into profit by converting CO2 into baking powder – and could lock up 60,000 tonnes of CO2 a year.

A breakthrough in the race to make useful products out of planet-heating CO2 emissions has been made in southern India.

A plant at the industrial port of Tuticorin is capturing CO2 from its own coal-powered boiler and using it to make soda ash – aka baking powder.

Crucially, the technology is running without subsidy, which is a major advance for carbon capture technology as for decades it has languished under high costs and lukewarm government support.

The firm behind the Tuticorin process says its chemicals will lock up 60,000 tonnes of CO2 a year and the technology is attracting interest from around the world.

Debate over carbon capture has mostly focused until now on carbon capture and storage (CCS), in which emissions are forced into underground rocks at great cost and no economic benefit. The Tuticorin plant is said to be the first industrial scale example of carbon capture and utilisation (CCU).

UK must move now on carbon capture to save consumers billions, says report

There is already a global market for CO2 as a chemical raw material. It comes mainly from industries such as brewing where it is cheap and easy to capture.

Until now it has been too expensive without subsidy to strip out CO2 from the relatively low concentrations in which it appears in flue gas. The Indian plant has overcome the problem by using a new CO2-stripping chemical.

It is just slightly more efficient than the current CCS chemical amine, but its inventors, Carbonclean, say it also needs less energy, is less corrosive, and requires much smaller equipment meaning the build cost is much lower than for conventional carbon capture.

The new kit has been installed at Tuticorin Alkali Chemicals. The firm is now using the CO2 from its own boiler to make soda ash – a base chemical with a wide range of uses including glass manufacture, sweeteners, detergents and paper products.

The firm’s managing director, Ramachandran Gopalan, told BBC Radio 4: “I am a businessman. I never thought about saving the planet. I needed a reliable stream of CO2, and this was the best way of getting it.” He says the plant now has virtually zero emissions to air or water.

Carbonclean believes capturing usable CO2 can deal with perhaps 5-10% of the world’s emissions from coal. It’s no panacea, but it would be a valuable contribution because industrial steam-making boilers are hard to run on renewable energy.

CO2 turned into stone in Iceland in climate change breakthrough

The inventors of the new process are two young chemists at the Indian Institute of Technology in Kharagpur. They failed to find Indian finance and were welcomed instead by the UK government, which offered grants and the special entrepreneur status that whisks them through the British border.

The firm’s headquarters are now based in London’s Paddington district. Its CEO, Aniruddha Sharma, said: “So far the ideas for carbon capture have mostly looked at big projects, and the risk is so high they are very expensive to finance. We want to set up small-scale plants that de-risk the technology by making it a completely normal commercial option.”

By producing a subsidy-free carbon utilisation project, Carbonclean appears to have something of a global lead. But it is by no means alone. Carbon8 near Bristol is buying in CO2 to make aggregates, and other researchers are working on making plastics and fuels from waste CO2.

At last, it seems, the race to turn CO2 into profit is really on.

(ref. https://www.theguardian.com/environment/2017/jan/03/indian-firm-carbon-capture-breakthrough-carbonclean dated 3rd January-2017)

|

|

BACK |

COMMERCE MINISTRY STARTS REVIEW OF FOREIGN TRADE POLICY: NIRMALA SITHARAMAN.

|

GANDHINAGAR: The commerce ministry has started the review of the foreign trade policy by consulting all stakeholders to see whether any support is required for certain sectors to further boost exports.

Commerce and Industry Minister Nirmala Sitharaman said the foreign trade policy (FTP) is in the process of a review.

"When it (FTP) was announced in 2015, we had said we will go in for a mid-term review so that if there is any tweaking that has to be done, it will be done," she said here at the Vibrant Gujarat summit.

She said that the exercise of consulting people and taking stakeholders into confidence is on. The ministry is doing this "to see as to where and which sectors need that kind of tweaking in the policy".

Since December 2014, exports fell for 18 months on the trot till May, due to weak global demand. Shipments witnessed growth only in June this year, thereafter again entered the negative zone in July and August.

The outbound shipments are growing from September. But the global situation is still uncertain.

In April 2015, the government unveiled its first five-year Foreign Trade Policy (FTP), aiming to double exports of goods and services to USD 900 billion by 2020. In the FTP (2015-20), the government replaced multiple schemes with Merchandise Exports from India Scheme and Services Exports from India Scheme.

Sitharaman also said that the ministry had requested the states to appoint export commissioners and formulate a policy.

"The strategy behind that is that the states must have, in line with the FTP, but highlighting their own states' strengths," Sitharaman added.

When asked extending extra concessions to US-based iPhone maker Apple to set up manufacturing unit in India, the minister said: "we have not taken a final call" on this.

A team of the US-based iPhone maker Apple will meet a group of senior officials from ministries, including IT and finance, on January 25 to discuss its demands for setting up a manufacturing unit in the country.

The company had sought exemption on the ground that it makes state-of-the-art and cutting-edge technology products for which local sourcing is not possible.

(Ref. http://economictimes.indiatimes.com/news/economy/foreign-trade/commerce-ministry-starts-review-of-foreign-trade-policy-nirmala-sitharaman/articleshow/56481186.cms dated 11.01.2017)

|

|

BACK |

DGFT SIMPLIFIES IEC PROVISIONS UNDER THE FOREIGN TRADE POLICY

|

The Dollar Business Bureau

Directorate General of Foreign Trade (DGFT) on Wednesday amended IEC provisions under the Foreign Trade Policy 2015-20, related to jurisdictions of IEC transfer, applications and adjustment of fees.

In its notification No.54/(2015-2020), DGFT informed, “When an IEC holder seeks modification/change of Branch Office/Head Office/Registered Office address in its IEC and which involves a shift in its jurisdictional RA, a request to that effect will have to be made to RA concerned under whose jurisdiction the applicant exists.”

In the earlier provision, the request to that effect will have to be made to the new RA to whose jurisdiction the applicant is shifting its Office.

“On the basis of this request, the RA (custodian of the IEC file till now) will process such requests and amend IEC, if found appropriate, under intimation to the RA under whose jurisdiction the applicant wants transfer. The new RA shall allow the person in its new address to carry out necessary functions and also apply for eligible benefits as per FTP,” it added.

As per the revised provision, “Applicants are required to pay fees of Rs.500 for IEC application. If the application is rejected, applicants shall be able to rectify the grounds on which previous application was rejected, without paying any further fees.”

Earlier, if an online IEC application was once rejected, the applicant had to apply afresh.

With regards to adjustment of fee, the new provision said, “In cases, where a new Advance Authorisation, EPCG and Duty Credit Scrip is issued by RA in lieu of the earlier Authorisation (which has been cancelled by RA, on the request of the firm, on account of non-registration at the Customs Port), or in case the RA suggests the firm to file application under correct scheme the application fees paid in the earlier Authorisation will be adjusted by the RA for the new Authorisation.

However, a minimum application fee of Rs.200 shall be paid for the new Authorisation. Head of Office of concerned RA while issuing Authorisations under this provision shall ensure proper linkage with the earlier cancelled Authorisation, it added.

(Ref. https://www.thedollarbusiness.com/news/dgft-simplifies-iec-provisions-under-the-foreign-trade-policy/49103 dated 11.01.2017)

|

|

BACK |

ASIAN M&A ACTIVITY FALLS, CHINESE OUTBOUND INVESTMENT SOARS

|

| |

|

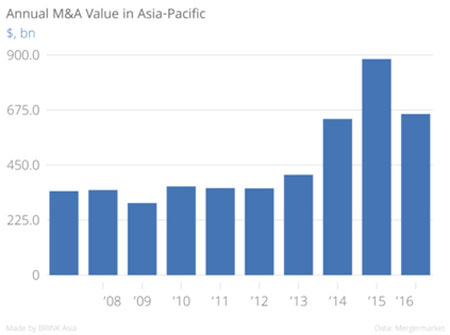

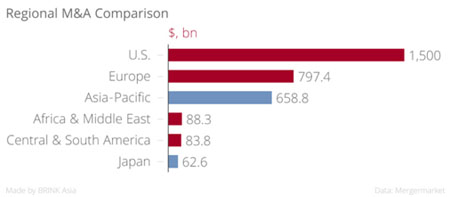

Total merger and acquisition (M&A) deal value in the Asia-Pacific (ex-Japan) declined by 25.5 percent from $883.7 billion to $658.8 billion in 2016, according a recent report, and the outlook for improvement remains uncertain for 2017.

Over the year, the total number of M&A deals declined as well, from 3,812 to 3,675. Despite the slowdown, the numbers mark the second highest annual value and deal cost since 2001, the report added. In 2016, Asia accounted for 20.3 percent of global deal value, which itself was down 18.1 percent to $3.2 trillion in 2016.

Separately, M&A deal value in Japan increased from $61.3 billion in 2015 to $62.6 billion in 2016, and the numbers were dominated by domestic activity as Japanese companies “looked to improve profitability amid a stuttering economy and ageing population,” the report said.

Across Asia-Pacific (ex-Japan), the technology sector saw the highest deal value ($96.8 billion or 14.7 percent of total Asian M&A value); followed by industrials and chemicals (14.4 percent); energy, mining and utilities (13.2 percent); financial services (13.0 percent); transport (7.9 percent); and consumer (6.1 percent).

Outbound Investments Dominate Chinese M&A. In 2016, China contributed 56.4 percent of total M&A activity in the Asia-Pacific region. The defining characteristic of China’s M&A activity in 2016 was outbound foreign investment, which increased 118.7 percent to $206.6 billion across 372 deals. Although Chinese investors’ strong appetite for outbound investments remains, the Chinese government’s recent turn in financial policy, “pledging to crackdown on costly outbound deals over US$ 2bn,” will likely result in a moderation of deals in 2017, the report said.

Likely Pickup in Domestic Chinese M&A. Meanwhile, domestic M&A activity between Chinese companies, which decreased by 21.6 percent in 2016 and was valued at $337 billion, may see an uptick owing to the potential reduction in outbound activity. “Yet the Chinese government’s changing stance as to where it would prefer its corporates to invest could look to re-address the current imbalance between domestic and outbound activity,” the report added.

Indian Manufacturing Benefits. In 2016, India was a “bright spot” for Asian M&A activity, witnessing 388 transactions worth $64.5 billion, reflecting a 90.5 percent increase in value over the previous year. Mergermarket, which produced the report, expects the Indian chemical industry—including specialty chemicals, aroma chemicals, agro chemicals, flavors and fragrances, and niche chemicals—to see a larger number of deals in 2017 as a result of the relative slowdown in the Chinese manufacturing sector and the growing appetite among foreign companies to expand their operations in the country.

The continuing changes in China’s economy and financial market and its move to rein in outward capital flight, along with major political changes in the west, are factors that will likely have the greatest implications for M&A activity in the Asia-Pacific in 2017, the report said.

(Ref. http://www.brinknews.com/asia/asian-ma-activity-falls-chinese-outbound-investment-soars/ dated 13.01,2017)

|

|

BACK |

TIME FOR MAJOR POLICY OVERHAUL

|

BUDGET-2017 EXPECT

Chemical industry in India is the third largest producer in Asia and ranks sixth largest across the globe. The country’s chemical industry is expected to double its share in global chemical industry to five to six percent by 2021, which translates into a healthy growth of up to nine percent in the next decade.

In their quest to cash in on the vibrancy, many MNCs are focusing on India for their manufacturing hub. Cost-effective labour, availability of key raw materials, large consumer markets and adaptability to technology are some of main attractions that are driving those companies to establish a strong manufacturing base in the country.

With the high significance of chemical industry in Indian economy, the industry players are nurturing some expectations from the Union Budget that could help address the bottlenecks and give impetus to growth. Incentives for export units under Make-In-India program: Indian chemical industry is a net importer with imports of $19bn compared to exports of $12.7bn for FY15. Government needs to incentivise the Chemical units set-up with new technology catering to export market to give boost to the exports thereby reducing the current account deficit.

Expediting GST with capped rates: Although the Union Government has achieved consensus on bringing legislation on GST, a speedier roll-out is essential for the benefit of select industries like chemical. , which have capital intensive manufacturing locations and a number of logistical activities to reach customers.

Presently, for inter-state sale of goods, most companies set up a warehouse in the destination states and resort to a stock transfer for bringing tax efficiencies, which could be done away with in the GST regime. Moreover, it will reduce administrative burden of multiple taxes. This will potentially improve efficiencies and reduce costs. Capping of GST rates at 18-20 percent for chemical industry will have a strong positive impact on the sector.

Rationalisation of Corporation tax: Given the continuous development, the industry needs to plough back a significant amount of profits for its growth. A reduction in corporation tax would lead to fund technology and modernization, which, in turn, can accelerate growth in the long-run.

Rationalisation of taxes in SEZ: The purpose of SEZ has not been served as much as desired when reforms were first introduced.

The Centre needs to rationalise taxes, especially removal of MAT, levied on the units located in SEZs, which could also augment the Make-In-India initiative. Competitiveness of domestic players: There are instances of inverted duty structure in several products where customs duty on import of final product is lower than its raw material[1]. This makes it difficult for the domestic players to effectively compete in the market. The government should revisit the duty structure for the specific products where rationalisation is required for protection of domestic industries.

Technology transfer: The key aspect of the chemical industry, especially specialty chemicals and agricultural chemicals, is the technology based on which the performance/yield is measured. While it has provided tax incentives for R&D, it is essential to support/fund the technology acquired by domestic industries for rising to the global standards.

The government should consider a budgetary allocation for partially funding such technology, which would be in the larger interest of the economy. Simultaneously, it needs to prepare a better patent protection roadmap to avoid technology infringement.

Infrastructure: Government initiatives like PCPIRs and cluster approach are in the process of implementation; nevertheless, there is quite a delay in project execution. An allocation for building robust infrastructure to support such clusters on a PPP model would help in smoother and timely completion of projects in such regions.

Skilled manpower: With the rapid growth in the industry, players are facing short fall in availability of skilled manpower/chemical engineers. To cater to this, one needs to invest in setting up skill-based training institutes and more ITIs.

Reduction in import duty: To help the industry, and impact on its already low margins, import duty on key petrochemical feedstock like naphtha, ethane and propane and reformate needs to be rationalised. India is facing challenges due to cheap imports from low power cost countries in South, SE Asia and the Middle East. In terms of technology,

India is second only to Japan in adoption of latest technology by investing substantially. However, the high cost of power renders Indian manufacturing at a comparative disadvantage. Import duties on various substances like membrane cell plant, soda ash, pvc, edc and VCM should be reduced.

National Chemical Policy: The overly delayed National Chemical Policy has to be formulated on a priority basis for enabling environment, infrastructure and duty structure for the industry in the country. It will place a framework for promoting safety & security and R&D in the sector. This will bolster the growth of the country's chemical industry and make it more competitive. (The writer is with Deloitte Touche Tohmatsu India LLP)ATIONS - INDIAN CHEMICAL INDUSTRY

(Ref. http://www.thehansindia.com/posts/index/News-Analysis/2017-01-16/Time-for-major-policy-overhaul/273803 dated 16.01.2017)

|

|

BACK |

BENGALURU ADDNL DGFT OFFICE IS NOW EXPORTER FRIENDLY

|

MANGALURU: Office of additional director-general of foreign trade in Bengaluru has taken a slew of steps to make it exporter community friendly in more ways than one. Daily meetings with traders in the afternoon on every working day, open house every Wednesday, setting up of grievances redressal committee, an in-house developed website and short videos initiating the uninitiated into the world of exports are some of these proactive steps that the office has taken.

Explaining these steps to local cashew and marine exporters at a meeting organized by the office in association with Kanara Chamber of Commerce and Industry (KCCI) on Monday, Vijay Kumar, additional DGFT, said the whole idea is to make the office a one-stop solution for the myriad needs of the exporter community. The exporter community had reservations about the office and these initiatives were taken at the local level to address the issues, Vijay Kumar explained.

"We will give resolvable commitment to exporters who turn up with their grievances at the open house," he said, adding one of the major issues that exporters flagged at this fora was delays in issuing export obligation discharge certificate (EODC), which in some cases was delayed up to a year. "We have now started pre-scrutiny of EODC and if the documents are in order, issue the same within 10-days, which was not heard of in the recent past," he added.

Referring to the other initiative, Vijay said the trade satisfaction survey carried out by his office randomly with exporters walking in has shown positive results. "While 98% have expressed their satisfaction with our work, we are focusing on the 2% who have their reservations," he said. In addition, the exporters may reach him directly on the office's twitter handle @dgftbangalore, he said adding they could also do so by logging on to www.jdgft-bangalore.kar.nic.in.

The videos tutoring upcoming exporters and available on ministry of commerce website too were developed in-house at Bengaluru, he said. Exporters should also make use of the dashboard on the ministry's website, an analytical tool that gives them an insight in to export trends and markets available for them. The ministry has also taken up the midterm review of foreign trade policy 2015-20 and exporters may share their areas of concerns, suggestions, he added.

(Ref. http://timesofindia.indiatimes.com/business/india-business/bengaluru-addnl-dgft-office-is-now-exporter-friendly/articleshow/56600924.cms dated 16.01.2017)

|

|

BACK |

APP NAMED 'SEZ INDIA' LAUNCHED BY COMMERCE MINISTRY

|

AKIPRESS.COM - A Mobile app named “SEZ India” has been launched by the Commerce Secretary on 06.1.2017, reports the Press Information Bureau of Government of India.

SEZ Division, Department of Commerce under its broader e-Governance initiative i.e. SEZ Online System, has developed mobile app for Special Economic Zones (SEZs). Commerce Secretary launched the app and mentioned that the App would help the SEZ Units and Developers to find information easily and track their transactions on SEZ Online System. Now the SEZ Developers & Units can file all their transactions digitally through SEZ Online system and track the status on the go through the SEZ India mobile app.

The app is available on Android Platform for use by SEZ Developers, Units, officials and others. The app has four sections i.e. SEZ Information, SEZ Online Transaction, Trade Information, and Contact details. Salient Features of the four sections are as under:-

1. SEZ INFORMATION: This is a compendium of the SEZ Act, 2005, SEZ Rules, 2006, MOCI Circulars, details of SEZs and Units etc. It gives up to date comprehensive details on all the above aspects.

- TRADE INFORMATION: This provision gives access to important information / tools such as Foreign Trade Policy, Hand Book of procedure , Duty Calculator , Customs & Excise Notification and MEIS Rates.

- CONTACT DETAILS: We see that the contact details of all Development Commissioners Office, DGFT, DG System, DGCI & S and SEZ online.

- SEZ online Transaction This is a dynamic submenu that tracks the Bill of Entry / Shipping Bill processing status and also does verification.The app also helps the Importers / Exporters to track the status of 'Bill of Entry / Shipping Bill” integration and processing in the EDI system of the ICEGATE.

(Ref. http://akipress.com/news:587747/ dated 17.01.2017)

|

|

BACK |

Future Of Exports

|

Mr. SudhakarKasture

Director

Exim Institute (a division of Helpline ImpexPvt. Ltd.)

Tel: 022-29252771/28507329/6576 9126

E-mail: sk@helplineimpex.co.in |

While announcing the Foreign Trade Policy 2015-20 Government has set very ambitious export target of $ 900 billion (goods and services put together) to be achieved by 2020. By the end of FY 2016-17 we are expected to reach only $ 280 billion (for goods) which is far too below expectations. We need to think about this very seriously. It is also important that we should look at the future & initiate some concrete steps as export incentives cannot be continued for long due to the fact that India has achieved GNI per capita US $ 1000 for three consecutive years (2013-14 & 2015) at constant 1990 dollars.

If incentives are not to be continued, we will have to look at reduction of transaction costs to remain competitive. Transaction costs are estimated between 12 to 15% & there is good scope to reduce these costs.

We should also look into what is happening internationally & nationally. If we look at last six months, we will find that countries are becoming more & more conservative in approach & are likely to follow restrictive policies. This would result into more dependence on Internal Trade, e.g. EU will buy within EU, ASEAN will buy within ASEAN & so on. This would further lead to more Free Trade Agreements (FTAs) & diversion of trade. Many new countries will emerge as competitors. This necessitates in depth understanding of Free Trade Agreements (FTAs). If duty concessions are granted by importing countries on our products then our products become more competitive compared to other supplying countries that are not entitled to such treatment. By and large our attitude towards FTAs is more defensive; we always wish to protect our local market from incoming imports. We however need to be more “aggressive” in asking concessions & should have definite plans to expand our exports purely on our own strength without relying on incentives.

Shipping costs and cross border movement costs are our major worries. In this connection we need to study Trade Facilitation Agreement (TFA), which is likely to be a binding agreement at WTO once ratified by 110 countries. Till December 2016, 103 countries have already ratified this agreement and hence, it is expected that it would be implemented by February 2017. This agreement makes it compulsory for WTO members to frame the rules which are transparent for cross border movement. The agreement also emphasizes on reduction in shipping cost through single window mechanism & electronic documentation. We therefore need to be more knowledgeable on these issues. Exports would anyway be a knowledge based activity henceforth. To facilitate customs clearance at our end, we need to understand the concept of Authorized Economic Operator (AEO), which allows faster clearance on self-declaration basis & deferred payment of duty. In addition it also allows direct port delivery facility. Put together accreditation as Authorized Economic Operator (AEO) will reduce our transaction cost.

Needless to say quality, proper delivery & care in documentation will continue to have its importance. Chinese influence on the global economy is very well known. If we look at the market of ASEAN countries, this fact can be easily observed. The ASEAN market is fully flooded with Chinese goods. Instead of complaining, we need to find our own strength with ASEAN 10, Japan, Korea, Australia& New Zealand. We need to do proper market research and tap opportunities wherever they exist.

The world is passing through challenging times. We need to prepare ourselves on our own. My personal belief is that, we have adequate entrepreneurial spirits & capability to face any challenge. What we actually need is a change in mind set. We must understand that export is a national priority.

|

|

BACK |

Class 4.2:Pyrophoric& Self-Heating Substances

|

| Shashi Kallada

Consulting & Training-

Dangerous goods by Rail, Road, River and Sea

|

Class 4.2 includes: Pyrophoric substances, which are substances, including mixtures and solutions (liquid or solid), which, even in small quantities, ignite within 5 minutes of coming into contact with air. These substances are the most liable to spontaneous combustion &Self-heating substances, which are substances, other than pyrophoric substances, which, in contact with air without energy supply, are liable to self-heating. These substances will ignite only when in large amounts (kilograms) and after long periods of time (hours or days).

Classification of Pyrophoric Substances

Pyrophoric means "fire-bearing". United Nations Manual of Tests and Criteria, part III, 33.3.1.4&33.3.1.5 lays out the criteria for testing and classification of pyrophoric solids and liquids respectively. These are extremely hazardous substances as they can start burning upon coming into contact with air. Pyrophoric liquids are comparatively easier to handle as solids require glow box sealed and flushed with inert gas. Liquids are stored in hydrocarbon solvents or in mineral oil. These substances are stored and transported in specialized cylinders and tanks.

Procedure for testing pyrophoric solid: One to two ml of the powdery substance to be tested should be poured from about 1 m height onto a non-combustible surface and it is observed whether the substance ignites during dropping or within 5 minutes of settling. This procedure should be performed six times unless a positive result is obtained earlier. If the sample ignites in one of the tests, the substance should be considered pyrophoric and should be classified in packing group I of Division 4.2.

Procedure for testing pyrophoric liquid: A porcelain cup of about 100 mm diameter should be filled with diatomaceous earth or silica gel at room temperature to a height of about 5 mm. Approximately 5 ml of the liquid to be tested should be poured into the prepared porcelain cup and it is observed if the substance ignites within 5 minutes. This procedure should be performed six times unless a positive result is obtained earlier. If a negative result is obtained, then A 0.5 ml test sample should be delivered from a syringe to an indented dry filter paper. The test should be conducted at 25 ± 2 °C and a relative humidity of 50 ± 5%. Observations are made to see if ignition or charring occurs on the filter paper within five minutes of addition of the liquid. This procedure should be performed three times using fresh filter paper each time unless a positive result is obtained earlier.

Finely divided aluminium and iron have pyrophoric properties.

Depending on their properties organometallic substances may be classified in class 4.2 or 4.3 in accordance with section 2.4.5 of IMDG Code.

Loading on board ships and emergency response

In the old days when size of ships were smaller certain pyrophoric substances were prohibited to be carried on board vessel when she is also carrying Class 1 explosives. This is to prevent a fire when there is explosive cargo on board. Today the rule is to keep the pyrophoric container "Separated longitudinally by an intervening complete compartment or hold from" Class 1 explosives. Thus on deck stowage will be Vertical: Prohibited, Athwartships: Prohibited, Fore & Aft: Minimum horizontal distance of 24 meters.

There is no spillage control measures as within 5 minutes of coming out of packages these substances will start burning hence spillage schedule is firefighting.

Examples of Pyrophoric substances: tert-Butyllithium, Diethylzinc, Triethylaluminium

Self-heating substances & Classification: Self-heating of a substance is a process where the gradual reaction of that substance with oxygen (in air) generates heat. If the rate of heat production exceeds the rate of heat loss, then the temperature of the substance will rise which, after an induction time, may lead to self-ignition and combustion. The ability of a substance to undergo oxidative self-heating is determined by exposure of it to air at temperatures of 100 °C, 120 °C or 140 °C in a 25 mm or 100 mm wire mesh cube.

Section 33.3.1.6 of UN Manual for Tests and Criteria lays down the procedure for classification and assignment of packing group for Class 4.2 Self-heating substances. Oily cotton waste and wet cotton are classified under self-heating as they may start fire spontaneously. Most oil bearing seeds have this nature. Copra when loaded on ships must be kept as dry as reasonably practical & protected from all sources of heat. Provide a good through ventilation for bagged cargo. During the voyage regular temperature readings shall be taken at varying depths in the hold and recorded. If the temperature of the cargo exceeds the ambient temperature and continues to increase, ventilation shall be closed down.

There are four factors which determine or contribute to a substance to under self-heating or spontaneous combustion.

- Volume of Cargo

- Rate of Self-heating

- Presence of moisture

- Ambient temperature and heat dissipation.

Compost of organic material can run into spontaneous combustion. When self-heating causes temperature to rise up to 150 Deg C - 200 Deg C self-ignition occurs. Smothering the compost pile top layer and waiting for fire to die down may take 1 to 2 years! A container stuffed with pistachio can show the properties of spontaneous combustion. Container must be stowed protected from sunlight to avoid possibility of same.

|

|

BACK |

LATIN AMERICA WILL RESUME GDP GROWTH IN 2017 AFTER THE RECESSION OF 2016

|

Latin America is projected to recover with 1.5% GDP growth in 2017 after the economic contraction of 0.9% in 2016, according to the 12 October report of ECLAC, the UN Commission for Latin America and Caribbean.

The growth champion in 2016 is Dominican Republic with 6.5%, followed by Panama at 5.4%, Bolivia and Nicaragua at 4.5%, Costa Rica at 4.2% and Paraguay at 4%. Central America is expected to grow at 3.5%, Mexico at 2.1%, Colombia 2.3% and Chile 1.6%. Venezuela holds the top ranking for negative growth with –8%, followed by Brazil at –3.4%, Argentina at –1.8% and Ecuador at –2.5%.

In 2017, all the countries except Venezuela will show positive growth. Brazil will recover to a positive growth of 0.5%, Argentina 2.5% and Ecuador 0.2%. Dominican Republic, Panama, Nicaragua, Costa Rica and Bolivia will continue to grow over 4%. The ten South American countries will grow at 1.1% in 2017 after a negative growth of 2.2% in 2016. Even Venezuela will half its GDP contraction rate to 4%.

The most significant turnaround in 2017 will be in the case of Brazil which now has a business-friendly government of President Temer since August 2016. The new regime has already started opening the economy and removing some of the restrictive and protectionist policies of the PT government which was in power from 2002 to 2016. However there are many challenges ahead, given the paralysis of the infrastructure and construction industry as well as bank credit. The top company chiefs are in jail or under investigation following the "Car Wash" (Lava Jato) scandal involving Petrobras. The centre-right government of Macri in Argentina since December 2015 has been pursuing market reforms and business-friendly policies after the disastrous economic management by President Cristina Kirchner in the period 2007-15. However, Venezuela remains hopeless under President Maduro who has no clues to control the inflation raging at over 600% or stop the economic deterioration. Venezuela can hope for improvement only when the Chavista rule ends.

There is a tendency to blame the socialist policies of the Leftist governments in the region for the economic downturn since 2011. It is not a failure of the socialism. It is due to the abuse of power in the name of socialism by some crazy leaders. The Left in Latin America has become moderate and pragmatic moving towards a Brasilia Consensus with a balanced mix of pro-poor and business-friendly policies. President Lula of Brazil was the role model for this New Left. President Michelle Bachelet of Chile, President OllantaHumala of Peru, Presidents Jose Mujica and Tabare Vasquez of Uruguay, President Evo Morales of Bolivia and President Ortega of Nicaragua have followed the Lula model in varying degrees. President Evo Morales, a staunch leftist has ensured the consistent growth of Bolivia at an annual average of 4.8% since his coming to power in 2006. Bolivia has remained among the highest growth countries in Latin America, although his rhetoric sometimes tends to get extreme. The GDP of the country has grown spectacularly from 9.54 billion dollars in 2005 to 34.68 billion in 2019. Even after the global financial crisis, Bolivia maintained its growth at 3.4% in 2009 and 4.1% in 2010. It is not only the absolute GDP but the per capita growth has also been impressive and consistent, making Bolivia as a successful example of poverty alleviation in the region. It is also true of Nicaragua under the leftist president Ortega, which has consistently grown at an average of 3.8% since his assumption of power in 2007. The GDP of the country has doubled from 6.78 billion dollars in 2006 to 13.26 billion in 2016. But Hugo Chavez, Dilma Rouseff and Cristina Kirchner had tried to control everything and refused to have dialogue with the private sector business. They lost the game playing it their own way. Chavez went out of his way to destroy the Venezuelan industry and business as a revenge against their support to the coup against him in 2002.

The main reason for the downturn in South America is the drastic fall in demand and price of their commodities, caused mainly by the Chinese slow down. But now the global prices are recovering and the domestic demand is also picking up. It is to be noted that the region has adequate foreign exchange reserves (except Venezuela) and inflation under control in single digit, except for Venezuela and Argentina. No country is in any desperate need for IMF rescue. The region is set on a relatively stable course of growth in the coming years. This is evident form the large inflow of FDI into the region betting on its growth potential. They are, of course, also taking advantage of the lower prices of assets and favorable exchange rates.

Here are some positive stories to cheer up the Indian business who might feel discouraged by the negative news flowing out of Latin America:

-UPL (United Phosporous Ltd), the number one Indian agrochemical company does more business in Brazil ( over 500 million dollars) than in India. They are not deterred by the so called 'crisis' in Brazil. They have invested over 300 million dollars and are upbeat about their growth prospects in Brazil, which has got solid growth fundamentals as an Agricultural Powerhouse in the world.

-Indian pharmaceutical companies operating in Brazil have an impressive combined annual turnover exceeding 500 million dollars. Torrent alone does a business of more than 100 million dollars.

-India's exports of vehicles to Mexico have increased by 41% in the first quarter of 2016 reaching 380 million dollars from 267 million in the first quarter of 2015. They have doubled from 665 million dollars in 2013 to 1175 million in 2015.

|

|

BACK |

LATIN AMERICA OUTLOOK FOR 2017

|

Latin America is projected to grow by 1.3% in 2017, according to the 14 December report of the UN Economic Commission for the region (ECLAC). This comes as a relief after the economic contraction of the region in the last two years, by 1.1% in 2016 and 0.5% in 2015.

South America is expected to grow by 0.9%, Mexico by 1.9% (down from 2% in 2016) and Central America at 3.7% (up from 3.6%). Brazil, the largest economy of the region should see a growth of 0.4% (after the negative growth of 3.6% in 2016), Argentina 2.3% ( from –2% in 2016), Colombia 2.7%, Peru 4% ( highest in South America) and Chile 2%. Venezuela's contraction in 2017 will be 4.7%, better than the 9.7% in 2015. Dominican Republic will be the region's growth champion with 6.2%, followed by Panama- 5.9% and Nicaragua - 4.7%.

|

Mr. R. Viswanathan, also known as Rengaraj Viswanathan, is a retired Indian diplomat, writer and speaker specializing in Latin American politics, markets, and culture.

Viswanathan gives speeches in both Spanish and Portuguese and has visited almost all of the countries in the Latin American region. Records exist of more than 100 speeches since June 2004. More than thirty of these speeches are preserved on the internet

|

The main reason for optimism is the expectation of rise in commodity prices by 8% in 2017, which had declined by 6% in 2016.

The slowdown in the region’s economic activity in 2016 was essentially due to lower investment and consumption as well the fall in demand and prices of commodities and the Chinese slowdown.

Total imports of the region are estimated to have fallen by 21% from 984 billion dollars in 2015 to 774 billion in 2016 while exports have come down by 6.3% to 866 billion dollars in 2016 from 925 billion in 2015.

The sovereign risk of the region which peaked at 677 basis points in January 2016 has come down to 500 basis points in late October 2016.

Average inflation in the region has increased to 8.4% in September 2016 from 6.9% in Sept 2015. While Venezuela has maintained the world's highest inflation (over 600%) Argentina's inflation hassurprisingly doubled to 42.4 % in 2016 from 21.9% in 2015. Brazilian inflation has come down to 8.5% from 9.5% last year.

The total external debt of the region has reached 1.52 trillion dollars in 2016 from 1.44 trillion in 2015. However, the ratio of external debt to GDP at 36.4% is not high and is very much under control. Foreign exchange reserves have increased (surprisingly) to 812 billion dollars in 2016 from 795 billion in 2015.

Unemployment rate has risen sharply from 7.4% in 2015 to 9.0% in 2016.

Currencies of many countries of the region have depreciated vis-a-vis dollar in 2016.

The new year brings a new worry for the region. Trump threatens to dissolve NAFTA and other Free Trade Agreements and pursue protectionist policies. Mexico, which is overwhelmingly dependent upon US for over 75 % of its exports, will be in the direct firing line of Trump. He has already arm twisted a few American companies such as Ford to stop their plans for shifting of some manufacturing to Mexico. This will hurt Mexico which has been booming in recent years as the 'manufacturing hub of Americas'. Mexico along with Central America will be hurt by the fall in remittances from their emigrants in US. The only hope is that as President, Trump is likely to tone down his rhetoric and be more pragmatic. The US will be hit as badly as Mexico if he does all that he says.

Brazil's political crisis has deepened after the plea-bargain revelations of Odebrecht according to which about 150 political leaders including President Temer and the speakers of the lower and upper houses of the congress as well as Lula had received bribes and illegal campaign funds. The scandal has paralyzed the ongoing infrastructure projects and investments and frozen bank lending to companies. The Temer government and the corrupt Congress have passed a law freezing the spending limits for the next twenty years. This will hit the country's education and health care among other development sectors. It is a reversal of the pro-poor policies adopted by the Workers Party government which had helped millions of people to come out of the poverty line.

Argentina has surprised everyone with a very high inflation and by its economic contraction in 2016, despite the centre-right President Macri's proactive stimulus measures for the last one year. But it is going to get better in 2017.

Venezuela remains hopeless and continues to worsen. The Chavista regime is still clueless about how to arrest the deterioration. While the Venezuelan people suffer from shortages of food and other essential items, the Wall Street is feasting on the ultra high yield of the Venezuelan bonds.

India can hope to increase its exports to Latin America which will resume growth in 2017. India's car exports to Mexico have increased by 38% in the first eight months of 2016, reaching 1.077 billion dollars as against 728 million in the same period last year. The car exports to Mexico has been steadily going up in the last three years.

India will continue to increase its large imports of petroleum crude, vegetable oils and minerals from Latin America. While the volume of these exports continue to increase, the import bill has sharply declined in 2015 and 2016 thanks to the lower prices of commodities. For example, the oil imports have come down from 20 billion dollars in 2014-15 to 10 billion in 2015-16. This will go up slightly next year. However, the total Indo-Latin American trade in 2016-17 will be much less than the peak of 43 billion dollars in 2014-15 due to the lower value of imports.

There was no major Indian investment in Latin America in 2016. The Indian companies operating in the region will face less pressure in 2017 after the difficult conditions in 2016. Renuka Sugar, which had invested half a billion dollars in the Brazilian sugar mills, declared bankruptchy in 2016, unable repay the debts. Some other Indian investors including Havells are selling off their assets in Latin America. On the other hand, UPL's (United Phosphorous) agrochemical business has been booming in Brazil. Their Brazilian turnover has now overtaken their Indian business. This should encourage other Indian companies who might be interested in acquisition of assets in Latin America at this time when the prices are low.

Latin American democracies which have matured over the years, cannot believe that the Caudillo (strong man) has reappeared in the north. Trump's bullying and offensive discourses and his protectionist policies are forcing the Latin Americans to look for other markets. This comes on top of their frustration with the protectionist trends in Europe. They are also actively trying to reduce over dependence on China, which has hurt their domestic manufacturing and has been pursuing non-transparent policies in the region. So the Latin Americans are now looking at India even more seriously as an economic partner in the long term. This is an opportune time for India to formulate a strategic policy and intensify its engagement with Latin America which is contributing to India's energy and food security and is offering a large market for its exports.

Effect of demonetization on investment and manufacturing of chemical industry

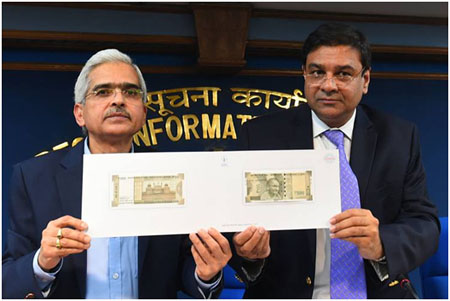

The demonetization in India

8th November 2016, the demonetization of 500 and 1000 rupee banknotes was a bold step taken by the Indian Prime Minister, Narendra Modi. The step was taken to fight against the increased corruption rate and black money issued in India. Moreover, as per RBI, this scheme is introduced to withdraw the fake notes that were used for antinational and illegal activities. This was the main reason that our PM announced that the 500 and 1000 rupee notes are no more to accept as a legal tender in India. The Government banned 500 and 1000 rupee banknotes (approx. 7.4 USD and 15 USD) and announced new series of 500 and 2000 rupee notes in exchange of old notes and gave time to surrender the old notes in banks or post-offices and other RBI branches.

The annual report of Reserve Bank of India of 31st March 2016 quoted that, the total banknotes in circulation valued to 16.42 lakh crore rupee of which nearly 86.4% (i.e. 14.18 lakh crore rupee) was 500 and 1000 rupee notes while Rs. 10 and Rs. 100 banknotes constituted about 53% of the total volume of the banknotes in circulation.

The decision of demonetization has affected few markets and other investments in the country. Overall, the short-term impact of demonetization can be seen in the rural India where the money circulation is still a bigger challenge because of the lower number of ATM’s and ATM users. The customer behavior in India is still set to use hard cash rather than the use of cashless or cards system/online system. The changes in money system have boosted the market share for online retailers while the small shops and village vendors have been affected negatively.

Foreign Investors have taken the demonetization scheme in India positively as it will help them in long-term investment decisions. The banking systems have now enough cash deposited (i.e. about 13.2 lakh crore as of date 14 Dec. 2016 and increasing) in their accounts which can be now used for loans and other investment purposes, that will give financial support for new or existing investors in India.

|

| Source: wall street journal |

Impact on investment and manufacturing in chemical industry

Demonetization will increase the cash deposit in the bank by huge margin. This will also increase the lending ability of the banks because they have a CRR (cash reserve ratio) to maintain and with more deposits, credit (loans) will become easier and interest rates may decrease. Thus, it will attract more foreign investments in various sectors like electronics industry, chemical industry, etc. The move will probably drop down property prices, including land prices, as investors will not be able to use their cash in real estate and thereby forcing real estate sellers to sell the property at lower prices. In chemical sector, 100% FDI is permissible subject to all applicable laws. This will boost the foreign investment by major as well as minor chemical industry players to start or expand their ventures in India. The commodity chemical companies will look for entry into Specialty Chemicals for growth and profitability in the country. Indian chemical industry is currently stands about USD139 billion and is growing at an expected CAGR of 5-6%. In India, the chemical companies can explore alternate feedstock or can invest in setting up the plants in resource rich nations to secure feedstock.

The supply chain of smaller and larger chemical manufacturing industries has been affected adversely. It is estimated that in short-term, all the transactions where the cash was the primary way to trade, are suffering a downturn. The raw material suppliers are unable to transport the materials to the manufactures due to the cash crunch. This move is freezing the income of rudimentary businesses for the manufacturing sectors like transporters, raw materials suppliers, etc. In this way, it is affecting the production of chemical industries in India. It may have drawbacks in the short term but it has positive effect on medium- to long- term once the money supply-demand saturates.

The kind of bold moves and the frequent foreign visits by Narendra Modi are attracting lot of foreign investment in the countries. His government has relaxed foreign-investment rules in many sectors including insurance, manufacturing, etc. His bold moves and economically robust decisions are enabling ease of doing business in India. Hence, it will definitely strengthen the Indian economy and accelerate the chemical industry GDP contribution in coming years.

Effect of Demonetization on Chemical Industry

On November 8 2016, Indian Prime Minister Narendra Modi announced that, at the stroke of midnight, some 14 trillion rupees worth of 500 rupee notes and 1,000 rupee notes, which contributes around 86% of all the currency in circulation, would no longer be legal tender. Also people were given 50 days to deposit them in bank accounts or exchange them for new notes at banks and post offices.

The Argument in support of Demonetization

With the bold decision of demonetizing 500 and 1000 Rupees notes, the government of India has announced a war against black money and corruption.This measure has been taken by the PM in an attempt to address the resolve against corruption, black money, terrorism and counterfeit notes. This move is expected to cleanse the formal economic system and discard black money at the same time.

One of the reasons that prompted the Government to demonetize 500 and 1000 Rupees notes is that their circulation was not in line with the Economic Growth. As per the Finance Ministry, during 2011-2016 periods, the circulation of all notes grew 40% but the circulation of 500 and 1000 Rupeesnotes went up by 76% and 109% respectively. Relatively speaking, the economy has grown only by 30% which is way below the money circulation.

At an aggregate level, this move will significantly eliminate the existing stock of black money, fake currency and will benefit the economy in the medium to long run.

The Argument against Demonetization

The liquidity squeeze caused by demonetization will be negative across sectors with high level of cash transactions. Real estate, jewellery, retailing, restaurants, logistics, consumer durables and luxury brands,cement and some segments in retail/SME lending space will be facing short term instability. Those companies with high level of debt will face more pressure and can face loan defaults.

Furthermore, there will be an added replacement costs of currency, which will occur due to the increased cost of operating ATMs that needs to be refilled more often and also it will be a huge burden on banks. Initially, it is very difficult to create a cashless society as more than 50 percent of Indian population is not well versed with card transactions. Also for these initial months, it will be very difficult to make cash transactions of a higher amount. But the government is taking steps to improve liquidity into the system and reduce inconvenience as much as possible.

Consequences on Chemical Industry

With an estimated size of about USD 139 billion, the chemical industry is a key constituent of the Indian economy, accounting for about 1.38% of the nation’s GVA (Gross Value Addition) in 2013-14. With the implementation of demonetization, the chemical sector has taken a huge hit, which is mostly negative. Restriction of withdrawals from bank is expected to impact the weekly payment to contractual workers, working in the chemical industry. Additionally, constraints on cash withdrawals would negatively influence the procurement of new basic raw materialsfor chemical industry in India.

The nature, frequency and amounts of the commercial transactions involved within the chemical sector necessitate cash transactions on a more frequent basis. Thus, chemical sector are expected to have the most significant impact post this demonetization process and the introduction of new notes in circulation.

Production

Total production of the major chemicals including petrochemicals was 23.9 million tons during 2015-16 while production of polymers stood at around 9 million tons. Production in chemical sector is highly dependent on the supply of raw materials. However, demonetization has created a huge impact on overall production in chemical industry. Chemical industry production capacity in India is hugely impacted through the input-output channels as well as price and output feedback effects. Sale, transport, marketing and distribution of chemical product to wholesale centres, is dominantly cash-dependent. Disruptions, breaks in the supply chains feedback to suppliers as sales fall, increased wastage of perishables, lower revenues that show up as trade dues instead of cash in hand and when credited into bank accounts with limited access affect the sector.

Currently, many of these networks are operating sub-optimally or altogether at a standstill, depending upon location, market links and other item-specific factors. Chemicals sector also acts as a key enabling industry and provides support for variety of other sectors like agriculture, construction, leather etc. Therefore, disruption in chemical industry production, significantly disrupts the performance of the above mentioned sectors.

Import/Export

Basic chemicals and their related products (petrochemicals, fertilizers, paints, varnishes, glass, perfumes, toiletries, pharmaceuticals, etc.) constitute a significant part of the Indian economy. Among the most diversified industrial sectors, chemicals cover an array of more than 70,000 commercial products. In 2015-16, total Foreign Direct Investments (FDI) in chemicals (excluding fertilisers) stood at US$ 1.47 billion whereas cumulative FDI till March 2016 from April 2000 was US$ 11.9 billion.

Total exports of chemical commodities such as dyes and dye intermediates, organic and inorganic chemicals, including agro chemicals, cosmetics and toiletries, essential oils, incense sticks and castor oil, stood at US$ 3.8 billion in April-July 2016. The US, the UAE, the UK, Bangladesh and Saudi Arabia are the leading importers of cosmetics, toiletries and essential oils from India.

The chemical industry export & import business is significantly impacted by the demonetization scheme, implemented by GOI, 8th November 2016 onwards. The Indian Government has always paid incentives and promoted export with easy policies. However the exports market is taking a toll at the moment. Make in India projects need easy flow of currency for manufacturing, hence the demonetization scheme have significantly reduced theimport and export of chemical commodities in trade business.

|

|

BACK |

CHEMICAL INDUSTRY IN SINGAPORE:

|

IN BRIEF

Mega growth trends like rapid urbanisation, changing demographics and the rise of the Asian middle-class are shifting the need for products and services to Asia. With greater demand for transportation fuel, as well as petrochemical and specialty chemical products, the Asia growth story creates a window of opportunity for the chemical industry and top chemical companies in Singapore.

As one of the world’s leading energy and chemical industry hubs, Singapore’s contribution to the industry is vast, both in terms of output and research, and the Republic is constantly working to stay at the forefront of the industry’s advancement. In 2010, the chemicals and chemical products sector contributed S$38 billion of the manufacturing output, a significant rise from S$28 billion in 2009.

KEY LOCATION: JURONG ISLAND

Singapore’s position as a global chemicals hub has grown in tandem with the extensive development of Jurong Island — an integrated complex housing many of the world’s leading energy and chemical companies, among them BASF, ExxonMobil, Lanxess, Mitsui Chemicals, Shell and Sumitomo Chemicals. Presently, Jurong Island has successfully attracted investments in excess of S$35 billion.

TRUSTED BASE FOR HIGH-TECH MANUFACTURING AND R&D

Proprietary manufacturing processes are key to the competitiveness of energy and chemical companies along the entire value chain. Given the nation’s strong track record for intellectual property rights protection, Singapore is ideal for companies seeking to develop and commercialise proprietary technologies and first-class manufacturing processes. Jurong Island is also a secured manufacturing location that places a priority on safety and security. Additionally, Singapore has invested heavily, and will continue to do so, in R&D infrastructure and seeks to work with the industry to create new beginnings in the country

RESEARCH AND DEVELOPMENT

Located on Jurong Island, the Institute of Chemical and Engineering Sciences (ICES) is an autonomous national research institute under A*STAR (Agency for Science, Technology and Research). It was created to undertake a diverse range of activities from exploratory research to process development, optimization and problem solving as well as the running of pilot-scale projects. With a focus on providing highly trained R&D manpower, establishing a strong science base and developing technology and infrastructure, ICES is well-positioned to support top energy and chemical companies as they develop new products and processes from Singapore. Together with public research institutes such as ICES, Singapore is host to a number of private sector research centers by some of the largest chemical companies in the world like 3M, Bayer and BASF.

SPECIALTY CHEMICALS

Leveraging on the country’s strengths as a leading market player in other areas such as marine and offshore engineering, water treatment and lubricants, Singapore is well-positioned to further expand the chemical industry by focusing on high value-added specialty chemicals that serve these sectors. Additionally, specialty chemicals companies can leverage the close proximity from Singapore to their customers and the end-consumer, and respond with agility to the emerging needs of Asian consumers by innovating new applications.

ACCESS TO SKILLED TALENT

Talent is a key enabler for a complex and dynamic chemical industry, for which Singapore’s distinguished academic establishments graduate a well-trained pool of engineering and management talent as well as skilled technicians annually. To further prepare the engineering graduates entering the industry every year, the government invested in a live kerosene splitter on Jurong Island. This facility within the Chemical Process Technology Centre (CPTC) provides graduates the invaluable opportunity to simulate start-up, shut-down, and safety procedures.

In addition to a well-trained, home grown workforce, Singapore’s attractive central location and live ability allows companies to attract experienced talent from all over the world. The strong local talent base, complemented by diverse international talent both contribute a world-class workforce, which companies can hire from to quickly ramp up their operations and drive growth in Asia.

MOVING AHEAD

As Singapore positions itself for the next phase of growth in its energy and chemical industry, the Republic aims to be a model of sustainable development. To address climate change concerns and global resource constraints, Singapore is taking the lead in terms of raising the bar in energy efficiency, emissions management as well as accelerating the development of new, sustainable feedstock and technologies in partnership with industry through the Jurong Island version 2.0 initiative. A number of high impact projects, to ensure Jurong Island’s continued attractiveness as an integrated manufacturing location will be implemented over the next few years. These include key infrastructure such as a gasification plant, a LPG terminal and a multi-user product grid. Recognising the importance to companies of plant-level sustainability efforts, which reduce a plant’s carbon footprint, the city also actively supports companies to encourage adoption of energy efficiency improvement projects.

The city continues to receive glowing reviews year after year for its infrastructure, manpower capabilities, as well as ease of doing business. For companies seeking a location from which to connect to their customers and manage their operating entities in Asia, Singapore’s strategic location and physical connectivity means that companies can oversee their activities in this fast-growing region.

ECONOMY:-

Singapore has a highly developed and successful free-market economy. It enjoys a remarkably open and corruption-free environment, stable prices, and a per capita GDP higher than that of most developed countries. Unemployment is very low. The economy depends heavily on exports, particularly of consumer electronics, information technology products, medical and optical devices, pharmaceuticals, and on its vibrant transportation, business, and financial services sectors.

The economy contracted 0.6% in 2009 as a result of the global financial crisis, but has continued to grow since 2010 on the strength of renewed exports. Growth in 2014-15 was slower at under 3%, largely a result of soft demand for exports amid a sluggish global economy and weak growth in Singapore’s manufacturing sector.

The government is attempting to restructure Singapore’s economy by weaning its dependence on foreign labor, addressing weak productivity, and increasing Singaporean wages. Singapore has attracted major investments in pharmaceuticals and medical technology production and will continue efforts to strengthen its position as Southeast Asia's leading financial and high-tech hub. Singapore is a member of the 12-nation Trans-Pacific Partnership free trade negotiations, as well as the Regional Comprehensive Economic Partnership negotiations with the nine other ASEAN members plus Australia, China, India, Japan, South Korea, and New Zealand. In 2015, Singapore formed, with the other ASEAN members, the ASEAN Economic Community.

MARKET CHALLENGES

Singapore is highly urbanised with a large pool of skilled labour. Its multicultural population makes it a great place to research potential market trends across the rest of Asia.

Intense competition and a small domestic market – Singapore has a relatively small domestic market compared to other Asian countries. For this reason, it can be difficult to find unexplored niches in the market – especially in the service industries.

The cost of day-to-day operations can be high – Attracting and retaining skilled labour can be costly due to the tight labour market. Prime office space is limited and rental prices remain high.

Singapore is culturally diverse – The population comprises a melting pot of multicultural, ethnic and religious backgrounds. This presents a good opportunity for Australian businesses to market their products and services to a diverse consumer group, and research urban trends for the rest of Asia.

Robust infrastructure and services – Singapore has excellent infrastructure for transport and communications. This means that the entire market is easily accessible and serviced. Singapore has a very low crime rate, making it a safe place to do business.

Strong intellectual property laws – Singapore is regarded as having the strongest intellectual property (IP) protections in the world – a major benefit to business.

Open and competitive as a free market – Singapore adopts an open border and transparent approach to both local and foreign businesses. In positioning itself as a regional business centre, it offers pro-business incentives, such as low corporate taxation and assistance on resources and facilities.

Singapore is a key regional hub – Many businesses use Singapore as their entry point to Asia and a large number of Australian businesses have a presence in Singapore, including ANZ, BHP Billiton, Rio Tinto, Lend Lease Asia, Leighton and Toll Holdings.

Build up your Singapore business network – There are a number of trade and business associations to help build your industry network in Singapore. These organisations include International Enterprise (IE) Singapore, SPRING Singapore, and the Singapore Business Federation.

MAJOR INDUSTRIES IN SINGAPORE

Singapore’s major industries have attracted some of the world’s largest global operators.

Aerospace engineering – With the rate of air travel growing in the Asia Pacific region, opportunities exist for aerospace manufacturers; maintenance, repair and operations (MRO) companies; and aviation and aerospace equipment and service providers.