|

|

|

Chemexcil Workshop on IGST/ Un-utilized ITC refund on exports And AEO (Certification And Documentation) at Radisson Hotel, Bangalore on 12/07/2018

| |

|

| Shri Satish Wagh, Chairman,Chemexcil welcoming Smt Priya Patil, Deputy Commissioner, AP & ACC |

A Sensitization Workshop on IGST/Un-utilized Refunds and Authorized Economic Operators (AEO) was organized on July 12, 2018 at Bangalore. Shri. Satish Wagh, Chairman, Chemexcil, welcomed the participants and two senior customs officials MrsPriyaPatil, Deputy Commissioner, AP & ACC and MrShafeeq, Assistant Commissioner, Bangalore East GST Commissionerate

To guide the exporters regarding the procedure and process of the IGST/ ITC refund, sensitize them to avoid hassles while applying for the refund and take appropriate measures to rectify the errors, the council had organized a "Workshop on Refund of IGST/Un-utilised ITC for Exporters" on 12th June 2018 at Hotel Radisson Hotel, Bangalore. The Council had invited Mrs Priya Patil, Deputy Commissioner and MrShafeeq, Assistant Commissioner. From the council side Shri Satish Wagh- Chairman, Shri S.G Bharadi-ED and other Officers/ staff of Chemexcil attended the Workshop. Highlights of the workshop Shri Wagh welcomed the esteemed participants and opined that the timing of the workshop was apt since Government has organized refund drive fortnight. He urged the members to make best use of this opportunity to clear their pending refunds. Smt Priya Patil, Assistant Commissioner and Shri Shafeeq, Assistant Commissioner, briefed regarding exporters who have mentioned IGST in 3.1(a) of GSTR-3B, She informed that in such cases the details are being sent to GSTN who will subsequently transmit to Customs EDI for processing. Exporters will have to later on submit a certificate from Chartered Accountant before 31st October, 2018 to the DC(IGST), at the port of export to the effect that there is no discrepancy between the IGST amount refunded on exports and the actual IGST amount paid on exports of goods for the period July 2017 to March 2018. Further, SmtPriyaPatil added that in cases where there is a short payment of IGST proof of payment shall be submitted to Assistant/Deputy Commissioner of Customs in charge of IGST at Customs. Later on they will submit a certificate from Chartered Accountant before 31st October, 2018 to the DC(IGST), Customs. She also informed that other errors like SB003, SB005 & SB006 are also being handled now during the drive. Replying to queries on short payment, supplementary claims and merchant exporter Notification, Smt Priya Patil advised that these are new queries and will have to be taken up with CBIC for final resolution. She also advised the council to send such representations with details for examination. Shri Shafeeq explained the entire procedure and process in detail and covered topics like Categories of Supply under GST, Zero rated supply, Pre-requisites for refunds, Returns and Refund Applications, Refund of un-utilised ITC, Refund of IGST Paid on Exports, Refund under 0.1% merchant exporter supply etc..

Calling AEO a safety programme, Mrs Priya Patil exhorted all those engaged in international business to get AEO certified to endure in the competitive global trade environment. Almost 70- 80 countries have already joined AEO.She cautioned while expressing concerns over very few AEOs in the country in comparison with China and European Union. Mrs Priya Patil explained in detail the following benefits of AEO: Inclusion of Direct Port Delivery (DPD) of imports to ensure just-in-time inventory management by manufacturerclearance from wharf to warehouse; Inclusion of Direct Port Entry (DPE) for factory stuffed container meant for export by AEOs; Provision of deferred payment of duties – delinking duty payment and customs clearance; Mutual Recognition Agreements with other Customs Administration; Faster disbursal of drawback amount; Fast tracking of refunds and adjudications; Acceptance of self-certified copies of FTA/PTA origin related or any other certificates required for clearance; Paperless declarations with no supporting documents and Recognition by Participating Government Agencies (PGAs) and other stakeholders n Government of India has introduced Authorized Economic Operators (AEO) scheme as part of its obligation to World Customs Organization under the framework of Standards to Secure and Facilitate global trade (SAFE). The scheme envisages various benefits to different categories of economic operators. The intention is to give AEO certified operators preferential treatment in terms of lesser customs examination, relaxed procedural requirements etc. Authorized Economic Operators include inter alia manufacturers, importers, exporters, brokers, carriers, consolidators, intermediaries, ports, airports, terminal operators, integrated operators, warehouses and distributors. Any economic operator such as manufacturer, importer, exporter, logistics provider and CHA can apply for authorization, provided they fulfill and comply with certain provisions.

The Workshop got excellent response with more than 38 Member Exporters. The participants asked several queries during the Workshop which were answered satisfactorily by the eminent panelists

BACK |

|

Brief report on

Interactive session with the Commissioner of Customs (Exports), Air Cargo Complex, Mumbai on “Third Refund Fortnight from 16th July, 2018 to 30th July, 2018 to clear pending refunds” &“Authorised Economic Operator” on 24/07/2018 at Hotel Marine Plaza, Mumbai

Delays in IGST refunds/ un-utilised ITC on exports due to inadvertent errors etc has been a cause of concern amongst the exporters.

As a service to the member-exporters, the council had organized an Interactive session with the Commissioner of Customs (Exports), Air Cargo Complex, Mumbai on “Third Refund Fortnight from 16th July, 2018 to 30th July, 2018 & “Authorised Economic Operator” Program.

The objective of this session was to create awareness about the “Third Refund Fortnight from 16th July, 2018 to 30th July, 2018 to clear pending refunds” & also make the trade aware of benefits of the “Authorised Economic Operator” program.

The seminar was graced by following:

Customs Officers

1. Shri S. Anantha Krishnan, Commissioner of Customs (Exports), Air Cargo Complex Mumbai

2. Shri Tapan Kumar, Joint Commissioner , Air Cargo Complex Mumbai

3. Shri Jaideep Dubey, Assistant Commissioner of Customs, Drawback, Air Cargo Complex

4. Other officers/ staff of Air Cargo Complex Mumbai

Council Representatives

1. Shri Satish Wagh, Chairman Chemexcil

2. Shri Ajay Kadakia, Vice Chairman Chemexcil

3. Shri S.G Bharadi, ED and other Officers/staff of Chemexcil

4. Member-exporters of chemexcil

Shri Wagh welcomedthe gathering and expressed happiness that CHEMEXCIL has organizedthis interactive session at the appropriate time when CBIC is Observing Third Refund Fortnight to Clear Pending Refunds" from 16th July 2018 to 30th July 2018

all over the Country for facilitating IGST/ Un-utilised refunds on exports. This initiative which is third such drive after the one in March & June is reallycommendable and will hopefully resolve liquidity issues of the exporters. He also thanked Shri S. Anantha Krishnan, Commissioner of Customs (Exports), Air Cargo Complex, Mumbai and his officers for sparing their valuable time for interaction with the participants.

Shri S. Anantha Krishnan, Commissioner of Customs (Exports), Air Cargo Complex, Mumbai informed that till date IGST refund disbursed @ ACC was aroundRs. 1572 cr. Total pending claims due to SB 005 errors isAmount-Rs 64.19 cr and Pending Claims due to PFMS rejection – Rs 19.58 Crs. He urged all the participants to kindly take note and if applicable submit the Annexure A for rectification of errors/ refund processing.

Shri Jaideep Dubey explained in detail the step wise process of refund and also took specific company wise queries. Wherever any deficiency was observed, he advised to do the needful for processing.

Shri Tapan Kumar made detailed presentation on AEO scheme and explained the process of application, documents needed, benefits etc.

The interactive session was attended by around 30 participants. They participants interacted with the Customs officers and where satisfied with the response. The session ended with vote of thanks followed by networking lunch.

| Glimpses of the Interactive Session |

|

| Shri Satish Wagh, Chairman welcoming Shri S Anantha Krishnan, Commissioner (Exports), ACC Mumbai during interactive session on IGST refunds & AEO on 24.07.2018 |

| |

|

| Shri Ajay Kadakia, Vice Chairman welcoming Shri Tapan Kumar, Joint Commissioner ACC Mumbai during interactive session on IGST refunds& AEO on 24.07.2018 |

| |

|

| Shri S.G Bharadi, ED welcoming Shri Jaideep Dubey, Asst. Commissioner, DBK/ IGST, ACC Mumbai during interactive session on IGST refunds & AEO on 24.07.2018 |

| |

|

| Shri Satish Wagh, Chairman addressing the gathering during interactive session on IGST refunds & AEO on 24.07.2018 |

| |

|

| Shri S Anantha Krishnan, Commissioner (Exports), ACC Mumbai addressing the participants during interactive session on IGST refunds& AEO on 24.07.2018 in Mumbai |

| |

|

| Shri Tapan Kumar, Joint Commissioner, Air Cargo Complex Mumbai making a presentation on AEO program |

| |

|

| Shri Jaideep Dubey, Asst. Commissioner making a detailed presentation on IGST refunds during the seminar |

BACK |

|

Brief report on

Seminar on "Trade Finance & Forex Risk Management" in association with Kotak Mahindra bank on 27/07/2018 in Mumbai.

Volatility in Forex markets and high cost of export finance has been a cause for serious concern amongst the members exporters.

As a service to the members, the council had organised a knowledge seminar on "Trade Finance & Forex Risk Management" in association with Kotak Mahindra bank on 27/07/2018 in Mumbai.

The objective of this seminar was to create awareness about various aspects of "Trade Finance & Forex Risk Management" specially among MSME members so that they can take informed decisions about trade finance and risk management.

The seminar was graced by following:

Council Representatives

1. Shri Satish Wagh- Chairman Chemexcil

2. Shri Deepak Gupta- Deputy Director, Chemexcil

3. Member-exporters of chemexcil

Kotak Mahindra Bank Faculty

1. Shri Venu Gopal Rao Paidimarry- National Manager- Trade Finance, Kotak Mahindra Bank (KMB)

2. Shri RohitJethra- Sr. Vice President- Treasury, KMB

3. Shri Maneesh Srivastava- Vice President- Priority Banking, KMB

4. Shri Milind Gokral- Chief Manager- Privy Business Banking KMB

5. Shri Pankaj Kapoor,Sr Manager, KMB

Shri Maneesh Srivastava welcomedthe participants for the seminar and particularly thanked Shri Satish Wagh, Chairman for providing this opportunity to Kotak Mahindra Bank for interaction with our members.

Shri Venu Gopal Rao Paidimarrymade a comprehensive presentation on Trade Finance touching all the aspects of Trade Finance, credit risk including business with OFAC countries and also briefed about certain trade finance products of KMB which can be useful for exporters.

Shri RohitJethra explained in detail the dynamics of INR/ USD movement in India for the last few years and the important reasons for depreciation such as crude oil price, election, Trade war with US etc. He also explained the risk management products like forward contracts, options, FCTL etc.

He advised the members to avoid speculation and take an informed view on forex risk management.

The interactive session was attended by around 30 member-exporters.The participants interacted with the eminent experts from Kotak Mahindra Bank and where satisfied with the response.

The session ended with vote of thanks by Shri Satish Wagh, Chairman followed by Hi-Tea.

| Glimpses of the Seminar on "Trade Finance & Forex Risk Management" |

|

| Shri Venu Gopal Rao, National Manager- Trade Finance, Kotak Mahindra Bank making presentation on Trade Finance during seminar in association with Kotak Mahindra Bank on 27.07.2018 in Mumbai |

| |

|

| Shri Satish Wagh, Chairman Chemexcil attending the seminar on Trade Finance & Forex Risk Management |

| |

|

| Overall view of seminar on Trade Finance & Forex Risk Management |

BACK |

REACH - REIMBURSEMENT OF 50% OF ECHA FEES INCURRED TO MEMBERS FOR REGISTRATION OF THEIR SUBSTANCES UNDER EU REACH DURING THE 3RD DEADLINE OF REGISTRATION I.E. 31ST MAY 2018

| EPC:PROJ:REACH2018 |

31/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

REACH - REIMBURSEMENT OF 50% OF ECHA FEES INCURRED TO MEMBERS FOR REGISTRATION OF THEIR SUBSTANCES UNDER EU REACH DURING THE 3RD DEADLINE OF REGISTRATION I.E. 31ST MAY 2018 |

|

|

Dear Sir / Madam,

Please refer to our circular dated 13th July 2018 on ‘REIMBURSEMENT OF 50% OF ECHA FEES INCURRED TO MEMBERS FOR REGISTRATION OF THEIR SUBSTANCES UNDER EU REACH DURING THE 3RD DEADLINE OF REGISTRATION I.E. 31ST MAY 2018’.

It is informed that the last date for submitting the claims for reimbursement of 50% of ECHA fees has been extended upto 16th August 2018.

Hence, the concerned members are requested to take a note of it and submit their claims alongwith the relevant documents on or before 5 pm at 16th August 2018.

Please note, no further extension of deadline will be provided in this matter.

Thanking You,

Yours faithfully,

Prafulla Walhe

Deputy Director

|

|

BACK

|

GST - CBIC Note on Simplified Returns and Return Formats (July 2018)

| EPC/LIC/GST |

31/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST - CBIC Note on Simplified Returns and Return Formats (July 2018) |

|

|

Dear Members,

As informed earlier, GST Council in its 28th meeting held on 21' July, 2018, has approved the key features and new format of the GST returns.

In this regard, CBIC portal has uploaded a brief note listing the salient features of the new return format and business process for the information of trade and industry and other stakeholders. This note is available for reference using below links-

http://cbic.gov.in/htdocs-cbec/draft-circ/GST_Returns_3007.pdf

http://cbic.gov.in/resources//htdocs-cbec/draft-circ/GST_Returns_3007.pdf;jsessionid=714089A3177CE765B33DD925DF5175FA

Further, as per updates on CBIC portal, Draft GST returns and formats will be placed on Mygov.in portal shortly, for the feedback of stakeholders on the MyGov portal.

Members are requested to take note of the same and use above hyperlinks for downloading the note. We shall also keep you updated about the Draft GST returns/ formats once uploaded on MyGov portal and seek your feed-back on the same.

Thanking you,

Yours faithfully,

(S. G. BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

DGFT - Amendment of Policy Conditions of Urea under Chapter 31 of the ITC (HS) 2017, Schedule - I (Import Policy)

| EPC/LIC/UREA |

31/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Amendment of Policy Conditions of Urea under Chapter 31 of the ITC (HS) 2017, Schedule - I (Import Policy) |

|

|

Dear Members,

The O/o Directorate General of Foreign Trade, New Delhi has issued Notification No. 23/2015-2020 dated 27/07/2018 regardingAmendment in import policy condition of Urea under ITC (HS) code 31021000 of Chapter 31 of ITC (HS), 2017 - Schedule -1 (Import Policy).

The amendment has been done as follows:

| Exim Code |

Item Description |

Policy |

Policy Conditions |

| 3102 10 00 |

Urea, whether or not in aqueous solution |

State Trading Enterprise |

State Trading Enterprise.

However, import of Urea for industrial/non-agricultural/ technical grade shall be "Free" with Actual User Condition. |

As an effect of this Notification, Import Policy of Urea for industrial/non-agricultural/technical grade shall be "Free" with Actual User Condition.

Relevant members are requested to take note of the same. Original notification, is available using below link-

http://dgft.gov.in/Exim/2000/NOT/NOT18/Noti%2023%20eng.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

|

|

BACK

|

Non-tariff Measures applied by the countries of LAC region

| EPC/LIC/LAC/NTM |

30/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Non-tariff Measures applied by the countries of LAC region |

|

|

Dear Members,

We have received communication from FT-LAC Division, Department of Commerce, Government of India regarding inputs on the Non-tariff Measures applied by the countries of LAC region.

You will appreciate that despite high potential, India’s exports to LAC region are not substantial. As a part of DoC’s strategy to revitalize exports to the LAC region, one of the action points is to identify and take up remedial measures with the respective country on the non- tariff measures/behind the border measures applied by the countries of the LAC region, which could include a range of policies that may deliberately or inadvertently, restrict trade.

In view of the above, members are requested to kindly send us detailed inputs on the non-tariff measures/behind the border measures, including the policies that may deliberately or inadvertently, restrict our exports to the LAC region. The inputs be sent to us at the earliest on deepak.gupta@chemexcil.gov.in, balani.lic@chemexcil.gov.in & rodelhi@chemexcil.gov.in .

Your early replies will be appreciated and enable us put forth to the government.

Thanking You,

Yours faithfully,

(S G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

GST - Notifications pursuant to recommendations of 28th GST Council Meeting held on 21/07/2018

| EPC/LIC/GST |

27/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST - Notifications pursuant to recommendations of 28th GST Council Meeting held on 21/07/2018 |

|

|

Dear Sir/Madam,

This is in continuation of our circular dated 23/07/2018 informing you about the recommendations of 28th Meeting of GST Council held on 21/07/2018 wherein several decisions were taken related toreturn simplification/ to exemptions / changes in GST rates / ITC eligibility criteria, rationalization of rates / exemptions and clarification on levy of GST on services.

For the convenience of the members, some of the GST notifications issued related to rate changes etc are mentioned below-

| 19/2018-Integrated Tax (Rate) ,dt. 26-07-2018 |

View (258 KB) |

देखें (203 KB) |

Seeks to amend Notification 01/2017-Integrated Tax (Rate),dt. 28-06-2017 to give effect to the recommendations of the GST Council in it’s 28th meeting held on 21.07.2018 |

http://cbic.gov.in/resources//htdocs-cbec/gst/notfctn-19-2018-igst-rate-english.pdf;jsessionid=B894772F4DE3AA30A66F256E53574FED

| 14/2018-Integrated Tax (Rate) ,dt. 26-07-2018 |

View (258 KB) |

देखें (203 KB) |

Seeks to amend notification No. 8/2017- Integrated Tax (Rate) so as to notify IGST rates of various services as recommended by Goods and Services Tax Council in its 28th meeting held on 21.07.2018. |

http://cbic.gov.in/resources//htdocs-cbec/gst/notfctn-14-2018-igst-rate-english.pdf;jsessionid=4BE8A241B153E921711F9B834D406C17

Apart from above-mentioned notifications, if members wish to refer to all the notifications, the same are available using below links-

http://cbic.gov.in/htdocs-cbec/gst/central-tax-rate-notfns-2017

http://cbic.gov.in/htdocs-cbec/gst/integrated-tax-rate-2017

http://cbic.gov.in/htdocs-cbec/gst/union-territory-tax-rate-2017

Finally, in due course, as remaining notifications are issued about simplified return filing etc we shall update you.

Thanking you,

Yours faithfully,

(S.G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

ADD Initiation of the Review by Korea Trade Commission (KTC) on the Need for the Continued Imposition of the Anti-dumping Duty on Ethyl Acetate originating from India

| EPC/LIC/ADD/EA |

26/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

ADD Initiation of the Review by Korea Trade Commission (KTC) on the Need for the Continued Imposition of the Anti-dumping Duty on Ethyl Acetate originating from India |

|

|

Dear Members,

As informed earlier, Korea Trade Commission (KTC) had imposed Anti-Dumping Duty on imports of Ethyl Acetate (HS Code-2915.31.0000) into South Korea originating from India.

The Council has now received communication from Directorate General of Trade Remedies (DGTR), India wherein Embassy of India, Seoulhas informed that Ministry of Strategy and Finance, Korea has issued Public Notice to initiate a review on the need for the continued imposition of an anti-dumping duty on imports of Ethyl Acetate originating from India.

As per the Public Notice (No. 2018-112) of the Ministry of Strategy and Finance, Korea Alcohol Industrial Co., Ltd. has requested the Korean Government to review the need for the continued imposition of the anti-dumping duty on Ethyl Acetate originating from India. Therefore, the Ministry of Strategy and Finance has determined to initiate the review after consultation with the Korea Trade Commission.

The documents received from Embassy of India, Seoul are attached herewith for your information. In the course of the investigation, interested parties may inquire, make comments or submit information to the relevant authorities mentioned in the Public Notice.

Relevant members are requested to take note of the same and do the needful. We also request you to kindly revert with your comments and also keep the council updated on your further action, on our e-mail id’s deepak.gupta@chemexcil.gov.in & info@chemexcil.gov.in .

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl:- Documents received from Embassy of India, Seoul

|

|

BACK

|

Imp - Details of IGST Refund Help Desk at FIEO Mumbai and Ahmedabad Office

| EPC/LIC/IGST |

23/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Imp - Details of IGST Refund Help Desk at FIEO Mumbai and Ahmedabad Office |

|

|

Dear Members,

We would like to inform you that CBIC had issued Circular No. 21/2018-Customs dated 18/07/2018 regarding setting up of Help Desks at the offices of FIEO and AEPC for expeditious resolution of IGST refund related issues. The Help Desks would be located at 10 locations of FIEO and AEPC (Tirupur) and would function for a period of 2 weeks till 1st August, 2018.

In this regard, we have received intimation from FIEO (WR) regarding details of the same which are as follows:

The Help Desk at FIEO Mumbai and Ahmedabad office will be function from 23rd July 2018 to 01st August 2018 at following location from 10.00 am to 06.00 pm :

FIEO Mumbai

TIMES SQUARE BUILDING, Unit 3A,

B-Wing, 4th Floor, Andheri Kurla Road,

Andheri East, Mumbai – 400 059

Ph. 022-4057 2222 / 214

FIEO Ahmedabad

408/A, Akshar Complex,

Shivranjani Cross Road,

Vastrapur, Ahmedabad – 380 015

Ph. 998063322 / 9974040606

Officials from Customs Dept. will be available to help the exporters whose claims are pending for want of submission of further documents to carry out the rectification exercise. In case any further information is required in this regard, you may call us at 022-40572222 / 2214 or send mail at harpreetmakol@fieo.org

Members are requested to kindly note above details and take advantage of this excellent opportunity to get the pending refunds cleared by visiting the above Help Desk locations along with documents relating to Tax paid, exports made & returns filed. Exporters are not required to visit any Port of Export / Custom House once the requisite documents / information have been submitted to the officers at the Helpdesk for processing.

For other locations, members may check with local offices of FIEO and take it forward accordingly.

Thanking you,

Yours faithfully,

(S.G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

V. Imp - Recommendations of 28th GST Council Meeting held on 21/07/2018

| EPC/LIC/28thGST_Council |

23/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

V. Imp - Recommendations of 28th GST Council Meeting held on 21/07/2018 |

|

|

Dear Members,

Kindly note that 28th Meeting of GST Council was held on 21/07/2018 wherein several decisions were taken related to return simplification/ to exemptions / changes in GST rates / ITC eligibility criteria, rationalization of rates / exemptions and clarification on levy of GST on services.

As per the press releases issued by PIB & CBEC, the various recommendations are highlighted/ reproduced as follows for your reference:

Simplified GST Return/ Quarterly filing of return for the small taxpayers having turnover below Rs. 5 Cr as an optional facility.

It may be recalled that in the 27thmeeting held on 4thof May, 2018 the Council had approved the basic principles of GST return design and directed the law committee to finalize the return formats and changes in law. The formats and business process approved now are in line with the basic principles with one major change i.e the option of filing quarterly return with monthly payment of tax in a simplified return format by the small tax payers.

All taxpayers excluding small taxpayers and a few exceptions like ISD etc. shall file one monthly return. The return is simple with two main tables. One for reporting outward supplies and one for availing input tax credit based on invoices uploaded by the supplier. Invoices can be uploaded continuously by the seller and can be continuously viewed and locked by the buyer for availing input tax credit. This process would ensure that very large part of the return is automatically filled based on the invoices uploaded by the buyer and the seller. Simply put, the process would be “UPLOAD – LOCK – PAY” for most tax payers.

Taxpayers would have facility to create his profile based on nature of supplies made and received. The fields of information which a taxpayer would be shown and would be required to fill in the return would depend on his profile.

NIL return filers (no purchase and no sale) shall be given facility to file return by sending SMS.

The Council approved quarterly filing of return for the small taxpayers having turnover below Rs. 5 Cr as an optional facility. Quarterly return shall be similar to main return with monthly payment facility but for two kinds of registered persons – small traders making only B2C supply or making B2B + B2C supply. For such taxpayers, simplified returns have been designed called Sahaj and Sugam. In these returns details of information required to be filled is lesser than that in the regular return.

The new return design provides facility for amendment of invoice and also other details filed in the return. Amendment shall be carried out by filing of a return called amendment return. Payment would be allowed to be made through the amendment return as it will help save interest liability for the taxpayers.

93% of the taxpayers have a turnover of less than Rs 5 Cr and these taxpayers would benefit substantially from the simplification measures proposed improving their ease of doing business. Even the large taxpayers would find the design of new return quite user friendly.

Changes in GST Rates

From chemical sector point of view following changes are made:

GST Rate reduced from 28% to 18%

Paints and varnishes (including enamels and lacquers)

Miscellaneous articles such as scent sprays and similar toilet sprays, powder-puffs and pads for the application of cosmetics or toilet preparations

GST Rate reduced from 18% to 5%:

Ethanol for sale to Oil Marketing Companies for blending with fuel

GST Rate reduced from 12% to 5%:

Phosphoric acid (fertilizer grade only)

Miscellaneous Change relating to valuation of a supply:

IGST @5% on Pool Issue Price (PIP) of Urea imported on Govt. account for direct agriculture use, instead of assessable value plus custom duty.

Export / other trade facilitation measures

Extend the exemption granted on outward transportation of all goods by air and sea by another one year i.e. up-to 30th September, 2019 as relief to the exporter of goods.

Opening of migration window

The taxpayers who filed Part A of FORM GST REG-26, but not Part B of the said FORM are requested to approach the jurisdictional Central Tax/State Tax nodal officers with the necessary details on or before 31stAugust, 2018.

The nodal officer would then forward the details to GSTN for enabling migration of such taxpayers. It has also been decided to waive the late fee payable for delayed filing of return in such cases. Such taxpayers are required to first file the returns on payment of late fees, and the waiver will be effected by way of reversal of the amount paid as late fees in the cash ledger under the tax head. Taxpayers who intend to complete the migration process are requested to approach their jurisdictional Central Tax/State Tax nodal officers in this regard.

Other important recommendations:

Upper limit of turnover for opting for composition scheme to be raised from Rs. 1 crore to Rs. 1.5 crore.

Prescribe GST rate slabs on accommodation service based on transaction value instead of declared tariff which is likely to provide major relief to the hotel industry

Composition dealers to be allowed to supply services (other than restaurant services), for upto a value not exceeding 10% of turnover in the preceding financial year, or Rs. 5 lakhs, whichever is higher.

Levy of GST on reverse charge mechanism on receipt of supplies from unregistered suppliers, to be applicable to only specified goods in case of certain notified classes of registered persons, on the recommendations of the GST Council.

The threshold exemption limit for registration in the States of Assam, Arunachal Pradesh, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand to be increased to Rs. 20 Lakhs from Rs. 10 Lakhs.

Taxpayers may opt for multiple registrations within a State/Union territory in respect of multiple places of business located within the same State/Union territory.

Mandatory registration is required for only those e-commerce operators who are required to collect tax at source.

Registration to remain temporarily suspended while cancellation of registration is under process, so that the taxpayer is relieved of continued compliance under the law.

The following transactions to be treated as no supply (no tax payable) under Schedule III:

Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India;

Supply of warehoused goods to any person before clearance for home consumption; and

Supply of goods in case of high sea sales.

In case the recipient fails to pay the due amount to the supplier within 180 days from the date of issue of invoice, the input tax credit availed by the recipient will be reversed, but liability to pay interest is being done away with.

Registered persons may issue consolidated credit/debit notes in respect of multiple invoices issued in a Financial Year.

Amount of pre-deposit payable for filing of appeal before the Appellate Authority and the Appellate Tribunal to be capped at Rs. 25 Crores and Rs. 50 Crores, respectively.

Commissioner to be empowered to extend the time limit for return of inputs and capital sent on job work, upto a period of one year and two years, respectively.

Supply of services to qualify as exports, even if payment is received in Indian Rupees, where permitted by the RBI.

Place of supply in case of job work of any treatment or process done on goods temporarily imported into India and then exported without putting them to any other use in India, to be outside India.

Recovery can be made from distinct persons, even if present in different State/Union territories.

The order of cross-utilisation of input tax credit is being rationalised.

Members are requested to take note of the above recommendations. The CBIC/ PIB press notes are available for reference using below links:

http://cbic.gov.in/htdocs-cbec/gst/Press-Note-on-Services-21072107-18.pdf

http://cbic.gov.in/htdocs-cbec/gst/Press-Note-GST-Law-Amendments.pdf

http://cbic.gov.in/htdocs-cbec/gst/Press-Release_Trade-friendly.pdf

http://cbic.gov.in/htdocs-cbec/gst/Press-Note-Return-28.pdf

Kindly note that above information is provided based on press notes of CBIC/ PIB. The notifications which are issued will be disseminated in due course, once issued.

Thanking you,

Yours faithfully,

(S.G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Analysis with the view to identify and recommend WTO compliant exports promotion initiatives - reg

| EPC/LIC/TPS |

19/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Analysis with the view to identify and recommend WTO compliant exports promotion initiatives - reg |

|

|

Dear Members,

Council is in receipt of an email requesting us to identify champion Manufacturing Sectors / segments e.g. chemicals, pharma, Engineering Exports etc. and undertake an analysis with the view to identify and recommend WTO compliant exports promotion initiatives, supporting domestic industry towards meeting regulatory compliances costs such as cost of Registration , Testing, etc. can be identified as an element of WTO proposed complaint Export Promotion initiatives. A report to be submitted by all commodity divisions after doing their sectoral analysis by July 20,2018

A copy of the letter is attached for your ready reference. Members are therefore requested to send their comments/ views on analysis with the view to identify and recommend WTO compliant exports promotion initiatives latest by 20/07/2018 on our email ids- deepak.gupta@chemexcil.gov.in, balani.lic@chemexcil.gov.in adreach@chemexcil.gov.in ed@chemexcil.gov.in

Your timely replies with relevant information will be highly appreciated and will enable us submit the same to DoC

Thanking You,

Yours faithfully,

(S G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl: Identify and Recommedn WTO Compliant Exports Promotion Initiatives

|

|

BACK

|

IGST - Refunds Clarification in case of SB003 errors Extension of date in SB005 & other cases using officer Interface for rectification of errors till 30/06/2018

| EPC/LIC/IGST_REFUNDS |

19/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

IGST - Refunds Clarification in case of SB003 errors Extension of date in SB005 & other cases using officer Interface for rectification of errors till 30/06/2018 |

|

|

Dear Members,

This is further to CBIC circular No. 15/2018-Customs dated 06.6.2018 wherein a solution was provided for the rectification of SB003 error in certain cases through the utility developed by the Directorate of Systems in a similar manner as SB005 error.

It has been brought to the knowledge of the CBIC that in several cases, the exporters have mentioned PAN instead of GSTIN in the Shipping Bills, even though GSTIN has been correctly mentioned while filing the GST returns. Due to this mismatch, the IGST refund claims are not getting processed..

Taking cognizance of the same, CBIC has now issued Circular No. 22/2018-Customs dated 18/07/2018 regarding refund of IGST on export of goods on payment of duty-Clarification in case of SB003 errors and extension of date in SB005 & other cases using officer Interface for rectification of errors.

The matter has been examined. As PAN is embedded in the GSTIN, CBIC has decided to accord similar treatment to such cases also as are already covered under Para 2 of Circular 15/2018-Customs.

Further, CBIC has issued circulars 05/2018-Customs dated 23.02.2018, 08/2018-Customs dated 23.03.2018 and 15/2018-Customs dated 06.06.2018 wherein an alternative mechanism with an officer interface to resolve invoice mismatches (SB005 error) was provided for the shipping bills filed till 30.04.2018. Despite wide publicity and outreach programmes, it has been observed that a few exporters continue to commit such errors. Therefore, in view of the ongoing Refund Fortnight, it has been decided by the CBIC to extend the rectification facility to Shipping Bills filed up to 30.06.2018.

Further, the facility of rectification through Officer Interface is also extended in case of other errors mentioned in circulars (8/2018-Customs and 15/2018-Customs) for shipping bills filed up to 30.06.2018. However, at the same time, exporters are advised to henceforth ensure due diligence and discipline to avoid such mismatch errors as such extensions are not likely to be considered in future.

Members are requested to take note of this new relaxation/ utility and do the needful accordingly. The Circular No.22/2018-Customs and dated 18/07/2018 is available for download using below link-

http://cbic.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2018/circ22-2018cs.pdf

Thanking You,

Yours faithfully,

(S G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

V.Imp- Inviting Pre-Budget Proposals for the Year 2019-20

| EPC/LIC/PRE_BUDGET_2019-20 |

18/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

V.Imp- Inviting Pre-Budget Proposals for the Year 2019-20 |

|

|

Dear Members,

The Council has received intimation from the EP-CAP Section, Dept. of Commerce regarding commencement of the Pre-Budget Exercise for the year 2019-20. It is requested to furnish the budget proposals for the pre-budget exercise for the forthcoming year 2019-20, duly filed in the prescribed Performa- I&II (Attached). Specific points to be noted while submitting the proposals are:.

Budget Proposals should be complete in all respects, properly categorized and HS Codes for each commodity must be provided.

Justification given in favour of the proposals shall be restricted to 300 words and Annexures should be used, if necessary.

Issues discussed year after year but never agreed to, may not be raised again.

Proposals, which are related to other Ministries/Departments, need not be considered and should be sent to the concerned Ministry/Department for necessary action.

There is a fiscal crisis. Therefore, proposals of small reduction/exemption in custom/excise duties, service tax etc. should be avoided unless they are absolutely necessary if such reduction/exemption are necessary, then ample justification should be given.

Where temporary relief has been given to some sector for particular period (i.e. up to 31st March, 2019), then it should be re-examined and views may be submitted on these as well.

Members are requested to kindly forward their proposals in the specified pro-forma format latest by 10/08/2018 on our e-mail ids ed@chemexcil.gov.in, deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in. & rodelhi@chemexcil.gov.in

Your timely/ complete responses will enable us examine the proposals, collate them and forward to the Ministry for consideration within the deadline of 16/08/2018.

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Proforma - I

|

|

BACK

|

JNCH - Monitoring of realisation of export proceeds on shipping bills on which drawback has been claimed & disbursed

| EPC/LIC/INDIA-PERU |

18/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

JNCH - Monitoring of realisation of export proceeds on shipping bills on which drawback has been claimed & disbursed |

|

|

Dear Members,

We would like to inform you that the O/o Commissioner of Customs, JNCH- NS-II has issued Public Notice No. 108/2018 dated 11/07/2018 regarding Monitoring of realisation of export proceeds on shipping bills on which drawback has been claimed & disbursed.

As you might be aware, w.e.f. 01.04.2014, monitoring of realisation of export proceeds is required to be done online from the RBI-BRC module. As per above PN, it has been observed that, in respect of 96460 shipping bills involving drawback amount of Rs. 678 crore, foreign exchange realisation is shown as pending in the RBI-BRC module for export shipments from 01.04.2014 till 31.12.2014.

The list of 96460 shipping bills, mentioned above, is available on the below link- .

http://jawaharcustoms.gov.in/pdf/Drawback-Recovery-Cell.pdf

The lists for subsequent periods will also be uploaded in due course

The exporters are advised to follow up with their authorised dealer bank for updating the export proceeds realisation details in the respective banks EDPMS system so that the data is transmitted to customs for reconciliation, failing which suitable alerts shall be placed against the defaulting exporters and show cause notices shall be issued for recovery of drawback disbursed along-with interest.

Any difficulties faced in this regard may be brought to the notice of the Deputy Commissioner of Customs in-charge of Export Proceeds Realisation Monitoring Cell, Drawback Section, N.S.-II immediately. The e-mail of the cell is- drawbackquery.jnch@gmail.com.

Members are requested to check and do the needful at the earliest, if applicable. The said PN and IEC/drawback recovery data is available using below links:

http://jawaharcustoms.gov.in/pdf/Drawback-Recovery-Cell.pdf

http://jawaharcustoms.gov.in/pdf/PN-2018/PN_108.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

JNCH - Revised instructions for registration/ change in AD Code and bank account details (for PFMS)

| EPC/LIC/JNCH/ IGST/PFMS |

16/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

JNCH - Revised instructions for registration/ change in AD Code and bank account details (for PFMS) |

|

|

Dear Members,

As you are aware, exporter’s account details already registered with the Customs are being verified by PFMS to facilitate transfer of IGST/ ROSL/ DBK etc. In case PFMS is not able to verify the account details, payments are held up.

In this regard, O/o The Commissioner of Customs, JNCH- NS-I has issued Public Notice No. 103/2018 dated 27/06/2018 regarding revised instructions for registration/change in AD Code and bank account.

The procedure to be followed shall be as under-

Fresh registration of AD Code or Bank Account details

In case of a fresh registration of AD Code or Bank Account details or the purpose of receiving remittance or disbursal of ROSL/drawback/IGST refund in any core banking branch of the bank, the exporters will be required to declare the following information duly certified by the bank branch where he operates his bank account: -

Name, address, contact number and email address of the account holder

IEC, PAN of the exporter

Account number & nature of account

IFSC of the branch where the above account is operated

Name, address, contact number and email address of the Branch mentioned in (d) above

Bank A.D. Code (as applicable)

Change in registered AD Code or Bank Account details of an Exporter

In case, an exporter intends to change his registered and active account, he will be required to submit a cancelled cheque of the existing bank account (which is intended to be changed) along with the documents listed above for getting the new bank account details registered in the system.

In case where the existing bank account is claimed to have already been closed, the exporter will be required to furnish a certificate from bank verifying closure of the said account. Such letters from the Bank produced in EDI Section shall be emailed to the issuing Bank for verifying genuineness of the same and based upon the reply from the issuing Bank, the request of the exporter shall be processed.

While submitting the above information/documents for the purposes elaborated above, Customs Broker/any authorized person shall also submit authority letter/copy of board resolution in favour of his authorization to submit documents on the behalf of the exporter for registration/change of AD Code or bank account details. Any certificate, letter or communication produced for the purposes elaborated above shall mandatorily bear the name, designation and functional contact details (such as mobile number, email address etc.) of the signatory. In the absence of the same, the request shall be rejected summarily without any further communication.

Members are requested to take note and check. Difficulty, if any, can be brought to the notice of the Additional Commissioner (EDI) or Deputy Commissioner (EDI), JNCH.

Members exporting through other custom Houses/ Ports, may also re-check for PFMS validation with the EDI Dept of their relevant Custom House.

http://jawaharcustoms.gov.in/pdf/PN-2018/PN_103.pdf

Thanking You,

Yours faithfully,

(S. G. Bharadi)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

From Chairmans Desk - Information on new products and new markets being considered for exports by the members

| EPC/LIC/Strategy |

13/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

From Chairmans Desk - Information on new products and new markets being considered for exports by the members |

|

|

Dear Members,

Greetings !

As you might be aware, India’s share in global trade of chemicals is around 2% which is not substantial and offers lot of scope for growth.

To boost India’s exports, Department of Commerce has been engaging in consultations with the EPC’s to formulate export promotion strategy for boosting exports from India.

Based on members feed-back, the council has regularly provided information on various constraints faced to Department Commerce and also need for their redressal.

However, now Department of Commerce has also sought information on the new products and new markets to boost exports.

In this regard, we kindly request you to provide following information:

1. Details of new products and new markets where the members exporter would like to venture out.

2. New market with specific details should preferably contain the potential of new market and how you envisage to capture the export potential of these new and emerging markets.

3. In case any issues are perceived in this endeavour, please provide details.

The purpose of seeking this information is to formulate a comprehensive export promotion strategy and also provide assistance to the members in entering new markets with active assistance of our embassies.

Members are requested to kindly provide information as requested by 15/07/2018 on e-mail id’s- ed@chemexcil.gov.in, deepak.gupta@chemexcil.gov.in & info@chemexcil.gov.in .

Your timely replies with requested details will enable us submit the details to the ministry in the interest of export promotion.

Thanking You,

Yours faithfully,

Satish Wagh

Chairman

Chemexcil

|

|

BACK

|

REIMBURSEMENT OF 50% OF ECHA FEES INCURRED TO MEMBERS FOR REGISTRATION OF THEIR SUBSTANCES UNDER EU REACH DURING THE 3RD DEADLINE OF REGISTRATION I.E. 31ST MAY 2018

| EPC:PROJ:REACH2018 |

13/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

REIMBURSEMENT OF 50% OF ECHA FEES INCURRED TO MEMBERS FOR REGISTRATION OF THEIR SUBSTANCES UNDER EU REACH DURING THE 3RD DEADLINE OF REGISTRATION I.E. 31ST MAY 2018 |

|

|

Dear Sir / Madam,

As you are aware, REACH is a regulation of the European Union (EU), adopted to improve the protection of human health and the environment from the risks that can be posed by chemicals, while enhancing the competitiveness of the EU chemicals industry. It also promotes alternative methods for the hazard assessment of substances in order to reduce the number of tests on animals.

The REACH registration deadline for the products being exported to the EU in a quantity between 1-100 tons per annum was 31st May 2018 and is over now.

The Ministry of Commerce & Industry, Govt. of India provides subsidy to the exporters who have registered their substances under the EU REACH as per the Market Access Initiative (MAI) Scheme of the Govt of India.

As per the scheme, the 50% of the ECHA fees is reimbursed to the exporter subject to a ceiling of Rs 50 lakh per annum per exporter.

In this context, the members who have registered their products under the REACH Regulation during the third phase of deadline i.e. 31st May 2018 are requested to submit the attached claim forms along with the documentary evidence as mentioned in the attached check list file on or before 31st July 2018.

The claim forms along with supporting documents may be sent to the CHEMEXCIL, Mumbai office on the below mentioned address.

Mr. Prafulla Walhe-Dy. Director /Ms. Amrita Sharma-Regulatory Officer

CHEMEXCIL

BASIC CHEMICALS, COSMETICS & DYES EXPORT PROMOTION COUNCIL

(Set-up by Ministry of Commerce & Industry, Government of India)

Jhansi Castle, 4th Floor, 7 Cooperage Road,

Mumbai – 400 001. India.

CIN : U91110MH1963NPL012677

Tel :+91-22-2202 1288/ 1330

Fax :+91-22-2202 6684

URL : www.chemexcil.in

Any queries in this regards may be sent by email to Ms Amrita Sharma, Regulatory Officer, Email Id – amrita.regulatory@chemexcil.gov.in .

Thanking You,

Yours faithfully,

Prafulla Walhe

Dy. Director

Encl:

Claim Form

List of documents

Affidavit Format

|

|

BACK

|

DGFT Clarification on acceptance of any copy of Shipping Bill in lieu of EP copy of Shipping Bill for grant of EODC of Advance Authorisation

| EPC/LIC/DGFT/EODC/SB |

11/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT Clarification on acceptance of any copy of Shipping Bill in lieu of EP copy of Shipping Bill for grant of EODC of Advance Authorisation |

|

|

Dear Members,

The Directorate General of Foreign Trade, New Delhi has issued Policy circular No.09/2015-2020 dated 09/07/2018 regarding Clarification on acceptance of any copy of Shipping Bill in lieu of EP copy of Shipping Bill for grant of EODC of Advance Authorisation.

As you might be aware, Directorate General of Foreign Trade had earlier allowed self-certified exporter copy of Shipping bill in lieu of EP copy of shipping bills for exports made after 23.11.2016 till such time of online verification facility is made available.

However, representations were received from Trade and Industry to allow acceptance ofExchange Control Copy of Shipping Bill in lieu of EP copy of Shipping Bill/ Exporter Copy ofShipping Bill which is prescribed under ANF-4F published vide Public Notice No 9/20152020 dated 14 May, 2018.

A viewing facility has been made available for RAs to view shipping bill details available in DGFT servers. However, many shipping bills are associated with an Advanced Authorisation and it is difficult at present for RAs to verify from the details available online. The facility is being improved to make it more user-friendly so that physical copy may not be required in future.

Taking cognizance of the issues faced and in order to reduce transaction cost, DGFT has decided that exporter shall have option to furnish self-certified copy of any copy of shipping bill i.e. Exporter copy/EP Copy/CHA copy/ Exchange Control Copy of shipping bill along with application for EODC in ANF-4F where exports were made on or after 23.11.2016

Members are requested to take note of this further relaxation. The said circular is available for download/ reference using below link-

CIRCULAR NO. |

DATE |

SUBJECT |

09/2015-2020 |

09.07.2018 |

Clarification on acceptance of any copy of Shipping Bill in lieu of EP copy of Shipping Bill for grant of EODC of Advance Authorisation. |

http://dgft.gov.in/Exim/2000/CIR/CIR18/POLICY%20CIRCULAR%209.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

SCOMET - Issuance of export authorisation/license by DGFT (Hqrs.) for export of SCOMET items

| EPC/LIC/SCOMET |

09/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

SCOMET - Issuance of export authorisation/license by DGFT (Hqrs.) for export of SCOMET items |

|

|

Dear Members,

The Directorate General of Foreign Trade, New Delhi has issued Trade Notice No.20/2018-19 dated 06/07/2018 regarding Issuance of export authorisation/license by DGFT (Hqrs.) for export of SCOMET items.

As you might be aware, delay in export authorisations for SCOMET items has been an issue which has also been represented by the trade/council to DGFT HQ.

Taking cognizance of the concerns of the trade, DGFT has notified that that w.e.f. 06.07.2018, export authorisations for SCOMET items would be issued by the SCOMET Cell, DGFT (Hqrs) under the signature of FTDO (SCOMET), DDG (Export) or any other official designated for the purpose, with a copy to jurisdictional Regional Authorities of DGFT.

However, issues relating to revalidation of SCOMET authorisations after expiry, penal action in terms of FTDR Act, grant of MEIS and other benefit, etc., would continue to be handled by the concerned jurisdictional Regional Authority, in terms of the existing provision in FTP/HBP.

Further, jurisdictional Regional Authorities would immediately issue export authorisations in respect of those SCOMET cases, against which permissions have been issued by DGFT (Hqrs) prior to issue of this Trade Notice.

Members exporting SCOMET items are requested to take note of this change. You are also requested to provide your feed-back on this new procedure for our records (deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in )

For further information, the trade notice is available for download using below link-

http://dgft.gov.in/Exim/2000/TN/TN18/Trade%20Notice%20No.%2020%20dated%2006.07.2018%20-%20SCOMET%20license.pdf

Thanking You,

Yours faithfully,

S.G. Bharadi

Executive Director

CHEMEXCIL

|

|

BACK

|

DCPC - Twelve Chemicals identified for examination for making BIS standards mandatory

| EPC/LIC/DCPC |

05/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DCPC - Twelve Chemicals identified for examination for making BIS standards mandatory |

|

|

Dear Members,

We have received communication from the Department of Chemicals & Petrochemicals (DCPC), Ministry of Chemicals & Fertilizers seeking Council's views on making existing standards for major chemicals as mandatory in respect of identified 12 Chemicals.

Please note that an Expert Committee was constituted in DCPC under the chairmanship of Joint Secretary (Chemicals) to review the current status of the BIS Standards and to develop technical regulations by making them as mandatory, recommending for setting new standards and reviewing existing standards of major chemicals.

In this context, the 4th meeting of expert committee under the chairmanship of Joint Secretary (Chemicals) is scheduled to be held on 13.07.2018 at New Delhi to discuss the issues of making existing standards for major chemicals as mandatory in respect of following identified 12 chemicals:

1 Citric Acid (Food Grade) IS 13186: 1991, Reaffirmed in 2014 (HS Code 29181400)

2. Acetic Acid IS 695: 1986, Reaffirmed 2013 (HS Code 29152100)

3. Synthetic Food Colours IS 5346: 1994, Second Reprint January 2006 (including Amendment No 1) (HS CODE 32030020)

4. Potassium Metabisulphite, Food Grade IS 4751: 1994, Reaffirmed 2014 (HS Code 28322010)

5. Calcium Propionate, Food Grade (IS 6031: 1997), Reaffirmed 2014 (HS Code 29155000)

6. Benzoic Acid, Food Grade (IS 4448: 1994), Reaffirmed 2014, (HS Code 29163110

7. Methanol (Methyl Alcohol) IS 517: 1986, Reaffirmed 2013 (HS Code 29051100)

8. Ethylene Glycol IS 5295: 1985, Reaffirmed in 2013 (HS Code 29053100)

9. Aniline, Technical IS 2833: 1973, Reaffirmed 2016 (HS Code 29214110)

10. Phosphoric Acid, Food Grade IS 10508: 2007, Reaffirmed 2013 (HS Code 28092010)

11. Anhydrous Ammonia IS 662: 1980, Reaffirmed 2015 (HS Code 28141000)

12. Sulphuric Acid IS 266: 1993, (Three revisions) (HS Code 28070010)

A detailed note on 12 chemicals with justification for making them mandatory is enclosed. Members are requested to go through the same and let us have your comments on the same by 10th July 2018.

Your valuable inputs/ comments be mailed on deepak.gupta@chemexcil.gov.in, Balani.lic@chemexcil.gov.in & rodelhi@chemexcil.gov.in with details which will enable us take it forward during the ensuing meeting.

Thanking you,

Yours faithfully,

(S.G. BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

http://chemexcil.in/uploads/files/Details+of+12+chemicals+for+making+BIS+standards+mandatory.pdf

|

|

BACK

|

DGFT - Introduction of new Para 3.24 in the Chapter 3 of the HBP 2015-20

| EPC/LIC/MEIS |

04/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Introduction of new Para 3.24 in the Chapter 3 of the HBP 2015-20 |

|

|

Dear Members,

The O/o Directorate General of Foreign Trade, New Delhi has issued Public Notice No 17/2015-2020 dated 03/07/2018 regarding introduction of new Para 3.24 in the Chapter 3 of the Handbook of Procedures, 2015-20.

As an effect of this PN, the procedure to obtain No Incentive Certificate under the MEIS is being notified.

NewPara 3.24 is being added as follows:

"3.24 No Incentive Certificate under MEIS

Wherever an exporter requires a certificate to the effect that No incentive under MEIS has been taken for shipment(s) which is being re-imported, the exporter will submit a request in the specified format , ANF 3E- "Application for No Incentive Certificate" to the concerned Regional Authority (RA) as per para 3.06 (a) of the HBP 2015-20.

The following procedure will be followed at the concerned Regional Authority while issuing the No Incentive Certificate, in the specified format Appendix 3F.

Wherever, MEIS has been utilized by the applicant for the relevant shipping bill(s), the applicant is required to refund the proportionate amount along with interest at the rate prescribed under the section 28AA of the Customs Act, in the relevant Head of Account of Customs. On receipt of proof of payment, the RA would issue the certificate.

Wherever, MEIS has been issued to the applicant for the relevant shipping bill (s) but the MEIS scrip has not been utilised, the applicant should surrender the MEIS scrip to the RA. The RA would then issue the certificate and simultaneously inform the N1C to block the relevant shipping bill(s).

Wherever, MEIS has not been applied for or MEIS has been applied for but no scrip has been issued, the RA would issue the certificate in the specified format, on the basis of the undertaking submitted in the application and simultaneously inform the NIC to block the relevant shipping bill(s).

The format of the "Application for No Incentive Certificate Under MEIS", ANF 3E and "No Incentive Certificate under MEIS", Appendix 3F are in the Annexure to this Public Notice and are also being notified.

Members are requested to take note of this addition of new Para 3.24 which notifies procedure to obtain No Incentive Certificate under the MEIS. The above-said PN is also available for reference using below link-

http://dgft.gov.in/Exim/2000/PN/PN18/PN-17%20English.pdf

Thanking You,

Yours faithfully,

(S.G. Bharadi)

Executive Director

CHEMEXCIL

|

|

BACK

|

SCOMET -Amendment in Appendix 3 (SCOMET Items) to Schedule-2 of ITC(HS) Classification of Export and Import Items, 2018

| EPC/LIC/SCOMET |

04/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

SCOMET -Amendment in Appendix 3 (SCOMET Items) to Schedule-2 of ITC(HS) Classification of Export and Import Items, 2018 |

|

|

Dear Members,

As you might be aware, in India the export of dual-use items are regulated by Director General of Foreign Trade (DGFT). The products under regulations and license are given the acronym “SCOMET” - which stands for - Special Chemicals, Organisms, Materials, Equipment and Technologies.

The Directorate General of Foreign Trade (DGFT), New Delhi has issued Notification No. 17/2015-2020 dated 03/07/2018 regarding Amendment in Appendix 3 (SCOMET Items) to Schedule-2 of ITC(HS) Classification of Export and Import Items, 2018.

Members exporting SCOMET items are requested to take note of these amendment. For further information, you may download above said Notification using below link-

| NOTIFICATION NO. |

DATE |

SUBJECT |

17/2015-2020 |

03.07.2018 |

Amendment in Appendix 3 (SCOMET Items) to Schedule-2 of ITC(HS) Classification of Export and Import Items,2018. |

http://dgft.gov.in/Exim/2000/NOT/NOT18/Noti%2017%20dt.%2003.07.2018%20SCOMET%20English.pdf

Thanking You,

Yours faithfully,

S.G. Bharadi

Executive Director

CHEMEXCIL

|

|

BACK

|

ADD - Definitive Anti-Dumping Duty by European Commission on Imports of Oxalic Acid originating in India & PRC

| EPC/LIC/DGAD/OXALIC_ACID |

03/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

ADD - Definitive Anti-Dumping Duty by European Commission on Imports of Oxalic Acid originating in India & PRC |

|

|

Dear Members,

This is in continuation of our earlier mailer regarding expiry review by Directorate-General for Trade of the European Commission on "Oxalic Acid” falling under HS Code 29171110 (TARIC code 2917110091) which is originating in India and PRC.

We have now received communication fromDirectorate General of Trade Remedies (DGTR) that they have been informed by Embassy of India (EU, Belgium and Luxembourg) that European Commission has decided to impose a definitive anti-dumping measure in the framework of the anti-dumping proceeding concerning imports of oxalic acid originating, inter alia, in the Republic of India.

For India, the anti-dumping duties, as per the EC Regulation, are as follows:

Punjab Chemicals and Crop Protection Limited: 22.8%

Star Oxochem Pvt. Ltd: 31.5%

All other companies: 43.6%.

Members are requested to take note of imposition of these Definitive measures on oxalic acid exported from India to EU. The Commission Implementing Regulation (EU) 2018/931 dated 28 June 2018 is available for reference/ download using below links:

Definitive measures

2 July 2018

COMMISSION IMPLEMENTING REGULATION (EU) 2018/931 of 28 June 2018 impos …

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018R0931&from=EN

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

APTA Tariff concessions on import of goods of the description specified in column (3) of the Table hereto annexed and falling under the Chapter. Amendment in the Rules of Determination of Origin of Goods under the Asia-Pacific Trade Agreement.

| EPC/LIC/CBIC/APTA |

03/07/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

APTA Tariff concessions on import of goods of the description specified in column (3) of the Table hereto annexed and falling under the Chapter. Amendment in the Rules of Determination of Origin of Goods under the Asia-Pacific Trade Agreement.

|

|

|

Dear Members,

The Central Board of Indirect Taxes and Customs (CBIC) has issued Notification No. 50/2018 dated 30/06/2018 regarding tariff concessions on import of goods of the description specified in column (3) of the Table hereto annexed and falling under the Chapter. The CBIC has also issued Notification No. 59/2018 - Customs (N.T.) dated 30/06/2018 amending Rules of Determination of Origin of Goods under the Asia-Pacific Trade Agreement.

For the convenience of the members, the gist of notifications is provided below-

Notification No. 50/2018 dated 30/06/2018 regarding tariff concessions on import of goods of the description specified in column (3) of the Table hereto annexed

The notification has following details:

The Column 4 of the notification provides the extent of tariff concession (percentage of applied rate of duty %). The tariff concessions on chemical items varies mainly from 5% to 45 % (with exception of one item with 71% concession)

Concessions in the case of goods specified in Part A of the said Table pertains to imports into India from a country listed in APPENDIX I (Bangladesh, PR China, Republic of Korea & Sri Lanka)

Concessions in the case of goods specified in Part B of the said Table, pertains to import into India from a country listed in APPENDIX II (Lao People's Democratic Republic & Bangladesh)

For the purposes of this notification, "applied rate of duty" means the standard rate of duty specified in the First Schedule to the said Customs Tariff Act 1975 in respect of the goods specified in the said Table, read with any other notification for the time being in force.

The above said notifications is available for download using hyperlink provided below-

Notification No. & Date of Issue |

English |

Subject |

50/2018-Cus,dt. 30-06-2018 |

View(539 KB) |

seeks to provide the tariff concession to the goods of the description specified in column (3) of the Table hereto annexed and falling under the Chapter. |

Notification No. 59/2018 - Customs (N.T.) dated 30/06/2018 amending Rules of Determination of Origin of Goods under the Asia-Pacific Trade Agreement

The details are provided in Annexure C of above notification.

For organic chemicals (Tariff heading 2852) & Inorganic chemicals (2901, 2902, 2903, 2904, 2905, 2906, 2907, 2908, 2909, 2910, 2911, 2912, 2913, 2914, 2915, 2931, 2932, 2933, 2934, 2935, 2936, 2937, 2938, 2939, 2940, 2941, 2942) the origin criteria will be CTH (Change in Tariff Heading).

The above said notification is available for download using hyperlink provided below-

59/2018-Cus (NT) d.t 30.06.2018 |

View (230 KB) |

|

seeks to amend the Rules of Determination of Origin of Goods under the Asia-Pacific Trade Agreement, (formerly known as the Bangkok Agreement) Rules, 2006. |

The above notifications come into force on the 1st day of July, 2018.

Members are requested to take note of above notifications and may download using hyperlinks provided therein.

You may also send your feed-back to the council on e-mail ids-deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

|

|

BACK

|

|

Commerce Minister Suresh Prabhu says it is a misconception that India subsidise exports

| |

|

| Union Minister for Commerce and Civil Aviation Suresh Prabhu today sought to dispel the notion of other countries that India subsidised its exports. |

Prabhu said it was important to provide market access to the farmers for which the highest standard of safety was needed to overcome the non-tariff barriers (NTBs).

Union Minister for Commerce and Civil Aviation Suresh Prabhu today sought to dispel the notion of other countries that India subsidised its exports. He said that the government was merely trying to mitigate the adversities of the exporters, which did not tantamount to subsidising of exports from India, specifically farm products.

“It is a misconception that we subsidise our exports. We are fully WTO compliant and not at all violating those”, Prabhu said at a chat session organised jointly by Shefexil and a leading business daily here. He said that OECD countries were giving more subsidises to their farmers, particularly in the export of agriculture products.

Talking about agriculture exports, he said “should it not be so that when India exports its agriculture products to other countries, those importing nations deter themselves from subsidising those items”. Stressing on agriculture, Prabhu said it was important to provide market access to the farmers for which the highest standard of safety was needed to overcome the non-tariff barriers (NTBs).

The government was already working on a craft agriculture policy to double farmers’ income, he said. “The commerce department is already working on the development of standards. The standard in the Western countries is very high “, he said.

Unless the highest standard was not adhered to, it would be difficult to do exports, he added. He also said there would be no market access and realisation of better prices.

Prabhu also said that the ministry was also working on preparing an integrated logistics plan to reduce costs and increase speed and efficiency. Earlier speaking at a CII event, he said that the ministry was preparing separate plans for the manufacture of drones and planes in the country.

Get live Stock Prices from BSE and NSE and latest NAV, portfolio of Mutual Funds, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

(Source:https://www.financialexpress.com/economy/commerce-minister-suresh-prabhu-says-it-is-a-misconception-that-india-subsidise-exports/1235119/ dated 7th July-2018)

BACK |

|

Re-Import of Exported Goods

| |

|

| SN Panigrahi |

In some occasions goods exported out of India are returned back for various reasons like

Cancellation of Export Order

For any Trade Disputes like Quality Reasons, Default of Payments, Non-Conformance to any Contractual Terms

After Exhibition/ Display in overseas Country

Return after Project / Contract Closure or Completion

Re-import of Exported Goods for Repairs, Reconditioning, Reprocessing

Imported Goods sent abroad within Warrantee Period and Re-import after repair

Because of some Certain Compliance / Regulatory / Restrictions in the Importing Country etc.,

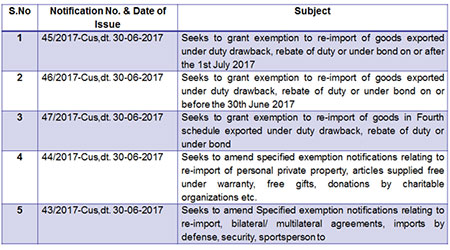

SECTION 20 of Customs Act 1962, refers to Re-importation of Goods, which states If goods are imported into India after exportation therefrom, such goods shall be liable to duty and be subject to all the conditions and restrictions, if any, to which goods of the like kind and value are liable or subject, on the importation thereof. Thus according to this section normal customs duty under Section 12 of Customs Act, 1962 shall be payable on re-import of exported goods. However certain concessions and exemptions are available for Re-import as per following Notifications :

|

Let us here discuss about re-import on or after the 1st July 2017 - that is after implementation of GST. The general principle is that the exporters who re-import after export should not get away with any benefits which may have been given as an export incentive or exemption or any other benefits like duty drawback/rebate claims, export under bond or under other export incentive claims, duty exemption schemes, EPCG schemeetcand then these benefits should be recovered by way of duty.

Notification No. 45/2017 – Customs; dt 30th June, 2017 covers different scenarios under which exports are made and applicable Customs Duty Payable upon Re-import of such goods. These provisions are shown in following Table :

Some Salient Features :

The above concessional duty or exemptions are applicable subject to certain conditions to be fulfilled. Some of them are :

This notification shall come into force with effect from the 1 st day of July, 2017

The goods are the same which were exported. The onus of proof is on the Re-importer with satisfactory evidence is produced before the authorities.

The Period of Re-import :

In case of goods exported under the Duty Exemption Scheme(DEEC/Advance Authorisation/DFIA) or Export Promotion Capital Goods Scheme(EPCG) or Duty Entitlement Passbook Scheme (DEPB) or any reward scheme of Chapter 3 of Foreign Trade Policy: Re-importation of such goods takes place within one year of exportation or such extended period not exceeding one more year.

In all other cases, the goods other than those exported under Duty Exemption Scheme(DEEC/ Advance Authorization/DFIA) or Export Promotion Capital Goods Scheme(EPCG) or Duty Entitlement Passbook Scheme (DEPB) or any reward scheme of Chapter 3 of Foreign Trade Policy :re-imported within three years after their exportation or within such extended period, not exceeding two years

Goods subject to Re-manufacturing or Reprocessing:

The goods shall not be deemed to be the same if these are re-imported after being subjected to re-manufacturing or reprocessing through melting, recycling or recasting abroad

The beneficial provisions in this notification shall NOTapply to re-imported goods in following cases :-

(a) which had been exported by a hundred percent export-oriented undertaking or a unit in a Free Trade Zone as defined under section 3 of the Central Excise Act, 1944 (1 of 1944);

(b) which had been exported from a public warehouse or a private warehouse appointed or licensed, as the case may be, under section 57 or section 58 of the Customs Act, 1962 (52 of 1962);

(c) which fall under the Fourth Schedule to the Central Excise Act, 1944 (1of 1944). (Non- GST Items)

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com

BACK |

|

EXPORT STRATEGY-COLOMBIA

|

BRIEF OF COUNTRYCOLOMBIA

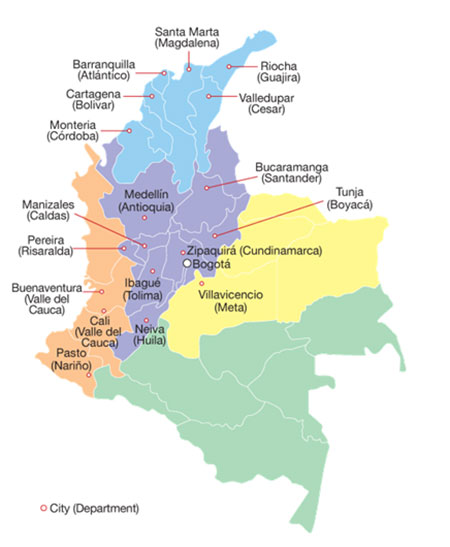

Colombia was one of the three countries that emerged after the dissolution of Gran Colombia in 1830 (the others are Ecuador and Venezuela). A decades-long conflict between government forces, paramilitaries, and antigovernment insurgent groups heavily funded by the drug trade, principally the Revolutionary Armed Forces of Colombia (FARC), escalated during the 1990s. More than 31,000 former United Self Defense Forces of Colombia (AUC) paramilitaries demobilized by the end of 2006, and the AUC as a formal organization ceased to operate. In the wake of the paramilitary demobilization, illegal armed groups arose, whose members include some former paramilitaries. After four years of formal peace negotiations, the Colombian Government signed a final peace accord with the FARC in November 2016, which was subsequently ratified by the Colombian Congress. The accord calls for members of the FARC to demobilize, disarm, and reincorporate into society and politics. The accord also committed the Colombian Government to create three new institutions to form a “comprehensive system for truth, justice, reparation, and non-repetition,” to include a truth commission, a special unit to coordinate the search for those who disappeared during the conflict, and a “Special Jurisdiction for Peace” to administer justice for conflict-related crimes. The Colombian Government has stepped up efforts to expand its presence into every one of its administrative departments. Despite decades of internal conflict and drug-related security challenges, Colombia maintains relatively strong democratic institutions characterized by peaceful, transparent elections and the protection of civil liberties.

- OFFICIAL NAME: Republic of Colombia

- FORM OF GOVERNMENT: Republic

- CAPITAL: Bogotá

- POPULATION: 46,245,297

- OFFICIAL LANGUAGE: Spanish

- MONEY: Peso

- AREA: 439,619 square miles (1,138,910 square kilometers)

- MAJOR MOUNTAIN RANGES: Andes, Sierra Nevada de Santa Marta

- MAJOR RIVERS: Magdalena, Cauca, Atrato, Sinú

Colombia is nicknamed the "gateway to South America" because it sits in the northwestern part of the continent where South America connects with Central and North America. It is the fifth largest country in Latin America and home to the world's second largest population of Spanish-speaking people.

Colombia is a land of extremes. Through its center run the towering, snow-covered volcanoes and mountains of the Andes. Tropical beaches line the north and west. And there are deserts in the north and vast grasslands, called Los Llanos, in the east.