CONTENTS

Chairman's Desk |

Chemexcil Activities |

|

Brief Report on - 19th China International Agrochemical & Crop Protection Exhibition held at SNIEC, Shanghai, China during 7th-9th March, 2018

|

Exim Updates |

|

FSSAI / JNCH Advance submission of documents for NOC from FSSAI

|

|

DGFT- Amendments in Handbook of Procedures 2015-20 (Para 4.07A Self - Ratification Scheme)

|

|

IGST Refund - Extension of date in SB005 alternate mechanism cases to shipping bills filed till 28.02.2018 & clarifications in other cases

|

|

GST - Notifications issued amending the CGST Rules, notifying date for E-Way Bill Rules, deferment of RCM and prescribing due dates for filing of FORM GSTR- 3B

|

|

DGFT - Notifications on exemption of IGST & Compensation cess under EOU, Advance Authorisation and EPCG schemes extended up-to 01.10.2018.

|

|

Gentle Reminder - IGST/ ITC Exports Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end

|

|

EGM errors related to IGST refund on exports

|

|

Air Cargo Complex, Mumbai - List of SB005 errors pertaining to various exporters and list of PFMS which still require validation

|

|

Reminder - IGST/ ITC Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end

|

|

Online Application for uploading the supporting documents i.e. e- SANCHIT shall be made mandatory for Bills of Entry filed w.e.f 01.04.2018

|

|

GST - Clarifications on exports related IGST/ ITC refund issues

|

|

DGFT Amendment in Chapter 2 of the Handbook of Procedure (2015-20)

|

|

Inputs for 5th India-Brazil Trade Monitoring Mechanism (TMM) to be held in New Delhi during June 2018

|

|

V. Imp - IGST Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end

|

|

DGFT - Launch of e-MPS facility to make online payment for miscellaneous applications

|

|

JNCH - IGST Refund not disbursed due to PFMS error

|

|

RBI - Discontinuation of Letters of Undertaking (LoUs) and Letters of Comfort (LoCs) for Trade Credits

|

|

Draft “Indian National Strategy for Standards (INSS)”- Comments Requested

|

|

Grievance Redressal Committee (GRC) Meeting at O/o Addl. DGFT Mumbai on 22/03/2018 at 3pm

|

|

JNCH Issuance of Form E-13 before LEO for Export Containers in JNCH Operationalization of “one time default intimation” to Shipping Lines by DPD importers at JNCH

|

|

V. Imp - Recommendations of the 26th GST Council Meeting held on 10/03/2018

|

|

JNCH - Procedure for registration of Self Sealing for Electronic Sealing of containerized cargo at factory or warehouse premises

|

|

JNCH - Mandatory declaration of GSTIN, IEC and email address of importer in the Bills of Lading obtained from foreign supplier/ shipper

|

|

IGST Refund Camp/ Mela organised by Ahmedabad/ Mundra/Kandla/ Jamnagar Custom Houses on 10th and 11th March 2018 for Rectification of Error SB005 and SB006

|

|

GST : Second Amendment (2018) to CGST Rules (E-way bill Rules, RFD-01A form declaration, Tran 2 form etc)

|

|

Comments on Draft document on “Indian National Strategy for Standards (INSS)

|

|

PMFAI comments on the Draft Pesticides Management Bill 2017

|

|

Stakeholders Consultations in India-EU BTIA on 14/03/2018 at New Delhi

|

|

The Pesticides Management Bill, 2017 (PMB 2017)- Comments requested

|

|

CBEC : Online Application for uploading the supporting documents i.e. e-SANCHIT shall be made mandatory for Bills of Entry filed w.e.f 15.03.2018

|

News & Articles |

|

Dangerous Goods by Road – India

|

|

India Extends Urea Subsidy Till 2020

|

|

U.S. Launches WTO Challenge Against Almost All Of India’s Export Subsidies

|

|

Exports from India jumped 4.5 pct, imports by 10.4 pct; trade deficit estimated at $12 bn: Rita Teaotia

|

|

EXPORT STRATEGY- VIETNAM

|

|

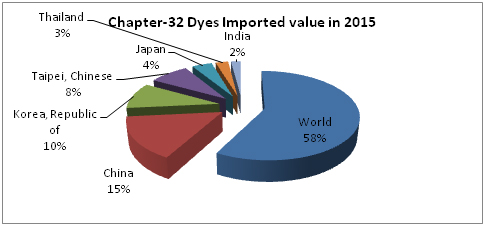

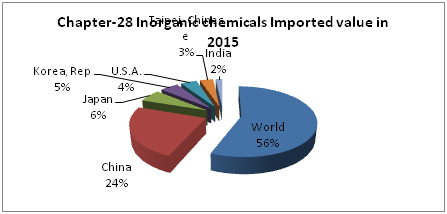

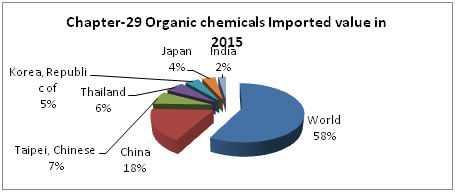

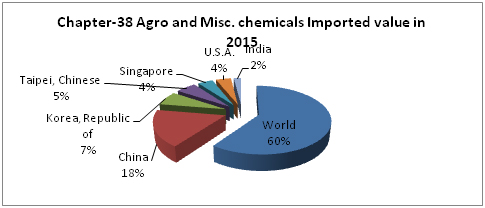

CHEMEXCIL EXPORTS TO VIETNAM

|

|

|

|

Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-Exporters,

I have pleasure to bring to you the 23rd issue of the CHEMEXCIL e-Bulletin for the month of March 2018, which contains the following activities undertaken by the Council and other useful information/EXIM Notifications, etc.

I hope that you would find the newsletter informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions so as to enable us to improve this e-bulletin further.

With Regards,

SHRI SATISH W. WAGH

CHAIRMAN,

CHEMEXCIL

|

BACK |

|

Brief Report on - 19th China International Agrochemical & Crop Protection Exhibition held at SNIEC, Shanghai, China during 7th-9th March, 2018

|

| |

The 19th China International Agrochemical & Corp Protection (CAC 2018) exhibition was a 3 days event held from 7th – 9th March 2018 at the Shanghai New International Expo Centre (SNIEC) in Shanghai, China. This event was held concurrently with the 19th China International Agrochemical and Crop Protection Equipment Exhibition (CAC 2018) and the 9th China International Fertilizer Show (FSHOW 2018).

In order to promote exports of Agro Chemicals from India and also to assist our members to explore the market potential in China, the Council has participated in the 19thChina International Agrochemical & Corp Protection (CAC2017) held from 7th-9th March 2018.

As the largest Agrochemicals exhibition in China, CAC offers an international trade, communication and exchange platform involving pesticides, fertilizers, seeds, beyond-agriculture, production & packaging equipment, crop protection equipment, logistics, consultancy, laboratories and supportive services.

The three shows which were spread over 60,000 square meters, 1,100 exhibitors; more than 120 countries and regions 30,000 domestic and foreign professional buyers; more than 10 sessions over the same period of meetings and activities in five exhibition Halls namely- N1 to N5 in Shanghai New International Expo Centre.

CHEMEXCIL had organised an India Pavilion in CAC 2017 by booking 622 sq.mt. of space in Hall N3 at SNIEC. Total 35 exhibitors from India had showcased their products under the umbrella of CHEMEXCIL.

Chemexcil’s India pavilion attracted good visitor interest from Local buyers and global business professionals/ dealers/ buyers etc from countries such as Argentina, Bangladesh, Brazil, Egypt, Iraq, Jordan, Korea, Mexico, Pakistan, Turkey, Yemen, Vietnam etc. Indian exhibitors were happy to interact and network with them.

BACK |

FSSAI / JNCH Advance submission of documents for NOC from FSSAI

|

EPC/LIC/JNCH/FSSAI |

27.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

FSSAI / JNCH Advance submission of documents for NOC from FSSAI |

|

|

Dear Members,

This is in continuation of our recent circulars regarding issues being faced by members during import of chemicals due to FSSAI Mapping and also HS code classification. The council has already taken up this issue with CBEC HQ/ JNCH/ FSSAI etc.

In this regard, O/o The Commissioner Of Customs, NS-III Mumbai Zone-II, Jawaharlal Nehru Custom House have issued Public Notice No. 46 /2018 dated 21/03/2018 regarding advance submission of documents for NOC from FSSAI.

As per the above-said Public Notice, trade/ industry had requested for procedure for “submission of necessary documents in advance” for obtaining NOC from FSSAI. The FSSAI Authorities have been consulted in this regard and they have informed the presently followed Foods Import Clearance System (FICS) by them as below:

| No. |

Step |

Basic Prerequisite |

Remarks |

|

1. |

Filing of BOE with ICES (Customs) by Applicant |

Proper CTH code and end use dropdown be selected in EDI |

NA |

|

2. |

If applicable, filing of application to FSSAI |

Advance B/E should be filed and routed to FSSAI for necessary NOC |

Berthing of vessel or IGM details are not required |

|

3. |

Scrutiny of application by FSSAI |

Necessary documents along with agency specific documents (e.g. COO, end use declaration, certificate of analysis from supplier, etc.) needs to be furnished including specimen copy of label, ingredient list and FSSAI Import license. |

Berthing of vessel or IGM details are not required |

|

4. |

Payment of inspection and analysis charges by applicant |

Applicant should pay such charges online or through Demand Draft |

Berthing of vessel or IGM details are not required |

|

5. |

Scheduling appointment for inspection |

Appointment should be acknowledged by applicant and importer’s representative or Custom Broker should be present in the CFS where samples needs to be drawn at the time fixed for sampling. |

Consignment should be readily available in CFS

|

|

6. |

Forwarding Samples to Laboratory for Analysis |

Article should meet labelling requirements and no visible spoilage and infestation should be observed. (basic requirement for the imported goods) |

If non-conforming, article is rejected |

|

7. |

Food analysis by laboratory |

Sample should be fit for analysis (FSSAI officers to ensure) and meet the specifications |

| If not, then article is rejected. |

|

| 8. |

Grant of NOC by FSSAI |

Article should be conforming to the FSSAI requirements and IGM details should be duly furnished in application |

If non-conforming, rejection certificate is issued. |

Further, as per PN it is conveyed that the option of advance filing of application for scrutiny is already operational for all applicants including ‘Out of Scope’ articles and applicants can update IGM details at any stage as listed above.

It has been further clarified by FSSAI that Entry inward or IGM details are not required at stage of filing of application to FSSAI or scrutiny or documents inspection or during sampling and analysis. IGM details are required only to generate NOC/NCC certificate after analysis since it is part of NOC certificate format.

Members are requested to take note of this Public Notice and also the facility for expeditious procurement of NOC from FSSAI. Public Notice No. 46 /2018 dated 21/03/2018 is available for download using below link-

http://164.100.155.199/pdf/PN-2018/PN_046.pdf

In case of any specific issue, the same may be brought to the notice of Deputy/Assistant Commissioner in charge of Appraising Main (Import), NS-III (email address: appraisingmain.jnch@gov.in ).

Persistent difficulties, if any, can also be highlighted to us on e-mail id’s- deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT- Amendments in Handbook of Procedures 2015-20 (Para 4.07A Self - Ratification Scheme)

| EPC/LIC/DGFT |

27.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT- Amendments in Handbook of Procedures 2015-20 (Para 4.07A Self - Ratification Scheme) |

|

|

Dear Members,

In the recent Mid-Term Review of FTP 2015-20, a New trust based Self Ratification Scheme was introduced to allow duty free inputs for export production under duty exemption scheme with a self-declaration.

Under this scheme, instead of getting a ratification of the Norms Committee for inputs to be used in the manufacture of export products, exporters will self-certify the requirement of duty free raw materials/ inputs and take an authorization from DGFT. The scheme would initially be available to the Authorized Economic Operators (AE0s).

In this regard, the O/o Director General of Foreign Trade has issued Public Notice no. 68/2015-2020 dated 23/03/2018 regarding amendments in Hand Book of Procedures 2015-20 whereby a new para 4.07A is added Below the existing para 4.07 HBP 2015-20.

The contents of the Public Notice no. 68/2015-2020 dated 23/03/2018 are reproduced as follows for your convenience:

Para 4.07A Self - Ratification Scheme

(i) Policy related to Self ratification Scheme is provided at Para 4.07A of Foreign Trade Policy (2015-20). Applications shall be filed online along with complete details as per Appendix-4E along with a certificate from Chartered Engineer in Appendix-4K. For issuance of such a certificate, the Chartered Engineer shall act only in the domain of his/her competence.

(II) General Notes given In the book titled Standard Input Output Norms Including policy for packing material and fuel shall also be applicable to this scheme in so far as they are not inconsistent with this scheme.

(Iii) The applicant shall apply for inputs with specific descriptions along with 8 digit ITC (HS) Classification. Where ever the export product and/or inputs are given in brand names, the correct chemical /technical name shall also be given in the application.\

(iv) RA may issue Advance authorisation as applied for subject to the conditions specified in FTP and Handbook of Procedures (2015-20). Input Output Norms as applied and wastage claimed by the applicant shall be treated as final. Ratification of the same by NC is not required.

(v) Applicant or his supporting manufacturer/co-licensee shall maintain a proper account of consumption and utilization of duty free imported / domestically procured inputs against each authorisation, as prescribed in Appendix-4H. Application for EODC shall be submitted in prescribed format along with Appendix-4H to the Regional Authority concerned. Regional Authority shall compare the details of Appendix-4H, with that of the inputs allowed in the Authorisation. Such records shall be preserved by the authorisation holder/manufacturer for a period as specified in Para 4.51 of HBP.

(vi) Production and consumption records of the export item under this scheme shall be audited by DGFT or any Authorised/nominated agency (ies) or team of officers as may be nominated from time to time. Such audit may be conducted within three years from the date of issue of Authorisation based on Risk Based Management System (RBMS). Exporters shall be required to provide necessary facility to verify Books of Accounts or other documents and assistance as may be required for timely completion of the audit. DGFT shall constitute the audit teams and specify the manner of audit from time to time through administrative orders.

(vii) Non providing of prescribed documents/information to the Audit team by the applicant shall make him liable for penal action under the provisions of FT(D&R) Act, 1992, as amended and Rules and order made there under. In case items imported/procured duty free are found to be in excess or not consumed fully, the applicant shall suo moto pay immediately duty with applicable interest to the Customs Authority. However, if Audit team found that duty free items were imported in excess and not consumed fully in the resultant products and duty and interest have not been paid suo moto, the applicant shall be placed under Denied Entity List (DEL) under Rule 7 of FT(Regulation) Rules, 1993, as amended, in addition to other penal action under FT(DR) Act/Customs Act. The Chartered Engineer shall also be liable for penal action for abetment under the provisions of Section 11(2) of the FT(DR)Act.

(viii) All the provisions of Advance Authorisation scheme shall also be applicable to this scheme in so far they are not inconsistent with the specific provisions of this scheme.

The amended Appendix 4K is annexed to this Public Notice.

Members are requested to take note of this new amendment in HBP. The above-said Public Notice is available for download using below link-

| PUBLIC NOTICE NO. |

DATE |

SUBJECT |

| 68/2015-2020 |

22.03.2018 |

Amendments in Handbook of Procedures 2015-20. |

http://dgft.gov.in/Exim/2000/PN/PN17/PN%2068%20eng.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

IGST Refund - Extension of date in SB005 alternate mechanism cases to shipping bills filed till 28.02.2018 & clarifications in other cases

| EPC/LIC/IGST_REFUND_ERRORS |

27.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

IGST Refund - Extension of date in SB005 alternate mechanism cases to shipping bills filed till 28.02.2018 & clarifications in other cases |

|

|

Dear Members,

As informed earlier, Central Board of Excise and Customs (CBEC) has issued Circular No 5/2018-Customs dated 23-02-2018 which provided for an alternative mechanism with officer interface to resolve invoice mismatch cases (SB005). In the said circular, it was specified that the mechanism would be available for the shipping bills filed till 31.12.2017.

Now CBEC has issued Circular No. 08 / 2018-Customs dated 23/03/2018 wherein it has been decided to extend this facility to those shipping bills filed till 28.02.2018 keeping in view the difficulties likely to be faced by the exporters in case SB005.

Further, as per above said circular,

clarifications are also provided in other cases of errors:

SB006:

Local customs officers have sought resolution of SB006 errors due to discontinuance of transference copy of shipping bill. It has been proposed that in lieu of transference copy either the final Bill of Lading issued by the shipping lines or written confirmation from the custodian of the gateway port , may be treated as valid document for the purposes of integration with the EGM. The proposal sent from field formations in such EGM error cases hasbeen agreed.

It has come to knowledge from exporters that by mistake they have mentioned the status of IGST payment as "NA" instead of mentioning "P" in the shipping bill. In other words, the exporter has wrongly declared that the shipment is not under payment of IGST, despite the fact that they have paidthe IGST. As a one-time exception, it has been decided to allow refund of IGST through an officer interface wherein the officer can verify and satisfy himself of the actual payment of IGST based on GST return information forwarded by GSTN. DG (Systems) shall open a physical interface for this purpose.

Members whose IGST refunds are stuck due to SB005/ SB006 errors etc are requested to take note of the above circular and steps being taken. The original Circular No. 08/2018-Customs dated 23/03/2018 is available for download using below link-

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2018/circ08-2018cs.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

GST - Notifications issued amending the CGST Rules, notifying date for E-Way Bill Rules, deferment of RCM and prescribing due dates for filing of FORM GSTR- 3B

| EPC/LIC/IGST_REFUND_ERRORS |

26.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST - Notifications issued amending the CGST Rules, notifying date for E-Way Bill Rules, deferment of RCM and prescribing due dates for filing of FORM GSTR- 3B |

|

|

Dear Members,

This is in continuation of our recent circular informing you about the recommendations of 26th GST council meeting held on 10/03/2018 pertaining to implementation of e-way bill, exporters tax exemptions, RCM, GSTR-3b/ GSTR-1.

In this regard, CBEC has issued notifications for amending the CGST Rules, notifying E-Way Bill Rules, deferment of RCM and prescribing due dates for filing of FORM GSTR-3B (April to June, 2018).

The relevant notifications are highlighted as follows for your reference:

Central Tax Notifications

Notification No. & Date of Issue |

English |

Subject |

16/2018-Central Tax ,dt. 23-03-2018 |

View (329 KB) |

Seeks to prescribe the due dates for filing FORM GSTR-3B for the months of April to June, 2018 |

15/2018-Central Tax ,dt. 23-03-2018 |

View (198 KB) |

Notifies the date from which E-Way Bill Rules shall come into force |

14/2018-Central Tax ,dt. 23-03-2018 |

View (416 KB) |

Amending the CGST Rules, 2017(Third Amendment Rules, 2018). |

Central Tax (Rate) Notifications

Notification No. & Date of Issue |

English |

Subject |

10/2018-Central Tax (Rate) ,dt. 23-03-2018 |

View (203 KB) |

Seeks to exempt payment of tax under section 9(4) of the CGST Act, 2017 till 30.06.2018. |

Integrated Tax (Rate) Notifications

Notification No. & Date of Issue |

English |

Subject |

11/2018-Integrated Tax (Rate) ,dt. 23-03-2018 |

View (340 KB) |

Seeks to exempt payment of tax under section 5(4) of the IGST Act, 2017 till 30.06.2018. |

Members are requested to take note of above notifications. For further details, the above-said notifications are available for download using hyperlinks provided therein.

Thanking you,

Yours faithfully,

(S.G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

DGFT - Notifications on exemption of IGST & Compensation cess under EOU, Advance Authorisation and EPCG schemes extended up-to 01.10.2018.

| EPC/LIC/IGST_REFUND_ERRORS |

26.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Notifications on exemption of IGST & Compensation cess under EOU, Advance Authorisation and EPCG schemes extended up-to 01.10.2018. |

|

|

Dear Members,

As you are aware, in its last meeting dated 10/03/2018, GST Council had made several recommendations pertaining to implementation of e-way bill, exporters tax exemptions, RCM, GSTR-3b/ GSTR-1 etc.

In this regard, O/o DGFT New Delhi has issued following Notifications regarding Exemption from Integrated Tax and Compensation Cess under EOU, Advance Authorisation and EPCG schemes which is extended up-to 01.10.2018:

NOTIFICATION NO. |

DATE |

SUBJECT |

55/2015-2020 |

23.03.2018 |

Amendments to Foreign Trade Policy 2015-20 - Extension to Integrated Goods and Service Tax (IGST) and compensation Cess exemption under EOU Scheme till 01.10.2018. |

54/2015-2020 |

22.03.2018 |

Amendments to Foreign Trade Policy 2015-2020 - Extension of Integrated and Goods and Service Tax (IGST) and Compensation Cess exemption under Advance Authorisation and EPCG Scheme till 01.10.2018. |

http://dgft.gov.in/Exim/2000/NOT/NOT17/Noti%2055%20english.pdf

http://dgft.gov.in/Exim/2000/NOT/NOT17/NOTIFICATION%2054%20english.pdf

Members are requested to take note of these notifications. The original notifications are available for download using hyperlinks provided therein.

Thanking you,

Yours faithfully,

(S.G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Gentle Reminder - IGST/ ITC Exports Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end

| EPC/LIC/IGST_ ITC_REFUND_CAMPS |

26.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Gentle Reminder - IGST/ ITC Exports Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end |

|

|

Dear Members,

This is in continuation of our circulars dated 15/03/2018 & 20/03/2018 informing you about IGST refund facilitation camps being organised by CBEC all over India.

CBEC has decided to observe “IGST/ ITC Exports Refund Fortnight” from 15th March to 29th March 2018 to liquidate all the pending export refund claims at various customs locations.

In this regard, the council had also deputed an Officer to JNCH (Nhava Sheva) to meet the Senior Customs Officers regarding specific issues pertaining to IGST refunds and also understand IGST refund facilitation process during this fortnight. During interactions, we understand that IGST refund liquidation is being done mainly for error code SB005. The council has been advised to inform the members once again to make use of this opportunity (till 29/03/2018) of liquidating IGST refunds stuck specially due to error code SB005. The same facilitation, we understand will be offered at all the customs locations during this fortnight.

For the convenience of members, the information about such IGST refund facilitation camps being organised at various Customs Locations is being reproduced as follows:

JNCH (NHAVA SHEVA)

Jawaharlal Nehru Custom House has issued PN No. 39/2018 dated 14/03/2018 (http://164.100.155.199/pdf/PN-2018/PN_039.pdf) whereby an ‘IGST Refund Facilitation Camp’ will be organised commencing from 15.03.2018 to 29.03.2018 at Ground Floor of JNCH.

During this fortnight all shipping bills in respect of which data has been validated by GSTN but refund has not been disbursed due to invoice mismatch error (error code SB005) will be processed on priority.

Those exporters who have exported their consignments from Nhava Sheva port can approach the “IGST Exports Refund Facilitation Centre” on the ground floor of the Custom House with the prescribed concordance tables in respect of those shipping bills where SB005 error exists, along with the GSTR1 and Table 6A, if any, for the relevant month. After preliminary verification in the help desk these cases would be taken up for priority processing in the IGST refund processing centre at Room no 601 (6th floor of the custom house)

Exporters may please ensure that concordance tables/GSTR1/Table 6A are submitted only in respect of those shipping bills where SB005 error exists and which have been exported through Nhava Sheva port. The format for the concordance table has also been mailed earlier to the exporters.

For any issues, you may contact (Deputy Commissioner of Customs, Drawback NS-II, JNCH, e-mail: igstrefundjnch@gmail.com, Tel: 022-27244708/27243039).

AIR CARGO COMPLEX, SAHAR, MUMBAI

Members can contact IGST Refund Facilitation Cell which has been constituted to facilitate IGST refunds specially for SB005 error codes. The contact details are- Mr. Jaideep Dubey, Asst. Commissioner, Tel- 22-26816631, e-mail igstexportrefund.accmumbai@gmail.com .

NEW CUSTOMS HOUSE (ZONE1), Mumbai

As per updates on http://www.mumbaicustomszone1.gov.in/ a special drive on disposal of 'IGST REFUNDS' is being observed from 15th March to 29th March, 2018. Exporters are requested to make full use of it.

Principal Chief Commissioner, CGST & CX, Mumbai Zone (ITC Refunds)

Trade Notice No.40/2018 dated 14.03.2018 has been issued by the PCCO, CGST & CX, Mumbai Zone as they are observing “ITC Exports Refund Fortnight”till 29/03/2018. The details of nodal officers are provided in the attached Trade Notice, members are requested to make use of this opportunity in case you have pending. ITC refunds.

GUJARAT

O/o Chief Commissioner of Customs, Gujarat Zone has issued communication regarding special drive to liquidate pendency of IGST refund during 15th to 29th March 2018 at all customs locations under Gujarat Zone. The communication from O/o CCO, Ahmedabad is also attached for reference.

Similarly, Hazira port has issued advisory regarding IGST refund fortnight attached for your reference.

Further, we understand that local trade associations (GCCI etc) are also actively facilitating in this drive at various locations. In this regard, Council’s Ahmedabad Regional office can also be contacted for further details or assistance.

SOUTHERN REGION

As per updates, following offices are holding such IGST facilitation camps:

ICD Moosapet Hyderabad office : The members can walk-in any time between 10am to 6pm at ICD Office at New Railway Goods Shed Road, Moosapet, Hyderabad with their REFUND issues and meet Mr. Mohan – Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Mohan (9840260959).

ICD Office at White Field, Bangalore: The members can walk-in any time between 10am to 6pm with their REFUND issues and meet Mr. Gopalkrishna – Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Gopalkrishna (9845097038).

ICD Office at 60, Rajaji Salai, Chennai, Tamil Nadu: The members can walk-in any time between 10am to 6pm with their REFUND issues To meet Mr. Prashant Kumar Kakala – Deputy Commissioner and Mr. Karthik Raj Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Karthik Raj (9751650067).

Cochin Customs House: has also decided to conduct a special drive to clear the pending refunds of Integrated Goods and Services Tax (IGST) from March 15-March 29. It has been noticed about `120 crore of IGST refunds of exports through Cochin Port is pending disbursal. The pending disbursal is mainly due to errors committed by the exports themselves. The exporters can contact the special officer M S Suresh, assistant commissioner (+91 484 2668040) at Custom House, Willingdon Island, Cochin, Kerala, during this period with their clarification so that the errors committed can be removed and IGST claims processed.

KOLKATA

The Office of the Commissioner, Kolkata South CGST & CX Commissionerate has issued PN No. 01/2018 dated 15/03/2018 (copy enclosed) whereby an ‘IGST Refund Facilitation Camp’ now organised commencing from 15.03.2018 to 29.03.2018 at Hqrs, Technical Section, Room No. 403, 4th Floor, GST Bhawan, 180 Shantipally, Rajdanga Main Road, Kolkata – 700107. All concerned are requested to file their pending refund claims with their jurisdictional officers under this Commissionerate immediately for expeditious processing of the same. The exporters who have received any ‘Deficiency Memo’ in respect of refund claims already filed by them, they are requested to submit their reply forthwith for disposal of the same within the aforesaid period.

For any issues, you may contact (Hqrs, Technical Section, Room NO. 403, 4th Floor, GST Bhawan, 180 Shantipally, Rajdanga Main Road, Kolkata - 700107, e-mail: kolsouth.gst@gov.in, Tel: 033 24417013).

NEW DELHI

As per Public Notice no. 28/2018 (http://delhicustoms.gov.in/files/air-cargo-export/public-notices/2018/PNE28-090318.pdf) a camp is being organized at DBK Dept, Export Shed, near IGI Air Port, New Delhi from 12/03/2018 till weekend to facilitate refunds in case of error code SB005. Relevant members may contact the concerned and benefit from this drive. Such camps are also being organized in other locations such as ICD Tughlakabad etc from 15th onwards till March end 2018.

Kindly note that we have tried to provide information about as many customs locations as possible. However, such camps are being organised at most of the locations in the country for liquidating IGST/ ITC refunds pendency. As soon as information is received, we shall provide information to you. Alternatively, you can check with your local Jurisdiction office for such facilitation and available the opportunity of liquidating IGST/ ITC refunds on exports which are pending.

Persistent issues, if any, may also be highlighted to the council on ed@chemexcil.gov.in & deepak.gupta@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

JNCH Camp 15.3.2018 onwards

Trade Notice No. 40-2018

Gujarat IGST Camp 15 March onwards

IGST Camp Hazira

PNE28 – (NEW DELHI)

Notice No. 1 – IGST – ITC EXPORTERS REFUND FORTNIGHT

|

|

BACK

|

EGM errors related to IGST refund on exports

| EPC/LIC/IGST_REFUND_EGM_ERRORS |

20.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

EGM errors related to IGST refund on exports |

|

|

Dear Members,

As you are aware, IGST refunds in many cases have been delayed due to matching errors and limitations in corrective action to be taken.

Apart from Invoice Mismatch error (SB005), another major error category delaying IGST refunds in ICD’s is related to non-filing of EGM at the gateway port or information mismatch between local and gateway EGM’s.

In this regard, CBEC has issued circular no 06/2018 dated 16/03/2018 regarding Refund of IGST on Export-EGM Error related cases.

You will appreciate that filing of EGM by shipping lines is also a mandatory requirement for processing of refunds apart from S/B, GSTR-3B & GSTR-1/ 6A. The Shipping Lines/ agents have been filing EGM electronically for exports from gateway ports, but for cargo from ICD’s, shipping lines/ Agents filed EGM in manual mode. Therefore, absence of electronic EGM’s and their integration with local EGM’s has been a hindrance in processing of IGST refunds from ICD’s.

To overcome this issue, following steps are proposed to be undertaken by Jurisdiction officers (ICD’s and gateway ports)/ Shipping lines:

Shipping lines have been mandated to include S/B’s originating from ICD’s while filing gateway EGM’s. In case needful is not done, Shipping lines/ Agents have been asked to file supplementary EGMs.

Jurisdictional officers in ICD’s to take following steps:

Filing of local EGM immediately after cargo leaves the port

Liaising with jurisdictional officer at gateway port for incorporation of shipping bills pertaining to cargo originating in ICD’s in the EGM’s filed at the gateway ports by shipping lines/ agents.

Rectification of errors in local EGM’s, wherever necessary.

The jurisdictional officers at gateway port should monitor the EGM pendency and error reports in ICES. The officers at the gateway port have to resolve the EGM errors in expeditious manner by asking shipping lines/ agents to file requisite amendments and approving amendments in ICES.

It has been observed that mismatch of information in local and gateway EGM mainly occurs because of incorrect port code, change in container for LCL cargo, incorrect count of containers, LEO after sailing date. The procedure to be followed has been provided in step by step guide made available recently by DG Systems.

There is a shared responsibility of the officers at ICD’s and gateway ports. They have to ensure swift rectification of erros and effective co-ordination between domestic carriers, who file local EGM’s and shipping lines agents.

Members whose IGST refunds are stuck due to EGM related issues are requested to take note of the above circular and steps being taken for error free filing and integration of EGM’s. The original Circular No. 06/2018-Customs dated 16/03/2018 is available for download using below link-

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2018/circ06-2018cs.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

Air Cargo Complex, Mumbai - List of SB005 errors pertaining to various exporters and list of PFMS which still require validation

| EPC/LIC/ACC/SAHAR/IGST |

20.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Air Cargo Complex, Mumbai - List of SB005 errors pertaining to various exporters and list of PFMS which still require validation |

|

|

Dear Members,

We have received communication from the Assistant Commissioner, Air Cargo Complex, Mumbai regarding list of SB005 errors pertaining to various exporters and list of PFMS which still require validation.

As per the communication, exporters have been once again requested to forward Concordance Table as enlisted in Annexure A of CBEC Circular 05/2018 - CUS dated 23/02/2018 as Public notice no 02/2018 dated 26/02/2018 issued by Chief commissioner of Customs, Mumbai Zone -III

Since special drive is being undertaken for a fortnight w.e.f. 15th March, 2018 till 29th March, 2018 as a special endeavour to liquidate pending refund claims, exporters are requested to utilise this effort and get their refund claims processed pertaining to SB005 errors. Exporters are also requested to log in to their ICEGATE id and see status of their Shipping Bills and the errors therein . Only errors pertaining to SB005 are been given utility of manual interface.

Last but not the least, many Exporters have still not validated their Bank Account in PFMS. All these exporters are requested to approach Air cargo Complex and get their Bank Accounts validated in the ICES System so the disbursement can be effected after scrolling out of their IGST Refunds.

Members exporting through Air Cargo Complex, Mumbai are requested to take note of above and go through the attachment and take appropriate action wherever applicable.

For any issues, please contact Mr. Jaideep Dubey, Assistant Commissioner of Customs (Drawback), Air Cargo Complex, Sahar, Mumbai (Tel- 022-26816631/ 022-26816711, e-mail- igstexportrefund.accmumbai@gmail.com )

Thanking You,

Yours faithfully,

(S. G. BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

http://chemexcil.in/uploads/files/InvoiceError(SB005)_GSTINWise.xlsx

http://chemexcil.in/uploads/files/PFMS_Error_IECWise.xlsx

|

|

BACK

|

Reminder - IGST/ ITC Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end

|

EPC/LIC/IGST_ ITC_REFUND_CAMPS |

20.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Reminder - IGST/ ITC Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end |

|

|

Dear Members,

This is in continuation of our mailer dated 15/03/2018 informing you about IGST refund facilitation camps being organised by CBEC all over India. To further facilitate the exporters and expedite IGST refunds, CBEC has decided to observe “IGST/ ITC Exports Refund Fortnight” from 15th March to 29th March 2018 to liquidate all the pending export refund claims at various customs locations.

In this regard, the council had also deputed an Officer to JNCH (Nhava Sheva) to meet the Senior Customs Officers regarding specific issues pertaining to IGST refunds and also understand IGST refund facilitation process during this fortnight. During interactions, we understand that IGST refund liquidation is being done mainly for error code SB005. The council has been advised to inform the members once again to make use of this opportunity (till 29/03/2018) of liquidating IGST refunds stuck specially due to error code SB005. The same facilitation, we understand will be offered at all the customs locations during this fortnight.

For the convenience of members, the information about such IGST refund facilitation camps being organised at various Customs Locations is being reproduced as follows:

JNCH (NHAVA SHEVA)

Jawaharlal Nehru Custom House has issued PN No. 39/2018 dated 14/03/2018 (http://164.100.155.199/pdf/PN-2018/PN_039.pdf) whereby an ‘IGST Refund Facilitation Camp’ will be organised commencing from 15.03.2018 to 29.03.2018 at Ground Floor of JNCH.

During this fortnight all shipping bills in respect of which data has been validated by GSTN but refund has not been disbursed due to invoice mismatch error (error code SB005) will be processed on priority.

Those exporters who have exported their consignments from Nhava Sheva port can approach the “IGST Exports Refund Facilitation Centre” on the ground floor of the Custom House with the prescribed concordance tables in respect of those shipping bills where SB005 error exists, along with the GSTR1 and Table 6A, if any, for the relevant month. After preliminary verification in the help desk these cases would be taken up for priority processing in the IGST refund processing centre at Room no 601 (6th floor of the custom house)

Exporters may please ensure that concordance tables/GSTR1/Table 6A are submitted only in respect of those shipping bills where SB005 error exists and which have been exported through Nhava Sheva port. The format for the concordance table has also been mailed earlier to the exporters.

For any issues, you may contact (Deputy Commissioner of Customs, Drawback NS-II, JNCH, e-mail: igstrefundjnch@gmail.com, Tel: 022-27244708/27243039).

AIR CARGO COMPLEX, SAHAR, MUMBAI

Members can contact IGST Refund Facilitation Cell which has been constituted to facilitate IGST refunds specially for SB005 error codes. The contact details are- Mr. Jaideep Dubey, Asst. Commissioner, Tel- 22-26816631, e-mail igstexportrefund.accmumbai@gmail.com .

NEW CUSTOMS HOUSE (ZONE1), Mumbai

As per updates on http://www.mumbaicustomszone1.gov.in/ a special drive on disposal of 'IGST REFUNDS' is being observed from 15th March to 29th March, 2018. Exporters are requested to make full use of it.

Principal Chief Commissioner, CGST & CX, Mumbai Zone (ITC Refunds)

Trade Notice No.40/2018 dated 14.03.2018 has been issued by the PCCO, CGST & CX, Mumbai Zone as they are observing “ITC Exports Refund Fortnight”till 29/03/2018. The details of nodal officers are provided in the attached Trade Notice, members are requested to make use of this opportunity in case you have pending. ITC refunds.

GUJARAT

O/o Chief Commissioner of Customs, Gujarat Zone has issued communication regarding special drive to liquidate pendency of IGST refund during 15th to 29th March 2018 at all customs locations under Gujarat Zone. The communication from O/o CCO, Ahmedabad is also attached for reference.

Similarly, Hazira port has issued advisory regarding IGST refund fortnight attached for your reference.

Further, we understand that local trade associations (GCCI etc) are also actively facilitating in this drive at various locations. In this regard, Council’s Ahmedabad Regional office can also be contacted for further details or assistance.

SOUTHERN REGION

As per updates, following offices are holding such IGST facilitation camps:

ICD Moosapet Hyderabad office : The members can walk-in any time between 10am to 6pm at ICD Office at New Railway Goods Shed Road, Moosapet, Hyderabad with their REFUND issues and meet Mr. Mohan – Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Mohan (9840260959).

ICD Office at White Field, Bangalore: The members can walk-in any time between 10am to 6pm with their REFUND issues and meet Mr. Gopalkrishna – Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Gopalkrishna (9845097038).

ICD Office at 60, Rajaji Salai, Chennai, Tamil Nadu: The members can walk-in any time between 10am to 6pm with their REFUND issues To meet Mr. Prashant Kumar Kakala – Deputy Commissioner and Mr. Karthik Raj Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Karthik Raj (9751650067).

Cochin Customs House: has also decided to conduct a special drive to clear the pending refunds of Integrated Goods and Services Tax (IGST) from March 15-March 29. It has been noticed about `120 crore of IGST refunds of exports through Cochin Port is pending disbursal. The pending disbursal is mainly due to errors committed by the exports themselves. The exporters can contact the special officer M S Suresh, assistant commissioner (+91 484 2668040) at Custom House, Willingdon Island, Cochin, Kerala, during this period with their clarification so that the errors committed can be removed and IGST claims processed.

KOLKATA

The Office of the Commissioner, Kolkata South CGST & CX Commissionerate has issued PN No. 01/2018 dated 15/03/2018 (copy enclosed) whereby an ‘IGST Refund Facilitation Camp’ now organised commencing from 15.03.2018 to 29.03.2018 at Hqrs, Technical Section, Room No. 403, 4th Floor, GST Bhawan, 180 Shantipally, Rajdanga Main Road, Kolkata – 700107. All concerned are requested to file their pending refund claims with their jurisdictional officers under this Commissionerate immediately for expeditious processing of the same. The exporters who have received any ‘Deficiency Memo’ in respect of refund claims already filed by them, they are requested to submit their reply forthwith for disposal of the same within the aforesaid period.

For any issues, you may contact (Hqrs, Technical Section, Room NO. 403, 4th Floor, GST Bhawan, 180 Shantipally, Rajdanga Main Road, Kolkata - 700107, e-mail: kolsouth.gst@gov.in, Tel: 033 24417013).

NEW DELHI

As per Public Notice no. 28/2018 (http://delhicustoms.gov.in/files/air-cargo-export/public-notices/2018/PNE28-090318.pdf) a camp is being organized at DBK Dept, Export Shed, near IGI Air Port, New Delhi from 12/03/2018 till weekend to facilitate refunds in case of error code SB005. Relevant members may contact the concerned and benefit from this drive. Such camps are also being organized in other locations such as ICD Tughlakabad etc from 15th onwards till March end 2018.

Kindly note that we have tried to provide information about as many customs locations as possible. However, such camps are being organised at most of the locations in the country for liquidating IGST/ ITC refunds pendency. As soon as information is received, we shall provide information to you. Alternatively, you can check with your local Jurisdiction office for such facilitation and available the opportunity of liquidating IGST/ ITC refunds on exports which are pending.

Persistent issues, if any, may also be highlighted to the council on ed@chemexcil.gov.in & deepak.gupta@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

JNCH Camp 15.3.2018 onwards

Trade Notice No. 40-2018

Gujarat IGST Camp 15 March onwards

IGST Camp Hazira

PNE28 – (NEW DELHI)

Notice No. 1 – IGST – ITC EXPORTERS REFUND FORTNIGHT

|

|

BACK

|

Online Application for uploading the supporting documents i.e. e- SANCHIT shall be made mandatory for Bills of Entry filed w.e.f 01.04.2018

| EPC/LIC/CBEC/e_SANCHIT |

16.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Online Application for uploading the supporting documents i.e. e- SANCHIT shall be made mandatory for Bills of Entry filed w.e.f 01.04.2018 |

|

|

Dear Members,

This is in continuation of our recent mailer informing you about mandatory implementation of e-SANCHIT w.e.f 15/03/2018.

Now as per latest updates on CBEC/ICEGATE portals, Online Application for uploading the supporting documents i.e. e-SANCHIT, shall be made mandatory from 01.04.2018.

All Customs Brokers and self-filers are requested to start filing Bill of Entry using e-SANCHIT.

Members are requested to take note of this measure and also inform their CHA’s/ Logistics Providers to do the needful accordingly.

For additional information on e-SANCHIT, Procedure for electronic document upload & FAQ’s etc, please use below link for reference:

https://www.icegate.gov.in/eSANCHIT.html

Thanking you ,

Yours faithfully,

(S.G. BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

GST - Clarifications on exports related IGST/ ITC refund issues

|

EPC/LIC/GST

|

15.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST - Clarifications on exports related IGST/ ITC refund issues |

|

|

Dear Members,

The Central Board of Excise and Customs, GST Policy Wing has issued Circular No. 37/11/2018-GST dated 15/03/2018 regarding Clarifications on exports related refund issues.

We understand that CBEC has received several representations seeking further clarifications on various issues relating to IGST/ ITC refunds on exports. In this regard, clarifications have been provided in the circular which are reproduced/ highlighted as follows:

Non-availment of drawback in case of ITC refund:

The third proviso to sub-section (3) of section 54 of the CGST Act states that no refund of input tax credit shall be allowed in cases where the supplier of goods or services or both avails of drawback in respect of central tax.

It is now clarified that a supplier availing of drawback only with respect to basic customs duty shall be eligible for refund of unutilized input tax credit of central tax / State tax / Union territory tax / integrated tax / compensation cess under the said provision. It is further clarified that refund of eligible credit on account of State tax shall be available even if the supplier of goods or services or both has availed of drawback in respect of central tax.

Amendment through Table 9 of GSTR-1:

It has been reported that refund claims are not being processed on account of mis-matches between data contained in FORM GSTR-1, FORM GSTR-3B and shipping bills/bills of export. In this connection, it may be noted that the facility of filing of Table 9 in FORM GSTR-1, an amendment table which allows for amendments of invoices/ shipping bills details furnished in FORM GSTR-1 for earlier tax period, is already available. If a taxpayer has committed an error while entering the details of an invoice / shipping bill / bill of export in Table 6A or Table 6B of FORM GSTR-1, he can rectify the same in Table 9 of FORM GSTR-1. It is advised that while processing refund claims on account of zero rated supplies, information contained in Table 9 of FORM GSTR-1 of the subsequent tax periods should be taken into cognizance, wherever applicable.

Local offices are also advised to refer to Circular No. 26/26/2017 – GST dated 29th December, 2017, wherein the procedure for rectification of errors made while filing the returns in FORM GSTR-3B has been provided. Therefore, in case of discrepancies between

the data furnished by the taxpayer in FORM GSTR-3B and FORM GSTR-1, the officer shall refer to the said Circular and process the refund application accordingly.

Exports without LUT:

Export of goods or services can be made without payment of integrated tax under the provisions of rule 96A of the Central Goods and Services Tax Rules, 2017 (the CGST Rules). Under the said provisions, an exporter is required to furnish a bond or Letter of Undertaking (LUT) to the jurisdictional Commissioner before effecting zero rated supplies. A detailed procedure for filing of LUT has already been specified vide Circular No. 8/8/2017 –GST dated 4th October, 2017. It has been brought to the notice of the Board that in some cases, such zero rated supplies have been made before filing the LUT and refund claims for unutilized input tax credit have been filed.

In this regard, it is emphasised that the substantive benefits of zero rating may not be denied where it has been established that exports in terms of the relevant provisions have been made. The delay in furnishing of LUT in such cases may be condoned and the facility for export under LUT may be allowed on ex post facto basis taking into account the facts and

circumstances of each case.

Exports after specified period:

Rule 96A (1) of the CGST Rules provides that any registered person may export goods or services without payment of integrated tax after furnishing a LUT / bond and that he would be liable to pay the tax due along with the interest as applicable within a period of fifteen days after the expiry of three months or such further period as may be allowed by the Commissioner from the date of issue of the invoice for export, if the goods are not exported out of India.

It has been reported that the exporters have been asked to pay integrated tax where the goods have been exported but not within three months from the date of the issue of the invoice for export. In this regard, it is emphasised that exports have been zero rated under the Integrated Goods and Services Tax Act, 2017 (IGST Act) and as long as goods have actually been exported even after a period of three months, payment of integrated tax first and claiming refund at a subsequent date should not be insisted upon. In such cases, the jurisdictional Commissioner may consider granting extension of time limit for export as provided in the said sub-rule on post facto basis keeping in view the facts and circumstances

of each case. The same principle should be followed in case of export of services.

Deficiency Memo (RFD-01A):

If the RFD-01A application for refund is complete, an acknowledgement in FORM GST RFD-02 should be issued and CGST Rules provides for communication in FORM GST RFD-03 (deficiency memo) where deficiencies are noticed.

The said sub-rule also provides that once the deficiency memo has been issued, the claimant

is required to file a fresh refund application after the rectification of the deficiencies.

In this connection, a clarification has been sought whether with respect to a refund claim, deficiency memo can be issued more than once. In this regard rule 90 of the CGST Rules may be referred to, wherein it has been clearly stated that once an applicant has been communicated the deficiencies in respect of a particular application, the applicant shall furnish a fresh refund application after rectification of such deficiencies. It is therefore, clarified that there can be only one deficiency memo for one refund application and once such a memo has been issued, the applicant is required to file a fresh refund application, manually in FORM GST RFD-01A. This fresh application would be accompanied with the original ARN, debit entry number generated originally and a hard copy of the refund application filed online earlier. It is further clarified that once an application has been submitted afresh, pursuant to a deficiency memo, the proper officer will not serve another defficiency memo with respect to the application for the same period, unless the deficiencies pointed out in the original memo remain unrectified, either wholly or partly, or any other substantive deficiency is noticed subsequently.

Self-declaration for non-prosecution:

It is representation that exporters are being asked for a self-declaration with every refund claim to the effect that the claimant has not been prosecuted. It is clarified that this requirement is already satisfied in case of exports under LUT and asking for self–declaration with every refund claim where the exports have been made under LUT is not warranted.

Discrepancy between values of GST invoice and shipping bill/bill of export:

It is clarified that the zero rated supply of goods is effected under the provisions of the GST laws. An exporter, at the time of supply of goods declares that the goods are for export and the same is done under an invoice issued under rule 46 of the CGST Rules. The value recorded in the GST invoice should normally be the transaction value. The same transaction value should normally be recorded in the corresponding shipping bill / bill of export.

During the processing of the refund claim, the value of the goods declared in the GST invoice and the value in the corresponding shipping bill / bill of export should be examined and the lower of the two values should be sanctioned as refund.

Refund of taxes paid under existing laws:

CGST Act provides that refunds of tax/duty paid under the existing law shall be disposed of in accordance with the provisions of the existing law. It is observed that certain taxpayers have applied for such refund claims in FORM GST RFD-01A also. In this regard, the field formations are advised to reject such applications and pass a rejection order in FORM GST PMT-03 and communicate the same on the common portal in FORM GST RFD-01B. The procedures laid down under the existing laws viz., Central Excise Act, 1944 and Chapter V of the Finance Act, 1994 read with above referred sub-sections of section 142 of the CGST Act shall be followed while processing such refund claims.

Furthermore, it has been brought to the notice of CBEC that the field formations are rejecting, withholding or re-crediting CENVAT credit, while processing claims of refund filed under the existing laws. In this regard, attention is invited to sub-section (3) of section 142 of the CGST Act which provides that the amount of refund arising out of such claims shall be refunded in cash. Further, the first proviso to the said sub-section provides that where any claim for refund of CENVAT credit is fully or partially rejected, the amount so rejected shall lapse and therefore, will not be transitioned into GST. Furthermore, it should be ensured

that no refund of the amount of CENVAT credit is granted in case the said amount has been

transitioned under GST. The field formations are advised to process such refund applications accordingly.

Filing frequency of Refunds:

Various representations have been received by CBEC regarding the period for which refund applications can be filed. Section 2(107) of the CGST Act defines the term “tax period” as the period for which the return is required to be furnished. The terms ‘Net ITC’ and ‘turnover of zero rated supply of goods/services’ are used in the context of the relevant period in rule 89(4) of CGST Rules. The phrase ‘relevant period’ has been defined in the said sub-rule as ‘the period for which the claim has been filed’.

In many scenarios, exports may not have been made in that period in which the inputs or input services were received and input tax credit has been availed. Similarly, there may be

cases where exports may have been made in a period but no input tax credit has been availed in the said period. The above referred rule, taking into account such scenarios, defines relevant period in the context of the refund claim and does not link it to a tax period.

In this regard, it is hereby clarified that the exporter, at his option, may file refund

claim for one calendar month / quarter or by clubbing successive calendar months / quarters. The calendar month(s) / quarter(s) for which refund claim has been filed, however, cannot spread across different financial years.

BRC / FIRC for export of goods:

It is clarified that the realization of convertible foreign exchange is one of the conditions for export of services. In case of export of goods, realization of consideration is not a pre-condition. In rule 89 (2) of the CGST Rules, a statement containing the number and date of invoices and the relevant Bank Realisation Certificates (BRC) or Foreign Inward Remittance Certificates (FIRC) is required in case of export of services whereas, in case of export of goods, a statement containing the number and date of shipping bills or bills of export and the number and the date of the relevant export invoices is required to be submitted along with the claim for refund. It is therefore clarified that insistence on proof of realization of export proceeds for processing of refund claims related to export of goods has not been envisaged in the law and should not be insisted upon.

Supplies to Merchant Exporters:

Notification No. 40/2017 – Central Tax (Rate), dated 23rd October 2017 and notification No. 41/2017 – Integrated Tax (Rate) dated 23rd October 2017 provide for supplies for exports at a concessional rate of 0.05% and 0.1% respectively, subject to certain conditions specified in the said notifications.

It is clarified that the benefit of supplies at concessional rate is subject to certain conditions and the said benefit is optional. The option may or may not be availed by the supplier and / or the recipient and the goods may be procured at the normal applicable tax rate.

It is also clarified that the exporter will be eligible to take credit of the tax @ 0.05% / 0.1% paid by him. The supplier who supplies goods at the concessional rate is also eligible for refund on account of inverted tax structure as per the provisions of clause (ii) of the first

proviso to sub-section (3) of section 54 of the CGST Act. It may also be noted that the exporter of such goods can export the goods only under LUT / bond and cannot export on

payment of integrated tax. In this connection, notification No. 3/2018-Central Tax, dated

23.01.2018 may be referred.

Requirement of invoices for processing of claims for refund:

It was envisaged that only the specified statements would be required for processing of refund claims because the details of outward supplies and inward supplies would be available on the common portal which would be matched. However, because of delays in operationalizing the requisite modules on the common portal, in many cases, suppliers’ invoices on the basis of which the exporter is claiming refund may not be available on the system. For processing of refund claims of input tax credit, verifying the invoice details is quintessential. In a completely electronic environment, the information of the recipients’ invoices would be dependent upon the suppliers’ information, thus putting an in-built check-and-balance in the system. However, as the refund claims are being filed by the recipient in a semi-electronic environment and is completely based on the information provided by them, it is necessary that invoices are scrutinized.

List of documents required for processing the various categories of refund claims on exports is provided in the Table available in the circular. Apart from the documents listed in the Table, no other documents should be called for from the taxpayers, unless the same are not available with the officers electronically

These instructions shall apply to exports made on or after 1st July, 2017.

Members are requested to take note of aboveclarifications regarding export related IGST/ ITC refund issues. The original circular is available for download using below link-

http://www.cbec.gov.in/resources//htdocs-cbec/gst/circularno-37-cgst.pdf

Persistent issues, if any, may also be highlighted to the council on ed@chemexcil.gov.in & deepak.gupta@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT Amendment in Chapter 2 of the Handbook of Procedure (2015-20)

| EPC/LIC/DGFT |

15.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT Amendment in Chapter 2 of the Handbook of Procedure (2015-20) |

|

|

Dear Members,

The O/o Director General of Foreign Trade, New Delhi has issued Public Notice no. 65/2015-2020 dated 13/03/2018 regarding amendment in Chapter 2 of the Handbook of Procedure (2015-20).

As an effect of this Public Notice, Para 2.86 of the Handbook of Procedure (2015-20) is deleted.

Kindly note that Para 2.86 of HBP deals with admissibility of duty credit scrip / discharge of EO applications in cases where payments are backed by Irrevocable Letter of Credit. The Para 2.86 reads as follows:

“2.86 Irrevocable Letter of Credit

In case where applicant applies for duty credit scrip / discharge of EO against confirmed irrevocable letter of credit (or bill of exchange which is unconditionally Avalised / Co-Accepted / Guaranteed by a bank) and this is confirmed and certified by exporter’s bank in relevant Bank Certificate of Export and Realization, payment of export proceeds shall be deemed to have been realized. For Status Holders, irrevocable letter of credit would suffice”

Members are requested to take note of this amendment regarding deletion of Para 2.86 from HBP. The Public Notice no 65/2015-2020 dated 13/03/2018 is available for download using below link-

http://dgft.gov.in/Exim/2000/PN/PN17/PN%2065%20eng.pdf

Thanking you,

Yours faithfully,

S.G Bharadi

Executive Director

CHEMEXCIL

|

|

BACK

|

Inputs for 5th India-Brazil Trade Monitoring Mechanism (TMM) to be held in New Delhi during June 2018

| EPC/LIC/TMM_BRAZIL |

15.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Inputs for 5th India-Brazil Trade Monitoring Mechanism (TMM) to be held in New Delhi during June 2018 |

|

|

We have received communication from the Under Secretary (FT – LAC), Department of Commerce, Government of India that the 5th Meeting of India-Brazil Trade Monitoring Mechanism (TMM) is being scheduled in New Delhi during June, 2018. The meeting will be co-chaired by Commerce Secretary from Indian side.

Kindly note that India-Brazil TMM is an institutional mechanism to identify bottlenecks and to take appropriate measures to overcome operational/ tariff and non-tariff obstacles to bilateral trade between India and Brazil.

The last (4th) meeting of TMM was held on 30th September, 2016 in Sao Paulo, Brazil. A copy of the minutes of the 4th meeting of TMM is enclosed for your ready reference.

In view of the proposed 5th meeting of India-Brazil TMM during the month of June, 2018, you are requested to kindly furnish bilateral issues (tariff & non-tariff) to be raised with Brazil with some justification/ background.

Therefore, members are kindly requested to revert with inputs/ comments latest by 20th March 2018 on our e-mail ids- deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in for consideration.

Your timely replies will be appreciated.

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

http://chemexcil.in/uploads/files/Minutes_4th_TMM_30_9_2016_Brasilia.compressed_.pdf

|

|

BACK

|

V. Imp - IGST Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end

| EPC/LIC/IGST_REFUNDs_CAMPSPS |

15.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

V. Imp - IGST Refund Facilitation Camps at various Customs locations from 15/03/2018 onwards till march end |

|

|

Dear Members,

To further facilitate the exporters and expedite IGST refunds, CBEC has decided to observe “IGST Exports Refund Fortnight” from 15th March to 29th March 2018 to liquidate all the pending export refund claims at various customs locations.

For the convenience of members, the information about such IGST refund facilitation camps being organised at various Customs Locations is as follows:

JNCH (NHAVA SHEVA)

Jawaharlal Nehru Custom House has issued PN No. 39/2018 dated 14/03/2018 (http://164.100.155.199/pdf/PN-2018/PN_039.pdf) whereby an ‘IGST Refund Facilitation Camp’ will be organised commencing from 15.03.2018 to 29.03.2018 at Ground Floor of JNCH.

During this fortnight all shipping bills in respect of which data has been validated by GSTN but refund has not been disbursed due to invoice mismatch error (error code SB005) will be processed on priority. Those exporters who have exported their consignments from Nhava Sheva port can approach the IGST refund helpdesk on the ground floor of the Custom House with the prescribed concordance tables in respect of those shipping bills where SB005 error exists, along with the GSTR1 and Table 6A, if any, for the relevant month. After preliminary verification in the help desk these cases would be taken up for priority processing in the IGST refund processing centre on 6th floor of the custom house.

Exporters may please ensure that concordance tables/GSTR1/Table 6A are submitted only in respect of those shipping bills where SB005 error exists and which have been exported through Nhava Sheva port. The format for the concordance table has also been mailed earlier to the exporters.

For any issues, you may contact (Deputy Commissioner of Customs, Drawback NS-II, JNCH, e-mail: igstrefundjnch@gmail.com, Tel: 022-27244708/27243039).

AIR CARGO COMPLEX, SAHAR, MUMBAI

Members can contact IGST Refund Facilitation Cell which has been constituted to facilitate IGST refunds specially for SB005 error codes. The contact details are- Mr. Jaideep Dubey, Asst. Commissioner, Tel- 22-26816631, e-mail igstexportrefund.accmumbai@gmail.com .

NEW CUSTOMS HOUSE (ZONE1), Mumbai

As per updates on http://www.mumbaicustomszone1.gov.in/ a special drive on disposal of 'IGST REFUNDS' is being observed from 15th March to 29th March, 2018. Exporters are requested to make full use of it.

GUJARAT

O/o Chief Commissioner of Customs, Gujarat Zone has issued communication regarding special drive to liquidate pendency of IGST refund during 15th to 29th March 2018 at all customs locations under Gujarat Zone. The communication from O/o CCO, Ahmedabad is also attached for reference.

Similarly, Hazira port has issued advisory regarding IGST refund fortnight attached for your reference.

Further, we understand that local trade associations (GCCI etc) are also actively facilitating in this drive at various locations. In this regard, Council’s Ahmedabad Regional office can also be contacted for further details in this regard as they are also working in tandem with various agencies/ stakeholders.

SOUTHERN REGION

As per updates, following offices are holding such IGST facilitation camps:

ICD Moosapet Hyderabad office : The members can walk-in any time between 10am to 6pm at ICD Office at New Railway Goods Shed Road, Moosapet, Hyderabad with their REFUND issues and meet Mr. Mohan – Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Mohan (9840260959).

ICD Office at White Field, Bangalore: The members can walk-in any time between 10am to 6pm with their REFUND issues and meet Mr. Gopalkrishna – Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Gopalkrishna (9845097038).

ICD Office at 60, Rajaji Salai, Chennai, Tamil Nadu: The members can walk-in any time between 10am to 6pm with their REFUND issues To meet Mr. Prashant Kumar Kakala – Deputy Commissioner and Mr. Karthik Raj Asst. Commissioner to sort out their complaint till March end. Members can contact Mr. Karthik Raj (9751650067).

Cochin Customs House: has also decided to conduct a special drive to clear the pending refunds of Integrated Goods and Services Tax (IGST) from March 15-March 29. It has been noticed about `120 crore of IGST refunds of exports through Cochin Port is pending disbursal. The pending disbursal is mainly due to errors committed by the exports themselves. The exporters can contact the special officer M S Suresh, assistant commissioner (+91 484 2668040) at Custom House, Willingdon Island, Cochin, Kerala, during this period with their clarification so that the errors committed can be removed and IGST claims processed.

NEW DELHI

As per Public Notice no. 28/2018 (http://delhicustoms.gov.in/files/air-cargo-export/public-notices/2018/PNE28-090318.pdf) a camp is being organized at DBK Dept, Export Shed, near IGI Air Port, New Delhi from 12/03/2018 till weekend to facilitate refunds in case of error code SB005. Relevant members may contact the concerned and benefit from this drive.

Such camps are also being organized in other locations such as ICD Tughlakabad etc from 15th onwards till March end 2018.

KOLKATA

We are awaiting direction/ information from the local customs office for such an initiative.

Kindly note that we have tried to provide information about as many customs locations as possible. However, such camps are being organised at most of the locations in the country. As soon as information is received, we shall provide information to you. Alternatively, you can check with your local Jurisdiction office for such facilitation.

Persistent issues, if any, may also be highlighted to the council on ed@chemexcil.gov.in & deepak.gupta@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

Encl : JNCH_IGST_CAMP_15.03_.2018

Gujarat_(IGST_Camp_15_March

IGST_CAMP_HAZIRA

PNE28-090318_(New_Delhi_IG)

|

|

BACK

|

DGFT - Launch of e-MPS facility to make online payment for miscellaneous applications

| EPC/LIC/DGFT/e-MPS |

14.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Launch of e-MPS facility to make online payment for miscellaneous applications |

|

|

Dear Members,

As an ease of doing business measure, the O/o Directorate General of Foreign Trade has launched e-MPS facility to make online payment for miscellaneous applications. This development has been notified vide Trade Notice no 25/2018 dated 14.03.2018.

Currently, online payment mode is available for submission of applications for various FTP schemes and digital payment for these applications. However, there are applications like amendment of license, payment of composition fee etc. where facility of online payment is not available.

In this regard, a facility is being made available to make online payment of feel charges for all the applications where payment is currently being made through manual mode i.e. through Demand Draft/ Bank Receipt.

Ø Using this facility, the online payment can now be made even for a manual application made to a DGFT Regional Office/ DGFT HQ.

Ø The proof of payment, along with the relevant application has to be submitted to the concerned DGFT Regional Authority)/ DGFT HQ. On submission, the concerned DGFT Regional Office will authenticate the payment from the system and update it as utilized. The DGFT Office will print the receipt, having unique DGFT reference number, of payment received and will link it with the particular application submitted. The fee for the application will be treated as paid and application will be processed.

Ø Both, the online payment and manual mode payment will be allowed for one month from the issue of this trade notice.The issues reported and problem faced with thee-MPS will be addressed in this one month period. At the expiry of the one month period all the fee payments will have to be made electronically only.

Ø This new facility is not to be used for making payment for applications where an online payment facility coupled with online application facility is already available. For example; fee for MEIS has to be paid through the MEIS application module only.

Ø The facility of online payment can be accessed from DGFT website using Online Application -> ECOM -> Online ECOM Application path or from http://l64.100.128.143/e_homepage.asp link. The applicant has to login using his Digital Certificate. Login ids/ pwds have been created for DGFT offices to access this module. The user guide for both members of the trade and internal users of DGFT Offices can be downloaded from the above link.

Members are requested to take note of this ease of doing business measure. The Trade Notice no. 25/2018 dated 14.03.2018 is available for download using below link-

RADE NOTICES NO. |

DATE |

SUBJECT |

Trade Notice No.25/2018 |

14.03.2018 |

Launch of e-MPS- facility to make online payment for miscellaneous applications |

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

JNCH - IGST Refund not disbursed due to PFMS error

| EPC/LIC/DGFT/e-MPS |

14.3.2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

JNCH - IGST Refund not disbursed due to PFMS error |

|

|

Dear Members,

Kindly note that the O/o Jawaharlal Nehru Customs House, Nhava Sheva (I) has issued Public Notice No. 38/2018 dated 12/03/2018 regarding procedure to be followed in cases where IGST Refund is not disbursed due to PFMS error.

As per the PN it is observed that after generation of IGST Refund Scroll through ICES, in some cases the IGST Refund could not be disbursed due to IFSC not being accepted by PFMS/not registered at PFMS.

The list of such IEC holders where IGST Refund has not been disbursed due to PFMS error is uploaded on the JNCH website and can download using below link-

http://164.100.155.199/pdf/IGST_REFUND.pdf

IEC holders can also check the PFMS verification status after registering themselves on ICEGATE (www.icegate.gov.in). Post registration, the PFMS status can be checked in IEC wise PFMS Invalidated A/Cs report.

For error codes TBE0001 to TBE0007 and TBE0018, the IEC holder should contact the ICEGATE at the e-mail ID (icegatehelpdesk@icegate.gov.in ) quoting the specific error code.

For other error codes (to be specified in the correspondence), IEC holders are required to submit the following documents to the EDI Section, JNCH at the e-mail ID (edi@jawaharcustoms.gov.in ) for updation of their IFSC account:

In case of Fresh Registration/Changes:

Request letter to DC/EDI for registration of IFSC.

Account details verified by concerned bank on exporter’s letterhead.

IEC copy.

PAN copy.

In case of cancellation of earlier account and registration of a new one:

All the above documents.

NOC from Exporter.

NOC from Bank.

Members whose IGST refunds on exports from JNCH are stuck due to PFMS error are requested to take note and do the needful. Members who have exported through other ports may also check through their CHA’s and do the needful submission at the EDI dept and rectify.

The PFMS related error codes are also enclosed with this Public Notice which is available for download using below link-

http://164.100.155.199/pdf/PN-2018/PN_038.pdf

Persistent issues, if any, may be also highlighted to the council on ed@chemexcil.gov.in & deepak.gupta@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S. G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

RBI - Discontinuation of Letters of Undertaking (LoUs) and Letters of Comfort (LoCs) for Trade Credits

| EPC/LIC/DGFT/e-MPS |

14.3.2018

|

| |