|

|

Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-Exporters,

I have pleasure to bring to you the 25th issue of the CHEMEXCIL e-Bulletin for the month of May 2018, which contains the following activities undertaken by the Council and other useful information/EXIM Notifications, etc.

The GSTN has made facility available for online submission of the RFD-11(Letter of Undertaking) for FY 2018-19. Online submission of LUT will save time & transaction costs. Members now can apply online for LUT on the GST Portal.

The Jawaharlal Nehru Custom House(JNCH), NhavaSheva has constituted “Environment Protection Unit” & Compliance of E-Waste (Management) Rules, 2016, respectively.

CBIC has clarified the renewal of online Letter of Undertaking (LUT ) for 2018-19. The registered person (exporters) shall fill and submit FORM GST RFD-11 on the common portal. An LUT shall be deemed to be accepted as soon as an acknowledgement for the same, bearing the Application Reference Number (ARN), is generated online. No document needs to be physically submitted to the jurisdictional office for acceptance of LUT. An LUT shall be deemed to have been accepted as soon as an acknowledgement for the same, bearing the Application Reference Number (ARN), is generated online.

The DGFT has launched the facility to check status of Importer Exporter Code (IEC) application made to them.

I hope, you will find this news bulletin informative and useful. The Secretariat look forward to receive your valuable feedback and suggestions which will help us to improve this bulletin.

With Regards,

SHRI SATISH W. WAGH

CHAIRMAN,

CHEMEXCIL

Chairman Office:

SWASTIK INDUSTRIES

207/208, UdyogBhavan,

Sonawala Road, Goregaon (East),

Mumbai 400063, INDIA.

Tel.: +91-22-40332727

Fax: +91-22-26860011

E-mail: satish@supriyalifescience.com |

BACK |

|

Chemexcil’s Participation in Beauty World Middle East Exhibition held in Dubai, UAE during 8th to 10th May 2018

The 23rd Beauty World Middle East Exhibition wasa three day event held from 8th to 10th May 2018 at Dubai International Convention Centre (Formerly Dubai World Trade Centre), Dubai.

As the largest International Trade fair for beauty products, Hair, Fragrances in the Mid-East & Africa (MEA), this exhibition attracts more than 40,000 trade visitors and beauty professionals from across the world. The show provides the participants an opportunity to tap the lucrative beauty and personal care market in MEA which is valued at approximately USD 32.7 Bn (2017) and expected to grow by around 10% in future.

The 2018 edition of the show featured 1736 exhibitors from 62 countries spread overs a sprawling area of 61,000 sqm which is a growth of 11% over the previous year.

The show also had excellent international presence of 25 country pavilions including India, China, Thailand, Morocco, Turkey, USA, Pakistan, Korea, France, Singapore, Russia etc.

In order to promote exports of Cosmetics and toiletries from India and also to assist our members to explore the market potential in GCC countries, CHEMEXCIL along-with Indian Trade Promotion Organisation (ITPO) and Shefexcil had organised an India Pavilion booking space of 90 sqm each in Arena (Hall 2) reserved for International Pavilions. There were total 29 stalls in the Indian Pavilion, out of which 9 exhibitors had showcased their products under the umbrella of CHEMEXCIL.

The Indian Pavilion was also graced by H.E Shri Vipul, Consul General of India, UAE who interacted with the stall holders in the Indian Pavilion to understand about their activities in the MEA region.

Chemexcil stall holders were also pleased to interact with Shri Vipul and briefed him about their products, current exports to MEA etc.

The India pavilion attracted good visitor interest from Local buyers and also global business professionals/ dealers/ buyers etc from countries such as Kuwait, Saudi Arabia, Turkey, Jordan, Egypt, Pakistan, Nigeria, Russia etc. Indian exhibitors networked with them for tapping the future business opportunities.

Chemexcil’s stall inside the Indian Pavilion was also visited by several local and overseas Buyers/consultants/ service providers etc who were provided leaflets and information about the exhibitors in the Indian Pavilion and also about the activities of the council.

| |

|

| H.E Shri Vipul, Consul General of India, UAE at CHEMEXCIL stall in Indian Pavilion |

BACK |

GST (Policy Wing)

Clarifications on refund related issues

| EPC/LIC/CBIC/IGST |

30/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST

(Policy Wing)

Clarifications on refund related issues |

|

|

Dear Members,

The “GST Policy Wing, Central Board of Indirect Taxes and Customs” has issued circular No. 45/19/2018-GST dated 30/05/2018 regarding clarification on certain refund related issues.

The above-said circular provides clarifications for following queries:

Claim for refund filed by an Input Service Distributor, a person paying tax under section 10 or a non-resident taxable person.

Application for refund of integrated tax paid on export of services and supplies made to a Special Economic Zone developer or a Special Economic Zone unit.

Refund of unutilized input tax credit of compensation cess availed on inputs in cases where the final product is not subject to the levy of compensation cess.

Whether bond or Letter of Undertaking (LUT) is required in the case of zero rated supply of exempted or non-GST goods and whether refund can be claimed by the exporter of exempted or non-GST goods?

What is the scope of the restriction imposed by rule 96(10) of the CGST Rules, regarding non-availment of the benefit of notification Nos. 48/2017-Central Tax dated the 18.10.2017, 40/2017-Central Tax (Rate) dated 23.10.2017, 41/2017-Integrated Tax (Rate) dated 23.10.2017, 78/2017-Customs dated 13.10.2017 or 79/2017-Customs dated 13.10.2017?

The self-explanatory clarifications in detail pertaining to above queries are provided in the circular No. 45/19/2018-GST dated 30/05/2018.

Members are requested to take note. For further details, the above said circular is available for download/ reference using below link-

http://cbic.gov.in/resources//htdocs-cbec/gst/Circular_No.45.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI )

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

CBIC - Web-help service is now available on www.cbec-gst.gov.in for query resolution

| EPC/LIC/GST/SELF_SERVICE |

30/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

CBIC - Web-help service is now available on www.cbec-gst.gov.in for query resolution |

|

|

Dear Members,

As per updates on CBIC Portal, a web-help service is now available on www.cbec-gst.gov.in for getting faster resolution of your queries.

Members can submit their queries by clicking the "SELF SERVICE" option under "HELP" tab in the top right of cbec-gst.gov.in .

Once you submit query, a reference number is generated for tracking/ monitoring.

Members are requested to take note of this new utility and use it accordingly. The link for SELF SERVICE" is provided as follows:

https://cbec-gst.gov.in/help.html

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Very Imp. - Sanction of pending IGST refund claims where the records have not been transmitted from the GSTN to DG Systems

| EPC/LIC/CBIC/IGST |

30/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Very Imp. - Sanction of pending IGST refund claims where the records have not been transmitted from the GSTN to DG Systems |

|

|

Dear Members,

As you are aware, there has been delay in processing/ credit of IGST refund on account of non-transmission of data from GSTN to customs.

One of the most common errors have been that total IGST payable is not specified correctly under Table 3.1(b) of GSTR 3B. It is either incorrectly mentioned under Table 3.1(a) or Table 3.1(c) of GSTR 3 B. Table 3,1(a) pertains to domestic supplies and Table 3.1(b) pertains to exports. Similarly, IGST submitted under Table 3.1(b) of GSTR 3 B is less than total IGST, payable through export invoices specified under Table 6A of GSTR 1 of that tax period. These errors have led to IGST validation failure on ICEGATE as data has not been transmitted from GSTN to ICEGATE.

Taking cognizance of the representations received from the exporter/ trade associations seeking resolution of problems which have hindered sanction of refund of IGST paid on exports, CBIC has issued Circular No. 12/2018-Customs dated 29/05/2018 whereby following procedure is being prescribed to overcome the problem of refund blockage. This would be an interim solution subject to undertakings/ submission of CA certificates by the exporters as given below and post refund audit scrutiny.

For the convenience of exporters, the procedure as proposed in the circular is reproduced/ highlighted as under:

A. Cases where there is no short payment:

(i) The Customs policy wing would prepare a list of exporters whose cumulative IGST amount paid against exports and interstate domestic outward supplies, for the period July’ 2017 to March’ 2018 mentioned in GSTR-3B is greater than or equal to the cumulative IGST amount indicated in GSTR-1 for the same period. Customs policy wing shall send this list to GSTN.

(ii) GSTN shall send a confirmatory e-mail to these exporters regarding the transmission of records to Customs EDI system.

(iii) The exporters whose refunds are processed/ sanctioned would be required to submit a certificate from Chartered Accountant before 31st October, 2018 to the Customs office at the port of export to the effect that there is no discrepancy between the IGST amount refunded on exports and the actual IGST amount paid on exports of goods for the period July’ 2017 to March’ 2018. In case there are exports from multiple ports, the exporter is at liberty to choose any of the ports of export for submission of the said certificate.

(iv) A copy of the certificate shall also be submitted to the jurisdictional GST office (Central/ State). The concerned Customs zone shall provide the list of GSTINs who have not submitted the CA certificate to the Board by the 15th November 2018.

(v) Non submission of CA certificate shall affect the future IGST refunds of the exporter.

(vi) The list of exporters whose refunds have been processed as above shall be sent to DG (Audit)/ DG (GST) by the Board.

B. Cases where there is short payment:

(i) In cases where there is a short payment of IGST i.e. cumulative IGST amount paid against exports and interstate domestic outward supplies together, for the period of July’ 2017 to March’ 2018 mentioned in GSTR-3B is less than the cumulative IGST amount indicated in GSTR-1 for the same period, the Customs policy wing would send the list of such exporters to the GSTN and all the Chief Commissioner of Customs.

(ii) e-mails shall be sent by GSTN to each exporter referred in para (i) above so as to inform the exporter that their records are held up due to short payment of IGST. The e--mail shall also advise the exporters to observe the procedure under this circular.

(iii) The exporters would have to make the payment of IGST equal to the short payment in GSTR 3B of subsequent months so as to ensure that the total IGST refund being

claimed in the Shipping Bill/GSTR-1(Table 6A) is paid. The proof of payment shall be submitted to Assistant/Deputy Commissioner of Customs in charge of port from where the exports were made. In case there are exports from multiple ports, the exporter is at liberty to choose any of the ports of export.

(iv) Where the aggregate IGST refund amount for the said period is upto Rs. 10 lacs, the exporter shall submit proof of payment (self-certified copy of challans) of IGST payment to the concerned Customs office at the port of export.

However, where the aggregate IGST refund amount for the said period is more than Rs. 10 lacs, the exporter shall submit proof of payment (self-certified copy of challans) of IGST to the concerned Customs office at the port of export along with a certificate from chartered Account that the shortfall amount has been liquidated.

(v) The exporter would give an undertaking they would return the refund amount in case it is found to be not due to them at a later date.

(vi) The Customs zones shall compile the list of exporters (GSTIN only), who have come forward to claim refund after making requisite payment of IGST towards short paid amount and complied with other prescribed requirements.

(vii) The compiled list may be forwarded to Customs policy wing, DG (Audit) and DG (GST). Customs policy wing shall forward the said list of GSTINs to GSTN. On receipt of the list of exporters from Customs policy wing, GSTN shall transmit the records of those exporters to Customs EDI system.

(viii) The exporters whose refunds are processed/ sanctioned as above would be required to submit another certificate from Chartered Accountant before 31st October, 2018 to the same Customs office at the port of export to the effect that there is no discrepancy between the IGST amount refunded on exports and the actual IGST amount paid on exports of goods for the period July’ 2017 to March’ 2018. A copy of the certificate shall also be submitted to the jurisdictional GST office (Central/ State). The concerned Customs zone shall provide the list of GSTINs who have not submitted the CA certificate to the Board by the 15th November 2018.

(ix) Non submission of CA certificate shall affect the future IGST refunds of the exporter.

Post refund audit

The exporters would be subjected to a post refund audit under the GST law. DG (Audit) shall include the above referred GSTINs for conducting Audit under the GST law. The inclusion of IGST refund aspects in Audit Plan of those units may be ensured by DG (Audit). In case, departmental Audit detects excess refunds to the exporters under this procedure, the details of such detections may be communicated to the concerned GST formations for appropriate action.

DG (GST) shall send the list of exporters to jurisdictional GST officers (both Centre / State) informing that these exporters have taken benefit of the procedure prescribed in this circular. The jurisdictional GST formations shall also verify the payment particulars at their end.

This Circular deals only with the cases where the records have not been transmitted by GSTN to Customs EDI system. Once the records are transmitted by GSTN to Customs System based upon the above mentioned procedure, the usual procedure adopted in case of sanction of IGST refunds would have to be followed. In cases where the errors like SB005, SB002, SB006 etc are encountered with the records so transmitted, the provisions of Circulars issued by Board earlier shall apply to them. Field formations may, therefore, take necessary steps to bring these changes to the knowledge of exporters.

Members are requested to take of this circular. For further details, the above said circular is available for download using below link-

http://cbic.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2018/circ12-2018cs.pdf

In case of further updates in connection with this procedure, we shall let you know.

Thanking You,

Yours faithfully,

( S.G. BHARADI )

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Imp - Details of embedded taxes across various states in the export value of the product which remain non-refunded

| EPC/LIC/DGFT/EXPORT_INCENTIVES |

29/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Imp - Details of embedded taxes across various states in the export value of the product which remain non-refunded |

|

|

Dear Members,

This is in continuation of our recent circulars requesting your valuable suggestions on WTO Compliant Export Incentives/ fine tuning of existing export promotion measures under FTP 2015-20 and Department of Commerce.

In this regard, the council has received communication from O/o DGFT HQ seeking inputs on embedded taxes across various states in the export value of the product which remain non-refunded.

As you might be aware, there are many types of central, state and local taxes like the taxes on energy/fuel consumed (such as electricity duty etc) in the manufacture/export of goods meant for exports.

It is requested that the inputs pertaining to your products as to the percentage cost of embedded taxes across various states in the export value of the product, which remain non-refunded by any existing schemes by the Central/State Governments may kindly be provided to us latest by 30/05/2018 (1st half) on e-mail id’s ed@chemexcil.gov.in, deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in.

Your timely replies will enable us provide the information to DGFT within the timeline of 30/05/2018.

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Banking issues / Financial problems faced while doing business with Russia

| EPC/LIC/RUSSIA |

28/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Banking issues / Financial problems faced while doing business with Russia |

|

|

Dear Members,

The Council has received communication from the FT-CIS Division, Department of Commerce, Ministry of Commerce & Industry regarding inputs/issues on banking and financial problems that are being faced by exporters while doing business with Russia.

We understand that the meeting of India-Russia Working Group on Banking and Financial Matters is scheduled to be held during August, 2018 and such issues can be taken up during the meeting.

Member-exporters are therefore requested to revert with inputs on Banking/ Financial problems related issues pertaining to Russia, if any.

Your replies be kindly sent to us (within a week) on e-mail id’s- deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in . Your early replies will be appreciated and enable us highlight the issues to the ministry for deliberations.

Thanking You,

Yours faithfully,

S.G. Bharadi

Executive Director

Chemexcil

|

|

BACK

|

ADD - Imposition of Definitive Anti-Dumping Duty on imports of Saturated Fatty Alcohols originating in, or exported from Indonesia, Malaysia and Thailand

| EPC/LIC/DOR/FAO |

28/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

ADD - Imposition of Definitive Anti-Dumping Duty on imports of Saturated Fatty Alcohols originating in, or exported from Indonesia, Malaysia and Thailand |

|

|

Dear Members,

The Department of Revenue, Ministry of Finance has issued Notification No. 28/2018-Customs (ADD) dated 25/05/2018 regarding Imposition of Definitive Anti-Dumping Duty on imports of 'Saturated Fatty Alcohols” originating in, or exported from Indonesia, Malaysia and Thailand.

As per the Notification, The designated authority as per final findings vide notification No. F. No.14/51/2016-DGAD, dated the 23rd April, 2018, concerning 'Saturated Fatty Alcohols" falling under Chapters 29 and 38 and originating in, or exported from Indonesia, Malaysia and Thailand, has come to conclusion that:-

The product under consideration is exported to India from the subject countries below its associated normal value, thus, resulting in dumping of the product.

Some of the imports were also causing material injury to the domestic industry, and has recommended the imposition of definitive anti-dumping duty on the imports of subject goods, originating in or exported from the subject countries and imported into India, in order to remove injury to the domestic industry.

The anti-dumping duty imposed on exports of above product originating in, or exported from Indonesia, Malaysia and Thailand varies from NIL to USD 92.23/MT (depending on various exporters as per the above notification)

The anti-dumping duty imposed shall be effective for a period of five years (unless revoked, superseded or amended earlier) from the date of publication of this notification in the Official Gazette and shall be payable in Indian currency (@ exchange rate which is specified in the notification of the Government of India, in the Ministry of Finance, Department of Revenue, issued from time to time)

Relevant members importing above-said products are requested to take note of the same. The above said notification is available for reference/download using below link:

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cs-act/notifications/notfns-2018/cs-add2018/csadd28-2018.pdf

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVEDIRECTOR

CHEMEXCIL

|

|

BACK

|

CBIC - Applicability of IGST on goods supplied while being deposited in a customs bonded warehouse

| EPC/LIC/CBIC/BE |

28/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

CBIC - Applicability of IGST on goods supplied while being deposited in a customs bonded warehouse |

|

|

Dear Members,

The Central Board of Indirect Taxes and Customs, GST Policy Wing has issued Circular No. 3/1/2018-IGST dated 25/05/2018 providing clarification on the applicability of Integrated Goods and Services Tax (integrated tax) on goods supplied while being deposited in a customs bonded warehouse.

As you might be aware, transfer/sale of goods while being deposited in a customs bonded warehouse" is a common trade practice whereby the importer files an into-bond bill of entry and stores the goods in a customs bonded warehouse and thereafter, supplies such goods to another person who then files an ex-bond bill of entry for clearing the said goods from the customs bonded warehouse for home consumption. In this regard CBIC had issued Circular No. 46/2017-Customs dated 24.11.2017 whereby the applicability of integrated tax on goods transferred/sold while being deposited in a warehouse (hereinafter referred to as the "warehoused goods") was clarified.

However, CBIC has received further queries regarding applicability of integrated tax on goods transferred/sold while being deposited in a warehouse (hereinafter referred to as the "warehoused goods").

In this regard, CBIC has issued above-said circular whereby it is clarified that integrated tax shall be levied and collected at the time of final clearance of the warehoused goods for home consumption i.e., at the time of filing the ex-bond bill of entry and the value addition accruing at each stage of supply shall form part of the value on which the integrated tax would be payable at the time of clearance of the warehoused goods for home consumption.

In other words, the supply of goods before their clearance from the warehouse would not be subject to the levy of integrated tax and the same would be levied and collected only when the warehoused goods are cleared for home consumption from the customs bonded warehouse.

This Circular would be applicable for supply of warehoused goods, while being deposited in a customs bonded warehouse, on or after the 1st of April, 2018.

Relevant members are requested to take note of the above circular and do the needful accordingly. The circular no Circular No. 3/1/2018-IGST dated 25/05/2018 is available for reference/ download using below link:-

http://www.cbic.gov.in/resources//htdocs-cbec/gst/igst-circu-3.pdf

Thanking You,

Yours faithfully,

(S. G. Bharadi)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Air Cargo Complex, Sahar, Mumbai Exporters whose Validation of Bank accounts by PFMS is still pending

| EPC/LIC/ACC/SAHAR/IGST |

24/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Air Cargo Complex, Sahar, Mumbai Exporters whose Validation of Bank accounts by PFMS is still pending |

|

|

Dear Members,

We have received communication from Assistant Commissioner of Customs, Air Cargo Complex, Sahar, Mumbai regarding Exporters whose Validation of Bank accounts by PFMS is still pending leading to hold up of IGST refunds.

We understand that despite various mailers in the past, several exporters have still not validated their bank accounts to be accepted by PFMS thereby resulting in non-disbursement of Refunds even after refunds being scrolled out in some of the cases.

The excel sheet with IEC’s of exporters (including Chemexcil members) who have not validated their bank accounts or found rejected by PFMS, is attached for reference.

Members exporting through Air Cargo Complex, Sahar, Andheri(E) Mumbai are requested to go through the attachment and in case they figure in the list, kindly revalidate their bank accounts duly accepted by PFMS so that refunds are credited.

For any issues, please contact Assistant Commissioner of Customs (Drawback), Air Cargo Complex, Sahar, Mumbai (Tel- 022-26816631/ 022-26816711, e-mail- jaideepdubey1@gmail.com, customs.dbkedi@gmail.com)

Thanking You,

Yours faithfully,

(S. G. Bharadi)

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl : http://chemexcil.in/uploads/files/PFMS_(2).xlsx

|

|

BACK

|

DGFT - Maintenance of Annual Average Export Obligation under EPCG Scheme

| EPC/LIC/DGFT/EPCG |

24/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Maintenance of Annual Average Export Obligation under EPCG Scheme |

|

|

Dear Members,

The O/o Directorate General of Foreign Trade has issued Public Notice No.10/2015-20 dated 22/05/2018 regarding flexibility in Maintenance of Annual Average Export Obligation under EPCG scheme.

A new para 5.19A will be inserted as under in HBP:-

5.19A : Maintenance of Annual Average Export Obligation

The excess exports done towards the average export obligation fulfilment of an EPCG authorization during a year can be used to offset any shortfall in the Average EO done in other year(s) of the EO period or the block period as the case may be provided Average EO imposed is maintained on an overall basis, within the block period or the EO period as applicable.

As an effect of this Public Notice, Export obligation under EPCG scheme has been made more flexible as non-maintenance of Annual Average in some years can be offset by excess exports in other year(s) in respect of EPCG authorisations.

Members are requested to take note of this relaxation and do the needful, wherever applicable. The said PN is available for download/ reference using below link:

http://dgft.gov.in/Exim/2000/PN/PN18/PN%2010%20eng.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

US GSP Details of Key Importers in USA

| EPC/LIC/US-GSP |

22/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

US GSP Details of Key Importers in USA |

|

|

Dear Sir / Madam,

This is in continuation of our mailers dated 02/05/2018 & 07/05/2018 regarding US GSP Review and follow-up action to be undertaken.

So far we have received few responses and also hope the concerned companies have submitted the response online on USTR Federal Rulemaking Portal : https://www.regulations.gov with the docket Number, (The docket No. for India review is USTR-2018-0006). Please do forward us the copies of the submission for records.

We have just received communication from NAFTA Division, DoC seeking details of the key importers in USA so that the Indian Embassy could request them to file petitions (copy attached).

In view of the above, we kindly request you to provide the requested details so that the same could be provided to the NAFTA division. The replies be sent at the earliest to (ed@chemexcil.gov.in; adreach@chemexcil.gov.in & deepak.gupta@chemexcil.gov.in

Your immediate response / reply will be appreciated.

Thanking you,

Yours faithfully,

S G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Enclosure:- GSP Letter

|

|

BACK

|

RBI EDPMS - Date for implementation of caution list extended till 30-Sep-2018

| EPC/LIC/EDPMS/EXTENSION |

21/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

RBI EDPMS - Date for implementation of caution list extended till 30-Sep-2018 |

|

|

Dear Members,

As you are aware, caution listing on account of RBI-EDPMS has been a cause of concern as it impacts export shipments, document submission to buyers and also resultant business.

In this regard, the Commerce Secretary had recently convened a meeting with RBI and leading bankers to discuss various issues concerning the exports sector (including caution listing issue).

We understand that RBI’s representative has informed that the date for implementing the caution list in EDPMS has been extended till 30-Sep-2018.

Therefore, members are requested to take note of this relaxation and utilise this additional time up-to 30-Sep-2018 to clear such cases, if any.

In case issues still persist, do write to us on ed@chemexcil.gov.in and Deepak.gupta@chemexcil.gov.in

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

JNCH:- Important Public Notices issued (Pilot implementation of paperless processing under SWIFT/ Increase in the validity period of Chapter 3 Scrips/ Modification in the procedure of the Container Movement Permission etc)

| EPC/LIC/JNCH/PN’s |

18/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

JNCH:- Important Public Notices issued (Pilot implementation of paperless processing under SWIFT/ Increase in the validity period of Chapter 3 Scrips/ Modification in the procedure of the Container Movement Permission etc) |

|

|

Dear Members,

Kindly note that the O/o Commissioner of Customs (NS-III) Mumbai Zone-II, Jawaharlal Nehru Custom House has recently issued several Public Notices regarding paperless processing under SWIFT, EODC for EPCG Authorisations, Increase in the validity period of Chapter 3 Scrips , procedure of the Container Movement Permission, SOP to be followed for Export and Import at Bharat Mumbai Container Terminal (BMCT), JNCH etc.

The relevant Public Notices issued are listed as follows for information:

PUBLIC NOTICE FOR 2018

Members are requested to take note of above-said PNs. For further details, members may use below link for reference/ download.

http://jawaharcustoms.gov.in/information.aspx?PageID=1161

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

Major problems which you are facing on export of your items to LAC countries?

| EPC:PROJ:LAC COUNTRIES: |

14/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Major problems which you are facing on export of your items to LAC countries? |

|

|

Dear Sir/Madam,

As you might be aware, that although India is emerging as an important player in the world trade, it’s importance in Latin America and Caribbean (LAC)has been much lower than several other competing countries in the region. India's presence in LAC is ranked low compared to other major trading countries in the region such as the US, the European Union and China. However, in recent years, India has accorded high priority to this region in its trade policy, despite important constraints such as distance factor and low level of current economic engagement with the region.

Notwithstanding above constraints, India has strong export potential to become an important trading player in LAC. It has been reported that prudent action plan is needed to develop regional strategies and accordingly, India can embark on LAC in future because it is an emerging market, with presence of large middle income groups, high resources, efficiency in production of agro products and expanding manufacture importing destination.

There is convergence of interest between India and LAC in the external sector engagement. Therefore, India expects its deep integration with Latin America for both trade and investment. India has not only maintained very high growth performance with the region, but also is providing large market access to countries in the LAC region. Moreover, region’s eagerness to engage with Asia is an added advantage for India to develop a long term strategy in trade and investment to integrate with the region.

India is in the quest of new markets for trade and investment as the country is poised to enter into a five trillion economy by 2030. In order to enable India to emerge as a major Player in the LAC region by 2030, the Ministry of Commerce &Industry desires to have a focus study evolving an export strategy.

Since you are one of the member-exporters of the items covered by CHEMEXCIL to the LAC countries, we would request you to kindly send us your detailed comments/views/suggestions on the following , so as to enable us forward a consolidated note to the Ministry of Commerce & Industry with our recommendation to increase exports of the items covered by CHEMEXCIL to the LAC Countries:-

What are the major problems which you are facing on export of your items to LAC countries?

Are you facing any Nature of NTBs in the LAC?

According to you, what are the major sectors/future markets for India’s exports and imports?

What is the Future potential in specific goods sectors?

Who are the major competitors in specific countries/RTAs/Sectors?

How to counter distance factor specially towards reduction of transaction cost?

How major trading partners are getting specific trade preferences in specific countries/RTAs through the Bilateral/Regional process?

According to you what is the country specific import interest of India ?

What type of benefit you require in your export product in LAC Countries ?

What are the constraints you are facing in case of investment in LAC?

What domestic policies are required by you to incentivise to invest in LAC countries?

Your suggestion as to which form of investment would induce you to invest in LAC and which form of investment would induce LAC firms to Invest ? – M&A, Joint Ventures .

Your suggestion/ direction if any on policy liberalisation to attract LAC investment in India.

You are also requested to give your last three year exports in LAC Countries. Please give country wise exports of last three years.

Your replies with requisite details on the above be sent to us at the earliest (within a week) on e-mail id’s ed@chemexcil.gov.in adreach@chemexcil.gov.in & Deepak.gupta@chemexcil.gov.in and will enable us prepare a comprehensive note to be sent to the Ministry to have useful discussion in their ensuing multi-Stakeholders meeting on India’s Engagement with LAC in Trade and Investment.

Thanking you and awaiting your immediate response on the above.<

Yours faithfully,

(S G BHARADI)

EXECUTIVE DIRECTOR

|

|

BACK

|

FSSAI / JNCH Additional list of HS Codes of Non-Food/ Out of Scope items (as per JNCH PN no. 71/2018)

| EPC/LIC/JNCH/FSSAI |

14/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

FSSAI / JNCH Additional list of HS Codes of Non-Food/ Out of Scope items (as per JNCH PN no. 71/2018) |

|

|

Dear Members,

This is in continuation of our earlier circular dated 17/01/2018 informing you about List of “Out of Scope” items as provided vide JNCH Public Notice No 09/2018, dated 12.01.2018.

In this regard, JNCH (Nhava Sheva) have now issued Public Notice No. 71/2018 dated 02/05/2018regarding an additional list of HS CODE of Non Food Items for which out of scope certification was given in the past, which has been received from FSSAI.

As per above PN, it is being informed that except revised list of HS CODE and product description, as enclosed with the Public Notice No. 12/2018 dated 19.01.18 (Annexure-A1) and additional list as provided in this Public Notice (Annexure-A2), other content of Public Notice No 09/2018, dated 12.01.2018 remains unchanged.

Concerned members are requested to take note of this Public Notice. For details of items, the Public Notice No. 71/2018 dated 02/05/2018 is available for download using below link-

http://jawaharcustoms.gov.in/pdf/PN-2018/PN_071.pdf

In case of any difficulty, the specific issue may first be brought to the notice of Deputy/Assistant Commissioner in charge of Appraising Main (Import), NS-III (email address: appraisingmain.jnch@gov.in ).

Persistent difficulties, if any, can also be highlighted to us on e-mail id’s- deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in.

Thanking You,

Yours faithfully,

( S.G. BHARADI )

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

e-Way Bill Grievance Redressal Officers (CBIC and State / UT Governments) for e- way bill system under rule 138D of Central / State GST Rules, 2017

| EPC/LIC/E_WAY_BILL |

14/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

e-Way Bill Grievance Redressal Officers (CBIC and State / UT Governments) for e- way bill system under rule 138D of Central / State GST Rules, 2017 |

|

|

Dear Members,

This is in continuation of our recent circulars regarding roll-out of e-way bill system for inter-state movement since 01/04/2018 and also phased roll-out of e-way bill system for intra-state movement in various states.

Kindly note that to address the issues/ grievances of tax payers, CBIC has issued the list of Grievance Redressal Officers (CBIC and State / UT Governments) for e-way bill system under rule 138D of Central/ State GST Rules, 2017.

Members are requested to take note of the same. The details of Grievance Redressal Officers (CBIC and State / UT Governments) for e-way bill system under rule 138D of Central/ State GST Rules, 2017 are available for reference/ download using below link:

http://www.cbec.gov.in/resources//htdocs-cbec/gst/Centre&State-GRO-rule_138-D.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Imp - Suggestions on WTO Compliant Export Incentives in lieu/ fine tuning of existing export promotion measures under FTP 2015-20 and Department of Commerce

| EPC/LIC/DGFT/EXPORT_INCENTIVES |

14/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Imp - Suggestions on WTO Compliant Export Incentives in lieu/ fine tuning of existing export promotion measures under FTP 2015-20 and Department of Commerce |

|

|

Dear Members,

As you are aware, in the recent times India has come under pressure from USA/WTO in connection with direct export incentives/subsidies (specially MEIS).

In this regard, O/o DGFT HQ has set up a committee to review Export Promotion measures under FTP 2015-20/ DoC and suggest remedial measures for fine tuning as per WTO norms. This committee is chaired by the DGFT himself and also comprises of representatives of TPD, IIFT, FIEO, EPCs etc. The committee also has state commissioners/ authorities via video conferencing to understand what subsidies states are offering.

The first meeting was held recently in New Delhi which was also attended by CHEMEXCIL representatives. The important points deliberated are as follows:

This meeting was mainly focused on discussing phase out/ fine tuning of incentives (specially MEIS) and explore possible other ways of WTO compliant export incentives which are not counter-vailable as India has crossed USD 1000 per capita criteria.

General perception amongst participants (specially academics) is that MEIS is not WTO Compliant. It was also felt that nowadays even state subsidies need to be relooked as some of them are counter-vailable.

Out of existing provisions, duty remission/ neutralization schemes advance authorization/ DBK are only somewhat WTO compliant and may be continued/ fine tuned. Similarly, state levies such as electricity duty etc can be neutralized, but only with proper justification/ workings.

Chemexcil representative submitted the points from chemical sector perspective. and also requested the committee that we should get level playing field vis.a.vis China as they are getting very high incentives. However, some of participants countered that incentive in China is not flat 13% but includes several hidden areas such as duty remission, land availability, subsidized power etc. Further, it was highlighted that if there was an issue with MEIS then to give some additional incentive in DBK which had come down in recent years despite no change in customs tariffs and also factor state levies such as electricity duty etc. We also requested them to provide support for registration costs, fighting anti dumping investigations, SPS-TBT measures etc

The group will keep discussing/meeting to submit report to DoC within 3 months.

In our view, our council should also discuss/ undertake study in this regard and suggest export promotion measures which are WTO-compatible and production-based, provide support for technology upgradation, capacity building and resolve infrastructure bottlenecks and move away from direct incentives to exporters.

Members are therefore requested to provide suggestions at the earliest (within a week) on ed@chemexcil.gov.in and deepak.gupta@chemexcil.gov.in to enable us submit the same to DGFT.

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

US GSP - Review of US GSP benefit on exports from India

| EPC/LIC/US-GSP |

07/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

US GSP - Review of US GSP benefit on exports from India |

|

|

URGENT AND IMPORTANT

Dear Member-exporters,

Kindly refer our earlier email dated 2nd May 2018 on the above subject. As stated therein, a stakeholders meeting was held under the chairmanship of Shri Shyamal Misra, IAS, Joint Secretary, Ministry of Commerce and Industry on 4th May, 2018 at New Delhi, on "Review of US GSP benefit on exports from India" and future course of action to be taken in this matter.

As you are aware, the United States (U.S.) Congress authorised extension of GSP benefit and currently India is one of the largest beneficiary under this programme. However, the extension of Generalised System of Preferences (US-GSP) program is a general extension.

As you may be aware, the United States Trade Representative (USTR) would be reviewing the eligibility of India and some other countries in the GSP. USTR notified that the review process for India is going to start as per details given below:

The Federal Register (FR) provides for interested parties to submit comments and hearing as per following timelines:

Ø 5 June 2018 - Deadline for interested parties to submit comments, pre-hearing briefs and request to appear in the public hearing.

Ø 19 June 2018:- The Trade Policy Staff Committee (TPSC) will hold a public hearing for interested parties.

Ø A transcript of the public hearing will be available on www.regulations.gov within approximately two weeks after the date of the hearing.

Ø 17 July 2018 - Deadline for interested parties to submit post-hearing briefs.

For India, GSP country eligibility review is based on concerns related to its compliance with GSP market access criteria which includes schedule for submission of public comments and a public hearing. It is understood that the US formally notified in Federal Register (FR) on 27.4.2018 initiating Country Practice Review of India regarding compliance with the GSP eligibility criteria.

We are enclosing herewith a list of the items which are coming under the purview of CHEMEXCIL with the MFN duties applicable against each product/HS code. If the US Office withdraws the GSP benefit of India, our exports will be adversely affected by the MFN duties mentioned against such products. We have also attached herewith FR notice announcing initiation of country practice reviews of India etc. which provides detailed information of submission.

Since you are one of the manufacturer-exporters to USA, you are requested to kindly go through the list of the items mentioned in the enclosure and send a representation directly through online submission to the USTR Federal eRulemaking Portal : https://www.regulations.gov with the docket Number, (The docket No. for India review is USTR-2018-0006) latest by 15/05/2018 with a copy to CHEMEXCIL (ed@chemexcil.gov.in; adreach@chemexcil.gov.in;deepak.gupta@chemexcil.gov.in )as well as the Ministry of Commerce & Industry (email : moc_epcap@nic.in) highlighting justifications on

a) items being exported by your company,

b) why GSP benefit should continue and

c) how the GSP importers into USA are benefiting US industry as most the items are intermediates and raw materials. If you have any other justification which can strengthen the case for continuation of US GSP benefits you can highlight the same in your representation.

In your representation being submitted to the USTR, you may also mention about not involvement of child labour in your industry, well defined labour law, India still a developing country, how it is helping employment generation and how it is helping the US importers as your products are raw materials and intermediates for the US industry who are doing value addition and manufacturing the value added / end products for the benefit to US consumers. Further, you can also impress upon your US importers to take up the same at their end also with USTR and send us a copy of such communication for our perusal.

Your immediate response / reply on or before 15th May, 2018 will enable us to update the Ministry of Commerce & Industry for taking up the matter with concerned authorities appropriately.

Thanking you,

Yours faithfully,

S G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

BASIC CHEMICALS, COSMETICS & DYES EXPORT PROMOTION COUNCIL

(Set-up by Ministry of Commerce & Industry, Government of India)

Jhansi Castle, 4th Floor, 7 Cooperage Road,

Mumbai – 400 001. India.

CIN : U91110MH1963NPL012677

Tel :+91-22-2202 1288/ 1330

Fax :+91-22-2202 6684

URL : www.chemexcil.in

Twitter : @chemexcil

Enclosure:- Copy of USA IMPORT FROM INDIA UNDER GSP PROGRAM (4)

FR notice announcing initiation of country practice reviews India Indonesia Kazakhstan (2)

|

|

BACK

|

e-Way Bill Notification regarding e-Way Bill for Intra-state Movement of Goods in Maharashtra

| EPC/LIC/E_WAY_BILL |

02/05/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

e-Way Bill Notification regarding e-Way Bill for Intra-state Movement of Goods in Maharashtra |

|

|

Dear Members,

Kindly note that the Commissioner of State Tax, Maharashtra has issued notification no. 15C/2018-State Tax dated 25/04/2018 amending an earlier notification No. 15A/2018 –State Tax dated 27/03/2018 which stated that on or after the 1st April 2018, no e-way bill shall be required to be generated, for the intra-State movement that commences and terminates within the State of Maharashtra, in respect of any goods of any value. As per clause 2 of the earlier notification, the notification shall be in force until further orders are issued.

However, the notification dated 25/04/2018 has amended clause 2 and the same has been extended till 30th May 2018.

This would imply that from 31st May 2018 onwards e-way bill shall become a requirement for the intra-State movement that commences and terminates within the State of Maharashtra.

Members are requested to take note and do the needful accordingly. The said notification is enclosed herewith for your reference. In case of any further changes, we shall update you.

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl : http://chemexcil.in/uploads/files/E_WAY_Bill_Intrastate.jpg

|

|

BACK

|

Fair Trade and the World Trade Organization

|

May is World Trade Month, a time to recognize and echo the importance of global trade, particularly fair trade. As we kickoff World Trade Month here at USDA, it’s important to acknowledge that trade is on our minds not only during May but every single day of the year. Our work supporting fair trade is a 24-hour job as few industries depend more upon – and benefit more from – trade than American agriculture.

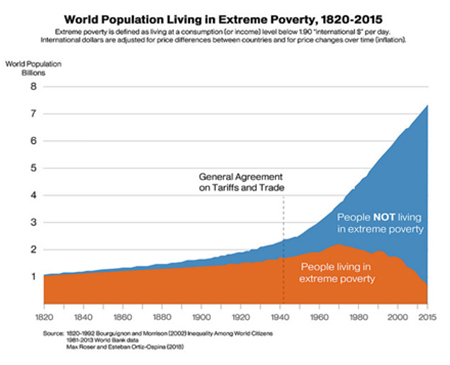

It’s not an understatement to say that the gains from trade are powerful. When people produce what they are best at, and trade it for things they are less adept at producing, both sides benefit. Historically, economic integration in the post WWII era delivered immense benefits. Trade is not the only reason, but it is a major factor in helping the number of people living in extreme poverty fall to record lows and become dwarfed by the number of people not living in extreme poverty.

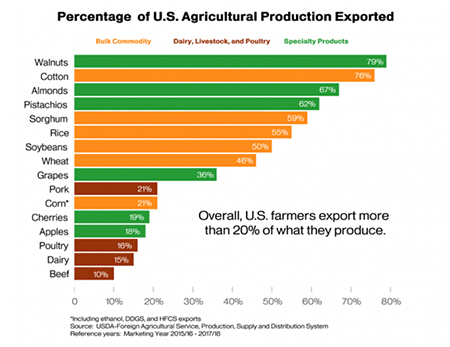

For U.S. agriculture, this success story is also a profitable one. Our farmers are the best in the world and we produce way more than we can consume. For many commodities, a significant share of U.S. production is exported. Without customers overseas, we would have huge surpluses, which would drive down prices, and result in hardships for our farmers that would ripple throughout the rural economy.

| |

|

For me, these data raise two questions. First, since trade is good, what can we do to encourage more of it? Second, while trade is clearly good, how can we ensure it is fair? More specifically, while society as a whole benefits from access to foreign customers and the availability of imported goods, what can we do to protect particular industries from losing out to unfairly traded goods from foreign competitors? After working on trade policy for over 25 years, my view is that the answer to both of these questions is the same – a strong set of rules operated through a multilateral institution.

| |

|

Importance of the WTO

Fortunately, we have a strong set of rules paired with an effective institution to both lay down rules for trade and enforce them – the World Trade Organization (WTO). WTO rules have been agreed to by 164 countries, including all the important trading nations, and have helped reduce barriers to trade that have powered the impressive growth in trade and expansion of world income. The core rules of the WTO are straight-forward and intuitively fair.

You may wonder how did these rules come about? Following the great depression and WWII, leaders in the United States recognized the importance of guarding against trade restrictions and wanted to expand trade to rebuild the world’s economies and foster closer diplomatic relations. Working initially with a small group of like-minded countries, a set of trade rules were agreed to in 1947, called the General Agreement on Tariffs and Trade (GATT). These rules were so successful that over time more countries joined the agreement, committing to follow the rules for trade among members of the GATT and also finding ways to negotiate reductions in trade barriers, principally tariffs. Building on this success, in 1994 the GATT was converted to the WTO, with further rules agreed to and, importantly, a binding dispute settlement system established.

The GATT, and now the WTO, have both helped expand trade and have established a set of rules that define ‘fair trade.’ So, what are those rules?

Key Rules Supporting Fair Trade

When I was a guppy government worker my former colleague Kevin Brosch once summarized the core rules for fair trade to me: three-and-a-half rules of the GATT. They are both strong rules to guard against trade restrictions and are also manifestly fair. They promote fair trade by limiting government restrictions and legitimizing the trading system. Here in a nutshell are the key rules:

1. Don’t discriminate across suppliers. The first article of the GATT ensures ‘Most Favored Nation’ treatment for all members. Basically that means that an importing country can’t treat one supplier less favorably than the treatment it provides its most favored supplier. For example, if the United States imposes a 5 percent tariff on mango imports from the Philippines, and that is the lowest tariff it applies on mangoes, India is ensured that it will not be subject to a tariff higher than 5 percent. Or, if the United States requires imported peaches from Argentina to be allowed in without fumigation, we can’t require imported peaches from Chile to be fumigated prior to entry. This ensures fair treatment across supplying countries.

2. Tariffs are the only justifiable tool for protecting domestic markets. The second article of the GATT says non-tariff measures like quotas, bans, and variable import restrictions are prohibited. Countries can however use tariffs, but they are set at maximum levels (for example the U.S. tariff on beef cannot exceed 26.4 percent). By establishing tariffs as the basis for regulating trade, the rules ensure more transparency and predictability and also facilitate negotiations between countries to bring down trade restrictions. It is really as simple as a negotiation over numbers!

3. Don’t discriminate against imports. The third article of the GATT protects imported products from facing requirements or taxes that are less favorable than those imposed on domestic products. For example, if the United States imposes a 15 percent excise tax on U.S. whisky, it can’t impose an excise tax higher than 15 percent on imported products. Or, if the United States says U.S. beef can be sold in grocery stores, convenience stores, and wholesale markets, imported Korean beef cannot be restricted to just be sold through convenience stores. This ensures imports are not restricted arbitrarily from the market. A key exception is tariffs (imports can be taxed while domestic products are not), which is covered next.

3.5 Subsidies. The WTO rules on subsidies are weaker, so I call it a half rule. Subsidies are permitted, with some exceptions. For example, export subsidies (which are government payments that help exporters win sales in international markets) are banned. While some subsidies are permitted, if an importing country shows that the subsidies are leading to increased imports from the subsidizing country, and injuring the importing country’s domestic industry, it can ‘remedy’ the situation by imposing restrictions –counter-vailing duties. Similarly, if a country is selling its product at a less than fair value, an importing country can restrict imports through anti-dumping duties. This rule recognizes that subsidies are pervasive instruments of government policy, but aims to control the negative impacts. This is easier said than done. China’s unjustified use of these trade remedies to unjustifiably restrict U.S. sorghum exports this year shows how these rules can be twisted for protectionist purposes.

Exceptions to the Rules and Enforcement

Is that it? Not quite. The WTO rules run for hundreds of pages and these three-and-half rules account for less than 1 percent of all the rules. The rest of the rules are exceptions to these rules. For example, countries agree to not discriminate across suppliers, however, if there is a threat to health or safety from imports, the trade rules allow the importing country to discriminate against imports from the impacted country. For example, if an exporting country is suffering from a disease outbreak that could spread to an importing country, a country may ban imports of the dangerous product from the exporting country, even as it imports from another supplier and continues to allow domestic commerce of the same product. The rules do lay out provisions to ensure this ‘health and safety’ exception is not abused: before imposing a trade restriction the importing country must complete a scientific risk assessment and it can’t arbitrarily impose overly restrictive measures. This can be pretty complicated!

Similarly, there are exceptions that allow countries to discriminate across supplies by forming Regional Trade Agreements. This allows the United States to eliminate tariffs on Mexican and Canadian imports, while maintaining them on other countries, like the European Union. There are conditions that a Regional Trade Agreement must substantially cover all trade to guard against arbitrary commercial preferences aimed at disadvantaging other countries. This rule has allowed countries to enter Free Trade Agreements which have helped boost global trade and expand incomes.

There are tons of these exceptions: goods made from prison labor can be banned, countries can impose technical standards, in times of a currency crisis countries can restrict imports to protect foreign currency reserves, and many more. My main point is these are good rules. If we were going to start from scratch today and try to identify a set of trade rules, I believe we could not do better than the ones agreed to through the GATT and WTO process. The proof is in the pudding – despite shortcomings, global trade has boomed under this system, and these rules have protected against abuse of the trading system by protectionist interests.

One last comment regarding fair trade, rules are only as good as their enforcement provisions. The WTO agreement of 1994 set up a dispute settlement system to give the rules real teeth. If a country believes a trading partner is violating the rules, it can request a panel of experts to here the merits of the case and render a judgement. If the policy is found to be inconsistent with trade rules, the offending country needs to resolve the violation. If it does not, the injured country can impose trade sanctions to retaliate.

The WTO dispute process has been very successful for U.S. agriculture. The threat of litigation keeps countries honest for the most part and has helped us negotiate reforms in other countries when they have caved to the temptation to cheat. The United States has initiated numerous WTO cases and in all instances we have either successfully negotiated a settlement or have prevailed in litigation. This has led to policy reforms by our trading partners, and kept markets open for our products. Even when countries have found it politically impossible to reform, such as the infamous EU hormone ban, we have been able to send a strong signal to other trading partners to not imitate bad behavior, and even in the EU we have negotiated compensatory import access. Other countries have also challenged some of our policies, but much less frequently than we have used the litigation option, and they have not challenged core U.S. farm or trade policies. We currently have two important disputes on China’s grain policies working their way through the WTO now – a positive outcome should give us leverage to encourage market-oriented reforms in China.

The WTO rules have served U.S. agriculture well. There are important areas were improvement is needed: too many high tariffs restrict trade, too many countries use very distorting price supports and input subsidies, and rules need to be strengthened with respect to unjustified non-tariff measures. Additionally, some countries have been circumventing WTO obligations for protectionist purposes, undermining the trading system. What U.S. agriculture, and the world, needs is a stronger and more useful global trading system.

(Source: https://www.fas.usda.gov/newsroom/fair-trade-and-world-trade-organization dated 1st May-2018)

|

|

BACK |

India must become globally competitive in manufacturing to boost merchandise exports

|

As the government never fails to point out, India is the fastest growing major economy, and expects to grow even faster in the coming years. It has liked talking about record FDI inflows, and how India is one of the most attractive investment destinations. What it doesn't like talking about is its dismal track record on merchandise exports.

In 2013/14, India's merchandise exports stood at $314.4 billion. In the next year, it fell to $310.3 billion. And the next year, 2015/16 saw a further fall to $262.3 billion before it improved marginally to $275.9 billion in 2016/17. This financial year, it has clocked $302 billion, which is still lower than what it was four years ago.

Some bit of the export drop can be blamed on falling crude prices. Petroleum products including high speed diesel forms a biggish chunk of Indian exports, and when crude prices fall, so do exports. But beyond that, India's merchandise exports are still in gems and jewellery, agriculture & allied, textiles, chemicals and transport equipment and machinery and base metals. Of these, exports of gems &jewellery, transport equipment and textiles actually fell in the current year.

In the past two years, India has not been able to take advantage of rising world trade. The disruptions caused by demonetisation first, and later the hiccups during the roll out of GST, have been blamed for hitting small exporters in a number of sectors.

The bigger problem though, in my opinion, is India's failure to get become globally competitive in manufacturing. So far, most countries that have grown rapidly have depended on globally competitive manufacturing to power them to high growth. In Asia, especially, Japan showed the way initially when its manufacturing techniques powered it to become a global manufacturing powerhouse in sectors ranging from autos, to consumer durables to imaging. Later the Asian Tigers, especially Taiwan and South Korea grew rapidly because of their engineering and manufacturing competitiveness. Then came the rise of China, which became the production base for all sorts of products from steel to solar panels, and from mobile phones to computers.

India has never managed to get its manufacturing act right despite many tries. At different times, the reasons proffered have ranged from higher raw material and electricity costs, low productivity of labour, difficulties in setting up greenfield factories because of land acquisition and government clearances, and other sundry reasons.

The problem has always been that India has always been proud of its small and medium industries and the jobs it created. For a long time, a range of products were reserved for the SME sector. Thankfully that reservation has gone now, but the natural inclination to look tilt on the side of SMEs and not large scale manufacturing has remained. Even this government continues that mindset probably because of the assumption that SMEs will continue to create more jobs than bigger manufacturers.

There are multiple problems with that assumption. SMEs are generally not globally competitive when it comes to production of high value products. Economies of scale and productivity problems plague them. But merchandise exports will not go up unless the products are globally competitive and can take a bite out of the global market. And that is where the policy makers need to focus on when they unveil the new industrial policy, which has been in the works for some time.

Focusing on giving benefit packages for exporters in textiles, and other such sectors will not make India a big merchandise exporter. And that is something this government will have to keep in mind when it finalises the policy.

(Source:-https://www.businesstoday.in/opinion/prosaic-view/india-must-become-globally-competitive-in-manufacturing-to-boost-merchandise-exports/story/276100.html dated 2nd May-2018)

|

|

BACK |

Utilising Free Trade Agreements for what they mean to business

|

Free Trade Agreements (FTAs) are rising in prominence, abeit laden with challenges. A cursory glance into the origin and evolution of FTAs over the past centuries would explain how and why. A specialised and updated information system designed for storage and processing of all the important information pertaining to FTAs is essential to overcome the various challenges in effectively utilising them.

FTA is an agreement facilitating trade between countries by reducing or even eliminating various tariff and non-tariff barriers to trade. It opens up new markets for industries to expand their sales outreach to. FTAs can also include in their scope or sphere of influence, areas such as foreign investment, economic growth, employment, infrastructure development, intellectual property rights, protectionism and international competition among others. Hence the different forms and terms, other than FTA, associated with Trade Agreements namely, PTA (Preferential Trade Agreement), CECA (Comprehensive Economic Cooperation Agreement), CEPA (Comprehensive Economic Partnership Agreement), Trading Bloc, Customs Union, Economic Union, Common Market, and so on.

For India alone, the various trade agreements and treaties, both in force as well as under negotiations, involve countries across regions as far-flung as Asia, Central America and South America. Of late, mutual efforts in advancing FTAs between India and a vast variety of countries and regions have been gathering speed, particularly with Nordic countries, South Korea, Egypt, European Union, Canada, Poland, Switzerland, France, Israel, United States, Great Britain, Mauritius, Singapore and Vietnam.

In the aftermath of World War II, a new global economic order was created by General Agreement on Tariffs and Trade (GATT) in 1947, forcing economic powers out of protectionism and globally institutionalising the idea of multilateralism.

Countries became independent and so did their economic decision-making. There came about an increase in awareness of their trade interests which could be served by FTAs. WTO (World Trade Organization) replaced GATT in 1995. Signed by 123 and currently with 162 member states, it is the largest international economic organisation in the world regulating trade in goods, services and intellectual property by providing a framework for negotiating trade agreements. As a result, FTAs started proliferating on the strong principles of bilateralism and multilateralism. This not only guided trade negotiations, but also made FTAs complex, particularly their conclusion and effective utilisation. For there needed to be a mechanism which could track the changes in tariff headings resulting from value addition on inputs, a system of rules to calculate the extent of value addition in regions concerned and a set of criteria to determine if the goods so converted could be considered as originating from that particular country to be eligible for an import or export consignment under FTA.

Apart from various economic, political and legal challenges, several surveys clearly bring out lack of information as the biggest obstacle in utilising FTAs. There are other challenges like low margins of preference, complications in interpreting Rules of Origin (ROOs), non-tariff measures (NTMs) inhibiting exports, other exemption schemes easier to use than FTAs, etc. However, at over 35 percent, lack of information tops the list of challenges.

Evidently, therefore, the considerable under-utilisation of FTAs despite their high utility value is attributable to the inability to access, manage and process the immense amount of information that is integral to it. Manual control on any of these activities is simply out of question. Tracking of developments on FTAs being negotiated or signed by governments, analyses of the different articles therein and important information about inclusion and exclusion of tariff lines with their HS (Harmonised System) classification codes, changes in tariff classification, Most Favoured Nation (MFN) duty rates, interpretation of the Rules of Origin (ROOs), actual duty exemptions or concessions, safeguard measures, procedure and authorised agencies for obtaining Certificate of Origin, Mutual Recognition Agreements (MRA) and non-tariff measures (NTMs) namely, customs, licensing and inspection procedures, documentation and comparative analysis of tariff concessions by different FTAs, and so on, is quite crucial to effectively utilising them.

And the furious proliferation of these FTAs only exasperates the pressing need for organisations to have an advanced information management system as the only way to store and process all this information. More specialised this system is in its design and more integrated it is with the other participating systems in the supply chain trading partner ecosystem including the government agencies, more effectively would it help organisationsutilise the various FTAs applicable to their business geographies. For all the cost advantages and the business benefits that FTAs are intended to bring in, this investment, which comprehensively covers automation, documentation, integration and compliance, is most likely to pay back large dividends.

References:

- Frequently Asked Question (FAQ) Free Trade Agreements: Indian Trade Portal

- Free Trade Agreements – A brief history: European Student Think Tank, Sep 2016

- International Trade Agreements: Ministry of Commerce and Industry, Dept. of Commerce, Govt. of India

- What is an FTA and what are the benefits: Article by Matthew Grimson, ABC News, Apr 2014

- Asian FTAs: Trends, Prospects, and Challenges: ADB Economics Working Paper Series, Oct 2010

- Thomson Reuters-KPMG International Annual Global Trade Report 2017

Margin of preference: It means the percentage difference between the Most-Favoured-Nation (MFN) rate of duty and the preferential rate of duty for the like product, and not the absolute difference between those rates. Margin of preference = (MFN duty– tariff rate conceded under the Agreement) × 100(per cent).

(Source: http://www.forbesindia.com/blog/economy-policy/utilising-free-trade-agreements-for-what-they-mean-to-business/ dated 2nd May-2018)

|

|

BACK |

India tops list of fastest growing economies for coming decade: Harvard study

|

NEW YORK: India tops the list of the fastest growing economies in the world for the coming decade and is projected to grow at 7.9 per cent annually, ahead of China and the US, according to a Harvard University report.

The Centre for International Development (CID) at Harvard University said in new growth projections yesterday that countries that have diversified their economies into more complex sectors, like India and Vietnam, are those that will grow the fastest in the coming decade.

The researchers also find India ranks the best on the criteria termed the Complexity Opportunity Index (COI), which measures how easy it is to redeploy existing knowhow to enter new complex products.

"India's existing capabilities have not only diversified its exports, but also allow for easy redeployment into related products that depend on those capabilities, making further diversification relatively easy," it said.

China is projected to grow at 4.9 per cent annually to 2026, the US three per cent and France 3.5 per cent.

The top ranking in COI means India has many "unrealised opportunities" to diversify into related, high-value sectors to continue to drive productivity growth and job creation.

"Up to now, that potential remains unrealized, however, as India's complexity has not changed over the past decade. The rapid growth that is predicted is effectively capitalizing on previous gains in complexity," the report added.

It stressed that ensuring the long-run potential of India's economic growth will rely on realizing diversification into related products. The other major challenge will be to ensure the inclusive nature of this productive transformation, as the gains made in new chemical, vehicle and electronics exports are highly concentrated in specific localities of the subcontinent.

"Whether that knowhow can be disseminated into new areas of India will in part determine whether rapid growth can be sustained in the long-term," it said.

Director of CID, professor at Harvard Kennedy School (HKS) and the leading researcher of The Atlas of Economic Complexity, Ricardo Hausmann said that Southeast Asia continues to dominate the global growth landscape, driven by the diversification of economies into complex manufacturing, but the leading countries have shifted within the region, with the Philippines, Vietnam, Indonesia, and Thailand poised to lead growth in the coming decade.

The researchers further point out that many low-income countries, including Bangladesh, Venezuela, and Angola have failed to diversify their knowhow and face low growth prospects.

"Others like India, Turkey, and the Philippines have successfully added productive capabilities to enter new sectors and will drive growth over the coming decade," said Sebastian Bustos, a lead CID researcher in trade and economic complexity methods.

(Source: https://economictimes.indiatimes.com/news/economy/indicators/indias-7-projected-growth-rate-amazingly-fast-adb/articleshow/64049171.cms dated 4th May-2018)

|

|

BACK |

View: India must tread carefully on free trade agreements

|

By VK Saraswat, Prachi Priya & Aniruddha Ghosh

Trade theory has consistently been a strong proponent of free trade of goods, services, capital and labour. However, a growing wave of protectionism has dominated global trade of late. While it is difficult to assess whether this will lead to a significant shift in the global trade paradigm, a review of India’s existing free trade agreements (FTAs) before negotiating new ones is necessary.

India is a fairly open economy with overall trade (exports plus imports) as a percentage of GDP at around 40%. Its exports have diversified both in terms of markets and products in the past two decades. Indian exports have gradually found their way into new markets and the export sector has moved up the value chain, leading the way with high-value products like industrial machinery, automobiles and car parts, and refined petroleum products.

India’s exports to FTA countries have not outperformed overall export growth, or exports to rest of the world. Both have grown at a commensurate rate of 13% y-o-y. FTAs have led to increased imports and exports, although this has widened the trade deficit. For example, India’s trade deficit with Asean (Association of Southeast Asian Nations), South Korea and Japan has doubled to $24 billion in FY2017 from $15 billion in FY2011 (with the signing of the respective FTAs) and $5 billion in FY06.

Also, India’s exports are much more responsive to income changes as compared to price changes. So, a tariff reduction or elimination does not boost exports significantly. Utilisation rate of regional trade agreements (RTAs) by exporters in India is very low. Most estimates put it at less than 25%. Lack of information on FTAs, low margins of preference, delays and administrative costs associated with rules of origin, non-tariff measures, are major reasons for under-utilisation.

When it comes to the India-Asean FTA, there is a deterioration of the quality of trade. Apart from the surge in total trade deficit due to tariff cuts, sectorwise trade flows also paint a grim picture. As per the UN’s Harmonised System of Product Classification, products can be grouped into 99 chapters, and further into 21sections like textiles, chemicals, vegetable products, etc. India has experienced a worsening of trade balance (deficit increased or surplus reduced) for 13 out of 21 sectors.

This also includes value-added sectors like chemicals and allied, plastics and rubber, minerals, leather, textiles, gems and jewellery. Sectors where trade balance has improved include animal products, cement and ceramic, arms and ammunitions. Sectors where trade deficit has worsened account for approximately 75% of India’s exports to Asean.

So, there are genuine concerns of trade asymmetry when India signs up new FTAs because of past FTA experience. However, FTAs are instrumental in creating seamless trade blocs that can aid trade and economic growth. Here are some suggestions while going forward with future FTA negotiations.

Before getting into any multilateral trade deal, India should review its existing FTAs in terms of benefits to various stakeholders like industry and consumers, trade complementarities and changing trade patterns in the past decade. Negotiating bilateral FTAs with countries where trade complementarities and margin of preference is high may benefit India in the long run.

Also, higher compliance costs nullify the benefits of margin of preference. Thus reducing compliance cost and administrative delays is extremely critical to increase utilisation rate of FTAs. Proper safety and quality standards should be set to avoid dumping of lower quality hazardous goods into the Indian market.

Circumvention of rules of origin should be strictly dealt with by the authorities. Well-balanced FTA deals addressing the concerns of all the stakeholders is the need of the hour.

(Source: https://economictimes.indiatimes.com/news/economy/foreign-trade/view-india-must-tread-carefully-on-free-trade-agreements/articleshow/64055496.cms dated 7th May-2018)

|

|

BACK |

Specialty chemical sector may double market size by FY25: Report

|

The specialty chemicals sector registered double-digit growth over FY13-FY17, supported by subdued oil prices and strong domestic and export demand.