Chairman's Desk

|

| DR. B.R. GAIKWAD |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-exporters,

I have pleasure to bring to you the 7th issue of CHEMEXCIL e-Bulletin for the month of November, 2016.

I am happy to inform you that the Government of India is working on addressing key problems of exporters with logistic cost and taxation to boost the country’s exports. The Government has proposed introduction of Goods and Services Tax (GST) which would be one of the pioneering and game changing transformative initiatives taking shape in our country. It is also expected that the GST will boost domestic demand as also create more opportunities for domestic business in addition to make Indian economy more robust. While addressing in one of the Conference held in New Delhi recently, the Hon’ble Minister of State for Commerce & Industry, Mrs. Nirmala Sitharaman mentioned that since the taxation matter also involves many states, the Government is making sure that it takes them on board and further as simplification of tax is the top agenda of the Government, it will definitely address these issues.

Taking into account on the importance of the above as also in continuation of our capacity building initiatives for the benefit of member-exporters, CHEMEXCIL had organized a seminar on “Model GST Law: Critical Issues Impacting the Industry” at Hotel Marine Plaza, Mumbai on 30th November, 2016. During this event, question answer session was also organized, wherein queries of the member-exporters on the above topics were answered by eminent speakers.

I have also pleasure to inform you that a meeting on Impact of Demonetization under the Chairpersonship of Smt. Nirmala Sitharaman – Hon’ble MoS(I/C)- Commerce & Industry was held on 19th November, 2016 at UdyogBhawan - New Delhi and discussed exporters concern on various issues. I had also explained in detail on possible implication on chemical sector.

As you are aware, under the aegis of Ministry of Commerce & Industry and supported by Department of Chemicals & Petrochemicals, Ministry of Chemicals & Fertilizers, Government of India, the second edition of CAPINDIA 2017 exhibition will be held on 21st& 22nd March, 2017 at Bombay Exhibition Centre, Goregaon, Mumbai and CHEMEXCIL will be the lead Council along with PLEXCONCIL, CAPEXIL and SHEFEXIL for organizing this exhibition. I request all member exporters to actively take part in this exhibition.

You are also aware, every year, in order to encourage trade and industry to aim at higher targets of export performance and thus, would play a major role in the progress of India’s economy, CHEMEXCIL would be felicitating the outstanding exporters who have shown substantial growth in exports. CHEMEXCIL has invited nomination from member-exporters to submit their nominations. I request all members to submit their nominations.

We hope that you would find this e-Bulletin informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions which help us to improve this bulletin.

With regards,

Dr. B.R. Gaikwad

Chairman,

CHEMEXCIL

|

BACK |

CHEMEXCIL 3RD MEETING OF COMMITTEE OF ADMINISTRATION FOR THE YEAR 2016-17 AT HOTEL COURTYARD BY MARRIOTT AT AHMEDABAD, GUJARAT.

|

| Chemexcil COA in progress. |

| |

|

| Mr. Bipin R. Patel, President – Gujarat Chamber of Commerce & Industry, Ahmedabad welcomed Shri Sunil Kumar, IAS, Jt. Secretary - EP(CAP), Deptt. of Commerce, Ministry of Commerce & Industry, New Delhi during COA meeting. |

The 3rd Meeting of Committee of Administration was held on Friday the 18th November, 2016 at 2.30 pm in Hotel Courtyard by Marriott at Ahmedabad, Gujarat.

Following Members of the Committee of Administration and Government Nominees were present during the meeting:

Shri Sunil Kumar, IAS, Jt. Secretary - EP(CAP), Deptt. of Commerce, Ministry of Commerce & Industry, New Delhi; Shri Sunil Kumar Sharma, Director (Chemicals), Deptt. of Chemicals & Petrochem., Ministry of Chemicals and Fertilizers, New Delhi; Dr. B.R. Gaikwad, Chairman, CHEMEXCIL; Shri Harin D. Mamlatdarna, Member; Shri Abhay V. Udeshi, Chairman, Castor Oil Panel; Shri Ajay Kadakia, Chairman,M.E. Panel; Shri Bhupendra Patel, Member and Ahmedabad Regional Chairman, CHEMEXCIL.

Special Invitees:Mr. Shankar R. Patel, Chairman- The Green Environment Services Co-Op. Soc. Ltd., Vatva, Ahmedabad; Mr. Bipin R. Patel, President – Gujarat Chamber of Commerce & Industry, Ahmedabad; Mr. Shailesh Patwari, Senior Vice President - Gujarat Chamber of Commerce & Industry, Ahmedabad.

CHEMEXCIL’s Secretariat: Shri S.G. Bharadi, Executive Director; Shri Prafulla Walhe, Deputy Director, Mrs. Vaishali Zinzuwadia, Regional Director-Ahmedabad.

Shri Sunil Kumar, IAS, Jt. Secretary - EP(CAP), Deptt. of Commerce, Ministry of Commerce & Industry, New Delhi

Below agenda points were then taken up for discussion:

- Confirming the Minutes of the 2nd meeting of the CoA for the year 2016-17 held on 23rd August, 2016 at Mumbai.

- Review of Action Taken Report of the 2nd meeting of the CoA for the year 2016-17 held on 23rd August, 2016.

- Review of the panel wise export performance of the items coming under the purview of the Council for the period April / August, 2016 (Source: DGCI & S).

- Declaration of the results of election of two Committee Members.

- Updating the Committee on the meeting with Builder regarding Jhansi Castle Building.

- Briefing the Committee on the status of events completed during June-August, 2016.

- Agri Business Global Trade Summit, Orlando, USA to be held from 17th-19th August, 2016.

- Viet Beauty 2016, Sai Gon Exhibition & Convention Center, (SECC), Ho Chi Minh, Vietnam to be held from 18th–20th August 2016.

- 26th Dye+chem Bangladesh 2016, International Expo to be held from 31st August to 3rd September, 2016 at Bangabandhu International Conference Centre, Dhaka, Bangladesh.

- Indian Chemicals & Cosmetics Exhibition Buenos Aries, Argentina to be held from 19-20thOctober, 2016.

- Buyer Seller Meet Brazil 17th October, 2016 at Brazil.

- Updating the Committee on various Seminars organized by the Council.

- Updating on the new recruitments for the post of Administration Officer/Membership Officer & Office Assistant.

- Post Facto Approval towards the expenses for the purchase of 30 New Office Chairs for the conference room.

- Updating the Committee on CAPINDIA 2017.

|

BACK |

CHEMEXCIL MEMBERS GET TOGETHER WITH WESTERN REGION AT HOTEL COURTYARD BY MARRIOTT, AHMEDABAD ON 18TH NOVEMBER 2016.

A small get together was organized by Chemexcil at HOTEL COURTYARD BY MARRIOTT, AHMEDABAD ON 18TH NOVEMBER 2016 at 7.00pm in order to meet the members in western region and to know their problems.

Shri.Bhupenrda Bhai Patel, Chemexcil Regional Chairman Western Regions welcomed all members and briefed the purpose of get together, Dr.B.R. Gaikwad Chairman Chemexcil and Shri. Shankar Patel, President, The Green Environmental Services Co.Op Soc., interacted with members.

|

| Shri.Bhupenrda Bhai Patel, Chemexcil Regional Chairman Western Regions welcomed all members and briefed the purpose of get together, Dr.B.R. Gaikwad Chairman Chemexcil and Shri. Shankar Patel, President, The Green Environmental Services Co.Op Soc., interacted with members. |

| |

|

| Shri.Bhupendra Patel, Chemexcil Regional Chairman Western Regions welcoming members during get together |

| |

|

| Dr. B.R. Gaikwad Chairman Chemexcil facilitating Mr. Bipin R. Patel, President – Gujarat Chamber of Commerce & Industry, Ahmedabad |

| |

|

| Shri. Shankar R. Patel, Chairman- The Green Environment Services Co-Op. Soc. Ltd., Vatva, Ahmedabad briefing about the get together. |

| |

|

| Shri. Ajay Kadakia along with Gujrat region members during get together |

| |

|

| Shri. Shankar R. Patel, Chairman- The Green Environment Services Co-Op. Soc. Ltd., Vatva, Ahmedabad briefing about the get together. |

|

BACK |

CHEMEXCIL VISIT TO COMMON EFFLUENT TREATMENT PLANT, VATWA (GREEN- BIOLOGICAL TREATMENT PLANT) ON 18TH NOVEMBER, 2016 FROM 10.00 AM TO 12.45 PM

PURPOSE OF VISIT: TO STUDY ABOUT CETP AND NOVEL SPENT ACID TREATMENT PLANT

Chemexcil arranged a visit to common effluent treatment plant, vatwa (green- biological treatment plant) on 18th November, 2016 from 10.00 am to 12.45 pm Mr. Sunil Kumar , IAS – Jt. Secretary, Ministrey of Commerce and Industry, Govt. of India, New Delhi,Mr. Sunil Kumar Sharma – Director, Chemicals, New Delhi,Dr. B.R. Gaikwad – Chairman, Chemexcil,Mr. Ajay Kadakia – Chairman ME Panel,Mr. AbhayUdeshi – Chairman Castor Oil and Specialty Chemical Panel,Mr. Bhupendra Patel, Gujarat Region Chairman,Mr. SuhasBharadi, ED, Chemexcil,Mr. PrafullaWalhe, Dy Director – Chemexcil, Mrs. Vaishali Zinzuwadia, Regional Director, Gujarat,Mr. Shankar Patel, President, The Green Environmental Services Co.OpSoc., Mr. Yogesh Parikh,Mr. Sachin Patel – President, Vatva Industries Association, Mr. Deepak Dawda – CEO, The Green Environmental Services Co.OpSoc., Mr. Jitendra Joshi, Jt. Secretary, The Green Environmental Services Co.OpSoc., Mr. Harish Bhuta,Mr. Anil Jain were present during the visit.

Mr. Shankar Patel, President – The Green Environmental Services Co.Op Soc. welcomed the Chemexcil guests, Mr. Sachin Dawda gave a presentation on the working of Common Effluent Treatment Plant in detail and shared information on present infrastructure and also shared all estate relation information.

The Vatva Industrial Estate was established by Gujarat Industrial Development Corporation in the year 1960 in the south east direction of Ahmedabad City on Ahmedabad – Mehmadabad state highway to accommodate small and medium scale industrial units.

There are approximately 1800 units in this industrial Estate, out of which approximately 680 generate wastewater and have potential to cause water pollution. These include units manufacturing Pharmaceutical Products, Dyes, Dye-Intermediates, Pigments, Fine Chemicals and other organics. They also include Textile Process Houses, Rolling Mills and other Non Chemical Process Industries. During the decade of 1990s, many industries started planning compressive treatment. However it was very difficult and techno-economically not viable to arrange for necessary treatment of wastewater by these units individually. There was also constraint of space to install Effluent Treatment Plants by these units in their premises.

The most practical and cost effective approach was to establish a Common Effluent Treatment Plant for the treatment of effluent being generated by these units. In fact it was necessary to establish proper infrastructure to take care of the environment related aspects being faced by the individual industrial units in the estate. In order to fulfill these objectives the ‘Green Environment Services Co-operative Society Limited’ (GESCSL) was formed with the support of Vatva Industries Association and Gujarat Dyestuff Manufacturers’ Association. Initially there were 620 industrial units of GIDC Estate, Vatva, Ahmedabad as members. The GESCSL is managed by 15 members including Chairman, Vice Chairman, Hon. Secretary and Hon. Treasure.

The important aspects of CETP Project is as under

The CETP Site is located at Plot Nos.: 244-251, Phase: II, GIDC Estate, Vatva, Ahmedabad. The CETP and associated facilities are set up on the land area admeasuring 24328 sq. m. M/s Advent Corporation, USA gave the process design based on the treatability study carried out by Sudarshan Chemical Industries Ltd., Pune. The detailed engineering was provided by M/s Sudarshan Chemical Industries Ltd.,Pune. The construction of CETP was commenced in March 1996 and was completed in all respects including installation of mechanical and electrical components in May 1998.

Salient Features of the CETP:

- The CETP was designed to treat 16000 m3 of effluent / day making use of new technology known as AIS (Advent Integral System) which consists of Aeration Basin surrounded by Integrated Peripheral Secondary Clarifier. Later during the up-gradation program this Integral Clarifier was converted into Aeration Zone and two separate Secondary Clarifiers were provided.

- The aeration is accomplished with the help of medium bubble aeration grid supplemented by 18 nos. of Triton type aerators supplied by Aeration Industries International Inc., Minneapolis, USA.

- Charging Basis: The treatment charges are levied from the member units at the rate of Rs. 20 per kg of TOC in the effluent.

- Inlet Norms: The CETP inlet norms applicable to the member units in respect of the quality of the effluent are BOD 1200 mg/l,COD 3000 mg/l,TSS 600 mg/l

- The upper limits for the heavy metals and other pollutants have also been specified.

The member units are required to adhere to the inlet norms. The quality of the effluent received at CETP is monitored and extra penal charges are levied from the member units violating these norms.

Mr. Sunil Kumar , IAS – Jt. Secretary, Ministrey of Commerce and Industry, Govt. of India, New Delhi, was impressed to learn these details and congratulated Mr. Shankar Patel, President, The Green Environmental Services Co.OpSoc and all office bearers for extending their whole hearted service to run this CETP so efficiently. He also mentioned that “The estate has the road map and should now stick to it, the timely change in the technology and infrastructure should be welcomed for maintaining the plant. Further he added that the SSI units should stick to these rules and seriously work for betterment of Environment and human life. He was also happy to know that there is transparency between The Green Environmental Services Co.OpSoc and each SSI units.

After the visit to CETP the team visited Novel Spent Acid Management Plant.

This treatment plant was established to carry out segregation and collection of spent acid received at site in different tanks depending on the concentration of Sulphuric acid and other properties.

The colour less and concentrated spent acid is directly supplied to the actual users to utilize it as a raw material in the process for the manufacture of value added products such as single super phosphate, ferrous sulphate, alum etc.

The rest of the spent acid is neutralized using hydrated line for the production of gypsum which is supplied to the cement manufacturing plants.

The waste water generated as the filtrate is treated in the ETP consisting of primary and secondary treatment facilities and the effluent after treatment is sent to CETP of GESCSL (GREEN) for further treatment and joint disposal.

|

BACK |

CHEMEXCIL SEMINAR ON "MODEL GST LAW: CRITICAL ISSUES IMPACTING INDUSTRY" AT HOTEL MARINE PLAZA, MUMBAI ON 30.11.2016

|

| Shri S.G Bharadi- ED Chemexcil, Shri Pradeep S Gandhe, Honorary Secretary, ASMECHEM, Shri S.G Mokashi- Addl Vice Chairman Chemexcil, Shri UdayanChoksi- Managing Partner-VoxLaw, Ms. Tejal Mehta, Partner- VoxLaw on the dias during Chemexcil seminar on Model GST Law at Marine Plaza, Mumbai on 30/11/2016 |

In continuation of our capacity building initiatives, the Council has now organized a seminar on "Model GST Law: Critical Issues Impacting the Industry” at Hotel Marine Plaza, Mumbai.This seminar was organized in association with ASMECHEM.

From CHEMEXCIL, the seminar was attended by Shri S.G Mokashi, Addl Vice Chairman Chemexcil, Shri S.G Bharadi, ED Chemexcil, ChemexcilOffcers/ Staff from Mumbai and our member-exporters. Shri Mokashi in his address welcomed the initiative and stressed the need for understanding the GST law. He also urged the participants to make best use of such seminars for knowledge enhancement.

From Asmechem, Shri Pradeep S Gandhe, Hon Secretary and other office bearers were present. Shri Gandhe also addressed the gathering briefly.

The Technical sessions where covered by VoxLaw, Mumbai who had deputed following eminent speakers:

- Shri UdayanChoksi, Managing Partner

- Shri Samir Kapadia, Partner

- Ms. Tejal Mehta, Partner

The speakers spoke on Updated Model GST Law (Nov 2016), Critical Issues Impacting Industry and the way forward including training of man-power, IT preparedness etc.

This event attracted good response with over 50 participants attending the seminar. The participants asked several queries during the seminar and where answered satisfactorily by the eminent speakers.

|

BACK |

Commerce Ministry begins review of foreign trade policy

"Sectors which feel they want something amended, deleted, tweaked or brought in, will have to engage with the Ministry. We certainly want lot more discussions," sources said.

The Commerce Ministry has started review of the foreign trade policy to carry out mid-course corrections in the export schemes, if required. As part of the review, it would hold stakeholders' consultations to understand the issues faced by exporters. "Sectors which feel they want something amended, deleted, tweaked or brought in, will have to engage with the Ministry. We certainly want lot more discussions," sources said.

The Ministry is also looking at the rollout of the Goods and Services Tax (GST). "Right now, we have two schemes -- advance authorisation and Export Promotion Capital Goods (EPCG) where we allow duty free imports, right from the beginning. In GST regime, everybody have to pay the duty first and then seek reimbursement. So, once that gets decided by the GST council, then we can modify our schemes," the sources added. In April 2015, the government unveiled its first five-year Foreign Trade Policy (FTP) aiming to nearly double exports of goods and services to USD 900 billion by 2020. In the FTP (2015-20), the government replaced multiple schemes with Merchandise Exports from India Scheme (MEIS) and Services Exports from India Scheme (SEIS). Since December 2014, exports fell for 18 months in a row till May 2016, due to weak global demand. Shipments witnessed growth only in June this year, thereafter again it entered the negative zone in July and August. Recovering from a two-month decline, exports went up by 4.62 per cent to USD 22.9 billion in September. To cut the transaction cost for exporters, the Ministry is also talking to railways and shipping to find ways to reduce the high freight cost. On India's concept note about trade facilitation agreement in services in WTO, sources said the text is being scrutinised by the legal department.

Further, talking about the issue of overcapacity of steel in China and its impact on India, Ministry sources said that everybody is facing the heat of both overcapacity and subsidised exports of steel from China. The OECD and the G-20 have been talking about it and in every fora, the issue comes up for discussion. "China is clearly under pressure because this has become an issue of every global trade negotiations. People have now started realizing that this is completely trade distorting," they said. When asked whether the issue is figuring in the RCEP negotiations, the sources said that RCEP may not be the right platform in which this particular issue could be sorted out. "It is a major issue on which globally, there is lot happening," they added.

(Ref. http://www.moneycontrol.com/news/economy/commerce-ministry-begins-reviewforeign-trade-policy_7869841.html dated 1st November-2016)

|

|

BACK |

India construction chemical market will exhibit a CAGR of 17.2% during 2014 to 2020

Construction chemicals are added to construction materials in order to improve their workability, performance, functionality, chemical resistance and durability. Utilisation of construction chemicals has witnessed significant growth over the past decade due to increasing infrastructure development activities in developing economies.

The report analyses the India construction chemicals market in terms of market value (US$ Mn), segment, end user, and regions, providing information regarding market dynamics, competitive landscape, current trends, market estimations and forecast.

Government regulations based on the concept of ‘Green Revolution’, increase in foreign investment activities, urbanisation, and growing preference for utilisation of ready-mix concrete (RMC) are some of the prominent factors that are driving the growth of the construction chemicals market in India. A few challenges faced by this market are low availability of skilled manpower, volatility in raw material prices, and lack of interest for implementation of quality standards by infrastructure developers.

Some major trends in India construction chemical market are increase in investment in R&D, entry of new players, adoption of sustainable products and technological advancements. Asian region is turning out to be focus point for most of the major construction chemicals companies for investment in R&D. Rising construction of new buildings and renovation activities across India is expected to boost the overall demand for construction chemicals in the near future.

India construction chemicals market on the basis of types is segmented as admixtures, flooring chemicals, water proofing compounds, adhesives & sealants, repair and rehabilitation & others. Adhesives & sealants and admixtures segment is expected to collectively account for 61.2% share of the India construction chemicals market by 2020. It is anticipated that there will be a decline in the growth of the repair, rehabilitation & others segment from 12.7% in 2014 to 11.9% in 2020, indicating a lack of inspection and maintenance in the construction industry in India.

On the basis of end use sectors, India construction chemical market is segmented as infrastructure sector and residential & commercial sector. Infrastructure sector is likely to grow at a CAGR of 18.3%. The residential and commercial segment has a share of 34% in overall Indian construction chemical market with a steady Y-o-Y growth of 16% in 2020.

From regional perspective, India construction chemical market is segmented into northern region, eastern region, western region and southern region. Currently, northern region is expected to experience highest CAGR of 17.8% as compared to other regions. Southern region is likely to create an opportunity which is three times the value in 2013. The southern region comprises the states of Tamil Nadu, Andhra Pradesh, Karnataka and Kerala. This region realises the potential of IT services and hence are able to attract significant investment from these service and manufacturing companies. Chemical and engineering industries are the main drivers of growth in western region particularly in Maharashtra and Gujarat.

Key market participants covered in the report include BASF India, Pidilite, Sika India Pvt. Ltd., Forsoc Chemicals (India) Ltd., Chembond Chemicals and CICO Technologies

(Ref. http://www.openpr.com/news/382680/India-construction-chemical-market-will-exhibit-a-CAGR-of-17-2-during-2014-to-2020.html dated 15.11.2016)

|

|

BACK |

Chemical Industry to strengthen with pick up in realizations across the products

Indian chemical industry is a capital and knowledge intensive industry and plays vital role in the development of Indian economy, accounting for 2.11 percent of the Indian Gross Domestic Products (GDP). It is one of the most diversified sectors with more than 80,000 varieties of commercial products and the industry is the foundation of industrial and agricultural development of the country it also provides building blocks for several downstream industries like chemicals and other related products, petrochemicals, fertilizers, paints, varnishes, gases, soaps, perfumes, toiletry and pharmaceuticals.

The chemical industry is mainly divided into two categories -- organic and inorganic chemicals. Organic chemicals cover over half of all known chemical compounds, and include petrochemicals, drugs, cosmetics, agrochemicals, etc, while inorganic chemicals comprises alkalis, dyes and dyestuffs. Based on a more functional classification, chemicals can further be divided into basic, specialty, Pharmaceuticals, Agro chemicals and Biotechnology.

India is the seventh largest producer of chemicals worldwide and third largest producer in Asia after china and Japan. It is growing at a significant pace since past several years and the industry is likely to achieve $200 billion mark by 2020 from around $145 billion at present, the government is rendering extensive support to give impetus to the Indian chemical industry and has set up the task force to consider suggestions for National Chemical Policy to ensure steady growth of the country’s chemical sector. India accounts for around 16 percent of the world production of dyestuff and dye intermediates, particularly for reactive acid and direct dyes, while the country is currently the world’s third largest consumer of polymers and third largest producer of agrochemicals.

Exports

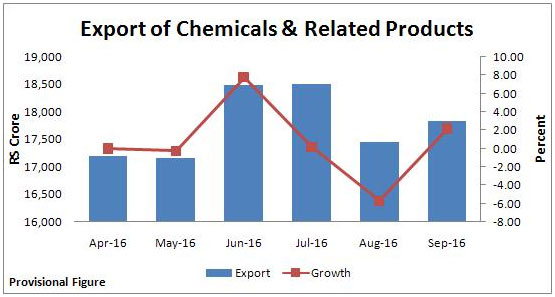

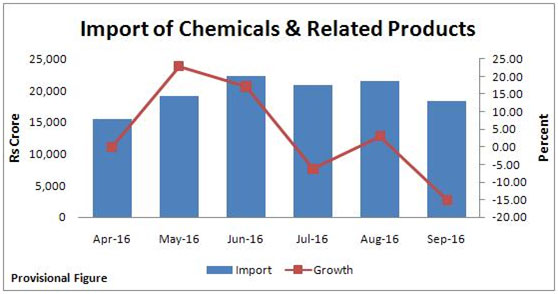

The share of Chemical products in the overall exports for April-September 2016 stood at 12.07%, while export of Chemical products was at Rs 1,06,652.75 crore (Provisional) up by 2.86%, as compared to Rs 1,03,687.29 crore in April-September 2016. The country’s highest export in value terms was in the month of July 2016 at Rs 18,514.34 crore, followed by Rs 18,481.87 crore and Rs 17,839.42 crore in June and September respectively. Of the total export of chemical and related products in April-September 2016, Drug Formulations and Biological contributed the most (39.71%), followed by Organic Chemicals (14.26%), Residual Chemical and Allied Products (11.70%) and Bulk Drugs, Drug Intermediates (10.51%).

Imports

The share of Chemical products in the overall import in April-September 2016 stood at 10.04%, while import of Chemical products for April-September 2016 stood at Rs 1,17,731.54 crore (Provisional), down by 11.50% as compared to Rs 1,33,028.19 crore in April-September 2015. The country imported highest in the month of June 2016 at Rs 22,331.55 crore followed by Rs 21,557.66 crore and Rs 20,923.30 crore in August and July respectively. Of total import of chemical and related products in April-September 2016, Organic Chemicals contributed over 27%, followed by Fertilezers Manufactured (16.21%), Residual Chemical and Allied Products (14.35%) and Inorganic Chemicals (12.17%).

Investments in Chemical Industry (Other than fertilizer)

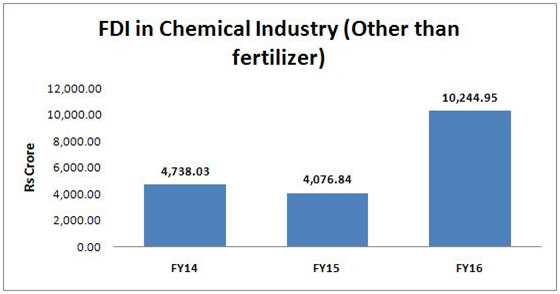

The Government of India has approved 100 per cent foreign direct investment (FDI) in the chemicals sector. The Chemical Industry (Other than fertilizer) has attracted 4.12% of total inflows in terms of US Dollar. The sector has attracted Foreign Direct Investment (FDI) worth Rs 10,244.95 crore or $1,563.31 million in FY16, as compared to Rs 4,076.84 crore and $669.40 million in FY15.

Specialty chemical segment likely to witness significant growth

Specialty chemicals, also known as effect chemicals or specialties, manufactured either by a single chemical formulation or a combination of two or more than two chemicals whose composition significantly contributes to performance of the final product. The companies in the Specialty chemical segment are making a niche for products having higher and more stable margins. At present, the Indian specialty chemical segment is in encouraging stage and is characterized by substantially lower penetration against a user base that sees increasing globalization and higher disposable income. Moreover, positive macro-economic trends too are providing benefits to the specialty chemical segment

On the basis of product type, specialty chemicals business can be segmented as agrochemicals, polymers & plastic additives, construction chemicals, electronic chemicals, cleaning chemicals, surfactants, lubricants & oilfield chemicals, specialty coatings, paper & textile chemicals, food additives, adhesives & sealants and others. The Indian specialty chemicals sector is likely to attain $50 billion mark by the end 2018 on the back of strong growth outlook for end use industries i.e agrochemicals, personal care ingredients, polymer additives, water chemicals, textile chemicals and construction chemicals. The sector will also get some support with the increased adoption of specialty chemicals and their increased usage in different products categories. Paints coating and construction chemicals, colorants, Active Pharmaceutical Ingredients (APIs), personal care chemicals and flavors& fragrances are the specific segments that are expected to do well in the Indian market.

Petrochemical segment to grow considerably in coming time

Petrochemicals are obtained from different chemical compounds which are by-products of crude oil refining. The petrochemicals industry includes a broad range of products like olefins, ethane, propane, aromatic compounds such as benzene, toluene, intermediate petrochemicals, end products, polymers, synthetic fibres, and synthetic rubber. Currently, the level of penetration of the petrochemical products in routine use is increasing day-by-day. It basically cater most of the sectors such as apparels, accessories, household items, furniture, electronics, construction, housing, automobiles, medical appliances, packaging, horticulture, and agriculture.

Petrochemicals is one of the fastest growing segments of chemical sector with a growth of around 13%, which is more than double the growth of India’s gross domestic product (GDP). The per capita consumption of polymers in India is estimated at 5.2kg as compared to per capita consumption of 30kg in China. India consumes around 6.2 million tonnes of polymers, which represents around 3% of global consumption of 200 million tonnes. The demand in rising gradually and to meet this increasing demand, the domestic petrochemical industry is preparing to spend over $25 billion. Hence, the Indian petrochemicals industry is estimated to reach $100 billion by the end of 2020 form around $40 billion at present.

Impact of GST on Chemical sector

The long-awaited Constitution Amendment Bill -- Goods and Services Tax (GST) -- was passed in the Parliament recently and is likely to be implemented by April 2017, replacing all the indirect taxes levied on goods and services by the Centre and States. This will surely improve the ease of doing business in the country. The chemical sector is plagued with the burden of complying with a multifaceted indirect taxation system and the current tax rate prevailing is between 24 percent to 26 percent. If the government agrees to cap the GST tax slab by around 18-20 percent, it will have massive positive impact on the Chemical sector. The trickle-down and cascading effects of the GST in other sectors such as logistics, manufacturing, automotive and consumer products too will impact the chemical and polymer industry.

Recent developments

Chemical companies urge Centre to set up cracker plant in Tamil Nadu

Chemical companies from the South have urged the Centre to facilitate the establishment of a naphtha cracker plant in Tamil Nadu to support investments in downstream industries. A Petroleum Chemicals and Petrochemicals Investment Region (PCPIR) proposed in the southern part of Tamil Nadu has remained on the drawing board, with a proposed oil refinery, the anchor industry for the PCPIR, being delayed. Tamil Nadu PCPIR was to have been developed along the lines of those coming up in Andhra Pradesh, Gujarat, West Bengal and Odisha. It was proposed in Cuddalore and Nagapattinam districts along the coast covering 256 sq km with Nagarjuna Oil Corporation, which is setting up an oil refinery, identified as an anchor tenant. However, the refinery project has been delayed due to financial constraints.

KINFRA to set up Rs 1864 crore Petrochemical Park at Kochi

The Kerala Industrial Infrastructure Development Corporation (KINFRA) has obtained in principle approval from the state government for setting up aRs 1,864 crore petrochemical park in 600 acres of land to be procured from FACT at Ambalamugal, Kochi. The cost includes the cost of land and cost of internal infrastructure. The petrochemical park is proposed to be set up in Kochi which already has a large refinery, fertiliser and chemical factories besides LNG terminal & gas pipeline network being established and a Bulk Terminal and International Container Transshipment Terminal (ICTT). The proposal assumes significance in view of the expansion proposal of BPCL, nearness to the Port and Natural Gas infrastructure at the location. India's petrochemical industry has been one of the fastest growing industries in the country. Petrochemicals contribute about 30 per cent to India's $120 billion worth chemical industry which is likely to grow at a CAGR of 11 per cent over next few years and touch $250 billion by 2020.

Outlook

Indian chemical sector has been performing significantly well since last several years on domestic as well as global front. India is an important player in the global trade of chemicals, plastics and allied products. There is tremendous scope to increase its share in the global trade. This is also reflecting in the form of increasing exports. However, most of the players performance remained weak in FY16, with profit reducing on account of steep fall in chemical prices and inventory losses. But in FY17, the companies in the sector are likely to perform better, as realizations across the chemical products are picking up. Significant growth in specialty chemical and petrochemical segment will also provide fillip to the overall Chemical sector, as increasing consumption from high-end polymer industry and other user segments will help it to garner a growth in double digits in the next 10 years. Implementation of GST will also play important role in growth of the sector, as it will allow tax set offs across the production value-chain, resulting in a drop of the cascading effect of taxes and reduction in the overall production cost.

(Ref. http://money.livemint.com/news/sector/outlook/chemical-industry-to-strengthen-with-pick-up-in-realizations-across-the-products--507818.aspx dated 22.11.2016)

|

|

BACK |

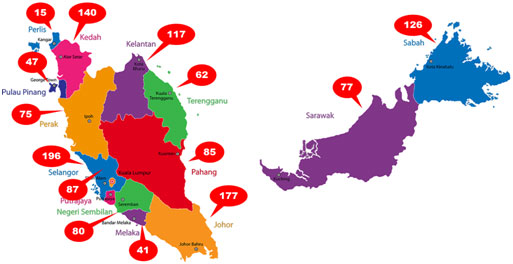

EXPORT STRATEGY MALAYSIA

Market Overview

Malaysia, a middle-income country, has transformed itself since the 1970s from a producer of raw materials into an emerging multi-sector economy. Under current Prime Minister

NAJIB, Malaysia is attempting to achieve high-income status by 2020 and to move farther up the value-added production chain by attracting investments in Islamic finance, high technology industries, biotechnology, and services. NAJIB's Economic Transformation Program is a series of projects and policy measures intended to accelerate the country's economic growth. The government has also taken steps to liberalize some services sub-sectors. Malaysia is vulnerable to a fall in world commodity prices or a general slowdown in global economic activity.

The NAJIB administration is continuing efforts to boost domestic demand and reduce the economy's dependence on exports. Nevertheless, exports - particularly of electronics, oil and gas, palm oil, and rubber - remain a significant driver of the economy. Gross exports of goods and services constitute more than 80% of GDP. The oil and gas sector supplied about 29% of government revenue in 2014. As an oil and gas exporter, Malaysia has previously profited from higher world energy prices, although the rising cost of domestic gasoline and diesel fuel, combined with sustained budget deficits, has forced Kuala Lumpur to begin to address fiscal shortfalls, through initial reductions in energy and sugar subsidies and the announcement of the 2015 implementation of a 6% goods and services tax. Falling global oil prices in the second half of 2014 have strained government finances, shrunk Malaysia’s current account surplus and put downward pressure on the ringgit. The government is trying to lessen its dependence on state oil producer Petronas.

Bank Negara Malaysia (the central bank) maintains healthy foreign exchange reserves; a well-developed regulatory regime has limited Malaysia's exposure to riskier financial instruments and the global financial crisis. In order to attract increased investment, NAJIB raised possible revisions to the special economic and social preferences accorded to ethnic Malays under the New Economic Policy of 1970, but retreated in 2013 after he encountered significant opposition from Malay nationalists and other vested interests. In September 2013 NAJIB launched the new Bumiputra Economic Empowerment Program, policies that favor and advance the economic condition of ethnic Malays.

Malaysia is a member of the 12-nation Trans-Pacific Partnership free trade agreement negotiations and, with the nine other ASEAN members, will form the ASEAN Economic Community in 2015.

Market Challenges

Malaysia restricts open trade in protected industries, such as the automotive and agricultural sectors. Malaysia protects domestic industries by imposing higher duty rates and excessive excise taxes. Malaysia also uses a system of import permits or licenses to reduce imports in protected and strategic sectors.

Government restrictions hamper foreign involvement in several areas, including government procurement contracts; financial, business, and professional services; and telecommunications. In many cases it is imperative to have a local partner, usually a Bumiputra (ethnic Malay-owned) company, to effectively compete in the market.

Malaysian officials continue to make progress in establishing fair and adequate protection of IPR. Although challenges remain, Malaysian officials have augmented their resources to combat online piracy and have sustained their efforts to deny access to piracy websites, taking down infringing content on domestic sites, and conducting raids and arrests of Malaysians either operating or posting links to sites with pirated content. The Ministry of Domestic Trade, Cooperatives and Consumerism (MDTCC), responsible for IPR enforcement, has been largely dependent upon complaints from companies to take action on transshipments of pirated goods.

In the World Bank’s global Doing Business 2016 report, Malaysia ranked 18th place overall among the 189 economies covered in the survey. The 2016 ranking is a slight decrease from 2015, where Malaysia ranked 17 out of 189 economies. Malaysia’s lowest topic rankings are in “registering property” (38th), “enforcing contracts” (44th), “trading across borders” (49th), and “resolving insolvency” (45th). Many of aforementioned market challenges will be resolved or improved under the TPP. Under TPP, Malaysia has committed to eliminate tariffs or substantially improve market access on imports from the United States through tariff reductions and tariff-rate quotas. Further, the TPP Agreement sets strong and balanced standards on IPR protection and enforcement. Under TPP, Malaysia will also make significant improvements to its services markets.(Ref. Prepared by U.S. Embassies abroad).

Malaysia's FTA Involvement

International trade is an important contributor to Malaysia 's economic growth and development. Malaysia 's trade policy is to pursue efforts towards creating a more liberalizing and fair global trading environment. While Malaysia continues to accord high priority to the rule-based multilateral trading system under the World Trade Organisation (WTO), Malaysia is also pursuing regional and bilateral trading arrangements to complement the multilateral approach to trade liberalisation.

Free Trade Agreements (FTAs) are generally aimed at providing the means to achieve quicker and higher levels of liberalisation that would create effective market access between the participants of the FTA. Traditionally confined to trade in goods, with the establishment of the WTO, trade in services has been included in many FTAs.

Malaysia has established FTAs with the following countries:

- Japan;

- Pakistan;

- New Zealand;

- India;

- Chile; and

- Australia.

At the regional level, Malaysia and its ASEAN partners have established the ASEAN Free Trade Area. ASEAN has also concluded FTAs with China, Japan, Korea and India, as well as Australia and New Zealand.

Malaysia 's Free Trade Agreements

- Malaysia-Australia

- Malaysia-Chile

- Malaysia-India

- Malaysia-Japan

- Malaysia-New Zealand

- Malaysia-Pakistan

- ASEAN-Australia and New Zealand

- ASEAN-China

- ASEAN-India

- ASEAN-Japan

- ASEAN-Korea

- Malaysia-Turkey

- Trade Prefential System-Organisation of Islamic Conference(TPS-OIC)

- Developing Eight (D-8) Preferential Tariff Agreement (PTA)

Malaysia Free Trade Agreements under Negotiation

- Malaysia-European Union Free Trade Agreement (MEUFTA)

- Malaysia-EFTA Economic Partnership Agreement (MEEPA)

- ASEAN - Hong Kong Free Trade Agreement (AHKFTA)

Malaysia Economy:-

GDP (purchasing power parity):$817.4 billion (2015 est.),$778.7 billion (2014 est.),$734.6 billion (2013 est.)

Industries:-Peninsular Malaysia - rubber and oil palm processing and manufacturing, petroleum and natural gas, light manufacturing, pharmaceuticals, medical technology, electronics and semiconductors, timber processing; Sabah - logging, petroleum and natural gas production; Sarawak - agriculture processing, petroleum and natural gas production, logging.

Exports: -$175.7 billion (2015 est.), $207.5 billion (2014 est.)

Exports Commodities:- semiconductors and electronic equipment, palm oil, petroleum and liquefied natural gas, wood and wood products, palm oil, rubber, textiles, chemicals, solar panels

Exporting Partners: -Singapore 13.9%, China 13%, Japan 9.5%, US 9.4%, Thailand 5.7%, Hong Kong 4.7%, India 4.1% (2015)

Imports: -$147.7 billion (2015 est.), $172.9 billion (2014 est.)

Import Commodities:- electronics, machinery, petroleum products, plastics, vehicles, iron and steel products, chemicals

Import Partners: -China 18.8%, Singapore 12%, US 8.1%, Japan 7.8%, Thailand 6.1%, South Korea 4.5%, Indonesia 4.5% (2015)

Chemexcil Exports to Malaysia

| Chapter No./Panel |

2013-2014 (Actual) |

2014-15 (Actual) |

% over 2013-14 |

2015-16 (Provisional) |

% over 2014-15 |

| (32) Dyes & (29) Dye Intermediates |

12.51 |

16.49 |

31.81 |

13.33 |

-19.16 |

| (28) Inorganic, (29) Organic & (38) Agro chemicals |

565.85 |

420.66 |

-25.66 |

183.25 |

-56.44 |

| (33) Cosmetics, (34) Soaps, Toiletries and (33) Essential oils |

25.46 |

39.29 |

54.32 |

36.65 |

-6.72 |

| (15) Castor Oil |

3.02 |

67.80 |

2145.03 |

21.99 |

-67.57 |

| Total |

606.84 |

544.24 |

-10.32 |

255.22 |

-53.11 |

Malaysia is the 19th largest export economy in the world and the 25th most complex economy according to the Economic Complexity Index (ECI). In 2014, Malaysia exported $273B and imported $204B, resulting in a positive trade balance of $68.8B. In 2014 the GDP of Malaysia was $338B and its GDP per capita was $25.6k.

The top exports of Malaysia are Integrated Circuits ($40.7B), Refined Petroleum ($24.7B), Petroleum Gas ($21.3B), Palm Oil ($12.4B) and Telephones ($11.6B), using the 1992 revision of the HS (Harmonized System) classification. Its top imports are Integrated Circuits ($28.2B), Refined Petroleum ($22.2B), Crude Petroleum ($7.27B), Gold ($3.17B) and Planes, Helicopters, and/or Spacecraft ($3.15B).

The top export destinations of Malaysia are Singapore ($37.1B), China ($32.6B), the United States ($27.7B), Japan ($27.4B) and Thailand ($12.6B). The top import origins are China ($36.4B), Singapore ($27.4B), Japan ($14.6B), the United States ($14.5B) and Thailand ($12.3B).

Malaysia borders Brunei, Indonesia and Thailand by land and the Philippines, Singapore and Vietnam by sea.

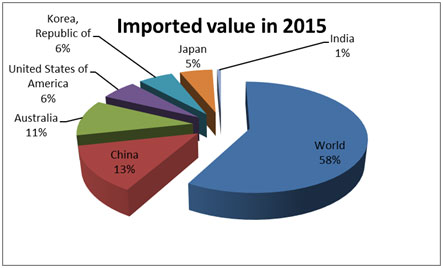

Chapter no. 28 Inorganic chemicals, precious metal compound, isotopes imported by Malaysia

| Exporters |

Imported value in 2015 |

| World |

1898.03 |

| China |

437.66 |

| Australia |

347.05 |

| United States of America |

194.20 |

| Korea, Republic of |

187.69 |

| Japan |

177.80 |

| India |

21.44 |

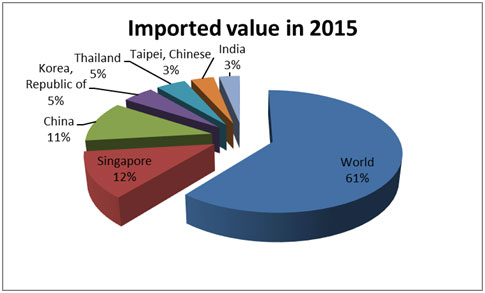

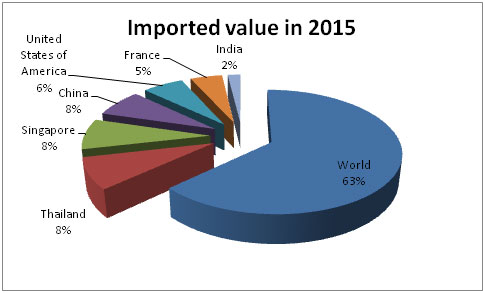

Product: 29 Organic chemicals imported by Malaysia

In USD Million

| Exporters |

Imported value in 2015 |

| World |

3073.14 |

| Singapore |

619.27 |

| China |

555.39 |

| Korea, Republic of |

238.78 |

| Thailand |

227.34 |

| Taipei, Chinese |

176.66 |

| India |

158.88 |

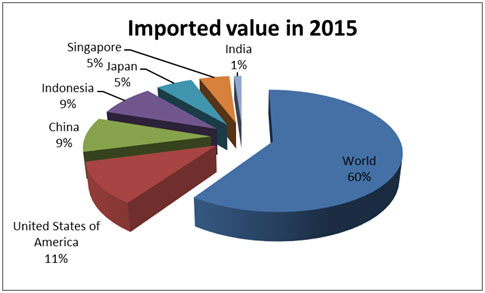

Product: 38 Miscellaneous chemical products imported by Malaysia

In USD Million

| Exporters |

Imported value in 2015 |

| World |

2500.43 |

| United States of America |

469.32 |

| China |

389.31 |

| Indonesia |

359.61 |

| Japan |

231.81 |

| Singapore |

191.21 |

| India |

47.68 |

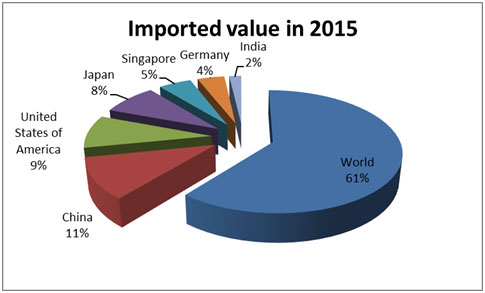

Product: 32 Tanning, dyeing extracts, tannins, derivs,pigmentsetc imported by Malaysia

In USD Million

| Exporters |

Imported value in 2015 |

| World |

743.02 |

| China |

133.30 |

| United States of America |

108.34 |

| Japan |

102.09 |

| Singapore |

60.68 |

| Germany |

50.15 |

| India |

22.34 |

Product: 33 Essential oils, perfumes, cosmetics, toiletries imported by Malaysia

In USD Million

| Exporters |

Imported value in 2015 |

| World |

820.91 |

| Thailand |

107.24 |

| Singapore |

106.50 |

| China |

96.41 |

| United States of America |

80.67 |

| France |

63.01 |

| India |

24.94 |

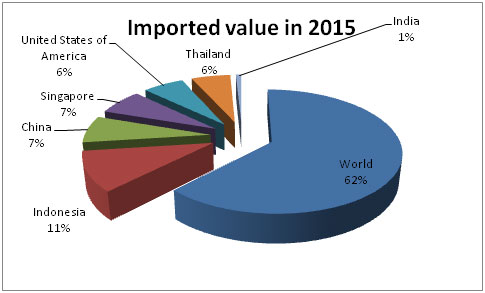

Product: 34 Soaps, lubricants, waxes, candles, modelling pastes imported by Malaysia

In USD million

| Exporters |

Imported value in 2015 |

| World |

597.97 |

| Indonesia |

101.16 |

| China |

69.32 |

| Singapore |

66.05 |

| United States of America |

59.28 |

| Thailand |

56.66 |

| India |

7.84 |

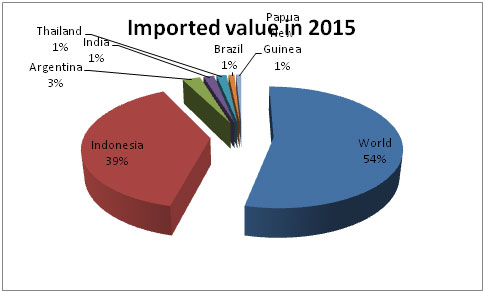

Product: 15 Animal, vegetable fats and oils, cleavage products, etc imported by Malaysia

In USD million

| Exporters |

Imported value in 2015 |

| World |

1821.63 |

| Indonesia |

1314.42 |

| Argentina |

91.04 |

| India |

54.21 |

| Thailand |

51.47 |

| Brazil |

30.68 |

| Papua New Guinea |

27.33 |

|

|

Enrolment of Existing Taxpayers on GST Network Portal

| EPC/LIC/GST_ENROLMENT |

16th November, 2016 |

| |

| ALL THE MEMBERS OF THE COUNCIL |

| |

|

Enrolment of Existing Taxpayers on GST Network Portal |

|

Dear Members,

We would like to inform you that the “Goods and Services Tax Network (GSTN)” for providing IT infrastructure and services to the Central and State Governments, taxpayers and other stakeholders has been set up and has started accepting registration applications on portal www.gst.gov.in .

The schedule of the enrolment activation drive for states is given below for completion during the specified dates. However, the window will be open till 31/01/2017 for those who miss the chance.

|

States |

Start Date |

End Date |

|

Puducherry, Sikkim |

08/11/2016 |

23/11/2016 |

|

Maharashtra, Goa, Daman and Diu, Dadra and Nagar Haveli, Chhattisgarh |

14/11/2016 |

30/11/2016 |

|

Gujarat |

15/11/2016 |

30/11/2016 |

|

Odisha, Jharkhand, Bihar, West Bengal, Madhya Pradesh, Assam, Tripura, Meghalaya, Nagaland, Arunachal Pradesh, Manipur, Mizoram |

30/11/2016 |

15/12/2016 |

|

Uttar Pradesh, Jammu and Kashmir, Delhi, Chandigarh, Haryana, Punjab, Uttarakhand, Himachal Pradesh, Rajasthan |

16/12/2016 |

31/12/2016 |

|

Kerala, Tamil Nadu, Karnataka, Telangana, Andhra Pradesh |

01/01/2017 |

15/01/2017 |

|

Enrolment of Taxpayers who are registered under Central Excise Act/ Service Tax Act but not registered under State VAT |

01/01/2017 |

31/01/2017 |

|

Delta All Registrants (All Groups) |

01/02/2017 |

20/03/2017 |

For additional information, members may refer to the attached update provided by our GST Consultants- M/s. VoxLaw Mumbai.

Members are therefore requested to take note of the same and arrange to do the needful accordingly

http://chemexcil.in/uploads/tbts/VoxLaw_GST_Update_15112016.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI

Executive Director

CHEMEXCIL

|

BACK

|

Amendments in Product Description in MEIS Schedule (Appendix 3B)

| EPC/LIC/DGFT/MEIS-AMENDMENTS |

25th November 2016 |

| |

| ALL THE MEMBERS OF THE COUNCIL |

| |

|

Amendments in Product Description in MEIS Schedule (Appendix 3B) |

|

Dear Members,

We would like to inform you that O/o DGFT, New Delhi has issued Public Notice No. 44/2015-2020 dated 15th November 2016 notifying amendments in product description in MEIS Schedule ( Table 2 of Appendix 3B).

The list of items where product description has been amended/ changed, can be downloaded using below link :

http://dgft.gov.in/Exim/2000/PN/PN16/PN4416.pdf

The above changes are deemed to have been applicable from the initial dates on which the said products where included in MEIS Schedule (Table 2 of Appendix 3B).

Members are requested to take note of these amendments and do the needful, so that product description mismatch related issues are not faced while claiming the incentive.

Thanking You,

Yours faithfully,

(S.G. BHARADI

Executive Director

CHEMEXCIL

|

BACK

|

UPDATED MODEL GST LAW (NOVEMBER 2016)

| EPC/LIC/MODEL-GSTLAW (updated) |

30th Nov, 2016 |

| |

| ALL THE MEMBERS OF THE COUNCIL |

| |

|

UPDATED MODEL GST LAW (NOVEMBER 2016) |

|

Dear Members,

As you are aware, Goods and Services Tax (GST) is expected to get implemented on April 1, 2017.

In this connection, government had earlier issued Model GST Law in June 2016 for comments of trade/ industry. Subsequently, several representations were sent from industry related to provisions of Model GST law.

Now on 26 Nov 2016 has issued revised/ updated Model GST Law. The links for downloading the updated Model GST Law (November 2016) are given below:

http://www.cbec.gov.in/resources//htdocs-cbec/gst/draft-model-gst-law-25-11-2016.pdf

http://www.cbec.gov.in/resources//htdocs-cbec/gst/draft-igst-law-25-11-2016.pdf

http://www.cbec.gov.in/resources//htdocs-cbec/gst/draft-gst-compensation-law.pdf

Members are requested to go through the same and send their comments/ observations, if any, on our e-mail id’s deepak.gupta@chemexcil.gov.in & info@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI

Executive Director

CHEMEXCIL

|

BACK

|

|