CONTENTS

Chairman's Desk |

Chemexcil Activities |

|

Report of Awareness Seminar on Sabka Vishwas (Legacy Dispute Resolution) Scheme 2019 and CAP INDIA PROMOTION at EEPC INDIA’S Conference Hall, Kolkata on 14-11-2019

|

|

CAPINDIA Road Show and Chemexcil Membership Seminar Vapi

|

|

2nd China International Import Expo (CIIE) Exhibition” to be held at Shanghai, China from 5th to 10th November, 2019

|

|

Workshop on Developments in Chemical Regulations (S.Korea, UK & EU)" Chennai

|

|

Workshop on Developments in Chemical Regulations (S.Korea, UK & EU)" Mumbai

|

News Articles |

|

Govt urged to look into data protection for Pesticide Management Bill |

|

India: Draft amendment to the Geographical Indications of Goods (Registration & Protection) Rules, 2002 |

|

How Brexit can change trade negotiations between India and UK |

|

India may downsize imports from Malaysia after Kashmir remark at UN: Report |

|

India’s concerns about RCEP remain the major obstacle to world’s largest trade deal |

|

PM Modi to take a call on all pending RCEP issues |

|

Indian firms eye base in the Netherlands, post-Brexit |

|

DGFT issues advisory for exports over issue of late cut imposed by the system while applying for MEIS |

|

Non-Tariff Trade Regulations on the Rise in Asia-Pacific |

|

Govt committed to safeguarding IP content: Commerce Secretary |

|

India Raising Trade Barriers against South Kore |

|

New foreign trade policy may have simpler export promotion schemes |

|

Govt steps improving India's ease of doing business rank: Commerce ministry |

|

Commerce Ministry considers 5-year extension of income tax benefits for SEZ units |

|

Commerce Ministry held discussions with exporters: MEIS, credit, IGST refund issues raised |

|

India and Ecuador ink Protocol to start trade negotiations |

|

India, Peru to hold next round of FTA talks in Dec |

|

New Delhi keen for early conclusion of India-European Union free trade agreement |

|

Efforts on to fast-track India's free trade agreements with UK, EU |

|

India not in a hurry to sign FTAs, but trade isolation not good for country: Commerce Minister |

|

WTO panel upholds US case, rules India's export subsidies illegal |

|

WTO rules against India’s export subsidies: All you need to know |

|

India to appeal against WTO dispute panel’s ruling on export promotion schemes |

|

India, Germany agree to boost industrial cooperation |

|

India decides to not join RCEP agreement, Modi says deal does not address our concerns |

|

Review of FTA with Asean will help balance trade: PM Narendra Modi |

|

Chemical & petrochemical industry must protect environment at any cost: Chemical Secy |

|

India proposes making 72 chemical standards mandatory |

|

India, EU to push for free trade pact again |

|

WTO ruling against export incentives: Should Indian exporters be worried? |

|

India resumes buying Malaysian palm oil as Kuala Lumpur offers discount |

|

Opinion | Asia’s miracle economies have lessons for India’s trade policy |

Chemexcil Notices |

|

Incoterms 2020 released by International Chamber of Commerce (ICC) |

|

RBI EDPMS, Exemption from provisions of Caution listing extended till 31/12/2019 |

|

DGTR, Final Findings of New Shipper Review (NSR) pertaining to Anti-Dumping Duty imposed on the imports of “Saturated Fatty Alcohols” originating in or exported from Indonesia, Malaysia, Thailand and Saudi Arabia, as requested by Pt. Energi Sejahtera Mas, (PTESM) (Producer from Indonesia) and Sinarmas Cepsa Pte. Ltd. (SCPL) (Exporter from Singapore) initiated on 15.01.2019 |

|

GST, Eligibility to file a refund application in FORM GST RFD-01 for a period and category under which a NIL refund application has already been filed |

|

DGFT, Issue of Late Cut being imposed by the system while applying MEIS on reactivated shipping bills |

|

GST, Notifications issued to implement the decisions of recent GST Council meeting |

|

DGFT, Amendment in Import Policy Condition of Urea under Exim Code 31021000 in the ITC (HS) 2017, Schedule- I (Import Policy) |

|

Reduction of excessive dependence on imports of chemical & petrochemical sector, Reduction of Duties on certain Chemicals Imported from USA |

|

DGFT, Amendment in Import Policy Condition of Urea under Exim Code 31021000 in the ITC (HS) 2017, Schedule- I (Import Policy) |

|

JNCH Claim of refund amount on account of double-payment of Customs Duty, Eligibility Criteria for availing of DPD Scheme by Importers |

|

CBIC, Clarification regarding inclusion of cesses, surcharge, duties, etc. levied and collected under legislations other than Customs Act, 1962, Customs Tariff Act, 1975 or Central Excise Act, 1944 in Brand Rate of duty drawback |

|

Updates on Recent Trade Remedy Measures by DGTR(from 1st Oct 2019 onwards) |

|

DGFT Mis-declaration of imported goods under 'Others' category of ITC (HS), 2017, Schedule-I (Import Policy) |

|

JNCH, Introduction of online module for facilitation of MSMEs |

|

DGFT, Amendment in Conditions for refund of Deemed Export Drawback |

|

CBIC, Generation and quoting of Document Identification Number (DIN) on any communication issued by the officers of the CBIC to tax payers and other concerned persons on or after 8th Nov 2019 |

Export Strategy Peru |

|

|

|

Chairman's Desk

|

| Ajay Kadakia |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-Exporters,

I have pleasure to bring to you the bi-monthly issue of CHEMEXCIL Bulletin for the month of OCT-NOV-2019.

I am glad to know that India gained about $755 million in additional exports, primarily related to chemicals, metals and ore, to the US in the first half of 2019 due to the trade diversion effects of Washington’s tariff war with China, as per the study conducted by the UN trade and investment body.

Friends, I attended the recently concluded meeting on discussion on Export Performance called by Commerce Secretary AnupWadhawan under his chairmanship on 24th October, 2019 in New Delhi Commerce Secretary (CS) welcoming the EPCs to the meeting and outlining the current situation of Indian Exports and the challenges being faced by export sector. Given the backdrop of the global slowdown, feedback and inputs are being sought on key issues related to exports, which can also be taken up for redressal. It was mentioned that EPCs would get full support from government. EPCs were urged to work towards better export performance and take all possible steps to promote exports. I had highlighted below two issues

· NGT (National Green Tribunal) was imposing environment based penalties on many chemical industries, thereby hampering export performance.

· A request was made that Interest Equalization Scheme (IES) be expanded by including additional tariff lines for merchant exporters/ Non MSME exporters from chemical sector.

Commerce Secretary advised the respective departments to look into the matter of our requests.

Besides, product and territory specific issues, some of the overall cross-cutting issues which required priority attention were also discussed which includes

TMA (Transport and Marketing Assistance) scheme - Many exporters felt that presently the scheme covers only freight component. However, for optimal utilization, there is need for coverage of Transport and Marketing Assistance for exports by air and sea. It was mentioned that, due to budget constraints and this being a new scheme, present status of implementation, covers a few components. However, the same can be extended during subsequent years.

ROSTCL (Rebate of State and Central Taxes and Levies) –There were issues raised in the meeting regarding implementation of existing export promotion schemes. This was clarified and it was emphasized that scheme like MEIS which may be discontinued since they are not compatible with WTO framework. In this regard, government has proposed to come with a new scheme called “Remission of Duties and Taxes on Exported products (RoDTEP)” which is eventually expected to phase out MEIS w.e.f 01/01/2020. Export Promotion Councils/ Trade bodies havebeen requested to provide data with respect to un-rebated taxes/ duties/levies used in the manufacture of export product(s)in the prescribed formats. Council members have been requested to participate in this important exercise and provide data.

Category of risky exporters - The matter of categorizing exporters as ‘Risky Exporters’ and subsequent harassment by way of holding up export consignments for 100% physical verification was flagged by various EPCs during the meeting. EPCs informed that the categorization was being made based on RMS on GST portal which the EPCs said may not be fair and was not non-transparent. It was pointed out that the criteria of categorization is never revealed and once declared a risky exporters, the process of getting removed from the categorization is also not clear. Due to this arbitrariness, the exports were getting affected. In this regard, the council has sent representation to CBIC requesting them for relief in this matter so that exports are not impacted.

Export credit and e-wallet - Exporters continued to face problems, pertaining to availability of export credits, faster GST refunds etc. It was mentioned that the proposed e-wallet scheme, needs to be implemented on a priority basis and would help in addressing this issue. It was also mentioned that this issue would be addressed appropriately.

Pre-import issue: We understand that Problems are again being faced by exporters due to Pre-import condition even after paying IGST plus interest as per DRI claims. In this competitive business environment where exports have started declining, it is essential for legitimate exporters to concentrate on export promotion rather than getting distracted by such harassment. In the interest of export promotion, have sent representation to CBIC so that immediate relief is provided to such exporters and pre-import condition is withdrawn retrospectively.

Amendments in MAI scheme - Many exporters mentioned about need for amendments in MAI scheme, including providing assistance to buyers, from developed as well as, developing countries and ensure better participation from a larger number of exporters and EPCs.

Friends you might be aware that India is considering restricting imports of some products from Malaysia including palm oil, which is a raw material for Indian cosmetics Industry. India is looking for ways to limit palm oil imports and may place restrictions on other goods from the country. Palm oil accounts for nearly two-thirds of India’s total edible oil imports. India buys more than 9 million tons of palm oil annually, mainly from Indonesia and Malaysia. As per my industry sources Indonesia is eager to sell more and more palm oil to India. India could also increase imports of soya oil from Argentina and sunflower oil from Ukraine to offset any drop in Malaysian palm oil shipments. Indonesia wants to increase exports of palm oil to India and wants to buy sugar from India in exchange.

You might also be aware that India Lost the Export Incentive Case Filed by US at WTO due to 'Inconsistency' with International Trade Norms. With this ruling, India will have to re-work these incentive schemes to comply with the WTO ruling. However, it can file appeal against the ruling at the appellate body of the WTO dispute settlement mechanism. In such a scenario, the proposed RoDTEP scheme becomes very relevant as it will neutralize un-refunded taxes on exports which makes it WTO compatible.

India decides not to join RCEP agreement, as the deal does not address our concerns. Also, India has decided not to be a party to join the Regional Comprehensive Economic Partnership (RCEP) agreement with China and other Asean countries over imbalance in the agreement that was reached.

On trade promotion part council initiated various trade promotional activities in last 2-months the detailed report of which is a part of this bulletin.

The 9th Asia International Dye Industry, Pigments and Textile Chemicals Exhibition (Interdye Asia 2019), co-organized by Shanghai International Exhibition Co Ltd., took place from November 14th to 16th, 2019 at the Gujarat University Convention and Exhibition Center. Undersigned inaugurated the event, wherein approximately 100 exhibitors from India, mainland China and Taiwan province showcased their products in this event. The exhibition was cohosted by China Dyestuff Industry Association and China Council for the Promotion of International Trade, Shanghai Sub-Council and supported by CHEMEXCIL.

The exhibition followed closely the development of the industry, with international exhibitors including Runtu, Jihua, Yabang, Boao, Liansheng, Tianyuan, Runhe, Yadong Longxin, Liyuan, Jinjing, KIRI, ROSSARI, GOPINATH, HINDPRAKASH, FUMO, SPECTRUM, DEEPAK and so on. They promoted the new environment-friendly printing and dyeing products and new application technologies.

China and India are now global leaders in the Colorants fields with immense opportunities for further growth and consolidation, and thus it is natural for Colorants industry of both the countries to come closer and collaborate for mutual benefit. A strong domestic market in both the countries gives further boost to colorants' growth potential, with anticipated sharp increase in per capita consumption in the coming years. This growth has not gone unnoticed by the global colorants fraternity.

As far as exports are concerned, the chemical Exports for April-October, 2019-20 were valued at USD 11.06 billion as compared to the corresponding period last year, viz. April-October-2018-19 which was USD 10.98 Billion registering a surplus of 0.68 percent because of overall decrease in demand. Chemical Imports for April-October-2019-20 were valued at USD 13.21 billion as compared to the period April-October-2018-19 which was USD 14.86 Billion registering a deficit of 11.09 percent

I sincerely hope and trust that you would find this Chemexcil News bulletin informative and useful. Meanwhile, the Secretariat eagerly and enthusiastically looks forward to receiving your valuable feedback and suggestions which would eventually help us to further improve this bulletin.

With Regards,

Ajay Kadakia

Chairman Chemexcil

|

BACK |

|

Report of

Awareness Seminar on Sabka Vishwas (Legacy Dispute Resolution) Scheme 2019 and CAP INDIA PROMOTION at EEPC INDIA’S Conference Hall, Kolkata on 14-11-2019

CHEMEXCIL, PLEXCONCIL & IPF had jointly organized an Awareness Seminar on Sabka Vishwas (Legacy Dispute Resolution) Scheme 2019 and CAP INDIA Promotion on 14th November, 2019 at EEPC INDIA’s Conference Hall, ITFC (Ground Floor), 1/1 Wood Street, Kolkata.

The following representatives were present in the meeting –

- Mr. Partha Santra, Superintendent , CGST, Kolkata

- Mr. Debdudal Chatterjee, Superintendent , CGST, Kolkata

- Shri Amit Pal – COA Member Plexconcil

- Shri Nilotpal Biswas, Regional Director Plaxconcil

- Shri Soumen Guha, Regional Officer Chemexcil

The program began with honoring the distinguished guests with presentation fresh flowers. Welcome speech was given by Shri Amit Pal – COA Member Plexconcil.

Mr. Debdudal Chatterjee, Superintendent , CGST, Kolkata made a presentation on Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 and interacted with the participants.

Mr. Chatterjee covered the following points –

- Objectives of Sabka Vishwas Scheme.

- Benefits

- Features

- Cases covered under the Scheme

- How to apply for SVLDRS.

Mr. Partha Santra, Superintendent , CGST, Kolkata, the Key Note Speaker, gave an informative presentation on New Returns System under GST. He explained about the New Return System under GST, Sec 43A, Sec 16(2), Sec 37 & 38 etc., and Returns under the New GST Return System.

The event attracted good response with above 40 member-exporters attending the seminar. During the Seminar, we have promoted Cap India exhibition with shown screening of film on CAP INDIA and banner also been displayed and brochure given to the participations.

All questions and doubts of the delegates were answered methodically. The session concluded with Vote of Thanks.

The seminar was well appreciated by all our member exporters.

| |

|

Dignitaries during the Seminar on Sabka Vishwas (Legacy Dispute Resolution) Scheme 2019 and CAP INDIA Promotion @ Kolkata on 14-11-2019 |

| |

|

Mr. Partha Santra, Superintendent , CGST, Kolkata during the interactive session on the Seminar on Sabka Vishwas (Legacy Dispute Resolution) Scheme 2019 and CAP INDIA Promotion @ Kolkata on 14-11-2019 |

BACK |

|

CAPINDIA Road Show and Chemexcil Membership Seminar Vapi

| |

|

| From left Mr. Manish Shah, Sr. VP from Unison, Mr. Manoj Kumar, Chief Advisor Credit insurance Unison, Mr. Prakash Bhadra, President VIA, Mr. Satish Patel, Hon. Secretary VIA, Mr. Prafulla Walhe Dy. Director Chemexcil . |

Chemexcil Mumbai Office organized Chemexcil Membership awareness seminar along with seminar on Export Risks Management followed by CAPINDIA interactive meeting on 23rd October-2019 at Vapi Industries Association, VIA House, Plot No. 135, GIDC, Vapi - 396195 jointly organized by CHEMEXCIL, PLEXCONCIL, in association with Vapi Industries Association.

The seminar was attended by Mr. Manish Shah, Sr. VP from Unison, Mr. Manoj Kumar, Chief Advisor Credit insurance Unison, Mr. Prakash Bhadra, President VIA, Mr. Satish Patel, Hon. Secretary VIA, Mr. Prafulla Walhe Dy. Director Chemexcil and 30-member exporters from Vapi region.

Mr. Prafulla Walhe Dy. Director, Chemexcil briefed about the activities of Chemexcil and interacted with participants. He requested the non members of chemexcil to become the member of council and take an advantage of various schemes of Ministry of commerce and Industries. He also requested them to exhibit and visit CAPINDIA 2019 event dated 2nd - 4th December 2019 at Mumbai.

The seminar was well attended by the 30-member exporters of the Vapi and nearby region. Mr. Manish Shah, Sr. VP from Unison, Mr. Manoj Kumar, Chief Advisor Credit insurance Unison, emphasized the need to credit insurance and urged participants to cover the risk of trade by following proper insurance process.

BACK |

|

2nd China International Import Expo (CIIE) Exhibition” to be held at Shanghai, China from 5th to 10th November, 2019

Indiaparticipated in 2nd China International Import Expo (CIIE) held from November 5-10, 2019 at National Exhibition and Convention Centre (NECC), Shanghai, China with the support of Ministry of Commerce & Industry, Government of India. The key objective was to enhance trade and economic cooperation between India & China.The Government of China has given a “Guest Country of Honor” status to India in this 2nd editionthereby giving India a bigger Country Pavilion to showcase its developments & achievements in goods, trade in services, Investment opportunities etc. FIEO was designated as a lead agency by the Government of India to set up Country Pavilion.

CIIE is an import-themed expo, an open and cooperative platform for countries and regions worldwide to showcase their development and to engage in international trade and economic globalization.CIIE event was inaugurated by the Hon’ble President of the People’s Republic of China.

Keeping in view the above position of India in the Expo in the 2nd edition and an ideal platform to promote India’s exports to China, CHEMEXCIL participated as an associate partner in INDIA Country Pavilion to showcase developments, achievements andstrengths of Indian Chemical Industry and the role of CHEMEXCIL to promote exports of Dyes & Dye Intermediates, Basic Organic & Inorganic Chemicals, Agrochemicals, Cosmetics & Toiletries, Essential Oils & Castor Oil pertaining to our sector.

Shri Ajay Kadakia (Chairman), Shri S G Bharadi (Executive Director) and Dr J P Tiwari (Regional Director) from CHEMEXCIL participated in this event. Graphics / Videos / Brochures were displayed to showcase about strengths of Indian Chemical Industry and the role of CHEMEXCIL in promoting exports.

Shri Vikram Misri, Ambassador of India in China, and Shri Sanjay Chaddha, Additional Secretary, Ministry of Commerce, Govt of India inaugurated India’s Country Pavilion. Commerce Secretary, Dr.Anup Wadhawan visited India Pavilion and interacted with the participants. Buyer Seller Meet (BSM) was organized by FIEO and ICC wherein Dr.Anup Wadhawan, Commerce Secretary was the Chief Guest and a presentation was made by our chairman, Shri Ajay Kadakiaabout Indian Chemical Industry &Potential of Exports to China.

| |

|

Shri Vikram Misri, Ambassador of India in China, and Shri Sanjay Chaddha, Additional Secretary, Ministry of Commerce, Govt of India inaugurated India’s Country Pavilion. |

|

Shri Vikram Misri, Ambassador of India in China, and Shri Sanjay Chaddha, Additional Secretary, Ministry of Commerce, Govt of India interacting with the Shri Ajay Kadakia, Chairman and Shri S G Bharadi, Executive Director, CHEMEXCIL. |

|

Dr. Anup Wadhawan, Commerce Secretary, Govt of India interacting with Shri Ajay Kadakia, Chairman and Shri S G Bharadi, Executive Director, CHEMEXCIL alongwith Shri Anil Kumar Rai, Consul General of India at Shanghai, China. |

|

Left to right Shri Ajay Kadakia, Chairman, CHEMEXCIL, Shri Vikram Misri, Ambassador of India in China,Shri S G Bharadi, Executive Director, CHEMEXCIL, Dr J P Tiwari, Regional Director, CHEMEXCIL in CHEMEXCIL stall. |

BACK |

|

Workshop on Developments in Chemical Regulations (S.Korea, UK & EU)" Chennai

CHEMEXCIL, with SSS (Europe) AB had jointly organized seminar on “Developments in Chemical Regulations (S. Korea, UK & EU), Chennai dated 26th November 2019 at Rajpark Hotel., TTK Alwarpet, Chennai, India.

The following representatives were present during the Seminar

• Mr. Shisher Kumra, Executive Director, SSS (Europe) AB, Sweden

• Mr. Prafulla Walhe, Dy. Director, CHEMEXCIL, Mumbai

• Mr. Ilanahai, President of Chemical Industry Association, Chennai

• Mr. Shrirang Bhoot, CTO,NSSS Pvt. Ltd, Nagpur

The program started with honoring Mr.Ilanahai, President of Chemical Industry, association, Chennai and Mr. Prafulla Walhe, Dy. Director, CHEMEXCIL, Mumbai.

The flow of program was as under

TIME SLOTS |

TOPIC |

SPEAKER |

INAUGURAL SESSION |

16:00 – 16:10 Hrs. |

Welcome address |

Mr. Shisher Kumra

Executive Director,

SSS (Europe) AB, Sweden |

16:10 – 16:20 Hrs. |

Inaugural address |

Mr.Prafulla Walhe

Dy. Director

CHEMEXCIL, Mumbai |

16:20 – 16:30 Hrs. |

Key Note address |

Mr.Ilanahai, President of Chemical Industry Association, Chennai |

TECHNICAL SESSION | EU REACH | K-REACH | UK REACH |

16:30 – 17:15 Hrs. |

Update on EU REACH Regulation - Roles and Responsibilities of no EU exporter. |

Mr. Shisher Kumra

Executive Director,

SSS (Europe) AB, Sweden |

17:15 – 18:00 Hrs. |

Introduction to Revised K-REACH

and Sub-ordinance (draft) |

Mr. Shrirang Bhoot

CTO,

NSSS Pvt. Ltd, Nagpur |

18:00 – 18:30 Hrs. |

Update on Brexit – its implications and Draft Indian Chemical Policy |

Mr. Shisher Kumra

Executive Director,

SSS (Europe) AB, Sweden |

18:30 – 19:00 Hrs. |

Q&A Session |

|

19:00 – 20:30 Hrs. |

Dinner |

Welcome speech was given by Mr. Shisher Kumra,Executive Director, SSS (Europe) AB, Sweden.

Mr. Prafulla Walhe Dy. Director Chemexcil briefed about the revised MAI guideline on support for statutory compliances, he also briefed about the case on REACH evaluation process and advised members to take the compliance documentation and declaration very seriously in order to avoid heavy penalties under REACH.

Mr.Ilanahai, President of Chemical Industry Association, Chennaiinformed about the overall situation in chemical industry and suggested participants to enhance their skills in order to facilitate international trade business.

Mr. Shisher Kumra,Executive Director, SSS (Europe) AB, Sweden made presentation on Update on EU REACH Regulation - Roles and Responsibilities of no EU exporter, Update on Brexit – its implications and Draft Indian Chemical Policy.

Mr. Shrirang Bhoot, CTO, NSSS Pvt. Ltd, Nagpur briefed and presented Introduction to Revised K-REACH,and Sub-ordinance (draft)

The Seminar attracted good response with above 60 member-exporters participation. CAPINDIA brochure were distributed toall participants. All questions and doubts of the delegates were answered by the speakers. The session concluded with Vote of Thanks

The seminar was well appreciated by all our member exporters

| |

|

|

A bouquet of flowers presented by Mr.Shisher Kumra,Executive Director, SSS (Europe) AB, Sweden to Mr. Prafulla Walhe, Dy. Director, Chemexcil and in center Mr.Ilanahai, President of Chemical Industry Association, Chennai |

Mr. Shisher Kumra,Executive Director, SSS (Europe) AB, Sweden making a presentation on technical topic |

BACK |

|

Workshop on Developments in Chemical Regulations (S.Korea, UK & EU)" Mumbai

CHEMEXCIL, with SSS (Europe) AB had jointly organized seminar on “Developments in Chemical Regulations (S. Korea, UK, Turkey, Taiwan& EU), in Mumbai dated 28thNovember 2019 at The Orchid Hotel Mumbai Vile Parle

The following representatives were present in the Seminar –

• Mr. Shisher Kumra, Executive Director, SSS (Europe) AB, Sweden

• Mr. Prafulla Walhe, Dy. Director, CHEMEXCIL, Mumbai

• Mr. Shrirang Bhoot, CTO,NSSS Pvt. Ltd, Nagpur

• Mrs. Ankansha,AGM, NSS Nagpur

TIME SLOTS |

TOPIC |

SPEAKER |

10:30 – 10:40 Hrs. |

Welcome address |

Mr. Shisher Kumra

Executive Director,

SSS (Europe) AB, Sweden |

10:40 – 10:50 Hrs. |

Inaugural address |

Mr.Prafulla Walhe

Dy. Director

CHEMEXCIL, Mumbai |

10:50 – 11:10 Hrs. |

Update on EU REACH Regulation - Roles and Responsibilities of no EU exporter. |

Mr. Shisher Kumra

Executive Director,

SSS (Europe) AB, Sweden |

11:10 – 11:30 Hrs |

Update regarding the Poison Center Notification |

Mr. Shrirang Bhoot

CTO,

NSSS Pvt. Ltd, Nagpur |

11:30 – 12:00 Hrs. |

Introduction to Revised K-REACH

and Sub-ordinance (draft) |

Mr. Shrirang Bhoot

CTO,

NSSS Pvt. Ltd, Nagpur |

12.00-12.35 Hrs. |

Introduction to Turkey REACH and Taiwan Regulations |

Mrs. Ankansha

AGM

NSS Nagpur |

12:35 – 13:00 Hrs. |

Update on Brexit – its implications and Draft Indian Chemical Policy |

Mr. Shisher Kumra

Executive Director,

SSS (Europe) AB, Sweden |

13:00 – 13:30 Hrs. |

Q&A Session |

|

13:30 – 14:30 Hrs. |

Lunch |

Welcome speech was given by Mr. Shisher Kumra,Executive Director, SSS (Europe) AB, Sweden followed by REACH update.

Mr. Prafulla Walhe Dy. Director Chemexcil briefed about the revised MAI guideline on support for statutory compliances, he also informed the case on REACH evaluation process and advised members to take the compliance documentation very seriously.

Mr. Shisher Kumra,Executive Director, SSS (Europe) AB, Sweden made presentation on, Update on Brexit – its implications and Draft Indian Chemical Policy

Mr. Shrirang Bhoot, CTO, NSSS Pvt. Ltd, Nagpur briefed Update regarding the Poison Center Notification and presented Introduction to Revised K-REACH,and Sub-ordinance (draft)

Mrs. Ankansha, AGM, NSS Nagpur updated on Introduction to Turkey REACH and Taiwan Regulations.

The Seminar attracted good response with above 70 member-exporters participation. All questions and doubts of the delegates were answered by the speakers. The session concluded with Vote of Thanks.

The seminar was well appreciated by all our member exporters.

| |

|

Mr. Prafulla Walhe, Dy. Director, Chemexcil briefing on New MAI guideline to participants |

|

Mr. Shisher Kumra,Executive Director, SSS (Europe) AB, Sweden during the presentation on technical topic |

| |

BACK |

|

Govt urged to look into data protection for Pesticide Management Bill

The onus is on the government to address the concerns of the crop protection industry in the Pesticide Management Bill, which is on the agend

a in the winter session of Parliament. These include data protection and alignment with best international practices and regulatory reforms by reducing registration timelines of crop protection products.

This was stated Rajendra Velagala, chairman, CropLife India, at its 39th Annual General Meeting (AGM). CropLife India is an association of 18 R&D-driven crop science companies.

P Raghavendra Rao, secretary, Department of Chemicals and Petrochemicals, Government of India, said, “The role of agrochemicals in the development of the food grains production in India is critical, considering the fact that India is predicted to be the most populous country by 2030.”

The day-long AGM witnessed an inaugural and four technical sessions with experts’ and key government officials’ conglomeration, on the cause of supporting the farmer.

The sessions included such topics as New Government’s Vision for Agriculture Transformation in India; Bringing Innovation to the Farmers; Case for Regulatory Data Protection in India; Regulatory Reforms and Global Best Practices; Fast Track Adoption of Drones Application Technology Solutions and Ensuring Quality Inputs for Farmers.

Concurring with Rao, Panjab Singh, president, National Academy of Agriculture Sciences, said, “From a problem of deficit, we are now going through the problem of plenty. The issue of rising population needs to be addressed by sustaining agriculture and production, so that livelihood can be maintained.”

Ashok Dalwai, chief executive officer, National Rainfed Area Authority, Ministry of Agriculture and Farmers Welfare, Government of India, said, “Unfortunately the reforms of 1991, bypassed the agricultural sector hence we need to improve our agriculture, now. It is imperative for the government to listen to the industry, as it will lead to solutions.”

He added, “Democracy, institution and technology are the important ingredients for development of a nation and there is need for inorganic competition.”

Ashwani Kumar, joint secretary, seeds and M&T, Ministry of Agriculture and Farmers’ Welfare, Government of India, informed, “ICAR-IARI is conducting a study on the application of crop protection products by drones and the report will be submitted soon to the ministry. We are working in close coordination and will issue the guidelines for drone applications, at the earliest.”

P K Chakrabarty, member, Agricultural Scientists Recruitment Board (ASRB), informed, “The Government of India has approved an International Best Practice of Croup Grouping on August 14, 2019.”

“Regulatory reforms and the new crop protection products has to be given faster registration,” he added.

Sianghee Tan, executive director, CropLife Asia, said, “The expertise of the Indian IT sector should be utilised in the growth of agriculture in India. Apart from attracting the Indian youth to farming, technology will help in mitigating the risk and aid in doubling farmers’ incomes.”

K C Ravi, vice-chairman, Crop Life India, stressed, “The need for coordinated action by all stakeholders to address the policy bottlenecks, which are slowing the growth of the agriculture sector.”

The crop protection industry has played a major role in ensuring food and nutritional security of the nation besides making us one of the key agricultural output countries in the world. Challenges are getting complex with invasion of new pests like fall army worm, build-up of resistance, climate change and associated vagaries of weather.

Crop Life India members are not only committed to bring latest and safer innovations, but also equally committed to educate farmers on their safe and responsible use. There are many examples of this commitment over the years:

India is among the few countries to introduce latest innovations and greener chemistries.

Over 40 lakh farmers have been trained in the safe and responsible of crop protection products

Crop Life members continue to work closely with farmers, scientific community and policy makers to address current as well as future challenges. However, the cost of research has gone up, and it is estimated that the cost of discovery and development of a new active ingredient is about $280 million.

While Crop Life member companies are committed to innovation to the core, this also means fewer new active ingredients are coming out of research now than in the past.

If Indian agriculture must flourish, be more competitive, quality-driven, reducing wastages as well as losses to enable our farmers to be more successful, it is absolutely essential that a progressive environment is in place that fosters innovations.

(Source: http://www.fnbnews.com/Top-News/govt-urged-to-look-into-data-protection-for-pesticide-management-bill-51904 dated 1st Oct-2019)

BACK |

|

India: Draft amendment to the Geographical Indications of Goods (Registration & Protection) Rules, 2002

The Ministry of Commerce and Industry on September 16, 2019 has released the Draft amendment to the Geographical Indications of Goods (Registration & Protection) Rules, 2002 (hereinafter referred to as the ‘draft amendment rules’). The amendment proposes to further strengthen the Intellectual Property Ecosystem by reducing the fees to be paid for the GI registration process and easing the procedure for registration of an authorized user of the registered geographical indication.

The draft amendment rules were released for the information of the stakeholders and is available for suggestions and comments by stakeholders for a period of thirty days from the date on which the Official Gazette, containing the notification, were made available to the public.

Proposed Changes in the Draft Amendment Rules

Only Proposed authorized user can file application- The draft amendment rules proposes to make changes to Rule 56(1) of the Geographical Indications of Goods (Registration & Protection) Rules, 2002. Rule 56(1) deals with application by a producer as an Authorized User of a registered geographical location. The proposed amendment requires only the proposed authorized user to file an application to Registrar. The law at present requires that such an application shall be made jointly by the registered proprietor and the proposed authorized user. The Statement of Case of how the proposed authorized user claims to be the producer of the registered geographical indication was required to be filed along with an affidavit but under the draft amendment rules the statement of case can be filed without an affidavit.

Requirement of Letter of Consent under Section 56 proposed to be removed- According to the draft amendment rules, ‘the applicant shall also forward a copy of the application to the registered proprietor, and intimate the Registrar of due service of the same’ and the requirement for a copy of letter of consent under 56(2) has been removed.

Rule 59(1) is also proposed to be changed by the draft amendment rules. For the registration of an authorized user entry in the register, where an opposition is filed and dismissed the registrar can enter the authorized user in Part B of the register and shall issue a registration certificate with the seal of Geographical Indication Registry. The current position is that the Registrar has to wait till the end of the appeal period after the opposition is dismissed to enter the authorized user in Part B of the register and the same was to be done with the prescribed fees but the draft amendment rules seek to remove the appeal period obligation along with removal of the fees that is charged currently.

As per the draft amendment rules, Rule 59(3) will be amended and unmounted representation of the geographical indication will not be required at the time of registration.

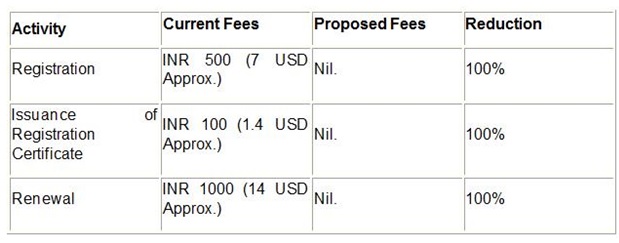

No fees for registration of an authorized user of a registered GI- In Schedule I, under Entry 3A, the fees to be paid for the registration of an authorized user of a registered geographical indication is proposed to be reduced from INR 500 (7 USD Approx.) to nil. Similarly, the fees for renewal under Entry 3C of Schedule I is proposed to be reduced from INR 1000 (14 USD Approx.) to nil. Entry 3B will be deleted from the Schedule I under the new draft amendment rules to cancel the fees charged for the issuance of certificates. Here is the Proposed changes to the fees structure for registration of an authorized user of a registered geographical indication:

(Source:https://www.lexology.com/library/detail.aspx?g=d07d1bbe-2325-49bd-844e-358be18a24cb dated 6th Oct-2019)

BACK |

|

How Brexit can change trade negotiations between India and UK

(For India, and several other countries, negotiating trade deals with UK—distinct from EU—might imply greater negotiating flexibility and better prospects of meaningful outcomes.)

Brexit is approaching fast. The deadline of October 31, 2019, is less than a month away. Till now, there is no clarity on whether the UK will have a deal with the EU. Some sort of a deal appears likely, given the legal necessity, and recommencing of Parliament following the directives of the UK Supreme Court. At the same time, possibility of fresh elections can’t be ruled out too. Notwithstanding these multiple possibilities, the reality of the UK and EU parting ways is obvious. What does that mean for others, including India, in so far as trade relations with UK are concerned?

Brexit is a more vexing issue than most comprehend. Since 1973, when the UK economically integrated with the EU, the world hasn’t looked at EU and UK markets separately. This is in spite of the UK not giving up the British Pound and not joining the Schengen regulations for common visas. From a trade perspective, the most important characteristic of UK and EU being together was that of tariffs being same for both. The other important aspect is the preferential access that service suppliers from the UK and EU get in each other’s markets; while non-EU service suppliers face several and often disconnected regulatory barriers, including taxation laws, across Europe, such impediments don’t arise for UK suppliers. The situation would change post-Brexit as Europe and UK would need to be looked as discrete economic entities.

The first implication of Brexit for countries like India, is the need for recognising distinct trade and investment relations with another ‘new’ major economy. Based on nominal GDP, and as estimated by the IMF for 2019, India and UK are the world’s fifth and sixth largest economies. India has a nominal GDP of around $3 trillion, followed by the UK with a GDP of $2.8 trillion. Following Brexit, India would have to formalise trade and investment relations afresh with UK, distinct from those with the EU. While partly smaller than India in economic size, the UK, nonetheless, is a major economy. It is a part of the G7 group of world’s largest advanced economies. It is also a member of the G20 group of world’s most influential economies, comprising the largest of the advanced and emerging market economies. Trade and investment relations with the UK have significant implications for India and need to be crafted accordingly.

The UK is expected to follow a proactive external trade policy after Brexit. There are two parts to the policy. The first is the effort to retain trade relations, through ‘continuity agreements’ with countries with whom the EU has FTAs. The second is to explore trade agreements with new countries. Presumably, the first part is a more immediate priority. On the second, there are countries that might receive precedence in engaging and be treated ‘first tier’. Earlier this year, deposing before the India-UK Foreign Affairs Committee of the House of Commons, a senior UK Minister had indicated that India, while being important, was not ‘first-tier’ in UK’s post-Brexit FTA schemes. But more robust indications on the UK’s interest in working on trade engagement with India have come in the recommendations in the report of the Foreign Affairs Committee itself, emphasising priority to trade talks with India. These are followed by recent positive comments by prime minister Boris Johnson on a FTA with India following his meeting with prime minister Modi on the sidelines of the last G7 Summit at France in late August 2019.

Much hurdles and roadblocks would be encountered by India and the UK whenever they discuss a bilateral trade deal. These would not just involve tariffs on beverages, automobiles and auto-parts, but also non-tariff barriers like safety and quality standards for goods, conditions for movement of professionals and data security. There would be carry-forward of many issues that came up during India’s now-stalled FTA negotiations with the EU. These issues would be revisited by India and the UK in a post-Brexit context with the UK refocusing on comparative advantages after separating from EU, and India evaluating market access options solely on the basis of prospects in UK.

As mentioned earlier, the eventual character of Brexit would decide the course of future trade talks and engagement between India and the UK. A deciding factor in this regard would be whether the UK’s MFN tariffs, post-Brexit, remain the same as those now. The current UK MFN tariffs are those of the EU. A ‘hard’ separation might produce differences with the UK implementing tariffs distinct from EU. Similarly, there could be several other internal regulations influencing trade standards, investments and service supplies that would come up in the UK and influence trade talks. Nonetheless, for India, and several other countries, negotiating trade deals with UK—distinct from EU—might imply greater negotiating flexibility and better prospects of meaningful outcomes. A group of 28 heterogeneous economies is a far more difficult trade bloc to deal with than an individual economy. It would be good if India seizes the opportunity to get going on a deal with UK that corresponds to its interests.

(The author is Senior Research Fellow and Research Lead (trade and economic policy), Institute of South Asian Studies, NUS. Views are personal)

Get live Stock Prices from BSE and NSE and latest NAV, portfolio of Mutual Funds, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

(Source:https://www.financialexpress.com/opinion/how-brexit-can-change-trade-negotiations-between-india-and-uk/1730058/ dated 9th Oct-2019)

BACK |

|

India may downsize imports from Malaysia after Kashmir remark at UN: Report

India’s government was angered after Malaysian Prime Minister Mahathir Mohamad said last month at the United Nations that India had "invaded and occupied" Jammu and Kashmir and asked New Delhi to work with Pakistan to resolve the issue.

India is considering restricting imports of some products from Malaysia including palm oil, according to government and industry sources, in reaction to the Southeast Asian country’s leader criticising New Delhi for its actions in Kashmir.

India is looking for ways to limit palm oil imports and may place restrictions on other goods from the country, said a government source and an industry source who participated in discussions led by the Ministry of Commerce and Industry on the planned restrictions.

The sources asked not to be named as the proposal was still under discussion.

India’s government was angered after Malaysian Prime Minister Mahathir Mohamad said last month at the United Nations that India had "invaded and occupied" Jammu and Kashmir and asked New Delhi to work with Pakistan to resolve the issue.

The government wants to send a strong signal of its displeasure to Malaysian authorities, the sources said.

India, the world’s biggest importer of edible oils, is planning to substitute Malaysian palm oil with supplies of edible oils from countries such as Indonesia, Argentina and Ukraine, said the sources.

Palm oil accounts for nearly two-thirds of India’s total edible oil imports. India buys more than 9 million tonnes of palm oil annually, mainly from Indonesia and Malaysia.

In the first nine months of 2019 India was the biggest buyer of Malaysian palm oil, taking 3.9 million tonnes, according to data compiled by the Malaysian Palm Oil Board.

A spokeswoman for India’s commerce ministry said the ministry could not comment on things that were under consideration.

ALTERNATIVE SELLERS

Malaysia’s prime minister on Friday said he had not received anything official from India, after Reuters first reported that India was mulling restricting imports of Malaysian palm oil and other products.

The news prompted Malaysian palm oil futures to snap five days of gains to end lower on Friday evening.

The benchmark palm oil contract for December delivery on the Bursa Malaysia Derivatives Exchange that had earlier been trading up on the day, fell 0.9 per cent to close at 2,185 ringgit ($522.23) per tonne.

A Mumbai-based refiner said it would not create a shortage of edible oils in India if buyers there stopped importing palm oil from Malaysia.

Indonesia is eager to sell more and more palm oil to India, the refiner said, adding that India could also increase imports of soyoil from Argentina and sunflower oil from Ukraine to offset any drop in Malaysian palm oil shipments.

Indonesia wants New Delhi to increase palm oil purchases and wants to buy sugar from India in exchange.

Higher Indian imports had helped Malaysia reduce stockpiles in 2019, but stocks could rise again and prices could come under pressure if India curtails or stops imports, said a Mumbai-based dealer with a global trading firm.

India’s government is also planning some restrictions on imports from Turkey, one of the government sources said, as Ankara has issued repeated statements on Kashmir, an issue that India considers an internal matter.

In addition to tensions around Kashmir, there has also been friction between India and Malaysia over Islamic preacher Zakir Naik, whom Indian authorities want extradited from Malaysia.

(Source:https://www.indiatoday.in/business/story/indian-imports-malaysia-palm-oil-kashmir-dispute-1608475-2019-10-11 dated 11th Oct-2019)

BACK |

|

India’s concerns about RCEP remain the major obstacle to world’s largest trade deal

- The RCEP involves the 10 Asean countries and the six major economies to have formed free trade pacts with the bloc: China, India, New Zealand, Australia, South Korea and Japan

- New Delhi has pressed for ‘data localisation’ provisions in the e-commerce chapter of the trade pact, and is also worried about the effects of tariff liberalisation on local industries

Not for the first time, trade ministers from the 16 Asia-Pacific countries negotiating the world’s biggest trade pact indicated this weekend they were within reach of a deal, but analysts and people with knowledge of negotiations predicted the final leg of talks will be particularly fraught.

Insiders told This Week in Asia the main hurdle for finalising the Regional Comprehensive Economic Partnership (RCEP) will be the negotiation position of India – which has been holding out for concessions the other 15 countries consider untenable.

Even as China and India – the proposed trading bloc’s largest economies – on Saturday signalled their readiness to thrash out their differences over the deal, domestic pressure on Prime Minister Narendra Modi’s government could scuttle his country’s involvement.

Explained: the difference between the RCEP and the CPTPP

Key allies of Modi’s ruling Bharatiya Janata Party (BJP) have mounted a nationwide protest against the RCEP, claiming the deal is lopsided and will be ruinous to local industries.

The RCEP – in the works since 2014 – involves the 10 countries of the Association of Southeast Asian Nations (Asean), and the six major economies to have formed free trade pacts with the bloc: China, India, New Zealand, Australia, South Korea and Japan.

The talks were scheduled to have been the last major meeting of RCEP trade ministers before the leaders of the 16 countries meet in November during the Asean summit.

The expectation beforehand was for negotiators to reach a provisional agreement, allowing the leaders to announce a firm signing date during the summit. However, chapters on trade remedy measures, trade competition, trade in service, rules of origin, investment and e-commerce have yet to be concluded.

The officials said negotiating teams will now continue through next week before ministers convene again on November 1.

The additional talks were necessary to “ensure the trade pact will be finalised before the RCEP leader meeting”, Thai Commerce Minister Jurin Laksanawisit said.

People with knowledge of Saturday’s talks said they were more heated than usual, and confirmed India’s position was on the minds of most delegates.

Informal talks stretched on for hours longer than scheduled before the formal intersessional ministerial meeting began in the late afternoon.

Negotiators from some countries, including Malaysia, were reportedly dissatisfied with the perceived eagerness of other countries to accede to India’s demands to bring the talks to a conclusion. In contrast, it is understood Malaysia’s requests for some concessions were not entertained.

Asean countries negotiate as a bloc but Thailand, Singapore and Indonesia have formed a “troika” to tackle outstanding issues on behalf of the 10-nation grouping.

This Week in Asia understands India has eight key requests that are outstanding. Among them are the reopening of language used in the proposed pact about how a mechanism for investor-state dispute settlement is to be implemented, and “carve-outs”, or exemptions, on ratchet obligations.

Russia courts Southeast Asia with trade and arms, but it’s no match for China

In trade parlance, a ratchet mechanism prevents a country that has adopted trade liberalisation measures from implementing measures that are more restrictive.

Another contentious issue was New Delhi’s negotiators pressing for “data localisation” provisions in the e-commerce chapter of the trade pact.

Such a provision would allow a member country to mandate that data of national residents and citizens be stored within its borders, and approve whether such data can be copied and stored abroad.

E-commerce proponents claim this is antithetical to the way the digital economy works, and could result in governments misusing commercial data.

The data issue was just one of India’s several concerns regarding the RCEP.

In the last financial year, India recorded trade deficits with 11 of the other 15 countries in the proposed bloc – and critics have increasingly questioned why the Modi administration has persisted with a deal viewed as a gateway for China and other manufacturing nations to “flood” local markets with imports.

India is believed to have secured assurances for an auto-trigger mechanism that would guard against such a surge, but the pact’s domestic opponents want the government to withdraw altogether. Trump says ‘substantial phase-one deal’ reached in China trade talks .

The Swadeshi Jagran Manch (SJM), the economic wing of the nationalist Rashtriya Swayamsevak Sangh (RSS), last week kick-started an 11-day nationwide protest against the RCEP.

The development has raised eyebrows, as the RSS is widely viewed as the ideological fountainhead of Prime Minister Modi’s BJP.

Deepak Sharma, the national spokesman for the SJM, told This Week in Asia his organisation was merely seeking a “level playing field”.

US-China trade war leads to fierce battle for skilled labour in Vietnam

“We are people – poor, environment- and village-centric … we encourage competition but the micro, small and medium enterprises should not be killed off artificially. But that is what will happen because of the RCEP,” he said.

Sharma said was the impact the pact would have on the likes of the dairy sector – the country’s top agricultural produce – was of particular concern.

India enjoys a trade surplus in dairy because of high tariffs it imposes on goods such as milk powder and butter. The fear is that local farmers dependent on the protected sector would suffer if tariffs are liberalised under the RCEP, allowing more imports from the likes of Australia and Japan.

Trade analysts concede Modi’s government faces an uphill task navigating such concerns. Within his cabinet, some ministers have positioned themselves against the pact even though the government’s official position – put forth by Commerce Minister Piyush Goyal this week – is that the country cannot afford to stand “outside the room”.

At the informal weekend summit between Modi and Chinese President Xi Jinping, the Indian leader reportedly raised the issue of the trade pact, emphasising that New Delhi wanted an equitable deal not only in terms of trade in goods, but also in investment and services.

India’s foreign secretary Vijay Gokhale said Xi “noted” these concerns.

Deborah Elms, executive director of the Singapore-based Asian Trade Centre, said ultimately Modi’s judgment would determine whether his country joins the RCEP.

“India has always been in a pickle. There is very limited domestic support for RCEP, especially when broken down by specific agencies or ministries. Each largely fears change,” Elms said.

“Hopefully Modi will be wise and brave enough to see the larger picture and overcome specific points of resistance.”

(Source:https://www.scmp.com/week-asia/economics/article/3032728/indias-concerns-about-rcep-remain-major-obstacle-worlds-largest dated 13th Oct-2019)

BACK |

|

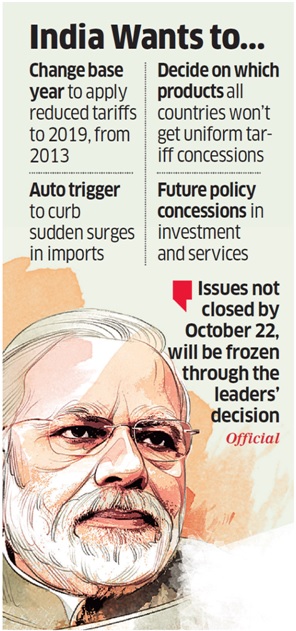

PM Modi to take a call on all pending RCEP issues

NEW DELHI: Prime Minister Narendra Modi will take up India’s unresolved issues in the proposed Regional Comprehensive Economic Partnership trade agreement at the leaders’summit next month if the 16 members are unable to resolve them over the next few days. As per a 10-day work plan of 14 issues compiled by member countries, at least five

demands pertain to India specifically. India wants to change the base year to apply reduced tariffs to 2019, from 2013; an auto trigger mechanism to curb sudden surges in imports and decide on which products it doesn’t want to offer the same tariff concessionsto all countries; and future domestic policy concessions in investment and services sectors(called ‘ratchet' in trade parlance).

“These issues need to be resolved by October 22. Those not closed by then, will be frozenthrough the leaders’ decision,” said a source aware of the development. “These issues need to be resolved by October 22. Those not closed by then, will be frozenthrough the leaders’ decision,” said a source aware of the development.

Intense bilateral parleys are expected in the next 10 days as Indian negotiators finetune

the position on these crucial issues, especially on strict origin norms to keep in check Chinese imports.

While no joint statement was planned after the RCEP ministerial meeting in Bangkok on October 11-12, attended by commerce and industry minister Piyush Goyal, a media statement was expected. However, talks were inconclusive.

The RCEP is a proposed FTA between the 10 member states of the Association of Southeast Asian Nations (Asean) and its six FTA partners – China, India, Japan, South Korea, Australia and New Zealand. RCEP negotiations began in November 2012.

Singapore is learnt to have told India to decide if it wants to stay in the trade pact.

“India has said it will remain if its asks are met,” the source said. Ecommerce, tariff differential, policy decisions at municipal and Panchayat levelsand exemption from taxation disputes are the other issues that India needs to resolve for the agreement to get concluded in November and signed next year.

India has pushed for these safeguards and caveats in ratchet and concessions given to a trading partner under a bilateral treaty automatically getting extended to RCEP members as it fears Chinese imports flooding the country especially through other RCEP members.

(Source:https://economictimes.indiatimes.com/news/economy/foreign-trade/pm-modi-to-take-a-call-on-all-pending-rcep-issues/articleshow/71589645.cms dated 15th Oct-2019)

BACK |

|

Indian firms eye base in the Netherlands, post-Brexit

Visit of the Dutch royal couple this week will usher in new phase in bilateral ties

With the Netherlands ready to replace the UK, post-Brexit, as the hub for Indian investments into the EU, the country is optimistic about deepening bilateral ties with New Delhi.

Building stronger economic ties with India will be an important part of of Dutch King Willem-Alexander and Queen Maxima’s agenda on their five-day visit to the country this week just ahead of Brexit.

The country’s Ambassador to India, Marten van den Berg, shared with BusinessLine, his thoughts on the existing cooperation between the two countries in areas of trade, investments, education, water management and research, and the areas for future course for cooperation. Excerpts:

What should we expect from the royal couple visit to India in terms of boosting bilateral ties?

We will try to achieve a new phase in our bilateral cooperation. In the current visit of the royal couple, the economic part is very much focused on healthcare, water, agriculture, horticulture, and maritime development. The technology summit is central to our economic agenda. There is a lot of interest among Dutch companies and more than 150 companies are part of the trade delegation. There is also a big cultural dimension to the visit.

With the Brexit scheduled soon, how do you see the dynamics of economic cooperation changing between India and the Netherlands?

We see Indian companies showing big interest in making the Netherlands their European head office. That is because if you want to be in the EU, you can no longer be in the UK as Brexit creates trade and investment barriers between the UK and the 27 countries in the bloc. A lot of shipments from India to the rest of Europe is anyway passing through the Rotterdam port. We do see an increase in interest and investment proposals going to the Netherlands instead of the UK.

In the longer run, companies will no longer produce in the UK but move production facilities or set up new facilities in EU countries. And the Netherlands is open for such investments. It is also likely that you will see a shift in trade.

With no progress in the India-EU Free Trade Agreement negotiations, what are the other options for increasing trade and investment flows between the two?

Both sides are looking at having at least an economic dialogue to see how we can further strengthen ties, open up markets, deal with investment protection issues and tariffs. The economic dialogue is also important in terms of how to deal with global trade tensions including what is happening at the World Trade Organization as both India and the EU support a multilateral rule based system.

Do you think the investment climate in India is better with its ranking in the World Bank index of ease of doing business improving?

You have to see it from the long-term perspective and not just in terms of movement from one year to another year. What we do see is an improvement in the business climate. We do see Dutch companies looking for investment opportunities and expanding their activities and investments. So, in the long term there is a confidence that India is improving its business climate. Of course, we sometimes face problems in terms of regulations, complying to local requirements and standards and issues on tariffs and public procurement. But then we have open dialogues with Indian government on these topics. So, in the long term we see the Indian business climate improving.

How successful have been the water projects that the Netherlands has already undertaken in India?

Both countries share huge challenges in water. We either have too much or too little or it is too dirty. We are trying to get our universities together with companies to work on the problem. We have done a programme in Chennai — which has heavy rains for six weeks and rest of the year there is no water. Now joint programme teams from the Netherlands and India have found out that if for those six weeks water is stored and is not allowed to go to the sea, one can clean it and use it rest of the year. You don’t have to bring water in trains or need expensive desalinated plants. We are also working on cleaning the Ganga.

Is there any hope for the tanneries closed down in UP for polluting the Ganga?

A number of tanneries have been closed down in UP and we are working with many of them to help them implement new technologies so that they can run their business in a sustainable way without producing much waste or polluting the water. We are also working very closely with the UP government and are opening a Centre of Excellence in the State to share our knowledge and expertise.

(Source:https://www.thehindubusinessline.com/news/indian-firms-eye-base-in-the-netherlands-post-brexit/article29673898.ece dated 13th Oct-2019)

BACK |

|

DGFT issues advisory for exports over issue of late cut imposed by the system while applying for MEIS

New Delhi, Oct 15 (KNN) Taking note of the representations made by trade and export promotion councils (EPCs) regarding issue of late cut being imposed by the system while applying Merchandise Export from India Scheme (MEIS), the Directorate General of Foreign Trade (DGFT) has issued an advisory.

In a Trade Notice, DGFT pointed it has been receiving multiple representations from the members of trade and EPCs regarding the difficulties being faced by exporters, when a claim is being made for shipping bills, which have been re-activated in the E com module.

The trade has reported that under the current online MEIS application mechanism, the system is applying late cut based on the second submission date and not counting the date of first online submission of the applied shipping bills.

DGFT said many such cases have also been decided in the PRC waiving late cut when exporter applies for the second time on the basis of the re-activated shipping bills.

DGFT issued an advisory on the steps to be taken by the exporters. The steps that DGFT asked the exporters to follow are given below:

The applicant firm will create a new Ecom application number for the re-activated shipping bills for which the MEIS is intended to be claimed. At the time of generation of the new Ecom number, the online system may show the applicable late cut as on the date of generation of new number.

The firm would not submit this new/ revised application after building the Ecom application and getting the new Ecom number and instead is required to register a request at contact@DGFT to remove late cut for the shipping bills and mention the Ecom application number.

On receipt of such request, the NIC team at the DGFT headquarters would edit the late cut fields in the application at the back end.

(Source: https://knnindia.co.in/news/newsdetails/sectors//dgft-issues-advisory-for-exports-over-issue-of-late-cut-imposed-by-the-system-while-applying-for-meis dated 15th Oct-2019)

BACK |

|

Non-Tariff Trade Regulations on the Rise in Asia-Pacific

While applied tariffs in the Asia-Pacific region have halved over the past two decades, the number of non-tariff measures (NTMs) - policy regulations other than tariffs affecting international trade - has risen significantly, according to a report launched on October 14 UNCTAD.

The Asia-Pacific Trade and Investment Report 2019 finds that NTMs are now affecting around 58 percent of trade in Asia and the Pacific. One reason for the rise of NTMs is their growing popularity as weapons of trade policy in regional and global trade tensions. This can include government procurement limitations, subsidies to export and import restrictions and import and export bans through unilateral or multilateral sanctions. Meeting these complex and often opaque rules can require significant resources, affecting in particular SMEs.

However, the report also notes that NTMs as policy instruments can often be legitimate. Most of the NTMs are technical regulations, such as sanitary and phytosanitary requirements on food. The average cost of these measures alone amounts to 1.6 percent of gross domestic product, roughly $1.4 trillion globally, but they also serve important purposes such as protection of human health or the environment.

While costly to traders, failure to have essential technical NTMs in place or their poor implementation may have serious detrimental impacts on sustainable development. For example, the report refers to the lack of NTMs covering illegal fishing and timber trade in many Asia-Pacific economies. It also points to the high economic costs for the region associated with the African swine fever epidemic, which can be linked to deficient implementation of NTMs. At the same time, new regulations on trade in plastic waste arising from amendment to the Basel Convention are promising.

On average, each imported product in Asia and the Pacific faces 2.5 NTMs, and 57 percent of imports are affected by at least one NTM. NTMs are often very different between countries, making it difficult for firms to move goods from one country to another. A synthesis of country-level private sector survey studies reveals that, on average, 56 percent of all interviewed firms reported encountering problems related to NTMs when engaging in international trade. Most significantly, it was reported that domestic procedural obstacles - rather than the required standards embedded in NTMs - are the primary reason why foreign and domestic NTMs are perceived to be burdensome. The obstacles include time constraints, informal or unusually high payments, lack of transparency, discriminatory behavior of government officials and a lack of appropriate testing facilities.

Looking ahead, the report also highlights that trade costs of NTMs can be significantly reduced by moving to paperless trade and cross-border electronic exchange of information. This could lower costs by 25 percent on average in the region, generating savings for both governments and traders of over $600 billion annually.

(Source:https://www.maritime-executive.com/article/non-tariff-trade-regulations-on-the-rise-in-asia-pacific dated 16th Oct-2019)

BACK |

|

Govt committed to safeguarding IP content: Commerce Secretary

NEW DELHI, Oct 16:Government of India is committed to safeguarding against infringement of originality and creativity of the makers to give a boost to services exports, Commerce Secretary Anup Wadhawan has said.

“The Government of India is committed to safeguarding against infringement of originality and creativity of the makers to give a boost to services exports. Intellectual Property (IP) is the most important asset for its creators in the media and entertainment sector,” said Dr Wadhawan in a message to the industry in the India IP Guide released at 36th MIPCOM at Cannes.

India firmly believes in the significance of IPR as the centrepiece of the industry’s future growth, he stated, according to Commerce and Industry statement on Wednesday.

Services Exports Promotion Council (SEPC), set-up by the Ministry of Commerce and Industry, has brought out the India IP Guide at Cannes in MIPCOM 2019, being held from October 14-17 for the Media and Entertainment industry.

The guide features a catalogue of over 60 Indian IPs, popular in over 160 countries. It comprehensively breaks the narrative of only low-end work being done in India.

For the second consecutive year, SEPC’s India Pavilion at MIPCOM, Cannes, France, the world’s largest content market, has enthused and attracted industry.

Over 60 Indian delegates are part of the India Pavilion delegation. Over 115 Indian companies comprising over 250 delegates are at MIPCOM.

SEPC Director General Sangeeta Godbole informed that some of the top renowned Indian Media and Entertainment companies are present at MIPCOM. Exhibition space has been increased over last year and 15 media and companies are participating for the first-time through the SEPC delegation at the India Pavilion, she said.

The Indian exhibitors and visiting companies are participating to buy, sell, serve and partner with companies present at MIPCOM from over 111 countries across the world.

India Pavilion is the one-stop place to meet content creators, audio visual service providers in animation, VFX, AR/VR, gaming, new media services, film production services and much more. Many of the Indian companies are here with their completed IPs or pitch for their in-production properties.

One of the key objectives at SEPC is to facilitate service exporters of India and handhold medium and small enterprises to expand their global footprint and to present IPs from India to the buyers and distributors from across the globe. The IP Guide is to illustrate strengths of the Indian content creators.

Intellectual Property (IP), especially in the innovation economy of today, is vital to a large number of SEPC’s stakeholders. Creation, protection and expansion of IP products alone will bring huge benefits to the sector, informed Ms Godbole.

In the coming months, SEPC plans to launch an online IP helpline, so that anybody who has simple questions can get feedback on IP related queries. SEPC will also be setting up a committee to help small and medium entertainment companies to navigate critical aspects of IP creation. The aim is to assist companies and content creators to maximise the value that IPs can provide.

(Source:https://www.dailyexcelsior.com/govt-committed-to-safeguarding-ip-content-commerce-secretary/ dated 17th Oct-2019)

BACK |

|

India Raising Trade Barriers against South Korea

The Directorate General of Trade Remedies of the Ministry of Commerce and Industry of India launched an investigation early this month regarding safeguard application to phthalic anhydride imported from South Korea. Earlier, Indian companies requested import restrictions, saying that the import volume of the product surged from late 2018 to early this year.

At present, the Indian government is raising trade barriers against South Korean steel and chemical products. For instance, it launched an anti-dumping investigation concerning tin plates in June this year and its investigations are expanding to cover stainless steel. It recently made a preliminary determination to impose an anti-dumping duty of 60 percent on chlorinated polyvinyl chloride.

This trend is likely to continue for a while with India’s economic growth falling short of expectations. Its quarterly GDP growth fell from approximately 8 percent to 5.8 percent from the second quarter of 2018 to the first quarter of this year.

India’s chronic trade deficit is continuing, too. “China accounts for approximately 70 percent of India’s trade deficit and this is a problem hard to solve,” said a South Korean government official, adding, “It seems that the Indian government is trying to deal with it by raising trade barriers against other countries.”

(Source:http://www.businesskorea.co.kr/news/articleView.html?idxno=37222 dated 22nd October-2019)

BACK |

|

New foreign trade policy may have simpler export promotion schemes

NEW DELHI, Oct 21:

The commerce ministry is considering rationalising and simplifying certain export promotion schemes such as EPCG in the next foreign trade policy, which provides guideline and incentives for increasing shipments, an official said.

The ministry is in consultation with all stakeholders for the preparation of the next policy (2020-25), as the validity of the old one ends on March 31, 2020, the official said.

The ministry may also include new chapters for services, and e-commerce exports besides simplifying advance authorisation and self ratification schemes.

EPCG is an export promotion scheme under which an exporter can import certain amount of capital goods at zero duty for upgrading technology related with exports.

On the other hand, advance authorisation is issued to allow duty free import of inputs, which is physically incorporated in export product.

Total exports of third party could be counted as export obligation instead of only proceeds realised from third party by EPCG holders, the official said.

Similarly in the advance authorisation scheme, export obligation period could be enhanced from the current 18 months.

For the export oriented units, the ministry is considering getting policy formulation, regulation and administration under one roof.

The ministry’s arm directorate general of foreign trade (DGFT) is formulating the policy.

At present, tax benefits are provided under merchandise export from India scheme (MEIS) for goods and services export from India scheme (SEIS).

In the new policy, changes are expected in incentives given to goods as the current export promotion schemes are challenged by the US in the dispute resolution mechanism of the World Trade Organisation (WTO).

Against this backdrop, the government is recasting the incentives to make them compliant with global trade rules, being formulated by Geneva-based WTO, a 164-nation multilateral body.

Exporters are demanding incentives based on research and development, and product-specific clusters under the new policy.

Ludhiana-based Hand Tools Association President S C Ralhan said the new policy should have provisions for refund of indirect taxes like on oil and power, and state levies such as mandi tax.

During April-September 2019, exports were down 2.39 per cent to USD 159.57 billion while imports contracted by 7 per cent to USD 243.28 billion. Trade deficit during the period narrowed to USD 83.7 billion as against USD 98.15 billion in April-September 2018-19.

Since 2011-12, India’s exports have been hovering at around USD 300 billion. During 2018-19, overseas shipments grew 9 per cent to USD 331 billion.

The government is targeting to increase the exports to USD one trillion in coming years. (PTI)

(Source: https://www.dailyexcelsior.com/new-foreign-trade-policy-may-have-simpler-export-promotion-schemes-2/ dated 22nd Oct-2019)

BACK |

|

Govt steps improving India's ease of doing business rank: Commerce ministry

India jumped 14 places to the 63rd position on the World Bank's ease of doing business ranking released earlier in the day

India has recorded continuous improvement in its ease of doing business ranking issued by the World Bank on account of steps taken by the government in this regard, the commerce and industry ministry said on Thursday.

India jumped 14 places to the 63rd position on the World Bank's ease of doing business ranking released earlier in the day, riding high on the government's flagship 'Make in India' scheme and other reforms attracting foreign investment. The report ranks 190 countries.

"As a result of continued efforts by the government, India has improved its rank by 79 positions in last five years (2014-19)," it said.

India has improved its rank in 7 out of 10 indicators, and has moved closer to international best practices.

"Significant improvements have been registered in resolving insolvency, dealing with construction permits, registering property, trading across borders and paying taxes indicators," it said.

The government is targeting to join the 50 top economies on the ease of doing business ranking.

Commenting on this, Deloitte chairman, Shyamak Tata said the development puts India in the rank of the most-favoured investment destinations, indicating an environment that encourages foreign investors to become part of the Indian growth story.

Rohinton Sidhwa, partner Deloitte, said that the report covers two cities -- Mumbai and New Delhi, and a single window for construction and labour related compliance in these cities have contributed to the improvement.

Former Department for Promotion of Industry and Internal Trade (DPIIT) Secretary Ramesh Abhishek said that the ranking show "how much can be achieved with a strong political will and total commitment of officials to reforms".

Government process re-engineering, massive use of technology and constant engagement with users have helped India in improving its position in the ranking, he added.

Apart from India, the other countries on this year's 'top 10 performers' list are Saudi Arabia (62), Jordan (75), Togo (97), Bahrain (43), Tajikistan (106), Pakistan (108), Kuwait (83), China (31) and Nigeria (131).

(Source: https://www.business-standard.com/article/pti-stories/govt-steps-helping-india-to-inch-up-its-ease-of-doing-biz-ranking-commerce-ministry-119102400342_1.html dated 24th Oct-2019)

BACK |

|

Commerce Ministry considers 5-year extension of income tax benefits for SEZ units

With exports and investments on the slide, the Centre is considering a five-year extension of tax benefits for units in Special Economic Zones (SEZs) by extending the sunset clause beyond March 31, 2020 to boost investor sentiment.