Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-Exporters,

I have pleasure to bring to you the 18th issue of the CHEMEXCIL e-Bulletin for the month of October 2017, which contains the following activities undertaken by the Council and other useful information/Notifications, etc.

- Chemexcil’s Indian Chemicals & Cosmetics Exhibition Dhaka, Bangladesh

- GST Outreach session at O/o Principal Commissioner, CGST, Mumbai South Commissionerate, Mumbai on 3rd October 2017

- Consultation meeting with Duty Drawback Committee on 31/10/2017 at Crowne Plaza, Ahmedabad

I hope that you would find the newsletter informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions so as to enable us to improve this e-bulletin further.

With Regards,

SHRI SATISH W. WAGH

CHAIRMAN,

CHEMEXCIL

|

BACK |

CHEMEXCIL's INDIAN CHEMICALS & COSMETICS EXHIBITION DHAKA, BANGLADESH

Chemexcil organised Indian Chemical and Cosmetics Exhibition at Dhaka, Bangladesh dated 8th -9th October, 2017 at international convention city Bashundhara Exhibition Centre (ICCB).

The exhibition was inaugurated by Mr. Shishir Kothari, Second Secretary, Commerce from the High Commission of India in Bangladesh.

The two days exhibition in Dhaka, Bangladesh was a successful event wherein the Indian manufacturers were able to showcase their capability as a supplier of steady and sustainable, low cost international quality products to Bangladesh. This exhibition turned out to be a platform for meeting potential buyers, dealers and end users of Chemicals, Agrochemicals, Cosmetics and Dyes in Bangladesh.

Bangladesh is Indian’s largest trade partner amongst the SAARC countries. It is also one of the biggest destinations of Indian exports in the SAARC region. India became the 11th largest destination for exports from Bangladesh in 2015-16. The total trade between the two countries has increased to US $ 6.14 billion in 2015-16 from US $ 5.2 billion in 2011-12.

Mr. Shishir Kothari laid the stress on organising such exhibitions every year to gain the momentum and showcase the strength to Indian industries to Bangladesh market. He also mentioned that for any trade dispute the High Commission office can assist Indian Companies / Individuals in amiable resolving their trade disputes with the Bangladeshi companies.

Participants from both the countries were highly satisfied, particularly with the extensive variety of products, services and know-how that were presented at the show. The exhibition survey revealed that maximum visitors were interested in setting up dealer networks and work through the agents to avoid payment issues. All exhibiting companies were satisfied with the good number of visitors and were able to develop new contacts for their business in Bangladesh.

| GLIMPSES OF THE EXHIBITION: |

|

| Mr. Shishir Kothari, Second Secretary (Commerce) High Commission Of India,

Dhaka –Bangladesh delivering Key Note Address

|

| |

|

| Booth visit by Mr. Shishir Kothari, Second Secretary (Commerce), High Commission India, Dhaka- Bangladesh

|

BACK |

GST Outreach session at O/o Principal Commissioner, CGST, Mumbai South Commissionerate, Mumbai on 3rd October 2017

The council had received intimation from the O/o Principal Commissioner, CGST, Mumbai South Commissionerate regarding GST Outreach program being organized for few sectors of the industry on 3rd October 2017.

With the roll-out of GST, exporters have been facing various issues related to GST Return filing, Transition Credit, Bond/ LUT etc and this was an excellent opportunity for exporters to interact with officers of CGST.

This two hour session was organized at the Conference Room of Mumbai South Commissionerate Office.

From CGST office, Shri Anjum Kadvi- Superintendent, CGST and his team of CGST Inspectors handled this outreach program and addressed exporters queries pertaining to practical issues in GST.

From Council side, apart from Council officer, around 14 exporters attended the session and interacted with the CGST officers.

The participants asked several queries during the interactive session on Bond/ LUT, CT1, Proof Of exports, Trans-1, GST Returns, Invoicing, Refunds, self-sealing, Input service distributor, Reverse Charge Mechanism etc which were answered satisfactorily by the officers of CGST office.

| Glimpses of the GST Outreach Session at CGST Office, Mumbai |

|

| |

|

BACK |

Consultation meeting with Duty Drawback Committee on 31/10/2017 at Crowne Plaza, Ahmedabad

CHEMEXCIL representative along-with Shri Bhupen Bhai Patel-Regional Chairman and representatives of Meghmani Group and Sajjan India attended the consultation meeting with the esteemed Duty Drawback committee headed by Shri G.K. Pillai (former Secretary, Government of India ) with members Shri Y.G.Parande ( former member –CBEC ) and Shri Gautam Ray ( former Chief Commissioner of Customs & Central Excise ).

As per our submission before the DBK Committee, the DBK Rates 2017 announced recently for majority of items under CHEMEXCIL Purview i.e. Chapter 29, 32, 33, 34 & 38 have remained at 1.5%. However, the DBK Rates of Chapter 28 items have been reduced from 1.5% to 1.1%.

Further, in chemical items falling under Chapter 28, 29 & 32 pertaining to Dye intermediates/ Dyes/ Organic & Inorganic chemicals, the All Industry rates of Duty Drawback is only factoring Customs duty which has remained stagnant at 5%/ 7.5%. Therefore, even though customs tariff has remained stagnant DBK rates for our export products were earlier reduced in 2016 from 1.9 % to 1.5% last year. Now, after recent announcement, the DBK rates are ranging from 1.1% & 1.5 %. The gradual reduction of DBK rates adversely impacts competitiveness of exporters in current scenario specially when exporters are concerned about status of export incentives/ GST refunds/ liquidity etc.

In addition to these hindrances, it was also pointed out that there are state levies such as electricity duty, VAT on Natural gasetc which are not neutralised and are a cost to the exporters.

In view of above factors, we have requested DBK Committee to re-instate the old AIR DBK of 1.9% for majority of our items as customs duty has remained stagnant and exporters competitiveness is getting impacted due to gradual decrease in DBK rate.

BACK |

Important Update on E-Seals -Implementing Electronic Sealing for Containers by exporters under self-sealing procedure prescribed by circular 26/2017-Cus dated 1st July 2017, circular 36/2017 dated 28.8.2017 and 37/2017 dated 20.9.2017

|

EPC/LIC/Self-Sealing |

31st October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Important Update on E-Seals -Implementing Electronic Sealing for Containers by exporters under self-sealing procedure prescribed by circular 26/2017-Cus dated 1st July 2017, circular 36/2017 dated 28.8.2017 and 37/2017 dated 20.9.2017 |

|

|

Dear Members,

This is in continuation of earlier circulars informing you about CBEC circular no.26/2017-Cus dated 1st July 2017, no. 36/2017 dated 28.8.2017 and 37/2017 dated 20.9.2017 regarding Implementation of Electronic Sealing for Containers by exporters under self-sealing procedure.The new procedure of self-sealing was supposed to become effective from 1st November 2017.

However, there have been concerns amongst the member exporters about the procedure/ availability of e-seals etc. The council has also sent representation to CBEC requesting clarity and time in this matter.

Taking note of the representations from the trade/ industry, CBEC has now issued Circular No. 41/ 2017-Customs dated 30/10/2017 providing information on various aspects of Electronic Sealing for Containers by exporters under self-sealing procedure.

The important points from the above-said circular are highlighted/ reproduced as follows:

Installation of Fixed Readers: In order to take stock of the preparedness of the trade, field formations, the CBEC has held consultations with the vendors. It is understood that the fixed Readers are already in place at Chennai port and are being already used to monitor the movement of trucks from CFSs to the Port. During the consultations, it has also been informed that installation of fixed readers at Mangalore and Cochin will be completed by 31st October 2017. It is also learnt that hand held Readers have been provided to Kolkata Port and to all ICDs in the NCR region. It has been informed that handheld readers have been dispatched to over 50 customs stations including JNCH, Mumbai, Mundra, Pipavav, Hazira etc. Commissioner of Customs, ICD, Patparganj and Kolkata have already had a familiarization program for the officers.

Exporter Categories for self-sealing: Circulars 26/2017 and 36/2017 have obligated following classes of exporters to adopt RFID e-sealing:

(a) exporters already enjoying the facility of self-sealing after having been approved by jurisdictional formations under the erstwhile procedures;

(b) exporters who have hitherto been availing of supervised sealing and have been automatically entitled to avail of self-sealing using RFID e-seals, without having to expressly seek any permission/approval of the jurisdictional commissioner for this purpose;

(c) AEOs, regardless of whether they were self-sealing or undertaking supervised sealing, have also been entitled to avail of the new procedure;

(d) Lastly, all exporters have been extended this facility subject to their filing GST returns but after seeking permission for self-sealing from the jurisdictional Commissioner as per procedure prescribed under para 9(iii) of circular 26/2017-Cus dated 1st July 2017.

The procedure prescribed under the above circulars applies only to cargo in full container load, sealed at an approved premise, by an entitled exporter. In case of an FCL being received at a Port or ICD under self-sealing using RFID e-seals, prescribed under circular 36/2017Customs dated 28th August 2017, it shall be deemed to be equivalent to a container sealed under the erstwhile system of officer supervised sealing. Unless and until there are good reasons or intelligence to warrant inspection of such containers, there shall be no need for examination of such containers once the RFID e – seal is read as intact or not tampered.

In case an RFID seal affixed on a self-sealed container is found tampered, the same shall be subject to examination as already prescribed under para 2(f) of Circular 36/2017-Cus dated 28th August 2017. However, after examination, the further movement of such a container shall not be under the RFID e-seal procedure. The existing system of using the traditional bottle seals by customs shall continue for such movements.

Full containers brought to Ports without RFID e-seals shall be taken to a CFS or allowed direct port entry, as the case may be, and will be subject to usual RMS treatment. Similarly, Full Containers Loads arriving at ICDs, but without RFID e-seals, will be subject to usual risk management parameters.

The procedure under the subject circulars does not apply to export of non-containerized cargo or Air cargo or for movement of cargo from CFSs to ICDs/Ports or cargo exported through Land Customs Stations. Extant practices in respect of such cargo shall continue.

The issue of the type of readers that vendor shall provide to customs has also been raised. The Board has permitted vendors to either provide fixed readers, in consultation with custodians at Ports and ICDs, or provide handheld Readers. Due to the flexibility provided by Handheld Readers, in as much as officers can use them to read seals at the point of entry or at the place of stacking or when containers are being loaded for further movement, the same are preferred. Vendors are advised that when they provide fixed readers, services must be supported with handheld readers so that officers can carry out additional checks at any point within the Port/ICD. Accordingly, the readers to be provided shall be: (a) Rugged and capable of withstanding shocks and vibrations and be generally adapted to outdoor/industrial environment. (b) Integrated devices with a large display screen for viewing of data fields specified in para 4 of circular 36/2017 customs. (c) The aforesaid data elements shall be displayed on the Reader display, on scanning of the e-seal by Customs.

Furthermore, all vendors shall provide an application on a desktop computer to be made available by field formations so that e-sealing data pushed to the destination customs port / ICD is searchable in terms of any of the data elements prescribed under para 4 (a) of circular 36/2017 customs. The said application may be made available in reasonable time but not exceeding 30 days from the date of this circular. In the meantime, the data elements shall be transmitted in excel format to risk management division (RMD) and the concerned field formation from where the cargo is to be exported. Field formations and RMD are advised to immediately communicate the email IDs for this purpose to vendors.

It is also re-iterated that data once uploaded by the exporter should not be capable of edited or deleted.

The web application shall capture the location where the RFID e-seal is read.

The vendors shall transmit the IEC details of such exporters who have purchased the RFID e-seals to RMD on a daily basis. The IEC number and the name of exporter shall be provided only when the vendor makes the first sale to the exporter; there is no need transmit the details of the exporter each time a sale is made.

The vendors shall make all efforts to serve the requirements of maximum number of exporters by providing the RFID e-seals. They shall also provide Readers to all the customs stations from where the client exporters are exporting their cargo. The department reserves its right to direct vendors to provide Readers at any particular port/ICD.

List of Stations where readers are installed: The list of stations where Readers have been provided by Vendors is annexed to this circular. As and when coverage is extended by vendors to more customs stations, they shall be included in the list of Ports / ICDs where e-sealing would be mandatory. While for the benefit of the trade, Board shall update the list of Customs stations from time to time, field formations are advised to issue trade notices regarding availability of Readers as soon as these are available at their Port/ICD.

Applicable Dates: It has been decided that mandatory e-sealing for different classes of exporters shall be brought in a phased manner as indicated below:

In respect of all exporters who have been permitted self-sealing facilities under erstwhile procedures and exporters who are AEOs, it would be mandatory to seal their export containers with prescribed RFID e-seal w.e.f 8th Nov. 2017. Any non-compliance will subject the containers to usual RMS parameters.

In respect of the category of exporters who are availing supervised stuffing at their premises, extant practice of supervised stuffing may continue till 19th November 2017. With effect from 20th November 2017, they shall have to switch to RFID e-sealing procedures.

Regarding the exporters who have newly applied to the jurisdictional customs authority for self-sealing permission under circular 26/2017-Cus dated 1st July 2017, they shall commence use of the facility subject to grant of permission and upon adoption of RFID e-sealing.

The applicable date for RFID e-sealing implies that exporters are required to use this procedure from the prescribed date. Any container sealed at the exporters premises before the prescribed date, shall not be required to be brought with RFID e-seal.

It is also clarified that those exporters who are in possession of RFID e-seals are at liberty to commence availing the facilitative procedures forthwith. It may be recalled that vide circular 37/2017-Cus, the e-sealing procedure had been made voluntary subject to availability of reader facilities.

As the RFID e-seal based self-sealing procedure has been introduced as a measure of export facilitation, the field formations are advised to guide the exporters and work closely with the private service providers for smooth roll-out of the system.

The procedures in respect of customs stations where readers have not been provided by any vendor so far shall continue till 31st December 2017, as per existing practice. Board shall take necessary steps to make sure that the readers are made available at such customs stations by 1st January 2018.

Members are requested to take of above circular and for additional details may refer to the original circular available for download using below link. Members may inform their CHA/ Logistics providers so that they do the needful accordingly. In case of any issues, please write to us on Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

Circ41-2017 cs (self sealing)

|

|

BACK

|

GST : Form GST TRAN-1 submission (with revision facility) extended to 30th November 2017 Eleventh Amendment to CGST Rules, 2017 Others

|

EPC/LIC/GST |

30th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST : Form GST TRAN-1 submission (with revision facility) extended to 30th November 2017 Eleventh Amendment to CGST Rules, 2017 Others |

|

|

Dear Members,

We would like to inform you that CBEC/ GST has issued new Notifications/ Orders issued for extending the time limit for furnishing GST TRAN-1 submission (with revision facility), other FORMS and further amendment in the CGST Rules.

The important notifications/ Circulars issued are highlighted as follows for your information:

Circulars/Orders

Circular No. |

English |

Date of issue |

Subject |

Order-08/2017-GST |

View(197 KB) |

28-10-2017 |

Extension of time limit for submitting the declaration in FORM GST TRAN-1 under rule 120A |

Order-07/2017-GST |

View(64 KB) |

28-10-2017 |

Extension of time limit for submitting the declaration in FORM GST TRAN-1 under rule 117 |

Order-06/2017-GST |

View(196 KB) |

28-10-2017 |

Extension of time limit for submitting application in FORM GST REG-26 |

Order-05/2017-GST |

View(201 KB) |

28-10-2017 |

Extension of time limit for intimation of details of stock in FORM GST CMP-03 |

http://www.cbec.gov.in/htdocs-cbec/gst/cgst-circ-idx-2017

Central Tax Notifications

Notification No. & Date of Issue |

English |

Subject |

53/2017-Central Tax ,dt. 28-10-2017 |

View (340 KB) |

Seeks to extend the due date for submission of details in FORM GST-ITC-04 |

52/2017-Central Tax ,dt. 28-10-2017 |

View (201 KB) |

Seeks to extend the due date for submission of details in FORM GST-ITC-01 |

51/2017-Central Tax ,dt. 28-10-2017 |

View (210 KB) |

Eleventh Amendment to CGST Rules, 2017 |

http://www.cbec.gov.in/htdocs-cbec/gst/central-tax-notfns-2017

Integrated Tax (Rate) Notifications

Notification No. & Date of Issue |

English |

Subject |

42/2017-Integrated Tax (Rate) ,dt. 27-10-2017 |

View (120 KB) |

Seeks to amend notification No. 9/2017- Integrated Tax (Rate) so as to exempt IGST on inter-state supply of services to Nepal and Bhutan against payment in INR. |

http://www.cbec.gov.in/htdocs-cbec/gst/integrated-tax-rate-2017

Members are requested to take note of some of the above notifications/ circulars. Original texts of all above notifications are available on the above hyperlinks:

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

DGFT -Important Public Notices issued regarding EPCG Scheme

|

EPC/LIC/DGFT/EPCG |

26th Oct 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT -Important Public Notices issued regarding EPCG Scheme |

|

|

Dear Members,

Kindly note that O/o DGFT New Delhi has issued several important Public Notices on 25/10/2017 regarding EPCG scheme.

As an effect of these PN’s, there will be relaxations to allow onetime condonation of time period in respect of obtaining block-wise extension in Export Obligation period, Onetime condonation of time period in respect of obtaining extension in Export Obligation period and Acceptance of installation certificate under EPCG Scheme by the RAs wherein installation certificate is submitted beyond 18 months.

For the sake of convenience, the PN details are as follows:

PUBLIC NOTICE NO. |

DATE |

SUBJECT |

37/2015-2020 |

25.10.2017 |

Acceptance of installation certificate under EPCG Scheme by the RAs wherein installation certificate is submitted beyond 18 months. |

36/2015-2020 |

25.10.2017 |

Onetime condonation of time period in respect of obtaining extension in Export Obligation period under EPCG Scheme. |

35/2015-2020 |

25.10.2017 |

Onetime condonation of time period in respect of obtaining block-wise extension in Export Obligation period under EPCG Scheme. |

Members are requested to take note of the same and regularise their old cases, if any, accordingly. The said PNs can be accessed by clicking the hyperlinks in above table or below link on www.dgft.gov.in :

http://dgft.gov.in/exim/2000/pn/pn17/indexpn2017-2018.html

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

http://chemexcil.in/uploads/files/PN_35_english.pdf

http://chemexcil.in/uploads/files/PN_No.36(e)_.pdf

http://chemexcil.in/uploads/files/PN_No.37(e)_.pdf

|

|

BACK

|

DGFT Enhancement in the validity period of Duty Credit Scrips issued on or after 01.01.2016

|

EPC/LIC/DGFT |

25th Oct 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT Enhancement in the validity period of Duty Credit Scrips issued on or after 01.01.2016 |

|

|

Dear Members,

Kindly note that O/o DGFT New Delhi has Issued Public Notice No.33/2015-2020 dated 23/10/2017 regarding enhancement in validity period of Duty Credit Scrips issued on or after 01.01.2016.

As you are aware, the existing validity of Duty Credit Scrip is 18 months from the date of issue and must be valid on the date on which actual debit of duty is made. Revalidation of Duty Credit Scrip shall not be permitted unless covered under paragraph 2.20(c) of HBP.

However, as an effect of this Public Notice, Duty Credit Scrip issued on or after 01.01.2016 under chapter 3 shall be valid for a period of 24 months from the date of issue and must be valid on the date on which actual debit of duty is made. Revalidation of Duty Credit Scrip shall not be permitted unless covered under paragraph 2.20(c) of HBP.

Members are requested to take note of this positive development and utilise accordingly. The above-said PN can also be accessed using below link:

http://dgft.gov.in/Exim/2000/PN/PN17/PN%2033%20in%20english.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT Onetime relaxation for EO extension and clubbing of Advance Authorisations

|

EPC/LIC/DGFT |

25th Oct 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT Onetime relaxation for EO extension and clubbing of Advance Authorisations |

|

|

Dear Members,

Kindly note that O/o DGFT New Delhi has Issued Public Notice No.34/2015-2020 dated 24/10/2017 regarding one time relaxations in the provisions of extension of export obligation period and clubbing of advance Authorisations.

For the sake of convenience, the PN is reproduced/ highlighted as follows:

Facility of Clubbing of Advance Licences/Authorisations:

Onetime relaxation of Para 4.38(i) of Handbook of Procedures 2015-2020, for clubbing of Advance licenses / Authorisations issued under Foreign Trade Policy 2002-2007 and 2004-09 is hereby permitted.

Request for clubbing shall be made in ANF-4C to the respective RAs along with prescribed documents. RA shall process the cases as per Para 4.38 of Handbook of Procedures 2015-2020. The last date for submission of such application shall be 31.3.2018. Any applications received in RA, after 31.3.2018 shall not be entertained for clubbing and case shall be regularized either under Para 4.49 of HBP or by initiation of adjudication proceedings on or before 31.05.2018 positively.

No clubbing shall be permitted in respect of Authorisations where misrepresentation / fraud have come to the notice of RA. Further, no clubbing of Authorisations, where EODC/redemption letter has already been issued or adjudication orders have already been passed by RA/Customs Authority, shall be permitted.

Extension of Export Obligation Period:

Onetime relaxation is provided for extending Export Obligation (EO) period subject to the conditions specified below.

Exports made under Advance Licences/Authorisations issued under Foreign Trade Policy 2002-07, Foreign Trade Policy 2004-2009 and Advance authorisations issued prior to 5.6.2012 under Foreign Trade Policy 2009-14 shall be regularized by way of extension of Export Obligation Period, as per the procedure prescribed below:

Where exports have been made within 36 months from the date of issue of Advance Licences / Authorisations, same shall be regularized without insisting for any composition fee, except the cases where authorizations issued under Policy circular No-9 dated 30.6.2003/ or items covered under Appendix-30 A of HBP 2004-09/ HBP 2009-14.

For the exports made after 36 months but within 48 months shall be regularized on payment of composition fees as follows:

@ 0.5% per month of FOB value of exports made after 36 months but within 42 months

@ 1% per month of FOB value of exports made after 42 months but within 48 months

c. For Authorisations issued under Policy circular No-9 dated 30.6.2003 or inputs covered under Appendix-30A of HBP 2004-09 / HBP 2009-14: Extension of export obligation period can be granted for a period equivalent to half of the stipulated initial export obligation period on payment of composition fee as follows:

@0.5% per month of FOB if exports made within initial export obligation period is more than 50% of stipulated EO.

@ 1% per month of FOB if exports made within initial export obligation period is less than 50% of stipulated EO.

d. Request for extension of Export obligation period shall be filed in respective RAs, on or before 31.3.2018. Any applications received after 31.3.2018 shall not be considered as per this Public notice.

e. Only shipping bills which bear file number/ Advance Authorisation number in question shall be taken into account. No free shipping bills shall be allowed to be accounted.

f. No extension in EO would be allowed in respect of Authorisations where misrepresentation / fraud have come to the notice of RA. Further, no extension of Authorisations, where adjudication orders have already been passed by RA/Customs Authority, shall be permitted.

Members are requested to take note of this important relaxation and regularise there old cases accordingly. The above-said PN can also be accessed using below link:

http://dgft.gov.in/Exim/2000/PN/PN17/PN%2034%20in%20english.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

http://chemexcil.in/uploads/files/PN_34_in_english_(EO_and_clubbing).pdf

|

|

BACK

|

GSTR-3B Waiver of late fee on filing of GSTR-3B for August and September, 2017

|

EPC/LIC/GSTR-3B |

25th Oct 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GSTR-3B Waiver of late fee on filing of GSTR-3B for August and September, 2017 |

|

|

Dear Members,

Kindly note that the Central Government, on the recommendations of the Council, has decided to waive off the late fee on filing of GSTR-3B for August and September, 2017.

Taking cognizance of the difficulties faced by the tax payers during return filing process, above trade facilitation measure has been notified vide Not No. 50/2017 – Central Tax dated 24/10/2017.

http://www.cbec.gov.in/resources//htdocs-cbec/gst/notifctn-ct-50.pdf

Members are requested to take note of above.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

NOTIFICATION NO. 41/2017 Integrated tax (Rate) Notification to prescribe Integrated Tax rate of 0.1% on inter-State supply of taxable goods by a registered supplier to a registered recipient for export subject to specified conditions.

|

EPC/LIC/Notification No. 41 |

24th Oct 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

NOTIFICATION NO. 41/2017 Integrated tax (Rate) Notification to prescribe Integrated Tax rate of 0.1% on inter-State supply of taxable goods by a registered supplier to a registered recipient for export subject to specified conditions. |

|

|

Dear Members,

We would like to inform you that Govt. of India, Ministry of Finance, Department of Revenue, has issued Notification No. 41/2017 -- Integrated Tax (Rate) dated 23rd Oct., 2017 informing that exempts the inter-State Supply of taxable goods by a registered supplier to a registered recipient for export from so much of the integrated tax leviable, thereon under Section 5 of the Integrated Good and Services Tax Act, 2017 (13 of 2017), and in the excess of the amount calculated at the rate of 0.1 per cent, subject to fulfilment of the following conditions, i.e.

1.Registered supplier shall supply the goods to the registered recipient on a tax invoice.

2.The registered recipient shall export the said goods with a period of ninety days from the date of issue of a tax invoice by the registered supplier.

3.The Registred recipient shall indicate the Goods and Services Tax Identification Number of the registered supplier and the tax invoice number issued by the registered supplier in respect of the said goods in the shipping bill or bill of export, as the case may be.

4.The registered recipient shall be registered with a Export Promotion Council or a Commodity Board recognized by the Department of Commerce.

5 The registered recipient shall place an order on registered supplier for procuring goods at concessional rate and a copy of the same shall also be provided to the jurisdictional tax officer of the registered supplier.

6.The registered recipient shall move the said goods from place of registered supplier –

a. Directly to the Port, Inland Container Deport, Airport or Land Customs Station from where the said goods are to be exported, or

b.Directly to a registered warehouse from where the said goods shall be move to the Port, Inland Container Deport, Airport or Land Customs Station from where the said goods are to be exported.

7. If the registered recipient intends to aggregate supplies from multiple registered suppliers and then export, the goods from each registered supplier shall move to a registered warehouse and after aggregation, the registered recipient shall move goods to the port, Inland container deport, airport or land customs station from where they shall be exported.

8. in case of situation referred to in condition (vii) the registered recipient shall be endorsed the receipt of good on the tax invoice and also obtain acknowledge of receipt of goods in the registered warehouse from the warehouse operator and the endorsed tax invoice and the acknowledgement of the warehouse operator shall be provided to the registered supplier as well as to the jurisdictional tax officer of such supplier, and

9. when goods have been exported, the registered recipient shall provide copy of shipping bill or bill of export containing details of Goods and Services Tax Indetification Number (GSTIN) and tax invoice of the registered supplier alongwith proof of export general manifest or export report having been filed to the registered supplier as well as jurisdictional tax officer of such supplier.2. The registered supplier shall not be eligible for the above mentioned exemption if the registered recipient fails to export the said goods within a period of Ninety days from the date of issue of Tax Invoice.

Members are requested to take note of the same. For complete details, you may use below link to download the original Notification- 41/2017 Integrated Tax (Rate)

Thanking You,

Yours faithfully,

(S. G. Bharadi)

Executive Director

http://chemexcil.in/uploads/files/Notification_No_41.pdf

|

|

BACK

|

Announcements by ECHA on the use of Zinc oxide and clarification for downstream users of Cromium VI Compounds

|

EPC/REACH |

23rd Oct 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Announcements by ECHA on the use of Zinc oxide and clarification for downstream users of Cromium VI Compounds |

|

|

Dear Members,

The European Chemical Agency (ECHA) recently published following regulation/information in respect of the use of Zinc Oxide in cosmetic products and clarification for downstream users of Chromium VI Compounds. The copy of the said regulation is attached for your ready reference.

1. EC regulation on the use of zinc oxide in cosmetic products

The European Commission adopted a regulation No 2017/1413 of 3 August 2017, amending Annex IV to Regulation (EC) No 1223/2009 on cosmetic products. The decision to amend the regulation is based on the opinion of Scientific Committee on Consumer Safety (SCCS) which considered that in view of the lung inflammation induced by zinc oxide particles after inhalation, the use of zinc oxide in cosmetic products that may result in exposure of the consumer's lungs to zinc oxide by inhalation was of concern. Hence the use of zinc oxide as a colorant, in its uncoated non-nano form, in cosmetic products should be restricted to those applications which may not lead to exposure of the end-user's lungs by inhalation.

From 24 February 2018, only cosmetic products which comply with this Regulation shall be placed on the Union market. This Regulation shall be binding in its entirety and directly applicable in all Member States. The relevant EU regulation is attached for information.

2. Clarification by ECHA for downstream users of Chromium VI Compounds after Sunset date of 21 September 2017

The European Chemical Agency (ECHA) through a Q & A published in its website has clarified that downstream users can continue using Chromium VI compounds after the sunset of the substance which is on 21 September 2017 even if the Commission has not decided to grant or not to grant an authorisation. This continuation is possible, if a company up their supply chain, has applied for an authorisation for their use before the latest application date for this substance, which was 21 March 2016.

As long as the authorisation is pending, the downstream users do not need to do anything extra. Once the Commission has made its decision, and if an authorisation is granted, downstream users will need to notify their use to ECHA. If the Commission has made the decision of granting an authorisation users must notify the use to ECHA three months from the first delivery of the substance. The notification needs to refer to the specific authorisation number indicated in the label of the product and the safety data sheet they receive from your supplier, which corresponds to your use. For the companies which need more information, they can contact via: ECHA: application-authorisation@echa.europa.eu.<

All members are requested to please take a note of it.

Thanking You,

Yours faithfully

Prafulla Walhe

Deputy Director

Commission Regulation No. 1413

|

|

BACK

|

IGST Refunds Validation of Bank Accounts in the Public Financial Management System (PFMS)/ Issues hindering the disbursal of IGST Refund

|

EPC/LIC/JNCH |

18th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

IGST Refunds Validation of Bank Accounts in the Public Financial Management System (PFMS)/ Issues hindering the disbursal of IGST Refund |

|

|

Dear Members,

We have received communication from the Assistant Commissioner of Customs, Drawback, Air Cargo Complex, Mumbai with list of Exporters along with their IEC No. wherein IGST Export Refund could not be generated because of any of the certain deficiencies.

We are given to understand that the process of disbursal of IGST Export Refund requires updated and validated Bank Account in PFMS. Also the Bank Account details of Custom EDI/ ICEGATE be same as that mentioned in GSTN. Further, GSTR1 in specific reference to table 6A and GSTR3 Refund should be filed. Also the EGM Error if any should be corrected on priority. Deficiency in any of the above mentioned prerequisite will hinder the disbursement of IGST Export Refund.

In this regard, we would like to inform you that Jawaharlal Nehru Custom House (JNCH)has issued also Public Notice No. 123/2017 dated 28/09/2017 regarding Validation of Bank Accounts in the Public Financial Management System (PFMS) for speedy & smooth disbursal of IGST (Integrated Goods & Services Tax) Export refund. However, in order to avail the IGST refund, it is mandatory that the exporters have validated their bank accounts by “Public Financial Management System (PFMS)”. If bank accounts of the exporters are closed and/or not validated by PFMS, then the IGST refund, even if sanctioned, may not get credited to the accounts of the exporters.

As per above PN, it is reported to JNCH that “closed” bank accounts of the exporters still exist in the system and PFMS has invalidated such accounts making the prospective disbursal of IGST refund to such closed accounts impossible. The list of list of accounts, which are not validated by PFMS pertaining JNCH(Export) is uploaded on the website of the “Jawahar Lal Nehru Customs House” (http://www.jawaharcustoms.gov.in) under the heading “Latest Updates” for wider publicity and necessary action at the end of the concerned exporters.

Members are requested to take note of the same and advised to get the anomalies rectified, if any, to ensure disbursement of IGST Refunds.

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Enclosure:- IEC_BNK_CD

Email Copy

|

|

BACK

|

Important GST : Notifications to exempt integrated tax and compensation cess on import of goods under AA/EPCG schemes / Notification to exempt goods imported by EOUs from integrated tax and compensation cess / Others

|

EPC/LIC/GST |

16th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Important GST : Notifications to exempt integrated tax and compensation cess on import of goods under AA/EPCG schemes / Notification to exempt goods imported by EOUs from integrated tax and compensation cess / Others |

|

|

Dear Members,

As you are aware, GST Council in its 22nd meeting of 6th October 2017, had recommended an export package to provide relief to the small exporters.

In this regard, CBEC has now issued various supporting notifications regarding exemption of IGST & Cess under AA/EPCG/by EOU’s, NIL GST on sale of MEIS scrips etc.

Some of the important/ relevant notifications issued so far are highlighted as follows for your information:

Customs Notifications

Notification Search:

Notification No. & Date of Issue |

English |

Subject |

79/2017-Cus,dt. 13-10-2017 |

View (237 KB) |

Seek to amend various Customs exemption notifications to exempt Integrated Tax/Cess on import of goods under AA/EPCG. schemes |

78/2017-Cus,dt. 13-10-2017 |

View (234 KB) |

Seeks to exempt goods imported by EOUs from integrated tax and compensation cess |

Central Tax Notifications

45/2017-Central Tax,dt. 13-10-2017 |

View (342 KB) |

Seeks to amend the CGST Rules, 2017 |

40/2017-Central Tax,dt. 13-10-2017 |

View (342 KB) |

Seeks to make payment of tax on issuance of invoice by registered persons having aggregate turnover less than Rs 1.5 crores |

Central Tax (Rate) Notifications

Notification No. & Date of Issue |

English |

Subject |

35/2017-Central Tax (Rate) ,dt. 13-10-2017 |

View (258 KB) |

Seeks to amend notification No. 2/2017-Central Tax (Rate). |

32/2017-Central Tax (Rate) ,dt. 13-10-2017 |

View (307 KB) |

Seeks to amend notification No. 12/2017-CT(R). |

Integrated Tax Notifications

10/2017-Integrated Tax,dt. 13-10-2017 |

View (82 KB) |

Seeks to exempt persons making inter-State supplies of taxable services from registration under section 23(2) |

Integrated Tax (Rate) Notifications

Notification No. & Date of Issue |

English |

Subject |

39/2017-Integrated Tax (Rate) ,dt. 13-10-2017 |

View (181 KB) |

Seeks to amend notification No. 8/2017-Integrated Tax (Rate). |

36/2017-Integrated Tax (Rate) ,dt. 13-10-2017 |

View (258 KB) |

Seeks to amend notification No. 2/2017-Integrated Tax (Rate). |

33/2017-Integrated Tax (Rate) ,dt. 13-10-2017 |

View (275 KB) |

Seeks to amend notification No. 9/2017-IT(R) . |

32/2017-Integrated Tax (Rate) ,dt. 13-10-2017 |

View (62 KB) |

Seeks to exempt payment of tax under section 5(4) of the IGST Act, 2017 till 31.03.2018 |

| |

|

|

|

Members are requested to take note of some of the above notifications issued so far. Notifications which are pending shall be disseminated once issued.

Original texts of all above notifications are available on below links:

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-act/notifications/notfns-2017/cs-tarr2017/cs79-2017.pdf

http://www.cbec.gov.in/htdocs-cbec/customs/cs-act/notifications/notfns-2017/cs-tarr2017/cs78-2017.pdf

http://www.cbec.gov.in/htdocs-cbec/gst/central-tax-notfns-2017

http://www.cbec.gov.in/htdocs-cbec/gst/central-tax-rate-notfns-2017

http://www.cbec.gov.in/htdocs-cbec/gst/integrated-tax-notfns-2017

http://www.cbec.gov.in/htdocs-cbec/gst/integrated-tax-rate-2017

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

DGFT Amendments in Foreign Trade Policy 2015-20

|

EPC/LIC/DGFT |

16th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT Amendments in Foreign Trade Policy 2015-20 |

|

|

Dear Members,

Kindly note that O/o DGFT New Delhi has issued Notification no 33/2015-2020 dated 13th Oct 2017 regarding Amendments in Foreign Trade Policy 2015-20 which are in line with recent recommendations by GST Council.

With effect of this notification, various provisions of Foreign Trade Policy 2015-20 are amended to enable certain additional duties/taxes/cess exemptions for Advance authorisations, EPCG Authorisations and units under EOU/EHTP/ STP/BTP Scheme.

Members are requested to take note of the same. For complete details, you may use below link to download the original notification-

http://dgft.gov.in/Exim/2000/NOT/NOT17/Notification_No._33_(English).pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

GST: CBEC Instructions to field formations for Refund of IGST paid on export of goods under Rule 96 of CGST Rules 2017

|

EPC/LIC/IGST_REFUNDS |

10th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST: CBEC Instructions to field formations for Refund of IGST paid on export of goods under Rule 96 of CGST Rules 2017 |

|

|

Dear Members,

As you are aware, GST Council has recommended that IGST refunds for exports made in July 2017 shall be done expeditiously i.e. start by 10.10.2017.

In this regard, CBEC has issued Instructions to the field Formations (Local Commissionerates) vide reference no. 15/2017 & 16/2017 both dated 09/10/2017 for smooth handling of the Refunds of IGST paid on export of goods (by exporters) under Rule 96 of CGST Rules 2017, in line with recommendations of the 22nd GST Council Meeting dt. 6 Oct. 2017.

Though these instructions are meant for field formations, the same are highlighted below, so that members can do the needful wherever applicable-

Export General Manifest filing by Shipping lines/ carriers

Filing of correct EGM is a must for treating shipping bill or bill of export as a refund claim. Field formations shall ensure that the concerned airlines/ shipping lines/ carriers file EGM/ Export report within prescribed time. Cases which remain in EGM error due to any reason should be followed up to ensure that records are updated at the gateway port, especially for ICDs.

Exporters are also advised that they may follow up with their carriers to ensure that correct EGM/ export reports are filed in a timely manner.

Details of export supplies in Table 6A of GSTR-1

The details of zero rated supplies declared in Table 6A of return in Form GSTR-1 are matched electronically with the corresponding details available in Customs Systems as per details provided in shipping bills/ bill of export. Thus exporters must file their GSTR-1 very carefully to ensure that all relevant details match. For their convenience, the details available in the Customs System have been made available for viewing in their ICEGATE login.

Exporters who have not filed their GSTR-1 for month of July 2017 may be advised to do so immediately.

For month of August 2017 and subsequent months, facility of filing GSTR-1 has not been made available by GSTN at present. In order to facilitate processing of refunds, GSTN is making available a separate utility for filing details in Table 6A of GSTR-1 on the GSTN Web portal. Exporters are advised to submit the requisite details once GSTN develops the utility.

Valid return in Form GSTR-3 or Form GSTR-38

Filing of valid return in GSTR -3 or GSTR -3B is another pre-condition for considering shipping bill/ Bill of export as claim for refund. Exporters are be advised that they must file these returns expeditiously without waiting for the last date, to ensure that their refund is processed in a timely manner.

Bank account details

As per Rule 96 of CGST Rules 2017, the refund is to be credited in the bank account of the applicant mentioned in his registration particulars.

In the given circumstances, existing system will be used by concerned authority to make payment of refund of IGST on Exports w.e.f. 10th October 2017 till l4th October 2017. The payment through PFMS portal would be started from 16th October 2017.

Later on as the refund payments will be routed through the PFMS the bank account details need to be verified and validated by PFMS. The status of validation of bank account with PFMS is available in ICES. Exporters are advised that if the account has not been validated by PFMS, they must get their details corrected in the Customs system so that their bank account gets validated by PFMS. Exporters are also advised not to change their bank account details frequently to avoid delay in refund payment.

Processing of refund claims

Detailed EDI procedure for processing of claims and generation of refund scrolls is being circulated by Directorate of Systems. Proper officers may be designated in each Commissionerate, who should be in readiness to start generating refund scrolls from 10.10.2017 onwards.

Guidelines and procedures for filing and processing of refunds of IGST paid on export goods for exports made under manual (non-EDI) shipping bills shall be communicated separately.

The original instructions to field formations can be referred using below links-

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-instructions/cs-instructions-2017/cs-ins-16 igst.pdf

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-instructions/cs-instructions-2017/cs-ins-15 igst.pdf

Members are requested to take note of same and do the needful, wherever needed. In case of any issues, members may revert to us on deepak.gupta@chemexcil.gov.in and balani.lic@chemexcil.gov.in .

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Important GST : Recommendations made during 22nd GST Council meeting of 06/10/2017 Relief Package for Exporters

|

EPC/LIC/GST_EXPORTS

|

9th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Important GST : Recommendations made during 22nd GST Council meeting of 06/10/2017 Relief Package for Exporters |

|

|

Dear Members,

The GST Council, in its 22nd meeting held at New Delhi on 6th October 2017, has recommended the following facilitative changes to ease the burden of compliance on small and medium businesses.

General Relief Measures for Small and Medium Enterprises

The composition scheme shall be made available to taxpayers having annual aggregate turnover of up to Rs. 1 crore as compared to the current turnover threshold of Rs. 75 lacs.

Quarterly Return Filling for aggregate turnover up to Rs. 1.5 crores:

To facilitate the ease of payment and return filing for small and medium businesses with annual aggregate turnover up to Rs. 1.5 crores, it has been decided that such taxpayers shall be required to file quarterly returns in FORM GSTR-1,2 & 3 and pay taxes only on a quarterly basis, starting from the Third Quarter of this Financial Year i.e. October-December, 2017. The registered buyers from such small taxpayers would be eligible to avail ITC on a monthly basis. The due dates for filing the quarterly returns for such taxpayers shall be announced in due course. Meanwhile, all taxpayers will be required to file FORM GSTR-3B on a monthly basis till December, 2017. All taxpayers are also required to file FORM GSTR-1, 2 & 3 for the months of July, August and September, 2017. Due dates for filing the returns for the month of July, 2017 have already been announced. The due dates for the months of August and September, 2017 will be announced in due course.

Reverse charge mechanism suspended till 31.03.2018:

It will be reviewed by a committee of experts. This will benefit small businesses and substantially reduce compliance costs.

Relaxation from Registration for inter-state supplies:

Anyone making inter-state taxable supplies, except inter-State job worker, is compulsorily required to register, irrespective of turnover. It has now been decided to exempt those service providers whose annual aggregate turnover is less than Rs. 20 lacs (Rs. 10 lacs in special category states except J & K) from obtaining registration even if they are making inter-State taxable supplies of services. This measure is expected to significantly reduce the compliance cost of small service providers.

Relaxation in GST on advances:

The requirement to pay GST on advances received was proving to be burdensome for small dealers and manufacturers. In order to mitigate their inconvenience on this account, it has been decided that taxpayers having annual aggregate turnover up to Rs. 1.5 crores shall not be required to pay GST at the time of receipt of advances on account of supply of goods. The GST on such supplies shall be payable only when the supply of goods is made.

NIL GST on GTA services to un-registered person:

It has come to light that Goods Transport Agencies (GTAs) are not willing to provide services to unregistered persons. In order to remove the hardship being faced by small unregistered businesses on this account, the services provided by a GTA to an unregistered person shall be exempted from GST.<

The e-way bill system shall be introduced in a staggered manner with effect from 01.01.2018 and shall be rolled out nationwide with effect from 01.04.2018. This is in order to give trade and industry more time to acclimatize itself with the GST regime.

After assessing the readiness of the trade, industry and Government departments, it has been decided that registration and operationalization of TDS/TCS provisions shall be postponed till 31.03.2018.

Relief Package for Exporters

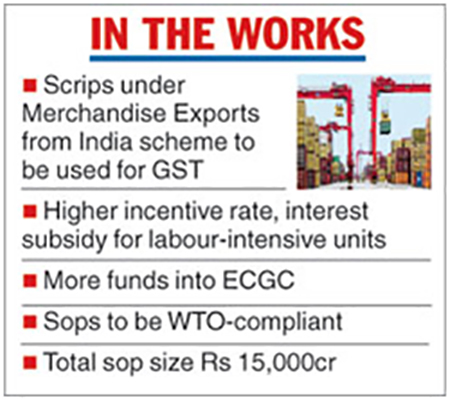

The GST Council has also approved a major relief package with immediate effect for exporters keeping in mind the difficulties faced by exporters post-GST impacting their competitiveness.

For the sake of your convenience, the export related measures are highlighted/ reproduced as follows :

IGST Refunds of exporters:

By 10.10.2017, the held-up refund of IGST paid on goods exported outside India in July would begin to be paid. The August backlog would get cleared from 18.10.2017 and refunds for subsequent months would be handled expeditiously. Other refunds of IGST paid on supplies to SEZs and of inputs taxes on exports under Bond/LUT, shall be processed from 18.10.2017 onwards. For this, the Government has agreed to suitably empower Central and State GST officers so that exporters get refunds from one authority only. Related matters of settlement of funds are being resolved.

Exemption from IGST on supplies/ Imports against Advance Authorization (AA) / Export Promotion Capital Goods (EPCG) / 100% EOU schemes to sourcing inputs etc.

To prevent cash blockages of exporters due to upfront payment of GST on inputs etc. the Council approved two proposals, one for immediate relief and the other for providing long term support to exporters. Immediate relief is being given by extending the Advance Authorization (AA) / Export Promotion Capital Goods (EPCG) / 100% EOU schemes to sourcing inputs etc. from abroad as well as domestic suppliers. Holders of AA / EPCG and EOUs would not have to pay IGST, Cess etc. on imports. Also, domestic supplies to holders of AA / EPCG and EOUs would be treated as deemed exports under Section 147 of CGST/SGST Act and refund of tax paid on such supplies given to the supplier

Merchant exporters:

Will now have to pay nominal GST of 0.1% for procuring goods from domestic suppliers for export. The details would be released soon.

E-Wallet for exporters w.e.f 1st April 2018:

The permanent solution to cash blockage is that of "e-Wallet" which would be credited with a notional amount as if it is an advance refund. This credit would be used to pay IGST, GST etc. The details of this facility would be worked out soon. The Council desired that the “e-Wallet” solution should be made operational w.e.f. 1st April 2018.

Exemption from Bond / BG:

This facility has already been extended few days back and now exporters have been exempted from furnishing Bond and Bank Guarantee when they clear goods for export, except those who have been prosecuted for any offence under the Central Goods and Services Tax Act, 2017 or the Integrated Goods and Services Tax Act, 2017 or any of the existing laws in force in a case where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

NIL GST on sale of MEIS Scrips

To restore the lost incentive on sale of duty credit scrips, the GST on sale-purchase of these scrips is being reduced from 5% to 0%.

GST on bunker fuel is being reduced to 5% for both coastal vessels and foreign going vessels. This will boost coastal shipping. It will also improve India's competitiveness.

The government is confident that these measures would provide immediate relief to the export sector and enhance export competitiveness of India.

Members are requested to take of all above and benefit from same. Original texts of all relevant press releases/ press notes are available on below links:

http://cbec.gov.in/resources//htdocs-cbec/gst/Press%20note%20export%20package.pdf

http://pib.nic.in/newsite/erelease.aspx

http://cbec.gov.in/resources//htdocs-cbec/gst/GST%20RATE%20APPROVED%20BY%20GST%20Council-%206.10.2017.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

GST : Facility of furnishing Letter of Undertaking extended to more exporters/ Clarifications

| EPC/LIC/LUT_BOND |

5th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST : Facility of furnishing Letter of Undertaking extended to more exporters/ Clarifications |

|

|

Dear Members,

As you are aware, in recent times the criteria for LUT or Bond with BG has been relaxed with acceptance of RCMC with Bond. However, MSME exporters have still reported issues due to difference in interpretation by local GST Offices and difficulties faced.

Taking cognizance of these issues, CBEC has issued Notification No. 37/2017 – Central Tax dated 4th October, 2017 which extends the facility of LUT to all exporters under rule 96A of the CGST Rules 2017, subject to certain conditions and safeguards.

Along-with this notification, Master Circular No. 8/8/2017-GST dated 4th October 2017 has also been issued providing updated clarifications on Bond/ LUT application modalities, applicability on payments in INR, self-sealing, Transactions with EOU, CT1 etc. This master circular actually sums up all the recent clarification issued by CBEC/ GST Policy Wing.

As per Notification No. 37 /2017 – Central Tax dated4th October, 2017, following conditions and safeguards are specified for furnishing a Letter of Undertaking in place of a Bond by a registered person who intends to supply goods or services for export without payment of integrated tax –

(i) All registered persons who intend to supply goods or services for export without payment of integrated tax shall be eligible to furnish a Letter of Undertaking in place of a bond except those who have been prosecuted for any offence under the Central Goods and Services Tax Act, 2017 or the Integrated Goods and Services Tax Act, 2017 or any of the existing laws in force in a case where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

(ii) The Letter of Undertaking shall be furnished on the letter head of the registered person, in duplicate, for a financial year in the annexure to FORM GST RFD – 11 and it shall be executed by the working partner, the Managing Director or the Company Secretary or the proprietor or by a person duly authorised by such working partner or Board of Directors of such company or proprietor;

(iii) Where the registered person fails to pay the tax due along with interest, the facility of export without payment of integrated tax will be deemed to have been withdrawn and if the amount mentioned in the said sub-rule is paid, the facility of export without payment of integrated tax shall be restored.

(iv) The provisions of this notification shall also apply in respect of zero-rated supply of goods or services or both made by a registered person (including a Special Economic Zone developer or Special Economic Zone unit) to a Special Economic Zone developer or Special Economic Zone unit without payment of integrated tax.

Relevant members (specially MSME’s) are requested to take note of above points in the Notification No. 37 /2017 and do the needful.

Forupdated clarifications on Bond/ LUT application modalities, applicability on payments in INR, self-sealing, Transactions with EOU, CT1 please also refer to Master Circular No. 8/8/2017-GST dated 4th October 2017.

For full details of above said Notification and Master circular, respectively, please use below links to download directly from CBEC portal-

http://cbec.gov.in/resources//htdocs-cbec/gst/Final_Master_circular_LUT_Bond_04102017.pdf

http://cbec.gov.in/resources//htdocs-cbec/gst/notfctn-37-central-tax-english.pdf

In our view, above notifications/ clarifications should resolve the existing issues related to Bond, LUT etc. However, if any difficulty is still faced by the members, they may revert to us ondeepak.gupta@chemexcil.gov.in and balani.lic@chemexcil.gov.in .

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl:- as above.

|

|

BACK

|

E-Seals: Details of Vendors providing E-seals (as per Circular 36/2017-Customs & 37/2017-Customs)

| EPC/LIC/E-SEALS |

4th October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

E-Seals: Details of Vendors providing E-seals (as per Circular 36/2017-Customs & 37/2017-Customs) |

|

|

Dear Members,

This is in continuation of our recent mailers informing you about recent CBEC circular No. 36/2017 dtd 28/08/2017 & 37/2017 dtd 20/09/2017 regarding Electronic Sealing for Containers by exporters under self-sealing procedure.

As informed earlier, to ensure that electronic seals deployed are of a reliable quality, CBEC has prescribed that all vendors proposing to offer RFID Tamper Proof One-Time-Bolt Container Seals to exporters for self-sealing, must submit self-attested certificates from seal manufacturers to the Director (Customs), CBEC, North Block, New Delhi before commencing sales. Where the certification is found to comply with the requirements of the ISO standard, the names of such vendors shall be put up on the Board's website (www.cbec.gov.in) for ease of reference of the trade and field formations, as soon as they are received.

In this regard, CBEC has uploaded an update on www.cbec.gov.in providing details of few Vendors providing E-seals (as per Circular 36/2017-Customs & 37/2017-Customs).

The original update is available on CBEC portal using below link for download-

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/details-of-vendors-for-webload.pdf

We also understand from the update, that the process of verifying the documents of the Vendors is an ongoing process. As and when aspiring vendors complete the required documentation their names will be put up on CBEC website. We shall update you in due course.

Members are requested to take note of the same and do the needful accordingly.

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Upgradation of India Korea CEPA Comments on additional 146 tariff lines from Korean side

| EPC/LIC/INDIA-KOREA CEPA/ |

3rd October 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Upgradation of India Korea CEPA Comments on additional 146 tariff lines from Korean side |

|

|

Dear Members,

This is in continuation of our earlier circular dated 2nd May 2017 seeking comments on Korean request list of 745 tariff lines for concessions under India-Korea CEPA. The negotiations for upgrading India-Korea CEPA are going on.

We have now received communication from the FT (NEA) Division, Department of Commerce that the Korean side has forwarded list of 146 additional tariff lines seeking tariff concessions from India under CEPA. The list of additional 146 items is attached herewith for your reference.

Members are requested to kindly send comments/views, if any, on these additional tariff lines which can up with the Ministry. Your comments, if any, be sent to us latest by 10th October 2017 on our email mail ids deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking you.

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl:- as above.

|

|

BACK

|

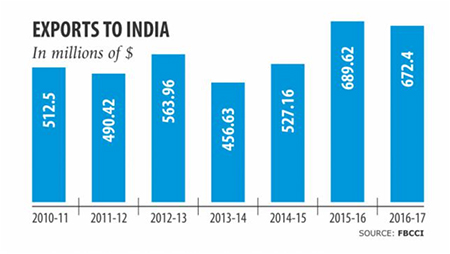

Exports to India fail to pick up

|

Exports to India are not picking up despite a host of positive initiatives by both the countries.

“We are struggling to cross the $1 billion-mark on export to India although India is one of the high potential markets for Bangladesh,” said Abdul Matlub Ahmad, former president of the Federation of Bangladesh Chambers of Commerce and Industry.

In fiscal 2016-17, Bangladesh's exports to India stood at $672.40 million, according to data from the Export Promotion Bureau.

Bangladesh will now endeavour to hit the milestone within the next two to three years, he said.

The exports have not been increasing mainly for two reasons -- a lack of diversity in Bangladeshi goods and non-tariff barriers in India, according to Ahmad, also a former president of the India-Bangladesh Chamber of Commerce and Industry.

Goods cannot enter freely into the Indian market from Bangladesh for having non-tariff barriers like mandatory testing and poor banking system along the bordering areas.

On the other hand, Bangladesh has very few products in its export basket, he said.

“Only garment products, jute and jute goods are exported to India from Bangladesh.”

Subsequently, he urged the government to launch strong lobbying efforts with the Indian government for removing the anti-dumping duty of $19-$352 a tonne imposed on January 5 this year on jute and jute good exports.

Although India allows duty-free access to all Bangladeshi items save for some alcoholic beverages, the Indian government imposed a countervailing duty of 12.50 percent on the import of Bangladeshi apparel items. As a result, Bangladesh's garment exports to India are not increasing.

The Indian market can be a good export destination for Bangladeshi garment makers for its rising middle-class population, Ahmedabad.

Last fiscal year, garment shipments to India, a market of more than $40 billion, fetched $129.81 million, down 4.85 percent year-on-year.

“We will again raise the issue of non-tariff barriers in a meeting on Tuesday with the visiting Indian Finance Minister ArunJaitley,” said FBCCI President Shafiul Islam Mohiuddin.

Mohiuddin said they will also raise the issue of testing certification. Currently, the Bangladesh Standards and Testing Institution certificate for 21 food products is recognized by India.

Recently, Bangladesh proposed to India to accept the BSTI certification for 14 other products like frozen food, potato crackers, candy, milk powder, white bread, dry cake, drinking water, flavoured drinks, canned juices, soap, cement, mild-steel rod, GI pipes and textile items. The balance of trade between the two countries is heavily tilted towards India because Bangladesh imports some basic products like cotton, cereal, vehicles, chemicals and pharmaceuticals from the neighbouring country.“We want to invest in India. We also sent teams to visit some places in Kolkata and Gujarat recently to assess the investment potential in India,” Mohiuddin added.

A total of 29 business delegations from India are scheduled to hold meetings with the Bangladeshi businessmen at the capital's Sonargaon Hotel today, said Hussain Jamil, secretary to the FBCCI. Pankaj R Patel, president of the Federation of Indian Chambers of Commerce, will lead the Indian business delegation in the presence of Jaitley and Commerce Minister Tofail Ahmed in the meeting.

Mohiuddin will lead the Bangladeshi businessmen in the meeting. Bangladesh imports goods worth more than $6 billion from India in a year through the formal channel, about $2 billion of which is cotton.

More than 50 percent of Bangladesh's cotton requirement in a year is met by imports from India. It is believed that India exports goods worth more than $5 billion to Bangladesh a year through informal channels.

Indian companies such as Marico, CEAT, Tata Motors, Godrej, Sun Pharma, Asian Paints have made substantial investments in Bangladesh.

(Source: http://www.thedailystar.net/business/exports-india-fail-pick-1470901 dated 3rd Oct-2017)

|

|

BACK |

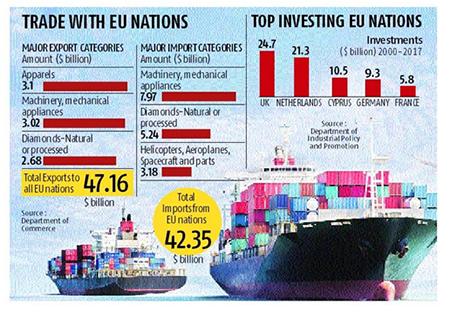

India, European Union may form joint group on FTA

|

The 14th India-EU Summit aims to deepen the India-EU Strategic Partnership and advance collaboration in priority areas, a Ministry of External Affairs statement said.

Four days ahead of the 14th India-European Union summit on October 6, hectic negotiations are underway between officials from India and the EU to explore ways on how they will move forward on the stalled negotiations over a new and ambitious Free Trade Agreement (FTA), which will encompass goods, services as well as mutual investment protection.

Sources told The Indian Express that the two sides may announce a mechanism or a joint working group to push for an early conclusion of the pact, which will also take care of the concerns arising out of the lapsed bilateral investment protection agreements with EU countries. “The idea is to turn the page on the issue of investments and trade, which may be adversely impacted due to the lapsed agreements on bilateral investment protection with all EU countries,” a source told The Indian Express.

This is the first summit between India and the EU, after the Brexit verdict came out last year. This also comes about four months after Prime Minister Narendra Modi strongly endorsed German Chancellor Angela Merkel’s vision of the European Union and committed at the earliest to resume talks between India and EU to stitch up a free trade agreement encompassing goods, services as well as mutual investment protection.

EU is India’s largest regional trading partner with bilateral trade in goods standing at $ 88 bn in 2016. The EU is also the largest destination for Indian exports and a key source of the investment and cutting edge technologies. India received around $ 83 bn FDI flows from Europe during 2000-17 constituting approximately 24 per cent of the total FDI inflows into the country during the period.

India and the EU are in the process of negotiating a bilateral Broad-based Trade and Investment Agreement since 2007. As of late, both sides are discussing the modalities of resumption of BTIA talks on a fast track.

Sources said that the meetings between the President of the European Council, Donald Franciszek Tusk and the President of the European Commission, Jean-Claude Juncker and Modi will be key to give their stamp of approval about this issue.

Tusk and Juncker will be accompanied by a high-level delegation including EU’s High Representative for Foreign Affairs and Security Policy and Vice-President of the European Commission, Federica Mogherini.

The 14th India-EU Summit aims to deepen the India-EU Strategic Partnership and advance collaboration in priority areas, a Ministry of External Affairs statement said.

(Source:-http://indianexpress.com/article/business/business-others/india-european-union-may-form-joint-group-on-fta-4871823/ dated 3rd Oct-2017)

|

|

BACK |

Bangladesh: Jaitley arrives in Dhaka, will ink $4.5 billion Line of Credit deal

|

| Jaitley being welcomed at Bangladesh Air Force Base |

Bangladesh will sign a $4.5 billion third Line of Credit (LoC) agreement with India on Wednesday. The agreement will be signed in the presence of Indian Finance Minister ArunJaitley and his Bangladesh counterpart Abul Mal Abdul Muhith.

A press release from Bangladesh government official said, Economic Relations Division (ERD), Secretary and Managing Director of Indian EXIM Bank, will ink the agreement on behalf of their respective sides at the Finance Ministry in Dhaka.

It was during the visit of Bangladeshi PM Sheikh Hasina's visit to India in April 2017, the Indian Line of Credit of US $4.5 billion was announced for Bangladesh.

This will bring the total quantum of credit lines extended by India to Bangladesh over the last six years to $8 billion. Signing of the Third Dollar Credit Line Agreement will enable the implementation of a number of key infrastructure priority projects of Bangladesh.

Later, the Joint Interpretive Notes on the agreement between the two countries will also be signed at the ministry to promote and protect investments.

JAITLEY TO HAVE A BUSY SCHEDULE

Indian Finance Minister ArunJaitley arrived in Dhaka, Wednesday noon on a three-day official visit. A special aircraft carrying the Jaitley-led Indian delegation landed at Bangladesh Air Force Base at around 2 pm. He was received by Bangladeshi Finance Minister Muhtih.

Bangladesh finance ministry official told that, Jaitley is being accompanied by Subhash Chandra Garg, secretary of Department of Economic Affairs under the Indian Ministry of Finance and other senior officials of Indian government.

A 30-member high-level business delegation from the Federation of Indian Chambers of Commerce and Industry (FICCI) is also accompanying the finance and corporate affairs minister of India.

On Wednesday, Jaitley will also join a meeting with the delegation of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) at Pan Pacific Sonargaon Hotel in Dhaka.

President of FICCI Pankaj Patel, FBCCI President Shafiul Islam Mohiuddin and director Shahed Reza, among others, addressed the meeting.

He will also hold bilateral meeting with his Bangladesh counterpart AMA Muhith. Jaitley will also attend an event to be organised by the Policy Research Institute of Bangladesh and the High Commission of India, on the subject of 'Macroeconomic Initiatives of the Government of India'.

A media statement of the Indian High Commision said, as India and Bangladesh have witnessed deepening of bilateral economic cooperation in recent years, particularly in terms of increasing volumes of trade and investment. The two ministers are expected to review the status of economic cooperation and initiatives taken during the visits of Modi and Hasina in 2015 and 2017, respectively.

Jaitley and Muhith will jointly inaugurate a new scheme for cashless transactions in visa services run by the State Bank of India on behalf of the High Commission of India. The two ministers will also inaugurate the Dhaka representative office of the EXIM Bank of India.

BANGLADESH SEEKS MORE INDIAN INVESTMENTS

Bangladeshi Commerce Minister Tofail Ahmed seeked more Indian investments in Bangladesh to reduce trade gap.

Ahmed said, in order to increase trade between India and Bangladesh we should focus on removing non-tariff and para-tariff barriers, improving the physical facilities, mutual recognition of certificates and standards and better connectivity needs to be ensured.

Ahmed was speaking at 'Bangladesh India Business Meeting' organized by FBCCI at a city hotel today.

Jaitely said, India has a large population and it has concentrated on skill development and India can extend cooperation to Bangladesh in this area through exchange programs.

(Source:-http://indiatoday.intoday.in/story/bangladesh-arun-jaitley-dhaka-line-of-credit-deal/1/1061030.html dated 4th Oct-2017)

|

|

BACK |

India Considers Free Trade Zone For Afghan Goods

|

India is thinking about establishing a free trade zone for Afg

han goods in order to increase the export of Afghan products to other countries, the Ministry of Commerce said on Wednesday.

Afghanistan’s exports will considerably increase if a free trade zone is created in India, the commerce ministry spokesman MusafirQoqandi told TOLOnews.

“For sure, these zones will be built by India for Afghan exports in order to send our products to other parts of India and out of that country,” he said. “We welcome this move and it will be effective for the increase of Afghanistan’s exports.”

Meanwhile, the International Chamber of Commerce stressed the need for such zones inside Afghanistan.

Abdul Qadir Bahman, CEO of the chamber, said they will send a draft plan to government in the near future.

“It is a good move. If India gives this chance to Afghan businessmen, they will be able to send their goods to other countries from India. But it will be better if these free zones are established in Afghanistan,” he told TOLOnews.

Experts say free zones provide more facilities for investors as they will not have to deal with taxes and customs issues if they use these zones.

(Source:-http://www.tolonews.com/index.php/business/india-considers-free-trade-zone-afghan-goods dated 3rd Oct-2017)

|

|

BACK |

Commerce Ministry announces time relaxation for Navi Mumbai SEZ to address issues

|

New Delhi, Oct 3 (KNN) As the Special Economic Zone projects continue to face operational and regulatory issues in the state, the commerce ministry has decided to give more time to the SEZ developer Navi Mumbai SEZ, hat has over eight projects in its cap.

The decision by the commerce ministry comes in response to the appeal fo the Maharashtra government.

Earlier, the Maharashtra government had sought more time from the Board of Approval (BoA), headed by Commerce Secretary Rita Teaotia, to resolve the issues faced by Navi Mumbai SEZ Ltd (NMSEZ).

NMSEZ informed the board that the proposed SEZ project is pending because the Maharashtra government failed to enact the state SEZ act.

Following which, in the absence of proper legislation, the entrepreneurs are hesitating to set up their units in the zones.

Navi Mumbai SEZ in a press interview informed that with more time in hand, the state government, City and Industrial Development Corporation (CIDCO) and NMSEZ are in the process of resolving operational and regulatory issues. (KNN/DA)

(Source:-http://knnindia.co.in/news/newsdetails/sectors/commerce-ministry-announces-time-relaxation-for-navi-mumbai-sez-to-address-issues dated 3rd Oct-2017)

|

|

BACK |

India – Europe business outlook, Recovering from pessimism despite persistent challenges

|