Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-Exporters,

First of all, I wish you a very Happy Diwali.

I have pleasure to bring to you the 17th issue of the CHEMEXCIL e-Bulletin for the month of September 2017, which contains the following activities undertaken by the Council and other useful information/Notifications, etc.

We have completed nearly three months post the GST era. This period of transition has been quite challenging for the exporters due to initial lack of clarity on export procedures under GST, liquidity issues on account of blockage of funds/ delay in GST refunds, compliance burden of GST Returns, Technical glitches on GST Portal and also concerns regarding status of export incentives under Foreign Trade Policy 2015-20.

The Council has regularlytaken up these issues with the concerned authorities for redressal. The trade/ industry awaits government support particularly in faster processing of GST refunds which will provide relief to the exporters.

The issues regarding LUT/ Bond/BG have been resolved to some extent and organized industry and the exporting community seem to have now got a good measure of the various issues of the GST provisions with respect to export. I must add that in many cases, the government has timely provided guidance notes, both general and sectoral, as well as clarificatory notifications and circulars which is highly appreciated. In particular, member exporters had requested us to take up various issues of GST and urge the government to do away with need of Bank Guarantee in case of exports being undertaken through the Bond route. Chemexcil, had taken up the matter at the different levels of the government. The CBEC responded positively through Circular No 5/52017-GST dated 11 August, 2017, which has now allowed the waiver of Bank Guarantee in case the exporter submits a self-attested copy of the proof of registration with a respective Export Promotion Council. Similarly, the GST Council has also decided to reduce GST rate on MEIS scrip sale from 12 % to 5% which is highly appreciated.

I also thank the Government of Gujarat for issuing order for remission in VAT Rate on Natural Gas by 9% which will effectively reduce applicable VAT rate on Natural Gas in Gujarat from 15% to 6%. This will provide relief to the consumers for natural gas in Gujarat. From council, we have also represented to the Revenue Dept for inclusion in GST which will allow users to take ITC.

Friends, now we are keenly awaiting the announcement of the Mid Term Foreign Trade Policy 2015-20 and hope the same addresses the concerns of the exporter’s which will boost exports.

I congratulate our Hon. Shri. Suresh Prabhu, Minister of Commerce and industry on his appointment to this position.

I also congratulate newly appointed Shri. Shyamal Misra, IAS, Joint Secretary, EP (CAP) Ministry of Commerce and Industry.

I met our Hon. Shri. Suresh Prabhu, Minister of Commerce and industry on 27th September-2017 at his office and discussed below issues

- GST Related Issues

- Liquidity Problems faced by exporters/ processing of exporter’s refunds under GST.

- Status of Export Incentives under GST Framework.

- Request for enhanced incentives support to Overcome Trade Barriers in Overseas Markets

- Reduction of the GST Rate for Surfactants from 28% to 18%

- Higher All Industries Duty Drawback Rate for 2017-18.

- Review Of ASEAN FTA / Better Market Access In Key Markets

- Expansion Of Interest Equalization Scheme by inclusion Of Merchant Exporters and addition of More tariff Lines:

- Inclusion of Chapter 28 and 29 items under EU GSP:

- Environment Related Controls:

- Promotion of value added Products of Castor Oil:

- Allow Import of Technical Pesticides:

- RBI Caution Listing:

- ICEGATE Working/ DGFT Server/ GST PORTAL glitches

Besides this, CHEMEXCIL organized 54th Annual General Meeting on 15th September, 2017 at 11.00 a.m. in the Conference Room of the Council along with the presentation of Annual Report for the year 2016-17 of the Council.

I do hope that the members would appreciate this edition of the bulletin and will continue to write to us with their comments and suggestions.

With Regards,

SHRI SATISH W. WAGH

CHAIRMAN,

CHEMEXCIL

|

BACK |

CHEMEXCIL’s 54th ANNUAL GENERAL MEETING HELD ON 15th SEPTEMBER, 2017

54th Annual General Meeting of the BASIC CHEMICALS, COSMETICS AND DYES EXPORT PROMOTION COUNCIL, and Mumbai was conducted on Friday the 15th September, 2017 at 11.00 a.m. in the Conference Room of the Council (Jhansi Castle, 4th floor, 7 Cooperage Road, Mumbai-400 001) along with the presentation of Annual Report for the year 2016-17 of the Council.

Following officials form Chemexcil committee of administration were present during the meeting viz. Shri Satish Wagh, Chairman & Regional Chairman – Northern Region, Shri Ajay Kadakia,

|

| Vice Chairman & Regional Chairman – Eastern Region, Shri S.G. Mokashi, Addl. Vice Chairman & Chairman- Basic Inorganic & Organic Chemicals including Agro Chemicals Panel & Regional Chairman – Southern Region, Shri Bhupendra Patel, Chairman-Gujarat Region; Shri Kirit Mehta, Member- Dyes & Dye Intermediates Panel; Dr. Smita Naram, Chairman- Cosmetics, Toiletries & Essential Oil Panel Shri Abhay V. Udeshi, Chairman - Castor Oil & Specialty Chemicals Panel; Shri S.G. Bharadi, Executive Director. |

| |

BACK |

CHEMEXCIL’s Submission to Shri Suresh Prabhu, Hon’ble Minister for Commerce & Industry on constraints faced by exporters in Chemical sector

- GST Related Issues

- Liquidity Problems faced by exporters/ processing of exporter’s refunds under GST.

- Status of Export Incentives under GST Framework.

- Request for enhanced incentives support to Overcome Trade Barriers in Overseas Markets

- Inclusion of Natural Gas under GST.

- Reduction of the GST Rate for Surfactants from 28% to 18%

- Higher All Industries Duty Drawback Rate for 2017-18.

- Review Of ASEAN FTA / Better Market Access In Key Markets

- Expansion Of Interest Equalisation Scheme by inclusion Of Merchant Exporters and addition of More tariff Lines:

- Inclusion of Chapter 28 and 29 items under EU GSP:

- Environment Related Controls:

- Promotion of value added Products of Castor Oil:

- Allow Import of Technical Pesticides:

- RBI Caution Listing:

- ICEGATE Working/ DGFT Server/ GST PORTAL glitches

BACK |

DGFT

Niryat Bandhu seminar for new IEC holders/ new exporters

at Addl. DGFT Mumbai Office

|

EPC/LIC/DGFT/NIRYAT_BANDHU |

28/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT

Niryat Bandhu seminar for new IEC holders/ new exporters

at Addl. DGFT Mumbai Office |

|

|

Dear Members,

Kindly note that Addl. DGFT Mumbai Office is conducting an in-house session on "Export & GST" for new Exporters/ IEC Holders under Niryat Bandhu Program.

The details of the session are as follows:

| Date |

11.10.2017 |

| Time |

4.00 PM TO 5.00 PM |

| Registration |

Prior registration not necessary. Entry is free subject to capacity of hall. |

| Venue |

Conference Hall of office of Additional DGFT Nistha Bhavan, 2nd floor, 48, Vithaldas Thakersey Marg, Churchgate, Mumbai-400020. |

The pamphlet issued by Office of Addl DGFT Mumbai is attached for reference.

New Member exporters are advised to take note and benefit from the session.

Your confirmations in this regard may be sent to us for records on e-mail id- Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

Encl : Niryat Bandhu house plan pamplet

|

|

BACK

|

Proper practice for representation to Govt. Departments

|

EPC/LIC/DOC/EP-CAP |

27/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Proper practice for representation to Govt. Departments |

|

|

Dear Members,

Kindly note that we have received communication from the Under Secretary, EP-CAP Section, Department of Commerce regarding Proper practice to be followed for representation to Govt. Departments.

As per direction, it has been noticed several times that the Council members take up their issues / grievances directly with the Hon'ble Prime Minister and Hon'ble Ministers of the Government rather than taking up the same with their respective Export Promotion Councils and with this Department. Such type of practice is not desirable.

It is suggested that if any member is aggrieved by any issue / grievance, he/she should initially take up the matter with the respective Export Promotion Council and with EP-CAP, DOC through proper channel of submission. However, if the grievance still remains unresolved, the aggrieved may address the public authority concerned.

Members are requested to take note of the directive from EP-Section (copy attached) and do the needful accordingly.

Thanking you ,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

OM dated 26 September 2017

|

|

BACK

|

Customs Valuation (Determination of Value of Imported Goods) Amendment Rules, 2017

|

EPC/LIC/CBEC/CVR |

27/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Customs Valuation (Determination of Value of Imported Goods) Amendment Rules, 2017 |

|

|

Dear Members ,

Kindly note that the Central Board Excise Customs (CBEC) has issued important Notification/ Clarification regarding Customs Valuation Amendment Rules 2107.

The Definition of the term ‘place of importation’, Treatment of the loading, unloading and handling charges, Computation of freight and insurance, Treatment of trans-shipment costs etc have been clarified vide the notification/ circular.

The gist of the recent Notification/ Circular are follows.

Circular No.39 / 2017-Customs |

26-09-2017 |

Clarifications regarding amendments to the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007 vide Notification No. 91/2017-Customs (N.T.) dated 26.09.2017 |

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/circ39-2017cs.pdf

Notification 91/2017-Cus |

26-09-2017 |

Customs Valuation (Determination of Value of Imported Goods) Amendment Rules, 2017 |

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-act/notifications/notfns-2017/cs-nt2017/csnt91-2017.pdf

Relevant members are requested to take note of these Notification/ Circular. For full details, you may download using above links.

Thanking you,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

V. IMP All Industry Rates of Duty Drawback 2017

|

EPC/LIC/DBK_2017 |

25/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

All Industry Rates of Duty Drawback 2017 |

|

|

Dear Members,

Kindly note that Ministry of Finance, Department of Revenue, GOI has notified All Industry Rates of Duty Drawback 2017.

In this regard, Government has issued Circular No. 38/2017-Customs F. No. 609/76/2017-DBK dated 22/09/2017 and Notification No. 88/2017-Customs (N.T.) dated 21.9.2017 and Notification No. 89/2017-Customs (N.T.) dated 21.9.2017 respectively, regarding changes in the Customs and Central Excise Duties Drawback Rules, 2017 and Changes in All Industry Rates (AIRs).

For the sake of convenience, important points are highlighted as follows:

DBK Rates for majority of items under CHEMEXCIL Purview i.e. Chapter 29, 32, 33, 34 & 38 remain at 1.5%. DBK Rates of Chapter 28 item rates reduced to 1.1%.

Definition of Drawback has been amended to provide for drawback of Customs and Central Excise duties excluding integrated tax and compensation cess leviable. References to input services and Service Tax have been omitted.

The Composite rates of Drawback are being discontinued w.e.f. 1.10.2017. Hence, the composite rates and Notes and Conditions pertaining to CENVAT credit, rebate of Central Excise duty, etc. stand omitted. Thus, the declaration required to be given by an exporter for claiming composite rate of drawback w.e.f. 1.7.2017 as per Circular no. 32/2017-Customs dated 27.7.2017 is no longer required w.e.f. 1.10.2017;

For fixation of Brand Rate, Circular no. 23/2017-Customs dated 30.6.2017 may be referred. The brand rate facilitation would continue.

Where in respect of export product, NIL rate or no rate of drawback is provided in AIR Schedule, an application for fixation of Brand Rate under Rule 7 of the Drawback Rules, 2017 shall not be admissible. In such situation, application for fixation of Brand Rate may be filed under Rule 6 of the Drawback Rules, 2017;

Changes in Drawback Rules 2017/ DBK Rates are applicable from 1st October 2017.

For full text of the AIR Drawback Schedule and above-said Notifications/ circulars, please use below links for downloading the same-

http://cbec.gov.in/resources//htdocs-cbec/customs/dbk-schdule/dbk-sch2017.pdf

http://cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/circ38-2017cs.pdf

http://cbec.gov.in/resources//htdocs-cbec/customs/cs-act/notifications/notfns-2017/cs-nt2017/csnt89-2017.pdf

http://cbec.gov.in/resources//htdocs-cbec/customs/cs-act/notifications/notfns-2017/cs-nt2017/csnt88-2017.pdf

Members are requested to take note of new provisions/ Rates in Duty Drawback. For any issues, you can write to us on Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

Reduction of VAT rate on Natural Gas in Gujarat

|

EPC/LIC/Gujarat/ PNG |

22/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Reduction of VAT rate on Natural Gas in Gujarat |

|

|

Dear Members,

Kindly note that Government of Gujarat has issued Order No. (GHN-76) VAT-2017/S 41 (1) (180 –TH dated Sept 05 2017 regarding remission of VAT rate on Natural Gas by 9% which will effectively reduce applicable VAT rate on Natural Gas in Gujarat from 15% to 6%.

As you are aware, during Pre-GST period, exporters were able to avail credit against the input 15% VAT paid on purchase of Natural Gas in Gujarat. However, Natural Gas is not covered in GST, as a result the VAT paid on Natural Gas is not available as ITC against the GST liability on the related end product. This, straight away increases the cost of production and adversely impacts industry at large, including companies in Chemicals industry. The council has been consistently taking up this issue with the Government.

However, pursuant to this Gujarat Government Order, the Natural Gas supplier shall charge and collect tax at the rate of 6 % (six percent) on sales of natural gas from consumers of the State except for those purchasing natural as for use in generation of electricity or for the manufacture of fertilizer. Further, the Gas supplier shall charge and collect full tax as applicable on the sales in the course of interstate trade or commerce and shall not be entitled to the remission on such sales.

To make the change operational, the Natural Gas consumers in Gujarat shall submit undertaking to the Natural Gas supplier to avail the benefit of reduced VAT rate of 6%.

The relevant members are requested to take note of this positive development. The Gujarat Government order is available for download on below link-

https://www.commercialtax.gujarat.gov.in/vatwebsite/ download/cir_noti/NOTI/Remission%20of%20Tax%20on%20Natural%20Gas.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

Encl : Remission of Tax on Natural Gas

Draft undertaking to be obtained from Customer

|

|

BACK

|

Request to follow CHEMEXCIL on Social Media like Twitter / Facebook

|

EPC: EDP: SOCIAL MEDIA |

22/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Request to follow CHEMEXCIL on Social Media like Twitter / Facebook |

|

|

Dear Sir / Madam,

In lines with the Govt of India’s Digital India initiative for dissemination of important information related to trade, Council is active on social media account like Twitter and Facebook.

Members will get following information on regular basis .

1. Circulars on various activities of Council, EXIM policy matters, GST etc.

2. Export Statistics

3. Information on Conferences/seminars/ Exhibitions/ RBSMs.

Below are the links for Twitter and Facebook

Twitter Account Link:- https://twitter.com/chemexcil

· Facebook Account Link:- https://www.facebook.com/chemexcil

In view of the importance of the above, all members of the Council are requested to please Follow CHEMEXCIL on Twitter & Facebook in order to receive latest notifications on the activities of the Council, important circulars etc.

Thanking You,

Yours faithfully

S G Bharadi

Executive Director

|

|

BACK

|

RFID Electronic Seals - Clarifications regarding RFID Electronic Seals under Self Sealing Procedure / Implementation Deferred till 1st Nov. 2017

|

EPC/LIC/RFID_Self_Sealing |

21/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

RFID Electronic Seals - Clarifications regarding RFID Electronic Seals under Self Sealing Procedure / Implementation Deferred till 1st Nov. 2017 |

|

|

Dear Members,

This is in continuation of our last circular dated 29/08/2017 informing you about CBEC circular No. 36/2017 dtd 28/08/2017 regarding Electronic Sealing for Containers by exporters under self-sealing procedure.

Subsequently, concerns were raised regarding availability of authentic RFID seal vendors, high costs of software and shortage of time. The council had also taken up this issue with CBEC and requested more clarity and time.

Taking cognizance of the issues raised the industry, CBEC has issued circular No. 37/2017 Dt. 20.09.2017 with clarifications about the Electronic Sealing For Containers By Exporters Under Self-Sealing Procedure and also deferred implementation till 1st Nov 2017.

The important points are being highlighted below for sake of convenience:

Considering the difficulties expressed by trade associations in locating vendors of RFID seals, CBEC has decided that the date for mandatory self-sealing and use of RFID container seals is deferred to 1st November, 2017.

The existing practice may continue till such time. It is also provided that exporters are free to voluntarily adopt the new self-sealing procedure based upon RFID sealing, if readers are in place at the customs station of export from 01.10.2017.

In order to ensure that electronic seals deployed are of a reliable quality, the Board has adopted international standards laid down under ISO 17712:2013 for high security seals and prescribed that all vendors proposing to offer RFID Tamper Proof One-Time-Bolt Container Seals to exporters for self-sealing, must submit self-attested certificates from seal manufacturers to the Director (Customs), CBEC, North Block, New Delhi before commencing sales. Where the certification is found to comply with the requirements of the ISO standard, the names of such vendors shall be put up on the Board's website (www.cbec.gov.in) for ease of reference of the trade and field formations, as soon as they are received.

The RFID Seal vendors shall also produce a contract or communication between the vendor and manufacturer, to serve as a link document and undertake that the seals for which ISO certifications are submitted are the same seals pressed into service. Any time a vendor changes his manufacturer-supplier, he shall provide the documentation referred in para 3 of circular 36/2017-Customs to the CBEC, before offering the seals for sale.

Web Hosted Application: While each vendor may develop and design their own web-enabled application, for the purposes of consistency in process of communication with the customs stations and the RMD, each vendor shall provide information as specified in para 4 (b) of circular 36/2017-Customs to the department by email in excel format or any other format that may be specified by any field formation or RMD. This would permit ease of consolidation of multiple feeds at the customs station and data integration. All field formations are advised to communicate the designation based email addresses to the vendors, once the list is placed on the website.

As a measure of data integrity and security of sealing, vendors are also required to ensure that the Tag Identification (TID) number is captured in their data base and the IEC code of the exporter is linked to the same at the time of sale of the seals. Upon reading at the Port / ICD, the software application shall ensure that the seal's identity is checked with its TID. Beyond this prescribed minimum feature, vendors will remain free to build upon any other features of RFID system for enhancing security / functionalities.

For the ease of reference of the exporters, vendors are advised to publicise on their website, name of each port / ICD where they have provided readers. Custodians and Customs brokers/CHA are also advised to proactively engage with vendors regarding availability of reading facilities at container terminals and ICDs so that there is no dislocation to logistics operations.

Apprehensions have been expressed by trade regarding the availability of reading facilities in hinterland ICDs. In view thereof, Custodians and Customs brokers/CHA of ICDs have been requested to facilitate the process of receiving handheld readers or installation of fixed readers at the ICDs and to approach the Board in case readers are not made available by vendors at any ICD by 10th October, 2017.

The original circular is available using below link for download-

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/circ37-2017cs.pdf

Members are requested to take note of the deferred date, clarifications and do the needful accordingly. Issues faced in this regard, may be communicated to the council on e-mail id’s- Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT - Amendments in Chapter 4 of Hand Book of Procedures 2015-20

|

EPC/LIC/RFID_Self_Sealing |

21/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Amendments in Chapter 4 of Hand Book of Procedures 2015-20 |

|

|

Dear Members,

Kindly note that O/o DGFT, New Delhi has made various amendments in Chapter 4 of Hand Book of Procedures 2015-20 which deals with Duty Exemption/ Duty Remission schemes.

These important amendments are notified vide Public Notice no. 26 dated 20/09/2017 which is available for download using below link-

http://dgft.gov.in/Exim/2000/PN/PN17/PN26%20(eng).pdf<

Members are requested to take note of these amendments.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT - Pending Cases of Norms Fixation

|

EPC/LIC/DGFT/ Norms |

19/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Pending Cases of Norms Fixation |

|

|

Dear Members,

This is regarding cases of norms fixation pending at DGFT HQ New Delhi.

The council has been regularly receiving complaints from members regarding delays in Norms fixation which is leading to delay in EODC or exporter figuring in DEL.

Kindly note that council has been regularly taking up such cases either directly with DGFT HQ New Delhi or Grievance Redressal Committee (GRC) Meeting held in Mumbai/ New Delhi.

During interactions with DGFT HQ, the Council has been advised to submit the entire lot of pending cases for redressal.

While we have few Norms cases in our records, but as a fresh initiative, we once again request the members to revert with their pending Norms case details so that we can consolidate the same and put-forth to DGFT HQ for fixation/ redressal. In case, your earlier query on Norms has been resolved, please do update us.

The replies on pending Norms cases, be provided ONLY in below format as word file:

Sr. No. |

Name of Member (with IEC) |

Grievance in detail with Name of DGFT RA, relevant file no., Authorisation number, Follow-ups done, Last Status etc. |

| |

|

|

| |

|

|

| |

|

|

The responses with relevant details be sent to us in above format latest by 26th September 2017 on our e-mail id’s Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in which will enable us consolidate and forward to the concerned officer in DGFT HQ.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

EXECUTIVE DIRECTOR

|

|

BACK

|

GST Extension of time limit for submitting the declaration in GST Form TRANS-1 Revision in GST Form Trans 1 submitted earlier

|

EPC/LIC/TRANS-1 |

19/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST Extension of time limit for submitting the declaration in GST Form TRANS-1 Revision in GST Form Trans 1 submitted earlier |

|

|

As informed earlier, during recent GST Council meeting dated 09/09/2017 it was decided to provide additional time for submission of FORM Trans-1 and also allowing one time revision in Trans-1 submitted earlier for Transition of Old Input Credits to GST Regime.

In this regard, CBEC/ GST has now issued following Orders/ Notifications:

Extension of deadline for submitting Form Trans-1 till 31st October 2017

As per CBEC Order No. 02/2017-GST dated 18/09/2017 the period for submitting the declaration in GST Form TRAN-1 has been extended till 31st October, 2017. Original order is available on following link:

http://www.cbec.gov.in/resources//htdocs-cbec/gst/order2-cgst.pdf

One-time Revision in Form Trans 1 submitted earlier

The provision for one time revision of GST Form Trans-1 has been made vide Notification No. 34/2017 – Central Tax New Delhi, the 15th September, 2017. Original notification is available on below link-

http://www.cbec.gov.in/resources//htdocs-cbec/gst/34_2017-CT_Eng.pdf

Members are requested to kindly take note of above and do the needful accordingly.

Thanking you.

Yours faithfully

S.G BHARADI

EXECUTIVE DIRECTOR

|

|

BACK

|

RBI- EDPMS Issuance of eBRC

|

EPC/LIC/RBI/EDPMS_eBRC |

19/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

RBI- EDPMS Issuance of eBRC |

|

|

Dear Members,

As you are aware, the Reserve Bank of India (RBI) had introduced additional modules under Export Data Processing and Monitoring System (EDPMS) in May 2016 for caution listing of exporters, reporting of advance remittance for exports and migration of old XOS data. However, several issues have cropped up due to delay in up-dation of data by AD banks on EDPMS server which have been taken up with RBI by the Council.

Now RBI has issued A. P. (DIR Series) Circular No. 04 dated September 15, 2017 wherein AD Category-I banks are directed to update the EDPMS with data of export proceeds on “as and when realised basis” and, with effect from October 16, 2017 generate Electronic Bank Realisation Certificate (eBRC) only from the data available in EDPMS, to ensure consistency of data in EDPMS and consolidated eBRC.

In our view, this might address the issue of mismatch in cases where eBRC was issued, but exporter was still caution listed.

Members are requested to take note of this change. The original circular is available for download on following url:

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11119&Mode=0

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

|

|

BACK

|

GSTR-3B filing deadlines for the months of August to December, 2017

|

EPC/LIC/GSTR-3B |

18/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GSTR-3B filing deadlines for the months of August to December, 2017 |

|

|

Dear Members,

As you are aware, during recent meeting of GST Council it was decided to extend GSTR-1/GSTR-2/GSTR-3 filing dates for July 2017. It was also informed that the last dates for filing GSTR-3B for Aug to Dec 2017 shall be notified later.

In this regard, CBEC has now issued Notification No. 35/2017 – Central Tax dated 15th September, 2017 notifying last date for filing the return in FORM GSTR-3B for the months of August to December, 2017.

The last dates as announced vide above notification are as follows:

Sl. No. |

Month |

Last Date for filing of return in

FORM GSTR-3B |

1 |

August, 2017 |

20th September, 2017 |

2 |

September, 2017 |

20th October, 2017 |

3 |

October, 2017 |

20th November, 2017 |

4 |

November, 2017 |

20th December, 2017 |

5 |

December, 2017 |

20th January, 2018 |

Members are requested to kindly take note of above and do the needful accordingly.

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Important notification regarding Stearic Acid Import

|

EPC/LIC/STEARIC_ACID |

18/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Important notification regarding Stearic Acid Import |

|

|

Dear Members,

Kindly note that CBEC has issued notification no. 76 dated 15/09/2017 for substitution of new Stearic Acid HS Code 38231100 in Notification no. 50 dated 30/06/2017.

The concerned members are aware that pursuant to change in HS code in the Union Budget 2017-18, stearic acid was being imported under HS code 38231100 which was not covered under AIFTA due to which higher duty was imposed. The council had also taken up the issue with TRU-CBEC.

With this new notification no. 76 dated 15/09/2017, Stearic Acid shall now be importable under HS Code 38231100 at concessional tariff (as per Serial No. 251 of Notification no. 50 dated 30/06/2017 which is now amended).

Members are requested to kindly take note of above. The original notification may be downloaded using below link.

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-act/notifications/notfns-2017/cs-tarr2017/cs76-2017.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

India-Peru Trade Agreement: Preparation of Indian Wish List

|

EPC/LIC/INDIA_PERU_FTA |

15/09/2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

India-Peru Trade Agreement: Preparation of Indian Wish List |

|

|

Dear Members,

We have received communication from FT-LAC Section, Department of Commerce (DoC) that a trade agreement covering trade in goods, services and investment with Peru is being negotiated.

The first round of negotiations was held on 8-11 August, 2017 in New Delhi. Under the chapter on National Treatment and Market Access of Goods (NTMA), both sides discussed on understanding each other’s position on the Preferential Treatment to be offered.

Both sides have committed to exchange Wish Lists by 15th November, 2017 so that fruitful discussions could be held during the next round.

In this regard, a tentative Indian Wish List containing 4970 tariff lines at 8-digit code has been prepared by DoC as per following parameters using Trade Map data:

Ø Tariff lines where India exports to Peru

Ø Tariff lines where Peru Imports from World

Ø Peru’s Imports from LAC region and

Ø India’s global exports

The file containing the tentative Indian Wish List of 4970 items along with sector-wise break up is attached for reference/ comments.

Members are therefore requested to kindly go through the enclosed Indian Wish List and give comments/suggestions on addition/ deletion of further items so as to finalize the India’s Wish List.

Your comments / suggestions should reach us latest by 19th September, 2017 on our email id- Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in

Thanking you,

Yours Faithfully,

S.G Bharadi

Executive Director

CHEMEXCIL

Encl : INDIAN WISH LIST

|

|

BACK

|

India-European FTA talks this month

|

India and the European Free Trade Association (EFTA) will meet this month in an attempt to conclude their long pending negotiations, Commerce Minister Nirmala Sitharaman said here on Friday.

|

India and the European Free Trade Association (EFTA) will meet this month in an attempt to conclude their long pending negotiations, Commerce Minister Nirmala Sitharaman said here on Friday. “Together with the EFTA countries (Switzerland, Norway, Iceland, Liechtenstein), we want to go ahead with the FTA,” Sitharaman said at a business session with Swiss President Doris Leuthardorganised by industry chambers Ficci, CII and Assocham.

“We’ll meet in September and want it (FTA) concluded for the benefit of both,” she said.

She also said that India would look into “every concern” of foreign investors on intellectual property rights (IPR) and investment protection. “Investment protection is being negotiated,” the minister said.

So far, 16 rounds of negotiations have taken place, talks for which started in 2008. The two sides resumed talks on the agreement here in January after a gap of three years

The proposed agreement covers trade in goods and services, investments, trade facilitation, customs cooperation, IRPR protection and public procurement.

“We want to bring the EFTA free trade negotiations going on since 2008 to an end and we hope that this visit, and the push by Prime Minister Narendra Modi for the FTA, will help the Minister conclude the pending issues on the agreement,” Leuthard said in her address.

“For India to benefit, she has to compete with other Asian countries with whom we are also negotiating. You can compete only by further opening up your economy.

“We Swiss are reliable partners of India and we would like a trade agreement and investment protection framework,” the President added, noting that this year marked the 70th anniversary of Indo-Swiss cooperation. The India-EFTA bilateral trade was worth $19 billion in 2016-17, which was lower than the trade value of $21.5 billion in 2015-16.

(Source: http://www.financialexpress.com/economy/india-european-fta-talks-this-month/836556/ dated 1st Sept-2017)

|

|

BACK |

Trade policy review only after resolving exporters’ cash woes, says Ministry

|

NEW DELHI, SEPTEMBER 3:

The Commerce Ministry will come up with the mid-term review of the foreign trade policy (FTP), initially scheduled this month, only after resolving the liquidity issues faced by exporters under the Goods and Services Tax (GST) regime, a government official has said.

“Two options are being examined by the Centre to deal with cash shortage faced by exporters who are no longer entitled to tax exemptions under various incentive schemes and have to instead pay taxes upfront and later claim reimbursement. Without a resolution to the issue, there is no point coming out with a mid-term review,” the official told BusinessLine.

One option is the much debated introduction of e-wallet facility for exporters for virtual payment of taxes while the other is putting in place an actual wallet for use by exporters with money deposited by the Centre.

The Finance Commerce Ministries will thrash out both options and examine others too, if required, to reach an understanding, before sorting the out the matter with the GST Council.

According to estimates made by the exporting community, over ₹1.85 lakh crore of their working capital may get stuck annually because of the time-lag between paying taxes and then getting refunds instead of exemptions.

e-wallet facility

In the previous round of consultations before the GST was implemented on July 1, the Commerce Ministry had proposed that an e-wallet facility could be introduced for exporters.

Under the mechanism, the e-wallet account of an exporter is debited based on the preceding year’s exports.

Whenever the exporter is supposed to pay GST, whether for imports or for procurement by merchant exporters, the payment is made from the e-wallet. Money, however, does not go out of the e-wallet account at all. It just goes from the GST account of exporter to the GST account of the supplier. The value of the e-wallet remains the same. When the exporter gives proof of export, her account is again re-credited. The other option of an actual wallet is similar to the e-wallet concept, but the virtual money is replaced by actual money to be provided by the Centre. In the actual account, too, no money would go out and accounts would only be debited and credited based on GST paid and reimbursements made.

“Although the Centre is more comfortable with the actual wallet proposal as it involves real money, the Finance Ministry may have to provide ₹30,000-40,000 crore quarterly for it which it may not be comfortable with,” the official said.

(Source:-http://www.thehindubusinessline.com/economy/policy/trade-policy-review-only-after-resolving-exporters-cash-woes-says-ministry/article9844588.ece dated 3rd September-2017)

|

|

BACK |

Suresh Prabhu says government will promote exports in 'shortest possible time'

|

NEW DELHI: Commerce and industry minister Suresh Prabhu on Wednesday said his ministry is looking at certain measures to give a leg up to India’s exports which are facing “challenging times”, partly because of the Goods and Services Tax (GST) rollout.

“We are trying to work out what to be done to promote exports in a shortest possible time which includes issues coming up because of the GST,” Prabhu, who assumed charge as the commerce and industry minister on Monday, told reporters here.

India's export growth slowed to an eight-month low of 3.94% in July, while the trade deficit widened to $11.44 billion on account of high gold imports.

He added that the ministry is working on the support measures which can facilitate quick increase in exports both in terms of volume and value.

The commerce ministry is expected to announce incentives in the review of the foreign trade policy, which is scheduled to be released next month.

(Source:-http://economictimes.indiatimes.com/news/economy/policy/suresh-prabhu-says-government-will-promote-exports-in-shortest-possible-time/articleshow/60393864.cms dated 7th September-2017)

|

|

BACK |

Government offers online tool to resolve foreign trade issues

|

NEW DELHI: The government has set up an online service facility that can be used by importers and exporters to resolve all foreign trade-related issues, an official statement said today.

The directorate general of foreign trade (DGFT), which comes under commerce ministry, has asked all exporters and importers to use the system - Contact@DGFT - for resolution of their matters.

Traders can raise all matters related to the directorate or other agencies of the Centre and States through this facility, which is activated at the DGFT website.

"Contact@DGFT system has been activated as a single point contact for resolving all foreign trade-related issues," the DGFT said in a notice to all regional authorities, export promotion councils, commodity boards and members of trade and industry.

It said best efforts will be made for expeditious resolution.

"In the interest of systematic monitoring and effective resolution, exporters/importers are requested not to send their queries through twitter or e-mail and use Contact@DGFT service instead," it added.

(Source:-http://economictimes.indiatimes.com/news/economy/policy/government-offers-online-tool-to-resolve-foreign-trade-issues/articleshow/60422566.cms dated 8th September-2017)

|

|

BACK |

GST opens a Pandora’s box for exporters

|

The strong rupee and an ambiguous goods and services tax (GST) is giving sleepless nights to exporters

|

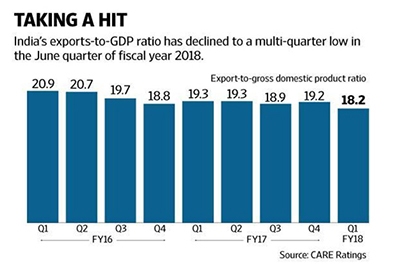

India’s export-to-GDP (gross domestic product) ratio slid to a multi-quarter low in June. Concerned over this, the new commerce and industry minister Suresh Prabhu has assured that the government will try to revive exports at the earliest. But that is a tough task in the current scenario.

The strong rupee and an ambiguous goods and services tax (GST) is giving sleepless nights to exporters.

Here’s why.

Like small and medium enterprises, the working capital needs of exporters too have increased. Under GST, they first have to pay integrated GST and seek a refund only after the goods are exported. Smaller exporters are required to furnish bonds and a letter of undertaking to the local commissioner, which is a financial burden, especially for service exporters.

Despite the new tax regime being in place for over two months now, there is limited clarity on the refund mechanism. This is making the situation worse.

The foreign trade policy (FTP) lays down the framework to incentivize exporters. They are eligible to get rebates since the aim is only to export the value of goods and not the tax paid on inputs required to manufacture them. In the pre-GST era, exporters enjoyed a slew of exemptions under FTP. They could import capital goods and raw materials without paying duties, thus having no impact on cash flow. However under GST, exporters are exempt only from paying the basic customs duty.

“Currently, the biggest concern among exporters is that FTP 2014-19 remains aligned to old taxes. Claiming export benefit has always been a documentation intensive process, hence clarity under the GST regime at this stage would be very beneficial. Since GST functions on the principle of refund and not exemptions, delays in the refund process severely strains working capital management of exporters,” said M.S. Mani, senior director (indirect tax) at Deloitte Haskins and Sells Llp.

In simple terms, there is a risk of working capital remaining blocked for a couple of months. This means loss of interest on this money, which an exporter may have otherwise earned. At the country level, capital to the tune of Rs95,000 crore is estimated to be locked-up from the time of buying raw materials and claiming refund on exported goods, which is typically four-six months, according to Suresh NandlalRohira, partner at Grant Thornton India Llp.

Amid this confusion, Parimal Shah, vice-president at MK Jokai Agri Plantations Pvt. Ltd, is worried that a longer wait to claim refund might prompt tea exporters to hike prices, thus hurting competitiveness. Mid-size tea producers and exporter caters to markets including Russia, Saudi Arabia, the European Union and the UK.

This is a valid concern because the tea plantation industry is one of the key contributors to India’s GDP and generates a lot of employment. “Clarity is yet to emerge on who should one approach for refunds—the centre or states. In the long term, we see a net-net gain of 1-1.25% on balance sheets of tea exporting companies, but for now we foresee four quarters of disruption as the tea industry would take one financial year to get used to the new regime,” he said.

If this estimate is anything to go by, then it raises serious questions about the future of smaller exporters across sectors. Even if a smaller exporter manages to deploy additional capital in the business, he may not be able to survive for long without timely refunds. Labour-intensive sectors like gems and jewellery, leather and ready-made garments have suffered the most, first by demonetisation and now GST.

Amid the gloom, the GST Council’s decision to form a committee headed by revenue secretary HasmukhAdhia to review exporter-related issues comes as a glimmer of hope.

However, some tax experts are sceptical of a speedy resolution of exporters’ problems since the commerce ministry (which frames FTP) and the finance ministry (under which the GST Council comes) have not worked together in the past on such a unique issue.

If this newly formed committee fails to resolve the aforementioned problems at the earliest, then a revival in export growth will get more distant. That would mean loss of foreign exchange earnings and, most importantly, many jobs as well.

(Source:-http://www.livemint.com/Money/KrifMLRnYcj7RRm8M03YnN/GST-opens-a-Pandoras-box-for-exporters.html dated 12th September-2017)

|

|

BACK |

Airports Authority of India undertakes construction of Integrated Cargo Terminal at Imphal airport

|

Airports Authority of India will undertake construction of Integrated Cargo Terminal at Imphal Airport after obtaining grant-in-aid under Trade Infrastructure for Export Scheme (TIES) of Ministry of Commerce & Industry, Govt. of India. The Government of Manipur had planned to establish an Export Import Cargo Terminal (EICT) at Tulihal, Imphal Airport under ASIDE Scheme of the Ministry of Commerce & Industry.

The proposed Integrated Cargo Terminal is expected to give a boost to the export of handicrafts items and perishable cargo. This will also help generate employment opportunities in the North Eastern region of the country, thereby fostering economic development of the region. In addition to this, the EICT will help establish better connectivity with South & Southeast Asia and give a boost to trade between India and the ASEAN countries.

The estimated cost construction of the cargo terminal is Rs.16.20 crores. Out of this, the Ministry of Commerce & Industry has sanctioned a grant of Rs.12.96 crores under TIES. The balance amount to construct will be met out of internal sources of AAI.

(Source: http://www.business-standard.com/article/government-press-release/airports-authority-of-india-undertakes-construction-of-integrated-cargo-terminal-at-117091101306_1.html dated 12th September-2017)

|

|

BACK |

As incomes rise, exporters pay the price of development

|

Per capita income above $1,000 for 3 years in a row, so subsidies have to end: WTO

NEW DELHI, SEPTEMBER 12:

The good news is that India’s per capita income has gone up, and stayed up. The bad news, going by a recent notification of the World Trade Organization (WTO), is that the country can no longer offer export subsidies, as its per capita gross national income (GNI) has crossed $1,000 for the third year in a row.

“The consequence of India graduating out of the list of poorer countries eligible to give export subsidies is serious. It will be open to penal action from other countries, including imposition of countervailing duties on its exports if it does not do away with its incentives soon,” an official told BusinessLine.

The development could deal a further blow to exports from the country, which posted weak growth last year after two consecutive years of decline due to low demand.

“The first scheme that could come under the WTO scanner is the popular Merchandise Export from India Scheme (MEIS), which provides a direct subsidy to exporters based on the value of exports,” the official said.

Wide impact

Almost all exports, ranging from textiles to agriculture products, stand to be affected as the scheme covers more than 7,000 items and costs the exchequer around ₹23,500 crore a year.

A team of officials from the Permanent Mission of India at the WTO held discussions with Commerce and Industry Minister Suresh Prabhu, Commerce Secretary Rita Teaotia and officials from the Trade Policy Division on how the situation could be tackled.

“The government knew all along that the special exemption that allowed India to give export subsidies was likely to go in 2017. In fact, the Foreign Trade Policy also mentions this. It should have prepared the exporters for this,” a trade economist from a Delhi-based thinktank said.

Other schemes that could also get affected, subject to interpretation of the WTO rules, are the interest subvention scheme under which banks charge lower interest on loans given to exporters, which is offset by the government, and the duty-drawback scheme where exporters are refunded duty paid on inputs.

“The WTO rules also consider the revenue that is otherwise due to the government but is foregone or not collected, such as tax credits, as subsidy. Some members may also insist that India’s interest subvention scheme and duty-drawback scheme qualify as subsidies,” said the trade economist.

The Commerce Ministry, which is supposed to announce the mid-term review of the Foreign Trade Policy this month, will be in a fix about whether to make any addition to the MEIS scheme as it could draw immediate criticism from other countries. It would also find it difficult to replace the existing MEIS schemes with production subsidies, which are allowed by the WTO.

(Source: http://www.thehindubusinessline.com/economy/as-incomes-rise-exporters-pay-the-price-of-development/article9856381.ece dated 12th September-2017)

|

|

BACK |

Subsidy on export goods may be scrapped; Merchandise Export from India Scheme under scanner: Report

|

The move may hurt the country’s exports, which showed a frail growth last year after due to low demand.

A recent notification from the World Trade Centre (WTO) said that the country can no longer propose export subsidies, as its per capita gross national income (GNI) has crossed USD 1000 for the third year in a row, as reported by Hindu Business Line.

“The consequence of India graduating out of the list of poorer countries eligible to give export subsidies is serious. It will be open to penal action from other countries, including the imposition of countervailing duties on its exports if it does not do away with its incentives soon,” an official was quoted as saying.

This development could hurt the country’s exports, which showed a frail growth last year after due to low demand.

“The first scheme that could come under the WTO scanner is the popular Merchandise Export from India Scheme (MEIS), which provides a direct subsidy to exporters based on the value of exports,” the official added.

How will this impact the country?

Most of the exports in India may be affected as the scheme covers more than 7,000 items and will cost the national treasury around Rs 23,500 crore a year, according to the report.

A meeting to discuss how the situation could be tackled was held. A team of officials from the Permanent Mission of India at the WTO held discussions with Commerce and Industry Minister Suresh Prabhu, Commerce Secretary Rita Teaotia and officials from the Trade Policy Division.

The Ministry of Commerce will announce the mid-term review of the Foreign Trade policy this month, to discuss the MEIS scheme.

(Source: http://www.moneycontrol.com/news/business/economy/subsidy-on-export-goods-may-be-scrapped-merchandise-export-from-india-scheme-under-scanner-report-2386829.html dated 13th Sept-2017)

|

|

BACK |

Exporters seek clarity on incentives under GST

|

MUMBAI: Exporters say they're facing difficulties owing to ambiguity about benefits continuing under goods and services tax (GST) from the previous tax regime and queries over accessing input credit, further clouding their prospects amid a dull global market and an appreciating rupee. Some of them have sought clarity on the matter from the government ahead of the peak export season, said people in the know.

The development has led to exporters being unsure about pricing products set for the European Union (EU) and the US and warnings that overseas sales could suffer a setback in the upcoming quarter. The Foreign Trade Policy, FTP 2015-2020, has several incentives based on the earlier levies such as excise duty and service tax. It had been expected that these incentives would be recalibrated under GST but that hasn't happened, exporters said.

"There is an urgent need for the government to clarify on the incentives available to exporters as their tax outgo has changed in GST," said MS Mani, partner, Deloitte India, adviser to some top exporters. "It is expected that the newly constituted committee headed by the revenue secretary (HasmukhAdhia) would fast track its recommendations so that exporters get muchneeded clarity ahead of the peak export season and are able to plan accordingly."

Sales surge in EU and the US during the Christmas period and exporters need to ensure that goods are shipped in September or at least October to catch that bump. "This is the need of the hour as the objective of the FTP is to ensure that goods are exported and not the taxes associated with the procurement or manufacture of these goods," said a person with direct knowledge of the matter. "Since the GST rates are not identical to the erstwhile indirect tax rates and because there is no exemption on procurements for exporters, the exporting community is not clear on whether the incentives would increase, decrease or remain the same."

(Source: http://economictimes.indiatimes.com/news/economy/policy/exporters-in-serious-fiscal-crisis-due-to-gst-refunds-delay/articleshow/60482451.cms dated 13th Sept-2017)

|

|

BACK |

From WTO to trade deals, 3 key challenges new Commerce Minister is likely to face

|

Commerce Ministry is entitled to represent India at the World Trade Organisation (WTO), enter into international trade deals, keep a check on all the sectors' growth of India and in turn, contribute a major chunk to the country's GDP.

he newly-appointed Commerce Minister Suresh Prabhu, who was earlier the Railways Minister for three years, is likely to face many challenges in his new list of duties.

|

Commerce Ministry handles the major component in developing the country. This is the government department entitled to represent India at the World Trade Organisation (WTO), enter into international trade deals, keep a check on all the sectors' growth of India and, in turn, contribute a major chunk to the country's GDP.

Here are 3 major challenges lined up for Suresh Prabhu

WTO

WTO is the world's largest trade forums where the countries who are a part of this forum take major decisions which revolve around building trade relations by either making new ones or resolving old ones. The trade-related matters are supervised by the WTO body.

The WTO conference is around the corner and Suresh Prabhu seems to be preparing himself by taking advice from his predecessors, according to Indian Express.

According to the report, he is taking inputs so that he is able to learn from their experiences.

Trade

India is an import-extensive country, making it one of the biggest challenges for the Commerce Ministry. The Ministry has to boost India's exports and lower the country's imports for the country to become more independent.

If India is made export-extensive, it will not have to be dependent on other countries for its growth and development.

In the recent data released by the Commerce Ministry, it states that India already has an import share of 79.17 percent as against the export share of 69.54 percent among the top 25 countries it trades with. This data accounts for the trade of April and June this year, making a 10 percent imbalance in trade prevalent in two months itself.

Higher imports cause a trade imbalance as the country will have to first pay off its import bills and then see its overall growth. More import bills mean a rise in the government's expenditure and more export bills mean a rise in the government revenue. As of now, India's trade balance is negative, showing that the imports are much higher than the exports.

To tackle this situation, the Commerce Ministry has to boost domestic manufacturing, tap the resources within the country and make sure that the products are at par with the international standards.

Trade deals

With trade on one side, one can not deny that international relations for every economy are vital. These international relations become stronger with trade deals which can result in helping the economies to grow. Suresh Prabhu has a long list of trade deals which he has to look after.

He has to prepare himself to negotiate free trade deals with China, Japan and Australia and negotiate thoroughly for bilateral free trade deals with Canada and the European Union.

With US President Donald Trump turning hostile towards free trade deals, it will be even more challenging for Prabhu to strike these deals with WTO's tougher norms.

(Source: http://www.moneycontrol.com/news/business/economy/from-wto-to-trade-deals-3-key-challenges-new-commerce-minister-is-likely-to-face-2388593.html dated 15th Sept-2017)

|

|

BACK |

EU To Strengthen ‘Strategic’ Ties With India

|

Ahead of the European Union (EU)-India Summit (to be held in New Delhi in October), the 28-member bloc has hinted that it will broaden its engagement and strengthen strategic and business ties with India. The EU has also indicated that it will formalise a big-bang action plan on various bilateral issues at the upcoming summit.

A senior EU official told an Indian broadsheet over the weekend that the two ‘partners’ would announce a string of joint declarations at the summit. The official, who wished to remain anonymous, revealed that the summit would prepare a concrete roadmap for addressing major issues, such as climate change, clean energy, maritime security, naval co-operation, space research and combating cyber crime.

The official expressed hope that the wide-ranging EU-India partnership would bolster co-operation between India and the Hague-based Europol’s European Cybercrime Centre on counter-terrorism operations and battling cyber crime. As far as bilateral security co-operation is concerned, he stressed that both the EU and India were eager to expand the scope of “counter-piracy dialogue to maritime security”.

Meanwhile, a top EU expert on foreign policy said that one of the major goals of the upcoming summit would be to exploring various ways to “deepen India’s strategic relationship with the EU in a post-Brexit world”. Soon after the Brexit vote, India had said that it wanted to strengthen strategic ties with the EU as Britain had “historically been India’s entry point to Europe”.

The expert informed the press that the EU would soon unveil a white paper on its new-look relationship with India in which the new areas of economic and strategic co-operation would be mentioned. He said that it would be important for both the parties to resolve outstanding issues, including the wide-ranging Free Trade Agreement (FTA), in New Delhi.

It is unfortunate that the FTA has proved elusive so far despite 10 years of negotiations, said the expert. He insisted that India’s decision to cancel a multitude of bilateral investment treaties unilaterally heightened the EU’s concerns about India’s “protectionist attitude” in some sectors. However, the EU leaders in Brussels still believe that the October summit will cement bilateral ties in the post-Brexit world.

(Source:-https://inserbia.info/today/2017/09/eu-to-strengthen-strategic-ties-with-india/ dated 18th Sept-2017)

|

|

BACK |

Chemical industry can reach USD 346 bn by 2025: Report

|

India's chemical industry has the potential to grow from the current USD 155 billion to USD 346 billion by 2025 with concerted efforts, a report said.

The domestic chemical market accounts for 3.4 per cent of the global market.

More than 80,000 chemicals are being used directly or indirectly in various sectors, said the report prepared by Tata Strategic Management Group. It was released by Fertiliser and Chemical Minister Ananth Kumar at an event in Gujarat.

According to the study, the industry faces critical issues like availability of key feedstock, infrastructure status, scale of operations, access to technology, energy security and ease of doing business.

"These issues have hampered industry growth and it needs government interventions to achieve its true potential," it said.

The report recommended adoption of alternate feedstock, increasing investment in R&D and achieving scale through collaboration for overcoming the challenges.

"Indian chemical industry is on the cusp of a growth trajectory. This industry should be looked at as a part of Indian economic growth story," Tata Strategic Management Group CEO ModanSaha said in a statement.

He said the chemical industry can play an important role in creating jobs and boosting the country's growth.

(Source:-http://www.business-standard.com/article/pti-stories/chemical-industry-can-reach-usd-346-bn-by-2025-report-117092101111_1.html dated 21st Sept-2017)

|

|

BACK |

Dahej to house country’s first Central Institute of Chemical Engineering and Technology: Ananth Kumar

|

Just like Wimbeldon is for tennis and Lords is for cricket, Dahej is the "kaashi" of chemical and petrochemical industry, the Union minister said at India Chem Gujarat 2017 held at Mahatma Mandir

Describing Dahej as the “Kashi” for chemical and petrochemical industry, Union Minister for Chemical and Fertilizers Ananth Kumar on Thursday said India’s first Central Institute of Chemical Engineering and Technology (CICET) will be set up within this industrial zone in South Gujarat that also houses the only functional Petroleum, Chemicals and Petrochemicals Investment Region (PCPIR).

“We want to open a specialised institution at Dahej on the lines of CIPET (Central Institute of Plastic Engineering and Technology). We have already conducted preliminary talks and we plan to set up India’s first Central Institute of Chemical Engineering and Technology,” said the minister while speaking at the inaugural function of “India Chem Gujarat 2017” at Mahatma Mandir.

“JaiseWimbeldonko tennis kikashikehtehai, jaise Lords ko cricket kakashikehtehai, aise hi chemical or petrochemical industry kakashi, yadi Bharat meinkisiekjagahbatasaktehaitohwohhaiDahej, Gujarat. (Just as Wimbeldon is called the kashi of tennis, Lords as the kashi of cricket, the same way, if there is one place in India which can be called the kashi of chemical and petrochemical industry, it is Dahej, Gujarat,” said Ananth Kumar.

“I am hoping that Chief Minister of Gujarat will allocate 10-15 acres needed for the project at Dahej PCPIR region,” he said adding that Dahej currently provides employment to 1.37 lakh youths. “Can we double this number? As per the vision statement for Dahej it is targeted to provide 8 lakh jobs by 2040,” the minister remarked.

Gujarat chief minister Vijay Rupani who spoke later readily agreed to provide the required land required for the project.

The Union minister also said that the Centre was ready to provide a helping hand to make Dahej PCPIR a success. “Today if Narendrabhai needs to give an example of a petrochemical hub to a foreign guest, then he cannot show a Pardip or Nagapatannam, Vishakapatam, but he can surely show Dahej,” Ananth Kumar said referring to Prime Minister Narendra Modi.

The Centre had approved setting up of four PCPIRs in the states of Andhra Pradesh (Vishakhapatanam-Kakinada), Gujarat (Dahej), Odisha (Paradeep) and Tamil Nadu (Cuddalore-Nagapattinam).

“Please send a proposal to us for the Viability Gap Funding (VGF) needed to make Dahej successful. We are going to help you… I have already told in Vijaybhai’s (Rupani) ears that the chief ministers of other states are sending VGF proposals. Andhra Pradesh, Telengana, Odisha and other states, but Gujarat hesitates because it is a self-sustaining and progressive state. I have come to say, please do not hesitate and send the proposal,” said Ananth Kumar.

The minister also suggested to the chief minister present at the event to organise a “Dahej investment summit” either as part of the Vibrant Gujarat summit or as a separate event for the next five years.

(Source:-http://indianexpress.com/article/education/dahej-to-house-countrys-first-central-institute-of-chemical-engineering-and-technology-ananth-kumar/ dated 21st September-2017)

|

|

BACK |

‘Govt to bring in standards for chemical products’

|

In order to stop imports of sub-standard chemicals in India, the Centre is working on bringing in standards for chemical products.

In order to weed out unregulated imports of sub-standard chemicals into India, the Modi government is working on introducing standards for chemical products.

“We do not have very good standards right now in case of many chemicals. The more better standards we set for consumer products, the more demand for better chemicals will be there; chemicals which are less harmful; chemicals which are more amiable to environmental sustainability. So in our ministry we have set up a committee with the joint secretary who will to start this work of setting standards in chemicals. We do not have a standards cell and we have had a discussion with BIS (Bureau of Indian Standards),” said Rajeev Kapoor, secretary, Department of Chemicals and Petrochemicals while speaking at the inaugural of “India Chem Gujarat 2017”, Thursday.

“Having set the standards in products, we also need to examine to what extent we can make it mandatory, to ensure that our country is not suffering from sub-standard imports. So both the issues were discussed yesterday and will be taken forward,” he said referring to FICCI CEO forum where this issue was discussed on Wednesday.

A report unveiled at the event held at Mahatma Mandir also bats for establishing product standards for the chemical industry. “Establishing product standards is of paramount importance. Availability of low quality and low performance products will eventually lead to health risks, customer dissatisfaction, negative industry image and will finally impact growth of the value chain,” states the report titled “Chemical Industry with focus to Gujarat and Speciality Chemicals” prepared by Tata Strategic Management Group.

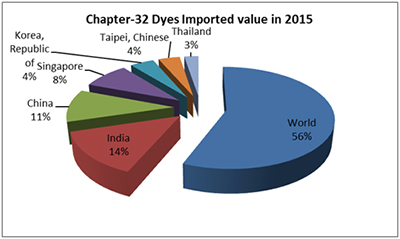

Setting of standards is one of the several steps suggested in the report that will help Indian chemical industry attain a size of USD 346 billion by the year 2025. Currently (in 2016), the industry is estimated to be valued at USD 155 billion and contributes 3.4 percent to the global chemical industry. India ranks 14th in exports and 8th in imports of chemicals (excluding pharmaceutical products) globally. India’s chemical trade balance is negative with imports being significantly higher than the exports.

“A number of products which are either banner or regulated in western markets are still used in India. Standards which do not meet global norms will lead to lower quality products at higher prices for high-tech goods in India,” states the report that was unveiled by Union Minister for Chemical and Fertilizers Ananth Kumar and Gujarat chief minister Vijay Rupani.

The report suggests implementation of “consumer standard” in segments like polymer additives, personal care, water treatment, flavours and fragrances, textile chemicals, colorants, construction chemicals and others. “The government should set standards and regulation across the segments to promote quality consciousness, sustainable development and efficiency improvements… Often, the domestic industry is at a severe disadvantage due to unregulated imports of sub-standard products which find a safe evacuation to India,” the report added.

It also lists out several challenges that is currently hindering the growth of the sector. “Lack of adequate physical infrastructure and sub-par chemical logistics infrastructure makes material production and movement cost intensive. Uninterrupted power supply remains a challenge for the energy intensive chemical industry. Significant glut in global chemical capacities has led to growth of imports in India. The duty structure needs rationalisation for several products in the value chain,” the report states.

(Source:-http://indianexpress.com/article/business/business-others/govt-to-bring-in-standards-for-chemical-products-4855220/ dated 21st September-2017)

|

|

BACK |

Indian exports may not gain much from rise in global trade

|

Demand in the United States and China will drive up trade volumes, according to the WTO

While global trade growth is expected to rebound in 2017, India may not be in a position to fully take advantage of it in United States and China, which are the major markets where consumer and industrial demand drive trade forward.

On Thursday, the World Trade Organization (WTO) raised the estimate of growth in world merchandise trade volume for 2017 to 3.6 per cent up from the 2.4 per cent estimate earlier.

The latest rise has been due to positive economic trends in North America - with the United States in particular - along with China, which has lead to resurgence of industrial and consumer demand.

However, exporters and trade experts alike believe it will be difficult for India to tap into this demand in the near future for a plethora of reasons.

Stagnation in the US

The US is the largest destination for Indian exports, earning $42 billion in 2016-17. The share of goods heading to the US has gradually increased over the past five years and stood at 15.3 per cent last year.

However, major export categories such as textiles, gems and jewellery have seen stagnation in the US market.

India's textile exports, across categories such as apparels and accessories have suffered over the past few years due to the onslaught of cheaper alternatives from Bangladesh, Vietnam and Philippines.

"Our market share has stagnated in the low single digit levels and I don't see a change anytime soon, both in the United States or Europe." S K Jain, Chairman of the Apparel Export Promotion Council said.

On the other hand, India's exports in gems and jewellery and especially rough or processed diamonds, stood at $9.7 billion, up 12 per cent in the last year. But industry experts believe the trend may be reversed next year.

For pharmaceutical products, the US is a major market for Indian generics, almost half of which, by volume, reach US shores. "In the United States, almost 80 per cent of generics are sourced from India. However, the market share has stagnated while growth in value terms have slowed down", P V Appaji, past Executive Director at Pharmexil said.

This is mainly due to price erosion, he added.

Not geared for China either

On the other hand, India is ill-equipped to grow its exports to China. While its northern neighbour is its largest trading partner, only 3.68 per cent of India's exports find their way to China.

Apart from finding it difficult to bridge the whopping $51-billion trade deficit, India is also looking to upgrade its current basket of exports to China.

Raw materials like cotton, iron ore and copper - long a hallmark of Indian exports to neighboring China - has come under increased scrutiny as both government as well as exporters try to shift exports towards value added products in a bid to cap growing trade deficit.

While previous Commerce and Industry Minister Nirmala Sitharaman had earlier said that export focus should shift from raw materials, her Ministry has identified key sectors such as hardware, electronics, pharmaceuticals, textiles and auto components, to realign and boost exports.

With a burgeoning middle class and rising labour prices, China is expected to relinquish its dominance over the labour intensive, low-end manufacturing space in the near future, which is being eyed by the Indian industry.

A changing consumer pattern has also moulded a greater demand for consumer goods in China where overall demand in the first half of 2017 was driven by solid growth in industry (up 6.4 per cent) and even stronger growth in services (up 7.7 per cent).

"We are looking to harness our strengths in labour intensive sectors where India enjoys significant advantage over other developing nations," a Commerce Ministry official said under conditions of anonymity.

Currently, the top 5 export categories to China are all input products. These are used by China to manufacture costlier goods which it ships abroad, often back to India.

These, along with other raw materials like iron and iron ores, constitutes for more than 70 per cent of India's exports to China, Ajay Sahai, Federation of Indian Exports Organisations said.

These are subject to volatile global commodity prices and should be periodically swapped with products higher in the value chain, a Delhi based trade expert said.

(Source: http://www.business-standard.com/article/economy-policy/indian-exports-may-not-gain-much-from-rise-in-global-trade-117092200935_1.html dated 22nd Sept-2017)

|

|

BACK |

Govt will announce additional measures to boost economic growth: ArunJaitley

|

The finance minister said the government has taken note of all economic indicators and will take additional moves; he said he would consult the prime minister before any announcement.

Finance minister ArunJaitley said his ministry would soon announce measures to revive economic growth that has decelerated to the slowest pace in three years.

Jaitley’s comments come against the background of the most serious economic challenge the government has faced since it came to power in 2014.

India’s gross domestic product (GDP) growth slowed to 5.7% in the quarter ended June, the slowest in three years, from 6.1% in the preceding three months, sparking concern over the state of the economy. The residual impact of the November invalidation of high-value banknotes and the July 1 implementation of the goods and services tax (GST) were seen as contributing factors. Current account deficit at a four-year high (2.4% of GDP in Q1 FY18) and rising retail inflation have further exacerbated the macroeconomic situation.

On Tuesday, Jaitley chaired a meeting to discuss the situation and find solutions to the problem. The meeting was attended by railway minister Piyush Goyal, commerce and industry minister Suresh Prabhu and the secretaries of the finance and commerce and industry ministries. The railway board chairman and representatives from the Prime Minister’s Office and NITI Aayog, the government’s policy think tank, were also in attendance.

Jaitley said the measures would be announced soon, after consulting Prime Minister Narendra Modi.

There has been speculation that the revival package could include incentives for exporters, fiscal sops and investments in large infrastructure projects. Reviving economic growth and creating more jobs, promises that the ruling Bharatiya Janata Party made to come to power in 2014, are crucial as the party seeks re-election in 2019.

DK Srivastava, chief policy adviser at EY India, said the government may announce fiscally expansionary programmes without breaching the 3.2% (of GDP) fiscal deficit target for 2017-18. “Public and departmental enterprises that can spend on infrastructure may be asked to speed up and enhance their capex (capital expenditure) plans for the year. The central government may also co-opt some state governments to work towards this objective.”

The government is already at 92% of its full-year fiscal deficit target in the first four months (April-July) of 2017-18 and may find it difficult to spend beyond its budgetary means this fiscal, Srivastava added.

Low oil prices have helped the government, which has not reduced the retail price of petrol and diesel, instead increasing levies on fuel. It has used this money to balance the fisc and spend on development programmes—a sound macroeconomic move, according to many economists.

Still, a recent increase in oil prices, coming in the wake of weak economic data, has resulted in a wave of criticism being directed at the government. It doesn’t help that the Bharatiya Janata Party had made fuel prices a big issue when the Congress-led United Progressive Alliance was in power.

Jaitley defended the levies on fuel.

“Funds for public investment are coming from resources such as excise duty on petrol and diesel.Public investment has become the foundation of growth at a time when private investment is low. Cutting those investments would mean cutting down allocations for social sector and infrastructure schemes,” he said.

(Source: http://www.hindustantimes.com/india-news/govt-will-announce-additional-measures-to-boost-economic-growth-arun-jaitley/story-BN0NNHLU8oaqEtJt6mPKAP.html dated 20th September-201&)

|

|

BACK |

Foreign trade policy review may be delayed

|

NEW DELHI, SEPTEMBER 21:

Exporters may have to wait an extra month, or even more, for the foreign trade policy (FTP) review, earlier scheduled for September, as the government is still grappling with implementation issues related to the Goods and Services Tax (GST).

The Centre has also not taken a call on the future of export incentive schemes that may no longer be permissible under the World Trade Organisation rules as India has graduated out of the list of poorer countries allowed to give export subsidies.