CONTENTS

Chemexcil Activities |

|

Seminar on "Chemexcil Membership awareness and E-way Bill System/

Export Refunds on 6th June 2018 at FTAPCCI Auditorium, Hyderabad

|

|

Brief Report

Chemexcil Workshop on IGST/ Un-utilized ITC refund Mumbai on

07/06/2018

|

|

CHEMEXCILS PARTICIPATION IN CHEMSPEC EUROPE-2018

|

|

ORGANIZED JOINTLY BY CHEMEXCIL & PLEXCONCIL

INTERACTIVE SESSION ON ISSUES RELATED TO KOLKATA PORT / GST / FTP

AT HOTEL LALIT GREAT EASTERN, KOLKATA ON 27-06-2018

|

Exim Updates |

|

GST - Reverse Charge Mechanism (RCM) further Deferred till 30 Sept. 2018

|

|

IGST Refunds - JNCH Scroll No. 6456 & Scroll No. 6314

|

|

e-Way Bill - Modifications to the procedure for interception of conveyances for inspection of goods in movement, and detention, release and confiscation of such goods and conveyances, as clarified in Circular No. 41/15/2018-GST dated 13.04.2018

|

|

AEO - Appointment of CRM within the jurisdiction of Chief Commissioner of Customs, Mumbai- II

|

|

IGST Refunds - JNCH IGST scrolls from 8th June 2018 to 18th June 2018

|

|

DGFT - Amendment in Para 4.29 (vi) and Para 4.29(vii) of FTP 2015-20 on DFIA / Submission of application seeking authorization for import / export of restricted items through e-mail

|

|

DGFT - Notifying office address of DGFT and its Regional Authorities and their jurisdiction and Private SEZs of Appendix 1A of Foreign Trade Policy, 2015-20

|

|

IGST Refunds - Facility on GST Portal to “Track status of invoice data shared/to be shared with ICEGATE”

|

|

CBIC - Amendment in notification No. 50/2017-customs dated 30th June 2017, to prescribe effective rate of duty on specified goods / Increase the tariff rate on goods in chapter 28 etc

|

|

Methanol :- Various issues raised during the visit of Secretary (C&PC) to State of Gujarat-reg

|

|

GST (Policy Wing) - Clarifications on miscellaneous issues related to SEZ/ Refund of unutilized ITC for job workers/ Other issues under GST

|

|

GST - Fifth Amendment (2018) to the CGST Rules, 2017

|

|

Trade issues related to Afghanistan

|

|

Inputs on Chinese Laws/practices hampering fair trade & Issues faced by Indian exporters to be deliberated in 7th Trade Policy Review of China in WTO

|

|

JNCH - Procedure to be followed for EGM error SB006 related to ICDs

|

|

DGFT - Schedule of EODC Camps to be conducted in Additional DGFT Mumbai Office from 11.06.2018 To 22.06.2018

|

|

Banking Issues faced by exporters (e-BRC delay etc)

|

|

JNCH (IGST Refunds) - List of Shipping Bills in Scroll no 5423 / SB005 list / Contact details of Officers at IGST camp

|

|

CBIC - Procedure for e-commerce exports through Post and clarification on personal imports / Exports by Post Regulations, 2018 /Clearance of goods through FPOs

|

|

IGST Refunds Extension of date in SB005 alternate mechanism cases and Clarification in other cases (SB003)

|

|

DGFT - Doing away with the requirement of DSC for online/digital payment through e-MPS

|

News & Articles |

|

Marine Pollutants – Compliance and Exemptions – IMDG CODE 38-16

|

|

Can India-China’s trade gap be trimmed? Boosting exports in

these areas may help, says report

|

|

US remains top export destination for India with shipments

worth $47.9 bn last fiscal: Commerce ministry data

|

|

India to ask US for renewal of GSP scheme

|

|

China’s ‘green’ issues boost India’s FY18 chemical exports

|

|

India: Indirect Tax Updates: Notification Of Customs Audit

Regulations, 2018, Amendments In The Foreign Trade Policy, Exemption

From Payment Of A Late Fee Under Profession Tax

|

|

Iran, India to Begin PTA Talks

|

|

Tough Times Ahead for Indian Businesses if Trump Imposes

Retaliatory Tariffs

|

|

Commerce Minister reviews progress of export promotion

strategy

|

|

India, US may discuss visa issues, steel export tariffs

|

|

SushmaSwaraj discusses steps to revitalise bilateral ties

with Italy

|

|

India committed to broad-based trade agreement with EU:

President Kovind |

|

Ease of Doing Business for exporters in filing DFIA |

|

CENTRE TO MAKE PCPIR POLICY MORE ATTRACTIVE |

|

PM Narendra Modi seeks double-digit GDP growth, raising

India's share in world trade |

|

Commerce Minister Suresh Prabhu says it is a misconception

that India subsidise exports |

|

|

|

|

Seminar on "Chemexcil Membership awareness and E-way Bill System/ Export Refunds on 6th June 2018 at FTAPCCI Auditorium, Hyderabad

| |

|

| Chemexcil chairman Shri Satish Wagh felicitating Shri Gowra Srinivas, President, FTAPCCI with a bouquet of flowers during the seminar Shri S. G. Bharadi, Executive Director Chemexcil at the right. |

| |

|

| From left Shri S.N. Pangrahi, Consultant, Shri Satish Wagh, Chairman, Chemexcil, Shri Gowra Srinivas, President, FTAPCCI, Shri S.G. Bharadi, Executive Director, Chemexcil, Shri Sanjay Kapoor, Secretary General, FTAPCCI |

Chemexcil along with Federation of Telangana Andhra Pradesh Chamber of Commerce and Industry (FTAPCCI)conducted seminar on "Chemexcil Membership awareness and E-way Bill System/ Export Refundsat Hyderabad on6th June 2018at FTAPCCI Auditorium, Hyderabad.

The very objective of this seminar was to create Chemexcil awareness and educate the members on various aspects of E-way Bill System/ Export Refunds under GST.

The Speaker for the seminar wasShri. Satish Wagh, Chairman Chemexcil, Mr. S.G. Bharadi,Executive Director Chemexcil along with SN Panigrahi a Versatile Practitioner, Strategist, Consultant, Energetic Coach, Learning Enabler, & Public Speaker, Shri Gowra Srinivas President (FTAPCCI), Shri Sanjay Kapoor, Secretary General FTAPCCI

Shri S.G. Bharadi, Executive Director Chemexcil covered the important topic of Chemexcil Membership Awareness and made a comprehensive presentation on the topic which was Customized has briefly explained Chemexcil assistance to the members & ForeignBuyers, Achievements and Chemexcil Events.

Shri S.N. Pangrahi, Consultant - covered the important topic of e-way bill system and Export Refunds and made a comprehensive presentation on both topics

Total 35-membersand 5 Media Person from Hyderabad region attended this seminar

BACK |

|

Brief Report

Chemexcil Workshop on IGST/ Un-utilized ITC refund Mumbai on 07/06/2018

| |

|

| Shri Satish Wagh, Chairman Chemexcil welcoming Shri Rohit Singla, IRS, Jt Commissioner, NS-II, JNCH |

To guide the exporters regarding the procedure and process of the IGST/ ITC refund, sensitize them to avoid hassles while applying for the refund and take appropriate measures to rectify the errors, the council had organized a "Workshop on Refund of IGST/Un-utilised ITC for Exporters" on 7th June 2018 at Hotel Marine Plaza, Mumbai.

Participants

Shri Rohit Singla, IRS, Joint Commissioner of Customs, NS-II, Jawaharlal Nehru Custom House graced the workshop as a key note speaker and also interacted with the participants. The Council had also invited Shri Mihir Shah who is a Consultant, Advisor and Trainer in International Business and also Proprietor – Universal Connections to give a detailed presentation on procedure and process of refunds. From the council side Shri Satish Wagh- Chairman, Shri S.G Bharadi-ED and other Officers/ staff of Chemexcil attended the Workshop.

Highlights of the workshop

Shri Wagh welcomed the esteemed panelists/ participants and opined that the timing of the workshop was apt since Government has organized refund drive fortnight. He urged the members to make best use of this opportunity to clear their pending refunds. Shri Rohit Singla briefed the members about the Special Drive by JNCH from 31.05.2018 to 14.06.2018. Regarding exporters who have mentioned IGST in 3.1(a) of GSTR-3B, he informed that in such cases the details are being sent to GSTN who will subsequently transmit to Customs EDI for processing. Exporters will have to later on submit a certificate from Chartered Accountant before 31st October, 2018 to the DC(IGST), JNCH at the port of export to the effect that there is no discrepancy between the IGST amount refunded on exports and the actual IGST amount paid on exports of goods for the period July 2017 to March 2018. Further, Shri Singla added that in cases where there is a short payment of IGST proof of payment shall be submitted to Assistant/Deputy Commissioner of Customs in charge of IGST at JNCH. Later on they will submit a certificate from Chartered Accountant before 31st October, 2018 to the DC(IGST), JNCH.

He also informed that other errors like SB003, SB005 & SB006 are also being handled now during the drive and in the last few days refunds worth at-least 1000 crs have been processed. Replying to queries on short payment, supplementary claims and merchant exporter Notification, Shri Singla advised that these are new queries and will have to be taken up with CBIC for final resolution. He also advised the council to send such representations with details for examination.

Shri Mihir Shah explained the entire procedure and process in detail and covered topics like Categories of Supply under GST, Zero rated supply, Pre-requisites for refunds, Returns and Refund Applications, Refund of un-utilised ITC, Refund of IGST Paid on Exports, Refund under 0.1% merchant exporter supply etc.

Shri Shah also gave a demo on “sign up / create login at ICEGATE portal” for IGST Validation Inquiry during the session.

The Workshop got excellent response with more than 70 Member Exporters attending the workshop.

The participants asked several queries during the Workshop which were answered satisfactorily by the eminent panelists.

BACK |

|

CHEMEXCILS PARTICIPATION IN CHEMSPEC EUROPE-2018

CHEMEXCIL is participated in Chemspec Europe-2018 exhibition being organized by MACK BROOKS EXHIBITIONS LIMITED UK, from 20th to 21st June, 2018 at Hall 8, Koln Messe, Cologne, Germany.

This project is sanctioned under MAI scheme. Altogether 41 chemexcil member-exporters participated in this exhibition.CHEMEXCIL Booked 836 sq. mt. space in Hall No.8. 300 Sq.mt. Space is converted in India Pavilion, Branding INDIA.5000+ visitors from various countries and regions visited this exhibition.

Visitors from Agrochemical intermediates, biotechnology, Catalysts, Colours& Pigments, Flavours& Fragrances, Organic Intermediates, Photographic Chemicals and Water treatment chemicals., International Trade Missions are the target visitors.

BACK |

|

ORGANIZED JOINTLY BY CHEMEXCIL & PLEXCONCIL INTERACTIVE SESSION ON ISSUES RELATED TO KOLKATA PORT / ST / FTP AT HOTEL LALIT GREAT EASTERN, KOLKATA ON 27-06-2018

| |

|

| From Left are Shri S.G. Bharadi, Executive Director - Chemexcil, Shri Subir Ghosh, PRO Commercial Taxes, Government of West Bengal, Shri Rajib Sankar Sengupta, Joint Commissioner, Commercial Taxes, Government of West Bengal, Shri Satish Wagh, Chairman - Chemexcil, Shri Mohan Lal Sukhpal, Joint Commissioner Customs (Port), Shri A.K. Basak, Chairman - Plexconcil, Captain Himangshu Shekar, Traffic Manager, Kolkata Port Trust, Shri Rohit Soni, Asst DGFT |

The above Seminar was jointly organized by the CHEMEXCIL and PLEXCONCIL on issues related to Kolkata Port / GST / FTP at Hotel Lalit Great Eastern, Kolkata. From CHEMEXIL, the seminar was attended by Shri Satish Wagh, Chairman - Chemexcil and Shri S.G. Bharadi - Executive Director - Chemexcil and from Plexconcil Shri A.K. Basak, Chairman was attended. The program began with honoring the distinguished guests with presentation fresh flowers.

Objective –

With the onset of GST regime, there have been lot of concerns amongst the member-exporters regarding refunds, e-way bill, custom issues related to port, fate of export promotion schemes etc and also Foreign Trade Policy 2015-2020 etc.

To address the concerns of the exporters, the Council organized this Seminar and Interactive Session on ISSUES RELATED TO KOLKATA PORT / GST / FTP.

Topics coverage –

- Custom issues related to Kolkata Port Categories of Supply under GST

- Zero rated supply

- Pre-requisites for refunds

- Returns and Refund Applications

- Refund of un-utilised ITC.

- Refund under 0.1% merchant exporter supply

- e-Way Bill

- e-sealing for export containers / RFID e-seals

- Foreign Trade Policy 2015-2020

- Other Trade remedies

Speakers –

- Shri Mohan Lal Sukhpal, Joint Commissioner of Customs (Port)

- Captain Himangshu Shekar, Traffic Manager, Kolkata Port Trust

- Shri Rajib Sankar Sengupta, Joint Commissioner, Commercial Taxes, Government of West Bengal

- Shri Subir Ghosh, PRO, Commercial Taxes, Government of West Bengal

- Shri Rohit Soni, Assistant DGFT

| |

|

| Shri Satish Wagh, Chairman CHEMEXCIL welcoming Shri Rohit Soni, Asst DGFT with bouquet of flower |

| |

|

| Shri Satish Wagh, Chairman CHEMEXCIL address the gathering |

| |

|

| Dignitaries on the Dias |

| |

|

| Shri S.G.Bharadi Exeuctive Director, CHEMEXCIL delivering the

Vote of Thanks

|

Shri A.K. Basak, Chairman - Plexconcil, welcomed the gathering and informed about the plastic potential in the world market. India’s share only 1% in export in worldwide.

Shri Satish Wagh, Chairman – Chemexcil delivered his address and informed to the participants that Central Government is working on a draft chemical policy which would focus on meeting the rising demand of chemicals from domestic industry and reduce dependence on imports. He informed that Rs.6,087 crore IGST refund has been sanctioned by the CBIC at the end of 16th June, 2018. He appealed to the exporters to ensure that the correct procedure of filing returns, giving accurate information in Shipping Bills and submitting RFD01A application forms to the jurisdictional formations are followed for quick disbursal of their refund claims. He thanks to the Government of West Bengal Government for taking initiative to develop deep sea port project in PPP basis at Tajpur, in Midnapore district, West Bengal.

Shri Mohan Lal SukhPal, Joint Commissioner of Customs (Port) delivered his key note address and inform to obtain facility of AEO. From the Kolkata Customs made PPT presentation about the AEO benefits and exemption on account of import and export. They informed to our members that AEO certification is Three-Tier AEO (T1, T2, T3) and this certification is launched by Indian Customs. Small and Medium Scale Enterprises who have filed 25 documents i.e. either Bills of Entry or Shipping Bills during the last financial year is also entitled for AEO. The applicant should have business activities for at least three financial years preceding the date of application.

Captain Himangshu Shekar, Traffic Manager, Kolkata Port Trust made presentation of ppt about the Kolkata Port Performance Analysis, Highlights of existing infrastructure, current constraints of Kolkata dock system, Projects already implemented, Projects in pipeline.

Shri Rajib Sankar Sengupta, Joint Commissioner, Commercial Taxes, Government of West Bengal made presentation of ppt about Refunds and e-way bill.

Shri Rohit Soni, Asst DGFT also address the gathering.

Floor was subsequently opened for queries. With the detailed and suitable illustrations on the technical session which evoked a good response from the participants. Over 80 participants attending the seminar. The participants asked several queries during the seminar and where answered satisfactorily by the eminent speakers.

In the Vote of Thanks session, Shri S.G. Bharadi, Executive Director then briefed the participants about the various export promotional initiatives undertaken by the council with a strong commitment to enhance export growth significantly. He urged member-exporters to get Certificate of Origin from the regional office immediately after shipment. and informed member exporters to give export return on quarterly basis regularly through use our ONLINE facility. He requested to the participants to check the Chemexcil website on daily basis to get up-to-date information.

| |

|

| |

|

| Shri Mohan Lal Sukhpal, Joint Commissioner of Customs (Port) delivering his address |

| |

|

| Captain Himangshu Shekar, Traffic Manager, Kolkata Port Trust delivering his valuable presentation. |

| |

|

| Shri Rajib Sankar Sengupta, Joint Commissioner, Commercial Taxes, Government of West Bengal delivering his valuable presentation.

|

| |

|

| Question - Answers session

|

| |

|

| A view of Participants

|

BACK |

e-Way Bill - Modifications to the procedure for interception of conveyances for inspection of goods in movement, and detention, release and confiscation of such goods and conveyances, as clarified in Circular No. 41/15/2018-GST dated 13.04.2018

| EPC/LIC/GST/E_WAY_BILL |

26/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

e-Way Bill - Modifications to the procedure for interception of conveyances for inspection of goods in movement, and detention, release and confiscation of such goods and conveyances, as clarified in Circular No. 41/15/2018-GST dated 13.04.2018 |

|

|

Dear Members,

This is in continuation of our circular dated 16/04/2018 informing you about CBIC Circular no. 41/2018 dated 13/04/2018 clarifying the procedure for interception of conveyances for inspection of goods in movement, and detention, release and confiscation of such goods and conveyances.

In order to clarify certain issues regarding the specified procedure, CBIC has now issued Circular No. 49/23/2018-GST dated 21/06/2018 regarding Modifications to the procedure for interception of conveyances for inspection of goods in movement, and detention, release and confiscation of such goods and conveyances, as clarified in Circular No. 41/15/2018-GST dated 13.04.2018.

The important modifications are highlighted/ reproduced as follows for your reference-

In para 2 (e) of the said Circular, the expression “three working days” may be replaced by the expression “three days”.

The statement after paragraph 3 in FORM GST MOV-05 should read as: “In view of the above, the goods and conveyance(s) are hereby released on (DD/MM/YYYY) at ____ AM/PM.

Further, it is stated that as per rule 138C (2) of the Central Goods and Services Tax Rules, 2017, where the physical verification of goods being transported on any conveyance has been done during transit at one place within a State or Union territory or in any other State or Union territory, no further physical verification of the said conveyance shall be carried out again in the State or Union territory, unless a specific information relating to evasion of tax is made available subsequently. Since the requisite FORMS are not available on the common portal currently, any action initiated by the State tax officers is not being intimated to the central tax officers and vice-versa, doubts have been raised as to the procedure to be followed in such situations. In this regard, it is clarified that the hard copies of the notices/orders issued in the specified FORMS by a tax authority may be shown as proof of initiation of action by a tax authority by the transporter/registered person to another tax authority as and when required.

It is also clarified that only such goods and/or conveyances should be detained/confiscated in respect of which there is a violation of the provisions of the GST Acts or the rules made thereunder. Illustration: Where a conveyance carrying twenty-five consignments is intercepted and the person-in-charge of such conveyance produces valid e-way bills and/or other relevant documents in respect of twenty consignments, but is unable to produce the same with respect to the remaining five consignments, detention/confiscation can be made only with respect to the five consignments and the conveyance in respect of which the violation of the Act or the rules made thereunder has been established by the proper officer.

Members are requested to take note of above modifications in the procedure for interception, detention of goods etc. The said CBIC circular is available for reference/ download using below links:

http://cbic.gov.in/resources//htdocs-cbec/gst/Circular_No.49.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

AEO - Appointment of CRM within the jurisdiction of Chief Commissioner of Customs, Mumbai- II

| EPC/LIC/CBIC/AEO |

25/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

AEO - Appointment of CRM within the jurisdiction of Chief Commissioner of Customs, Mumbai- II |

|

|

Dear Members,

As you might be aware, Authorized Economic Operator (AEO) programme seeks to provide tangible benefits in the form of faster Customs clearances and simplified Customs procedures to those business entities who offer a high degree of security guarantees in respect of their role in the supply chain.

For the economic operators other than importers and the exporters, AEO programme offers one tier of certification (i.e. AEO-LO) whereas for the importers and the exporters, there will be three tiers of certification (i.e. AEOT1, AEO-T2 and AEO-T3). Eligibility conditions and criteria laid are down under paragraph 3 of Board Circular No. 33/2016-Cus., dated 22-7-2016 (as modified vide and Circular No. 3/2018- Customs, dated January 17, 2018) ((available at: http://www.cbec.gov.in/Customs-Circulars-Instructions). The council has also informed the members about the amendments vide circular dated 31/01/2018.

The application for AEO certification may be submitted to the relevant Customs Houses of your Jurisdiction. The Customs Houses nominate their Client Relationship Manager (CRM) for AEO entities in the jurisdiction.

In this regard, O/o Commissioner Of Customs (NS-III), JNCH has issued Public Notice no 101/2018 dated 20/06/2018 regarding appointment of Client Relationship Manager (CRM) within the jurisdiction of Chief Commissioner of Customs, Mumbai- II.

The following officer is appointed as Client Relationship Manager (CRM) within the jurisdiction of Chief Commissioner of Customs, Mumbai- II.

Name & Designation of

the Officer |

Office Address/

Telephone |

Appointed as |

Jurisdiction |

Shri R.K Singh

Jt. Commissioner

Of Customs & |

Floor, JNCH,

Nhava Sheva |

Client

Relationship |

Mumbai- II |

Nodal Officer,

AEO, Zone- II |

022 27244751,

022 27242409 (direct) |

Manager(CRM)

for AEO entities |

|

The CRM will be responsible for-

Clarifying/resolving query, if any, of AEO applicant while filing the AEO application in the office of CC Customs, Zone- II. In case of unavailability or doubt, the CRM can direct the applicant to the AEO Cell of JNCH for guiding the applicant.

CRM shall be single point of interaction with AEO clients. CRM should act as a voice of AEO within Customs in relation to legitimate concern and issues of AEO. CRM should assist in getting procedural and operational issues resolved by co-ordinating with different sections within Customs as well as other stakeholders.

Members are requested to take note of the CRM details for JNCH and take it forward, if interested. The above said Public Notice is available for download using below links:

http://jawaharcustoms.gov.in/pdf/PN-2018/PN_101.pdf

For other custom houses, we shall let you to know the details in due course or the same can be obtained through the CHA’s.

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

IGST Refunds - JNCH IGST scrolls from 8th June 2018 to 18th June 2018

| EPC/LIC/JNCH/IGST |

22/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

IGST Refunds - JNCH IGST scrolls from 8th June 2018 to 18th June 2018 |

|

|

Dear Members,

As you might be aware, Authorized Economic Operator (AEO) programme seeks to provide tangible benefits in the form of faster Customs clearances and simplified Customs procedures to those business entities who offer a high degree of security guarantees in respect of their role in the supply chain.

For the economic operators other than importers and the exporters, AEO programme offers one tier of certification (i.e. AEO-LO) whereas for the importers and the exporters, there will be three tiers of certification (i.e. AEOT1, AEO-T2 and AEO-T3). Eligibility conditions and criteria laid are down under paragraph 3 of Board Circular No. 33/2016-Cus., dated 22-7-2016 (as modified vide and Circular No. 3/2018- Customs, dated January 17, 2018) ((available at: http://www.cbec.gov.in/Customs-Circulars-Instructions). The council has also informed the members about the amendments vide circular dated 31/01/2018.

The application for AEO certification may be submitted to the relevant Customs Houses of your Jurisdiction. The Customs Houses nominate their Client Relationship Manager (CRM) for AEO entities in the jurisdiction.

In this regard, O/o Commissioner Of Customs (NS-III), JNCH has issued Public Notice no 101/2018 dated 20/06/2018 regarding appointment of Client Relationship Manager (CRM) within the jurisdiction of Chief Commissioner of Customs, Mumbai- II.

The following officer is appointed as Client Relationship Manager (CRM) within the jurisdiction of Chief Commissioner of Customs, Mumbai- II. Dear Members,

Kindly note that Jawaharlal Nehru Customs House has uploaded a file on their portal having details of IGST scrolls from 8th June 2018 to 18th June 2018.

This 535 page file covers details of shipping bills processed/scrolls issued during the 8th June 2018 to 18th June 2018 period.

Members are requested to take note and check for their pending refund cases. The above said file is available for download using below link-

http://jawaharcustoms.gov.in/pdf/Scroll-from-8june-18june.pdf

Thanking You,

Yours faithfully,

(S. G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT - Amendment in Para 4.29 (vi) and Para 4.29(vii) of FTP 2015-20 on DFIA / Submission of application seeking authorization for import / export of restricted items through e-mail

| EPC/LIC/DGFT |

22/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Amendment in Para 4.29 (vi) and Para 4.29(vii) of FTP 2015-20 on DFIA / Submission of application seeking authorization for import / export of restricted items through e-mail |

|

|

Dear Members,

The O/o Directorate General of Foreign Trade, New Delhi has issued Notification No. 13/2015-2020 dated 20/06/2018 regarding Amendment in Para 4.29 (vi) & Para 4.29(vii) of FTP 2015-20 on DFIA & Trade Notice No.18/2018-19 regarding Submission of application seeking authorization for import / export of restricted items through e-mail.

For the convenience of members, the gist of the new notifications/ Trade Notices is provided as follows:

Notification No. 13/2015-2020 dated 20/06/2018- regarding Amendment in Foreign Trade Policy 2015-20

Paragraph 4.29 (vi) and Para 4.29(vii) of Foreign Trade Policy 2015-20 is replaced enabling exporters to file single DFIA application for exports made from any EDI port and separate applications for export made from each non-EDI port.

Trade Notice No.18/2018-19 dated 20/06/2018- regarding Submission of application seeking authorization for import / export of restricted items through e-mail.

To save time/ paper involved, it has been decided that w.e.f. 21.06.2018 applicants seeking import/export license from DGFT for "restricted" items, having paid the applicable fees, will submit online application to the concerned jurisdictional authority and subsequently send their application through email to either import-dgft@nic.in (for import licenses) or exportdgftickic.in (for export licenses) as the case may be, along with proof of the application fee paid; besides attaching the necessary documents for processing the case. Applications are required to be submitted in prescribed pro-forma ANF-2M (for import license) and ANF- 2N (for export license) along with ANF-1 (Applicant's Importer Exporter Profile), copy of IEC and other supporting documents, as applicable. Aayat Niryat forms are available on the DGFT's website www.dgft.gov.in . In case the applicant firm has received the NOC from the concerned administrative Ministry, the same should invariably be attached with the application. Applicants are requested to send their attachments only in PDF format.

Members are requested to take note of above changes and do the needful accordingly. The said Notification/ Trade Notice are available for reference/ download using below hyperlinks-

http://dgft.gov.in/Exim/2000/NOT/NOT18/Noti%2013%20eng.pdf

http://dgft.gov.in/Exim/2000/TN/TN18/Trade%20Notice%2018.pdf

Issues, if any, can be highlighted to us on e-mail id’s deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. Bharadi)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT - Notifying office address of DGFT and its Regional Authorities and their jurisdiction and Private SEZs of Appendix 1A of Foreign Trade Policy, 2015-20

| EPC/LIC/DGFT |

22/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Notifying office address of DGFT and its Regional Authorities and their jurisdiction and Private SEZs of Appendix 1A of Foreign Trade Policy, 2015-20 |

|

|

Dear Members,

The O/o Directorate General of Foreign Trade, New Delhi has issued Public Notice no. 14/2015-2020 dated 20/06/2018 notifying office address of DGFT and its Regional Authorities and their jurisdiction and Private SEZs of Appendix 1A of Foreign Trade Policy, 2015-20.

As an effect of this PN, the office address of DGFT and its Regional Authorities and their Jurisdiction have been updated and Private SEZ, from Serial No 47 to 53 have been added to Appendix 1A of FTP 2015-20.

Members are requested to take note of the same. The said Public Notice is available for reference/ download using below link-

| PUBLIC NOTICE NO. |

DATE |

SUBJECT |

| 14/2015-2020 |

20.06.2018 |

Notifying office address of DGFT and its Regional Authorities and their jurisdiction and Private SEZs of Appendix 1A of Foreign Trade Policy, 2015-20. |

http://dgft.gov.in/Exim/2000/PN/PN18/PN%2014%20eng.pdf

Thanking You,

Yours faithfully,

(S.G. Bharadi)

Executive Director

CHEMEXCIL

|

|

BACK

|

IGST Refunds - Facility on GST Portal to “Track status of invoice data shared/to be shared with ICEGATE”

| EPC/LIC/GSTN |

21/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

IGST Refunds - Facility on GST Portal to “Track status of invoice data shared/to be shared with ICEGATE” |

|

|

Dear Members,

As informed earlier, the status of IGST refund on exports can be checked on ICEGATE Portal using IGST Validation inquiry.

Kindly note that now GST Common Portal has also enabled a facility to “Track status of invoice data shared/to be shared with ICEGATE” with export ledger details.

By now members are aware that IGST refund is automatically processed upon matching of S/Bill data, EGM , correct payment in GSTR3B(3.1.b) and Complete Invoice wise details in GSTR1 (Table 6A).

Upon filling your GSTR1 and GSTR-3B, you can go to “Refunds” on Common Portal and Track your Shipping to ICEGATE. We understand that it will show you the no. of shipping bills processed and sent to ICEGATE. Any error will be pointed out.

Subsequently, you can login your ICEGATE use id and check for validation data to know the error if any and take action accordingly in case of error. In case of SB000 validation code, exporters can wait and expect refund to be processed by Customs as per scroll generation schedule.

Members are requested to take note of this tracking facility on GST portal and do the needful. We will also appreciate your feed-back on this facility on e-mail id’s- deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in.

Thanking You,

Yours faithfully,

( S.G. BHARADI )

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

CBIC - Amendment in notification No. 50/2017-customs dated 30th June 2017, to prescribe effective rate of duty on specified goods / Increase the tariff rate on goods in chapter 28 etc

| EPC/LIC/CBIC |

21/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

CBIC - Amendment in notification No. 50/2017-customs dated 30th June 2017, to prescribe effective rate of duty on specified goods / Increase the tariff rate on goods in chapter 28 etc |

|

|

Dear Members,

The Central Board of Indirect Taxes and Customs (CBIC) has issued Notification No. 48/2018—Customs and No.49/2018-Customs both dated 20/06/2018 respectively regarding amendment in effective rate of duty on specified goods and Increase in tariff rate on goods in chapters 28 etc.

From chemical industry perspective, the changes in customs tariffs are as follows:

Notification No. 49/2018—Customs dated 20/06/2018

(Amendment in Notification No. 50/2017-Customs, dated the 30/06/2017

regarding effective rate of duty)

In S. No. 169, for the entry in column (2), the following entry shall be substituted namely:-

“28 (except 28230010, 28092010 or 28100020)”; |

After S. No. 177 and the entries relating thereto, the following serial number and entries shall be inserted, namely:-

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| "177A |

28100020 |

Boric Acid |

7.5% |

- |

_ |

Notification No. 48/2018—Customs dated 20/06/2018

(increase the tariff rate on goods)

In Chapter 28, for the entry in column (4) occurring against-

tariff item 28092010, the entry "20%"shall be substituted;

tariff item 28100020, the entry "17.5%"shall be substituted;

Member-exporters importing above mentioned items are requested to take note of these tariff changes. The above said notifications are available for download using hyperlinks provided below-

| 49/2018-Cus,dt. 20-06-2018 |

View(153 KB) |

seeks to further amend notification No. 50/2017-customs dated 30th June 2017, to prescribe effective rate of duty on specified goods. |

| 48/2018-Cus,dt. 20-06-2018 |

View(192 KB) |

Seeks to increase the tariff rate on goods in chapters 7, 8, 28, 38, 72 and 73 in the First Schedule to the Customs tariff Act, 1975 . |

http://cbic.gov.in/htdocs-cbec/customs/cs-act/notifications/notfns-2018/cs-tarr2018/cs49-2018.pdf

http://cbic.gov.in/htdocs-cbec/customs/cs-act/notifications/notfns-2018/cs-tarr2018/cs48-2018.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Methanol :- Various issues raised during the visit of Secretary (C&PC) to State of Gujarat-reg

| EPC/LIC/METHANOL |

20/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Methanol :- Various issues raised during the visit of Secretary (C&PC) to State of Gujarat-reg |

|

|

Dear Members,

It is to inform that Secretary(C&PC) along with Joint Secretary (Chemicals) and representatives from FICCI under took three days tour to various chemical units / clusters and PCPIR Gujarat from 4th April, 2018 to 6th April, 2018.

During this visit, Secretary(C&PC) held discussions with various stakeholders on various chemicals including Methanol.

As you are aware, Methanol is a basic building block for the manufacture of number of chemicals and is finding use in number of industrial applications. We understand that lndia is facing shortage of this chemical in the country and its demand is supplemented by imports in large quantities, thereby involving foreign exchange out go.

lt is proposed to set up methanol plants in gas rich countries to promote downstream industries and thereby promoting "Make in lndia".

You are requested to send us your inputs / proposal in this regard asap to enable us forward the same to DCPC, Ministry of C&F for their consideration. Your inputs be mail on following email id. deepak.gupta@chemexcil.gov.in, rodelhi@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

(S.G. BHARADI )

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

GST - Fifth Amendment (2018) to the CGST Rules, 2017

| EPC/LIC/GST_NOTIFICATION |

19/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

GST - Fifth Amendment (2018) to the CGST Rules, 2017 |

|

|

Dear Members,

Kindly note that the Central Board of Excise and Customs (CBEC) has issued Notification No. 26/2018 – Central Tax dated 13/06/ 2018 regarding Fifth Amendment (2018) to the CGST Rules, 2017.

This notification mainly amends Rules 37, 83, 89, 95, 97, 133, 138 and revises Forms GSTR-4, GST PCT-01, GST RFD-01, GST RFD-01A (as annexure in the notification)

Members are requested to take note of above notification regarding Fifth Amendment (2018) to CGST Rules 2017. For full details, the above-said notification is available for download using hyperlinks provided therein or below link-

http://cbic.gov.in/resources//htdocs-cbec/gst/Notification-26-2018-central_tax-English.pdf

Thanking you,

Yours faithfully,

(S.G BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Trade issues related to Afghanistan

| EPC/LIC/AFGHNISTAN |

15/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Trade issues related to Afghanistan

|

|

|

Dear Members,

The Council has received communication from the FT-SA Division, Department of Commerce, Ministry of Commerce & Industry informing us that theThird meeting of the Joint Working Group on Trade, Commerce and Investment between India and Afghanistan is to be held in Kabul, during the last week of June 2018.

In this regard, members are kindly requested to let us know about Trade related issues, if any, with details which may be taken up for discussion with Afghan side during the above meeting, latest by 18th June, 2018.

Your early replies be sent to us on e-mail id’s-deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

S.G. Bharadi

Executive Director

Chemexcil

|

|

BACK

|

Inputs on Chinese Laws/practices hampering fair trade & Issues faced by Indian exporters to be deliberated in 7th Trade Policy Review of China in WTO

| EPC/LIC/WTO/CHINA |

14/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Inputs on Chinese Laws/practices hampering fair trade & Issues faced by Indian exporters to be deliberated in 7th Trade Policy Review of China in WTO

|

|

|

Dear Members,

We have received communication from the Department of Chemicals & Petrochemicals (DCPC) informing us about the forthcoming 7th Trade Policy Review of China in WTO.

In view of above, council has been requested to provide details/ information pointing out deficiencies in the Chinese Laws, policies and practices that restrain free and fair international trade in goods and services along with issues, if any, on problems being faced by our member-exporters while trading with China.

Members are therefore requested to revert with inputs (along-with facts & figures) to the council latest by 18/06/2018. Your inputs be mailed on e-mail id’s deepak.gupta@chemexcil.gov.in, balani.lic@chemexcil.gov.in & rodelhi@chemexcil.gov.in.

Your timely replies will be appreciated and shall enable us submit to DCPC for deliberations.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

JNCH - Procedure to be followed for EGM error SB006 related to ICDs

| EPC/LIC/JNCH/SB006 |

12/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

JNCH - Procedure to be followed for EGM error SB006 related to ICDs

|

|

|

Dear Members,

Kindly note that the O/o Commissioner of Customs (NS-G) Mumbai Zone-II, Jawaharlal Nehru Custom House has issued Public Notice No. 94/2018 dated 07.06.2018 regarding Procedure to be followed for EGM error SB006 related to ICDs.

As you might be aware, revalidation of EGMs at Gateway Port after rectification of EGM Errors (C and N errors of SB006) is being carried out on the basis of the copy of Shipping bill, Invoice, packing list and Bill of lading.

However, it is noticed that in some cases even after rectification of EGM error, the same cannot be revalidated in the System for the reasons summarised as follows:

Truck/ Train summary (Local EGM at ICD) has not been filed or filed after Gateway EGM date. In this situation, filing of supplementary EGM is a must.

M error (Gateway port code given in Truck/ Train summary differs from actual Gateway port) and L errors (Let Export Order date being later than Sailing date) also figures in SB006 Error. Exporters before sending the required documents through mail are advised to first get the M and L error corrected at ICD, if any.

Container number and Shipping line mentioned in Bill of Lading at ICD for LCL consignments often differs from those mentioned in the Shipping Bill as their LCL cargo is de-stuffed at Gateway Port and re-stuffed into another container at the Gateway port. The correct Container Number is recorded, in such cases, in the Master Bill of Lading and not the House Bill of Lading.

Exporters while emailing/providing copy of relevant documents for rectification of C and N error are, therefore, advised to ensure that copy of Master BL must also be emailed/provided, in case of LCL consignments.

Concerned members are requested to take note of above and do the needful accordingly. For further details, members may use below link for reference/ download-

http://www.jawaharcustoms.gov.in/pdf/PN-2018/PN_094.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

DGFT - Schedule of EODC Camps to be conducted in Additional DGFT Mumbai Office from 11.06.2018 To 22.06.2018

| EPC/LIC/EODC |

11/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Schedule of EODC Camps to be conducted in Additional DGFT Mumbai Office from 11.06.2018 To 22.06.2018

|

|

|

Dear Members,

This is in continuation of our circular dated 08/06/2018 informing you about DGFT New Delhi Trade Notice no 17/2018 dated 07/06/2018 regarding organising EODC Camp in RAs during 11.6.2018 to 22.6.2018 in order to facilitate expeditious disposal of EODC applications.

In this regard, we have received schedule from the Additional DGFT Mumbai Office providing details of timings, officers and sections etc (copy attached). Members (specially AA/ EPCG holders) having EODC related pendency’s at Additional DGFT Mumbai Office are requested to use this opportunity and resolve.

For other DGFT RA’s, members are requested to get in touch with the concerned officers and take it forward.

In case of persistent issues, please write to us on deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in

Thanking You,

Yours faithfully,

(S.G. Bharadi)

Executive Director

CHEMEXCIL

Schedule of EODC

|

|

BACK

|

Banking Issues faced by exporters (e-BRC delay etc)

| EPC/LIC/BANKING |

08/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Banking Issues faced by exporters (e-BRC delay etc)

|

|

|

Dear Members,

As you are aware, caution listing on account of RBI-EDPMS has been a cause of concern as it impacts export shipments, document submission to buyers and also resultant business. In this regard, we understand that the date for implementing the caution list in EDPMS has been extended till 30-Sep-2018.

However, we understand that there are still many cases of delays in uploading of e-BRC by the bank which result in delayed export incentives and other compliance related issues. Further, if in case you are facing any other banking related issues which is impacting exports, do let us know.

Member-exporters are requested to revert with full details of the banking issues faced, latest by 18/06/2018 on our e-mail ids- ed@chemexcil.gov.in & deepak.gupta@chemexcil.gov.in .

Your timely replies will enable us submit a comprehensive representation to the government and also arrange a stakeholders meeting.

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

CBIC - Procedure for e-commerce exports through Post and clarification on personal imports / Exports by Post Regulations, 2018 /Clearance of goods through FPOs

| EPC/LIC/CBIC/e-Commerce |

06/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

CBIC - Procedure for e-commerce exports through Post and clarification on personal imports / Exports by Post Regulations, 2018 /Clearance of goods through FPOs

|

|

|

Dear Members,

In order to facilitate exports and give a fillip to the global outreach of India’s exporters via e-commerce, the “Central Board of Indirect Taxes and Customs (CBIC)” has issued Circular No. 14/2018-Customs dated 04/06/2018, Notification no. 48/2018- Customs (N.T) and instructions dated 04/06/2018 regarding Procedure for e-commerce exports through Post and clarification on personal imports, Exports by Post Regulations, 2018 and also Clearance of goods through FPOs.

For the convenience of members, important points of circular/ instruction are reproduced as follows:

All IEC holders have been permitted to export goods through FPOs.

Any IEC holder exporting goods through the FPO, will be eligible for zero rating of exports, by way of IGST refund or discharge of LUT. Those who do not wish to avail this facility or fall in the category of Exempted/Non - Taxable are also permitted to export under the same procedure.

In order to cater to e-commerce exports through post, the Board has prescribed the declaration forms under “Exports by Post Regulations, 2018”.

In absence of EDI system at FPOs, the Postal Bill of Export (PBE-I) for e-commerce exports will be processed in manual environment for the time being. However, for the purpose of GST, data will be captured and uploaded through an off-line utility (ICAN) provided by DG(Systems).

It is clarified that till such time that computers with ICAN facility are installed and operationalised, exporters will be free to follow the procedure contained in the above-said circular.

Members interested in e-Commerce are requested to take note of the same. For further details of the procedure the above said circular/ instruction is available for download using below links-

http://cbic.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2018/Postal%20Circular%20June%202018.pdf (Procedure for e-commerce exports through Post and clarification on personal imports)

http://cbic.gov.in/resources//htdocs-cbec/customs/cs-instructions/cs-instructions-2018/cs-ins-11-2018.pdf

(Clearance of goods through FPOs)

http://cbic.gov.in/resources//htdocs-cbec/customs/cs-act/notifications/notfns-2018/cs-nt2018/csnt48-2018.pdf

(Exports by Post Regulations, 2018.)

Thanking You,

Yours faithfully,

(S.G. BHARADI )

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

IGST Refunds Extension of date in SB005 alternate mechanism cases and Clarification in other cases (SB003)

| EPC/LIC/GST/IGST_REFUNDS |

06/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

IGST Refunds Extension of date in SB005 alternate mechanism cases and Clarification in other cases (SB003)

|

|

|

Dear Members,

As informed earlier, CBIC had issued Circular No’s 05/2018-Customs dated 23.02.2018 and 08/2018-Customs dated 23.03.2018 wherein an alternative mechanism with officer interface to resolve invoice mismatches was provided for the shipping bills filed till 28.02.2018.

CBIC has now issued Circular No.15/2018-Customs dated 06/06/2018 whereby it is informed that although the cases having SB005 error have now reduced, however, some exporters nevertheless, continue to make errors in filing invoice details in the shipping bill and the GST returns.

Therefore, keeping in view the difficulties faced by the exporters in respect of SB005 errors,CBIC has decided to extend the facility of officer interface to Shipping bills filed up to 30.04.2018. However, the exporters are advised to align their export invoices submitted to Customs and GST authorities for smooth processing of refund claims.

Apart fromSB005 errors, IGST refunds are also stuck on account of SB003 error on the customs side. This error occurs when there is a mismatch between GSTIN entity mentioned in the Shipping bill and the one filing GSTR-1/GSTR-3B.

Further, CBIC has examined the issue and it has been decided to provide a correction facility in cases where although GSTIN of both the entities are different but PAN is same. This happens mostly in cases where an entity filing Shipping bill is a registered office and the entity which has paid the IGST is manufacturing unit/other office or vice versa. However, in all such cases, entity claiming refund (one which has filed the Shipping bill) will give an undertaking to the effect that its other office (one which has paid IGST) shall not claim any refund or any benefit of the amount of IGST so paid.

The undertaking shall be signed by authorized persons of both the entities. This undertaking has to be submitted to the Customs officer at the port of export. CBIC had some time back requested Directorate of Systems to develop a correction tool, on lines of one developed for SB005, for sanction of refund in cases where PAN provided in Shipping Bill is same as PAN of GSTR 1. DG Systems have developed this utility now which would facilitate processing of IGST refund claims stuck due to SB003 error in the manner similar to SB005 error.

Members are requested to take note of this new relaxation/ utility and do the needful accordingly. The Circular No.15/2018-Customs dated 06/06/2018 is available for download using below link-

http://cbic.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2018/circ15-2018cs.pdf

Thanking you,

Yours faithfully,

S.G BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

DGFT - Doing away with the requirement of DSC for online/digital payment through e-MPS

| EPC/LIC/DGFT/e-MPS |

06/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

DGFT - Doing away with the requirement of DSC for online/digital payment through e-MPS

|

|

|

Dear Members,

This is in continuation of our recent circulars informing you that the O/o Directorate General of Foreign Trade has launched e-MPS facility to make online payment for miscellaneous applications (amendment of license, payment of composition fee etc). The digital payment was made mandatory after one month from the date of issuance of the trade notice No. 25/2018. Subsequently, an extension in implementation date was also provided till 01/06/2018.

However, we understand that the difficulties were being faced by the exporters/importers in obtaining digital signatures for making miscellaneous payment digitally/online.

Taking cognizance of the issues faced by the trade, the requirement of DSC for exporters/importers to make digital/online payment through e-MPS has been done away with vide DGFT Trade Notice No.15/2018-19 dated 04/06/2018.

Now, a person desiring to make online/digital payment can login in e-MPS using his/her PAN details. There is no need for having digital signatures for making digital/online payment.

Members are requested to take note of this relaxation and do the needful accordingly. The trade notice no Trade Notice No.15/2018-19 dated 04/06/2018 is available for download/ reference using below link

| TRADE NOTICES NO. |

DATE |

SUBJECT |

| Trade Notice No.15/2018-19 |

04.06.2018 |

Doing away with the requirement of DSC for online/digital payment through e-MPS. |

http://dgft.gov.in/Exim/2000/TN/TN18/Trade%20Notice%2015.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

Non-Tariff Measures (SPS and TBT) issues being faced by our exporters to be raised in the forthcoming WTO SPS/TBT

| EPC/LIC/SPS_TBTs |

04/06/2018

|

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Non-Tariff Measures (SPS and TBT) issues being faced by our exporters to be raised in the forthcoming WTO SPS/TBT

|

|

|

Dear Members,

We have received communication from Ms. Tanu Singh, Deputy DGFT, Trade Policy Division, Department of Commerce informing us about the forthcoming WTO TBT/SPS committee meetings to be held in June/July 2018.

You will appreciate that these meetings provide an opportunity to the member-countries to raise their concerns relating to SPS/TBT measures being undertaken by other member countries.

In this regard, we request you to kindly let us know any such issues being faced in overseas markets which can be raised as Specific Trade Concerns(STCs) during the meetings of WTO TBT/SPS committee. A small background note relevant to the issue so identified which is impacting exports may also be provided.

Members are therefore requested to send us their inputs latest by 05/06/2018 on e-mail id’s – deepak.gupta@chemexcil.gov.in, balani.lic@chemexcil.gov.in & rodelhi@chemexcil.gov.in

Your replies will be appreciated and shall enable us submit to TPD, DoC for deliberations during the WTO meetings.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

|

Marine Pollutants – Compliance and Exemptions – IMDG CODE 38-16

Harmful substances when transported in packaged form needs to follow provisions of annex III of MARPOL and may have certain exemptions from said annex. Annex III of the International Convention for the Prevention of Pollution from Ships, 1973, as modified by theProtocol of 1978 (MARPOL), deals with the prevention of pollution by harmful substancescarried by sea in packaged form.

What are harmful substances?

“Harmful substances” are those substances which are identified asmarine pollutants in the International Maritime Dangerous Goods Code (IMDG Code) or which meetthe criteria in the Appendix of to annex III of MARPOL.

How does IMDG Code identify a substance as marine pollutant?

IMDG Code identifies marine pollutants with a symbol “P” in column 4 of dangerous goods list in chapter 3.2. Additionally,certain marine pollutants are identified only in the alphabetical index of IMDG Code. These are those marine pollutants which has not been assigned to an N.O.S. orgeneric entry.

If an entry is not identified as marine pollutant in column 4 of dangerous goods list in IMDG Code and the substance is not identified as marine pollutant in the alphabetical index however the properties of the substance meet the criteria of appendix of Annex III of MARPOL then it has to be transported as marine pollutant.

Appendix of annex III of MARPOL is in accordance with classification of environmentally hazardous substance in Globally Harmonized System of Classification and Labelling of Chemicals (GHS).

What are the compliance requirements for Marine Pollutants?

All dangerous goods and marine pollutants must only be transported in authorized Packagings, Intermediate Bulk Containers (IBCS) and Tanks with quantity limitations as stipulated by IMDG Code through Packing, IBC and Tank Instructions and must be marked, labelled placarded and documented as per the relevant provisions of IMDG Code.

Marks:

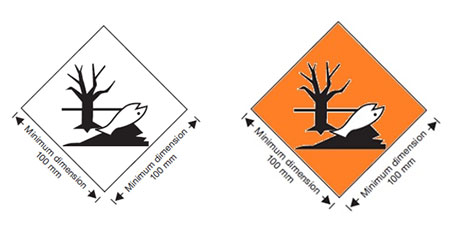

Every package, IBC and container and tank carrying marine pollutant must be marked with the environmentally hazardous substance mark as shown below.

| |

|

This mark must be a square set at 45 Deg angle, that is diamond shape. The symbol fish and tree must always be black in a background of white or any suitable contrasting color. The line forming this diamond shape must be 2 mm and the size must be 100 x 100 mm.

Size of Marine Pollutant mark:

On packages and IBCs size must be 100 x 100 mm when these packages and IBCs are loaded into a container all four sides of the container must be marked with 250 x 250 mm marine pollutant marks. When solid or liquid marine pollutants are loaded in a tank container the mark must be 250 x 250 mm size.

Durability of Marine Pollutant Mark:

Durability of marine pollutant mark must be such that it is still identifiable on packages and containers/tanks surviving at least three months’immersion in the sea.

Max quantity per package for marine pollutants:

Packing and IBC instructions in column 8 and 10 of IMDG Code restricts type of packages/IBCs and quantity thereof. When we transport a marine pollutant in tank containers it is little tricky to decide what is the maximum degree of filling. Degree of filling in a tank container is determined according to the hazard involved during transport which takes into consideration of the coefficient of expansion of liquid.

If an entry in dangerous goods list of chapter 3.2 which is not identified as a marine pollutant in column 4 and is assigned with degree of filling as TP1 and the actual cargo is a marine pollutant then shipper must use the formula as per TP2 for calculating degree of filling. Refer section 4.2.1.9.3 of IMDG Code.

Stowage on board ships:

On cargo ships stowage categories, A, B & E is on or under deck and categories C & d is on deck only. However, if a marine pollutant having stowage category A, B or E is being loaded, even though allowed on or under deck, preferably the container must be loaded under deck and for categories C & D which permits only on deck stowage preference shall be given to stowage on well-protected decks or to stowage inboard insheltered areas of exposed decks.

Documentation:

For any substance which is a marine pollutant the dangerous goods declaration must indicate same by words “MARINE POLLUTANT” which may be supplemented with term ENVIRONMENTALLY HAZARDOUS.

Exemptions:

As per section 2.10.2.7 of IMDG Code Marine pollutants packaged in single or combination packagings containing a net quantity per single or innerpackaging of 5 L or less for liquids or having a net mass per single or inner packaging of 5 kg or less for solidsare not subject to any other provisions of IMDG Code relevant to marine pollutants provided the packagingsmeet the general provisions as mentioned in sections 4.1.1.1, 4.1.1.2 and 4.1.1.4 to 4.1.1.8 of IMDG Code.

According to this exemption a cargo which has no other properties of another hazard class but only a marine pollutant which as solid is transported under UN No. 3077 ENVIRONMENTALLYHAZARDOUS SUBSTANCE, SOLID, N.O.S. or as liquid is transported under UN 3082 HAZARDOUS SUBSTANCE, LIQUID,N.O.S., when packed 5 kg or 5 liters less than per pack need not be marked, labelled placarded or documented or stowed as MARINE POLLUTANT.

BACK |

|

Can India-China’s trade gap be trimmed? Boosting exports in these areas may help, says report

While widening trade deficit between India and China is continuing to raise concerns, a recent report suggests that rice exports could actually help India to reduce the trade gap which it currently runs with China.

While widening trade deficit between India and China is continuing to raise concerns, a recent report suggests that rice exports could actually help India to reduce the trade gap which it currently runs with China. An SBI ‘Country Wrap’ report released earlier this week said that India should try to tap sectors such as pharmaceuticals and agriculture — particularly in commodities like rice — in the Chinese market with an aim to bridge the widening trade gap.

According to the Economic Research Department of the SBI, China is a top importer of rice globally. However, for some reason, India has not been able to export enough rice to China. Once India is able to tap those (agriculture and pharma) markets and increase its exports, the trade deficit will be quite balanced.

Demand for Indian goods has been on a decline in the Chinese market, while India’s dependence on China for items such as electric equipment, machines, medical and surgical instruments and fertilizers, among others, is on a rise. Other top imports from China include organic chemicals, plastic, ships and boats, iron and steel, and optical photographic. The report pointed out that this has led to a widening trade deficit between India and China. Huge imports of Chinese goods by India has made China the country’s largest trade partner, it added.

In FY17, India’s trade deficit with China expanded to $51.11 billion from $38.72 billion in FY13. Structural reforms in China has reduced its imports from India, the report said. Commerce ministry data showed on Tuesday that the US emerged as the top export destination for India with $47.9 billion worth of shipments in FY18, PTI reported. However, China was India’s largest source country for imports during 2017-18 with $76.3 billion worth of imports.

Items like ores, cotton, organic chemicals mineral fuels copper, iron and steel, nuclear reactor and mechanical appliances, electrical machinery and plastic make it to the list of top export items from India to China, the report said.

(Source:https://www.financialexpress.com/economy/can-india-chinas-trade-gap-be-trimmed-boosting-exports-in-these-areas-may-help-says-report/1194638/ dated 5th June-2018)

BACK |

|

US remains top export destination for India with shipments worth $47.9 bn last fiscal: Commerce ministry data

New Delhi: The US has emerged as the top export destination for India, with $47.9 billion worth of shipments last fiscal, followed by UAE and Hong Kong, as per the commerce ministry data.

"USA was India's top export market during April-March 2018 with exports reaching $47.9 billion, followed by UAE ($28.1 billion) and Hong Kong ($14.7 billion)," the department of commerce said in a series of tweets.

In 2016-17, the country's shipments to America stood at $42.2 billion.

The other key destinations include China, Singapore, UK, Germany, Bangladesh, Vietnam and Nepal.

The top ten exporting products last fiscal included petroleum; pearls, precious, semiprecious stones; pharmaceuticals; engineering goods; chemicals; textiles and rice.

According to trade experts, the US would always be the main export destination for domestic exporters as it accounts for about 16 percent of India's total merchandise shipments.

"It is a very big market for us as the US is largest economy in the world. We need to give special focus on this market as it is going to be an important destination for our exports," Professor at Indian Institute of Foreign Trade (IIFT) Rakesh Mohan Joshi said.

Federation of Indian Export Organisations (FIEO) Direct General Ajay Sahai said that the US, being the biggest consumer, is extremely important for sectors such as apparels and made ups, leather footwear, pharma and engineering.

"We should push those exports which account for major imports into US so as to achieve quantum jump in exports," he said.

Further in terms of imports, China was India's largest source country for imports during 2017-18 with $76.3 billion.

This was followed by America ($26 billion) and Saudi Arabia ($22.1 billion).

Top imported products in India during April-March 2018 were petroleum crude ($87.4 billion) followed by pearls and semi precious stones ($34.2 billion) and gold ($33.7 billion).

In 2017-18, exports recorded a growth of about 10 percent to $303 billion. Imports on the other hand totalled nearly $460 billion, leaving a trade deficit of about $157 billion.

Higher growth in outbound shipments helps create employment opportunities, earn foreign exchange and boost economic activities.

(Source:https://www.firstpost.com/business/us-remains-top-export-destination-for-india-with-shipments-worth-47-9-bn-last-fiscal-commerce-ministry-data-4497355.html dated 5th June-2018)

BACK |

|

India to ask US for renewal of GSP scheme

India will ask the United States for a fast renewal of the generalised system of preferences (GSP) scheme, which allows market access at zero or low duties for about 3,500 Indian products, including textiles and chemicals. The US Trade Representative’s (USTR) office did not renew the scheme for India in April, saying it wanted to hold an eligibility review.

India’s commerce and industry minister Suresh Prabhu will visit Washington in June and is expected to point out that GSP extension should not tied up with India’s policy on pricing of medical devices or the dairy industry as the United States had been unilaterally offering the concession to help labour intensive sectors, according to a report in a top Indian business daily.

Though the US Congress had voted to extend the GSP scheme through 2020, it was not done so for India, Indonesia and Kazakhstan. Petitions were filed by the US dairy and medical device industries highlighting trade barriers in India and requesting a review of India’s GSP benefits.

The United States is reportedly unhappy with recent caps imposed by India on medical products such as stents and Prabhu may discuss that issue separately during his visit. (DS)

(Source:http://www.fibre2fashion.com/news/textile-news/india-to-ask-us-for-renewal-of-gsp-scheme-242605-newsdetails.htm dated 6th June-2018)

BACK |

|

China’s ‘green’ issues boost India’s FY18 chemical exports

China’s decision to shutter several chemical manufacturing units to rein in air pollution and protect the environment has helped Indian chemical exports grow 31.94% to $15.91 billion in 2017-18, a top industry representative has said.

“Indian [chemical] industry has been revived,” said SatishWagh, chairman, Chemexcil (Basic Chemicals, Cosmetics and Dyes Export Promotion Council). He added that the huge volume of exports had resulted in a shortage for domestic consumption.

‘Crucial period’

Stating that exports had increased both in volume and value terms, he said the trend was expected to continue for another 2-3 years.

“This period will be very crucial for us to encash and see that we reach all over the world to each and every buyer.

“It is a good opportunity... [we need to build] confidence in buyers,” he said, expecting the Chinese manufacturers to bounce back in three years,” he said.

Chemexcil executive director S. G. Bharadi said growth last fiscal was significant as in 2016-17 exports rose at a modest 3.22% to $12.06 billion.

Chemexcil members export dyes and dye intermediates; inorganic, organic and agro chemicals among other things.

Inorganic, organic and agro chemicals account for a bulk of these exports, growing to $10.66 billion in 2017-18 ($7.71 billion in 2016-17). Their export growth was 38.29% in 2017-18 against 3.48% in the previous fiscal. Chemexcil office-bearers were in the city for a seminar on export refunds and e-waybill requirements organised at the Federation of Telangana and Andhra Pradesh Chambers of Commerce and Industry (FTAPCCI). There is a huge shortage of basic chemicals in the country, said GowraSrinivas, president, FTAPCCI. It is against this backdrop, Chemexcil wants the Centre to take a re-look at the processes relating to environmental clearances for the units to help them scale up.

(Source:http://www.thehindu.com/business/chinas-green-issues-boost-indias-fy18-chemical-exports/article24097713.ece dated

BACK |

|

India: Indirect Tax Updates: Notification Of Customs Audit Regulations, 2018, Amendments In The Foreign Trade Policy, Exemption From Payment Of A Late Fee Under Profession Tax

Important rulings by Authority for Advance Ruling (AAR)

Whether the sale of imported goods outside India, without such goods entering into India at any stage, taxable under GST?

AAR, Kerala has held that a transaction wherein a person registered under GST in India places an order for goods in China, and the Chinese supplier, on the directions of such person, ships the goods directly to a customer in the USA, GST will not be applicable in India since the goods cannot be said to have been imported in India in accordance with the provisions of the IGST Act, 2017. Furthermore, the position will not change even in a scenario wherein such goods are directly shipped by the Chinese supplier to such person's warehouse in the Netherlands, and thereafter sold to customers in and around the Netherlands.

(2018-VIL-02-AAR - Synthite Industries Ltd)

Whether reinstatement and access charges paid by businesses to a municipality towards digging and restoration of roads in the course of their business, be taxable under GST?

AAR, Maharashtra has held that recovering restoration charges by a municipality from business entities that have dug up a road cannot be equated to performing a sovereign function as envisaged under Article 243W of the Constitution. Thus, any reinstatement charges and any connected access charges paid to municipal authorities would be liable to GST under reverse charge mechanism.

(2018-VIL-22-AAR - Reliance Infrastructure Ltd)

Whether services of running a restaurant or a canteen for an entity, to provide meals to employees of such an entity, would be classifiable as 'outdoor catering' services (taxable under GST at the rate of 18%) or as 'restaurant' or 'canteen' service (taxable under GST at the rate of 5% without input tax credit)?

AAR, Gujarat, relying on the observations of the Allahabad High Court in the case of Indian Coffee Worker's Co-Op Society Ltd vs CCE & ST, Allahabad [2014 (34) S.T.R. 546 (All.)]), under the erstwhile service tax law, has ruled that services of running a canteen provided to an entity, within the premises of such entity, would not alter the nature of such services just because it is for providing meals to the employees of such entity, and would still be classified as 'outdoor catering' services and not as a restaurant or a canteen service. Consequently, such services would fall under the specific entry of 'outdoor catering services' and thereby be taxable at 18%.

(2018 (5) TMI 1181 - Rashmi Hospitality Services Pvt Ltd)

Applicability of IGST on the supply of Customs warehoused goods

The government vide circular no. 3/1/2018-IGST dated 25 May 2018 has clarified that IGST will be levied and collected on goods supplied while being deposited in Customs bonded warehouse only when such goods are cleared for home consumption from such a warehouse. The IGST would be charged either at the transaction value or the valuation done at the time of filing an into-bond bill of entry, whichever is higher.

It has been further clarified that GST should not be charged on any intermediate sale of such goods while they are deposited in the Customs bonded warehouse.

Notification of Customs Audit Regulations, 2018

Audit was introduced under the Customs law by inserting Section 99A in the Customs Act, 1962 vide the Finance Act, 2018. In furtherance of this, the government vide Notification No. 45/2018-Customs (N.T.) dated 24 May 2018 has introduced Customs Audit Regulations, 2018, guiding such audit under the Customs law.

Amendments in the Foreign Trade Policy

The Directorate General of Foreign Trade (DGFT) has made the following amendments to the Foreign Trade Policy 2015-20 vide public notices:

| Public Notice reference |

Effect of the notice |

| 7/2015-2020 dated 11 May 2018 |

The government, after the mid-term review of Foreign Trade Policy 2015-20 vide various public notices, had increased the rate of rewards for certain items under Merchandise Exports from India Scheme (MEIS) and Service Exports from India Scheme (SEIS) till 30 June 2018.

Now, vide this public notice, such enhanced benefits would be continued beyond 30 June 2018. |

| 9/2015-2020 dated 14 May 2018 |

Regional authorities can issue advance authorization for the annual requirement on the basis of self-declaration by the applicant (where the exporter intends to use additional inputs), even where ad-hoc norms already exist for the resultant product. |

| 10/2015-2020 dated 22 May 2018 |

Exporters can offset excess exports done towards the average Export Obligation (EO) fulfillment of an EPCG authorization against any shortfall in the average EO done in other years. However, it should be ensured that the average EO is maintained on an overall basis, within the block period or the EO period as applicable. |

As per para 3.08 (b) of Foreign Trade Policy 2015-2020, to qualify for SEIS, the service provider should have minimum net foreign earnings of USD 15,000 (USD 10,000 for individual service providers and sole proprietorship). Now, DGFT vide Notification No. 8/2015-2020 dated 24 May 2018 has amended the said para to clarify that such minimum threshold limit is to be considered for the year for which the duty credit scrip is being obtained and not the financial year preceding the year of providing the eligible services.

Exemption from payment of a late fee under profession tax

The Maharashtra government vide Trade Circular No. 15T of 2018 dated 21 May 2018 has exempted registered employers from payment of a late fee in respect of monthly or annual returns pertaining to the period April 2016 to June 2018 if the following conditions are fulfilled:

Any amount payable as per the return should have been paid before the due date.

The monthly/annual returns for the said period are submitted before 31 July 2018.

There will be no refund or set off against the liability for late fee already paid.

(Source:http://www.mondaq.com/india/ x/707780/sales+taxes+VAT+GST/Indirect+Tax+Updates+Notification+of+Customs+Audit+Regulations+2018+ Amendments+in+the+Foreign+Trade+Policy+

Exemption+from+payment+of+a+late+fee+under+profession+tax dated 6th June-2018)

BACK |

|

Iran, India to Begin PTA Talks

India will soon begin talks with Iran on a trade accord just as the US has turned hostile toward the Persian Gulf nation, threatening it with renewed sanctions after walking out of a nuclear accord with the country.

The first round of formal negotiations on a preferential trade agreement will be held between India and Iran by August, Indian daily The Economic Times quoted "people with knowledge of the matter" as saying.

Such an accord will see the two giving duty concessions to each other’s goods, enabling greater market access for India’s pharmaceutical, rice and auto component exports.

“We are making our wish lists,” said one of the officials. “The first round of text-based negotiations will take place in a month or two.”

Talks on a PTA began two years ago, then slowed because Iran had concerns about India’s indirect tax structure.

“Most of Iran’s exports to us are intermediates,” an unnamed official said. “Initially, they had problems with countervailing duty and its adjustment in the pre-GST (goods and services tax) regime but now it is confident of the new tax structure.”

Iran has sought details on India’s tax structure before and after the imposition of GST on around 100 products, including urea, various dry fruits and chemicals.

India implemented GST on July 1 last year.

On the issue of PTA talks gaining momentum when the US was becoming belligerent on sanctions, another commerce department official said the two were mutually exclusive.

“PTA is a permanent thing while sanctions are temporary. Moreover, there is already an existing solution—the rupee payment mechanism—which is working,” the second official said.

Banks have not objected to India going ahead with the pact despite the threat of sanctions, the official said. “In fact, with a PTA, banks will have to process less payments due to reduction of duties,” he added.

Iran’s major exports to India are oil, fertilizers and chemicals while imports include cereals, tea, coffee, spices and organic chemicals.

“India can benefit on products such as pharmaceuticals, manmade staple fiber, iron and steel, tea, coffee, spices and chemicals,” said Ajay Sahai, director general, Federation of Indian Export Organizations.