Chairman's Desk

|

| SHRI SATISH W. WAGH |

| Chairman, CHEMEXCIL |

|

| |

Dear Member-exporters,

I have pleasure to bring to you the 11th issue of the CHEMEXCIL e-Bulletin for the month of March 2017, which contains the following activities undertaken by the Council and other useful information/Notifications, etc.

- Brief Report on - 18th China International Agrochemical & Crop Protection Exhibition held at SNIEC, Shanghai, China during 1st-3rdMarch, 2017.

- CAPINDIA-2017 held on 21st-22nd March 2017 at Goregaon, Mumbai

- CHEMEXCIL 45th Export Awards

I hope that you would find the newsletter informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions so as to enable us to improve this e-bulletin further.

With regards,

SHRI SATISH W. WAGH

Chairman,

CHEMEXCIL

|

BACK |

Brief Report on - 18th China International Agrochemical & Crop Protection Exhibition held at SNIEC, Shanghai, China during 1st-3rdMarch, 2017.

|

| |

|

The 18thChina International Agrochemical & Corp Protection (CAC2016) exhibition wasa 3 day event held from 1st -3rdMarch 2017 at the Shanghai New International Expo Centre (SNIEC) in Shanghai, China. This event was held concurrently with the 18th China International Agrochemical and Crop Protection Equipment Exhibition (CAC2017) and the 8th China International Fertilizer Show (FSHOW2017).

In order to promote exports of Agro Chemicals from India and also to assist our members to explore the market potential in China, the Council has participated in the 18thChina International Agrochemical & Corp Protection (CAC2017) held from 1st-3rdMarch 2017.

As the largest Agrochemicals exhibition in China, CAC offers an international trade, communication and exchange platform involving pesticides, fertilizers, seeds, beyond-agriculture, production & packaging equipment, crop protection equipment, logistics, consultancy, laboratories and supportive services.

The three shows which were spread over 60,000 square meters, 1,100 exhibitors; more than 120 countries and regions 30,000 domestic and foreign professional buyers; more than 10 sessions over the same period of meetings and activities in five exhibition Hallsnamely- N1 to N5 in Shanghai New International Expo Centre.

CHEMEXCIL had organised an India Pavilion in CAC 2017 by booking approximately 532 sq.mt.of space in Hall N3 at SNIEC.Total 36 exhibitors from India had showcased their products under the umbrella of CHEMEXCIL.

Chemexcil’s India pavilion attracted good visitor interest from Local buyers and global business professionals/ dealers/ buyersetcfrom countries such as Argentina, Bangladesh,Brazil, Egypt, Iraq, Jordan, Korea, Mexico, Pakistan,Turkey, Yemen,Vietnam etc. Indian exhibitors were happy to interact and network with them.

BACK |

CAPINDIA-2017 held on 21st and 22 March 2017 at Mumbai

|

| From left Mr. Ramesh Mittal, Chairman Capexil, Dr. Sonia Sethi, IAS, Additional Director General of Foreign Trade, Mumbai, Mr. Pradip Thakkar-Chairman-PLEXCONCIL, Shri. Subhash Desai, Hon’ble Cabinet Minister of Industries & Mining, Government of Maharashtra, Smt. Rita Teaotia, IAS-Commerce Secretary, Department of Commerce, and Ministry of Commerce & Industry, Mr. Satish Wagh-Chairman-CHEMEXCIL, Shri. Sunil Kumar, IAS Joint Secretary, EP (CAP and Sumit Kumar Ghosh-Chairman -SHEFEXCIL. |

The second edition of CAPINDIAwasorganised jointly by CHEMEXCIL, PLEXCONCIL, CAPEXIL and SHEFEXILunder the aegis of the Department of Commerce, Government of India,supported by Department of Chemicals and Petrochemicals, Government of India . It was one of the largestsourcing and networking events for the Chemicals, Plastics, Construction Industry & Allied Products sector at Hall 6, Bombay Exhibition Center, Goregaon, Mumbai during 21st -22nd March-2017.

The Event attracted Retailers and wholesalers from the Industry.

CAPINDIA 2017 was an opportunity to:

- Display products, technologies, innovations, and the best practices of Indian companies

- A platform to network and share knowledge with foreign and Indian delegates.

- Cultivate business relations at a Global level

- An opportunity to explore investment opportunities

- Give access to innovative technologies and global best practices.

Altogether 383 exhibitors exhibited in this event, 189foreign delegates invited from 36 countries.

An inauguration was carried on 20th March-2017 at Hotel Taj Santacruz at 8.00pm

The event was inaugurated by chief guest Smt. Rita Teaotia, IAS-Commerce Secretary, Department of Commerce, and Ministry of Commerce & Industry, Guest of Honour Shri. Subhash Desai, Hon’ble Cabinet Minister of Industries & Mining, Government of Maharashtra in the presence of Dr. Sonia Sethi, IAS, Additional Director General of Foreign Trade, Mumbai, Shri. Sunil Kumar, IAS Joint Secretary, EP (CAP), Mr. Satish Wagh-Chairman-CHEMEXCIL, Mr. Pradip Thakkar-Chairman-PLEXCONCIL, Mr. Ramesh K. Mittal-Chairman-CAPEXCIL and Sumit Kumar Ghosh-Chairman -SHEFEXCIL.

BACK |

CHEMEXCIL 45th Export Awards

CHEMEXCIL Export Awards is an annual program which aims to recognize excellence in the export of Chemicals by Indian Chemical Exporters. The Awards acknowledge the important contribution of businesses to the economy through job creation and increased prosperity for the community and for the country.

CHEMEXCIL hosted its 45th Export Awards function on 24th March 2017 at 2.30pm at Jade Ballroom, Hotel Sahara Star, Opp. Domestic Airport, Vile Parle, and Mumbai400099.

The Chief Guest of the function was Smt. Nirmala Sitharaman, Hon’ble Minister of State (Independent Charge), Ministry of Commerce & industry, Government of India who conferred Export Awards to the outstanding exporters who have excelled in their export performance during theyear 2015-16.

CHEMEXCIL felicitated two Life Time Achievement Award Winners viz. Mr. Shankar Bhai Patel from “AMI PHTHALO PIGMENTS and Mr. Ashok M. Kadakiafrom “Emmessar Biotech & Nutrition Ltd.

The next highest awards was Trishul, Gold, followed by First and Second Awards and Certificate of Excellency and Certificate of Merit, of which Gold, First and Second Awards and the Certificate of Excellency and Certificates of Merit are given panel-wise.

|

BACK |

Inquiry from Embassy of India, Budapest for Herbal Extract Immortelle

| EPC/LIC/COSMETICS |

2nd March 2017 |

| |

| TO ALL THE MEMBERS OF COSMETICS, TOILETRIES AND ESSENTIAL OIL PANEL |

| |

|

Inquiry from Embassy of India, Budapest for Herbal Extract Immortelle |

|

Dear Members,

We have received below inquiry from the First Secretary, Embassy of India, Budapest regarding Herbal Extract Immortelle available in Bosna Hercegovina.

The specs, features etc are provided in the trailing mail and also the leaflet attached for your information.

Interested members can contact the supplier directly as per following details:

Mr. Anton Lovric

Sales Manager

Helichrysum-Hercegovina d.o.o.

Gospodarska zona, Tromeđa II

88 260 Citluk

Bosna i Hercegovina

tel: + 387 63 312 502

e-mail: anton@helichrysum-herzegovina.com

Web site: Email: http://www.helichrysum-herzegovina.com

Thanking you,

Regards,

Deepak Gupta

Deputy Director

CHEMEXCIL H.O, Mumbai, India

Tel : +91-22-2202 1288, e-mail: deepak.gupta@chemexcil.gov.in

Encl : Helichrysum Herzegovina

|

|

BACK

|

Suggestions on All Industry rates of Duty

Drawback under GST Framework

| EPC/LIC/DRAWBACK/GST |

7th March 2017 |

| |

|

TO ALL THE MEMBERS OF COUNCIL

|

| |

|

Suggestions on All Industry rates of Duty

Drawback under GST Framework |

|

Dear Members,

As you are aware, Goods and Services Tax (GST) is likely to be implemented by 1st July 2017.

Kindly note that we have received communication from Shri Nitish K Sinha, Joint Secretary (DBK Division), Ministry of Finance, GOI informing us that to ensure smooth transition to GST framework, DBK committee is going to formulate and recommend revised AIR DBK on exports and any other relevant DBK like rebate to be implemented for exports in the context of new GST regime and/or remnant tax structure.

In this regard, Council has been advised to revert with suggestions by 15th March 2017. Members are therefore requested to revert with their suggestions by 11th March 2017 which will enable us collate the responses and forward to the Ministry for examination.

Your timely replies be sent to our e-mail id- Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Operationalisation of International North-South Transport Corridor (INSTC) for CIS Trade

| EPC/LIC/INSTC |

8th March 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

Operationalisation of International North-South Transport Corridor (INSTC) for CIS Trade |

|

Dear Members,

This is in continuation of our mailer regarding International North-South Transport Corridor (INSTC) which is a multi-modal transport network that includes rail, road, and water transport from Mumbai in India via Bandar Abbas in Iran to Moscow in Russia.

Kindly note that we have received communication from Shri Sunil Kumar, IAS, Joint Secretary, EP-CAP, Department of Commerce (DoC) that the International North South Transport Corridor (INSTC) linking India to Central Asia and Russia via Iran is likely to get operationalized shortly and it would offer a shorter and cost effective trade route for India's bilateral trade with Russia and other CIS countries.

The Dry Run carried out by the Federation of Freight Forwarders Associations of India (FFFAI) in 2014 and transportation of 5 containers from Bengaluru to Moscow via INSTC route in October, 2016 has demonstrated that compared to the traditional route from Mumbai via St. Petersburg which takes about 41 days, the INSTC routes take only about 20 to 25 days. Efforts are underway to further reduce the transportation time to 19 days.

At this stage, there are two operational INSTC routes:

- Mumbai — Bandar Abbas — Astara — Samur — Moscow

- Mumbai — Bandar Abbas — Amirabad — Astrakhan — Moscow

Union Cabinet has on 6th March, 2017 approved India's accession to the Customs Convention on International Transport of Goods under cover of TIR Carnets (TIR Convention) and for completion of necessary procedures for ratification.

This will facilitate seamless movement of container cargo from India to Russia with further reduction in transit time and transportation costs. Once volume of EXIM cargo increases, there could be further reduction in transportation costs.

Further, we understand that the Hon'ble Prime Minister is likely to formally flag off the first shipment through the INSTC route on 13th April, 2017 and to ensure that sufficient number of containers get transported through this route commencing April 2017, full cooperation from your organization is needed.

Member-Exporters exporting to CIS are urged to explore this option and revert with their confirmation on e-mail ids=Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

In case of further queries in this regard, you may contact- Mr. Shankar Shinde, Vice Chairman- Federation of Freight Forwarders’ Association in India, Mobile- 9870000958, shankar.shinde@globalbm.com under copy to us for information.

Your early replies/confirmations, shall enable us forward the information to the Department of Commerce.

Thanking you,

Yours faithfully,

(S.G. BHARADI)

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

Harmonised MEIS as per ITC(HS) 2017

| EPC/LIC/MEIS/HARMONIZED |

10th March 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

Harmonised MEIS as per ITC(HS) 2017 |

|

Dear Members,

You are aware that ITC (HS) 2017 was implemented w. e. f. 01/01/2017. As a result of harmonization, HS codes of around 45 items from chemical sector where amended.

Due to change in HS codes of these items, we had received representations from some members, that their new HS codes were not covered under MEIS and whether they will be entitled to MEIS later on. The council had sent representations to the O/o DGFT New Delhi requesting suitable clarification.

We are glad to inform you, that taking cognizance of the concerns of the trade and industry, O/o DGFT New Delhi has issued Public Notice No. 61/2015-20 dated 07/03/2017 notifying the release of Harmonised and Consolidated Table 2 of Appendix 3B as per ITC (HS) 2017.

Members are requested to check their relevant HS Codes, by downloading the Harmonised and Consolidated Table 2 of Appendix 3B using below link-

http://dgft.gov.in/exim/2000/MEIS/MEIS070317.pdf

In case still there are issues related to your HS code/ description for MEIS, please let us know, we shall consolidate all the responses and take up with the DGFT office.

Thanking You,

Yours faithfully,

S.G. Bharadi

Executive Director

CHEMEXCIL

|

|

BACK

|

Export Data Processing and Monitoring System (EDPMS) – Regarding additional modules for caution listing of exporters, reporting of advance remittance for exports and migration of old XOS data

| EPC/LIC/EDPMS |

16th March, 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

Export Data Processing and Monitoring System (EDPMS) – Regarding additional modules for caution listing of exporters, reporting of advance remittance for exports and migration of old XOS data |

|

Dear Members,

As you might be aware, the Reserve Bank of India (RBI) had introduced additional modules under Export Data Processing and Monitoring System (EDPMS) vide Notification no BI/2015-16/41, D.P. (DIR Series) Circular No.74 dated May 26, 2016 for caution listing of exporters, reporting of advance remittance for exports and migration of old XOS data.

To simplify the procedure for filing returns on a single platform and for better monitoring, it was decided to integrate the returns related to

(a) handling of shipping bills for caution listed exporters;

(b) delayed utilisation of advances received for exports; and

(c) exports outstanding with Export Data Processing and Monitoring System (EDPMS) which has been in operation since March 1, 2014.

As per provisions, exporters could be “caution listed” if any shipping bill against them remains open for more than two years in EDPMS, provided no extension is granted by the bank/RBI. “The exporters can also be caution listed even before the expiry of two years period based on the recommendation of AD banks.

The Council has received representations from the member-exporters citing issues faced due to caution listing where payments where received or bank has not uploaded the details on EDPMS server of RBI. As a result, their names figure in the caution list and the shipments/ export transactions are getting impacted.

In this regard, you are kindly requested to revert with issues faced along-with scans of documents/ communication received from your bank. Your responses will enable the council examine the issue and represent to authorities, if needed. Your replies be mailed on Deepak.gupta@chemexcil.gov.in and info@chemexcil.gov.in .

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

|

|

BACK

|

India-Peru Trade Agreement:- Preparation of Indian Wish List

| EPC/LIC/PERU-PTA |

17th March 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

India-Peru Trade Agreement:- Preparation of Indian Wish List |

|

Dear Members,

We have received communication from Department of Commerce (DOC) that the process of negotiating a Trade Agreement with Peru covering trade in goods, services and investment has been initiated. The first round of negotiations are proposed to be held with Peru in June, 2017.

In this regard, we are required to submit Indian Wish List based on the 10-digit tariff lines on HS 2017 Nomenclature as Peru follows 10-digit Nomenclature. A format for this purpose has been devised and is attached.

Similarly, a copy of tariff lines as per HS 2012 Nomenclature along with trade data for the last three years received from Peru is also enclosed to work out our areas of interest in Peru. The tariff details as per HS 2017 will also be sent to all concerned after receipt of the same from Peru.

The requisite information in the enclosed format along with rationale may kindly be sent us latest by 24th March 2017 on e-mail id’s- deepak.gupta@chemexcil.gov.in& balani.lic@chemexcil.gov.in .

Your timely replies will be appreciated and will enable us submit the information to Department of Commerce by the deadline of 28th March 2017.

Thanking You,

Yours faithfully,

S G Bharadi

Executive Director

Chemexcil

Encl : http://chemexcil.in/uploads/tbts/Format17.3_.17_.docx

|

|

BACK

|

Migration to GST of existing Central Excise / Service Tax Assesses- GST MIGRATION SEVA KENDRAS

| EPC/LIC/GST |

17th March 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

Migration to GST of existing Central Excise / Service Tax Assesses- GST MIGRATION SEVA KENDRAS |

|

Dear Members,

This is in continuation of our earlier mailer regarding “Migration to GST” of existing Central Excise / Service Tax Assesses.

As you might be aware, the process of migration of taxpayers to the GST network started in November 2016, with a phased enrolment plan for each state and was supposed to have been completed by 31stJanuary 2017. Enrolment under GST means validating the data of existing taxpayers and filling up the remaining key fields. We hope you have already done the needful.

In this regard, we would like to inform you that the Central Board of Excise and Customs (CBEC) has issued communication regarding formation of GST MIGRATION SEVA KENDRAS to facilitate migration to GST of existing Central Excise / Service Tax Assesses.

For details of the updates on GST, members can access the dedicated Tab on www.cbec.gov.in website or use following link-

http://www.cbec.gov.in/htdocs-cbec/migration-to-gst/migration-to-gst

On accessing the above link, members can go through the PPT on GST Migration and various other releases issued by CBEC to facilitate the transition.

Members are requested to take note of the same and do the needful.

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

India-Mauritius Comprehensive Economic Cooperation and Partnership Agreement (CECPA) - reg.

| EPC/LIC/INDIA-MAURITIUS (CECPA) |

23RD MARCH, 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

India-Mauritius Comprehensive Economic Cooperation and Partnership Agreement (CECPA) - reg. |

|

Dear Members,

Council has received communication from Dy. Secretary to the Govt of India informing that Negotiations are presently underway on a Comprehensive Economic Cooperation and Partnership Agreement ( CECPA) between India and Mauritius.

Attached is the request list of tariff concessions received from the Mauritius (Annexure -1) coming under the purview of the Council and a list of possible request list from India for tariff concessions from Mauritius ( Annexure-II)

One of the tracks in the CEPCA would be rules of origin. These are rules conferring the origin to goods for availing of tariff ( or customs duty) preferences for exports under the proposed CECPA. These could include criteria such as wholly originating, change in tariff classification (CTC) value addition, any technical rule.

Members are requested to send the inputs at the HS 6 digit level on the possible rules of origin under the India-Mauritius CECPA as per the format given below:

6 digit |

Description |

Rule as per the actual process of production and assuming all inputs are imported |

Rule proposed and the rationale thereof (production cycle i.e inputs, raw materils, semi-finished goods, cost structure, production, capacity utilization |

|

|

|

|

Members are requested to analyse the request List and give their inputs at the earliest (by 25th March 2017) on our email id’s at Deepak.gupta@chemexcil.gov.in and balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

( S.G. BHARADI )

EXECUTIVE DIRECTOR

india-mauritius cepca |

|

BACK

|

Industry Consultations in Kolkata on 11/05/2017- Regarding Proposed FTA between India and Eurasian Economic Union (EAEU)

| EPC/LIC/FTA-EAEU |

29th March 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

Industry Consultations in Kolkata on 11/05/2017- Regarding Proposed FTA between India and Eurasian Economic Union (EAEU) |

|

Dear Members,

This is in continuation of our earlier communication dated 16th January 2017 informing you about the proposed FTA between India and Eurasian Economic Union (EAEU) comprising of Armenia, Belarus, Kazakhstan, Kyrgyzstan and the Russian Federation. We had also requested the members to provide inputs on items of Export and Import which could be deliberated for inclusion in FTA.

In this regard, we have now received communication from Department of Commerce that a meeting for consultations with exporters of goods regarding EAEU FTA and for briefing on INSTC, is scheduled in Kolkata under the Chairmanship of Shri Sunil Kumar, IAS, Joint Secretary, Department of Commerce, GOI.

The schedule of the meeting will be as under-

Ø Date: 11th May 2017

Ø Time: 11.00 to 14.00 hrs

Ø Venue: Exact venue in Kolkata shall be communicated shortly.

Ø Agenda: Stakeholder consultations with exporters of goods & Briefing on INSTC

Member-exporters are requested to avail this opportunity of interacting with Senior Officers from Department of Commerce / State Government on the subject matter and also provide inputs, if any.

In this regard, the report of Joint Feasibility Study Group (JFSG) for an FTA between India and Eurasian Economic Union (EAEU) can also be downloaded using below link.

Your early confirmation will be appreciated and be sent on e-mail id’s- rokolkata@chemexcil.gov.inunder cc to Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl : Final_JFSG_Report_27_December_2016.compressed_(1)_.pdf

|

|

BACK

|

Industry Consultations in Bengaluru on 26/04/2017 regarding Proposed FTA between India and Eurasian Economic Union (EAEU)

| EPC/LIC/FTA-EAEU |

29th March 20 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

Industry Consultations in Bengaluru on 26/04/2017 regarding Proposed FTA between India and Eurasian Economic Union (EAEU) |

|

Dear Members,

This is in continuation of our earlier communication dated 16th January 2017 informing you about the proposed FTA between India and Eurasian Economic Union (EAEU) comprising of Armenia, Belarus, Kazakhstan, Kyrgyzstan and the Russian Federation. We had also requested the members to provide inputs on items of Export and Import which could be deliberated for inclusion in FTA.

In this regard, we have now received communication from Department of Commerce that a meeting for consultations with exporters of goods regarding EAEU FTA and for briefing on INSTC, is scheduled in Bengaluruunder the Chairmanship of Shri Sunil Kumar, IAS, Joint Secretary, Department of Commerce, GOI.

The schedule of the meeting will be as under-

- Date: 26th April 2017

- Time: 15.00 to 18.00 hrs

- Venue: Exact venue in Bengaluru shall be communicated shortly.

- Agenda: Stakeholder consultations with exporters of goods & Briefing on INSTC

Member-exporters are requested to avail this opportunity of interacting with Senior Officers from Department of Commerce / State Government on the subject matter and also provide inputs, if any.

In this regard, the report ofJoint Feasibility Study Group (JFSG) for an FTA between India and Eurasian Economic Union (EAEU) can also be downloaded using below link.

Your early confirmation will be appreciated and be sent on e-mail id’s- robengaluru@chemexcil.gov.inunder cc to Deepak.gupta@chemexcil.gov.in & balani.lic@chemexcil.gov.in .

Thanking You,

Yours faithfully,

S.G. BHARADI

EXECUTIVE DIRECTOR

CHEMEXCIL

Encl : Final_JFSG_Report_27_December_2016.compressed_(1)_.pdf

|

|

BACK

|

Procedure for dealing with “shipping bill copies” consequent to doing away of “Exchange Control Copy” and “Export Promotion Copy” of shipping bill vide Board Circular No 55/ 2016-Cus, dated 23rd November, 2016

| EPC/LIC/JNCH |

30th March 2017 |

| |

| TO ALL MEMBERS OF COUNCIL |

| |

|

Procedure for dealing with “shipping bill copies” consequent to doing away of “Exchange Control Copy” and “Export Promotion Copy” of shipping bill vide Board Circular No 55/ 2016-Cus, dated 23rd November, 2016 |

|

Dear Members,

As you might be aware, that for Reducing/eliminating printouts in Customs Clearance, the Central Board of Excise Customs (CBEC) had issued Board No 55/ 2016-Cus, dated 23rd November, 2016 notifying dispensing of printing of Shipping Bill (Exchange Control copy and Export Promotion copy and other some other forms/ Challans.

However, representations were received from the industry that due to submission of “Exporter copy” of SB to shipping line, no copy of SB is available with them for their record, audit and various other business purposes specially when they are dealing with other government depts.

In this regard, JNCH has issued PN no. 36/2017 dated 17/03/2017 clarifying that following procedure should be followed for dealing with Shipping Bill (SB) consequent to doing away of “Exchange Control Copy” and “Export Promotion Copy” of shipping bill vide Board Circular No 55/ 2016-Cus, dated 23rd November, 2016:

- Customs will not retain “Customs copy” of SB at the time of issue of LEO

- “Customs copy” of SB should be submitted by exporter to shipping line as proof of “Customs clearance”. This “Customs Copy of SB” handed over to shipping line will be submitted by shipping lines to Customs as part of Export General Manifest (EGM)

- Exporter may retain “Exporter Copy” of LEO for their record / future reference / post audit etc.

For any issues, exporters may contact Deputy/ Assistant Commissioner in charge of Appraising Main (Export), JNCH through email/ phones (email address: apmainexp@jawaharcustoms.gov.in, Phone No: 022-27244959).

Members are requested to take note of the same. For further details, you may download the Public Notice using below link-

http://www.jawaharcustoms.gov.in/pdf/PN-2017/PN_NO_36.pdf

Thanking You,

Yours faithfully,

(S.G. BHARADI)

Executive Director

CHEMEXCIL

|

|

BACK

|

INDIA: LONG TERM BET FOR LATIN AMERICA'S EXPORTS

|

Mr. R. Viswanathan, also known as Rengaraj Viswanathan, is a retired Indian diplomat, writer and speaker specializing in Latin American politics, markets, and culture. |

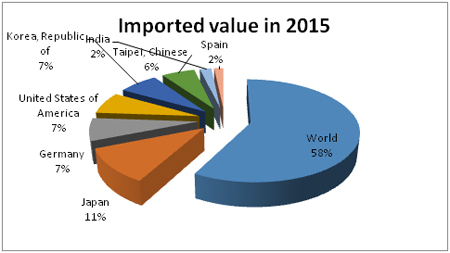

Many Latin Americans assume that India is less important for their exports than their traditional European partners such as Germany and France. Wake up..amigos. India was the third largest destination for Latin America's exports in 2014. The region exported 29 billion dollars of goods to India, while its exports to Japan and Spain were 21 billion dollars each, Germany-17 bn, Italy and UK-11 billion each and France-8 bn.

In 2015, India was Latin America's sixth important export destination with 18.8 billion dollars. This was more than the export to Japan, Germany, Italy, UK and France. The reason for the fall in exports to India in 2015 was the sharp drop in the price of crude oil.

India is the number one destination of Latin America's vegetable oil exports, with a share of 26.6% ( 2.57bn dollars) in 2015. China, the second largest importer, bought just 0.73 billion dollars from the region.

In 2014, India was the second largest importer of Latin American crude oil exports with 20.9 billion dollars, ahead of China's 17.6 bn. In 2015, India was the third largest, accounting for 9.65 billion dollars.

India ranks third for the region's exports of copper and fourth for gold.

India, as a major export market, is not a wonder of one or two years. India has emerged as a large and growing market for Latin American goods in recent years and is set to continue its ranking in the years to come. India has already overtaken China in GDP growth rate and will surpass China in population too.

Petroleum crude, copper, gold and vegetable oil are among the top global Latin American exports and coincidentally these are the major imports of India from the world. India has to increase its imports of these items in the future both globally and from Latin America in view of the of the growing gap between domestic demand and production. The increasing Indian population (15 million a year) and consumption power of the new middle class as well as the need for fuelling the high growth of the economy will continue to drive the rise in imports. This Indian need to import more is complemented by Latin America's potential to export more with its ample resources.

Crude oil

India's crude imports have doubled in the last decade from 99 million tons in 2005-6 to 202 mt in 2015-16 ( April-March, the financial year used by India). According to a 2015 report of International Energy Agency, imports are projected to reach 358 million tons by 2040. While India's crude imports are relentlessly increasing, Latin America is blessed with huge reserves, production capacity and surplus for exports. At the same time, the US which is the principal market for Latin American crude, has drastically reduced imports after the shale revolution. Although the middle eastern suppliers are nearer, India will continue its purchase of about 15 percent of its global imports from Latin America as part of its strategic energy security policy to avoid over dependence on the politically unstable gulf countries.

Agroproducts

In the case of vegetable oil, India's imports have jumped from 0.1 million tons in 1992-93 to 8.8 mt in 2009-10 reaching 14.6 million tons in 2014-15 ( November-October used as financial year by the Indian vegetable oil industry) and is estimated to touch 15.75 mt in 2015-16. Consumption has doubled from 10.1 million tons in 2001-2 to 20.08 mt in 2014-15 and is projected to reach 26.8 mt by 2025.

South America has started exporting small quantities of pulses to India which is the largest importer in the world. India's imports have reached 4.5 million tons in 2015-16 from just 0.56 mt in 1998-99 and 2.79 mt in 2007-8.

India's production of oil seeds and pulses is unable to cope with the increasing demand due to a number of issues, although the country is self-sufficient in cereals.

Chile, Peru and Argentina have started supplying fruits and vegetables to India. These are not considered as competition to domestic production but seen as complementary since they come during India's off-season from South America which is in the southern hemisphere.

Wines of Chile and Argentina as well as Tequila and Corona of Mexico are popular in India and their sales are growing.

Indian agriculture faces daunting challenges caused by the diversion of agricultural land for other purposes, shortage of water and low productivity due to inadequate investment by most farmers whose land sizes are small. On the other hand, South America has vast tracts of fertile land, abundant water, technologies and best practices with which the region has emerged as a global agricultural powerhouse.

Minerals

Gold is one of the major imports of India, which is the third largest importer after Switzerland and Hongkong/China. In 2015, India's imports were 35 billion dollars. India's imports have had a fourfold increase from 245 tons in 1997-98 to 957 tons in 2015-16.

India has been importing gold mostly from non-producing third countries such as Switzerland and UAE. It is only in the last few years that India has started direct imports from Latin American producers such as Colombia, Peru, Bolivia, Ecuador, Dominican Republic and Brazil. The imports from the region will go up in the coming years.

India's import of copper and other minerals are also set to rise, given the rapid industrialization, boosted by the 'Make in India' campaign. Imports of copper concentrates have seen an increase of twenty times from 0.08 million tons in 2000-1 to 1.8 million tons in 2015-16.

Beyond commodities..

Some critics complain that Latin America's exports to India are mostly commodities and raw materials. But they should be realistic and recognize the fact these are the main exports of the region except for the manufactured goods exported my Mexico to NAFTA partners. The number one item of exports of the region is crude oil, which stood at 115 billion dollars in 2015. This complements the number one item of India's import which is also crude oil. India's imports were 105 billion dollars in 2015-16.

Latin America has started exporting finished goods to India, although the figures are not that high. In 2015-16 the exports of electrical and electronic equipments were 401 million dollars, iron and steel items- 364 million, machinery and boilers- 196 million, organic chemicals- 195 million and even pharmaceuticals worth 58 million dollars. Embraer has sold planes to India and is set to increase its share in the fast growing aviation sector of India. Brazilian Marcopolo buses, made in joint venture with Tatas, are ubiquitous in Indian roads. 'Perto' from Brazil has supplied ATMs to Indian banks.

The 'retail revolution' of India has opened an unprecedented opportunity for Latin America to export processed foods and other consumables to fill the supermarket shelves. The new Indian middle class has developed taste for typical Latin American products such as quinoa, stevia, tequila, Corona beer, Argentine Malbec and Chilean wines. A Brazilian company 'Surya Brasil' imports henna ingredients from India and exports branded Henna products to many countries including India. A Peruvian firm 'Aje' has set up a plant in India to bottle and market its Big Cola drinks. Cinepolis from Mexico has become the fourth largest operator of multiplexes in India. A dozen other Latin American companies in sectors such as steel, auto parts and electrical motors have manufacturing units in India. There are a few Latin American software companies which provide services to Indian clients.

Uruguayan architect Carlos Ott has designed the largest office complex in India for TCS in Chennai. Another Uruguayan executive rose to the level of executive vice president of TCS for emerging markets, a reward for his success in establishing the company's operations across Latin America. Indian language institutes need more spanish teachers to cope with the growing popularity of Spanish which has replaced French as the most preferred foreign language even in schools. There is also scope for teachers of salsa dance, which has caught the fancy of the young Indians.

Latin American firms are yet to explore the opportunities offered by the huge investment India is making in infrastructure including highways, airports, ports, power and renewable energy. Some companies such as IMPSA of Argentina and Odebrecht and Andres Gutierrez of Brazil made some tentative attempts but did not sustain them seriously.

Entertainment and sports business

Mexican actress Barbara Mori and half a dozen Brazilians starlets have acted in Bollywood films. The famous Argentine music director Gustavo Santaolalla composed music for an Indian film Dhobi Ghat in 2010. There are a number of models from South America active in the Indian advertisement and fashion business. A Uruguayan model Carolina has married an Indian male model and settled in Mumbai as Carolina Grewal.

Colombian soap operas such as the Ugly Betty were shown in Indian TV, after adaptation. Mexican ' Kidzania' has set up edutainment theme parks in Mumbai and Delhi in collaboration with the famous actor Shahrukh Khan. Latino music is regular fare in Indian discos and gyms. Shakira from Colombia had successful live music shows in India 2007. Other pop stars and bands could follow. The Latin Americans can explore further opportunities in the Indian entertainment business which is seeking out the exotic.

There are over twenty Latin American football players and coaches in the clubs of India where football's popularity is soaring. Tata Motors has contracted Messi as their global brand ambassador. Cuban coaches have been training Indian athletes for olympics.

India as a base for regional and global business

The Latin American business could use India as a base for the Asian and global markets. Techint, a renowned Argentine steel firm has an outsourcing centre in Mumbai to service their engineering projects in West Asia. Three Latin American IT firms have acquired Indian software companies for their global delivery operations. The Argentine cofounder (along with Fabrice Grinda of France) of the online classified advertisement firm OLX launched the services not in Argentina or France but first in India where it remains as the largest in classified services. After its Indian success, the founders took it to other countries and now the firm has become one of the largest global players.

'Focus India' strategy

Most of the large- volume Latin American commodity deals are done either by multinational corporations operating out of US, Switzerland, Singapore and Hong Kong or Indian buying companies such as Reliance. There is therefore need for the Latin American governments to encourage their local companies, especially the small and medium ones, to explore the business opportunities in the Indian market. There should be more participation in Indian trade fairs, visits of business delegations and market studies. The Latin Americans could follow the example of the successful entry of Chilean fruits and vegetables in India after the commendable export promotion work done by the Chileans. If Latin Americans do a serious and sustained 'Focus India' strategy similar to the successful 'Focus Latin America and Caribbean' programme of India in the last two decades, there is tremendous scope to increase their share in the imports of India, which promises to be a large long term bet for Latin America.

|

|

BACK |

Trump Triggers Greater Latin American Interest in India

|

Mr. R. Viswanathan, also known as Rengaraj Viswanathan, is a retired Indian diplomat, writer and speaker specializing in Latin American politics, markets, and culture. |

| |

|

| Caught between the bullying Donald Trump, an indifferent Europe and the suspect Chinese, Latin America is looking more seriously at India, attracted by its huge and growing market, and its vibrant and diverse democracy. |

‘So far from God…but so close to Trump,’ is the cry of the Mexicans these days to their patron saint, Virgin of Guadalupe, affronted by US President Donald Trump‘s racist comments and accusation of Mexican immigrants being “criminals,” “rapists” and “drug dealers”. They also feel insulted by Trump’s demand that Mexico pay for the wall his administration plans to build on the US-Mexico border. Not since the US-Mexico war in the 19th century and the annexation of Mexican territories have the Mexicans been as outraged with the US. Trump has called NAFTA the “worst trade deal in human history” and has suggested imposing tariffs on imports from Mexico, which depends on the US for 81% of exports and close to 50% of its imports; in 2016, Mexico’s exports to the US were $294 billion and imports $231 billion. Traumatised by Trump, Mexico has started pursuing a diversification in its trade partnerships, focussing on large markets like India.

Like Mexico, Central American countries also fear increased deportations of large numbers of their citizens from the US and consequently a loss of remittances. Cuba, which saw a normalisation of ties with the US, is back to the wall again with the Trump administration’s planned reversal of some Obama era policies. Colombia, Chile, Peru, Dominican Republic and the five Central American countries that have signed free trade agreements with the US are apprehensive, expecting the worst from Trump. The Latin Americans cannot believe that the US, which preached and forced Latin American governments to open up their markets and liberalise imports under the ‘Washington Consensus,’ is doing exactly the opposite by resorting to protectionism.

During the annual CELAC (Community of Latin American and Caribbean States) summit in January this year, the region’s leaders were unanimous in their condemnation of the border wall and expressed solidarity with Mexico. Ernesto Samper, the outgoing secretary general of UNASUR (South American Community), had said, “US President Donald Trump’s migration policy and trade protectionism are threats to South America and the region must take a stand against them instead of appeasing him”. Mario Vargas Llosa, the celebrated Peruvian writer and Nobel Prize winner, has called Trump an “uncouth, populistic and nationalistic demagogue dangerous for Latin America”. The Latin Americans, who have suffered in the past under dictatorships, are shocked that the caudillo (a typical Latino authoritarian strong man) has reappeared in North America in the form of Trump, reviving their bad old memories of the ‘arrogant Yankee’.

While Trump is alienating the Latin Americans, the Chinese have steadily expanded their presence in the region. China has overtaken the US to become the largest export destination for Brazil, Chile and Peru, among others. It has replaced the EU as the second largest trade partner of the region. The Chinese target is $500 billion of trade and $250 billion investment by 2025. China has given a credit of $21 billion to Latin America in 2016 alone, with a cumulative credit at an impressive $141 billion since 2005. They have captured the imagination of Latin Americans with the announcement of mega infrastructure projects such as the Bi-Oceanic Railway between the ports of Santos in Brazil and Callao in Peru and the Nicaragua Canal project. But the Latin Americans have become conscious of the risks and perils of over-dependence on China, which has used its leverage to bully some countries in the region. In any case, the Latin Americans, given their recent history with dictatorships, are uncomfortable with the Chinese communist dictatorship and its non-transparent policies and intentions. Not surprisingly, US think tanks and NGOs are stoking the fires of distrust of China by maligning Chinese projects and exaggerating the damage to the region’s industry and environment by the flooding of cheap Chinese products and extractive ventures.

The Latin Americans are equally disillusioned with Europe, with its rising nationalism, anti-immigrant agenda and trade barriers.

Caught between the bullying Trump, an indifferent Europe and the suspect Chinese, the Latin Americans have started looking more seriously at India, attracted by its huge and growing market as well as its vibrant and diverse democracy. They have taken note that India has already overtaken China in growth rate and the Indian population is set to exceed that of the Chinese in the coming years. They do not feel threatened by Indian exports or investment. Indian IT and pharma companies are perceived as having contributed positively to the region. India has already become the second largest market (after the US) for crude oil, Latin America’s largest export. Since the US is reducing imports of crude oil (thanks to the shale discoveries), India will become an even more important a market for Latin American crude exports. In 2014, India was the third largest destination for Latin American exports. The region had exported more to India than to Germany, France, UK, Italy, Spain and Japan.

Trump’s withdrawal from Trans Pacific Partnership (TPP) is good for India. The TPP had extra protection for patents (pushed by multinational corporations), which would have caused problems for India’s pharmaceutical exports to Mexico, Colombia and Chile, the Latin American members of the TPP. If the TPP had become successful, it would have inspired more such second generation trade agreements, adversely impacting some Indian exports.

The Latin American economy has recovered from the recession of the last two years and has resumed growth in 2017. Except for Venezuela, the macroeconomic fundamentals of the region are generally stronger and growth prospects better. The region offers a large market of 614 million people with a combined GDP of $5.2 trillion and per capita income of $8500. The region’s imports are close to a trillion dollars.

Distance is no longer a deterrent. Fresh fruits from Chile, Peru and Argentina are available in Indian markets. India exports more to the distant Guatemala than to the nearby Cambodia. India’s exports to Brazil in 2014-15 were more than its exports to Japan, Korea, Malaysia, Indonesia, Thailand, France, Italy and Spain. India’s exports to Mexico exceeded its exports to Russia, Canada and Australia.

Latin America is the largest destination for India’s car and motorcycle exports. Indian pharmaceutical exports to the region are around a billion dollars. Over twenty Indian IT and BPO companies have established operations in the region, employing more than 25,000 local staff. Latin America, with a 15-20% share of India’s crude oil imports, has come to stay as an important contributor to India’s energy security, helping India’s strategic policy of diversification and reduction of over-dependence on West Asia. Besides the large reserves of oil, the region is well-endowed with minerals and agricultural potential, which are useful for ‘Make in India’ and food security. India-Latin America trade, which was $30 billion in 2015-16, has the potential to reach $100 in the near future.

This is, therefore, the right time and an unmissable opportunity for India to intensify its win-win economic partnership with Latin America. One of the immediate measures to take is to increase credit to the region to facilitate trade and investment. The cumulative Indian credit to the region is much below $100 million, while Chinese credit stands at $141 billion. Negotiations for widening and deepening the preferential trade agreement with Mercosur (which has been going on indifferently for the last ten years) needs to be concluded without further delay. Trade agreements could be signed with Mexico (the largest destination of Indian exports in the region for the last two years) as well as with Colombia and Peru, the other major markets. Prime Minister Narendra Modi should undertake annual visits to the region, like the Chinese president does. India’s commerce and external affairs ministers need to engage their Latin American counterparts with a new message of serious partnership. The annual India-Latin America and Caribbean Conclave needs to be organised at a larger scale with more funds and high-level participation. Opportunities for Indian exporters and businesses in the region need to be disseminated regularly with the latest information on the economies and markets through trade and industry bodies and export promotion councils.

|

|

BACK |

TEXTILE DYES AND PIGMENTS: E-TAILERS RESHAPING THE ALL-TIME LUCRATIVE TEXTILE MARKET

|

Introduction

Textile dyes and pigments used for coloring fabrics, yarns and fibers represent a vital chemical feedstock in textile production. Dyes and pigments, although perceived to be similar, have different applications due to key differences in their size and solubility. Dyes are soluble, whereas, pigments form a suspension. Dyes can be classified into azo dyes, disperse dyes, ingrain dyes, acid direct dyes, solvent and reactive dyes. Reactive dyes occupy the largest share in the market, followed by disperse dyes. On the other hand, pigments occur in two broad categories: organic and inorganic pigments.

Global Dyes Market: Highly Dependent on Textile and Clothing Sector

Textiles and leather processing industries consume over 80% of the total global dyes and pigments manufactured worldwide. The industry is benefitting from a large consumer market, trade competitiveness and advancements in technology; however, it is highly fragmented across the market with intense competition. Textile and clothing nominal sales ceded by 4% in 2015 and were crippled by unusually low commodity prices (cotton -15%, wool -7%, and manmade fibers 1%) and multiple currency depreciations worldwide, particularly so in emerging markets. As the latter produce about 80% of global output, poor economic prospects in Brazil and Russia, and China’s shift towards services are expected to continue to weigh down on the sector. However, the financial shape of major textile manufacturing industries has improved in the last five years.

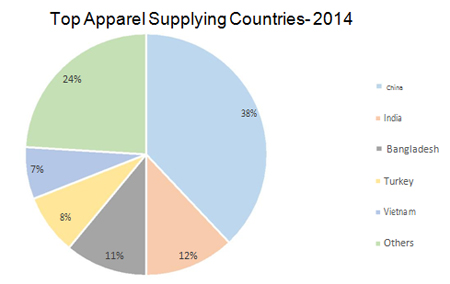

|

China has always been the largest consumer, as well as supplier, of textile dyestuffs. It is expected to remain the single-largest and fastest-growing market for the next ten years, at the least. Indian industries have witnessed significant growth thanks to government concessions to small-sized establishments and with the adoption of better technologies. In addition, trade liberalization policies have boosted export opportunities to countries in North America and Europe, where several facilities were shut down following strict pollution control regulations. At present, Europe is trailing behind Asia-Pacific in regard to this market, while the United States represents the next-largest market.

Developed economies of North America, Europe and Asia-Pacific primarily focus on the highest value stages of the textile and apparel value chain - designing, marketing and distribution. On the other hand, conventional textile activities are concentrated in China, India and other developing countries, such as Bangladesh, Vietnam, Pakistan and Indonesia, among others. The growth rate of developed countries is expected to decrease, while emerging economies, such as China, India and Vietnam, are expected to be key markets in the next five years. The connection between manufacturers and the end-users created by traders from Hong Kong, South Korea and Taiwan is a unique trait of the global textile and apparel sector. Vietnam is one of the fastest growing countries in the global textile and apparel sector.

Input-related risks for dyes market

Dyes and pigments are primarily produced from petrochemicals or their derivatives. Hence, feedstock prices are directly related to petrochemicals’ demand-supply and the price of crude oil. Raw material prices evidently plunged due to a global oversupply. This surplus supply and a limited demand lowered the bargaining power of players, thus leading to a decline in the prices of dyes and pigments. As a result, industries have faced pressure in maintaining overall profit margins.

Revolutionary trend shifts in the industry

The clothing and textile industry has always been labor-intensive and demanded skilled labor. However, with the adoption of modern technologies, production levels have multiplied manifold and have now become less labor sensitive. The face of the retail sector changed substantially in the past decade; modern retailing is now called "lean retailing". The technological building blocks of lean retailing are bar codes & uniform product codes, electronic data interchange (EDI) & data processing, distribution centers and common standards across firms.

This shift was gradual, but can be traced back to the 1970’s, where shopping malls, such as Walmart, were established in the United States. Wal-Mart insisted that the suppliers implement information technologies for exchange of sales data and adopt standards for product labelling & advanced methods of material handling. This ensured quick replenishment of apparel, which, in turn, allowed the retailers to offer a broad variety of fashion clothes without holding a large inventory. This approach gradually spread throughout the industry in the United States, as well as countries across the globe. This trend shifted the competitive advantage of suppliers from being mainly a question of production costs to becoming a question of costs in combination with lead time and flexibility.

|

One cannot ignore the similar new trend shaping the textile and apparel industry, namely, the eCommerce boom. With advancing economies, people have lesser time at their disposal, but their incomes have risen, fruitfully promoting these online retail chains. With minimal investment costs, many apparel ‘e-tailers’ have emerged across the globe, ultimately increasing the demand for dyes and pigments. The United States, the United Kingdom and Germany are currently leading in the market for online luxury fashion sales. However, China’s unpredictable exponential growth rate is expected to surpass these countries by the year 2019.

With retailers going online, technological advancements and trade liberalization in most countries, the demand for textile dyes has been on the rise, and yet, uncertain in most developed economies. The increasing severity of water crises and strict pollution control regulations have hindered the growth of traditional dyes. This has, however, encouraged the development of water-free dyeing technologies, plasma and electrochemical dyeing processes in the textile industry. Major players, such as Archroma Management LLC, Huntsman Corporation and Yorkshire Group Ltd., have actively entered into mergers and expanded their businesses into new emerging markets. Industries have increased investments in research and development to reap the benefits of this constantly growing and lucrative market.

|

DISCLAIMER

Mordor Intelligence Reports and their contents, including all the analysis and research containing valuable market information, are provided to a select group of customers in response to orders. Our customers acknowledge when ordering that Mordor Intelligence strategic analysis services are for our customers’ internal use and not for general publication or disclosure to third parties.

Quantitative market information is based primarily on interviews and therefore, is subject to fluctuation. Mordor Intelligence takes no responsibility for any incorrect information supplied to us by manufacturers or users.

No part of this strategic analysis service may be given, lent, resold or disclosed to non-customers without written permission. Reproduction and/or transmission in any form and by any means including photocopying, mechanical, electronic, recording or otherwise, without the permission of the publisher is prohibited.

ABOUT US

Mordor Intelligence is a global market research and consulting firm. Our singular focus is to provide research insights for business success.

Our research team has expertise in diverse fields like Agriculture, Healthcare, ICT, Chemicals, Manufacturing, Logistics, Electronics and Automotive. However diverse the expertise maybe, everyone in our team shares one common trait - we love data and we love providing solutions to clients using that data even more. Seeing your business flourish based on our solutions and strategy is what we love the most.

For information regarding permissions and sales, please contact: info@mordorintelligence.com

|

|

BACK |

Growth of E-Commerce in Chinese Cosmetics Industry

|

The skin care market, the largest in the cosmetics industry, has been witnessing dazzling trends over the past year. Beauty and personal care is one of the most active sectors on internet. Every day, the internet is flooded with numerous searches for beauty products, thousands of “how-to” beauty guides on YouTube and millions of peer reviews on social media. All these influence the purchasing decision of consumers across the globe. The rise in average income and inclination towards grooming and appearance drives a large section of the society, the middle-class, toward beauty and personal care products.

What are cosmetics?

Cosmetics products are used to enhance the appearance of one’s body without affecting its structure. Lipsticks, eyeshadow, foundation, rouge, mascara, skin cleansers and skin lotions, shampoo, gel, hair spray, etc. are some of the most-used cosmetic products.

Why Cosmetics?

Varying climatic conditions and seasonal shifts demands a careful skin care regimen. Protection from UV rays, removing dirt, dark spots, acne, dead skin and curing oily skin are essential for sensitive skin types. Makeup enhances the contrast of the human face, allowing for faster recognition of gender.

How E-commerce affects cosmetics market in China?

Shopping couldn't have been more helpful than at a click of a button, with the start of e-commerce period. Customers over the globe are progressively switching to the web to purchase things they need and e-commerce has positively changed the habits of people in a big way. Generally, online stores offer lower prices than physical stores. Online stores continually fulfill the needs of customers at lower prices, and customers keep waiting for fascinating deals for purchase.

At present, North America has the biggest cosmetic ingredients market. By 2017, however, China is expected to become the world's biggest business sector for cosmetics. Development rates of this market in North America, Western Europe and Japan are expected to grow from 0.5% to 2%, while the business sector in China is poised to develop at a normal yearly rate of 8% during 2015–20.

The Chinese cosmetics industry is going to be the most encouraging fields of business in China for the near future. Online cosmetics shopping has seen quick development and some mainland buyers are starting to purchase beauty care products and skin care items on the web. As per research, 70% of the female respondents and 66% of the male respondents purchase skincare items and beauty care products from online stores in China. Online offers of cosmetic represented 37.8% in the aggregate retail offers of cosmetics in China in 2015. It is expected that the offer will surpass 40.8% in 2018.

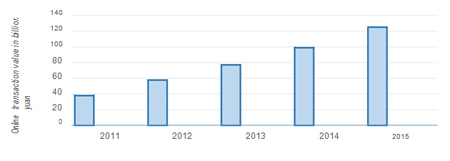

The following statistics show that online transaction value of cosmetics in China is increasing every year from 2011 to 2015 and is expected to continue the same during the period 2016-2020.

| Online transactions value of cosmetics from 2011 to 2015 |

|

Cross-border ecommerce rule in China

Recently adopted cross-border e-commerce rule in China makes it easier for Chinese consumers to buy foreign products online, whether through respective e-retail sites or through Chinese commercial centers that takes orders for outside goods. The cross-border rules provoked the huge Chinese e-commerce organizations like JD.com as well as its chief rival Alibaba Group Holding Ltd. to open segments of their internet shopping gateways, where outside brands could take requests and then fulfill by means of the facilitated trade zones or from distribution centers abroad.

Taobao was the key channel for Chinese online cosmetic shopping in 2015, followed by JD, vip. The rising foreign purchasing application energized the quick development of online cosmetic shopping Gross Merchandise Volume (GMV) in China in 2016.

DISCLAIMER

Mordor Intelligence Reports and their contents, including all the analysis and research containing valuable market information, are provided to a select group of customers in response to orders. Our customers acknowledge when ordering that Mordor Intelligence strategic analysis services are for our customers’ internal use and not for general publication or disclosure to third parties.

Quantitative market information is based primarily on interviews and therefore, is subject to fluctuation. Mordor Intelligence takes no responsibility for any incorrect information supplied to us by manufacturers or users.

No part of this strategic analysis service may be given, lent, resold or disclosed to non-customers without written permission. Reproduction and/or transmission in any form and by any means including photocopying, mechanical, electronic, recording or otherwise, without the permission of the publisher is prohibited.

ABOUT US

Mordor Intelligence is a global market research and consulting firm. Our singular focus is to provide research insights for business success.

Our research team has expertise in diverse fields like Agriculture, Healthcare, ICT, Chemicals, Manufacturing, Logistics, Electronics and Automotive. However diverse the expertise maybe, everyone in our team shares one common trait - we love data and we love providing solutions to clients using that data even more. Seeing your business flourish based on our solutions and strategy is what we love the most.

For information regarding permissions and sales, please contact: info@mordorintelligence.com

|

|

BACK |

Frost & Sullivan On Opportunity in Chemicals Trade between China and India

|

Overview of the Chemical Industry

Global production of chemicals (excluding pharmaceuticals) has seen a growth of 3.4% in 2016, which is slightly slower than in 2015 (+3.6%). The global growth rate of the chemical market is typically determined by developments in China, which accounts for more than one-third of worldwide production.

Major categories include organic chemicals and inorganic chemicals, including alkali, pesticides, dyestuffs, and specialty chemicals. Among the most diversified industrial sectors, basic chemicals cover an array of over 70,000 commercial products.

In India, base chemicals account for 74% of the chemical industry, followed by pharmaceuticals and biotechnology. India's chemical industry is the twelfth largest in the world and it has diverse advantages, such as its sizeable manufacturing base, strategic location close to key consuming Asian and Middle East markets, and a highly skilled workforce. Moreover, the country is slowly beefing up its credentials in the R&D space.

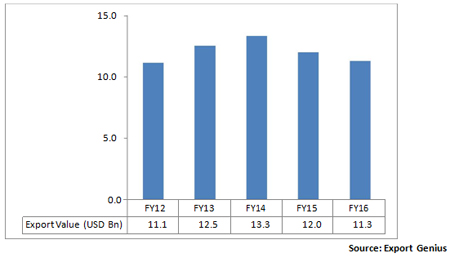

India’s global chemical exports have been rising over the years. Total exports of chemicals grew from $3.5 billion in FY03 to $19.2 billion in FY15 at a CAGR of 16.9%. Of the $19.2 billion exports in FY15, organic chemical exports were valued at $12.02 billion (approximately 62%), followed by inorganic chemicals at $1.36 billion (approximately 7%). The United States, Netherlands, and China are the leading export destinations for Indian inorganic, organic, and agro-chemicals.

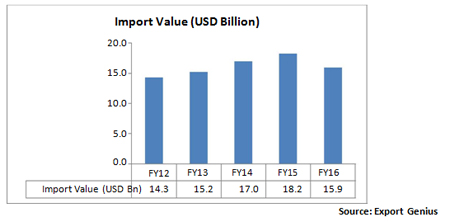

Despite this impressive growth in export, India remains a net importer of chemicals, where the total imports of chemicals was approximately $27.3 billion in FY15.

Indian Chemical Sector

The chemical sector in India primarily consists of three segments, namely Specialty Chemicals, Agro Chemicals, and Colorant Chemicals. According to the Federation of Indian Chambers of Commerce and Industry (FICCI), the Indian chemical sector was valued at $144 billion in 2015. India stands 12th worldwide in terms of volume contribution toward global chemical sector. The chemical sector accounts for about 14% in overall Index of Industrial Production (IIP).

Some of the major goods exported to China are cotton yarn, refined copper and copper alloys, construction chemicals, and vegetable oils, accounting for 30% of total global exports.

Chinese Chemical Market

The chemical industry is the third largest in China, after textiles and machinery, and accounts for 10% of the country’s GDP. The Chinese chemical industry accounts for 52.1% of the Asia-Pacific chemical manufacturing sector’s value, making China the largest consumer of basic chemical products in Asia and the second largest globally after the United States.

China's chemical industry has grown dramatically in the past 30 years, in line with the country's overall growth and the fundamentals of key customer industries. China's share of the global chemicals market is projected to rise to 29% by 2020. Strong growth in chemicals comes in large part from growth in customer industries.

The bilateral trade of chemicals between India and China has seen a fall off from $1.3 billion in FY14 to $1.07 billion in FY15 due to the devaluation of Chinese yuan and fluctuations in rupee value.

A R T I C L E

A G l o b a l G r o w t h P a r t n e r s h i p C o m p a n y

Exports from India to China

Chemical exports of India comprise several product groups such as inorganic and organic chemicals, plastics and petrochemicals, drugs and pharmaceuticals, dyes and pigments, pesticides and agrochemicals, fine and specialty chemicals, and fertilizers.

Globally, organic chemicals and pharmaceuticals are the major exports of India in the chemicals category earning India $12.1 billion and $11.7 billion, respectively, in 2015 however, exports of organic chemicals to China were only about $600 million, accounting for about 5% of India’s global exports.

India maintained a good rate of export growth to China between 2004 and 2007, but the global recession adversely affected India’s exports to China, making India’s export growth almost negligible since 2008. A majority of the fluctuation in export value since 2008 has typically been linked to exchange rate fluctuations rather than overall growth in export volumes. However, this trend is slowly changing since FY13, where export volumes are gradually beginning to increase for India as a whole.

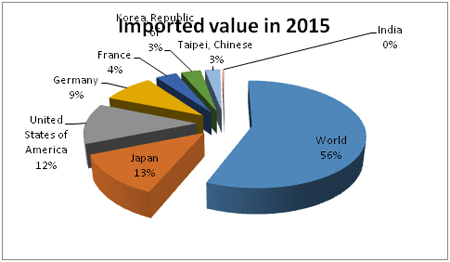

| Exhibit 1: Year-wise India Export Performance of Organic Chemicals |

|

Major exporters to China include Petrochem Middle East (India) Pvt. Ltd., Thermo Fisher Scientific India Pvt. Ltd., Aurigene Discovery Technologies Ltd., Finar Limited, Sharon Bio Medicine Ltd., Sigma Aldrich Chemicals Pvt. Ltd., Anantco Enterprises Pvt. Ltd. Top chemicals exported are linear low density polyethylene, natural resins, polypropylene, PVC suspension resin, and so on.

India exports many essential oils and aroma chemicals to China, materials that are mostly based on natural resources. India is the leading manufacturer of menthol and castor oil. Sulphuric acid, phosphoric acid, titanium dioxide, carbon black, and chlor alkali industry form a major part of inorganic sector.

Imports to India from China

Despite growth within its industry, India remains a net importer of chemicals. Leading importer countries of organic chemicals to India in 2015 were China (38.7%), Singapore (7.9%), Saudi Arabia (7.5%), the United States (5%), and Kuwait (4.3%).

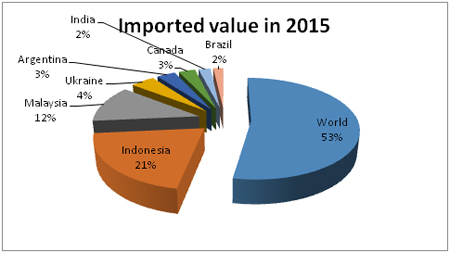

| Exhibit 2: Year-wise India Import Performance of Organic Chemicals |

|

Chinese exports play a substantial role in several Indian chemical segments. Some examples:

• India is consistently among the top 10 export destinations for pesticides from China

• India also receives inorganic pigments such as titanium dioxide from China

• For organic colour pigments, China is also by far the most important exporter to India, accounting for more than 40% of India’s total imports

Major importers of chemicals from China include Amoli Organics Pvt. Ltd., Alpa Laboratories Ltd., Aurobindo Pharma Ltd., Apharm Chemicals Pvt. Ltd., Benzo Chem Industries Pvt. Ltd., Berger Paints India Ltd., Brenntag Ingredients (India) Pvt. Ltd., and Coromandel International Ltd.

Top products imported are methanol, cyclohexane, c-hexane, tetrad cane, methylene diphenyl isocyanate, cyclic hydrocarbons, caustic soda, and liquid chlorine.

China’s more developed chemical industry focuses on large-scale synthetic production of chemicals primarily defined by specification. In contrast, India has an edge in some naturally sourced chemicals as well as in some smaller and more formulation oriented segments. This second group may become larger in the future, as some of the key customer industries that use such formulations (for example, the textile industry) will probably seek to shift at least part of their production from China to India and other countries with lower labour costs.

Opportunities also arise for third parties and consultants. They can help chemical companies in both countries close the current knowledge gaps related to competitive situation, specific market opportunities and business practices– a severe problem particularly for smaller producers.

Conclusion

Since the dawn of the 21st century, the bilateral trade between India and China has witnessed rapid growth. Along with that, India's trade deficit with China has also swelled to $52.68 billion in 2015-16, from $48.48 billion in the previous fiscal. The major imports from China include telecom instruments, computer hardware and peripherals, fertiliser, electronic component, project goods, chemicals and drug intermediaries. Major Indian chemical exports to China are organic chemicals, plastics and other products including iron ores, slag and ash, iron and steel, and cotton. It is to be noted that India’s imports from China majorly revolves around manufacturing. To prevent this gap from growing to alarming proportions, it is imperative for India to develop competence in the core manufacturing sector and reduce its dependence on Chinese imports. Policies and reforms by the government to nurture growth in the industrial sector, along the lines of “Make in India”, and its implementation are expected to play a pivotal role in this growth.

|

|

BACK |

What is GSP in nutshell

|

Dear All

This has reference to the recent Public Notice No. 51 (2015-20) – New Delhi dated 30.12.2016. According to the said PN, The DGFT inserts a new sub para 9 c), under Para 2.104 (GSP) of FTP 2015-20. Effect of this PN is “Registered Exporters

System as of 01.01.2017 for the EU Generalized System of preferences (GSP) is notified.

Since this REX is notified from 01.01.2017, to understand the system, rules, regulations and the procedure mentioned in Annexure 1 to Appendix 2C, it is essential to understand the GSP scheme in brief and then it will be easy for us to understand the newly developed scheme (REX) in detail.

What is GSP in nutshell:

The Generalized System of Preferences (GSP) is a EU trade program designed to promote economic growth in the developing world by providing preferential duty-free entry for up to 4,800 products from 129 designated beneficiary countries and territories.

In short it is a scheme whereby a wide range of industrial and agricultural products originating in certain developing countries are given preferential access to the markets of the European Union.

Preferential treatment is given in the form of reduced or zero rates of customs duties.

Certain products on importation into the EU are eligible for reduced or zero rates of customs duties provided that they:

- are eligible for preference under the GSP scheme

- qualify as originating products under the rules of origin set down in the Community Customs Code Implementing Provisions

- transported directly from the GSP country to the EU (commonly referred to as the Direct Transport Rule)

- are accompanied by a valid Certificate of Origin Form A or, if the value of the consignment is less than €6,000 are accompanied by an Invoice Declaration made out by the exporter on an invoice or other commercial document

- GSP Forms A and Invoice Declarations issued in a GSP Beneficiary country have a period of validity of 10 months from their date of issue, and they must be presented in support of a claim to preference within that period.

The Eligible Countries:

The categories of countries that can benefit under the GSP scheme provided the goods are produced in accordance with the relevant rule of origin

- Developing countries/territories enjoy preferential access to EU markets

- Least developed countries (LDCs) benefit from zero duty on import into the EU for all products of Chapters 01- 97 with the exception of Chapter 93.

Details of eligible products

Can be found in the EU legislation governing the GSP scheme i.e. Commission Regulation 978/2012

The preferential rates of duty available under the GSP scheme

Rates of duty are available in the Taric database at:

http://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=en&Scr een=0&redirectionDate=20110530

You all are aware that under this GSP Scheme, the Indian exporters exporting certain products to EU are eligible for preferential or ZERo duty, provided that the consignment is accompanied by Certificate of Origin issued against “Rules of Origin” framed under GSP Scheme.

Till now the exporter used to obtain this certificate of origin issued by EICs.

To facilitate trade and reduce administrative burden and costs for exporter, the EU is continuously undertaking reforms of its GSP rules of origin. One such major reform is “Self-Certification of rules of origin criteria by exporters themselves. For this the exporter exporting their products to EU and wish to take the benefit of GSP scheme (by the importer in EU), will have to register themselves with “REX” scheme.

This new scheme of “Self Certification” is introduced from 01.01.2017

What is the REX:

It was felt by EU that as exporters are in the best position to assess the origin of their products, the European Union considers it appropriate that the exporters

directly provide their customers in the EU with „statements on origin‟ that no longer need to be endorsed by their national authorities.

For this purpose, exporters will need to be registered by the competent authorities in an electronic system, named the REX system or the „Registered Exporter System‟.

The REX is a composite system relating to both registration of exporters and all other aspects related to the self-certification of the rules of origin under the EU GSP.

The competent authorities would have access to the REX system for registration of exporters as well as access to relevant information.

The registration of exporters in the system will not require any fees. An exporter will be registered in the system only once and the REX system will be common to the GSP schemes of the European Union, Norway, Switzerland and Turkey (based on Turkey fulfilling certain conditions).

The current system of issuance of certificates of origin will be replaced with

“statements on origin” to be issued by exporters themselves.

This “statement on origin” is to be made out on, any commercial document (such as commercial invoice etc.) of the exported consignment.

However, during the transition period of twelve months from 1.1.2017 until 31.12.2017, the competent authorities would continue to issue certificates of origin (Form A) at the request of exporters who are not registered in the REX system.

At the end of this period, i.e. from 1.1.2018 onwards, the consignments above the value of € 6000 will be entitled to GSP preferential tariff treatment, only if accompanied by a statement on origin made out by a registered exporter.

Local Competent Authorities:

The Department of Commerce is the Local Administrator of India for Administrative Cooperation (ADC) under the EU GSP self-certification scheme.

Besides, the Department of Commerce, India would have sixteen Local Administrators for Registration (REG). The Local Administrators for Registration along with the name of their nodal officers, designation, email id and telephone

numbers are listed at Annexure.-"1A”. All these Local Administrators would access the REX system through their ECAS IDs.

The task and responsibilities of the Registered Exporters under REX system

They are also given in detail, in the annexure. However, few important points are given below:

These GSP schemes may differ in terms of country and product coverage. As a result, a particular registration will only be effective for exports under a GSP scheme that considers India as a beneficiary country.

Exporters, whether registered or not, (i.e. even those whose consignment values are less than €6000) must comply with the following obligations:

- they must maintain appropriate commercial accounting records for the production and supply of goods qualifying for preferential treatment;

- they must keep all evidence relating to the material used in manufacturing these goods;

- they must keep all customs documentation relating to the material used in manufacturing these goods; for at least three years from end of the calendar year in which the statement on origin was made out, or more if required by national law. They must keep records of:

- The statements on origin they made out, and

- Details of their originating and non-originating materials, its production and stock accounts.

These records and statements on origin can be kept in an electronic format but must allow the materials used in manufacturing the exported products to be traced and their originating status to be confirmed.

These obligations also apply to suppliers who provide exporters with supplier‟s declarations certifying the originating status of the goods they supply.

The Registered exporters would provide a summary of the “statement on origin” to the Local Users for Registration. This summary would contain the following details:

- HS Code

- Description

- Document No/ date on which Statement on Origin is made out

- FOB value of exports (in $)

- destination port

- Destination of export

- Origin Criteria, W/P HS four digit

The “statement on origin” is made out by the registered exporter in the country of export to the EU as soon as the exportation has taken place or is ensured, if the goods can be considered as originating in the beneficiary country concerned.