|

e-Bulletin

|

|

December 2016

|

No. 008

|

|

Chairman's Desk

|

|

DR. B.R. GAIKWAD

|

|

Chairman, CHEMEXCIL

|

|

|

|

|

Dear Member-exporters,

First of all, let me Wish you and your family A VERY HAPPY & PROSPEROUS NEW YEAR 2017 AND CONTINUOUS SUCCESS IN ALL YOUR EFFORTS AND ENDEAVORS.

I have pleasure to bring to you the 8th issue of CHEMEXCIL e-bulletin for the month of December 2016.

As you are all aware, the Government of India has taken several initiatives aimed at eradicating corruption and black money from our country. In order to give push to its dream pet project “Digital Campaign”, the Government has directed all Departments to make cashless transactions/ payment through electronic mode only. The Council has already taken necessary initiative and advised the members to make payment of Membership Subscription Fees, Stall charges of Exhibitions, Seminar Fees, etc., online through NEFT and RTGS and CHEQUE payments.

Members are also requested to adopt cashless transactions for their operations as per the guidelines issued by the Government. If all of us start transacting through online and mobile banking, it will be our great contribution towards eradicating corruption and black money from our country. If any Clarification or assistance is required by any member on cashless transaction/e-payment (digital payment), the same can be resolved by reaching to NitiAayog’s website (http://niti.gov.in/content/digital-payments ).

Further, for ease of doing business, CBEC has taken several positive steps such as Renewal of Self Sealing of containers and Self Certification Permission to the Exporters up-to 31st December2020, Dispensing off the requirement of Mate Receipt, Reducing printouts of certain forms in Customs Clearance. The DGFT has also notified Registered Exporters System (REX) as of 1 January 2017 for the EU Generalised System of Preferences (GSP) etc. These measures will reduce transaction costs of exports.

Moreover, DGFT has alsocome out with an important policy clarification by notifying the Procedure for claiming Duty Credit Scrips under Chapter 3 of FTP 2009-14 for shipments where LEO date is up-to 31.03.2015 but date of export is on or after 01.04.2015. This will provide relief to exporters who had become in-eligible after policy change under FTP 2015-20 and can now apply for Chapter 3 incentive under erstwhile FTP 2009-14.

As you may be aware, in order to benefit from the extended Registration deadline under EU REACH, a late pre-registration can be submitted to European Chemical Agency (ECHA). If you are planning to introduce new products into the European Union, please consider to late pre-register them under EU REACH before 31st May, 2017. This deadline is the last chance to benefit from the late pre-registration so as to continue exports into the EU below 100tpa. After 31st May 2017, companies are required to obtain full registration to sell their products above 1tpa into the EU. For any clarification or support, please get in touch with the Council immediately.

I am pleased to inform you that the second edition of CAPINDIA 2017 exhibition being held on 21st& 22nd March, 2017 at Bombay Exhibition Centre, Goregaon, Mumbai under the aegis of Ministry of Commerce & Industry is taking shape. This will be the largest event being organized by four Export Promotion Councils viz. CHEMEXCIL, PLEXCONCIL, CAPEXIL and SHEFEXIL and this time, Chemexcil will be the lead Council for organizing this exhibition. There will be 450 exhibitors comprising of manufacturer- exporters of chemicals, plastics and allied products and we are planning to invite more than 250 foreign buyers from different parts of the world. All the respective Councils have started correspondence with Indian Missions and in the process of inviting foreign buyers for this event. I request all members to actively participate in this event and make it a grand success.

We hope that you would find this e-Bulletin informative and useful. The Secretariat looks forward to receiving your valuable feedback and suggestions which help us to improve this bulletin.

With regards,

Dr. B.R. Gaikwad

Chairman,

CHEMEXCIL

|

BACK

|

|

DIGITAL PAYMENT ANNOUNCEMENT

EPC/ACCTS/ |

December 16, 2016

|

|

TO ALLMEMBERS OF THE COUNCIL

|

|

SUBJECT: -DIGITAL PAYMENTS / CASHLESS TRANSACTION

|

|

|

Dear Member-exporters,

As you are all aware, the Government of India , in order to give push to its dream pet project “Digital Campaign” and its fight against black money & corruption, has directed all Government Departments to make cashless transactions/ payment through electronic mode only.

As part of the exercise being undertaken on sensitization of cashless transaction/electronic payments and to educate & guide all bodies/departments dealing with Government to spread the message of e-payment & to attain the tag of cashless economy in near future, a meeting was organized by Department of Commerce, on 5th December 2016. at New Delhi. In this meeting it was decided that all Export Promotion Councils being the arms of Government of India should implement the system of cashless transaction/digital payments in their organization as well as to teach/train and encourage their members to adopt the same in their respective organizations.

It was also advised that Export Promotion Councils should communicate the same to all their members and ensure that they also adopt cashless transactions for their operation. Presently, we have given option to our members to pay Membership Subscription Fees, Stall charges of Exhibitions, Seminar Fees, etc., online through NEFT and RTGS and CHEQUE payments. CHEMEXCIL also undergo process in Payment Gateway Systems for Members-exporters.

We would therefore request all members to adopt cashless transactions as per the guidelines issued by Govt,. In the process, members can avail the service of e-wallet, UPI (Unified Payment Interface), U.S.S.D. (Unstructured Supplementary Service Data), Debit Cards, Aadhar Enabled Payment System (AEPS), etc. Detailed process is well documented on website of NitiAayog and we would also like to assist our members in doing this. If any Clarification or assistance is required by any member, the same can be resolved by reaching to NitiAayog’s website (http://niti.gov.in/content/digital-payments ).

If all of us start transacting through online and mobile banking, it will be our great contribution towards eradicating corruption and black money from our country.

Thanking you,

Yours faithfully,

(S.G. BHARADI)

EXECUTIVE DIRECTOR

|

BACK

|

|

REACH –EU Regulation for Chemicals LATE PRE-REGISTRATION WINDOW CLOSES ON 31st MAY 2017FOR 1-100 TPA EXPORTS TO EU

|

|

|

|

|

REACH that stands for Registration, Evaluation, Authorisation and Restriction of Chemicals, is a regulation of the European Union, adopted to improve the protection of human health and the environment from the risks that can be posed by chemicals. It also promotes alternative methods for the hazard assessment of substances in order to reduce the number of tests on animals. In principle, REACH applies to all chemical substances; not only those used in industrial processes but also in our day-to-day lives, for example in cleaning products, paints as well as in articles such as clothes, furniture and electrical appliances. Therefore, the regulation has an impact on most of the companies. REACH entered into force on 1 June 2007.

|

|

Companies based outside the European Economic Area (EEA) can appoint a European-based only representative (OR) to take over the tasks and responsibilities of importers for complying with REACH. This can simplify access to the EEA market for their products, secure the supply and reduce the responsibilities for importers.

|

The REACH Regulation had set the following registration deadlines:

30 November 2010

Deadline for registering substances manufactured or imported at 1000 tonnes or more a year; substances that are carcinogenic, mutagenic or toxic to reproduction above 1 tonne a year; and substances dangerous to aquatic organisms or the environment above 100 tonnes a year.

31 May 2013

Deadline for registering substances manufactured or imported at 100-1000 tonnes a year.

31 May 2018

Deadline for registering substances manufactured or imported at 1-100 tonnes a year.

In order to benefit from an extended registration deadline, a late pre-registration can be submitted to European Chemical Agency (ECHA). A late pre-registration can be submitted for a phase-in substance within six months after the manufacturing or placing on the market of the substance that exceeds the one-tonne per year threshold and no later than twelve months before the next relevant registration deadline (next deadline is 31stMay 2018). Late pre-registration does NOT apply to companies that failed to meet the pre-registration deadline for phase-in substances between 1 June 2008 and 1 December 2008.

Hence, IF YOU ARE PLANNING TO INTRODUCE NEW PRODUCTS INTO THE EUROPEAN UNION THEN, PLEASE CONSIDER TO LATE PRE-REGISTER THEM UNDER EU REACH BEFORE 31ST MAY 2017. THIS DEADLINE IS YOUR LAST CHANCE TO BENEFIT FROM THE LATE PRE-REGISTRATION SO AS TO CONTINUE EXPORTS INTO THE EU BELOW 100TPA.

After 31st May 2017, companies are required to obtain full registration in order to sell their products above 1tpa into the EU.

For any clarification or support, kindly get in touch with our regulatory department by sending email to Ms Amrita Sharma, Regulatory Officer (Email amrita.regulatory@chemexcil.gov.in) or Only Representatives (OR) appointed by the Chemexcil for compliance of EU REACH pre-registration/Registration) Mr. Gagan Kumar, REACHLaw Finland (Email: gagan.kumar@reachlaw.fi; Ph: +91 9871002075).

|

BACK

|

|

HIKE IN EU CUSTOMS DUTY TO HIT INDIAN EXPORTS

New Delhi will ask Brussels to reconsider the decision by the European Commission (EC) to end a preferential tariff system for imports from India and other developing nations. Should the current regime of low customs duties end, it would make Indian goods more expensive with exporters paying anywhere between 6% and 12%. “We have a month’s time before the new GSP (generalised system of preferences) regime to convince the EU,” an official familiar with the development told FE.

The EU has decided to “graduate” exports of several items including textiles, chemicals, minerals, leather goods and motor vehicles from India out of its GSP scheme with effect from January. Preferential or nil customs duty to exports from developing nations under GSP is an exception to the World Trade Organisation obligation of member states to give every other member equal and non-discriminatory treatment under the ‘Most Favoured Nation’ status. Other products to be excluded from the preferential import tariff include bicycles, aircraft, spacecraft, ships and boats. India’s exports to the European Union, which accounted for 17% of the country’s total exports, shrank by over 4% in 2012-13 to $50 billion.

According to official sources, India’s commerce ministry will also protest the EU’s move to simultaneously grant zero customs duty on textile imports from Pakistan from January. This, according to New Delhi, will affect the regional competitiveness of India’s textile industry, its second largest employment creator after agriculture.

“We will take it up with Brussels because for textiles, it is a double whammy. The EU has removed Indian textiles exports from GSP, which means higher duty at EU borders, and they are in the process of giving textile exports from Pakistan GSP Plus status, which means zero duty,” an official confirmed to a news agency.

The move gives clothing, apparel and accessories exports from Pakistan a 10% duty advantage over those from India. The official explained that the EU Parliamentary Committee’s vote on November 5 to give GSP Plus status to textiles from Pakistan will have to be ratified by the European Parliament, which it is expected to do in early December. The EC’s decision to graduate the Indian textile industry out of GSP from January 1 already has the approval of the European Parliament.

The EU’s move to deny India the GSP benefit for certain goods is part of its plan to redesign the scheme. The idea is to exclude advanced developing economies that have integrated into the world trade and to focus on the needs of those that are lagging. Textile exports from India are being phased out of GSP as they exceed 14.5% in value of textile imports into the EU from all beneficiary countries, going by a three-year average up to 2012. For other products the threshold for exclusion is 14.5% as per the EU regulation. The European parliamentary committee’s vote to grant for GSP Plus status to textile imports from Pakistan and nine other countries is aimed at promoting international conventions on core human and labour rights, environment and good governance. According to overseas reports, a GSP Plus tag for Pakistan would help it create a million new jobs, boost its exports to EU by $500 million and facilitate capital flow to the sector because of the competitive edge from tariff removal.

Ajay Sahai, director general and CEO, Federation of Indian Export Organisations, said the EC’s decision would affect the competitiveness of the country’s exports. “Even though the EC has suspended this preference for both India and China, we would be hit more since China is more competitive," Sahai said.

Indian officials are also worried about the prospect of a decline in forex inflows in a year in which they had to take harsh steps like curbing gold imports to contain the current account deficit to below $70 billion or 3.8% of GDP. "It is important for affected industries to prepare themselves for the change. The cost of specified Indian exports to the EU shall, as a result of the proposed changes, increase and accordingly will impact their competitiveness," said Saloni Roy, senior director, Deloitte in India.

"The US has already given many advantages to Pakistan due to various political reasons and with this suspension from the EU, we might see a shortfall of 2-5% in exports," said Vishwanath, joint managing director of Nath Brothers Exim International, a Noida-based firm exporting garments.

To get broader preferential access to the EU market, India is now negotiating a free trade pact with the EU, which already has such arrangements with about 34 other countries. Talks on the proposed India-EU pact are progressing slowly due to a lack of agreement on areas of market access and its extent.

(Ref. http://ieport.blogspot.in/2013/12/hike-in-eu-customs-duty-to-hit-indian.html 1.12.2016) |

|

BACK

|

|

FERTILISER MINISTRY SEEKS FUNDS FOR SETTING UP 11 NEW CIPET CENTRES

NEW DELHI: Fertiliser Ministry has sought funds from the Finance Ministry for setting up 11 new plastics engineering institute (CIPET) centres in states such as Karnataka and Jammu and Kashmir, Parliament was informed today.

There are 28 CIPET centres in the country at present.

The Centre has approved setting of up of 11 new centres including an Advanced Polymer Design and Development Research Laboratory of CIPET, Minister of State for FertilisersMansuk L Mandaviya said in the Rajya Sabha.

"Funds/budget for setting up of these centres have been requisitioned from the Ministry of Finance," he said in his written reply to the Upper House.

The new centres of the Central Institute of Plastics Engineering and Technology (CIPET) will be set up in Jammu and Kashmir, Uttarkhand, Uttar Pradesh, Bihar, Rajasthan, Tripura, Karnataka, Andhra Pradesh, Jharkhand, Chhattisgarh and Maharashtra, he said.

They will aim at enhancing technology support to industries, strengthen skill development initiatives, promote entrepreneurship and research and development for indigenous technologies, Mandaviya said.

That apart, he said, the government has plans to set up Central Institute of Chemical Engineering and Technology (CICET) on the lines of CIPET as well as chemical and petrochemical hubs around 22 refineries in the country.

"The government has initiated the process for preparation of the concept note and feasibility study for establishing a CICET... The government will start five CICET centres and CIPET will work as a mentor organisation," he said while replying to a separate query.

In case of chemical hubs, he said the government has set up "a committee to deliberate and examine the possibility of setting up of chemical and petrochemical hubs including availability of various products and by-products at various refineries in the country."

Mandaviya also informed that the chemical sector is de-licensed and de-controlled. The entrepreneurs are setting up units in the private sector based on techno-economic feasibility, demand and supply scenario and cost of feedstock/raw materials.

The government has taken various steps including rationalisation of customs duty on the feedstock/building blocks for having synergy in the complete value chain for boosting the chemical sector and competitiveness of the industry in the country, he said. That apart, various workshops and seminars were held for exchange of technology, ideas, innovations and buyer seller's meet in the field of chemicals for growth in the chemical sector, he added. (Ref.

"http://economictimes.indiatimes.com/industry/indl-goods/svs/chem-/-fertilisers/fertiliser-ministry-seeks-funds-for-setting-up-11-new-cipet-centres/articleshow/55749240.cms">http://economictimes.indiatimes.com/industry/indl-goods/svs/chem-/-fertilisers/fertiliser-ministry-seeks-funds-for-setting-up-11-new-cipet-centres/articleshow/55749240.cms dated 02.12.2016) |

|

BACK

|

|

THE TRUMP ADMINISTRATION’S INTERNATIONAL TRADE AND ECONOMIC POLICY: AVAILABLE OPTIONS AND POSSIBLE IMPLICATIONS FOR INDUSTRY.

During the recent campaign and the transition, President-elect Donald Trump generally has advocated a more aggressive U.S. international trade and economic policy as part of his plan to generate economic growth and retain and return U.S. manufacturing. This week he also expressed an unusual willingness to directly engage with, and potentially take adverse actions against, U.S. firms planning to move their operations offshore.

The possible measures he has outlined include, among others:

(a) the potential withdrawal from trade agreements such as the North American Free Trade Agreement (NAFTA) and the Trans-Pacific Partnership (TPP);

(b) the negotiation of fairer bilateral trade agreements with foreign countries;

(c) a possible retreat from President Obama’s lifting of economic sanctions on Cuba;

(d) the imposition of high tariffs and other trade remedies against countries that allegedly engage in unfair trade practices such as China; and

(e) potential actions against U.S. firms that seek to move manufacturing plants offshore, including the possible imposition of border taxes on their imported products; and

While not explicitly mentioned during the campaign, it also is possible that the Trump Administration could take a different approach toward foreign investment from China or other countries that restrict U.S. investment opportunities.

As discussed below, U.S. law and regulations generally afford the President broad discretion to take most of these types of robust actions, subject to required procedures and, in some cases, legal limitations. At the same time, however, President Trump also can utilize the prospect rather than the actuality of tougher actions – withdrawal from trade agreements, high tariffs, “tweets” of disapproval over corporate moves offshore, or the imposition of sanctions – as a tool to achieve negotiated solutions rather than rely on blunt legal instruments that can trigger retaliatory actions and resulting costs for American workers, businesses and consumers.

While time will tell how the new Administration will proceed, the new team is already signaling that this type of deal-making approach may be used – i.e., that the prospect of selective 35% tariffs, for example, are more likely to be used as negotiating sticks if other countries or firms considering moving offshore are unwilling to bargain.

U.S. manufacturing and services firms, therefore, should carefully consider the potential effects of a more aggressive U.S. trade policy on their business operations at home and abroad, develop contingency plans as appropriate, and identify issues they would like to see addressed in any negotiations. Some of these U.S. government actions can be taken with little prior notice and could impact global supply chains, actual and potential offshore manufacturing operations, the right to provide services abroad and bid on government contracts, as well as other aspects of a company’s business operations.

I. North American Free Trade Agreement A signature element of President-elect Trump’s campaign is his promise to renegotiate, or failing that, withdraw from NAFTA, which he called the “worst trade agreement in history.” Generally, the President has the authority to take these actions.

On the one hand, the President certainly can seek to negotiate amendments to NAFTA with Canada and Mexico if they are so willing, and submit a revised agreement to Congress for approval under so-called fast track (trade promotion) authority to facilitate an “up or down” vote on a revised agreement. Current fast track authority only pertains to agreements negotiated by June 1, 2018, but this authority can be extended by Congress at the President’s request.

On the other hand, should negotiations not succeed, NAFTA’s Article 2205 allows a party to withdraw six months after written notice to the other parties. Under applicable U.S. law, the President then would have the authority to proclaim increased duties on Mexican or Canadian imports subject to other trade agreements to which the United States and Mexico are parties. Since both countries are members of the World Trade Organization (WTO) and, therefore, are subject to its most favored nation treatment, the United States would likely be limited to imposing WTO-level duties.

But other legal interpretations may be possible, and the matter is not entirely free from doubt. While there is a legal provision calling for a public hearing before the imposition of such duties, the President also has the authority to postpone such a hearing until after duties are imposed if he or she determines it to be in the public interest.

Not only tariff levels would be affected by a NAFTA withdrawal. For example, NAFTA’s special rules of origin would no longer apply in determining which products are subject to tariffs. Rather, the normal rules of origin under the WTO, or, in their absence, under U.S. law would apply. Also, U.S. firms potentially could be denied participation in Mexico’s or Canada’s procurement system.

Accordingly, U.S. firms that have globalized supply chains or have manufacturing facilities in Mexico or Canada, which derived benefits from NAFTA, could potentially be adversely affected.

II. TPP and Bilateral Trade Agreements

Since the election, President-elect Trump has made it clear that on “day one” of his Presidency he will give notice of the U.S. withdrawal from the Trans-Pacific Partnership with 12 Asian rim countries (which has yet to be approved by Congress) and will instead “negotiate fair, bilateral trade deals that bring jobs and industry back to American shores.”

Certainly, a Trump Administration can negotiate bilateral agreements that include various types of preferential treatment between the signatories. The United States has negotiated a number of bilateral agreements in the past with key trading partners, including free trade agreements where the parties eliminate substantially all trade restrictions. Such bilateral agreements with built in preferences do, however, raise tensions with the most-favored-nation (MFN) provisions of the WTO, which generally require parties to offer the benefits of such concessions (e.g., lower tariffs) to third parties that are WTO members unless the agreement qualifies for a WTO exemption (e.g., such as a free trade agreement).

But the broad use of bilateral agreements that establish tariff and other preferences where WTO disciplines do exist, in addition to proving time-intensive, would raise serious questions about the future of the international trading system.

III. Cuba Sanctions

In recent years, the Obama Administration has partially lifted the U.S. Cuban Sanctions, issuing licenses and guidance that authorized specific types of travel, travel-related, trade and banking transactions. In numerous cases, U.S. and foreign firms have adjusted their business operations to take advantage of these liberalized rules.

With the death of Fidel Castro, however, there is a renewed focus on the new Administration’s relationship with Cuba and in particular whether the Obama Administration’s partial lifting of sanctions will be reversed.

Simply put, under the International Economic Emergency Powers Act, President Trump will have the authority to issue a new Executive Order that would re-impose such sanctions without prior notice; under the law, such an action generally would not be judicially reviewable. The re-imposition of sanctions also could be accomplished immediately, without an opportunity for notice and comment. While one assumes that a company’s actions prior to a new Executive Order would be grandfathered and, therefore, not subject to penalty, how this is handled and what transition rules would be implemented remain to be seen.

The President-elect threatened to re-impose full Cuba sanctions late in the campaign after taking a more flexible position earlier. Since Castro’s death, President-elect Trump has posted on Twitter earlier this week his view that “[i]f Cuba is unwilling to make a better deal for the Cuban people, the Cuban-American people and the U.S. as a whole, I will terminate [the] deal.” Earlier, he had suggested during the campaign that he would reverse the lifting of sanctions unless Cuba agreed to “religious and political freedom for the Cuban people, and the freeing of political prisoners.”

Whether Cuba and the United States would be able to reach an understanding that would enhance democratization in Cuba is an open question. Some members of Congress and supporters of the President undoubtedly will press for internal Cuban reforms that are unlikely to be forthcoming, while the business community is likely to advocate a continuation of the current approach.

In all events, at least some period of bilateral discussions are expected prior to any U.S. action on the existing sanctions. Nevertheless, U.S. firms in the travel, tourism and banking sectors, which may have changed their business operations in light of the recent partial lifting of sanctions, should develop appropriate contingency plans in case stronger sanctions are re-imposed.

IV. Self-Initiated Trade Remedy Proceedings for Steel and Other Industries

To more aggressively pursue unfair trade practices, President Trump could, as he promised in the campaign, self-initiate antidumping, countervailing duty and section 201 escape clause proceedings against imports of select products from China and elsewhere, and upon finding of unfair trade practices, impose high duties, or in the case of section 201, various other types of remedies. Also, President Trump can invoke section 301 of the trade laws to commence proceedings against China (whether under the WTO or otherwise) for various unfair subsidies.

In a globalized environment where domestic firms with foreign operations may be reluctant to bring antidumping and countervailing duty petitions (or may have difficulty meeting standing requirements), the Administration itself can bring these proceedings in order to impose duties in selective sectors – or to use these proceedings as a mechanism for seeking favorable settlement agreements.

This robust approach to trade enforcement has been tried in the past, typically with mixed success. The Reagan Administration robustly used sections 201 and 301 against a range of industries, and the Obama Administration has sought WTO relief against China with respect to various subsidies. In numerous cases, foreign governments have retaliated as well.

It is entirely possible that such proceedings could be brought in steel and other domestic manufacturing industries that have allegedly been injured by foreign competition.

V. Punitive Actions Against Firms That Move Facilities Offshore: Policy by Tweet?

A more controversial area would be potential punitive actions, including the imposition of border taxes, on products from U.S. firms that move their facilities offshore.

A core area of the President-elect’s campaign was his advocacy against U.S. firms moving manufacturing operations overseas and the need to change U.S. tax and other laws to create a more favorable environment to retain these facilities and jobs at home.

The President-elect’s actions and statements during the transition signal that he may take a more direct and engaged approach than past Presidents with respect to U.S. firms planning such offshore moves in the future.

For one thing, his recent negotiation with Carrier’s parent Company, United Technologies, and its decision to keep one of Carrier’s Indiana facilities open (after receiving Indiana tax incentives and possibly other benefits) suggests a willingness to use the power of the Presidency to directly influence corporate decision making on offshoring. The combination of direct outreach to United Technologies, a major federal contractor, and the state tax incentives apparently caused Carrier to reverse direction (although the plant will have a lower level of employment than in the past and another domestic facility will still close).

In a statement made yesterday while at the Carrier facility, the President-elect explicitly warned that businesses that decide to go abroad will pay a price through stiff tariffs on imports back to the United States. “This is the way it’s going to be,” Mr. Trump said in an interview with The New York Times. “Corporate America is going to have to understand that we have to take care of our workers also.” He added that “I don’t want them moving out of the country without consequences.”

The President-elect’s willingness to directly engage with, and threaten punitive actions against, U.S. firms that plan to move offshore – possibly by “tweet” – is largely uncharted territory. While other Presidents have engaged with private industry, it has rarely been done on this type of company-specific basis. Rather, it is usually accomplished through the setting of broad policies that incentivize private business conduct.

In any event, certainly, the President has the authority to engage directly with individual companies and to threaten punitive actions. Whether the President has specific authority to actually put punitive tariffs in place remains to be seen, however, and would depend on the particular type of action taken.

It may be possible to do this, as discussed above, on a broader basis, in the context of self-initiated unfair trade proceedings, or the use of authorities under the International Economic Emergency Powers Act, which is the legal basis for most sanction regimes. But the President’s authority to impose duties on a particular company’s imports that has moved a facility offshore is uncertain at best. And, depending on the country involved, there may be limitations on Presidential authority to impose tariffs of this nature under the WTO or other agreements, such as NAFTA, to which the United States is a party.

Nevertheless, firms considering whether to move manufacturing facilities abroad now need to carefully evaluate the implications of this option for their overall business. Will they be putting federal business at risk? What are the costs of adverse publicity - possibly by “tweet”?

VI. Foreign Investment: Possible Reciprocity and a Policy Tilt on China

While not directly addressed during the Presidential campaign, it is possible that the U.S. review of foreign acquisitions on national security grounds under the Exon-Florio law may become more restrictive, especially with respect to China, during a Trump Presidency.

The U.S. Committee on Foreign Investment in the United States (CFIUS), which administers the law, already has taken a more robust view in recent cases involving China. As Chinese investments have substantially increased, CFIUS has stopped an increasing number of acquisitions of U.S. firms in sensitive sectors or located proximate to sensitive U.S. facilities.

In this context, there is a real prospect that U.S.-China relations will become more contentious in the early years of the Trump Administration; the President-elect campaigned on a platform of eliminating unfair Chinese trade practices (including currency manipulation), and it is reasonable to believe that these types of disputes will likely spill over into CFIUS and affect its deliberations.

A recent report by the U.S.-China Economic and Security Review Commission recommends that the United States block all Chinese state-owned companies from carrying out U.S. acquisitions. “There is an inherently high risk that whenever an SOE acquires or gains effective control of a U.S. company, it will use the technology, intelligence, and market power it gains in the service of the Chinese state to the detriment of U.S. national security,” the Commission Report declared.

While the Trump Administration’s approach to CFIUS remains to be seen, it is possible that the Commission’s approach may resonate with it given its apparent attitudes on globalization generally and China in particular. In particular, under President Trump, there also may be more willingness to take investment reciprocity into account (i.e., how China treats U.S. investors) in making CFIUS determinations. While Congress declined to expand the criteria for CFIUS decisions to include economic security, the law’s “national security” standard nevertheless affords it considerable discretion in its judgments.

* * * In sum, it remains to be seen whether and to what extent President Trump will follow through on the robust international trade positions he advocated during the campaign – and whether he will use the threat of agreement terminations or trade remedy actions to achieve new arrangements prior to resorting to unilateral tariffs or other sanctions.

Nevertheless, U.S. manufacturing firms with globalized supply chains or operations abroad and U.S. services firms whose interests are affected should review the potential actions and develop contingency plans as appropriate. (Ref. http://www.jdsupra.com/legalnews/the-trump-administration-s-26907/ dated 5.12.2016) |

|

BACK

|

|

INDIA-UK EASE OF DOING BUSINESS CONFERENCE

India-UK ease of doing Business Conference

The India-UK Conference on Ease of Doing Business has been jointly inaugurated by Secretary, Department of Industrial Policy and Promotion, Ministry of Commerce & Industry, India, Shri Ramesh Abhishek and British High Commissioner Sir Dominic Asquith, on 8th December, 2016 in New Delhi. It will act as a springboard to propel the strategic bilateral partnership between the two countries to the next level.

The India and UK partnership on Ease of Doing Business is important because of the role that the business environment plays in encouraging trade, investment, innovation and economic growth. This conference, following the commitments made by UK Prime Minister Ms. Theresa May and Prime Minister Shri Narendra Modi last month, will provide a forum for experts from both countries to share best practice and to make the connections that will lead to further collaboration in the future.

During the UK Prime Ministers visit to India last month, both Prime Minister Shri Narendra Modi and Prime Minister Ms. Theresa May witnessed the exchange of a Memorandum of Understanding on the Ease of Doing Business, which set out how the UK and India would work together to share expertise and best practice.

This conference is the next step in this process, bringing together officials from state and central Government in India with UK experts. The discussion will cover areas including regulatory reform, inspection reform, tax administration, trade facilitation, electricity provision, insolvency, land registry and standards.

The conference will be the most ambitious outreach yet undertaken on the Ease of Doing Business. It will showcase Indias focus on simplifying its business ecosystem and making it a preferred business destination, as well as the work that the UK government is doing to share the key features of its globally renowned business ecosystem and practices. Representatives from various Indian State Governments will also highlight their business reform action plan, implementation strategy, and lessons & leanings.

(Ref. http://www.business-standard.com/article/government-press-release/india-uk-ease-of-doing-business-conference-116120800483_1.html dated 8th December-2017) |

|

BACK

|

|

CABINET APPROVES MOU BETWEEN INDIA AND UNITED KINGDOM (UK) TO SUPPORT EASE OF DOING BUSINESS IN INDIA

Press Information Bureau: December 08, 2016

New Delhi: The Union Cabinet chaired by the Prime Minister Shri Narendra Modi has given its ex-post facto approval to the MoU between India and United Kingdom (UK) to support Ease of Doing Business in India. The MoU was signed earlier this month.

The MoU shall enable exchange of officials from both the Governments to facilitate sharing of best practises, offering technical assistance and enhanced implementation of reforms. The collaboration shall also cover State Governments in its ambit. The UK government has shown interest to offer expertise in the following areas:

a) Support to small businesses and start ups

b) Starting business and registration

c) Paying taxes and tax administration

d) Insolvency

e) Construction permits

f) Getting electricity

g) Risk based framework for inspection and regulatory regimes

h) Trading across the borders

i) Competition economics

j) Getting credit

k) Drafting of laws and regulations

I) Reducing stock and flow of regulation

l) Impact assessment of regulations

Currently, India is ranked 130th out of 190 economies (as per Doing Business Report, 2017). The UK Government has achieved phenomenal improvement in Ease of Doing Business (EoDB) rankings in recent years. The beneficiaries include the officials from Central Government Ministries / Departments and State Governments through sharing of best practises, capacity building etc. Each side shall bear the cost of travel and logistics for its officials as well as for co-hosting trainings/ seminar/conferences.

The MoU shall facilitate various agencies of the UK government to offer professional courses on better regulation drafting for officials, capacity-building of frontline inspectors, sharing of best practises, etc. The collaboration is expected to expedite adoption of innovative practises by the Government of India, State Governments and their agencies leading to easing of regulatory environment in the country and fostering of conducive business climate in India.

(Ref.http://www.ibef.org/news/cabinet-approves-mou-between-india-and-united-kingdom-uk-to-support-ease-of-doing-business-in-india?utm_source=phplist578 dated 8th December-2016) |

|

BACK

|

|

SURPRISE SURGE IN FOREIGN TRADE

China's foreign trade surged in yuan terms in November, indicating stronger external and domestic demand, at least in the short term, according to data released by the General Administration of Customs yesterday.

Yuan-denominated exports rose 5.9 percent year on year in November, compared to the decline of 1 percent that the market had been expecting.

Imports continued to pick up by jumping 13 percent year on year, again exceeding expectations, this time for a 5.6 percent increase.

The nation's trading value totaled 2.35 trillion yuan ($340 billion) last month with its trade surplus narrowing to 298 billion yuan, the data showed.

In US dollar terms, exports broke a seven-month losing streak to edge up 0.1 percent while imports rose 6.7 percent, the most in over two years.

"November trade data surprised the market on the upside," said HSBC economist Li Jing.

"The improvement in exports is mainly driven by better shipments to developed markets such as the EU and the US," Li said. "November import growth rose as ordinary imports picked up significantly. Imports of commodities continued to improve in both value and volume terms, signaling accelerating industrial and construction activity."

The Customs data showed exports to the European Union, China's largest trading partner, were up 8.1 percent year on year last month.

Over the same period, shipments to the United States rose 5.6 percent and those to Japan were up 3.3 percent.

Li said the data pointed to a modest recovery in both external and domestic demand, but the outlook remains more uncertain given the potential of a more protectionist US trade policy.

The cheaper yuan in November was also considered a driver for exports, Li said.

The yuan weakened 1.66 percent against the US dollar, widening from a 1.53 percent devaluation in October.

In a note, economists with the Australia and New Zealand Banking Group said that while rising imports signaled an improved domestic economy, the narrowing trade surplus was leading to a decrease in foreign exchange inflow, adding pressure to the country's ability to balance capital flow under yuan devaluation.

The trade data added signs of economic stability in China as earlier official data showed that November's official manufacturing Purchasing Managers' Index, an indicator of manufacturing activity, reached a two-year high of 51.7 points.

The expansion in the services industry also accelerated in November, rising at its quickest pace since June 2014 with the PMI for the sector rising to 54.7 last month.

The Customs said yesterday that an index predicting future trade growth prospects began to rise again in November, climbing by 1.3 points from the previous month, indicating an improving export outlook for early next year.

Exports have dragged on economic growth this year as global demand remained sluggish, forcing policy-makers to rely on higher government spending and record bank lending to boost activity.

(Ref. http://www.ecns.cn/business/2016/12-09/237058.shtml dated 09.12.2016) |

|

BACK

|

|

NETHERLANDS AMBASSADOR ALPHONSUS STOELINGA WANTS INDIA, EU MEET FOR FTA

NEW DELHI: India and the European Union should meet at the political level at the shortest notice to resume negotiations for India-EU Free Trade Agreement that would also safeguard investments from both sides, said Netherlands Ambassador to India AlphonsusStoelinga.

Following Delhi’s decision to terminate the India-Dutch bilateral investment protection treaty on November 30, current Dutch investments in India and vice versa will be protected for a 15-year period under the old treaty, according to the Ambassador. “The Netherlands is the fourth largest investor in India, and India is the fifth largest investor in the Netherlands. The Indian government has decided unilaterally to terminate bilateral investment protection treaties with all European nations. The Indo-Dutch bilateral investment treaty ended on November 30 and Holland became the first country whose treaty was terminated,” Stoelinga told ET in an exclusive interaction, days after the expiry of the pact.

The envoy pointed out that existing Dutch as well as Indian investments currently have 15 years protection in each other’s country after November 30. However, no new investments from either side to each other’s country will now have any protection, he noted.

“We had urged the Indian government to give a window of six months after November 30, but that was not agreed to. We hope that the political leadership here and in the EU now expedite the Indo-EU FTA which will offer protection to European investments in India and vice-versa,” said Stoelinga.

Delhi’s decision is not the right signal, especially when India is pitching for the Make in India initiative and ease of doing business, senior Dutch government officials told ET.

“While some progress has been made during the past two years in the ease of doing business in India and states are offering more incentives to foreign investors, we are hoping for additional reforms now that India is the brightest spot in the economy globally,” said the senior diplomat. The total investment from Netherlands between April and September 2016 is $1,615 million, according to DIPP.

India has announced that in general it wishes to adjust some bilateral tax treaties as well. This has been done with regard to Singapore, Cyprus and Mauritius. The tax treaty with the Netherlands is different in the sense that the Netherlands does not allow double non-taxation of capital gains.

“We had urged the Indian government to give a window of six months after November 30, but that was not agreed to. We hope that the political leadership here and in the EU now expedite the Indo-EU FTA which will offer protection to European investments in India and vice-versa,” said AlphonsusStoelinga, Netherlands Ambassador to India.

(Ref. http://economictimes.indiatimes.com/news/economy/foreign-trade/netherlands-ambassador-alphonsus-stoelinga-wants-india-eu-meet-for-fta/articleshow/55944222.cms dated 12.12.2016) |

|

BACK

|

|

INDIA-INDONESIA TRADE TO REACH USD 50 BILLION: EXPERTS

NEW DELHI: The volume of annual bilateral trade between India and Indonesia is set to touch a whopping USD 50 billion in next nine years from the present USD 9 billion, as per a vision document prepared by an Eminent Persons Group tasked to identify areas for deeper two-way engagement.

Observing that the two fast growing economies were blessed with an "epic legacy of cooperation", it said it was high time for India and Indonesia to elevate their relations to a New Comprehensive Strategic Partnership.

"By 2025, India-Indonesia bilateral economic cooperation shall blossom to reach a bilateral trade volume of USD 50 billion and two-way investment of USD 50 billion," as per the Vision Document.

In the talks yesterday between Prime Minister Narendra Modi and Indonesian President Joko Widodo, the findings of the Eminent Persons Group, comprising experts from both sides, were discussed.

Referring to maritime security cooperation, the group said the partnership will contribute to strategic stability in the Indian Ocean and called for closer security and defense relations including counter-terrorism collaboration.

It said India and Indonesia will develop convergent maritime interests, and will intensify their maritime linkages by developing the necessary infrastructure and connectivity.

The document said the partnership will contribute to strategic stability in the Indian Ocean and India and Indonesia, as the largest Indian Ocean rim countries, will work closely to prevent potential conflict and rivalry.

"India and Indonesia shall have ever closer security and defense relations, marked by close military-to-military relations, counter-terrorism collaboration, naval cooperation including combined maritime patrols, regular exchanges and joint exercises, intelligencesharing, and joint production of defense equipment and systems," it said.

Calling for deeper defence and security cooperation, particularly in maritime sphere, it said Indonesia too had been affected by China's maritime incusions into its waters off Natuna Islands.

The group said the India-Indonesia partnership must be robust, forward looking and multi-sectoral and that it must carry significant impact, both bilaterally and in the context of regional order, commensurate with the strategic weight of both the nations.

"By 2025, the partnership shall contribute to a more durable Asian order, marked by peaceful relations among the major powers, win-win cooperation involving all the countries in the region, open regionalism, resolution and/or reduction of conflicts, and the prevalence of strategic trust," it said.

(Ref. http://economictimes.indiatimes.com/news/economy/foreign-trade/india-indonesia-trade-to-reach-usd-50-billion-experts/articleshow/55965387.cms dated 13.12.2016) |

|

BACK

|

|

INDIA-CHINA TRADE TO TOUCH $65 BILLION IN 2016

MUMBAI: Bilateral trade between Asian giants India and China will touch $65 bn for the year ending December 2016, a Chinese diplomat said here on Tuesday.

"The bilateral trade between the two nations stood at $52.14 bn from January-September 2016 and is expected to cross $65bn by the year-end, according to official figures," said Wang Shicai, Commercial Counsellor at the Chinese Consulate here.

Speaking at the inauguration of the three-day long 4th China Homelife Fair and China Machinex Fair 2016 twin exhibitions, organised in partnership with Confederation of Indian Industry at NSE Grounds, Goregaon, Wang said that mutual cooperation between the two countries has resulted in a win-win situation for both and would help increase profitability in the coming years.

He said the key sectors China focused in India during the year were financial, infrastructure, electronics and IT, besides many others. Co-chairman of CII Task Force on Ease of Doing Business and CMD Chemtrols Industries Ltd K. Nandakumar said India is at the same position where China was 10 years ago and hence there is a huge potential here considering its present demographics.

"Indian exports are expected to reach $30 bn in next ten years and we have welcomed Chinese companies participation across sectors. Due to urbanisation, the electronics sector could take over the oil sector in the next five years," he said. Meorient International Exhibition Co Ltd Chairman Pan Jianjun said the ongoing trade show has attracted visitors not only from India but also neighbouring Asian countries.

"The two exhibitions witnessed remarkable success in the past three editions with over 15,000 business visitors last year, this year it will cross over 20,000," he said.

Present at the inauguration was Ministry of Commerce officer Ajay Shankar, Wenzhou Commercial Bureau director Chen Xiang Dong, Mumbai Mayor SnehalAmbekar and other dignitaries.

As many as 523 companies are taking part in the China Machinex and 136 are displaying products in the China HomeLife expo ranging from appliances to furniture, textiles-garments, kitchen and bathroom, garden and leisure, lightings and gifting.

(Ref. http://economictimes.indiatimes.com/news/economy/foreign-trade/india-china-trade-to-touch-65-billion-in-2016/articleshow/55963959.cms dated 13.12.2016) |

|

BACK

|

|

DONALD TRUMP'S VOW TO END TPP AFFECTS INDIA’S TRADE TALKS

NEW DELHI: The impact of US president-elect Donald Trump’s announcement to withdraw from the Trans-Pacific Partnership (TPP) after assuming office in January is being felt in India’s trade pact talks with 15 other countries under the Regional Comprehensive Economic Partnership (RCEP).

The members common to the two agreements (TPP and RCEP), especially developed countries such as Australia, Japan and New Zealand, want talks at the RCEP trade bloc to move ahead full steam, indicating the need to stitch together more agreements before the US, under a Trump administration, pulls out of TPP.

“There were discussions on TPP and some common countries want RCEP to move forward. The developed countries say that it is an opportunity to fast track the talks,” said an official aware of the development on condition of anonymity. The point was raised in the just concluded round of RCEP talks in Indonesia, the first to take place after Trump’s vowed to pull out of TPP last month.

On November 22, Trump said: “On trade, I am going to issue a notification of intent to withdraw from TPP, a potential disaster for our country. Instead, we will negotiate fair, bilateral trade deals that bring jobs and industry back on to American shores.” The other countries, according to the official quoted above, haven’t opposed the RCEP’s pace but are waiting for Trump to make a clear statement on the fate of TPP. Trump is scheduled to take over as US president from Barack Obama on 20 January 2017 RCEP is a proposed free trade agreement between 10 Asean countries besides China, Japan, South Korea, Australia, New Zealand and India. It aims to cover goods, services, investment, competition, economic and technical cooperation, dispute settlement and intellectual property rights.

“These are external countries with heavy dependence on exports and would certainly show interest in the RCEP. They have a strong export base which helps in their GDP growth,” said TS Vishwanath, principal advisor of APJ-SLG Law Offices.

However, experts feel that with TPP unlikely to move as expected, developed countries have pinned their hopes on RCEP for some preferential treatment and trade concessions. “With Trump’s statements on trade, an anti-trade sentiment was engulfing everyone.

These countries now want to send the message that trade is still important and mega agreements are the new norm, instead of bilateral free trade pacts,” said a Delhi-based expert on trade, who did not want to be named.

The RCEP grouping comprises of over 45% of the world’s population, with a combined GDP of about $21 trillion.

(Ref. http://economictimes.indiatimes.com/news/economy/foreign-trade/donald-trumps-vow-to-end-tpp-affects-indias-trade-talks/articleshow/55969208.cms dated 13.12.2016) |

|

BACK

|

|

CEFIC SAYS EU CHEMICAL SALES DECLINED 4% IN FIRST NINE MONTHS

Cefic says that the chemical business climate in the European Union is showing no clear dynamics, with its assessment of the current situation and prospects for the coming months moving in opposite directions. Production growth is stagnant for the EU chemical sector, with strong asymmetry across segments: production of polymers “grew significantly,” and petrochemicals are “showing signs of stabilization,” according to Cefic. Overall sales decreased by 4.1% year over year (YOY) during the period January through September, with domestic sales showing a decline of 5.1% YOY. Flat output and declining prices have negatively impacted sales for at least three years, Cefic says.

EU exports of chemicals were worth €96.9 billion ($102.6 billion) during the period January–August, a decrease of 1.8% YOY. The top 10 EU partners account for 80% of extra-EU chemicals exports, Cefic says. Imports of chemicals to the European Union were worth Є66.8 billion during the first eight months of this year, down 2.9% YOY. The top 10 EU partners account for 85% of EU chemical imports. Chemical imports from the non-EU area dropped by €2.02 billion, with the largest decline in occurring in petrochemicals and basic inorganics mainly from Russia.

The European Union had a net trade surplus of €30.1 billion in chemicals during first eight months of this year. The EU chemicals sector still shows a trade deficit with South Korea, India, and Japan. The EU chemical trade surplus rose to €223 million through August 2016. The rest of Europe contributed largely to this surplus, whereas the EU’s chemical trade surplus with the United States “registered a severe drop.”

Capacity utilization was 81.9% in the third quarter of 2016, an increase of 0.6% YOY. This level, slightly above the long-term average, nevertheless remains 3.2 percentage points below the post-crisis peak recorded in the first quarter of 2011. Employment in the EU chemical sector has stabilized, but is still far below pre-crisis levels. A total of 1.17 million people were directly working in the EU chemical industry during the second quarter of 2016

(Ref. http://www.chemweek.com/home/top_stories/Cefic-says-EU-chemical-sales-declined-4-percent-in-first-nine-months_84202.html dated 13.12.2016) |

|

BACK

|

|

SERVICE EXPORT FROM INDIA SCHEME

The Government has introduced the Service Exports from India Scheme (SEIS) w.e.f. 01.04.2015 under the Foreign Trade Policy (FTP), 2015-20 replacing the earlier scheme 'Served from India Scheme under the FTP, 2009-15. Under SEIS, the service providers of notified services are incentivized in the form of Duty Credit Scrips at the rate of 3 or 5% on their net foreign exchange earnings. These SEIS scrips are transferrable and can also be used for payment of a number of Central duties/taxes including the basic customs duty.

Apart from services, there is also a scheme for incentivizing export of merchandise/goods. The Merchandise Exports from India Scheme (MEIS) in the Foreign Trade Policy (FTP) 2015-20 operating since April 1, 2015 rewards export of merchandise which are produced/manufactured in India through Duty Credit Scrips which are transferable and can be used to pay Central duties/taxes including customs duties.

SEIS and MEIS schemes are designed to make our exports (both services & goods) globally competitive.

This information was given by the Commerce and Industry Minister Smt. Nirmala Sitharaman in a written reply in Lok Sabha.

(Ref. http://www.business-standard.com/article/government-press-release/service-export-from-india-scheme-116121400684_1.html dated 14.12.2016) |

|

BACK

|

|

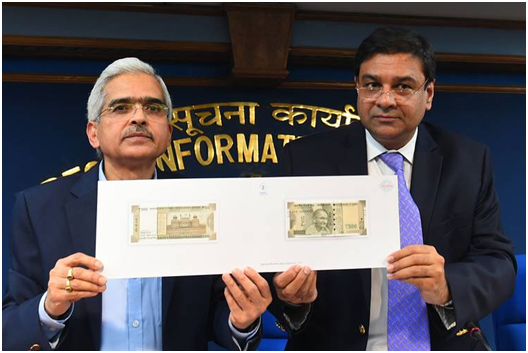

INDIA CHEMICAL MAKERS TURN TO EXPORTS AMID DOMESTIC CASH CRUNCH

SINGAPORE (ICIS)--India’s chemical and polymer producers are under pressure to tap the export markets as domestic buyers are grappling with a cash crunch that hit the country in early November, consultancy firm Wood Mackenzie said on Thursday.

“Producers are under immense pressure and are finding new ways to move excess inventories … India’s export volume is likely to increase multi-fold from November 2016 to January 2017,” Wood Mackenzie senior research analyst Ashish Chitalia said in a note.

India’s domestic trades of petrochemicals has markedly slowed down following the government’s decision to demonetize high-denomination rupee (Rp) notes effective 9 November.

The move was meant to crack down on black money, or illegally derived income.

But removing the Rs500 and Rs1,000 notes – which account for more than 80% of India’s money in circulation – caused chaos across markets in the cash-driven economy.

“Several producers are exporting chemicals due to lack of domestic demand, and running out of storage/warehouses space.”

Polymers such as polyethylene (PE), polypropylene (PP) and polyvinyl chloride (PVC) – which are used in fast-moving consumer goods sector (FMCGs) – “are likely to be impacted hardest at the onset but will find normalcy soon, as cash required for related transactions are relatively small,” according to Wood Mackenzie.

“A sudden increase in exports of Indian polyethylene into Chinese, Vietnamese and other South Asian markets is underway,” Chitalia said. Wood Mackenzie cited that Indian linear low density PE (LLDPE) and high density PE (HDPE) were being offered at “attractive prices” compared with products from other Asian countries.

“Our polyethylene supply demand balance calls for additional excess production in India once RIL [Reliance Industries Ltd] and OPAL [ONGC Petro additions Ltd) start up their cracker investments in Q1 2017,” the analyst said.

The cash crunch would hit India’s automotive and real estate markets hard, according to Wood Mackenzie. “Even if everything goes according to plan and there is sufficient cash available by the end of 2016, we expect impact of demonetisation to be a slowdown for a few quarters, at least,” Chitalia said.

“Our expectations of the speed of return to normalcy are highly dependent upon the release of more cash into the market. As a solution to the crisis, more cash will be speedier than waiting for conversion of business-to-business processes to digital transactions,” the Wood Mackenzie analyst said.

(Ref. http://www.icis.com/resources/news/2016/12/15/10062981/india-chemical-makers-turn-to-exports-amid-domestic-cash-crunch/ dated 15.12.2016) |

|

BACK

|

|

INDIAN EXPORTS AT $20 BN IN NOVEMBER GROW 2.3% OVER LAST YEAR

New Delhi: Exports of engineering products rose by 14.10 per cent, petroleum by 5.73 cent and chemicals by 8.3 percent compared to the same month last year, according to official data released on Thursday.

Imports too increased by 10.44 per cent to USD 33 billion, leaving a trade deficit of USD 13 billion in November.

The country's merchandise exports during April-November period of the current fiscal too recorded a growth of 0.10 per cent to USD 174.92 billion.

Imports, however, contracted by 8.44 per cent to USD 241.1 billion, leaving a trade deficit of USD 66.17 billion.

Gold imports during the month increased by 23.24 per cent to USD 4.36 billion.

Oil imports in November grew by 5.89 per cent to USD 6.83 billion. Non-oil imports rose by 11.7 per cent to USD 26.18 billion.

Since December 2014, exports fell for 18 consecutive months till May 2016 due to weak global demand and slide in oil prices.Shipments witnessed growth only in June this year but again slipped in July and August. Exports started recording positive growth from September.

(Ref. http://www.news18.com/news/business/indian-exports-at-20-bn-in-november-grow-2-3-over-last-year-1323501.html dated 15.12.2016) |

|

BACK

|

|

SPECIALTY CHEMICALS MARKET GLOBALLY TO REGISTER HIGHEST GROWTH BY 2021

Specialty chemical industry is one of the innovative, entrepreneurial, and consumer-driven industries. These specialty chemicals comprise low-volume, high-value chemicals with specific applications and constitute a significant part of the Indian chemical industry.

Specialty chemicals are high value-added products that are used as catalysts, intervenes, constituents, protectants, or preservatives in various products and applications. Specialty chemicals are sometimes referred to as “performance” chemicals, or “effect” chemicals, or “formulation” chemicals. Specialty chemicals are chemicals that are used in low quantities (not in bulk) and are targeted towards specific end-use applications. The physical and chemical characteristics of these chemicals influence the performance of end products.

Specialty chemicals are broadly segmented into agrichemicals such as insecticides, herbicides, and fungicides; adhesives; food additives such as salt, sugar, and vinegar; cleaning materials; cosmetic additives; construction chemicals; elastomers; flavors; industrial gases; polymers; surfactants (emulsifiers, foaming agents and dispersants); textile auxiliaries; and lubricants. The abovementioned types can be further sub-segmented on the basis of technology, function, applications, type, and plastic type. Specialty chemicals can be sub-segmented based on end-user industries. The major end-users of specialty chemicals are the automobile, food, aerospace, cosmetics, manufacturing, agriculture, and textile industries.

Growing need for these chemicals in the end-user industries due to their physical and chemical characteristics positively impacts the global market growth. Rising population, decreasing arable land, increasing the need for improvement in crop yields, and growing construction sector are some of the factors influencing the growth of specialty chemicals such as pesticides, Specialty coatings and surfactants, and construction chemicals. Moreover, these chemicals are increasingly used in water treatments. The introduction of more sophisticated water treatment technologies such as ion-exchange includes use of specialty chemicals in industrial water treatment. In addition, rising R&D activities for the development of innovative products to meet environmental regulations will offer ample opportunities for the growth of global specialty chemicals market.

Asia Pacific leads the global specialty chemicals market is forecasted to witness the highest growth in the near future. Increasing demand in the major end-user industries including construction, automotive, agriculture, packaging, textiles, personal care, and electronics along with rising infrastructure investments; and development of environment-friendly products offer ample revenue generation opportunities to the manufacturers of specialty chemicals. Increasing industrial activities in developing countries such as India and China will increase the demand for specialty chemicals in these countries.

On the other hand, few government regulations on the utilization of certain chemicals in food processing industry and other manufacturing industries may hinder the growth of global specialty chemicals market.

Key players in the global specialty chemicals market include Albemarle Corporation, Akzo Nobel N.V., Ashland, BASF SE, Clariant AG, Evonik Industries, and E.I. du Pont de Nemours and Company. Other major players dominating the market with their products and services are Eastman Chemical Company, Huntsman Corporation, INEOS Group, and The Dow Chemical Company.

Specialty Chemicals Market: Regional Segment Analysis

• North America

§ U.S.

• Europe

§ UK

§ France

§ Germany

• Asia Pacific

§ China

§ Japan

§ India

• Latin America

§ Brazil

• Middle East & Africa (Ref. http://patriarc.com/2016/12/16/specialty-chemicals-market-globally-to-register-highest-growth-by-2021/129378 dated 16.12.2016) |

|

BACK

|

|

INDIA AWAITS DATES FROM EU TO NEGOTIATE FTA, BILATERAL INVESTMENT TREATY: SITHARAMAN

(Commerce and Industry Minister Nirmala Sitharaman said that the ministry has repeatedly asked for dates for negotiations with the European Union.)

India is waiting for dates from European Union to negotiate the long pending Free Trade Agreement as well as a fresh Bilateral Investment Treaty, Commerce and Industry Minister Nirmala Sitharaman said on Saturday.

"I am waiting for dates to talk about both (FTA and BIT)," she said at a function in New Delhi organised by industry body Ficci. The proposed Broad based Trade and Investment Agreement (BTIA) or FTA has been pending for long. "We have repeatedly asked for dates for negotiations with the EU... This FTA has gone through several stages," the minister said. She indicated that the delay in resuming talks could be because EU is now looking more at getting the investment treaty "quickly done". The European Commission (EC) had raised concerns over negotiations for a fresh Bilateral Investment Treaty (BIT).

Sitharaman said the government has come out with the revised model text for BIT and all existing investment protection agreements will be null and void from March 31, "so we want countries to do that". Launched in June 2007, BITA negotiations have seen many hurdles with both sides having major differences on crucial issues like intellectual property rights, duty cuts in automobile as well as spirits and a liberal visa regime. On other FTAs which India is negotiating, Sitharaman sought feedback from industry chambers on those and ways to increase share of India in the global trade to 3.5% by 2020 from about 2% currently.

She also expressed concerns about the increasing protectionism in the world. "There is very high degree of protectionism across the globe," she said adding India is opening up but in a calibrated manner. Talking about quality and standards of products, she said Indian industry needs to increase standards and its compliance to boost its competitiveness in the world market. Sitharaman further said that the Commerce Ministry will soon call the meeting of Board of Trade to discuss issues related to exports. Exports rose for the third straight month in November, recording a growth of 2.29%, though the trade deficit shot up to about two-year high of $13 billion mainly due to increase in gold imports.

(Ref. http://www.dnaindia.com/money/report-india-awaits-dates-from-eu-to-negotiate-fta-bilateral-investment-treaty-sitharaman-2283891 dated 17.12.2016) |

|

BACK

|

|

NIRMALA SITHARAMAN HOPEFUL OF POSITIVE EXPORT GROWTH NEXT YEAR

NEW DELHI: The lacklustre show of exports from the country for almost past two years is no deterrent for the government, which is confident that it will see a "positive and solid difference" in 2017.

"I look at the new year which is going to definitely see positive and solid difference in exports compared to the previous years when we have been really very slow. I hope newer market should emerge," commerce and industry minister Nirmala Sitharaman told PTI.

The minister's optimism came against the backdrop of a positive growth recorded by the exports in the last three months.

Since December 2014, exports fell for 18 straight months till May 2016 due to subdued global demand and slide in oil prices. Shipments started witnessing growth only in June this year, but again entered the negative zone in July and August. In September, October and November, it registered growth though.

According to the commerce ministry's latest data, exports in November grew 2.29% to $20 billion. Exporters, too, expressed optimism for shipments in the new year. Federation of Indian Export Organisations (FIEO) said that out of the 30 key product groups, close to 20 are exhibiting positive trends in the past couple of months.

"If such a trend continues, we can achieve $280 billion or even more in exports in the current fiscal," FIEO president SC Ralhan said. There is a word of caution. He felt that poor demand pickup, slump in commodities prices, currency war may become more prominent in posing a greater challenge to exports in 2017. (The drop in crude oil prices had resulted in consequent decline in prices as well as export realisations for petroleum products.)

To be sure, improvement in outbound shipments will depend largely on demand revival in global markets. Experts say the uncertain global economic recovery may pose challenge to the country's export sector. The major markets for Indian exporters — the US and Europe — are yet to show strong signs of demand revival.

The two regions account for over 30% of the shipments. "Global economy is not going to grow. The world market is nervous," said BiswajitDhar, professor at the Jawaharlal Nehru University, adding that demonetisation will also impact exporters, particularly from the MSME sector. This sector contributes about 45% to India's total exports.

"Exports are expected to remain in depression for the first half of this fiscal. The government would have to extend support to boost exports," he said.

Labour-intensive sectors, including of handicrafts, have already flagged their concerns related to the impact of currency withdrawal. Ease of doing business too is another key parameter for higher export numbers.

Though the government has taken steps to improve that by reducing the number of documents required for import and export of goods, more is required. According to the multilateral body, global trade growth should hit 3.6% in 2017, but the figure is still below the average 5% since 1990.

The main reasons for the decline are fall in global demand and commodity prices, impacting terms of trade for exporters. The drop in crude oil prices had resulted in consequent decline in prices as well as export realisations for petroleum products. These are major product items of exports for India.

(Ref. http://economictimes.indiatimes.com/news/economy/nirmala-sitharaman-hopeful-of-positive-export-growth-next-year/articleshow/56054399.cms dated 19.12.2016) |

|

BACK

|

|

MAJOR INITIATIVES AND ACCOMPLISHMENTS OF DEPARTMENT OF COMMERCE(DOC)-2016

Major Initiatives and Accomplishments of Department of Commerce(DOC)-2016

Exports record a positive growth

Government E-Marketplace (GeM) launched in August, 2016 and becomes fully functional by October, 2016.

The WTO's Trade Facilitation Agreement in Goods ratified

1st BRICS Trade Fair organised in India from October 12-14, 2016

Vision and Mission The long-term vision of the Department is to make India a major player in the world trade by 2020 and assume a role of leadership in the international trade organizations commensurate with India’s growing importance. DOC’s goal is to increase India’s exports of merchandise and services from the present level of 465.9 billion USD (2013-14) to approximately 900 billion USD by 2019-20 and raise India’s share in world exports from present 2% to 3.5%.

Strategic Initiatives and Priorities

• Diversification of export product basket

• Diversification into non-traditional markets and conclusion of ongoing FTA negotiations and initiating new FTAs

• Strengthening export related infrastructure

• Enhancing credit flows for exports at lower cost

• Reducing Transaction Costs

• Diversification of Services exports

• Building up a Brand Image of India

• Support to Plantation Sector

• Protection to sensitive domestic industries

Improved export performance

• After negative growth for 18 successive months since December 2014, export recorded positive growth in June 2016.

• September, October and November 2016 saw positive growth in exports. Export from April to November 2016 is valued at US $ 174.9 billion against US $ 174.7 billion recorded in the corresponding period of 2015.

• With falling international crude prices and import of gold recording a significant decline, trade deficit had been in single digits for all successive months starting from January 2016.

Government E-Marketplace (GeM) – was launched in August, 2016 and became fully functional by October, 2016.Presently more than 4000 products in 86 categories and hiring of transport service are available on GeM POC portal. More than 1600 product sellers and service providers and about 1500 Government officials are currently are registered on GeM. Transactions for more than Rs45 Crore have already been processed on GeM. Purchases done through GeM so far, have indicated a reduction in prices to the tune of 10-20%, and in some cases even upto 56%. GeM is a tool to promote Maximum Governance Minimum Government, Make in India, Ease of Doing Business and Digital India. By providing timely payment to vendors GeM not only ensures competitive rates but also encourages small business units/individuals to do business with government organizations.

Trade Facilitation Agreement

• The WTO's Trade Facilitation Agreement represents an important milestone by creating an international framework for reducing trade costs. The Trade Facilitation Agreement (TFA) contains provisions for expediting the movement, release and clearance of goods, including goods in transit. It also sets out measures for effective co-operation between customs and other appropriate authorities on trade facilitation and customs compliance issues. These objectives are in consonance with India’s “Ease of Doing Business” initiative.

• As part of Special & Differential Treatment, Developing Countries and least Developed Countries (LDCs) has to categorise all the provisions under Category “A”, “B” or “C”. Category “A” commitments are those commitments which the notifying Country has to fulfil at the time TFA comes into force. Category “B” are those commitments for which notifying Country can ask for a transition time and for the implementation of category “C” commitments Developing and LDCs are entitled to get Technical assistance.

• After the approval from Cabinet in February 2016, India Notified its category “A” commitments to WTO under the (TFA) in March, 2016 and later on ratified it in April, 2016. Approximately 70% of the total provisions given under TFA has been notified as category “A”. India has not categorised any provisions under category “C”.

• The Cabinet has also approved the setting up of a National Committee on Trade Facilitation(NCTF) to facilitate both domestic coordination and implementation of the provisions under the Chairpersonship of Cabinet Secretary.

Signing of MOU with GSTN on data sharing

• DGFT on Oct 27, 2016 signed an MOU with the Goods and Services Network (GSTN) for sharing of foreign exchange realisation and Import Export code data. This will strengthen processing of export transactions of taxpayers under GST, increase transparency and reduce human interface.

• DGFT has signed MOUs with 14 state governments 2 central government agencies and GSTN for sharing of the data. At the state level, Commercial Tax Departments of 14 states have signed MoU with DGFT for receiving e-BRC data for VAT refund purposes. These are: (i) Maharashtra, (ii) Delhi, (iii) Andhra Pradesh,(iv) Odisha, (v) Chhattisgarh, (vi) Haryana, (vii) Tamil Nadu, (viii) Karnataka, (ix) Gujarat, (x) Uttar Pradesh, (xi) Madhya Pradesh, (xii) Kerala, (xiii) Goa, (xiv) Bihar.

• In addition, Ministry of Finance, Enforcement Directorate, Agricultural & Processed Food Products Export Development Authority and GSTN have signed MoU.

Increased Trade Interaction

• India organized the 1st BRICS Trade Fair from October 12-14, 2016 at India Trade Promotion Organisation (ITPO), PragatiMaidan, New Delhi.

• There were 397 exhibitors in the BRICS Trade Fair with participation from 14,612 business representatives.

• A number of key sectors such as agriculture and agro processing, auto and auto components, chemicals, green energy, handicrafts, healthcare and pharmaceuticals, high technology, ICT, infrastructure, leather, machine tools, mining and textiles and apparel were represented in the Fair.

• There were 1,601 Business to Business (B2B) meetings held during the BRICS Trade Fair.

• The BRICS Business Forum was also held on the sidelines of the BRICS Trade Fair that discussed pertinent topics like green energy, infrastructure development and finance etc.