Page 63 - Chemexcil NEWS August - September 2017 for web

P. 63

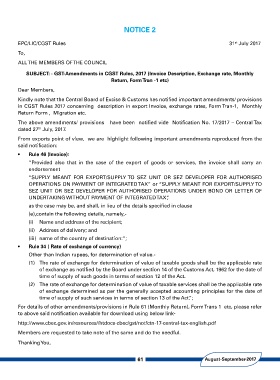

NOTICE 2

EPC/LIC/CGST Rules 31st July 2017

To,

ALLTHE MEMBERS OFTHE COUNCIL

SUBJECT: - GST-Amendments in CGST Rules, 2017 (Invoice Description, Exchange rate, Monthly

Return, Form Tran -1 etc)

Dear Members,

Kindly note that the Central Board of Excise & Customs has notified important amendments/ provisions

in CGST Rules 2017 concerning description in export Invoice, exchange rates, Form Tran-1, Monthly

Return Form , Migration etc.

The above amendments/ provisions have been notified vide Notification No. 17/2017 – Central Tax

dated 27th July, 2017.

From exports point of view, we are highlight following important amendments reproduced from the

said notification:

• Rule 46 (Invoice):

“Provided also that in the case of the export of goods or services, the invoice shall carry an

endorsement

“SUPPLY MEANT FOR EXPORT/SUPPLY TO SEZ UNIT OR SEZ DEVELOPER FOR AUTHORISED

OPERATIONS ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT/SUPPLY TO

SEZ UNIT OR SEZ DEVELOPER FOR AUTHORISED OPERATIONS UNDER BOND OR LETTER OF

UNDERTAKING WITHOUT PAYMENT OF INTEGRATEDTAX”,

as the case may be, and shall, in lieu of the details specified in clause

(e),contain the following details, namely,-

(i) Name and address of the recipient;

(ii) Address of delivery; and

(iii) name of the country of destination:”;

• Rule 34 ( Rate of exchange of currency)

Other than Indian rupees, for determination of value.-

(1) The rate of exchange for determination of value of taxable goods shall be the applicable rate

of exchange as notified by the Board under section 14 of the Customs Act, 1962 for the date of

time of supply of such goods in terms of section 12 of the Act.

(2) The rate of exchange for determination of value of taxable services shall be the applicable rate

of exchange determined as per the generally accepted accounting principles for the date of

time of supply of such services in terms of section 13 of the Act.”;

For details of other amendments/provisions in Rule 61 (Monthly Return), Form Trans 1 etc, please refer

to above said notification available for download using below link-

http://www.cbec.gov.in/resources//htdocs-cbec/gst/notfctn-17-central-tax-english.pdf

Members are requested to take note of the same and do the needful.

Thanking You,

61 August-September-2017