Page 65 - Chemexcil NEWS August - September 2017 for web

P. 65

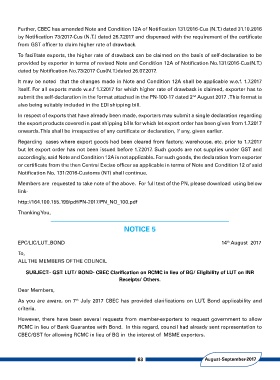

Further, CBEC has amended Note and Condition 12A of Notification 131/2016-Cus (N.T.) dated 31.10.2016

by Notification 73/2017-Cus (N.T.) dated 26.7.2017 and dispensed with the requirement of the certificate

from GST officer to claim higher rate of drawback.

To facilitate exports, the higher rate of drawback can be claimed on the basis of self-declaration to be

provided by exporter in terms of revised Note and Condition 12A of Notification No.131/2016-Cus(N.T.)

dated by Notification No.73/2017 Cus(N.T.)dated 26.07.2017.

It may be noted that the changes made in Note and Condition 12A shall be applicable w.e.f. 1.7.2017

itself. For all exports made w.e.f 1.7.2017 for which higher rate of drawback is claimed, exporter has to

submit the self-declaration in the format attached in the PN-100-17 dated 2nd August 2017 .This format is

also being suitably included in the EDI shipping bill.

In respect of exports that have already been made, exporters may submit a single declaration regarding

the export products covered in past shipping bills for which let export order has been given from 1.7.2017

onwards.This shall be irrespective of any certificate or declaration, if any, given earlier.

Regarding cases where export goods had been cleared from factory, warehouse, etc. prior to 1.7.2017

but let export order has not been issued before 1.7.2017. Such goods are not supplies under GST and

accordingly, said Note and Condition 12A is not applicable. For such goods, the declaration from exporter

or certificate from the then Central Excise officer as applicable in terms of Note and Condition 12 of said

Notification No. 131/2016-Customs (NT) shall continue.

Members are requested to take note of the above. For full text of the PN, please download using below

link-

http://164.100.155.199/pdf/PN-2017/PN_NO_100.pdf

Thanking You,

NOTICE 5

EPC/LIC/LUT_BOND 14th August 2017

To,

ALLTHE MEMBERS OFTHE COUNCIL

SUBJECT:- GST: LUT/ BOND- CBEC Clarification on RCMC in lieu of BG/ Eligibility of LUT on INR

Receipts/ Others.

Dear Members,

As you are aware, on 7th July 2017 CBEC has provided clarifications on LUT, Bond applicability and

criteria.

However, there have been several requests from member-exporters to request government to allow

RCMC in lieu of Bank Guarantee with Bond. In this regard, council had already sent representation to

CBEC/GST for allowing RCMC in lieu of BG in the interest of MSME exporters.

63 August-September-2017