Page 64 - Chemexcil NEWS August - September 2017 for web

P. 64

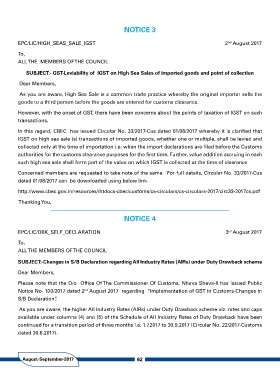

NOTICE 3

EPC/LIC/HIGH_SEAS_SALE_IGST 2nd August 2017

To,

ALLTHE MEMBERS OFTHE COUNCIL

SUBJECT:- GST-Leviability of IGST on High Sea Sales of imported goods and point of collection

Dear Members,

As you are aware, High Sea Sale is a common trade practice whereby the original importer sells the

goods to a third person before the goods are entered for customs clearance.

However, with the onset of GST, there have been concerns about the points of taxation of IGST on such

transactions.

In this regard, CBEC has issued Circular No. 33/2017-Cus dated 01/08/2017 whereby it is clarified that

IGST on high sea sale (s) transactions of imported goods, whether one or multiple, shall be levied and

collected only at the time of importation i.e. when the import declarations are filed before the Customs

authorities for the customs clearance purposes for the first time. Further, value addition accruing in each

such high sea sale shall form part of the value on which IGST is collected at the time of clearance

Concerned members are requested to take note of the same. For full details, Circular No. 33/2017-Cus

dated 01/08/2017 can be downloaded using below link-

http://www.cbec.gov.in/resources//htdocs-cbec/customs/cs-circulars/cs-circulars-2017/circ33-2017cs.pdf

Thanking You,

NOTICE 4

EPC/LIC/DBK_SELF_DECLARATION 3rd August 2017

To,

ALLTHE MEMBERS OFTHE COUNCIL

SUBJECT:-Changes in S/B Declaration regarding All Industry Rates (AIRs) under Duty Drawback scheme

Dear Members,

Please note that the O/o Office Of The Commissioner Of Customs, Nhava Sheva-II has issued Public

Notice No- 100/2017 dated 2nd August 2017 regarding “Implementation of GST in Customs-Changes in

S/B Declaration”.

As you are aware, the higher All Industry Rates (AIRs) under Duty Drawback scheme viz. rates and caps

available under columns (4) and (5) of the Schedule of All Industry Rates of Duty Drawback have been

continued for a transition period of three months i.e. 1.7.2017 to 30.9.2017 (Circular No. 22/2017-Customs

dated 30.6.2017).

August-September-2017 62