Page 76 - Chemexcil NEWS August - September 2017 for web

P. 76

NOTICE 12

EPC/LIC/GST 11th Sept 2017

To,

ALLTHE MEMBERS OFTHE COUNCIL

SUBJECT:- GST Important, Deadline Extended for GST Returns for July 2017, GST Rate on Sale of Duty

Credit Scrips (MEIS etc) reduced to 5%, Trans 1 submission date extended by 30 days

Dear Members,

Kindly note that the GST Council in its 21st meeting held on 9th September 2017, has recommended the

following measures to facilitate taxpayers:

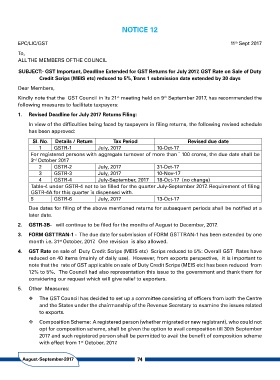

1. Revised Deadline for July 2017 Returns Filing:

In view of the difficulties being faced by taxpayers in filing returns, the following revised schedule

has been approved:

Sl. No. Details / Return Tax Period Revised due date

1 GSTR-1 July, 2017 10-Oct-17

For registered persons with aggregate turnover of more than ` 100 crores, the due date shall be

3rd October 2017

2 GSTR-2 July, 2017 31-Oct-17

3 GSTR-3 July, 2017 10-Nov-17

4 GSTR-4 July-September, 2017 18-Oct-17 (no change)

Table-4 under GSTR-4 not to be filled for the quarter July-September 2017. Requirement of filing

GSTR-4A for this quarter is dispensed with.

5 GSTR-6 July, 2017 13-Oct-17

Due dates for filing of the above mentioned returns for subsequent periods shall be notified at a

later date.

2. GSTR-3B- will continue to be filed for the months of August to December, 2017.

3. FORM GST TRAN-1 - The due date for submission of FORM GSTTRAN-1 has been extended by one

month i.e. 31st October, 2017. One revision is also allowed.

4. GST Rate on sale of Duty Credit Scrips (MEIS etc) Scrips reduced to 5%: Overall GST Rates have

reduced on 40 items (mainly of daily use). However, from exports perspective, it is important to

note that the rate of GST applicable on sale of Duty Credit Scrips (MEIS etc) has been reduced from

12% to 5%. The Council had also representation this issue to the government and thank them for

considering our request which will give relief to exporters.

5. Other Measures:

The GST Council has decided to set up a committee consisting of officers from both the Centre

and the States under the chairmanship of the Revenue Secretary to examine the issues related

to exports.

Composition Scheme: A registered person (whether migrated or new registrant), who could not

opt for composition scheme, shall be given the option to avail composition till 30th September

2017 and such registered person shall be permitted to avail the benefit of composition scheme

with effect from 1st October, 2017.

August-September-2017 74