Page 77 - Chemexcil NEWS August - September 2017 for web

P. 77

The registration for persons liable to deduct tax at source (TDS) and collect tax at source (TCS)

will commence from 18th September 2017. However, the date from which TDS and TCS will be

deducted or collected will be notified later.

The GST Council has also decided to constitute a Group of Ministers to monitor and resolve the

IT challenges faced during GST implementation.

Members are requested to kindly take note of above. The notifications etc regarding applicable

dates of GST rate reduction are awaited and shall be conveyed in due course.

Thanking you.

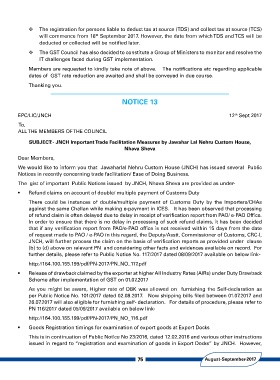

NOTICE 13

EPC/LIC/JNCH 12th Sept 2017

To,

ALLTHE MEMBERS OFTHE COUNCIL

SUBJECT:- JNCH Important Trade Facilitation Measures by Jawahar Lal Nehru Custom House,

Nhava Sheva

Dear Members,

We would like to inform you that Jawaharlal Nehru Custom House (JNCH) has issued several Public

Notices in recently concerning trade facilitation/ Ease of Doing Business.

The gist of important Public Notices issued by JNCH, Nhava Sheva are provided as under-

• Refund claims on account of double/ multiple payment of Customs Duty

There could be instances of double/multiple payment of Customs Duty by the Importers/CHAs

against the same Challan while making e-payment in ICES. It has been observed that processing

of refund claim is often delayed due to delay in receipt of verification report from PAO/ e-PAO Office.

In order to ensure that there is no delay in processing of such refund claims, it has been decided

that if any verification report from PAO/e-PAO office is not received within 15 days from the date

of request made to PAO / e-PAO in this regard, the Deputy/Asstt. Commissioner of Customs, CRC-I,

JNCH, will further process the claim on the basis of verification reports as provided under clause

(b) to (d) above on relevant PN and considering other facts and evidences available on record. For

further details, please refer to Public Notice No. 117/2017 dated 08/09/2017 available on below link-

http://164.100.155.199/pdf/PN-2017/PN_NO_117.pdf

• Release of drawback claimed by the exporter at higher All Industry Rates (AIRs) under Duty Drawback

Scheme after implementation of GST on 01.07.2017

As you might be aware, Higher rate of DBK was allowed on furnishing the Self-declaration as

per Public Notice No. 101/2017 dated 02.08.2017. Now shipping bills filed between 01.07.2017 and

26.07.2017 will also eligible for furnishing self- declaration. For details of procedure, please refer to

PN 116/2017 dated 05/09/2017 available on below link-

http://164.100.155.199/pdf/PN-2017/PN_NO_116.pdf

• Goods Registration timings for examination of export goods at Export Docks

This is in continuation of Public Notice No 23/2016, dated 12.02.2016 and various other instructions

issued in regard to “registration and examination of goods in Export Docks” by JNCH. However,

75 August-September-2017