Page 80 - Chemexcil NEWS August - September 2017 for web

P. 80

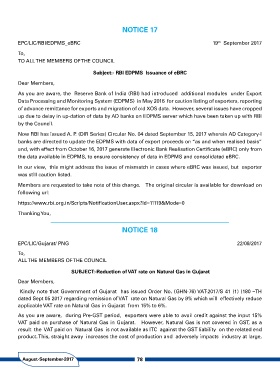

NOTICE 17

EPC/LIC/RBI/EDPMS_eBRC 19th September 2017

To,

TO ALLTHE MEMBERS OFTHE COUNCIL

Subject:- RBI EDPMS Issuance of eBRC

Dear Members,

As you are aware, the Reserve Bank of India (RBI) had introduced additional modules under Export

Data Processing and Monitoring System (EDPMS) in May 2016 for caution listing of exporters, reporting

of advance remittance for exports and migration of old XOS data. However, several issues have cropped

up due to delay in up-dation of data by AD banks on EDPMS server which have been taken up with RBI

by the Council.

Now RBI has issued A. P. (DIR Series) Circular No. 04 dated September 15, 2017 wherein AD Category-I

banks are directed to update the EDPMS with data of export proceeds on “as and when realised basis”

and, with effect from October 16, 2017 generate Electronic Bank Realisation Certificate (eBRC) only from

the data available in EDPMS, to ensure consistency of data in EDPMS and consolidated eBRC.

In our view, this might address the issue of mismatch in cases where eBRC was issued, but exporter

was still caution listed.

Members are requested to take note of this change. The original circular is available for download on

following url:

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11119&Mode=0

Thanking You,

NOTICE 18

EPC/LIC/Gujarat/ PNG 22/09/2017

To,

ALLTHE MEMBERS OFTHE COUNCIL

SUBJECT:-Reduction of VAT rate on Natural Gas in Gujarat

Dear Members,

Kindly note that Government of Gujarat has issued Order No. (GHN-76) VAT-2017/S 41 (1) (180 –TH

dated Sept 05 2017 regarding remission of VAT rate on Natural Gas by 9% which will effectively reduce

applicable VAT rate on Natural Gas in Gujarat from 15% to 6%.

As you are aware, during Pre-GST period, exporters were able to avail credit against the input 15%

VAT paid on purchase of Natural Gas in Gujarat. However, Natural Gas is not covered in GST, as a

result the VAT paid on Natural Gas is not available as ITC against the GST liability on the related end

product. This, straight away increases the cost of production and adversely impacts industry at large,

August-September-2017 78